Unlike most states, Alaska has no state income tax, but it does charge state unemployment taxes (SUTA), as is typical. Its payroll and HR laws are straightforward, although the child labor laws should be reviewed. There’s also a law concerning paying for transportation into and out of the state for employment—something unique to Alaska’s remote location and seasonal work. Learn more about how to do payroll in Alaska and the stat’s intricacies below.

Key Takeaways:

- Alaska has no state personal income tax

- Minimum wage is $10.85 per hour, and no tip credit is allowed

- If an employer pays an employee’s travel to Alaska for work, they must also pay for the employee’s return

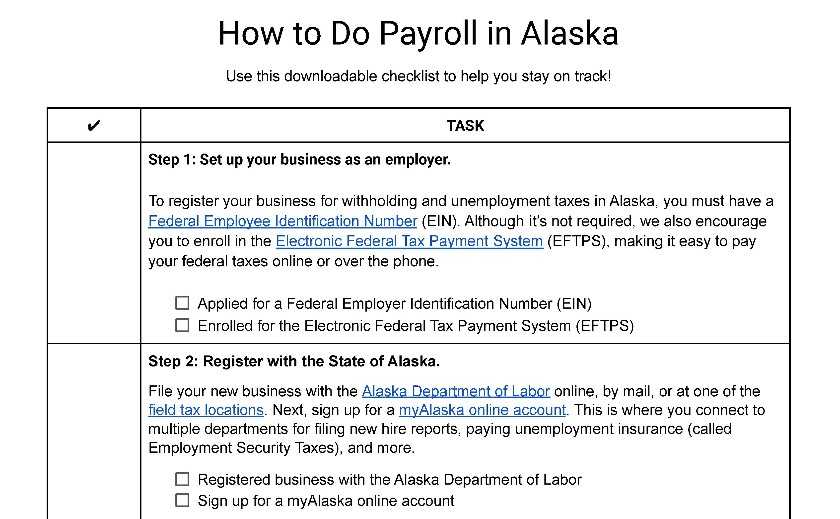

Step-by-Step Guide to Running Payroll in Alaska

Step 1: Set up your business as an employer. At the federal level, you need your Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with the State of Alaska. File your new business with the Alaska Department of Labor online, by mail, or at one of the field tax locations. Next, sign up for a myAlaska online account. This is where you connect to multiple departments for filing new hire reports, paying unemployment insurance (called Employment Security Taxes), and more.

Step 3: Set up your payroll process. Create a set schedule of paydays that are monthly or semimonthly as agreed upon with your employees. You can process payroll by hand (not the most efficient way), set up an Excel payroll template, or sign up for a payroll service.

Step 4: Collect employee payroll forms. Certain payroll forms are best filled out during employee onboarding. These include the W-4 form, I-9 verification, and direct deposit information. Alaska has no additional forms for employees to fill out.

Step 5: Collect, review, and approve time sheets. You must collect and approve time sheets before submitting payroll. You can use paper time sheets, but we recommend time tracking software that can save you time and ensure the accuracy of reported hours.

Step 6: Calculate payroll and pay employees. You can use software, a calculator, or even Excel to calculate payroll. There are multiple ways to pay employees legally, including check, direct deposit, pay card, and even cash.

Step 7: File payroll taxes with the federal and Alaska state governments. Follow the IRS instructions for federal taxes, including unemployment.

- Alaska Income Taxes: There are none, so there’s nothing for you to do.

- SUTA: The state mails you your contribution report by the end of the quarter. Even if you don’t get a contribution report or don’t owe anything, you must file and pay (if applicable) by the due dates below. You need to file online if you have 50+ employees in a quarter, generate more than $1 million in taxable wages in the current or preceding calendar year, or have a payroll agent file for you. Otherwise, you can pay online or via mail with Form TQ01C.

For Wages Paid During | Calendar Quarter Ends | Must be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

Step 8. Document and store your payroll records. Alaska requires you to keep records on employees for at least three years. SUTA information needs to be kept for five years. Information should include name and Social Security number, beginning and ending dates for periods worked, total wages in each period, and payroll information like wages earned, hours worked, and special payments. Learn more in our article on retaining payroll records or see Page 10 of the Alaska Unemployment Insurance Tax Handbook.

