Helcim and Square are both excellent merchant accounts that often place high on our evaluations for multiple uses. Helcim is best known for its affordable interchange-plus rates and monthly fees, as well as invoicing, point-of-sale, and ecommerce tools.

Meanwhile, Square has fixed-rate pricing but a premium POS system, top-notch free ecommerce and invoicing, and a whole range of additional tools to grow with your business.

Helcim vs Square Quick Comparison

|  | |

|---|---|---|

Our Score (out of 5) | 4.44 | 4.53 |

Best for | Midsize to large and international businesses, B2B | Small businesses |

Fee Structure | Interchange-plus | Flat rate |

Monthly Fee | $0 | $0 |

Chargeback Fees | $15 | Waived up to $250/month |

POS Monthly Fees | $0 | $0-$165+ |

Deposit Times | 2 business days | 1-2 business days, or same-day for 1.5% fee |

Integrations/Extensions | Limited | Extensive |

Customer Support | Extended hours | Extended hours |

4.26 | 4.69 | |

Our reviews |

You’ll find both Helcim and Square in our lists for:

- Best merchant services

- Best payment gateways

- Best retail payment processors

- Best online payment processors

- Cheapest credit card processing companies

- Best free merchant accounts

When to Use Helcim

Pros

- No monthly fee or long-term contracts

- Interchange-plus pricing, with automatic volume discounts

- You can choose to pass card processing fees on to customers

Cons

- Strict approval process

- Limited business integrations

- Lacks option for same- and next-day funding

You should choose Helcim over Square in the following scenarios:

- If you are a midsize to large business with high sales volume, the interchange-plus pricing and automatic volume discounts will help you save on fees.

- If you need a B2B sales payment solution or make international sales, Helcim’s wide range of supported payment types will make transactions faster and easier. Helcim is one of our leading B2B payment solutions and best international merchant accounts.

When to Use Square

Pros

- Free POS and online store

- Easy-to-use, intuitive system

- Multiple business add-ons, including payroll and banking

Cons

- Some account stability issues

- Limited support hours

- Features exclusive to Square ecosystem

You should choose Square vs Helcim in the following scenarios:

- If you are a restaurant or offer services rather than products, Square has better industry-specific tools for these business types (Square for Restaurants and Square Appointments).

- If you process lots of mobile payments (Square is our top pick among the best mobile credit card processors).

- If you are a small or new business that needs a quick, reliable, low-cost option (Square is the best overall free merchant account).

Alternatives

|  |  | |

|---|---|---|---|

Best For | Online payment processing | Surcharge and recurring bills | High-risk merchants |

Monthly Software Fees | $0 | $99+ | $10-$45 |

Payment Processing Fees | From 2.7% + 5 cents | Interchange + 8 cents to interchange + 15 cents | 2%-4.3% Interchange rates available |

International Payment Processing | 135 currencies | 2 currencies | Charges 1% to 2% for cross-border payments |

Integrations | 1,000+ | 15+ | 1,000+ |

Best for Pricing & Contract Terms: Helcim

|  | |

|---|---|---|

4.56 out of 5 | 4.31 out of 5 | |

Monthly Fee | $0 | From $0 |

Card-present Payment Processing | Interchange plus 0.15% + 6 cents to 0.4% + 8 cents | 2.6% + 10 cents |

Keyed-in or Online Payment Processing | Interchange plus 0.15% + 15 cents to 0.50% + 25 cents | 3.5% + 15 cents (keyed) 2.9% + 30 cents (online) |

Invoice Payment Processing | Depends on payment type | 3.3% + 30 cents (cards) 1%, min. $1 (ACH) |

ACH/e-Check fees | 0.5% + 25 cents, $5 return fee (ACH, domestic wire transfers) | 1%, min. $1 (ACH) |

QR Codes for Contactless Payments | Interchange plus 0.15% + 15 cents to 0.50% + 25 cents | 2.9% + 10 cents per transaction |

Chargeback Fees | $15 refundable | Waived up to $250/month |

POS Monthly Fees | $0 | $0-$165+ |

Card Reader Pricing | $99 | First magstripe reader free, $59 for chip and contactless reader |

Hardware Prices | $329+ | $299-$799 |

Helcim says that its average rates are 1.83% + 8 cents for in-person processing and 2.27% + 25 cents for online. Like Square, it offers free POS, online tools, and invoicing, but its interchange-plus pricing is generally cheaper.

