Paying employees in Idaho is a much simpler process than you’ll find in many other states. There are no local taxes, no paid vacation requirements, and overtime and minimum wage requirements are in line with federal regulations. You will want to make sure that you are abreast of child labor laws and establish a pay frequency that’s in line with state requirements—but overall, processing payroll in Idaho is a pretty easy process.

Key Takeaways:

- Idaho minimum wage mirrors the federal minimum wage of $7.25 per hour, but its tipped minimum wage is higher ($3.35).

- Idaho has a flat income tax rate of 5.8%.

- Every employer in Idaho with at least one employee must carry workers’ compensation insurance coverage.

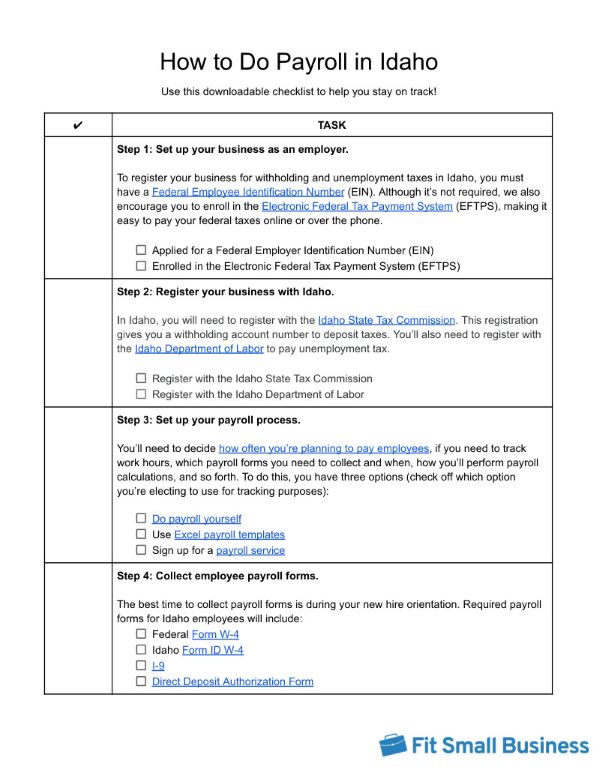

Step-by-Step Instructions to Running Payroll in Idaho

Step 1: Set up your business as an employer. At the federal level, you need to apply for a federal employer identification number (EIN) and register for an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register your business with Idaho. You can register your business online with the Idaho State Tax Commission (STC). You can expect to receive your Withholding Account Number and deposit schedule about 10 days after registering. Your Withholding Account Number is usually referred to as a “Permit Number” and will be nine digits in length.

Most companies will also be liable for state unemployment if they pay at least $1,500 in wages in a quarter or have one employee for at least 20 weeks during the year. You can register online with the Idaho Department of Labor and expect to receive your account number and unemployment insurance (UI) contribution rate about 10 days after registering.

Step 3: Set up your payroll process. Whether you’re going to do payroll yourself or use payroll software, you’ll need to determine a payroll process that works best for your business and is compliant with Idaho’s specific payroll and labor laws. This includes deciding what pay period you’d like to establish, how you’ll pay employees, how you’ll require hourly staff to track their time, and how you’ll verify hours and pay.

Step 4: Collect employee payroll forms. It’s best to collect employment forms from new hires during the onboarding process. Federal payroll forms include the W-4, I-9, and a direct deposit authorization form, if applicable. Idaho also requires employees to fill out a specific form for state withholding, referred to as the ID W-4.

Step 5: Collect, review, and approve time sheets. Idaho labor law requires regular paydays, which must be provided to all employees in writing upon hire. To be sure your team is always paid on time to remain in compliance, make sure to collect and approve timecards a couple of days before payday. Use one of our free time sheet templates to help if you don’t yet have an established time and attendance system.

Step 6: Calculate payroll and pay employees. There are many ways to calculate payroll, and it’s up to you to decide which is best for your business. You can use payroll software, a calculator (use our free time card calculator to do some basic time calculations), or even Excel (we have a free template).

Step 7: File payroll taxes with the federal government. Federal tax payments must be made via EFTPS. Generally, you have to deposit federal income tax withheld and both employer and employee Social Security and Medicare taxes based on the schedule assigned (either monthly or semiweekly) to your business by the IRS.

- Monthly depositors are required to deposit employment taxes on payments made during a month by the 15th day of the following month.

- Semiweekly depositors are required to deposit employment taxes for payments made Wednesday, Thursday, and/or Friday by the following Wednesday. Taxes on payments made Saturday, Sunday, Monday, and/or Tuesday are due by the following Friday.

