If you use Mac computers and laptops for your business, it’s important to find a payroll solution that’s intuitive, user-friendly, and ensures you’re paying employees accurately. Besides that, the best payroll software for Mac provides solid pay processing tools, allowing you to access its features across various Apple devices—from Mac computers to iPads and iPhones. With a cloud-based system, you won’t have to worry about Mac compatibility issues, as its tools are accessible online.

In this guide, we looked at a dozen payroll software that work on a Mac and narrowed our list to the nine best options.

- Gusto: Best overall payroll software for Mac and those looking for solid human resources (HR) tools

- QuickBooks Payroll: Best for small business QuickBooks users

- Paychex: Best for solopreneurs and startups who need a dedicated payroll specialist

- Square Payroll: Best for small restaurants, retail shops, and Square POS (point-of-sale) users

- OnPay: Best affordable payroll software with robust system permissions

- Rippling: Best for software integrations and global pay processing

- SurePayroll by Paychex: Best for microbusinesses that need a simple payroll solution

- ADP Run: Best for growing companies that need flexible plans

- Patriot Payroll: Best low-cost payroll with do-it-yourself (DIY) tax filings, although it also offers a full-service package

If you want a computer-installed system rather than a cloud-based solution, you should consider downloadable Mac payroll software that’s easy to use and comes with up-to-date tax tables.

- Aatrix: Best for budget-conscious companies that don’t need cloud-based software

- CheckMark Payroll: Best for small businesses that prefer a downloadable payroll system to print high-security checks

Best Mac Payroll Software Compared

Gusto: Best Overall Payroll Software for Mac Users

Pros

- Reasonably priced plans with an inexpensive contractor-only payroll tier

- Multiple payment options

- Unlimited pay runs with payroll tax filings and year-end reporting

- International payroll services covers 120-plus countries

Cons

- Not ideal for businesses planning to scale to enterprise level (lacks the advanced HR payroll solutions that enterprises need, such as learning management tools and global payroll)

- Next-day direct deposits, hiring, performance reviews, and time tracking available only in higher tiers

Gusto is a cloud-based payroll software that works well for both Mac and Windows computers. Given its reasonably priced plans and user-friendly online payroll tools, Gusto is an ideal pay-processing solution for small business Mac users. Aside from automatic and unlimited pay runs, you get tax filings and payments for federal, state, and local taxes, including year-end W-2 and 1099 reporting. It also offers employee benefits plans and basic HR tools to help you onboard new hires and track staff attendance.

Since our last update: Gusto is no longer offering the Cashout program, which enabled employees to access a portion of their earned salaries between paydays. It also removed the ability to add a 529 college savings account for its users.

With an overall rating of 4.81 out of 5 in our evaluation, Gusto scored perfect marks in pricing, reporting capabilities, user popularity, and our expert review. Many find its online tools easy to use, allowing them to compute and remit employee payments with a few clicks.

Gusto’s payroll dashboard contains helpful links for processing regular to off-cycle pay runs. (Source: Gusto)

Gusto’s affordability and solid payroll tools are just some of the reasons it ranks well in our buyer’s guides. It’s our top choice for small business payroll software. We also recommend it to those looking for HR payroll software and restaurant payroll software for small businesses.

- Simple plan: $49 per month + $6 per person per month:

- Includes full-service payroll, tax filings, payroll tax filings, single-state pay processing, two-day and four-day direct deposits, employee benefits, new hire reporting, offer letter templates, onboarding, and basic support

- Plus plan: $80 per month plus $12 per employee monthly:

- Simple, plus next-day direct deposits, time and paid time off (PTO) tracking, applicant tracking, basic job postings, project tracking, multistate payroll, and full support with extended support hours

- Premium plan: Custom-priced:

- Plus, along with performance reviews, surveys, full-service payroll migration, access to HR experts, direct line to priority phone and email support, and a dedicated account manager

- Contractor-only payroll plan: $35 plus $6 per contractor monthly:

- Full-service payroll, four-day direct deposits, and state new hire reporting

Add-ons

- State payroll tax registration: Pricing varies per state

- HR advisory services for Plus plan only: $8 per employee monthly, which is included for free in the Premium tier

- International contractor payroll: Custom-priced; contact Gusto for quote

*NOTE: Get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

- Multiple direct deposit and pay options: Apart from pay card and pay-on-demand, Gusto offers four- and two-day direct deposits (and a next-day option in higher tiers). Employees can even receive their salaries via the Gusto Wallet app, which lets them set up a spending account with a debit card that works with Apple Pay and Google Pay. However, if you require fast payments, consider QuickBooks Payroll since it offers next- and same-day direct deposits. For instant payouts, we recommend Square Payroll, although you need to have a Square Payments account to pay employees instantly.

- Employee benefits: For small businesses that don’t have an in-house HR team to handle benefits, the provider’s licensed brokers can help you select health insurance plans for your staff and manage online employee enrollments. Gusto offers commuter benefits, health insurance, retirement, college savings, life and disability, health savings account (HSA), flexible spending account (FSA), and pay-as-you-go workers’ compensation options. Note, however, its health benefits, life and disability, FSA, and HSA, are unavailable in 13 states (Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, Vermont, West Virginia, and Wyoming). Consider any other Apple payroll software on our list for benefits coverage that includes all states in the United States.

- Hiring and time tracking tools: Gusto offers basic hiring tools and services that include offer letter templates, electronic signatures, onboarding checklists, new hire reporting, and online document storage. Like QuickBooks Payroll, if you subscribe to Gusto’s higher tiers, you get additional tools for monitoring PTO and tracking your workers’ actual work hours. ADP Run and Rippling offer time tracking solutions as well, but these are paid add-ons. Meanwhile, with Square Payroll, you need to use its Square Team App (for iOS/Android devices) to capture employee clock-ins/outs and import them into its payroll solution.