It also reduces rates as your volume increases, making it even more affordable as you do more business. These volume discounts pushed me to place Helcim higher than Square in the pricing category. Helcim has also reduced the pricing for both its mobile card reader and smart terminal hardware, which bolstered its score for this category.

While Helcim’s fees are lower, Square’s hardware is less expensive—in fact, the first card reader is free. Square also offers POS systems that are cheaper, while Helcim requires a computer or tablet. Finally, Square does not charge for chargebacks up to $250 per month, which is generally sufficient for small businesses.

Learn more about Square’s pricing and fees.

Most Supported Payment Types: Helcim

|  | |

|---|---|---|

5 out of 5 | 4.88 out of 5 | |

Payment Types | ACH payments, card-on-file transactions, virtual terminal, invoicing, recurring payments, payment links, hosted checkout, buy buttons, buy now pay later, Tap to Pay for iPhone | ACH payments, card-on-file transactions, virtual terminal, invoicing, recurring payments, payment links, hosted checkout, buy buttons, buy now pay later, Tap to Pay for iPhone |

Mobile Payment | ✓ | ✓ |

B2B | ✓ | ✕ |

International Payments | Supported currencies: US and Canada | Supported currencies: US, Canada, Australia, Japan, the United Kingdom, Republic of Ireland, France, and Spain only |

Marketplaces (eBay, Amazon) | ✓ | ✕ |

Social Selling | ✓ | ✓ |

Subscriptions/Recurring Bills | ✓ | ✓ |

Buy Now Pay Later (BNPL) | ✕ | ✓ |

Ecommerce Integrations | 2 shopping carts, 1 billing system | 52 ecommerce, 52 delivery, 22 invoicing, 12 ticketing and events |

Helcim earned a perfect score for payment types, offering everything on our list. Of particular note is the Level 2 and 3 payment processing, which makes it a superior choice to Square for B2B merchants. It also handles cross-border payments, which makes it a better choice if you are selling in a different country, such as at an international trade show.

To top it all off, Helcim also offers a Fee Saver feature, which allows merchants to pass processing fees onto customers. As long as you accept card and ACH payments, and are using the Helcim Smart Terminal, the Fee Saver feature is available to you.

One area where Square has an advantage over Helcim is that it supports buy now, pay later sales through Afterpay. While the fees are higher than regular transaction fees, it’s a great incentive for retailers to encourage patrons to spend more. Square also features more ecommerce integrations than Helcim and is offered in more countries.

However, it does not have cross-border payment functionality. You can only accept payments in your home country—including international payments, if needed.

Best Features: Square

|  | |

|---|---|---|

3.5 out of 5 | 4.19 out of 5 | |

Integrations/Extensions | Limited; accounting, some ecommerce | 100+ for accounting, scheduling, delivery, ecommerce, forms, healthcare, invoicing, inventory, marketing, restaurants, team management, events, and more |

Additional Business Tools | None | Business loans, savings and checking accounts, product photography, business events |

Deposit Speed |

|

|

Chargeback Protection | $15; Dispute management dashboard, Helcim refunds the charge for disputes settled in your favor | Waived up to $250/month |

Fraud Prevention | Secure card vault with tokenization, dispute management, Fraud Defender (risk estimation tools) | Machine learning, dispute management, risk manager program |

POS Systems | Free, general use | Free, general use; specialized advanced plans for retail, appointment/service, restaurant |

POS Hardware | Card reader, handheld; can use on mobile, computer, laptop, or tablet for counter POS | Free magstripe reader; card readers, handheld, full counter POS system with some accessories (like kitchen display); can use on tablets or mobile |

Offline Mode | ✕ | ✓ |

Virtual Terminal | ✓ | ✓ |

Mobile App Scores | 2.5 out of 5 stars on iOS 3 out of 5 stars on Android | 4.8 out of 5 stars on iOS 4.7 out of 5 stars on Android |

Subscriptions/Recurring Bills | ✓ | ✓ |

Customer Survey | ✕ | ✓ |

Add-on Features | None | Advanced POS, Loyalty, Team Management, Marketing, Payroll |

