Illinois has state income taxes, with reciprocity agreements with nearby states to let employees pay income taxes for the state they reside in. The wage and labor laws closely follow federal regulations. We’ll cover how to do payroll in Illinois, with explanations of the most important taxes and labor laws that affect payroll.

Key Takeaways:

- Illinois’ minimum wage is $14.00 per hour, increasing to $15.00 per hour on January 1, 2025

- Illinois has income tax reciprocity with four states—Iowa, Kentucky, Michigan, and Wisconsin—so employees living in these states won’t face double taxation

- Illinois has recently enacted mandatory paid time off for any reason, just the third state to do so

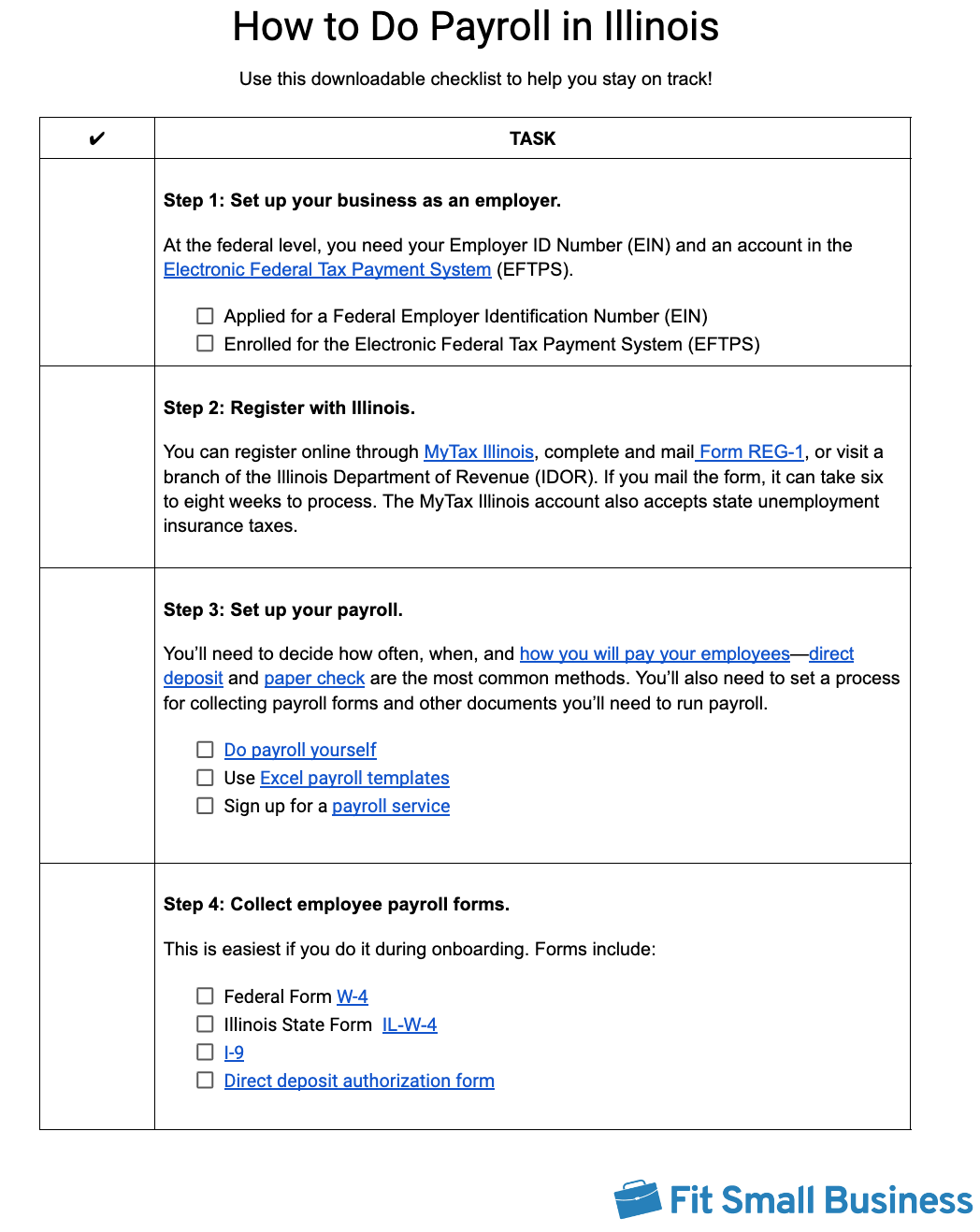

Step-by-Step Guide to Running Payroll in Illinois

At the federal level, you need your Employer ID Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

You can register online through MyTax Illinois, complete and mail Form REG-1, or visit a branch of the Illinois Department of Revenue (IDOR). If you mail the form, it can take six to eight weeks to process. The MyTax Illinois account also accepts state unemployment insurance taxes.

You’ll need to decide how often, when, and how you will pay your employees—direct deposit and paper check are the most common methods. You’ll also need to set a process for collecting payroll forms and other documents you’ll need to run payroll.

This is easiest if you do it during onboarding. Forms include the W-4, I-9, and direct deposit authorization. For Illinois, you need the IL-W-4.

If you have hourly or nonexempt employees, you’ll need a way to track employee work hours. Most small business owners create their own time sheets (consider one of our free templates) or use software (check our roundup of the best time and attendance software for some options).

You’ll need to make several payroll calculations, including totaling the hours worked (use our free timecard calculator to help), gross pay, paycheck deductions, tax withholdings, benefit premiums, etc. You’ll also pay employees on schedule. An Excel payroll template or software (choose from one of our recommended payroll software) can help automate this step.

Follow the IRS instructions for federal taxes, including unemployment.

- Illinois Income Taxes: You must file and pay these online at MyTax Illinois. If you are unable to do so, you must request a waiver from IDOR. Payments are due on the 15th of the following month for monthly payments. If you pay semiweekly, payments are due three to five days after payday. The Form IL-941 is due according to a set quarterly schedule—you can download the detailed schedule as a PDF. If you pay more than $500 per quarter, you need to file an IL-501.

- State Unemployment Taxes (SUTA): You can pay for these online with MyTax Illinois or mail a check with the payment coupon at the bottom of the UI-3/40 or collections coupon IDOR mails you. State UI tax reports and payments are due by the following dates:

For Wages Paid During | Calendar Quarter Ends | Must be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

If the due date for a report or tax payment falls on a Saturday, Sunday, or legal holiday, reports and payments are considered on time if they are received on or before the following business day.

Illinois requires you to keep records on employees for at least five years—a bit longer than the federal recordkeeping requirements (three years for payroll records and four years for payroll tax documents).

Send the federal W-2 forms (for employees) and 1099 forms (for contractors) by Jan. 31 following the year for which you’re reporting. You’ll also need to send copies to the IRS along with a summary form for each.

Here’s a free downloadable Illinois payroll checklist to make sure you don’t miss anything:

Illinois Payroll Taxes, Laws & Regulations

Naturally, you need to begin by following federal law for income taxes, Social Security, Medicare, and federal unemployment insurance (FUTA). You’ll pay Social Security at the rate of 6.2% of each employee’s paycheck and a corresponding 1.45% for Medicare. Both the employer and the employee will pay these taxes, each paying 7.65% for the combined Social Security and Medicare taxes.

To ensure you maintain compliance with payroll regulations, review the information about Illinois payroll laws, taxes, and regulations below.

Illinois Taxes

State Income Taxes

If you withhold federal income taxes for an employee, you must also withhold state income taxes. The only exceptions are nonresidents working in Illinois who live in states with a reciprocity agreement. Illinois has a flat tax rate of 4.95% of net income, with an allowance of $2,775 per exemption—you’ll need to subtract any exemptions from wages paid and multiply by the 4.95% tax rate. The IDOR Booklet IL-700-T has full instructions and the withholding tables.

If you exceed $12,000 in withholdings during a quarter, you must follow a semiweekly payment schedule as listed by the IDOR. Otherwise, you can pay monthly.

Reciprocity Agreements

Illinois has reciprocity agreements with Iowa, Kentucky, Michigan, and Wisconsin. If an employee works in Illinois but lives in one of these states, they pay state income taxes for their state of residency. This also applies to employees who are spouses of military members where both are residents of the other state, but the person is only living in Illinois while the military member is stationed in Illinois. Such employees need to fill out an IL-W-5-NR.

Local Income Taxes

There are no local income taxes in Illinois.

Unemployment Insurance

Illinois charges SUTA based on a taxable wage base of $13,590. Rates range from 0.850% to 8.650% for experienced employers. However, if your quarter’s total wages are less than $50,000, you pay the lesser of your rate or 5.4%. The standard rate for new employers is 3.950%.