- Third-party software integrations: Gusto integrates with several software options, such as accounting, expense management, performance, collaboration, time tracking, and POS systems. However, if you want a robust integration network, Rippling is a good choice, as it connects with more than 500 apps.

To learn more about Gusto’s payroll and HR functionalities, read our Gusto review.

QuickBooks Payroll: Best for Small Business QuickBooks Users

Pros

- Fast direct deposits; comes with next- and same-day options

- Unlimited pay runs with payroll tax filings (federal and state)

- Low-cost contractor payments plan

- Seamless integration with QuickBooks accounting

- Has a tax penalty protection program that covers both the provider and its clients’ tax errors

Cons

- Local tax filings available only in the highest tier

- Workers’ compensation and time tracking aren’t included in the basic plan (requires upgrading to at least its Premium plan)

- Lacks international payroll tools

- Health insurance plans doesn’t cover all US states (unavailable in HI, VT, and DC as of this writing)

QuickBooks Payroll offers reasonably priced plans with essential pay processing tools small businesses need. Given that its cloud-based payroll solution can be accessed directly and easily through the QuickBooks system, it saves QuickBooks accounting users time from having to separately set up a chart of accounts and import pay-related data into its platform. Similar to Gusto, it offers unlimited pay runs, full-service payroll, payroll tax filings and payments, employee benefits, online onboarding, and year-end tax reporting.

Scoring 4.56 out of 5 in our evaluation, QuickBooks Payroll was rated favorably for ease of use, payroll functionalities, and HR features—even getting perfect marks in pricing and reporting capabilities. However, it didn’t rank higher than Gusto due to its limited payment options and small number of user reviews (average number of reviews on G2 and Capterra is below 500). In addition, its health insurance plans are not available in all states, and you have to upgrade to its highest tier if you want QuickBooks Payroll’s tax filing services to include local taxes.

In terms of user feedback, reviewers who left reviews on G2 and Capterra said that its simple, yet efficient tools make running payroll easier for them. On the other hand, some users commented that its app can be glitchy and that connecting with its support team via phone can be difficult at times.

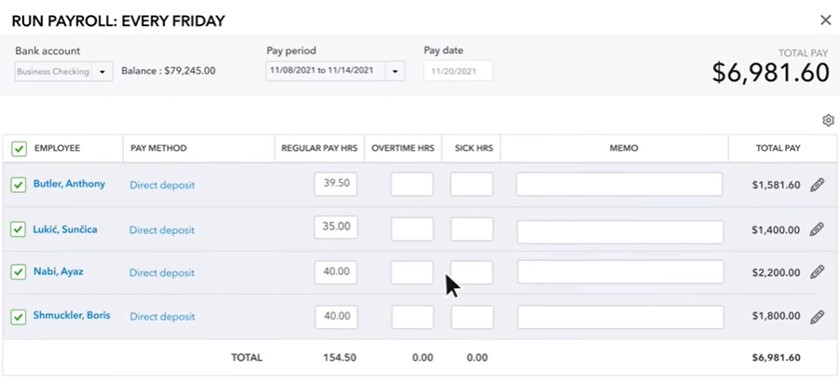

With QuickBooks Payroll, you can directly input overtime hours into its payroll tool for pay processing. (Source: QuickBooks Payroll)

Not only is QuickBooks Payroll one of our best payroll software for Mac users, but it’s also our top-recommended contractor payroll service and payroll solution for accountants.

- Core plan: $50 base fee plus $6 per employee monthly:

- Includes full-service payroll, next-day direct deposit, federal and state tax filings and payments, and access to 401(k) plans and benefits

- Premium plan: $85 base fee plus $9 per employee monthly:

- Core + same-day direct deposit, federal, state, and local tax payments and filings, workers’ compensation administration, and HR support center

- Elite plan: $130 base fee plus $11 per employee monthly:

- Premium plus multiple state tax filing, project tracking, personal HR advisor, tax penalty protection up to $25,000 per year, and expert setup

- Contractor payments package: $15 per month for up to 20 workers; plus $2 for each additional contractor

- Payroll processing: You get unlimited payrolls, wage garnishments, and automated taxes (federal and state) with year-end filings for Forms W-2 and 1099. However, you have to upgrade to its Elite plan if you want automatic local tax payments and filings, too. This is unlike most of the providers on this guide (except if you’re on Patriot Payroll and SurePayroll’s self-service plans, in which you handle tax filings yourself) whose basic plans have tax filing services that cover federal, state, and local taxes.

- Fast payment options: QuickBooks Payroll is the only provider on this list that offers next-day payouts as its standard direct deposit processing timeline. It even has a same-day option for Premium and Elite plan holders.

- Tax accuracy and penalty protection: All plans are covered by QuickBooks Payroll’s tax accuracy guarantee, in which it will pay for any penalties arising from late payments and form submissions—provided that you forwarded the correct tax information and have available funds in your account to pay the applicable taxes. Those on the Elite plan also get an extra tax penalty coverage, wherein QuickBooks will pay for all the penalties (up to $25,000 per year), regardless of who makes the mistake—none of the other providers offer this as an option.

- HR support and tools: QuickBooks Payroll’s partnership with Mineral grants you access to HR advisors and compliance support, as well as customizable job descriptions, onboarding, and performance tools. However, these features, plus time tracking (via QuickBooks Time), are available only for those who subscribe to its higher tiers.

