When it comes to the best cheap payroll service for small businesses, it’s not only about the price tag but also about the services and features available at that price. In this guide, I compiled the top five options and broke them down by what they offered for the money.

- Gusto: Best overall cheap payroll software

- OnPay: Best for payroll and HR tools

- Homebase: Best for paying hourly workers

- QuickBooks Payroll: Best for contractor payments

- Square Payroll: Best for small restaurants and retail shops

- Honorable mentions:

- Rippling: Best for payroll automation

- SurePayroll (by Paychex): Best for simple pay runs

Cheap Payroll Services Compared

Expert Score (out of 5) | Starter Monthly Pricing | Contractor-only Payroll Plan | Time Tracking in Basic Plan | |

|---|---|---|---|---|

| 4.32 | $49 per month + $6 per person per month | $6 per worker + $35 base fee monthly | $6 per employee monthly (free for higher tiers) |

4.09 | $6 per employee + $40 base fee | Included in payroll plan | Via integrations | |

3.93 | Included in payroll plan | ✓ | ||

| 3.82 | $6 per employee + $50 base fee | $15 monthly for up to 20 workers; plus $2 for each additional contractor | Included in higher tiers |

| 3.71 | $6 per employee + $35 base fee | $6 per worker monthly | ✓ |

Gusto: Best Overall Cheap Payroll Service

Pros

- Full-service payroll with tax remittance and filing services

- Basic hiring and onboarding tools included in the starter plan

- Gusto-brokered health insurance with access to financial management tools (via the free Gusto Wallet app)

- Wide range of HR features, such as talent acquisition and performance review tools

Cons

- Starter plan only comes with one state pay processing

- Time tracking, scheduling, advanced hiring, expense reimbursements, and next-day direct deposits included in higher tiers

- Priority support and HR advisory services only available in the Premium plan

Overview

Who should use it:

Gusto is great for those who want to hire, pay, and manage employees in one platform. It’s my top pick for cheap payroll software because of its rich HR features and reasonable price tag.

Why I like it:

Gusto is a full-service payroll software that provides unlimited pay runs, handles all tax filings, and offers automated pay runs, helping you save time. It lets you onboard new hires, offer different types of benefits, and track employee hours, making actual attendance data retrieval for pay processing easy. Gusto can even help you hire and pay international workers with its employer of record (EOR) service, Gusto Global. And if you need to process global contractor payments, Gusto can handle payouts in over 120 countries.

These features contributed to its overall score of 4.32 out of 5. Its starter tier has all the essential tools for managing simple pay runs. However, Gusto’s contractor-only payroll plan isn’t as affordable as Square Payroll and QuickBooks Payroll’s. Also, you must upgrade to at least its Plus plan or pay extra to access time-tracking functionalities. This is unlike Homebase and Square Payroll, which offer basic time tracking their starter tiers.

Gusto plans

- Simple: $49 per month + $6 per person per month

- Plus: $80 base fee + $12 per employee monthly

- Premium: $180 base fee + $212 per employee monthly

- Contractor-only payroll plan: $35 base fee + $6 per contractor monthly (for businesses that only pay contract workers)

Add-ons

- State payroll tax registration: Pricing varies per state

- R&D tax credits: 15% of identified tax credits

- Health insurance and other benefits: Pricing varies by benefit

- International contractor payments: Custom-priced

- Gusto Global): $699 per employee monthly ($599 per employee monthly until 12/312025)

Add-ons for the Simple plan only

- Time tracking with scheduling: $6 per employee monthly

- Next-day direct deposits: $15 base fee + $3 per employee monthly

- Performance reviews: $3 per employee monthly

- Priority support: $30 base fee + $4 per employee monthly

- HR resources: $50 base fee + $5 per employee monthly

- includes access to HR documents, federal and state compliance alerts, and HR advisory services

Add-ons for the Plus plan only

- Priority support and HR resources: $8 per employee monthly

- Tax services: Gusto handles quarterly and year-end tax filings for you. It can even help register your business in all the states where your company operates, although this service costs extra.