You must pay SUTA if:

- You employed one or more people in Illinois at any one day within each of the 20 or more calendar weeks of any calendar year

- Your annual gross wage payroll equals or exceeds $1,500 in a quarter

- You employed agricultural workers and paid $20,000 or more in cash during any quarter of the current or previous calendar year

- You employed 10 or more workers in agricultural labor in 20 different weeks during the current or previous calendar year

- You employed domestic workers and paid $1,000 or more in cash for domestic services in any quarter of the current or preceding calendar year

The following employee/worker types are exempted:

- Sole proprietors, directors

- Owner’s parent, spouse, or child under 18

- Employees not performing their work in state, unless not covered by their state or Canada—or those who do some work elsewhere and agree to count the other state as their primary

- Independent contractors under some conditions

- Agricultural workers under some conditions

- Domestic workers earning under $1,000 in a calendar quarter

- Maritime workers

- Real estate agents under some conditions

- Newspaper delivery persons under 18

- Insurance agents on commission

- Employees of nonprofits

- Full-time students in an organized camp under certain conditions

Did you Know? When you pay SUTA, you may qualify for up to a 5.4% discount on your FUTA. It is generally 6% of the first $7,000 of each employee’s paycheck, so if you take the discount, you can effectively pay 0.6%.

Workers’ Compensation Insurance

You must provide workers’ compensation insurance for your employees, even if you have only one part-time employee. This also includes family workers, except for those working very limited hours. You have the option to self-insure, but roughly 90% of employers buy insurance.

Minimum Wage Laws in Illinois

The Illinois minimum wage that applies to workers 18 and older is $14. Illinois is gradually increasing its minimum wage to $15 per hour (much higher than the federal $7.25 minimum wage) according to this schedule—please take note so you can budget for increases and maintain compliance:

Year | Wage for ages 18+ | Wages for under 18 |

|---|---|---|

2024 | $14 per hour | $12 per hour |

2025 | $15 per hour | $13 per hour |

The following exemptions apply:

- Employers with fewer than four employees, excluding a parent, spouse, child, or other immediate family

- Certain agricultural employees

- Outside salesmen

- Members of a religious organization

- Accredited Illinois college or university employees where the employee is a student covered under the Fair Labor Standards Act (FLSA)

- Certain employees of motor carrier companies

- Baseball players in minor leagues under certain conditions

- Camp counselors under certain conditions

Gratuities can count for up to 40% of minimum wage.

Local Minimum Wage Laws

Cook County and the City of Chicago have their own minimum wage that’s higher than the state’s current rate.

- Cook County: $14.05 per hour for non-tipped workers and $8.40 per hour for tipped workers.

- City of Chicago: $16.20 per hour for non-tipped workers of employers with at least four employees. Tipped workers have a minimum wage of $11.02 per hour for employers with four or more employees.

Illinois Overtime Regulations

You need to pay employees at least time-and-a-half overtime pay if they work more than 40 hours in a workweek. This includes some salary workers, but only if they’re classified as nonexempt employees.

Exceptions include:

- Salesmen and mechanics at dealerships

- Agricultural laborers

- Executive, administrative, and professional employees, as defined by the FLSA

- Certain radio/television employees

- Commissioned employees, as defined by the FLSA

- Employees who exchange hours per a workplace agreement

- Employees of certain educational or residential child care institutions

- Employees receiving remedial education that does not include job-specific training but is for general education to an eighth-grade level

Different Ways to Pay Employees

You can opt to pay employees by cash, paper check, direct deposit, or payroll card. Employees must agree to being paid electronically (direct deposit and pay card), however.

Pay Stub Laws

Employees must receive an itemized pay stub each payday showing wages, deductions, and net pay. If you’re not using a payroll system, you may not automatically have access to pay stubs. To create your own so you can stay in compliance, use one of our free pay stub templates.

Minimum Pay Frequency

You must pay wages at least semimonthly and within 13 days following the close of a pay period. Monthly paydays are permitted for executive, administrative, and professional employees, plus employees working on commission who are covered by the FLSA.

Paycheck Deduction Rules

You may deduct money from an employee’s paycheck for the following:

- Taxes

- Legally required garnishments (like child support)

- Employee benefits, like health insurance

- Valid wage assignments or deductions that employees consent to in writing

- Repayment of cash advances at a payment schedule of no more than 15% of the employee’s wages

You may not deduct money for:

- Uniforms, tools, or employer-owned equipment

- Cash or inventory shortages or damages, unless the employee agrees to it in writing

Final Paycheck Laws

Final paychecks are due by the next regularly scheduled payday, but the state recommends you pay them upon separation. Final compensation includes wages, salaries, commissions, bonuses, and the monetary equivalent of earned vacation, holidays, or other compensations that have not been paid.

Illinois HR Laws That Affect Payroll

Illinois New Hire Reporting

You must report new hires to the Illinois Department of Employment Security (IDES) within 20 days of the employee’s first day on payroll. You can do this through MyTax Illinois.

Lunch & Other Break Time Requirements

Employers must give employees a minimum of 24 hours of rest each calendar week—i.e., one day off every six. An employee may elect to waive this, but you must have a written agreement with the employee.

Employers must give a meal break of at least 20 minutes for every 7.5-hour shift. The break must be given no later than five hours after the start of the shift.

Commuter Benefits

Employers in Cook County with at least 50 full-time employees, must provide pre-tax commuter benefits to employees to purchase a public transit pass with pre-tax dollars. Eligible employees must work at least 35 hours per week for the employer, and employers must pay the benefit on the employee’s first full pay period after their 120th day of employment.

Paid Time Off & Sick Leave

Effective Jan. 1, 2024, Illinois provides mandatory paid leave. Under the new Illinois law, employees will receive up to 40 hours of paid leave per year. Employees can use this time off for any reason, including sick leave. Employers are allowed to have a more lenient policy that would comply with this new law.

Paid Time Off for Voting

Employees can take up to two hours of paid time off for voting. You can opt to schedule voting hours for them as well.

Child Bereavement Leave

Starting Jan. 1, 2024, employers with 50 or more employees in Illinois must provide workers with time off to mourn the loss of a child. The time off does not have to be paid, though an employee can use any accrued paid time off during this time. Employers with 250 or more full-time employees must provide up to 12 weeks of leave per year. Employers with 50 to 249 employees must provide up to six weeks of annual leave. Employees may use this time at any point up to one year after the death of their child.

Hiring Minors

The Illinois child labor laws cover minors under 16 and require all minors to have employment certificates. No minor can work in a hazardous job such as sawmills, construction, or where alcohol is served or sold (except as a busboy or at a park.)

Exemptions include:

- Minors doing lawn care and residential or domestic chores around the home when not business-related

- Minors over 13 who caddy at a golf course

- Minors 12 and 13 employed as officials at certain sports activities

Illinois allows minors 14 and 15 to work a maximum of three hours per day, 24 per week when school is in session, not to exceed eight hours combined school and work in a day—federal law restricts hours to 18 weekly when school is in session. When school is not in session, minors under 16 may work up to eight hours per day, six days per week, for a maximum of 48 hours in a week—federal law doesn’t place any limit on work hours for minors 16+.

Minors may work between 7 a.m. and 7 p.m. except between June 1 and Labor Day, when the work hours are extended to 9 p.m. They must receive a meal break of at least 30 minutes no later than the fifth consecutive hour of work.

Payroll Forms

Illinois State IL-W-4 Form

- IL-W-4: This form is to be used when calculating withholdings for Illinois state taxes. Employees should fill it out upon being hired. If an employee does not fill it out, you need to withhold the maximum without any exemptions.

Other Illinois State Payroll and Tax Forms

- IL-W-5-NR: Nonresident request for exemption for residents of Kentucky, Michigan, Iowa, or Wisconsin, or spouses of military currently living in Illinois while the military member is stationed there

- IL-501: Withholding payment coupon if you are unable to pay income tax withholdings online

- IL-941: Withholding tax return

- WC-I: To apply for income tax credits if you participate in certain programs

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculate unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing nonemployee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

Illinois Payroll Tax Resources/Sources

- Illinois Department of Revenue: Register your business, file returns, make payments, get withholding information, and more

- Illinois Department of Employment Security (IDES): Get information on job fairs, labor data, unemployment taxes, and other topics

- Illinois.gov Business Page: Articles on managing your business and employees, and links for registrations, licenses, and permits

- Illinois Workers’ Compensation Commission Website: All the information you need for how to obtain and make use of workers’ comp

Illinois Payroll Frequently Asked Questions (FAQs)

In Illinois, you must pay employees at least twice per month. You can make payments via direct deposit, check, or payroll card, ensuring all deductions for taxes, benefits, and other withholdings are correct and documented.

Yes, it was one of the first states to provide paid leave for any reason. Employers must provide employees with at least 40 hours of paid leave per year. You can comply with this law by having a paid time off policy that provides each worker with at least 40 hours per year, though most employers provide more than that.

Illinois has a flat income tax rate of 4.95% for all employees, regardless of income level. This applies to salary, wages, and other taxable compensation.

Bottom Line

When learning how to do payroll in Illinois, take note that the state charges state income tax and SUTA, plus requires you to get workers’ comp from a third-party insurer unless you self-insure. The minimum wage is ratcheting up to $15 per hour by 2025, and is already above that in Chicago. Most payments are handled through MyTax Illinois. Making sure you understand the rules and procedures for managing payroll in Illinois can help you avoid costly fines.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.