To do payroll in Indiana, you’ll need to comply with some state rules in addition to federal payroll laws. For instance, Indiana has a state income tax of 3.23%, and its counties also have their own taxes—you need to calculate withholdings for both. There are also reciprocity agreements with five states, meaning you’ll withhold taxes based on where the employees live vs where they work if they’re in any of the alternate states. However, the other payroll and HR laws are generally straightforward.

Key Takeaways:

- Indiana’s minimum wage remains $7.25 per hour

- Indiana has income tax reciprocity with Kentucky, Michigan, Ohio, Pennsylvania, and Wisconsin

- Indiana no longer requires work permits for workers under age 18

A Step-by-Step Guide to Running Payroll in Indiana

Step 1: Set up your business as an employer. At the federal level, you need to apply for your Federal Employer Identification Number (FEIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with the State of Indiana. Register your business at INTIME, the Indiana taxpayer information management engine. You’ll need your EIN, business name and address, and the names of the officers in the business. Then, create a user account to file your tax and other paperwork. You also need to register as a new business on the Uplink Employer Self Service website so that you’ll be able to pay state unemployment insurance taxes.

Step 3: Set up your payroll process. You’ll need to set up a payroll process and establish a set schedule of paydays that are semi monthly or biweekly at least. Determine how you’ll pay employees, what period each pay day will cover, and even the process you’ll follow to collect employee forms and other payroll documents.

Step 4: Collect employee payroll forms. Some payroll forms are best filled out during employee onboarding. Forms include W-4, I-9, and direct deposit information. For Indiana, you need the WH-4 or WH4MIL, as well as the WH-47 for employees that live in reciprocity states.

Step 5: Collect, review, and approve time sheets. If you have hourly or nonexempt employees, you’ll need to track their work hours. Most employers create their own time sheets or use time and attendance software—our free time card calculator can ensure your totals are correct. Be sure to plan for approvals so that you can pay employees within 10 days of the end of the pay period—and if the regular payday is a non-work day, then arrange payment for the day before.

Step 6: Calculate payroll and pay employees. You can use software, a calculator, or even Excel to calculate payroll.

Step 7: File payroll taxes with the federal and Indiana state government. Follow the IRS instructions for federal taxes, including unemployment.

- Indiana Income Taxes: Tax withholdings must be filed electronically according to schedule. If you have filed Indiana withholdings in the past, you need to continue to do so, even if you don’t owe anything. The state re-evaluates your withholdings annually and tells you what schedule to follow. New businesses follow the schedule set based on anticipated withholdings.

Monthly average tax withheld | Filing status | Must be Filed and Paid By |

|---|---|---|

$83.33 or less | Annual | 30 days after the end of the month |

$1,000 or less | Monthly | 30 days after the end of the month |

Over $1,000 | Early filer | 20 days after the end of the month |

- State Unemployment Taxes (SUTA): You need to pay SUTA electronically through the Uplink Employer Self Service website. You can enter information manually or by CSV file. You need a CSV or ICESA file if you have over 50 employees.

For Wages Paid During | Calendar Quarter Ends | Must be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

Step 8. Document and store your payroll records. Indiana requires you to keep records on employees for at least three years. Information should include contact details and other data, as required by the Federal Labor Standards Act. Learn more in our article on retaining payroll records.

Step 9. Do year-end payroll tax reports. Send the federal Forms W-2 (for employees) and 1099 (for contractors). You also need to submit the Indiana WH3 annual withholding form. If you filed more than 25 withholding statements in a calendar year, this must be done electronically.