It’s important to note that schedules for depositing and reporting taxes are not the same. Employers should only report their taxes quarterly or annually by filing Form 941 or Form 944.

Step 8: File payroll taxes with the state of Idaho. Idaho employers need to file and pay taxes withheld from employee wages. It’s important to know that filing and payment due dates are different. Return filings are quarterly and due on the 15th of the following month. Payments are due on either a semiweekly, monthly, or quarterly basis depending on how much withholding tax liability an employer has for the prior year.

Step 9: Document and store your payroll records. It’s important to keep records for all of your employees, even those terminated, for at least three to four years. Learn more in our article on retaining payroll records.

Step 10: Complete year-end payroll reports. You will need to complete W-2s for all employees and 1099s for all independent contractors. Both employees and contractors must have received these documents by Jan. 31 of the following year.

For a more general overview of what you should know when doing payroll according to federal standards, check out our guide on how to do payroll.

Download our free checklist to help you stay on track while you’re working through these steps:

Idaho Payroll Law, Taxes & Regulations

For the most part, Idaho’s payroll laws follow federal regulations. Compared to processing payroll in states like California or Washington, it has far fewer regulations for payroll. While most of the payroll regulations are pretty straightforward and simple to follow, you will want to make sure that you pay special attention to unemployment insurance and workers’ compensation requirements to ensure you’re in compliance.

Idaho Payroll Taxes

Idaho employees are subject to state withholding that employers are responsible to withhold and remit in a timely manner. There are no local taxes to worry about, making things simpler.

Keep in mind that you will still need to pay federal Social Security and Medicare taxes (FICA) and withhold a matching amount from your employees’ paychecks. Specifically, both you and your employees will each pay 6.2% of their paycheck for Social Security contributions and 1.45% for Medicare.

State Income Tax

Idaho has a flat income tax rate of 5.8%. This changed from a tiered system pre-2023, so make sure you’re withholding the correct amount.

Employers in Idaho are responsible for filing Form 910 online via the Idaho State Tax Commission on either a monthly, semimonthly, quarterly, or annual basis based on the following:

Unemployment Insurance

Idaho has a statewide UI benefits program that works to replace part of the income an individual would lose during a period of unemployment. Employers must report wages and pay unemployment insurance tax if they pay at least $1,500 in wages or have employees working for them for some portion of a week in 20 different weeks.

In 2024, Idaho’s taxable wage base is $53,500. This means that employers are charged a contribution for the first $53,500 that each employee earns in a calendar year. These contributions are the primary funding of this state program.

All new employers, except cost-reimbursement employers, begin with the same standard unemployment insurance tax rate for at least the first six calendar quarters. Unemployment rates range from 0.2816% to 5.4%.

New Employer Rate: 1.231%

As the employer builds experience with the unemployment insurance program, the rate can increase or decrease (more claims will typically lead to an increase). An employer’s experience rate is ranked by calculating the employer’s reserve ratio. This ratio is calculated by subtracting the employer’s accumulated benefit payments from the employer’s accumulated tax payments and then dividing it by the employer’s average taxable payroll. New rates are determined on an annual basis.

The Unemployment Insurance Division has defined certain employers as exempt, meaning they are not required to have coverage. Those exceptions include:

- Child and spouse employment

- Elected officials, judicial officers, and other governmental units

- Students, hospital interns, and correctional institution hospital workers

- Independent contractors

- Casual labor

- Newspaper delivery

- Insurance agents and real estate agents

- Direct sellers

- Religious, rehabilitation, unemployment work programs, and student/employer internships

It’s important to remember that you will also be responsible for federal unemployment taxes. The standard rate is 6% on the first $7,000 of each employee’s taxable wages. The maximum tax you’ll pay per employee is $420 ($7,000 x 6%).

Workers’ Compensation Insurance

Workers’ compensation insurance covers medical bills, rehabilitation costs, and lost wages for employees who get injured or experience a work-related illness. Employers with one or more full-time, part-time, seasonal, or occasional employees are required to have a workers’ compensation policy unless specifically exempt by law. Employers are required to have coverage in place before their first employee is hired.

You can obtain workers’ compensation insurance through a licensed insurance carrier or through the Idaho Workers’ Compensation State Insurance Fund (SIF).

Employers who operate without workers’ compensation insurance can be liable for a penalty of $2 per day per employee or $25 per day, whichever amount is greater. Operating a business without workers’ compensation insurance is a misdemeanor under Idaho law, and the employer may be subject to criminal penalties.