Step 9. Process annual payroll reports. Send the federal W-2 form (for employees) and 1099 form (for contractors) before Jan. 31 of the year following your reporting year. With no state income tax, there are no additional forms for you to file.

Download our free checklist to help you stay on track while you’re working through these steps:

New to payroll? Read our general articles on how to do payroll and how to ensure your payroll is compliant with regulations. Then read on for more on Alaska payroll law and taxes.

Alaska Payroll Laws, Taxes & Regulations

No matter what state you are in, you must follow federal law for income taxes, Social Security, Medicare, and federal unemployment insurance (FUTA). Learn more in our articles on FICA taxes and FUTA.

Alaska Taxes

Alaska does not charge income taxes, but it does have unemployment insurance taxes of 1% to 5.4% and requires workers’ compensation insurance for all employers.

State Income Taxes

There are no state income taxes here. However, make sure to file your federal income tax withholdings, which include 12.4% for Social Security (6.2% to be withheld from your employee’s paycheck and the other half from your bank account) and 2.9% for Medicare (1.45% to be withheld from your employee’s paycheck and the other half from your bank account).

Unemployment Insurance

Alaska charges state unemployment insurance taxes (SUTA), which it calls Employment Security Tax (ES). While most states base this on your direct benefits costs, Alaska measures changes in your payrolls to approximate benefits costs. It says this method keeps the unemployment fund solvent and is simpler and cheaper to administrate. You file online or via mail with the TQ01.

SUTA is charged on the taxable wage base of that year, which is defined as 75% of the statewide average annual earnings of workers covered by the program. In 2023, the wage base is $47,100.

The tax rates vary by your experience factor, which depends on the class of employer you are and your payroll decline over the past 12 quarters. There are 21 levels, ranging from 1% to 5.4%. You can see the rates on Alaska’s Dept. of Labor website and a full explanation of how the unemployment is calculated.

Alaska’s SUTA excludes some large, stable businesses like state and municipal governments and some nonprofits. Sole proprietors, partners, and LLC members are exempt from ES, but you may choose to have your excluded employees included so that they may be eligible for UI benefits. However, there are some rules to follow—see the Alaska Unemployment Insurance Tax Handbook for details.

Workers’ Compensation Insurance

Alaska requires you to have workers’ compensation if you have one or more employees in the state. You can find insurance companies on the Alaska DOL website.

Some exceptions to this rule are:

- Sole proprietors, partners, members of an LLC or executive officers with a minimum of 10% ownership, and executive officers of nonprofits

- Babysitters

- Housekeepers

- Harvest or transient help

- Entertainers under contract

- Cab drivers in some cases

- Professional hockey players and coaches

- Real estate agents in some cases

- High school students in work-study

- Volunteers

You can also elect to self-insure. If you do this, you must have been in business in Alaska for at least five years, have a safety/loss control program, employ at least 100 people in Alaska and elsewhere, and have a net worth of over $10 million (these requirements may be achieved through a parent company). If you qualify and are interested, you’ll need to apply using Form 07-6129.

Alaska also has special funds set up for workers who do not have an insured employer, commercial fishermen, and employees who are physically impaired permanently.

Minimum Wage Laws in Alaska

Alaska’s minimum wage for 2023 is $10.85 per hour. It’s been slowly increasing this rate but does not list future rates. Also, note that Alaska does not allow a tip credit against the state minimum wage for tipped employees.

Did you know?

School bus drivers must be paid at least twice the minimum wage.

The Alaska Wage and Hour Act lists 19 exceptions to the minimum wage laws. Some of the most common are:

- Executives

- Volunteers or employees of nonprofits

- Full-time students employed by the university they are attending

- Computer systems analysts, computer programmers, software engineers, or other similarly skilled workers

- Registered guides, for the first 60 days of employment during a calendar year

- Part-time employees caring for children in the employer’s home

- Minors under 18 employed part time (<30 hours a week)

- Certain employees at car dealerships

Alaska Overtime Regulations

Overtime laws apply to employers who have more than four employees in their regular course of business. Overtime starts for hours in excess of 40 in a workweek and is 1.5 times the employee’s regular wage—but Alaska law says you shall only employ someone over 40 hours when absolutely necessary. You cannot “pay” for overtime with comp time.