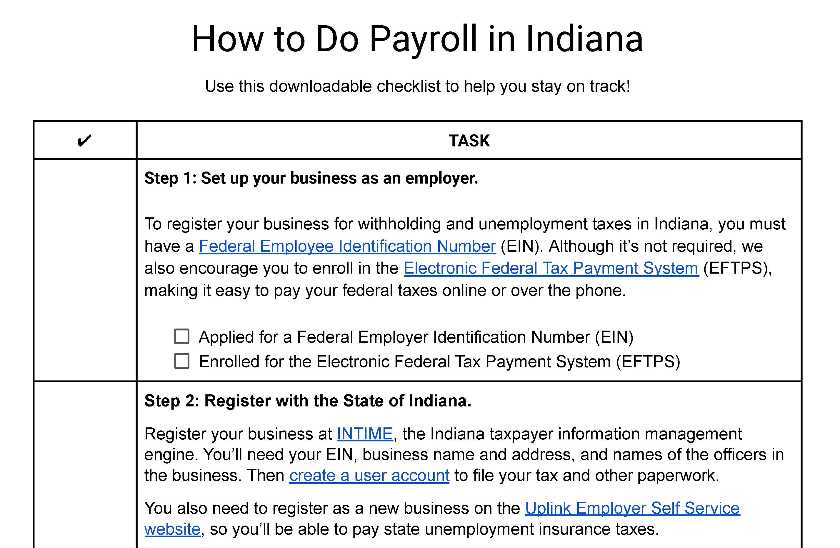

Download our free checklist to help you stay on track while you’re working through these steps:

Learn more about doing payroll yourself in our guide on how to do payroll, which includes a free checklist you can download to make sure you don’t miss any steps.

Indiana Payroll Laws, Taxes & Regulations

No matter what state you are in, you must follow federal law for income taxes, Social Security, Medicare, and federal unemployment insurance (FUTA). You’ll need to withhold 6.2% of each employee’s check for Social Security and 1.45% for Medicare taxes; you’ll also need to pay a matching amount from your bank account. FUTA is 6% on up to $7,000 of earnings. Learn more in our guides on FICA taxes and FUTA, as well as rules for overall payroll compliance.

Indiana Taxes

Indiana taxes are 3.23%, with county taxes ranging from 0.0125% to 0.0265%. There are reciprocity agreements for five states you need to be aware of.

State Income Taxes

Indiana has a flat tax rate of 3.23%. However, each county also charges taxes at rates varying from 0.0125% to 0.0265%. Withholdings are based on the employee’s Indiana county of residence as of Jan.1 of the tax year. If they live out of the state, then use the county of their place of business.

Check the Indiana Department of Revenue site for the deduction tables and county codes and rates. There are two tables: one for personal deductions and one for dependent exemptions. You can find the exemptions on the form WH-4.

Reciprocity Agreements

Indiana has reciprocity agreements with Kentucky, Michigan, Ohio, Pennsylvania, and Wisconsin. All salaries, wages, tips, and commissions earned in these states by an Indiana resident must be reported as if they were earned in Indiana. Similarly, residents of these states that earn income in Indiana need to report and pay tax on that income to their state of residence. Out-of-state employees need to fill out a Form IT-40RNR if they earn wages, salaries, tips, or commissions.

For more information on Indiana’s reciprocity agreements, check out this Information Bulletin.

Unemployment Insurance

You need to pay unemployment insurance if you paid a dollar or more in remuneration to a covered worker, have acquired part or all of a business that pays SUTA, are a liable entity in another state, and have workers in Indiana. Some entities are exempt, however, such as churches, some agricultural businesses (it depends on how much you pay in wages and how many people you employ), and nonprofits.

Seasonal jobs: Workers in seasonal jobs only receive unemployment if they lose their job during that operating seasonal period. Therefore, if you hire for seasonal jobs, such as tourist attractions, then it helps lower your SUTA if you have the jobs classified as seasonal. These jobs must be materially different from year-round jobs to qualify. Learn more in the employer handbook.

Indiana’s state unemployment insurance tax is on the first $9,500 of an employee’s income and runs between 0.5% and 7.4%, with the new employer rate at 2.5%. Your rates are based on your experience balance as of June 30 and your past 36 months’ payroll. There is also a penalty rate of 2% if you fail to pay your premiums within 10 days of the date requested by the Merit Rate Delinquency Notice.

Did you Know?

When you pay SUTA, you may qualify for up to a 5.4% discount on your federal unemployment insurance taxes.

Workers’ Compensation Insurance

If you have one or more employees, you need to pay for workers’ compensation insurance—luckily, Indiana is one of the cheapest states in which to purchase workers’ comp. Several insurance companies offer policies. You do not need to include corporate officers in the coverage unless you wish to. Other exempt employees include casual workers, agricultural employees, household employees, and independent contractors.

You can apply to self-insure, but you must submit proof that you can afford to provide recompense to injured employees. You or your parent corporation must also have been in business for at least five continuous years. Self-insuring requires a surety bond of not less than $500,000, and you’ll pay the state annual fees to maintain your certificate.

Minimum Wage Laws in Indiana

Indiana’s minimum wage remains at $7.25 an hour. Tipped employees must be paid at least $2.13 and receive at least minimum wage when tips are added. If they do not, you must make up the difference. Employees under 20 may receive a training wage of $4.25 per hour for the first 90 days on a job. In addition, students working part time for up to 20 hours per week when working certain jobs, like work-study programs, are exempt from minimum wage.

