Learning how to do payroll in Texas is a much easier process than in other states. There’s no income tax, businesses aren’t required to purchase workers’ comp insurance, and employers only pay state unemployment taxes (SUTA). There are some special laws concerning overtime and minimum pay frequency, but overall, Texas follows federal regulations.

Key Takeaways

- Minimum Wage: $7.25 (federal minimum wage)

- Texas allows employees to be paid overtime at 1.5 times their regular rate of pay or take additional time off credited to them at 1.5 hours per overtime hour worked

- All exempt employees must be paid at least once a month; nonexempt employees (usually hourly workers) must be paid at least twice a month.

- There are no additional child labor restrictions when school is in session

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Running Payroll in Texas—Step-by-Step Instructions

Running payroll in Texas is a little different from running payroll in other states, but it’s not typically extra work.

Step 1: Set up your business as an employer. Get your company’s Federal Employer Identification Number (FEIN). If your company is brand-new, you may need to apply for a FEIN. This is a simple process that can be completed online via the Electronic Federal Tax Payment System (EFTPS). If you work for a company that already has one, keep the FEIN handy. The FEIN is required to pay federal taxes.

Step 2: Register with the Texas Workforce Commission (TWC). You need to register online within 10 days of the first check date to get your TWC Account Number. If you use a third-party payroll administrator, then you need to register them as your payroll administrator. Go to the TWC Unemployment Tax Services site and click on Sign up for User ID or log on. Once you are in, grant permissions to your payroll provider, being sure to assign Manage Wage Report permissions.

Step 3: Create your payroll process. If you work for an established business, you may have inherited a payroll process. But if your company is brand-new, you may need to start your payroll process, which means deciding how often you’ll be paying employees, when you’ll pay them, how you’ll track and calculate hourly employees’ work time, and how you’ll pay them. Overall, you can opt to do payroll yourself by hand, set up an Excel payroll template, or sign up for a payroll service to help you handle your Texas payroll.

Step 4: Collect employee payroll forms. This is easiest to do during onboarding. The forms to collect include the W-4, I-9, and direct deposit information. Texas does not have any additional forms.

Step 5: Review time sheets. This step is one you’ll repeat as you do payroll each period. Keeping track of employees’ hours is essential for ensuring accurate payroll. Whether you use paper time sheets or time and attendance software, always review time sheets for accuracy and discuss any errors or issues with employees right away. Having employees sign off on their time sheets is a good idea, whether they do so electronically or by pen on paper. Be sure to do this a couple of days before payday, as Texas Payday Law states that employees must receive their wages no later than the specified payday.

Step 6: Calculate payroll and pay employees. You can use software, a calculator, or even Excel to calculate payroll.

Step 7: File payroll taxes with the federal government. Follow the IRS instructions for federal taxes, including unemployment.

Step 8. File Texas state payroll taxes. In Texas, there is no income tax, but you do need to file State Unemployment Insurance (UI) taxes each quarter. Businesses with fewer than 1,000 employees can file online with an Excel or CSV report, manual entry, entry based on the last report you filed, or a No Wages report if you did not pay wages that quarter. Log on to the Unemployment Tax Services site and follow the directions.

State UI tax reports are due by the following dates:

For Wages Paid During | Calendar Quarter Ends | Date | Must be Filed and Paid By |

|---|---|---|---|

Jan, Feb, Mar | March 31 | April 1 | April 30 |

Apr, May, Jun | June 30 | July 1 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 1 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 1 | Jan. 31 |

If the due date for a report or tax payment falls on a Saturday, Sunday, or legal holiday on which TWC offices are closed, reports and payments are considered on time if they are received on or before the following business day.