Find more to like about this software by reading our QuickBooks Payroll review.

Paychex: Best for Solopreneurs & Startups That Need Dedicated Payroll Support

Pros

- Flexible plans with a special package for solopreneurs

- Solopreneur tier includes access to payroll, 401(k) retirement plan, and incorporation services

- Dedicated payroll support

- Feature-rich payroll plans; comes with onboarding, recruiting, and learning management tools

Cons

- Pricing isn’t all transparent

- Access to a dedicated payroll specialist is available only in higher tiers

- Time tracking, recruiting, benefits plans, performance reviews, and software integrations are paid add-ons

What’s great about Paychex is that it offers solutions for all business sizes. Aside from its payroll plans for small to large companies, it has a special tier for solopreneurs and the self-employed, which includes payroll, startup/incorporation services, and a retirement plan option. None of the payroll programs for Mac users we reviewed offer a similar package. With Paychex Flex as its main payroll platform, you get solid pay processing tools with essential HR solutions for managing new hire reporting, onboarding, benefits, time tracking, and even learning programs.

Since our last update: Paychex has made some adjustments to its Paychex Flex pricing plans, wherein a few of its solutions are now paid add-ons (like garnishment payment services and document management). The provider also no longer charges extra for payroll tax filings. It has even introduced a new “Paychex Pre-check” tool that lets employees review their paychecks before pay dates.

Scoring 4.53 out of 5 in our evaluation, Paychex posted perfect marks in reporting, HR features, and popularity among users. Its multiple payment options and tax filing services also contributed to its high scores. However, it lost points because not all of its pricing information is available on its website, and it also charges extra for some of its services and solutions, such as workers’ comp payment services, performance reviews, and applicant tracking tools.

In terms of user feedback, those who left reviews on G2 and Capterra appreciate its user-friendly interface and efficient payroll tools. Meanwhile, others said that its software runs slow at times and that the wait times when contacting its support team can be a bit long.

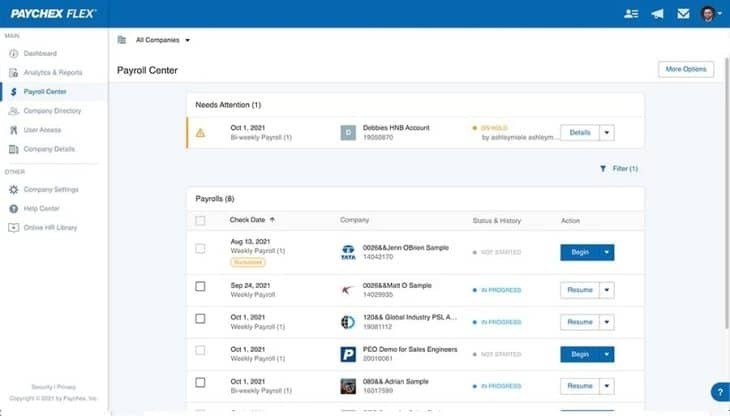

A snapshot of Paychex Flex’s online “Payroll Center” (Source: Paychex)

With Paychex Flex, you can choose from three plans:

- Paychex Flex Essentials: $39 base fee plus $5 per employee monthly:

- Includes full-service payroll, payroll tax administration with year-end tax reporting, new hire reporting, direct deposit option, self-service portals, onboarding, and access to financial wellness tools that include cash flow assistance

- Paychex Flex Select: Custom priced:

- Essentials + learning management and integration with job posting websites and accounting software

- Paychex Flex Pro: Custom priced:

- Select + dedicated payroll specialist, garnishment payment services, pre-employment screenings, custom analytics, state unemployment insurance (SUI) services, an employee handbook builder, and access to the “Paychex Pre-check” feature

For solopreneurs and the self-employed:

- Paychex Solo: Custom priced:

- Includes payroll, self-employed 401(k), and incorporation services

NOTE: Paychex is offering 6 months of free payroll for new clients who sign up before 11/30/2023 and run their first payroll by 12/7/2023.

- Multiple plan options: With Paychex, you can select the payroll plan that fits your business size—regardless of whether you’re a very small company or solopreneur. Its Paychex Solo package comes with all the tools that self-employed business owners will need to pay themselves. And when the time comes for solopreneurs to expand their business and hire workers, Paychex offers multiple payroll packages that even comes with dedicated payroll support and payroll tax filing services. You may need to pay extra for its tax services, but if this is a deal-breaker for you, the other payroll software for Mac (except ADP Run) are great options.

- Employee payments: Paychex lets you pay employees either through direct deposits (two-day and same-day processing), paper checks, and pay cards. It offers paycheck logo and signing services, although it doesn’t stuff checks into envelopes and delivers them to your office as ADP does.

- HR tools: Paychex Flex may be a payroll platform, but it also comes with useful HR features to automate new hire onboarding, candidate screening, and learning management. You can even use its online library of HR documents to view and access business forms and important files, such as company policies. If you need to create an employee handbook, Paychex has an online handbook builder that includes federal and state policies—although, you can also add your company’s policies into the handbook.

Check out our Paychex Flex review to know more about what it offers.

Square Payroll: Best for Small Retailers & Restaurants Using Square POS

Pros

- Flat pricing with an affordable contractor plan

- Seamless integration with Square POS

- Offers fast direct deposits, including an instant payment option

- Unlimited pay runs

Cons

- Next-day direct deposits and instant payments require a Square Payments account

- Standard direct deposit has a four-day turnaround time

- Phone support requires a customer code

Square Payroll is optimal for small restaurants and retail shops already using or planning to use Square POS (learn more about the latter in our Square POS review). Given the seamless integration between the two Square products, data imports of staff tips/commissions and employee attendance (Square POS can capture both information) for pay processing are much easier. Similar to Gusto and QuickBooks Payroll, Square Payroll comes with automatic and unlimited pay runs, as well as payroll tax filings and year-end tax reporting.