Idaho Minimum Wage

Idaho generally follows federal minimum wage regulations, although its tipped minimum wage is higher.

Classification | Wage |

|---|---|

Standard Minimum Wage | $7.25 |

Tipped Minimum Wage | $3.35 |

Training Minimum Wage (For employees under 20 years old for the first 90 calendar days of employment) | $4.25 |

The minimum wage applies to most employees in Idaho, with limited exceptions including:

- Outside salespeople

- Executive/professional/administrative staff

- Farmworkers

- Employees at seasonal camps

Idaho Overtime Regulations

Idaho also follows federal overtime regulations. In accordance with the federal Fair Labor Standards Act (FLSA), overtime must be paid at a rate of time and a half for all hours worked over 40 in a workweek, unless the employer or the individual employee is considered exempt.

Those exemptions include:

- Executive/professional/administrative staff

- Farmworkers

- Employees at seasonal camps

- Employees of railroads and air carriers, taxi drivers

- Casual babysitters and persons employed as companions to the elderly or infirm

- Employees of small newspapers and local newspaper delivery employees

- Seaman on American vessels

- Announcers, news editors, and chief engineers of non-metropolitan broadcasting stations

- Domestic service workers living in the employer’s residence

- Employees of motion picture theaters

Employers can schedule employees to work overtime unless a contract or agreement says otherwise. The overtime rate must be paid for hours exceeding 40 in one workweek.

Different Ways to Pay Employees in Idaho

While there are many different ways to pay employees, Idaho Statute Section 45-608 specifies that an employer must pay wages by either:

- Cash

- Paper checks

- Direct deposit (with employee authorization only)

Idaho Pay Stub Laws

Idaho pay laws require that all employers provide employees with access to a statement that details all of their payment information for each payment made to them.

There are no specific guidelines for what they need to include. It is not legally required to follow any certain format, and it’s not required that the paystub is provided in a physical form, meaning that electronic pay statements are allowed.

While there are no specific guidelines regarding what information needs to be included in pay stubs in Idaho, we recommend that you include all important payment information as a best practice. Use one of our free pay stub templates to start.

Minimum Pay Frequency

Idaho employers are required to pay all employees at least once per month on a payday that was previously established by the employer and provided to all employees upon hire. Once you establish a regular payday, it’s best to stick with it and not make frequent changes.

All payments need to be made fewer than 15 days after the end of the pay period.

Paycheck Deduction Rules in Idaho

Idaho employers are not allowed to make any deductions from an employee’s wages, except for deductions that are required by law (Social Security, Medicare, income taxes, etc.). Any other deductions need to be authorized by the employee in writing ahead of time.

Final Paycheck Laws

Idaho law requires that all wages due must be paid the sooner of the next regularly scheduled payday or within 10 days of the separation (not including weekends and holidays). This does not change whether the employee leaves voluntarily or is involuntarily terminated.

If, after separation occurs, the employee gives the employer a written request for earlier payment of all wages, the employee must be paid within 48 hours of the employer’s receipt of the written request (not including weekends and holidays).

Accrued Paid Time Off Payouts

Idaho law does not require employers to pay out an employee’s accrued vacation, sick leave, or other paid time off (PTO) at the termination of employment.

The employer will, however, be legally required to pay accrued vacation if there is a contract or policy in place obligating them to do so.

Idaho HR Laws That Affect Payroll

Idaho has quite a few HR laws, but many align with federal labor laws. When processing payroll in Idaho, it’ll be important to pay close attention to new hire reporting requirements and child labor laws.

New Hire Reporting

Idaho’s new hire reporting law requires all employers to report their new employees online via the Idaho Department of Labor’s New Hire Directory within 20 days of the date of hire. This also applies to rehired employees if their previous employment was terminated at least 60 days before their first day of employment.

The information that needs to be reported is as follows:

- Employer name and federal ID number

- Employer address

- State unemployment insurance account number (unless exempt)

- Employee name and Social Security number

- Employee address

- Start date (first day employee worked for wages)

Meal Breaks, Paid Sick Leave & Paid Time Off

Idaho law does not require employers to give breaks or meal periods. Employees would only be entitled to breaks if it is the employer’s policy to provide them.

Employers in Idaho are also not typically required to provide their employees with sick leave benefits, either paid or unpaid. In certain situations, however, employers in Idaho may be required to provide an employee unpaid sick leave in accordance with the Family and Medical Leave Act or other federal laws.