Step 9. Document and store payroll records. As with any business record, you want to make sure you have a copy for at least three years. Learn more in our article on retaining payroll records. Such records include:

- All check stubs and canceled checks

- Cash receipts and disbursement records

- Accounting records (e.g., payroll journal, general journal, and general ledger)

- Copies of federal and state tax reports

- Copies of payroll filings (W-2s and W-3s)

- For each pay period:

- The beginning and ending dates of each pay period

- Total amount and date paid for each pay period

- The day in each week where the most employees worked and how many employees worked on that date

- For each worker, the:

- Biographical information (first and last name, Social Security number)

- Hire information (hire, rehire, and/or return to work dates)

- Termination information (termination date and reason)

- Amount paid to each employee for each pay period and quarterly

- Date and amount of supplemental payments (e.g., bonuses, gifts, and/or commissions)

- Work location

Step 10. Do year-end payroll tax reports. Every employer, regardless of which state your business is in, will need to complete W-2s for all employees and 1099s for independent contractors. By law, you must provide all employees and contractors with their annual tax form no later than Jan. 31 of the following year.

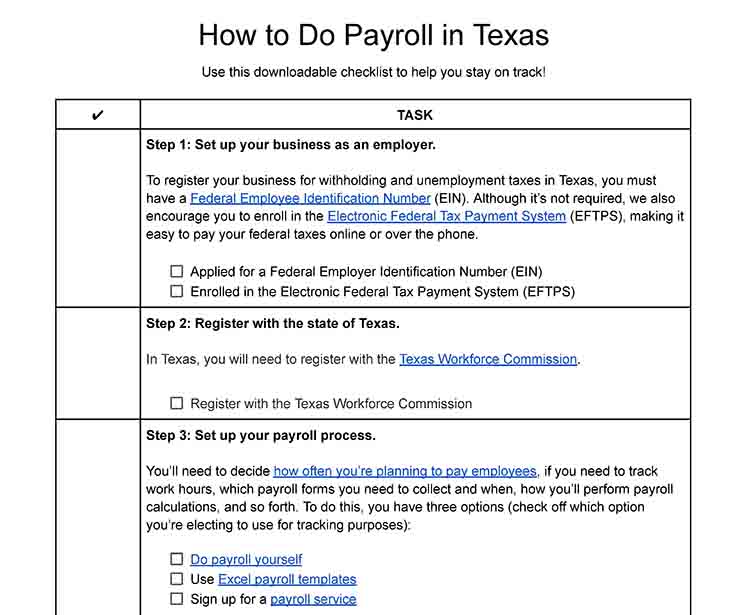

Download our free checklist to help you stay on track while you’re working through these steps:

Texas Payroll Laws, Taxes & Regulations

For the most part, Texas payroll laws follow federal regulations. Compared to doing payroll in states like California, it has far fewer regulations than most states when it comes to doing payroll. In addition, some of Texas’ payroll regulations that differ from federal law are even less strict—usually, when states set payroll regulations that contrast with federal law, they’re more restrictive.

Texas Taxes

The only Texas payroll tax that employers are responsible for paying is for state unemployment insurance. Keep in mind, however, that you will still need to pay federal Social Security and Medicare taxes (FICA) and withhold a matching amount from your employees’ paychecks. Specifically, both you and your employees will each pay 6.2% of their paycheck for Social Security contributions and 1.45% for Medicare.

Unemployment Insurance Tax

Texas charges unemployment insurance (UI) taxes on the first $9,000 that each employee earns in a calendar year. You must pay unemployment insurance taxes if you are liable under the Federal Unemployment Tax Act, pay $1,500 or more in total gross wages in a calendar quarter, or have at least one employee during 20 weeks in a calendar year. There are other liability rules; find them on the TWC website.

New employers use the average rate for employers in their North American Industry Classification System (NAICS) code or 2.7%, whichever is higher. After paying for four quarters, the state will give you a new UI tax assessment. In 2023, the tax rate ranges from 0.23% to 6.23%.

Please note: You must pay SUTA out of your business funds; the cost shouldn’t be passed to the employees.

Unemployment insurance taxes vary year by year and are comprised of five parts:

- General Tax Rate (GTR): Also known as the experience-rate, it’s based on the benefits that were paid to your former employees and charged to your account. It considers three years’ benefits in its calculations.

- Replenishment Tax Rate (RTR): This is a flat tax paid by all employers to replenish the Unemployment Compensation Trust Fund for the other half of the benefits paid to eligible workers that were not charged to any specific employer. The state sets the RTR for everyone.

- Obligation Assessment Rate (OAR): This collects money to pay bond obligations. However, the current rate is 0.0%.

- Deficit Tax Rate (DTR): If the amount of money in the Unemployment Compensation Trust Fund is less than the established minimum, the DTR is added for the next calendar year for each experience-rated (i.e., not new) employer. The DTR is $0 for 2023.

- Employment and Training Investment Assessment (ETIA): This money is deposited to an employment and training investment holding fund, and is 0.1% of wages paid by an employer. However, your replenishment tax rate is reduced by the same amount, so your unemployment taxes do not increase.

You’re also responsible for federal unemployment taxes (FUTA). The standard rate is 6% on the first $7,000 of each employee’s taxable wages. The maximum tax you’ll pay per employee is $420 ($7,000 x 6%).

Did you Know? When you pay SUTA, you may qualify for up to a 5.4% discount on FUTA. This can greatly reduce what you owe the IRS—from 6% to 0.6%. In addition, if you pay your terminated employees’ benefits, you may qualify for a discount on your UI taxes. For more information, go to the TWC Voluntary Contribution Program.

State and Local Income Taxes

Texas does not have state or local income taxes, saving you money that you can invest into your business—or your employees.

Minimum Wage Rules in Texas

The minimum wage in Texas is $7.25 an hour, which aligns with the federal minimum wage amount. Exemptions include those covered under the federal Fair Labor Standards Act (FLSA) and the following:

- Individuals employed by religious, educational, charitable, or nonprofit organizations

- Professionals or salespersons

- Domestic workers

- Certain youths and students

- Inmates

- Family members

- Employees working in amusement and recreational establishments

- Employees working for non-agricultural employers not liable for state unemployment contributions

- Employees employed in dairying and the production of livestock

- Employees in sheltered workshops

Commission & Bonus Amounts

If you pay an employee commission or a bonus, you are required to set up a clear written agreement laying out the details of the payment arrangement. This doesn’t mean the amounts have to be set in stone, and there’s no minimum amount. However, you are not allowed to make any changes retroactively—only for future payments.

For more information about Texas minimum wage and related rules, visit the Texas Wage Law page on the Texas Workforce Commission (TWC) website.

Approved Deductions That May Drop an Employee’s Pay Below Minimum Wage

Texas, as do all states, enforces its minimum wage laws. And, at times, payroll deductions can cause an employee’s pay to fall below that amount. In these cases, there are specific scenarios that the TWC will allow the deduction without penalizing the employer, but there are others that are illegal.

Payroll deductions that you can enforce, even if they drop an employee’s pay below Texas’ minimum wage are:

- Costs for meals, lodging, and other facilities: The amounts must be “reasonable,” and the employee must authorize you to withhold the money in writing.

- Tip credits: You can deduct a maximum of a $5.12 tip credit per hour from a tipped employee’s hourly pay rate; if they’re paid $7.25 per hour, their tipped minimum wage would be $2.13 per hour. This is actually federal law, but an important one to keep in mind. You are legally allowed to take the tip credit without an employee’s authorization.

- Voluntary deductions: If any employee authorizes you to deduct money from their paycheck, i.e., for a holiday savings fund or to repay a payday loan, you will be in the clear should their paycheck fall below minimum wage. However, if you initiate the deduction without their consent, you can be held liable for an FLSA violation.

- Repayment of loans and advances: You can deduct money to repay a loan or advance you issued to the employee; however, it can only cover the principal—no interest or administrative costs if it will bring their paycheck below the minimum wage. This also includes vacation pay advances.

- Uniforms and cleaning costs: If you, the law, or the type of work the employee is performing requires them to purchase a uniform, you cannot deduct money for it from their paychecks if it will cause the amount to fall below minimum wage. Of course, if it doesn’t, and the amount is reasonable, uniform and cleaning costs can be withheld. If the employee authorizes you to deduct money for such costs even though their paychecks will fall below minimum wage, you can do so without being held liable.

- Union dues: You can deduct union dues from an employee’s paycheck even if it causes their earnings to fall below minimum wage; the key is to get their authorization in writing first.

- Garnishments: Any court-ordered payments you’re legally obligated to deduct from an employee’s pay can lower their pay below minimum wage. This includes bankruptcy garnishments, child and spousal support, etc. Unlike how loans and advances are handled, you are allowed to deduct a $10 administrative fee for processing child support payments, IRS tax levies, and student loan wage withholdings.

- Cash shortages: If you employ cashiers or anyone who handles cash, it is likely that they may one day come up short at the end of their shift. By law, you are allowed to recapture the amount you lost via payroll deduction, but only if you can prove that the employee was personally and directly responsible for misappropriating the funds. You can’t recoup funds that are lost due to typical negligence or an issue with the equipment.

If you need a free template to help you with payroll calculations, check out our guide on doing payroll with Excel.

Texas Overtime Regulations

Texas follows the federal FLSA to determine who is entitled to overtime. Texas overtime law states that employees are entitled to overtime if they work over 40 hours in a workweek. They can be reimbursed either with overtime pay at 1.5 times their regular rate or compensatory time off at 1.5 hours for each hour of overtime. Employees choosing the time-off option cannot accumulate more than 240 hours (or for public safety, emergency response, or seasonal employees, 480 hours).

Different Ways to Pay Employees in Texas

Texas doesn’t have any special rules restricting the methods you use to pay employees. That means you can pay employees with cash, check, direct deposit, or even payroll card. If you’re paying the employee their wages in a form other than one of the types previously listed—for instance, in goods—you’ll need to prepare a written agreement for both you and the employee to sign with the details of the payment arrangement before distributing.

Pay Stub Laws

You don’t have to provide a pay stub for employees covered by the FLSA, but it is a good practice. If you pay an employee in cash, you should have them sign a receipt to verify they received it, the date, and the amount of the check. This will protect you in the event that the employee claims they never received the money.

If you want to issue pay stubs but don’t have the software to do it easily, download one of our free paystub templates to get you started.

Texas Minimum Pay Frequency for Employers

Employees have the right to be paid their wages on time. All exempt employees must be paid at least once a month; nonexempt employees (usually hourly workers) must be paid at least twice a month. If you’re paying semimonthly (twice a month), you must select the pay dates in a way that each included period will have, as closely as possible, an equal number of days between them (for example, the 15th and the 30th).

For more guidance on when to pay employees in Texas, read a breakdown of the Texas Payday Law; it outlines employer responsibilities and defines how employees can make claims for the compensation they did not receive.

If you need help selecting a pay period and scheduling pay dates, download one of our free payroll calendars to help.

Final Paycheck Laws in Texas

When an employee quits or is terminated, it’s important to distribute their final paycheck in a timely manner. Legally, you have six days to process it if you terminate their employment. If the employee quits on their own, the deadline is the next regularly scheduled pay date. So whether that’s in two days or two weeks, you’ll need to have a paycheck ready with all of the money you owe them.

Please note that even if any employee owes you money for a uniform they should have paid for or has a laptop they didn’t return, you are not legally allowed to delay their final paycheck in retaliation.

If the employee who is leaving is a commissioned employee or believes they’re due a bonus, you must follow the written agreement. If it states you will be paying a bonus for work done in the first quarter, and they’re leaving in the second quarter, you are obligated to pay.

Severance Pay in Texas

Texas law will only enforce you to pay a severance if you signed a written agreement stating you would under certain conditions that have come to pass (i.e., a massive layoff). As for deductions, you’re required to withhold money for taxes, but in addition to that, child support. If you’ve received an earnings withholdings order for someone you will be paying severance, it’s important to compute how much you’ll need to withhold and payout (use the period of time that the garnishment covers to compute how much the employee is responsible for).

Accrued PTO Payout

You don’t have to pay out unused paid time off (PTO) if you don’t want to. Both Texas and federal law leave it up to employers. The caveat to this is that if you included any statements about paying accrued PTO when an employee is leaving the company, then you must follow through. The law simply requires employers to abide by the policies and agreements they set at the beginning of the employment relationship.

Texas HR Laws That Affect Payroll

Texas has numerous HR laws, but many align with federal HR laws. You’ll need to pay close attention to how often you can pay employees (it varies for different types) and the specifics around hiring minors.

Texas New Hire Reporting

You must report new hires and rehired employees within 20 calendar days of the hire, or if you report electronically, at least twice a month, with reports 12 to 16 calendar days apart (strive to have it done before their second paycheck). Failure to report a new hire incurs a fine of $525 per unreported employee.

You can report new workers to the Texas Employer New Hire Reporting Operations Center. (Don’t panic when the link takes you to the Child Support Division of the Office of the Attorney General; it is responsible for new hire reporting.)

Please note: If you’re using an HR payroll software, it probably already has you covered. Most file new hire reports electronically, so you don’t have to.

Breaks, Meals & Paid Leave

Texas does not have laws concerning breaks or leave. However, businesses must provide up to 12 weeks of unpaid job-protected leave under the federal Family and Medical Leave Act (FMLA) if they have 50 or more employees stationed within 75 miles of the employee taking that kind of leave. The employee must also meet the various eligibility conditions to be entitled to the leave. You can get more information on FMLA Leave from Texas.gov’s website.

Naturally, providing paid time off makes you more desirable to candidates. Any PTO or breaks promised in a written policy or employment agreement are enforced under the Texas Payday Law. To protect yourself from liability and ensure your employees are properly compensated, you’ll need to set up a system to properly document their work hours using a timesheet or time clock.

Child Labor Laws

If you’re hiring any employees under the age of 18, you’ll need to comply with Texas’ Child Labor Laws, which differ slightly from federal law. For example, federal law states that children cannot work more than 18 hours a week when school is in session, while Texas law allows up to 48 hours a week at any time. It also allows hardship exemptions when the child is supporting their family. You’ll need to take this into consideration when you schedule and pay employees. If you’re ever audited, you will be required to hand over payroll reports, which will show the number of hours they worked and when.

For more detail on federal payroll compliance (which is important for employers in any state), check out our article on the most important payroll laws to know in 2023.

Payroll Forms

The only state-specific payroll form you’ll need to be an employer in the state of Texas is the Texas Unemployment Tax Report. Otherwise, you’ll just use federal payroll forms.

Texas W-4 Form

Since Texas does not have state income taxes, there is no state W-4 form. You’ll simply use the federal form that we linked in the federal payroll forms section below.

Texas Unemployment Tax Report

You will need to file a quarterly wage report and pay unemployment taxes. You can do this by uploading a spreadsheet or manually typing it into the TWC system.

Per the TWC website, you need:

- The number of employees, both full time and part time, employed in the months covered by the wage report

- The Texas county where the greatest number of your employees worked

- The number of employees who worked outside the county you reported above

- A Social Security Number for each employee unique to that quarterly wage report

- Each employee’s last name and first initial (the middle initial is optional)

- The Texas wages paid to each employee for the quarter

- The wages paid to each employee and reported to a state other than Texas, if applicable

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: To report total annual wages earned (one per employee)

- W-3 Form: To report total wages and taxes for all employees to the IRS (summary of information on all employee W2 forms)

- Form 940: To report and calculate unemployment taxes due to the IRS

- Form 941: To file quarterly income and FICA taxes withheld from paychecks

- Form 944: To report annual income and FICA taxes withheld from paychecks

- 1099 Forms: To provide non-employee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

Resources/Sources

- Texas Workforce Commission Businesses & Employers Site: Part of the larger TWC website, this is where you go to file unemployment taxes, learn about the latest changes to employment laws, and get resources for help in recruiting and managing employees and growing your business. It offers an automated chat to help you get answers to specific questions.

- Office of the Commissioner Page: Find links to COVID-19 resources, employer information and resources, and registration for Lunchtime Live 90-minute video sessions on employment law.

- Nolo.com’s Employer’s Guide for Paying Business Taxes: Learn about state rules for income and unemployment taxes, tax laws, and more.

Also, check with your payroll software for resources and state-specific features.

Bottom Line

Texas is one of the easiest states for payroll processing and payroll taxes. Its minimal laws and excellent website make it easy to get answers. You’ll still need to follow deadlines for reporting new hires, filing tax paperwork, and paying your employees on time.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.