There are exemptions for employees involved in canning, small mining operations, agriculture, switchboard operations, seamen, some forestry, line-haul trucking, community health, mechanics in some circumstances, and flight crew.

Different Ways to Pay Employees

Alaska Statute 2020, Sec. 23.10.040 says employees shall be paid in lawful US money or with “negotiable checks, drafts, or orders payable upon presentation without discount by a bank or depository inside the state.”

Direct deposit and paper checks are allowed, with employee consent, but the bank or depository institution cannot charge the employee fees to access their money. You can also pay employees using cash, but follow best practices to ensure it’s legal. Pay cards aren’t specifically addressed.

Pay Stub Laws

Each payday, you must provide an employee with a pay stub that includes the rate of pay, hours worked, gross and net wages, beginning and ending pay dates, deductions, advances, and overtime hours.

To get a head start on creating your own, download our free pay stub template.

Minimum Pay Frequency

Alaska law says that you must pay employees monthly or semimonthly, and the employee can decide which they prefer. It does not list specific paydays, but the usual practice is the first and/or 15th of the month.

To ensure you keep track of your pay schedule, download one of our free pay period calendars.

Paycheck Deduction Rules

In addition to deductions for retirement contributions, health benefits, and judicially mandated garnishments, you may also deduct pay for:

- Days not worked

- Unpaid disciplinary actions or for penalties imposed by safety or major rules infractions

- Reimbursement for goods or services stolen and cash register shortages

- Damages

- To pay off a creditor (at the written consent of the employee)

- Security deposit on uniforms and equipment as long as it does not exceed the price of the item and does not reduce the wage below the minimum wage

- Room and board, calculated at a reasonable cost

Jury duty and other deductions: You may offset any amounts paid to your employee by the court for jury duty, witness fees, or military pay against the salary for that particular week. The employee has to agree to sign it over to you, though.

Final Paycheck Laws

If you terminate someone’s employment, you need to pay them their final paycheck within three days. If an employee quits, the last paycheck is due at the next regular payday that is at least three days after the day the employer received notice.

Alaska does not have rules concerning severance pay. These should be spelled out in the employment contract.

Layoffs, Strikes & Lockout Paychecks

If an employee goes on strike, is laid off, or is subject to an employer lockout during a pay period, you still need to pay them their earned wages by their regular payday.

Payroll Rules for Public Construction Contracts

If you have a Department of Labor contract for public construction in the state of Alaska, you need to file your employee lists and payroll data in Excel format either weekly or biweekly, depending on how often you run payroll. You’ll do this through myAlaska. Check out online payroll instructions for complete details.

Alaska HR Laws That Affect Payroll

Alaska’s HR laws are very basic and, in most cases, depend on employer/employee agreement. You must still follow federal laws for anything not specified by the State of Alaska.

Alaska New Hire Reporting

New hires must be reported online via myAlaska within 20 days of hire or rehire. You’ll need to submit the employee’s name, address, and Social Security number, as well as your employer name, address, and EIN. If you are a multi-state employer, you can report your hires in Alaska or in another state with the rest of your hires and rehires.

If you do hire in multiple states, you need to notify the Secretary of the Department of Health and Human Services, Multistate Employer Notification, P.O. Box 509 Randallstown, MD 21133‐0509; fax: (410) 277‐9325.

Lunch & Other Break Time Requirements

Alaska does not require breaks for employees 18 and over. However, if you provide breaks under 20 minutes, you need to pay for the time. If you provide a mealtime of over 20 minutes and the employee is not working, then you do not need to pay for that time.

Minors get a 30-minute lunch break if they work six consecutive hours. They must take this at or before the five-hour point.

Paid Time Off (PTO)

Payment of sick leave, accrued vacation, or any other type of PTO is not a requirement of Alaska wage and hour laws.

However, it’s a good business practice to create a PTO policy and offer it to your employees as a benefit. Whatever you decide should be agreed upon in writing with your employee.