Child Labor Laws

Minors authorized to work in Idaho are subject to restrictions on when they can work and how many hours they can work. Restrictions are based on the age of the minor and are designed to ensure that work does not interfere with schooling.

Maximum Hours of Work for Minors

Working hour restrictions limit how many hours a minor may work per day, and per week:

For Minors Under 16 | Up to nine hours of work per day, 54 hours per week |

|---|---|

For Minors Ages 16 and 17 | Idaho has no restrictions on maximum working hours for minors aged 16 and 17 |

Night Work Restrictions for Minors

Night Work restrictions set limits on how late a minor can legally work:

For Minors Under 16 | Work is prohibited during these hours: 9 p.m. to 6 a.m. |

|---|---|

For Minors Ages 16 and 17 | Idaho has no restrictions on night work for minors aged 16 and 17 |

Employment Certificates

Employment Certificates (also referred to as Work Permits) are not required for minors to work under Idaho law. Even though minors are not required to obtain these working permits to be employed in Idaho, employers are still responsible for ensuring they comply with all Idaho child labor restrictions and regulations.

Employment Records for Minors

Employers of minors aged 14 to 16 must keep records of the employee’s name, age, and place of residence. This applies to all businesses employing minors in the following industries:

- Mining

- Factory

- Workshop

- Mercantile establishment

- Store

- Telegraph or telephone office

- Laundry

- Restaurant

- Hotel

- Apartment house

- Merchandising and messaging

Payroll Forms

Idaho has its own form for state income tax withholding, as well as a few others. Here are some of the important forms you will want to make sure you have on hand when processing payroll in Idaho.

Idaho State Forms

Idaho requires that you have all employees complete a federal W-4 form to determine their federal withholding. In addition, you will also need to have all employees complete Form ID W-4, Idaho’s withholding form for state income tax.

In addition to the state withholding form, there are also a few other withholding forms for employers to be aware of, all of which can be filed online with your business and employee’s pre-filled information:

- Form 910: Withholding Payment

- Form 967: Annual Withholding Report

- Form ID-MS1: Employee’s Idaho Military Spouse Withholding Exemption Certificate

Federal Payroll Forms

- Form W-4: To help employers calculate taxes to withhold from employee paychecks

- Form W-2: To report total annual wages earned (one per employee)

- Form W-3: To report total wages and taxes for employees to the IRS (summary of W-2s)

- Form 940: To report and calculate unemployment taxes due to the IRS

- Form 941: To file quarterly income and FICA taxes withheld from paychecks

- Form 944: To report annual income and FICA taxes withheld from paychecks

- Form 1099-MISC: To provide non-employee pay information that helps the IRS collect taxes on contract work

Idaho Payroll Tax Resources/Sources

- Idaho Department of Labor: Unemployment insurance tax help and resources, new hire reporting portal, information regarding current tax rate, reporting tax fraud, etc.

- Idaho State Insurance Fund: Idaho’s preferred provider of workers’ compensation insurance. The SIF helps organizations of all sizes get more value out of their coverage.

- Idaho State Tax Department: Apply for a business permit, business self-service for sales-related, income tax and withholding tax; e-file and e-pay, business operations permits, business income tax forms, property tax forms, withholding forms, sales tax forms, etc.

Doing Payroll in Idaho Frequently Asked Questions (FAQs)

Employers in Idaho cannot withhold any money from an employee’s pay unless required to do so by state or federal law, or if the employee has provided written authorization. In every instance, however, deductions cannot reduce the employee’s hourly wage to less than the minimum wage.

Yes. Idaho does not have income tax reciprocity with any other state. However, the employee who lives outside Idaho may be able to receive a credit on their taxes in their home state for taxes paid to Idaho.

As soon as you notice a mistake, take immediate action to correct it. This might mean updating your records with the state tax agency and paying a penalty if you’ve underpaid. Waiting and hoping a tax agency doesn’t notice is not a good plan.

Bottom Line

Idaho is one of the most straightforward states in which to process payroll. Many of the labor laws and HR rules follow federal guidelines, meaning that you won’t need to concern yourself with many state-specific regulations. Once you make sure that your business has the proper registrations in place, completing regular payroll runs becomes very routine.

If you need help running your Idaho payroll, consider using payroll software like QuickBooks Payroll. It files and pays your payroll taxes and covers any penalties you are charged if its reps make a mistake (it’ll cover your mistakes too, if you opt for a premium plan). You can pay employees via direct deposit or check, and same-day payment options are available as well. Sign up for a free trial or discounted rate today.