Since our last update: Square Payroll has increased its per-employee fees, from $5 to $6 per month.

Scoring 4.5 out of 5, Square Payroll earned 4 and above ratings in nearly all of our criteria. A hard-hit criterion is user popularity, mainly because its average number of user reviews on third-party sites (G2 and Capterra) didn’t reach 500. However, users still gave Square Payroll positive reviews, wherein many raved about its affordability and efficient payroll tools.

You can import employee timecards from Square POS or the Square Team app directly into Square Payroll. (Source: Square Payroll)

- Pay employee and contractors plan: $35 base fee plus $6 per employee monthly:

- Unlimited pay runs, full-service payroll, automatic tax payments and filings, year-end tax reporting, time tracking (via Square POS or Team App), pay-as-you-go workers’ compensation plans, and new hire reporting

- Pay contractors only plan: $6 per person monthly

- Includes everything in the above plan, except workers’ compensation and new hire reporting

- Seamless Square POS integration: Tracking and importing employee time data, as well as tips and commissions, are made easy given Square Payroll’s direct integration with Square POS. This reduces manual inputs while helping you manage payroll effectively.

- Affordable contractor-only plan: Similar to Square Payroll’s “pay employees and contractors” plan, this package comes with unlimited pay runs, full-service payroll, and multiple payment options. It’s also more affordable than Gusto’s contractor plan—costing only $5 per contractor monthly (Gusto’s is priced at $35 plus $6 per contractor monthly). However, if you’re looking for a more budget-friendly option, QuickBooks can help you pay up to 20 contractors for only $15 monthly (plus a $2 fee for each additional worker).

- Multiple payment options: Square Payroll supports employee payments made through manual checks, direct deposits, and its Cash App (for iOS/Android devices). Note, however, that the standard turnaround time for its direct deposits is four days. However, you can pay employees the next day or even instantly if you have a Square Payments account.

- Employee benefits: Square Payroll will provide your employees access to health insurance, pay-as-you-go workers’ compensation plans, and even retirement packages that will automatically sync with your payroll. However, it doesn’t have ADP’s employee discounts, Gusto’s college savings plans, and Paychex’s financial wellness tools.

Read our Square Payroll review to learn more about its functionalities.

OnPay: Best for Companies Looking for Affordable Payroll With Robust System Permissions

Pros

- Reasonably priced plan

- Six-level system permissions for controlling user access and managing pay runs

- Multiple payment options (such as direct deposits, manual checks, and debit cards)

Cons

- Limited third-party software integrations

- Lacks multiple payroll plans that can cater to varying pay processing and HR needs

- No phone support on weekends (only through email)

OnPay is great for budget-conscious businesses, given its flat-rate and reasonable pricing. With monthly fees of $40 plus $6 per employee, you are granted access to all of its features, unlike other Mac payroll software (like ADP, QuickBooks Payroll, Gusto, and Paychex) that require you to upgrade to higher tiers to unlock all functionalities. It’s also ideal for those needing robust system permissions to manage who has visibility into payroll and HR. Its six-level permissions even provide you with enough flexibility to control how you want to run payroll.

In our evaluation, OnPay earned an overall score of 4.3 out of 5. Its affordability, unlimited pay runs, and HR tools for managing PTO, benefits, and new hire onboarding contributed to its high ratings (4 and up). However, it scored the lowest in user popularity given the low number of user reviews in G2 and Capterra (less than 500, as of this writing). Despite this, many users still appreciate its ease of use and intuitive interface. However, some reviewers said that its PTO customization and software integration options are limited.

OnPay’s filter tool lets you select and run payroll by business location and for specific employees. (Source: OnPay)

OnPay offers one plan that costs $40 per month plus $6 per employee monthly. This includes access to all of its features, such as unlimited pay runs, multiple payment options, payroll tax management, onboarding and new hire reporting, PTO management, employee benefits, reporting tools, third-party integrations, and a self-service portal.

- Unlimited payroll runs: Like most of the providers in this guide (except ADP Run), this payroll program for Mac lets you run employee and contractor payroll as many times as you want in a month. Its services include tax payments and filings, as well as year-end tax reporting. This is unlike QuickBooks Payroll, which only offers local tax filings if you subscribe to its higher tiers, and ADP, which charges extra for W-2/1099 reporting at year-end. What’s also great about OnPay is that it can handle the payroll tax filing requirements for agricultural businesses—none of the payroll software for Mac we reviewed offers similar services.

- Essential HR tools: While it doesn’t have ADP and Rippling’s full suite of HR solutions, OnPay offers essential tools to help you streamline onboarding processes and state new hire reporting. It also has an online HR resource library if you need HR guides and legal templates. It even offers HR advisory services, but like Rippling, you have to pay extra if you want one-on-one HR support.

- Employee benefits: OnPay partners with top benefits carriers (like Aetna, United Healthcare, and Humana), allowing it to offer dental, vision, disability, and retirement plans to employees. Unlike Gusto and QuickBooks Payroll health insurance plans (which are unavailable in 13 and three states, respectively, as of this writing), OnPay’s health plans cover all US states.

- Payroll support: If you have payroll inquiries or need assistance using its software, OnPay provides weekday support via phone, chat, and email support. However, you only get email support on Saturdays and Sundays. If you want 24/7 support, consider ADP Run.

Learn more about this software by reading our OnPay review.

Rippling: Best for Businesses That Rely Heavily on Software Integrations & Require Global Payroll Tools

Pros

- Handles both local and international payroll; comes with unlimited pay runs

- Has integrated modular solutions; you can choose modules that you need and want

- Offers IT management of employee apps and devices

- More than 500 integration options

- Provides Employer of Record (EoR) services and a flexible Professional Employer Organization (PEO) solution

Cons

- Pricing isn’t all transparent

- Its workforce management platform is a must-purchase; you can’t buy its other solutions as a standalone product

- HR help desk option with phone and email support costs extra

- Can get pricey for small businesses, depending on the features and modules selected

Rippling’s base program is a workforce management platform with full-service payroll as an add-on module—international payroll included. It has the most integration options in this list of best Mac payroll software, with more than 500 partner apps—from accounting and information technology systems to office management and HR-related solutions. If you purchase its device management add-on, you can buy, set up, secure, and monitor software and company devices (like computers and laptops) that are issued to employees.

Since our last update: Rippling has increased pricing for its information technology (IT) tools, from $5 to $8 per employee monthly. Note that this is based on a quote we received.

Overall, it earned 4.14 out of 5 in our evaluation. Rippling received high ratings (4 and above) in our expert review, reporting, user popularity, HR features, and payroll functionalities. However, it lost points in pricing and ease of use because of its limited pricing transparency and the lack of phone support—you have to pay extra for its HR help desk services that include phone and email support.

In terms of user feedback, those who left reviews on G2 and Capterra raved about its intuitive interface, payroll analytics, and ease of managing benefits. On the other hand, some users complained about having experienced poor customer support and software glitches from time to time.

With Rippling, you can process payroll with just a few clicks. (Source: Rippling)

The Rippling pricing page shows that it charges a starter fee of $8 per employee, per month. However, it is unclear which solution or module this is for. We contacted the provider for pricing information, and in the quote we received, Rippling costs $35 plus $8 per employee monthly. This includes access to full-service payroll, time tracking, employee onboarding and offboarding, software integrations, and its core workforce management platform.

Other Per-Module Costs

- App, device, and computer inventory management: $8 per employee monthly

- Includes IT tools to manage business apps and computer provisioning and deprovisioning processes

- Benefits administration: Pricing varies, depending on your insurance broker

- HR help desk: Custom-priced

- One-on-one email/phone support from HR experts

- Feature-rich HR and IT solution suite: Rippling offers a full HR solution suite that includes recruiting, onboarding, time and attendance, payroll, employee benefits, and learning management. It even has IT products that allow you to manage business apps and computers issued to employees, a feature none of the other providers on our list offer (except Gusto, but it only has basic business app management).

- Full-service payroll: You can pay both employees and contractors via paychecks and two-day direct deposits, although it lacks ADP Run’s check-stuffing services and QuickBooks Payroll’s fast direct deposit timelines (next- and same-day options). If you have a lot of staff transferring from one work location to another, Rippling automatically calculates payroll taxes and files the applicable tax forms with the IRS and other federal, state, and local agencies. It also handles your business’ HR compliance work. This is to ensure that your company is always compliant and up-to-date with the latest laws and regulations, including the use of all relevant forms like I-9s and W-2s.

- International payroll: If you have business locations outside of the US and need to pay your workforce, Rippling can handle international payments in more than 100 countries.

- Flexible PEO: Rated highly in our best PEO companies guide, Rippling can provide you with the expert assistance you need to manage payroll and day-to-day HR operations. And unlike ADP, if you decide that you no longer need a PEO, then you can simply turn off Rippling’s PEO services from your account and start using its software again.

- Third-party software integrations: Among all of the Mac payroll software that we reviewed, Rippling has the most extensive network of third-party software partners. It provides over 500 integration options that include TSheets, Homebase, When I Work, GoodHire, Checkr, SurveyMonkey, Greenhouse, Guru, QuickBooks Online, Xero, Slack, Asana, DocuSign, and Adobe Sign.

Read our Rippling review to find more information about this system.

SurePayroll by Paychex: Best for Microbusinesses That Need a Simple Payroll Solution

Pros

- Unlimited and automatic pay runs

- Affordably priced

- Offers a full-service plan and a basic option with do-it-yourself (DIY) tax filings

Cons

- Charges add-on fees for multiple state and Ohio/Pennsylvania local tax filings

- Software integrations cost extra; with limited options

- Lacks online onboarding

SurePayroll by Paychex offers affordable and simple online tools for calculating salaries, taxes, and other earnings and deductions. This makes it ideal for those with less complex payroll needs, such as small companies and microbusinesses, including household employers wanting to pay their housekeeping staff and nannies (check our nanny payroll buyer’s guide if you have a household employee). Similar to Patriot Payroll, you have the option to save money filing payroll taxes yourself or have the provider manage this for you.

Scoring 4.11 out of 5, SurePayroll by Paychex’s ease of use, reporting capabilities, efficient payroll tools, and affordable pricing helped boost its ratings. It didn’t rank higher on our list given its limited payment options, third-party software integrations, and interface customizability. While its average number of user reviews is below 500, and it isn’t as highly rated (with average scores of 4 and up on G2 and Capterra) as most of the Mac payroll software in this guide, many users left positive feedback that commended its solid customer support, user-friendly interface, and affordably priced plans.

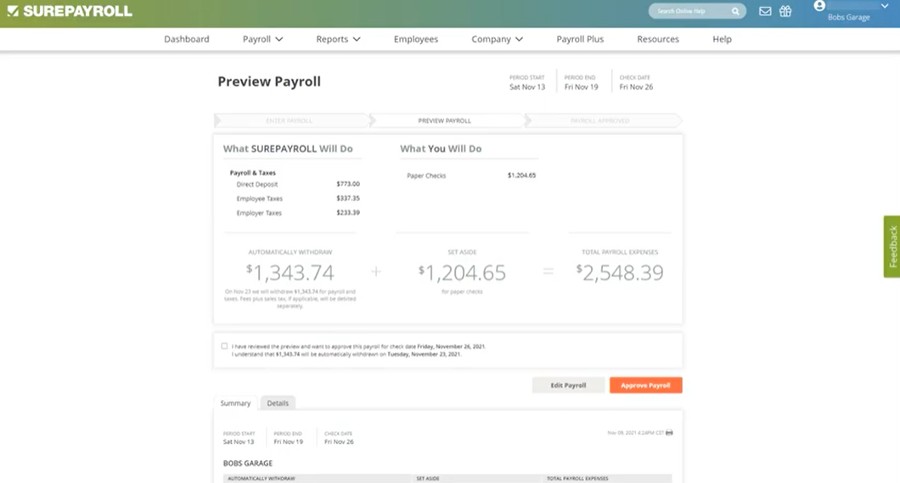

SurePayroll by Paychex lets you calculate payments and pay employees in three easy steps. (Source: SurePayroll by Paychex)

- Self-service plan with DIY tax filings plan: $20 base fee plus $4 per employee monthly:

- Includes unlimited pay runs, auto-payroll, two-day direct deposits, new hire reporting, and access to HR forms

- Full-service package: $39 base fee plus $7 per employee monthly:

- Self-service plus tax payment and filing services

Add-ons

- Multistate tax filings: $9.99 monthly

- Ohio and Pennsylvania local tax filings: $9.99 monthly

- Time clock integration: $9.99 monthly

- stratustime integrated time clock: $5 plus $3 per employee monthly

- Accounting integration: $4.99 monthly

- Payroll processing: Aside from automatic and unlimited pay runs, SurePayroll by Paychex can handle pay processing for contractors, hourly and salaried employees, nannies, and household staff. It also caters to the specific payroll needs of restaurants, agriculture businesses, churches, and nonprofit organizations.

- Payroll tax filings: While self-service plan holders have to remit tax payments and file tax forms on their own, those on the full-service tier are assured that SurePayroll by Paychex will handle all tax payments and filings for them. Aside from W-2 and 1099 reporting, it can also help you file 940, 941, W-3, and 1096 tax forms, as well as 1040-ES and Schedule-H for nanny taxes. Further, all tax filings are covered by SurePayroll by Paychex’s tax accuracy guarantee in which it will pay all penalties for tax errors made by its representatives. However, it isn’t as robust as QuickBooks Payroll’s tax penalty protection (for its Elite plan subscribers) that covers even the tax mistakes you might make.

- Preemployment screening services: Make better hiring decisions with SurePayroll by Paychex’s screening services, which include background checks, behavioral assessments, skills testing, and drug screening. For your current employees, SurePayroll by Paychex can help provide professional growth guidelines and identify their strengths/development opportunities through its “personal development inventories” solution.

- Third-party software integrations: It integrates with some accounting and time clock software like QuickBooks, Xero, stratustime, and TimeForge. However, unlike most of the providers on this list, you have to pay extra for software integrations.

Read our SurePayroll by Paychex review for more details about this system.

ADP Run: Best for Companies That Need Flexible Plans That Scale With Their Business

Pros

- Feature-rich platform with a wide range of HR tools

- Offers direct deposits and secure paychecks with advanced fraud protection

- Advanced HR support available

Cons

- Pricing isn’t transparent

- Benefits, time tracking, and workers' compensation are add-on products

- Year-end reporting costs extra

- Lacks unlimited pay runs

ADP Run has a suite of cloud-based payroll and human capital management solutions. It’s great for businesses that plan to scale because it has a wide selection of products to fit your company’s growing HR and payroll software needs. It also has payroll packages for small businesses to large enterprises, including a PEO option. This enables businesses to upgrade their ADP plan easily without having to change providers and get extra HR support if the need for a team of HR professionals and experts arises.

Earning an overall rating of 4.07 out of 5 in our evaluation, the criteria where ADP scored high (4 and up) includes HR features, payroll tools, ease of use, reporting capabilities, and our expert review. It’s also highly rated by users, given its easy-to-use interface and robust solution suite. However, ADP scored the lowest in pricing because it lacks unlimited payroll and transparent pricing.

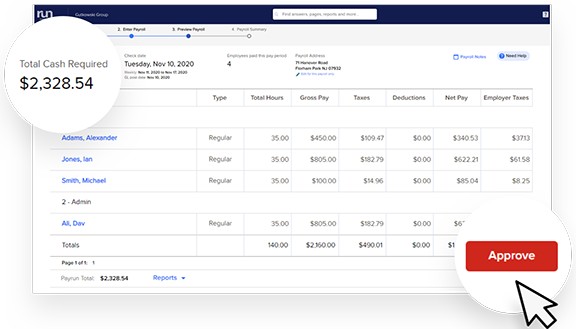

ADP Run provides a preview of your pay run’s total cash requirements, allowing you to easily click “Approve” and pay employees. (Source: ADP Run)

- Essential plan: $49 base fee + $2.50 per employee, per weekly pay run*

- Includes payroll processing, direct deposit, tax payment and filings, customizable reports, employee self-service portal, and new hire onboarding

- Enhanced plan: Custom-priced

- Essential + state unemployment insurance management, ZipRecruiter job postings, and background checks

- Complete plan: Custom-priced

- Enhanced + expert assistance

- HR Pro plan: Custom-priced

- Complete + Enhanced HR help desk, which includes scheduled check-ins and one-off questions with ADP’s HR business advisers

*Pricing is based on a quote we received

- Multiple pay options: You can pay your employees via direct deposits, paychecks, and a Wisely direct debit card. If you prefer paychecks, ADP Run has check signing, stuffing, and delivery services—wherein it will send the checks to your business just in time for you to hand them out to employees. None of the other Mac payroll software we reviewed offer paycheck stuffing services.