- Gusto Wallet: This app lets your employees split their paychecks into separate accounts, set budgets, and track debit card transactions so they can see how they spend their money versus their planned budgets.

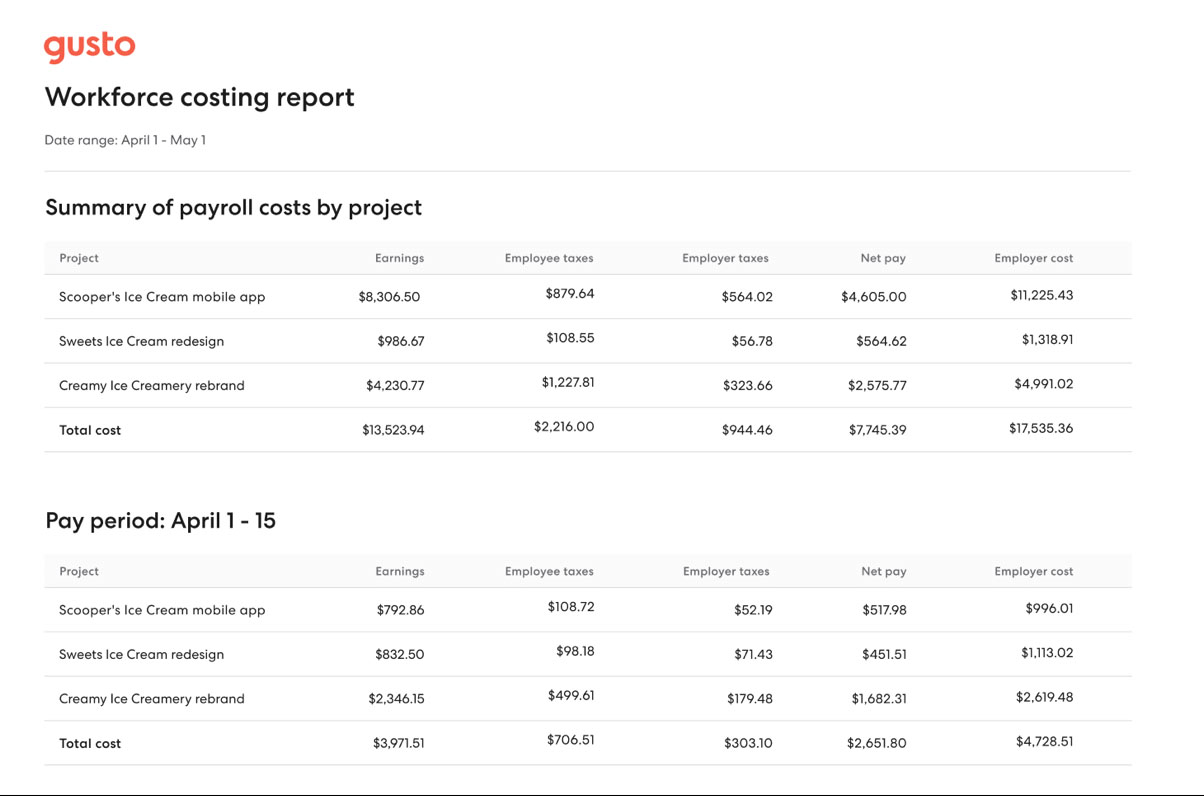

- Time and project tracking: Employees can clock in/out directly in the software or through the Gusto Wallet app. It also lets them track actual work hours spent on specific projects. This allows you to monitor projects against your goals, spot where workloads must be adjusted, and evaluate your payroll and workforce costs by project.

A workforce costing report will allow you to see a summary of payroll costs by project. (Source: Gusto)

Interested to see how Gusto compares with some of the payroll software in this guide and other competitors? Check out these articles:

- Gusto vs QuickBooks Payroll

- OnPay vs Gusto

- Gusto vs Square Payroll

- Rippling vs Gusto

- Gusto vs SurePayroll

- Best Gusto Competitors & Alternatives

OnPay: Best for Payroll & HR Tools

Pros

- One price includes all payroll and HR features

- HR features include new hire reporting, onboarding, time off management, an online org chart, a centralized staff database, and access to benefits plans

- Free account migration services

Cons

- Lacks time-tracking solutions

- Live support is only available on weekdays

- Limited third-party software integrations

Overview

Who should use it:

OnPay is ideal for those who want an all-in-one system to manage payroll and core HR functions. It onboards new employees, tracks their time off transactions, processes payments, and provides access to health plans from major insurers—all for the reasonable price of $40 plus $6 per employee monthly.

Why I like it:

It may cost the same as Gusto’s starter plan, but you save more with OnPay. With its flat pricing, you don’t need to upgrade to higher tiers to unlock other features. It even includes a searchable company directory and visual org charts that automatically update depending on changes you make to employee OnPay profiles.

In my evaluation, OnPay earned an overall score of 4.09 out of 5 because its efficient payroll tools can handle payments for many types of businesses, including farms and non-profit organizations. I gave it top marks for its new client services, which include free account migration and support for setting up integrations. However, unlike Gusto, it only offers benefits via partner brokers. It also connects with only a handful of third-party software and lacks time tracking and performance review tools.

OnPay only offers one plan, which costs $40 base fee + $6 per employee monthly.

- Niche payroll: OnPay can process pay runs for employees and contractors in various industries. Further, it’s the only provider on my list that processes payments and tax filings for agricultural workers. It can even handle payouts for workers with H-2A visas.

- Team management tools: OnPay offers document services where you can customize templates, send them for e-signatures, and instantly add them to your employee records. You can stay organized with in-app messaging between team members and use org charts to create employee rosters automatically.

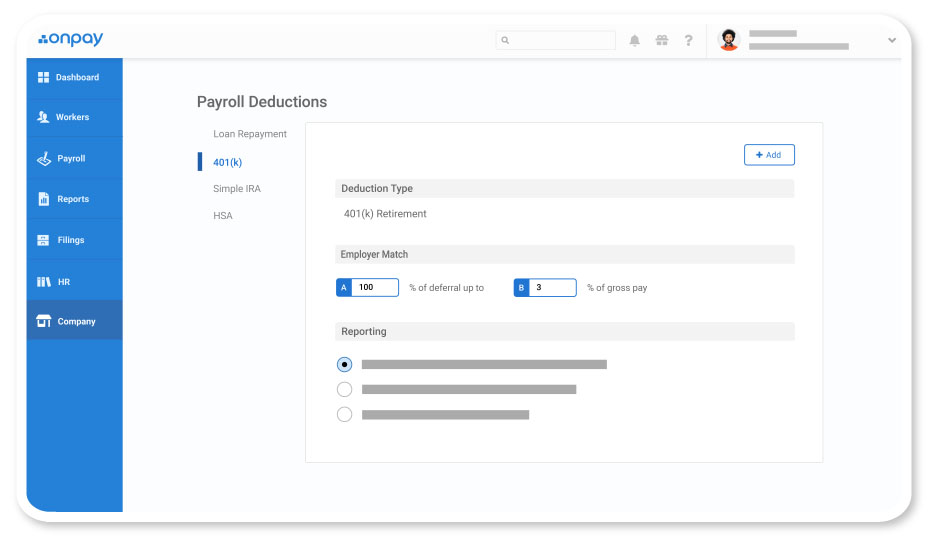

- Integrated benefits: OnPay partners with top healthcare and retirement plan providers, such as Humana, BlueCross BlueShield, Aetna, Vestwell, and Guideline. If you’re unsure which plan to get, OnPay’s in-house team of licensed experts can help you select the right one. The benefits programs you choose also sync with payroll for payment processing and deductions.

All payroll deductions for benefits are handled easily and with compliance through OnPay. (Source: OnPay)

Homebase: Best for Paying Hourly Employees

Pros

- Core Homebase time tracking and scheduling platform has a free plan for one-location companies with up to 20 employees

- Reasonably-priced Homebase Payroll add-on

- Offers a free Cash Out pay on-demand option

Cons

- Adding payroll can get pricey if you upgrade to the core Homebase platform’s paid plans

- Lacks access to employee benefits plans

- Starter core Homebase plan only includes email support; live phone and chat assistance available in higher tiers

Overview

Who should use it:

If you mostly hire hourly employees, Homebase’s core platform primarily has time tracking and scheduling features to help you manage staff attendance. With its Homebase Payroll add-on, you can easily use the core platform’s time data to pay employees compliantly.

Why I like it:

Homebase Payroll may be a paid add-on but it can be an inexpensive payroll service if partnered with the core platform’s free plan for one-location businesses with up to 20 workers. It’s even slightly cheaper than Gusto because you get time tracking, a feature that’s included in Gusto’s higher tiers or costs extra with the starter plan.

In my evaluation, Homebase earned a 3.93 out of 5 score. I gave it top marks in pay processing because of its automatic pay runs, next-day payroll, and tax filing services. Unlike Gusto, OnPay, and QuickBooks Payroll, you complete payroll with just a few taps via Homebase’s mobile apps for iOS and Android devices. However, it doesn’t provide access to benefits plans and performance reviews. It can also become a pricey option if you get the payroll add-on and upgrade to the core platform’s paid plans to access other features, such as labor cost management, hiring, and more advanced reporting tools.

Core Homebase time tracking and scheduling plans:

- Basic: Free for one location and up to 20 employees

- Essentials: $24.95 per location monthly; includes unlimited employees

- Plus: $59.95 per location monthly; includes unlimited employees

- All-in-One: $99.95 per location monthly; includes unlimited employees

Add-ons

- Homebase Payroll: $39 base fee + $6 per employee monthly

- Background checks: $30 each

- Job post boosts: Starts at $79 per job post

- Tip manager: $25 per location monthly; includes tip pool calculations and automatic tip data imports from your point-of-sale (POS) software into Homebase

- Task manager: $13 per location monthly; this lets you build and assign task lists in Homebase

- Pay on-demand: Homebase may not provide access to benefits plans but offers a pay-on-demand feature, Cash Out. Your employees must meet Homebase’s eligibility requirements to enjoy pay advances. However, instant payouts cost extra.

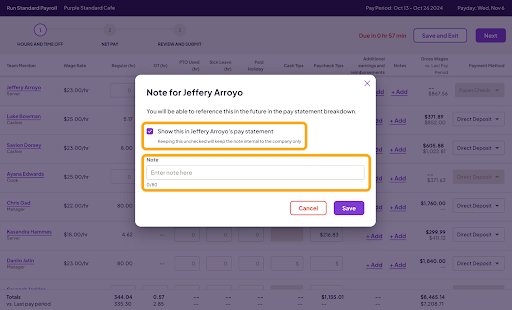

- Payroll notes: You can add special messages to specific employees without needing to exit the payroll process. Homebase’s pay grid has a Notes column where you click the “+ Add” button and input and save your pay message. The saved notes will automatically appear on the employee’s pay slip.

- Child-support garnishments and payments: Homebase can handle child-support wage garnishments and remit the payments to applicable government agencies in all US states. While Gusto offers the same feature, its service doesn’t cover South Carolina.

Homebase allows you to add short pay-related notes to specific employees while running payroll. (Source: Homebase)

Quickbooks Payroll: Best for Contractor Payments

Pros

- Easily integrates with Intuit products, such as QuickBooks Accounting

- Offers a separate low-cost contractor payment package

- Next-day direct deposits available in all plans

Cons

- Basic HR features

- Automated local tax filings available only in its higher tiers

- Access to HR advisory services reserved for Payroll Elite plan holders

Overview

Who should use it:

QuickBooks Payroll can handle contractor and employee payroll, but if you only pay contract workers, its contractor payments package is the cheapest payroll service on my list.

Why I like it:

The easy integration between Intuit products and QuickBooks’ fast payment options are just some of the things I like about this software. You get next-day direct deposits even with its starter tier—a feature Gusto offers in its higher plans. And you can easily import pay-related data into your general ledger for easy bookkeeping if you use both QuickBooks Accounting and QuickBooks Payroll.

It also offers full-service payroll with tax filing assistance, employee benefits plans, and time tracking tools—functionalities that contributed to QuickBooks Payroll’s overall score of 3.82 out of 5. While its contractor payments package is more affordable than Square Payroll, it has limited HR features. Unlike Gusto and Homebase, you can’t use its platform to hire employees or post jobs. It also doesn’t offer online org charts or an employee directory that you can search through.

QuickBooks Payroll plans

- Payroll Core: $50 base fee + $6 per employee monthly

- Payroll Premium: $85 base fee + $9 per employee monthly

- Payroll Elite: $130 base fee + $11 per employee monthly

- Contractor payments package: $15 monthly for 20 workers + $2 for each additional contractor

- Affordable contractor-only payments plan: For $15 monthly, you can process payments for up to 20 workers. This is significantly lower than Square Payroll’s contractor-only payroll option. For 20 workers, it will charge you $120 monthly (computed as $6 per worker × 20 contractors).

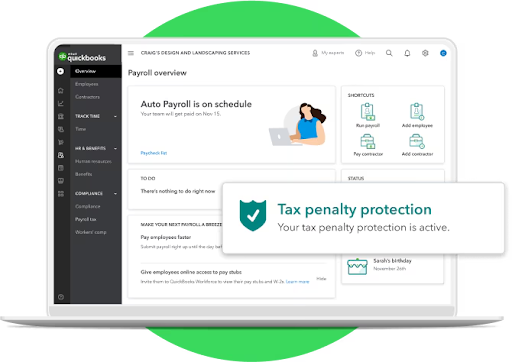

- Extensive tax accuracy and tax guarantee program: QuickBooks is the only software provider on my list that offers two tax penalty programs. Its tax accuracy program, available in all plans, covers mistakes that its representatives make. However, its tax guarantee program, limited to its Elite plan, covers all tax filing errors, regardless of who made the mistake but only up to $25,000.

QuickBooks Payroll offers tax accuracy and tax penalty protection programs to its clients. (Source: QuickBooks)

Square Payroll: Best for Small Restaurants & Retail Shops

Pros

- Easily syncs with Square’s POS system

- Instant and next-day payment options through its Cash App

- Affordable contractor-only payroll plan

Cons

- Has simple onboarding tools

- Workers’ comp, health insurance, and retirement benefits are paid add-ons

- Limited integration options

Overview

Who should use it:

If your restaurant or retail shop uses Square POS, getting Square Payroll to process employee payments is better than using third-party payroll software. You can track tips or commissions via Square POS and then automatically transfer the data into Square Payroll for payment processing.

Why I like it:

I appreciate the easy data imports between Square products. It helps save time and minimize errors from manual data entries. Square Payroll also has a mobile app that supports pay runs, which is great if you’re always on the go and need to submit payroll.

It earned an overall score of 3.71 out of 5 because of its efficient payroll features but lost several points because of its limited HR features and integration options. Its contractor plan isn’t as affordable as QuickBooks Payroll’s, and it also lacks the local state tax payment and filing assistance that most of the providers on my list offer.

Square Payroll plans

- Pay employees and contractors: $35 base fee + $6 per employee monthly

- Pay contractors only: $6 per person monthly

Add-ons

- Health, retirement, and workers’ comp plans: Custom-priced

- Mail paper copies of W2s/1099s: $3 per mailed form annually (digital delivery of Form W2s and 1099s is free)

- Cash App: You can deposit salary payments in the accounts of employees who sign up for the Cash App. They can get their money via the ATM or transfer it to another account.

- Instant or next-day payouts: You can pull money from your Square balance to pay workers via direct deposit the next business day or instantly through the Cash App.

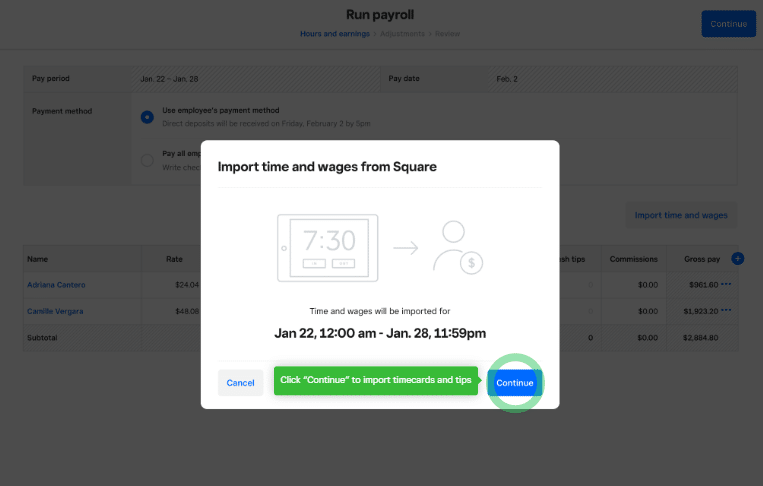

- Tips, commissions, and attendance data uploads: With the Square POS, you can capture tips and commission payments. You can even use it to capture employee clock ins/outs. With the seamless integration between Square products, transferring the information you need to process employee payments is very easy.

You can import timecards and tip information from Square or manually input the data during pay runs. (Source: Square Payroll)

Honorable Mentions

Rippling

Expert Score: 3.58 out of 5

Rippling offers an all-in-one HR, IT, and expense management platform with payroll tools that can handle US and global employee payments. Like the others on my list of best cheap payroll software for small businesses, it offers full-service payroll with tax filing and year-end tax reporting services.

What impressed me most about Rippling is its payroll automation tools. Its highly customizable workflows allow you to create triggers using employee data to automate processes. I also like that it has modular solutions, enabling you to choose the HR, IT, and expense management tools you need—provided you get the core Rippling Platform.

Why it Didn’t Make The List

While you can select the HR, payroll, and benefits management features you want, Rippling can get pricey depending on the modules you get. Pricing information is also not easy to find on its website. It isn’t on the pricing page, as of this writing. I found it on Rippling’s small business page.

Cost-wise, its starter monthly fee is slightly higher than Gusto’s ($40 base fee + $8 per employee vs $40 base fee + $6 per employee). It’s also unclear if Rippling’s starter fee includes payroll, benefits, and time-tracking features. Although its small business page seems to allude to it, I recommend calling Rippling to request a quote just to be sure.

SurePayroll (by Paychex)

Expert Score: 3.47 out of 5

SurePayroll is a good option if you only need simple pay runs. It supports multiple pay rates; calculates federal, state, and local taxes; and can run payroll automatically. While it has a full-service plan that includes tax filings, it offers a no-tax filing option that’s more affordable than the others on my list, but you will need to remit taxes and forward the tax forms to government agencies yourself.

Why it Didn’t Make The List

Sure Payroll is the cheapest payroll provider I evaluated, priced at $20 plus $4 per person monthly ($220 per month for 50 employees). However, this plan is only ideal if you have a handful of employees and a payroll staff who can handle tax filings.

Even if you get the full-service plan, it lacks Gusto and OnPay’s HR tools. It doesn’t have searchable company directories or an employee self-onboarding tool. You also have to pay extra for multiple state tax filings, including accounting and time-tracking software integrations.

How to Choose the Best Cheap Payroll Software

When looking for the best cheap payroll service, it’s important to assess your business needs. This goes beyond just price. Consider factors like the size of your company, the complexity of your payroll processes, and any HR needs you may have. Look for a service that offers the features you need at a price that fits your budget. Also, consider the following:

- Security: Ensure the service follows strict data protection protocols to keep your sensitive employee information safe.