Alaska Family Leave Act

Most businesses must follow the rules of the federal Family and Medical Leave Act. It provides up to 12 weeks of unpaid leave in a 12-month period for bonding with a new child, dealing with serious health conditions, or, in some cases, dealing with emergencies from a family member in military duty. The federal FMLA applies to employers with at least 50 employees in 20 weeks of the current or previous year. Learn more about FMLA in our article about federal labor laws.

The Alaska Family Leave Act does provide slightly different benefits, but that only applies to employees of the state, the University of Alaska, the Alaska Railroad, and political subdivisions of the state.

Hiring Minors

Alaska law requires a work permit for children 16 and under. Those older than 16 must have a permit if the establishment serves alcohol. Minors under 14 may only work as babysitters, in newspaper delivery or sales, or in the entertainment industry with a permit.

Minors under 19 cannot sell tobacco, and no one under 21 is allowed to work in the cannabis/marijuana industry.

Minors under 18 cannot work in jobs involving:

- Handling explosives

- Mining

- Logging, sawmills, or with power-driven woodworking devices

- Power-driven tools for hoisting, metal forming, bakery

- Roofing and excavation

- Electrical work with voltages exceeding 220

- Exposure to bloodborne pathogens

- Outdoor solicitation or sales

Minors 14 and 15 are limited to mostly office work. Find a complete list of prohibited occupations by age on the Alaska DOL website.

General work hours for minors: Alaska and federal law differ when it comes to minors, so you’ll need to adhere to the strictest rules to ensure you’re in compliance.

- Per Alaska law, no minor under 18 can work more than six days a week.

- There are no restrictions on hours for minors 16-18.

Federal law restricts 14- and 15-year-olds to only working hours as follows:

- WHEN SCHOOL IS IN SESSION: Hours will be limited to nine hours of school attendance plus employment in any one day; work will be performed only between the hours of 5 a.m. and 9 p.m. and total hours worked will be limited to 23 in any week.

- DURING SCHOOL VACATIONS: Work hours will be limited to 40 hours per week between the hours of 5 a.m. and 9 p.m.

They also aren’t allowed to work more than three hours on school days. For more information on federal child labor laws, check out our guide to hiring minors.

Transportation Costs

Alaska is unique in that employers often pay to have their employees brought to and from the state such as for seasonal work. If you provide this transportation, pay an employee’s way, or loan the cost of transportation to the employee’s place of employment—into or out of Alaska—then you must provide transportation back when that employment ends.

You don’t need to pay if the employee is fired for fighting, intoxication, lying on the job application, or having unexcused absences for three or more days. You also do not need to pay if the employee quits, unless it’s for health or safety reasons or because you misrepresented wages, lodging, or working conditions.

Payroll Forms

Most of Alaska’s payroll tax forms need to be filed online through myAlaska. However, there are several forms for filing SUTA. You can find these on the Alaska DOL website. They include TQ01A, B, and C for filing quarterly contributions and changes, TSUP for supplemental contributions, and the TOPT 1-4 for changes or other payments.

Form 07-6129 is used to request the option to self-insure for workers’ compensation.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculate unemployment taxes due to the IRS

- Form 941: Filing quarterly income & FICA taxes withheld from paychecks

- Form 944: Reporting annual income & FICA taxes withheld from paychecks

- 1099 Forms: Providing non-employee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

Alaska Payroll Tax Resources/Sources

- Alaska Unemployment Insurance Tax Handbook: This covers everything, from the history of unemployment insurance in Alaska to how to file your quarterly withholdings.

- Department of Labor Employer Website: Get information about apprenticeship programs, state ES tax filings, workers’ compensation, and more.

- Alaska Wage & Hour Administration Packet: This covers workers’ compensation, the Alaska Family Leave Act, payment of wages, overtime, and more.

- TQ01 First Time Filers: This covers how to fill out the Alaska Quarterly Contribution Report for unemployment insurance.

Bottom Line

Alaska is one of the easiest states for payroll taxes. It does not have a state income tax, and the employment security taxes are easier to calculate than in other states. It has workers’ comp insurance through private companies. The labor laws are generally left to federal rules or employee contracts. Be sure to spell out time off and breaks in your hiring contract. The other major consideration is if you pay to bring an employee into Alaska for employment, you need to be ready to pay their way back after employment ends.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.