Point of Sale

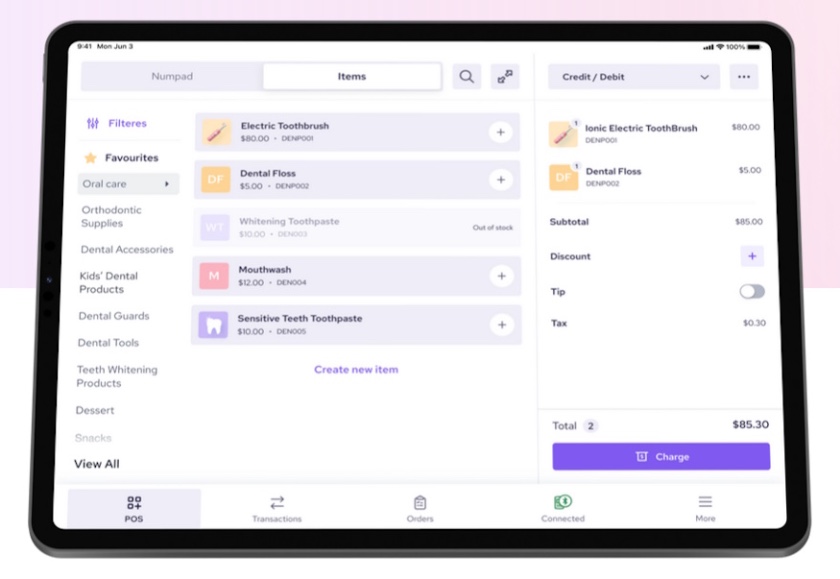

Helcim offers a free POS system that comes with basic inventory, stores customer information, tracks sales history, and manages employees. It does not have time-tracking or loyalty tools, however. Thus, it’s better for high-volume businesses that don’t need a lot of POS tools or that are getting additional functions through other programs.

The hardware is likewise basic. Designed to work on the cloud, Helcim’s POS system can be used on a computer or laptop as well as mobile. It also offers a handheld system and a mobile card reader, but they are both more expensive than Square’s. It should also be noted that the Helcim app has low customer scores, especially when compared to Square.

Fraud Protection

Helcim has strong protection with its Fraud Defender program. Fraud Defender evaluates each transaction based on data like IP address, shipping and billing location, and card security code, and scores it by risk. With automatic protection settings, it can void transactions that don’t meet your set acceptable risk score.

By comparison, Square has a Risk Manager program that lets you set rules for accepting or rejecting a transaction, though I found it somewhat lacking—it only works for online and eGift card transactions.

Customer Support

Like Square, Helcim has extended-hours customer support. In addition, Helcim has a comprehensive help section that includes video demos. (Square’s help section is excellent as well.)

Point of Sale

Point-of-sale systems is where Square really shines. Its POS ranks high on most of our POS evaluations because the free plan offers all the most important tools you need, from register functions to inventory management, yet it also offers advanced plans for restaurants and appointment businesses. For example, Square for Restaurants can integrate with delivery services or aggregators like Deliverect and works with kitchen display systems.

It can handle multiple locations, and while it has handheld and countertop hardware, you can easily use it on its high-ranking mobile app. If you need loyalty, marketing, time clocks, or even payroll tools, Square has you covered, though you will need to pay extra for some advanced features. That said, even the free plan is fairly extensive, which gives Square lots of points in my view.

Fraud Protection

Helcim has a more robust fraud protection program, but for online transactions, including eGift cards, Square has Risk Manager. This program lets you set up rules for sending risk alerts, such as Square’s own risk evaluation, AVS mismatch, invalid CVV, or suspicious transaction amounts. You can also defeat repeated fraud attempts by blocking suspicious cards or payments. The software provides analytics that help you spot fraud patterns and further optimize your rules and alerts.

In addition, Square does not charge for chargebacks up to $250 per month—something that would give me a lot of peace of mind as a merchant. Helcim charges a refundable $15 per chargeback.

Additional Business Tools

Unlike Helcim, Square offers services that go beyond payment processing. These, of course, have their own pricing, but you can use Square to manage your payroll, secure employee benefits that include workers’ compensation, health insurance, and 401(k), or run time tracking and scheduling. You can get a checking or savings account and apply for loans. Everything integrates with Square to make things faster and easier to run.

Expert Score: Square Wins

We determined the expert score based on our own experience of ease of use, affordability, and transparency of pricing—all of which both Helcim and Square did well on. We also considered the number and ease of integrations and what real-world users had to say about the services as recorded in third-party user review sites like Capterra and G2.