- Automated tasks: A service that can automate tasks like tax calculations and direct deposits will save time and reduce errors in your payroll processes.

- Benefits: Consider if you need HR benefits as well as payroll. This may cost you extra but can give you a complete package of benefits.

- Scalability: If your business plans to scale and grow, you may need a service that can grow with you. That may not be the cheapest option on the list, but it may still be within your budget.

- Compliance: Look for a service that provides both payroll and compliance needs.

- Reviews: Before relying on price alone, check the rating and what users say about the payroll service.

Methodology: How I Evaluated the Top Cheap Payroll Services

To evaluate the best cheap payroll software for small businesses, I collaborated with Irene Casucian, one of our expert research analysts. We used a new rubric with various criteria to compare seven payroll software:

- Gusto

- QuickBooks Payroll

- OnPay

- Rippling

- Square Payroll

- SurePayroll

- Homebase

We prioritized pricing and gave the most points to software that costs up to $300 monthly to pay 50 employees. We checked if the software has free trial offers, unlimited pay runs, and zero long-term contract requirements. In addition to customer support options, we looked for payroll tax payment and filing assistance, contractor payroll tools, third-party software integrations, reporting functions, and basic HR information (HRIS) features for easy employee onboarding and offboarding.

I also added my expert rating to each criterion, where I looked at the general effectiveness of that feature. While I couldn’t test all of the software on my list, I looked for key payroll features, watched video tutorials if available, and checked user reviews for feedback about the system’s overall ease of use.

To view the full evaluation criteria, click through the tabs in the box below.

30% of Overall Score

We looked for transparent pricing, free trial and discount offers, unlimited pay runs, and each platform’s “value for money,” which determines whether the number of features in the basic plan is competitive with other vendors in the space. We also gave points to software that only cost up to $300 monthly for businesses with 50 employees.

20% of Overall Score

We gave priority to those that offer multiple pay schedules, tax payment and filing services, year-end tax reporting (W-2s and 1099s), and two-day direct deposits. We also checked if it supports contractor payroll and pay processing in all US states.

15% of Overall Score

We looked at the support options available, such as the support hours and whether customer representatives can be reached via phone, chat, or email. We also checked for user help resources, such as a knowledge base or an online community forum.

15% of Overall Score

We looked for HRIS features to help with onboarding and offboarding, new hire reporting, employee data storage, and recordkeeping. We also gave points to those that offer employee self-service portals, payroll report templates, benefits plans available in all US states, and org charts or a company directory that employees can access online.

15% of Overall Score

Here, we considered the platform’s mobile app functionalities, data security controls, and integration options.

5% of Overall Score

We considered user reviews from third-party review sites like Capterra, G2, and TrustRadius. We also checked the ratings and number of reviews, wherein those with 500 or more reviews received higher points.

Other experts who contributed to this article’s rubric assessment include:

- Irene Casucian who conducted the initial software research and objectively scored the rubric based on specific criteria.

- Jessica Dennis who created the rubric’s criteria and selected the products for Robie and Irene to review based on her hands-on experience with HR software, her payroll expertise, and her over six years of experience as an HR generalist.

Frequently Asked Questions (FAQs) About Cheap Payroll Services

The best payroll software for small companies should have a user-friendly interface and offer full-service payroll with tax filing assistance. It should also have the features that most small businesses need, such as direct deposit payments, time tracking tools, and basic HRIS functions to securely store essential employee information.

You can use an Excel spreadsheet or free payroll systems, such as Payroll4Free, if you want to do payroll yourself at zero cost. However, I only recommend these tools if you only pay up to five employees. And since an Excel program and most free payroll tools don’t have automatic tax reporting features, you have to file tax forms yourself.

Several providers offer cheap payroll software, such as the ones on my list. However, don’t just focus on the cost. While affordability is important, consider the features you get for the price. You might be paying a low fee, but if the software requires a lot of manual data inputs and processes, it can lead to payroll errors and potential tax penalties—which can cost you more in the long run.