Under certain circumstances, like common construction, you may have to pay prevailing wages if they are more than the minimum wage.

In the News:

There is a bill working its way through the Indiana Legislature that would raise the minimum wage to $9.02 per hour starting July 1, 2024. This bill would increase the minimum wage annually based on the Consumer Price Index. In reality, this bill faces steep hurdles in Indiana but it’s something to keep an eye on. Should this bill, or any version of it, become law, we’ll update this guide accordingly.

Overtime Regulations

Overtime includes any hours worked above 40 in a workweek and is 1.5 times the employee’s regular wage. You must pay this for any hourly or other nonexempt employees who qualify; failing to comply will subject you to penalties and fines.

Exemptions include:

- Executives, administrators, and other professionals earning at least $455 per week

- Outsides salespeople

- Some computer-related workers (usually those who set their own hours)

- Some transportation, agricultural, and farmworkers

- Live-in housekeepers

- Salaried artists

- Certified teachers

Different Ways to Pay Employees

In Indiana, employers must pay wages in cash, check, draft or money order, or via direct deposit. You cannot force an employee to accept direct deposit, however. Pay cards are not addressed, but employees must receive their full wages (i.e., the pay card cannot take a percentage), or you must pay that percentage above the wages earned.

Pay Stub Laws

Indiana requires pay stubs to include hours worked, wages paid, and a listing of deductions made. It’s pretty basic and easily done with payroll software, though Indiana does not specify how you provide this information to employees.

If you’re still processing payroll on your own, you can create your own pay stubs quickly using one of our free pay stub templates.

Minimum Pay Frequency

You need to pay wages at least twice monthly and no later than 10 business days following the close of the pay period. Employees can request to be paid biweekly, and you must oblige.

Paycheck Deduction Rules

Indiana cannot deduct more than 25% of the employee’s disposable earnings for the week or the amount by which the disposable earnings for the week exceed 30 times the federal minimum hourly wage. Indiana allows deductions as required by law or court order and as requested by the employee for the following:

- Insurance premiums

- Charity contributions

- Purchase of bonds, securities, or stock of the employing company

- Labor union dues

- Merchandise sold by the employer to the employee

- Amount of loan made to the employee by the employer

- Healthcare

- Uniform or equipment purchases, not to exceed the lesser of $2,500 per year ($48.08 weekly) or 5% of the employee’s weekly disposable earnings

- Reimbursement for education or employee skills training, unless the education or employee skills training was provided through an economic development incentive from a federal, state, or local program

- An advance for payroll or vacation pay

- Merchandise, goods, or food offered by the employer, for the employee’s benefit, use, or consumption, at the written request of the employee

Final Paycheck Laws

If an employee leaves your employment, permanently or temporarily, then you need to pay the final paycheck by the next usual payday. The final paycheck must include any accrued PTO or vacation pay. You are not required by law to provide severance pay. If you decide to offer this, be sure it’s in the employee contract.

Accrued Paid Time Off

Indiana does not designate any paid time off or vacation rules. Therefore, it’s up to you to designate policies at the time of hiring—any agreements you make are legally binding and if your company policies do not indicate whether accrued and unused vacation time is paid out upon separation, then you must pay it to the employee. Accrued vacation is considered deferred wages.

Indiana HR Laws That Affect Payroll

Indiana’s laws generally default to federal law or contracts.

Indiana New Hire Reporting

You need to report new hires or rehires who return to work after 60 days of being laid off, fired, furloughed, separated, or given leave without pay. Do this within 20 days of hire or rehire on the new hire website. The instructions there will guide you through filling out the report. You need to submit at least the employee’s name, address, Social Security number, and date of hire, as well as your company name, address, and FEIN.

Lunch and Other Break Time Requirements

Indiana does not require you to provide meal breaks to employees of any age (the mandatory breaks for minors have been repealed). Default to federal law, which says that you don’t have to provide breaks; however, if you do, you need to pay for short breaks, but not bona fide meal breaks where the employee is not doing any work. Meal breaks are usually 30 minutes or longer, though they can be shorter depending on certain circumstances.

Breaks for Nursing Mothers: Indiana requires you to provide breaks for nursing mothers to express breast milk. They also need to be provided with a private location (not the bathroom) and a refrigerator or cold storage area for storing the milk until the end of the workday.