Helcim earned a higher overall score for pricing and contract terms than Square did. Unlike other interchange-plus merchant services, Helcim does not charge a monthly fee nor does it require a contract. We found the software overall very easy to use, and Helcim has remarkably few complaints for issues like held funds.

It does not offer many integrations, particularly when compared to Square, but it has a strong API for creating your own, and it offers excellent ready-made tools for accepting payments.

Helcim also fell behind Square in popularity because it does have an approval process (one reason why it has fewer held-fund issues), which means it has fewer users.

Helcim’s average user-review score is slightly lower than Square’s. People complained about the card terminal, and one customer mentioned a steep learning curve for the software. However, most people praised the customer support and overall product.

Square’s easy-to-use POS and ecommerce tools and transparent pricing make it a favorite with us as well as with small business owners. You’ll find it on many of our best-of lists. Real-world users over multiple review sites scored Square highly and praised the ease of use and flexibility of the system.

Square also has a plethora of integrations for all aspects of business, although other merchant services (like Stripe) are far better for integrating with other software.

Square lost points because it has a higher number of complaints about held funds and similar issues. Unlike Helcim, it does not vet new customers, so this can lead to issues in the early months or if there are sudden changes in your sales. Some Square users also complained of inconsistent customer support, with lower-quality service sometimes being noted for free-plan users.

Methodology: How We Compared Helcim and Square

Helcim and Square both underwent extensive testing for our list of best merchant services providers. For that list, we evaluate each product for what it offers, ease of use, real-world user response, and more. We compare pricing for methods, fees, terms, and rates. Then, we consider how different products work for individual use cases and types of merchants.

Click through the tabs below for our overall merchant account evaluation criteria:

30% of Overall Score

For pricing and contract, Helcim scored higher, with 4.56 out of 5, while Square achieved 4.31. They both have monthly pricing and reasonable rates, but Square’s lack of interchange-plus pricing placed it below Helcim.

30% of Overall Score

We looked at the variety of payment types each account accepted. This included not only POS and mobile payments from swipe to tap but also ecommerce transactions, ACH and e-check payments, and free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

Here, Helcim took the lead with a perfect 5 out of 5, with Square earning 4.88 out of 5. Helcim works with B2B payments and cross-border payments, while Square does not.

20% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Free same-day or next-day funding earned bonus points. We also looked for affordable and flexible hardware options as well as business management tools, like dispute and chargeback management, reporting, or customer management.

Square took the lead with 4.19 out of 5, while Helcim earned 3.5 out of 5. Deposit speed and available hardware gave Square the edge over Helcim.

20% of Overall Score

We judged each system based on four items: pricing and advertising transparency, ease of use (including account stability), popularity and reputation, and how well each system works with other popular small business software, such as accounting, POS, and ecommerce solutions.

Square won this category with 4.69 out of 5, while Helcim almost caught up with a score of 4.38. However, Helcim earned a higher score for ease of use, while Square is more popular.

Frequently Asked Questions (FAQs)

Click through the sections below to learn more about the differences between Helcim and Square and the advantages of each.

Helcim differs from Square in that it offers interchange-plus pricing instead of a flat rate. Interchange-plus pricing takes what credit bureaus like Mastercard or American Express charge for processing, then adds a small amount to it, usually an additional percentage or a few cents per transaction. This means how much you pay per transaction can vary, even by type of card, but it is usually cheaper than a flat rate like Square charges.

The interchange-plus pricing definitely puts Helcim ahead of Square if you do high-volume sales and if you don’t need the extra tools Square offers (like a restaurant POS system). Helcim also handles Level 2 and 3 credit card processing. These are special rates for businesses and government agencies, which are even lower than standard commercial interchange rates.

Square strives to be a complete business finance institution. As such, in addition to powerful payment processing tools like multi-use POS systems and ecommerce, it has payroll, savings accounts, and loans. It also has staffing solutions like scheduling and benefits.

Bottom Line

When it comes to choosing between Helcim or Square, the real question is what you need. Helcim has a reasonably strong toolset for sales, and interchange rates that are generally lower than what you’ll get from Square. It’s best for high-volume sales and medium and large companies.

Square, on the other hand, has somewhat higher fees, but a first-rate POS system with lots of integrations and additions, from appointments to payroll, that make it great for the small business wanting a complete package.