- Secure paychecks: ADP offers highly secured payroll checks, which come with 10 advanced fraud protection features, that your company’s designated approver can sign off. None of the software on our list has this feature.

- Payroll tax support: ADP Run automatically calculates, pays, files, and reconciles payroll taxes (federal, state, and local). In addition, you get tax compliance support, wherein ADP will respond to tax agencies in case they have questions about tax deposits and returns that the provider made for you. However, year-end tax reporting costs extra. Plus, it lacks QuickBooks Payroll’s tax penalty protection that covers even your tax mistakes.

- Hiring solutions: What’s great about ADP is that aside from payroll, new hire reporting, and employee onboarding, you have additional access to basic hiring tools that include background checks and job postings on ZipRecruiter—provided you subscribe to its higher tiers. Rippling and Paychex require you to purchase a separate recruitment module, while Gusto offers its applicant tracking and job posting tools in its higher plans. The other Apple payroll software on our list lacks hiring capabilities.

To learn more about what this software can offer, read our ADP Run review.

Patriot Payroll: Best for Small Businesses Looking for Low-cost Payroll With DIY Tax Filings

Pros

- Unlimited pay runs

- Affordable pricing

- DIY tax filing option available (aside from the full-service payroll package)

- Integrated solutions for time tracking, accounting, and basic HR

Cons

- Full-service garnishment or child support payments are not available

- Limited integration options

- Lacks online onboarding

- Accounting, time tracking, and basic HR modules are paid add-ons

Similar to SurePayroll by Paychex, Patriot Payroll offers affordably priced plans that come with DIY tax filings and full-service payroll. With its Basic plan, you get all the tools for calculating salaries, earnings, and deductions, including withholding payroll taxes, although you’ll need to get its Full Service plan if you want Patriot to handle tax filings and year-end reporting for you. However, its Basic plan with DIY tax filings is more low-cost than SurePayroll by Paychex, costing only $17 plus $4 per employee monthly (SurePayroll by Paychex’s basic package is priced at $20 plus $4 per employee, per month). This is great for small businesses with fewer than 10 employees and employs in-house payroll specialists who can remit tax payments and file tax forms.

Scoring 4.02 out of 5, Patriot Payroll earned high ratings (4 and up) in nearly all of our criteria. It lost points due to its limited HR functionalities and report customization options. Plus, you have to pay extra to get its time tracking tool and basic HR module, which lets you manage employee data and run HR reports. However, many users appreciate its efficient payroll tools and user-friendly platform. Others even commended its support team for being helpful and knowledgeable.

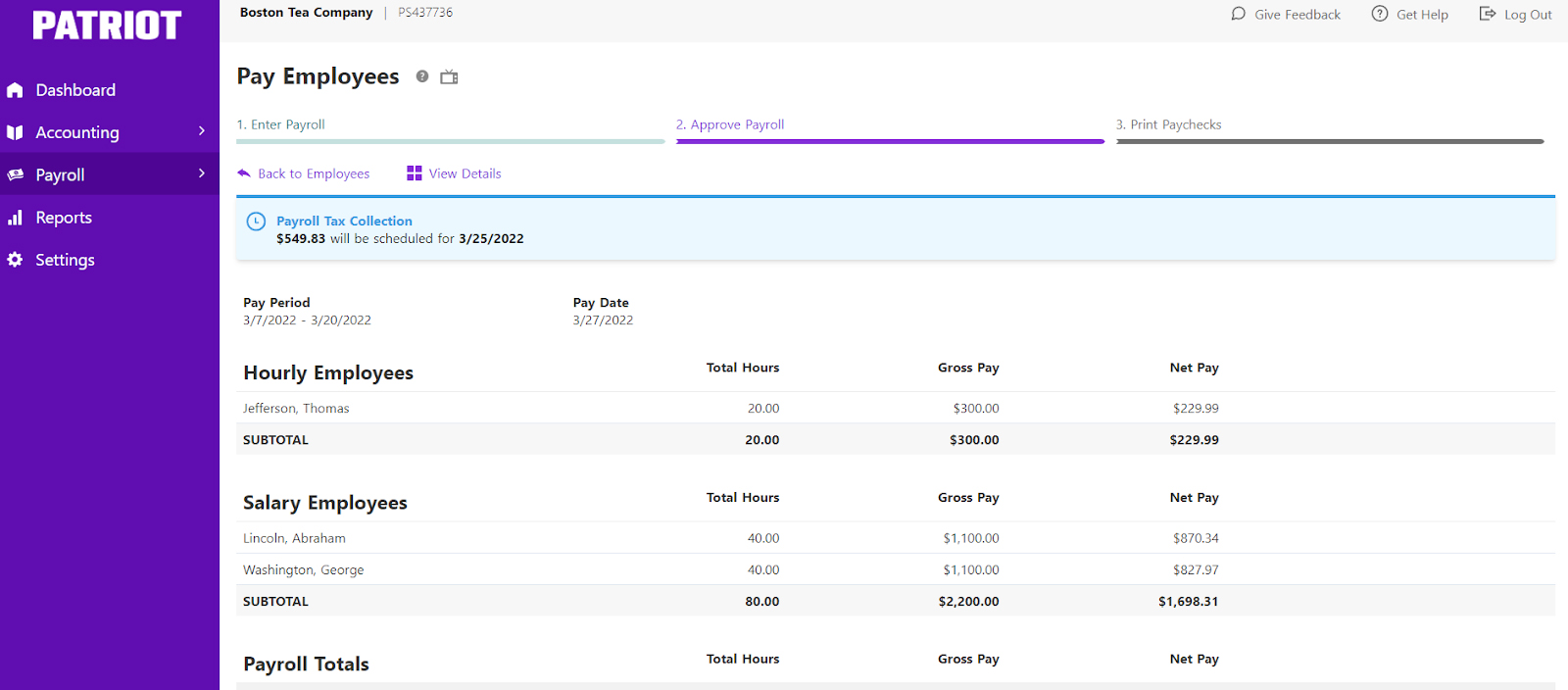

With Patriot Payroll, you can complete pay runs in three easy steps. (Source: Patriot Payroll)

- Basic plan: $17 base fee plus $4 per employee monthly:

- Includes unlimited pay runs, time-off accruals, electronic W-2s, direct deposit payments, an employee self-service portal, and accounting software integration with QuickBooks

- Full service plan: $37 base fee plus $4 per employee monthly:

- Basic plus tax payment and filing services

Add-ons

- Time tracking: $6 base fee plus $2 per employee

- HR software: $6 base fee plus $2 per employee:

- Basic employee data management and HR reports

- Multistate tax filings: $12 monthly for each additional state

- 1099 e-filings (for Basic Payroll subscribers only): $20 for up to five 1099 e-filings; an additional $2 per 1099 is required for six to 35 filings (no additional charge for 36 or more)

- Solid payroll tools: Patriot Payroll can handle pay runs for both employees and contract workers. It supports multiple pay rates and has a list of standard hours, deductions, and money types, but you can add your own for other company-paid contributions and deductions.

- Easy bonus calculations: Its “Net to Gross Payroll” tool allows you to input bonus amounts you want to give to your staff, and Patriot will automatically gross it up for taxes. None of the other software in this guide offers this feature.

- Optional 1099 filings for Basic plan subscribers: If you don’t want to prepare paper forms for 1099 filings, you can use Patriot Payroll to generate electronic forms. Unlike SurePayroll, Patriot offers this as an optional service to its basic plan subscribers. The provider will even send 1099-NEC and 1099-MISC forms to the appropriate government agencies for you.

To know more about this software, read our Patriot Payroll review.

How We Evaluated the Top Payroll Software for Mac

In finding the best payroll software for Mac users, we compared several reputable providers and looked for essential features like automatic payroll runs, direct deposits, payroll tax payments and filings, and whether it offered basic and customizable payroll reports. We also considered its ease of use, pricing, customer support, and feedback from users.

Click through the tabs below for a more detailed breakdown of our evaluation criteria.

20% of Overall Score

Aside from the low or high cost of monthly subscriptions (wherein anything below $50 monthly for one employee is best), it’s beneficial if the provider offers multiple plan options, unlimited payroll runs, and zero setup fees.

20% of Overall Score

Automatic payroll runs, payroll tax processing (federal, state, and local), year-end tax report preparation and filing, and direct deposit processing time of two days or less are just some of the essential functionalities that we looked at. We also checked whether or not the provider offered a penalty-free guarantee—in case they make a mistake when processing the client’s payroll.

20% of Overall Score

15% of Overall Score

15% of Overall Score

In this criterion, we assess whether the software’s ease of use, pricing, and the width and depth of its payroll and HR tools are ideal for small and medium-sized businesses (SMBs).

5% of Overall Score

We considered online user reviews, including those of our competitors like G2 and Capterra, based on a 5-star scale, wherein any option with an average of 4-plus stars is ideal. Also, software with 1,000 or more reviews on third-party sites is preferred.

5% of Overall Score

Aside from having access to basic payroll summaries, users should be able to customize and create new reports within the system.

Payroll Software for Mac Frequently Asked Questions (FAQs)

Can you do payroll on QuickBooks for Mac?

Yes, you can—provided you’re using QuickBooks Online Payroll. This system is cloud-based, allowing you to access it on web browsers, with no software download needed.

What is the cheapest way to run payroll?

If you only have a handful of employees (fewer than 10), you can use free payroll software or run payroll in Excel. For those comfortable handling payroll taxes, Patriot Payroll and SurePayroll by Paychex offer affordable payroll plans with DIY tax filings.

Small business owners can also look for reasonably priced payroll software, like Gusto and OnPay. These systems come with compliance and workflow automation tools, saving you time from manually tracking labor regulations and managing payroll processes.

Is free payroll secure?

Leading free payroll software, including paid systems, comes with standard security tools like data encryption, passwords, user access controls, and secure online data storage solutions.

Bottom Line

Just because you’re a Mac user doesn’t mean that you get limited access to payroll software. There are plenty of online payroll solutions that are easily accessible using Mac OS or iOS. Many of these options have the essential tools you need to process employee salaries. What’s important is finding the best payroll service that can handle your company’s needs.

Based on our evaluation, we found Gusto to be the best overall payroll software for Mac users. With its cloud-based platform, you can easily access it through any device. It also offers affordably priced plans with fees that start at $40 plus $6 per employee monthly. This makes Gusto an ideal option for small businesses that want quality services at reasonable rates.

Sign up for a Gusto plan today and see how its online tools can help streamline your payroll processes.