Paid Sick Leave

Indiana does not require you to pay for sick leave. However, if you do agree to paid sick leave, then you cannot deny anyone benefits or lesser benefits based on age, disability, race, color, sex, national origin, or religion.

Indiana Family Leave Act

Indiana follows the federal Family Medical Leave Act. The federal FMLA applies to employers who had at least 50 employees in 20 weeks of the current or previous year. It allows employees up to 12 weeks of unpaid leave in a 12-month period for bonding with a new child, dealing with serious health conditions, or dealing with emergencies from a family member on military duty.

Learn more about FMLA in our article about federal labor laws.

Hiring Minors

Indiana no longer requires work permits for workers under age 18. However, they do require all employers to report minor employees though the Department of Labor Youth Employment System.

Naturally, Indiana enforces federal law restricting minors from working in hazardous industries. It has also recently updated its list of prohibited occupations for minors. Here are a few examples, but check the Youth Employment website for details, including specific definitions.

There is a long list of prohibited occupations for 14- and 15-year-olds. The permitted lists are shorter. Here is a representative sampling:

- Office and clerical work

- Cashiering

- Selling

- Modeling

- Assembling orders

- Errand work

- Cleanup work/grounds maintenance

- Intellectual or artistic work

- Lifeguarding (15-years and up)

- Some agricultural work

There are some exceptions to the hazardous work rule. For example, 14-year-olds are prohibited from operating a tractor unless they are in 4-H and have had certain orientation courses.

The prohibited occupations for 16- and 17-year-olds include the following:

- Working around explosives or the manufacturing of explosives

- Coal mining

- Forest fire fighting, forestry, logging

- Sawmill operations

- Working around radioactive substances

- Operating bakery machines

- Operating circular and other powered saws

- Roofing

- Excavation

There are exceptions to this, such as with certain work-study programs.

Work hours for 14- and 15-year-olds are restricted to between 7 a.m. and 7 p.m. during the school year and 7 a.m. to 9 p.m., June 1 through Labor Day. They can work three hours a day during school days for 18 hours a week. During non-school days, they can work eight hours. On non-school weeks, they can work 40 hours.

For 16-year-olds, the hours extend to 6 a.m. to 11 p.m.—except on school nights, when it’s only until 10 p.m. They can work nine hours a day, 40 hours a week during school weeks, and 48 hours during non-school weeks.

Seventeen-year-olds can work between 6 a.m. and 10 p.m. on school nights or 11 p.m. with parental permission. They can work nine hours a day, 40 hours a week on school weeks, or 48 hours on non-school weeks.

For more information on federal child labor laws, check out our guide to hiring minors.

Payroll Forms

You’ll pay withholding taxes through INTIME, but the other payroll forms you need are available in PDF that you can download or fill out online.

Indiana State W-4 Form

Indiana’s withholding exemption form is the WH-1. The WH-1U is for underpayments and the WH3 for end-of-year withholding. These are filed through INTIME only.

Other Indiana State Payroll and Tax Forms

- WH-4: Exemption form that employees fill out. Nonresident military spouses should fill out the WH-4MIL to get a tax exemption.

- WH-47: Certificate of residence for non-Indiana residents who live in reciprocity states

Find other payroll forms on the Indiana government website.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculate unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing non-employee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

Indiana Payroll Tax Resources/Sources

- Departmental Notice #1: Walks you through calculating state and county income tax withholdings

- Information Bulletin #28: Discusses state and county income tax, reciprocal states, and withholdings

- W-2/WH-3 Electronic Filing Requirements: How to file these forms electronically

- Unemployment Insurance Employer Handbook: Everything about state unemployment insurance, from how your rates are determined to how the claims and appeals process works

- Self-Insurance Guide: Discusses the requirements and rules for self-insuring for workers’ compensation

- Indiana Labor and Safety Codes: The laws surrounding hiring, paying, and taking care of employees

Bottom Line

The county taxes and reciprocity agreements with neighboring states can make learning how to do payroll in Indiana a bit complex—but it’s reasonably straightforward for the rest of it. Just remember that withholdings are paid monthly, quarterly, or annually—depending on how much you withhold—and SUTA is charged quarterly. There’s also workers’ compensation insurance to consider, and you have some leniency when scheduling minors. If you ever get lost, consult our checklist and look through the documents on the Indiana government website to guide you.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more: