Nevada does not have a state income tax, and its overall reporting requirements are easy to follow. It does not require state disability insurance but does charge state unemployment taxes (SUTA) quarterly. However, there are some complexities to the Nevada minimum wage and overtime calculations.

Key Takeaways:

- Effective July 1, 2024, Nevada will eliminate the two-tiered minimum wage and the minimum wage for all employees in the state will be $12.00 per hour

- Nevada does not allow tip credits, so you’ll need to pay the full minimum wage to all employees, including tipped employees

- For employers with at least 50 employees, you’re required to provide at least 40 hours of PTO annually

- As of 2024, final pay must be paid immediately upon separation for terminated and laid-off employees

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Step-by-Step Instructions to Running Payroll in Nevada

Below are the basic steps for managing payroll in Nevada. For more guidance on the general payroll process, check out our article on how to do payroll.

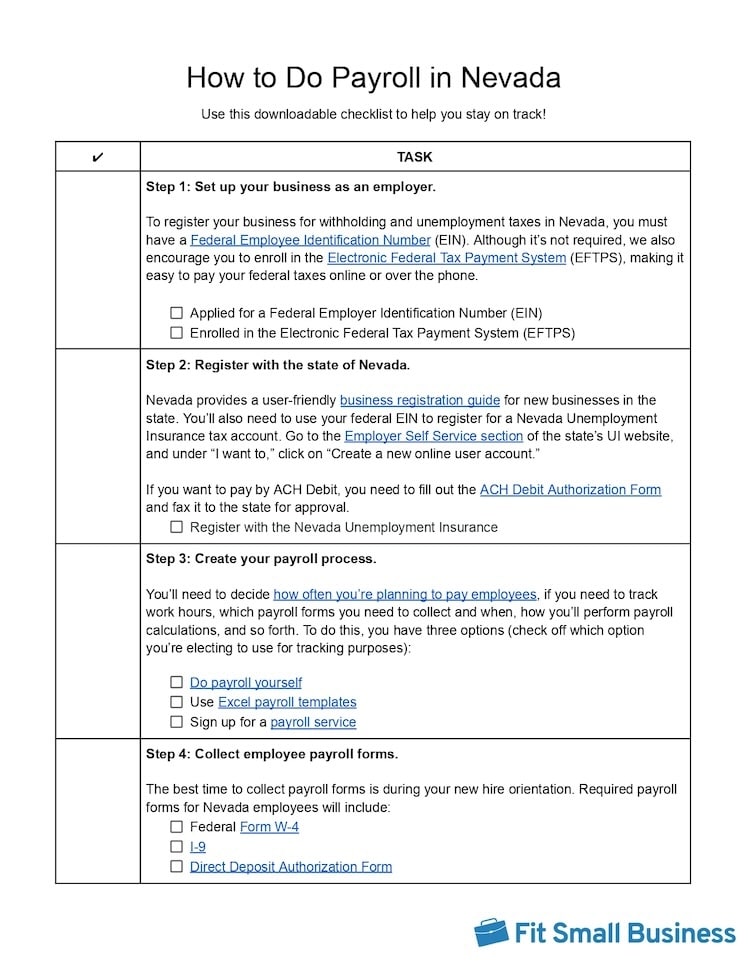

Step 1: Set up your business as an employer. At the federal level, you need your employer identification number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with the state of Nevada. Nevada provides a user-friendly business registration guide for new businesses in the state. You’ll also need to use your federal EIN to register for a Nevada Unemployment Insurance tax account. Go to the Employer Self Service section of the state’s UI website, and under “I want to,” click on “Create a new online user account.”

If you want to pay by ACH Debit, you need to fill out the ACH Debit Authorization Form and fax it to the state for approval.

Step 3: Create your payroll process. You may have inherited a payroll process if your business is established. However, if your company is brand-new, you may need to start your payroll process, which includes deciding when and how often you’ll be paying employees and how you’ll track and calculate hourly employees’ work time. You can opt to do payroll yourself by hand (not recommended), set up an Excel payroll template, or use a payroll service to help you handle your Nevada payroll.

Step 4: Collect employee payroll forms. It is ideal to do this during onboarding. Some of the most common payroll forms that small businesses need include W-4, I-9, and direct deposit information. Nevada does not have additional forms, although you will want to report your new hires.

Step 5: Collect, review, and approve time sheets. Several days before your payroll is due, collect and review documented work time from hourly and nonexempt employees so you can speak with anyone who might have made mistakes. There are numerous ways to track employee time—including using one of our free time sheet templates. If you have employees who work or live out of state, tracking where they perform the bulk of their work is important as it can affect whether you are liable for state unemployment insurance (UI).

Step 6: Calculate payroll and pay employees. Use a standard process to calculate payroll. A payroll software will reduce errors. Don’t forget to calculate withholdings for non-residents unless you have a bona fide business location in the state. Most companies today use direct deposit to pay their employees, but cash (not the best way) and paper check are also payment options. You can pay your federal and state taxes online. If you use a benefits provider, it should work with you to make deductions simple, automatic, and electronic.

Step 7. File payroll taxes with the federal government. Federal tax payments must be made via EFTPS. You’ll need to deposit federal income tax withheld and both employer and employee Social Security and Medicare taxes based on the schedule assigned (either monthly or every other week) to your business by the IRS.

- Monthly depositors are required to deposit employment taxes on payments made during a month by the 15th day of the following month.

- Every other week depositors are required to deposit employment taxes for payments made Wednesday, Thursday, and/or Friday by the following Wednesday. Taxes on payments made Saturday, Sunday, Monday, and/or Tuesday are due by the following Friday.

It’s important to note that the schedules for depositing and reporting taxes are different. Employers who deposit both monthly and semiweekly should only report their taxes quarterly or annually by filing Form 941 or Form 944.

Step 8: File payroll taxes with the State of Nevada. You can report your payroll taxes online, something you’ll need to do even if you have nothing to report. You can pay online at the Nevada Tax Center website.

For Wages Paid During | Calendar Quarter Ends | Must be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

You may file on the next business day if any of these dates fall on a Saturday, Sunday, or legal holiday. It is possible to pay with a check if you owe less than $10,000. If you exceed that, you need to file and pay electronically. To pay by paper, send the form and check to:

Department of Employment, Training and Rehabilitation

Employment Security Division, Contributions Section

500 East Third Street

Carson City, Nevada 89713-0030

Make sure to always be on time! Nevada charges a $5 late fee, plus 1% interest for each month or partial month you are overdue.

Step 9: Document and store your payroll records. Nevada requires you to retain records for all employees, even those terminated, for at least two years. Learn more in our article on retaining payroll records.

Step 10: Complete year-end payroll tax reports. These are the federal Form W-2 (for employees) and Form 1099 (for contractors). Employees and contractors must have these by Jan. 31 of the following year.

Download our free checklist to help you stay on track while you’re working through these steps:

Learn more about doing payroll yourself in our guide on how to do payroll—it even has a free checklist you can download to make sure you don’t miss any steps. Or, check out our state payroll directory to learn more about the specific guidelines for handling payroll in other states.

Nevada Payroll Laws, Taxes & Regulations

Nevada requires employers to pay for state unemployment insurance taxes (SUTA) and workers’ compensation insurance but not state income taxes or disability insurance. The rules are similar to federal laws, and filing is quarterly.

Nevada SUTA

With some exceptions, if you pay more than $225 in wages during a calendar quarter, you are liable for state UI tax withholdings. The tax rate for new employers is 2.95% of taxable wages. After that, the state determines your rate for you and sends it to you on your preprinted Form NUCS 4072. Nevada’s UI tax rates range from 0.25% to 5.4% of employee wages up to $40,600. If you pay less than 5.4%, you’ll also pay a Career Enhancement Program tax of 0.05%.

Most employers have to pay SUTA. Even agricultural employers are liable if they paid wages of over $20,000 or employed 10 or more people. Nevada exempts:

- Domestic workers in private homes

- Family

- Workers on a foreign vessel or aircraft abroad

- Certain nonprofits or charities

- Patients working in the hospital

- Students in student programs

- Spouses working in schools in exchange for financial assistance

- Minors delivering newspapers

- Agent-drivers, commission-drivers

- Some salespeople working on commission

Did You Know? You’re in luck! There are no state income taxes in Nevada, so you don’t need to worry about state income tax withholdings. You still need to calculate, file, and pay federal income tax withholdings, however.

Workers’ Compensation Insurance

Nevada requires employers to have workers’ compensation insurance for all workers, even noncitizens and minors, but excludes casual or theater performers, domestic workers in the home, volunteers, clergy, real estate brokers, workers doing direct sales via phone, and commission workers like salespeople. You can get your own policy, but it should include at least the following:

- Medical treatment

- Lost time compensation (Temporary total disability/temporary partial disability)

- Permanent partial disability

- Permanent total disability

- Vocational rehabilitation

- Dependent’s benefits in the event of death

- Other claims-related benefits or expenses (e.g., mileage)

Minimum Wage Rules

The current minimum wage in Nevada is $11.25 per hour for employers who do not offer health coverage, and $10.25 per hour for employers who do offer health coverage. On July 1, 2024, it will increase to $12.00 per hour for all employers, doing away with the state’s two-tiered minimum wage.

The following employees are exempt from minimum wage requirements:

- Workers employed under a valid collective bargaining agreement where minimum wage, tip credit, or other minimum wage provisions have been waived in clear and unambiguous terms

- Employees younger than 18 years of age

- Workers employed by a nonprofit organization for after-school or summer employment

- Paid trainees for a period of up to 90 days

Nevada does not allow employers to use a tip credit for tipped employees. That means you’ll need to pay any employees earning tips the minimum wage described above, plus tips.

Non-wage compensation, such as lodging or meals, may be considered part of wages. Lodging cannot constitute more than five times the minimum hourly wage each week. Breakfasts and lunches cannot be counted at more than 25% of minimum wage, and dinner, no more than 50%.

Overtime Regulations

Nevada sets a standard overtime rate of time-and-a-half of the employee’s wage rate when the employee works more than 40 hours in a workweek or more than eight hours in a day. The latter requirement only applies if the employee normally earns less than 1.5 times the Nevada minimum wage. The following are exemptions:

- Employees of businesses earning less than $250,000 per year in gross sales volume

- Employees in retail or service if their regular rate is already more than 1.5 times the minimum wage and over half their compensation comes from commissions

- Bona fide executive, administrative, or professional employees

- Employees covered by collective bargaining agreements that provide for overtime in other ways

- Drivers, drivers’ helpers, loaders, and mechanics for motor carriers subject to the Motor Carrier Act of 1935

- Railroad workers

- Aircraft employees

- Drivers and drivers’ helpers making local deliveries and paid by trip or other payment (like mileage)

- Taxi and limo drivers

- Agricultural employees

- Auto salespeople and mechanics of auto dealers

- Domestic workers

Reporting Out-of-State Employees

In some cases, out-of-state employees still count for Nevada tax filing. It’s similar to other states:

- If a worker performs all or most of their work in Nevada, wages must be reported to Nevada.

- If a worker performs some work in Nevada, but most elsewhere, all wages should be reported in the state where their “base of operations” lies. A base of operations is the place from which the employee works, whether an office or a home.

- If the employee lacks a “base of operations” or a specific location from where they get direction and control, wages should be reported to Nevada if that is the worker’s residence.

Different Ways to Pay Employees

Nevada does not require you to pay employees in a specific manner, but you cannot discriminate against those without a bank account. Since there are no specific rules that dictate how your employees need to be paid, it might be a good idea to offer a check or pay card option for those that prefer to not use direct deposit.

To learn more about the types of payments you can make, check out our suggestions on the different ways to pay your employees.

Pay Stub Laws

You need to provide employees with pay stubs that itemize their paycheck, including details on gross pay, deductions, net cash wages/salary, date of payment, and hours worked. Failure to do so can result in a $5,000 administrative fine and even misdemeanor charges.

If you’re doing payroll on your own and need a quick way to print a pay stub, download one of our free payroll stub templates.

Minimum Pay Frequency

Nevada requires you to pay employees semimonthly at least. You can agree on a different schedule, but cannot make that agreement a term of employment. Wages earned before the first of the month must be paid by 8 a.m. on the following 15th. Wages earned on the first through the 15th must be paid by 8 a.m. on the last day of the month.

Exceptions include those in an executive, administrative, or professional capacity, outside salespersons, or supervisors as defined in the National Labor Relations Act.

Paycheck Deduction Rules

Nearly every employee has deductions from their paycheck, usually taxes and healthcare premiums. In Nevada, you’re allowed to deduct wages from your employees’ paycheck if required or permitted under state law, or if the employee consents in writing.

Specifically, you may deduct the following:

- Garnishments from legal judgements, including unpaid taxes and child support

- Tax, Federal Unemployment Tax Act (FUTA), and State Unemployment Tax Act (SUTA)

- Employee’s share of health insurance and other benefits

- Recompense for damages caused by the employee in the workplace

Legal garnishments cannot exceed 82% of the take-home pay for any workweek if the employee’s gross weekly pay when the most recent writ of garnishment issued was $770 or less, or 75% of the take-home pay for any workweek if the gross weekly pay exceeded $770. If the employee’s weekly take-home pay is less than 50 times the federal minimum hourly wage, the entire amount may be exempt.

You also cannot charge workers for required uniforms or accessories if they are distinctive in style, color, or material.

Final Paycheck Laws

Termination pay must be paid to an employee immediately—this is a new change for 2024, and it also applies to laid-off workers. Meanwhile, if the employee quits, you must pay final wages no later than their usual payday or seven days after the employee quits, whichever is earlier.

Accrued Paid Time Off

Nevada employers with at least 50 employees must provide paid leave, accrued at a rate of 0.01923 hours per hour worked. Employers can cap this leave at 40 hours per year. In Nevada, you have the choice of front-loading leave at the start of the year or letting leave accrue.

If you’re not required to provide paid leave and your company has a paid time off policy, you must follow that policy for allowing rollover and paying out any unused and accrued time off. It’s good practice to have these policies written and included in your company handbook so employees know what to expect.

Nevada HR Laws That Affect Payroll

Nevada is relatively easy when it comes to payroll laws—many align with federal rules—but you do need to stay abreast of them.

New Hire Reporting

You must report new hires within 20 days of their hire dates. This includes rehires if they have been separated from your employment for more than 60 days. While the state does have a new hire form, it’s not required. However, you must include the following details:

- Employee’s full name

- Employee’s Social Security number

- Employee’s address (city, state, and ZIP)

- Federal EIN

- Employer’s Name

- Employer’s address (city, state, and ZIP)

- Employee’s start date

- Date of birth (optional)

- State of hire (optional)

You can send the information electronically, by mailing in the W-4 form to the Employment Security Division, or by faxing in a new hire form or the information listed above.

Time Off Requirements

Typically, you pay employees for the time they work but not when they don’t. However, there are more specifics around breaks and PTO that you may need to comply with.

State Disability Insurance

Nevada does not require you to pay disability insurance, nor does it have a state disability insurance program. However, such policies protect both you and your employees plus make you a more attractive employer to applicants.

Child Labor

NRS 609.240 defines provisions for working minors. Children under 16 may not work more than eight hours in a day or 48 hours in a week. A child being in their place of employment during working hours will be considered working.

Children under 14 are not allowed to work unless they have written permission from a district judge or his designee. Farm work, house work, and acting in a motion picture are the exceptions. Only child actors are exempt from working during public school hours unless excused by the school district or by order of juvenile court.

For more information about payroll and HR laws employers need to know, check out our payroll compliance guide.

Payroll Forms

Nevada has few payroll forms, making paperwork easier. Of course, there are federal forms to keep track of as well.

Nevada Form W-2

No state income taxes, no state W-2. That was easy!

Other Nevada Withholding Forms

- Form NUCS 4072, Employer’s Quarterly Contribution and Wage Report: For filing UI taxes by paper. You should get a pre-filled copy from the state each quarter. Access the Nevada Unemployment Insurance site if you need to download the form.

- ACH Debit Authorization: for paying UI taxes via ACH debit.

- State of Nevada New Hire Report: Useful, but not required since you can file online.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: To report total annual wages earned (one per employee)

- W-3 Form: To report total wages and taxes for all employees

- Form 940: To report and calculate unemployment taxes due to the IRS

- Form 941: To file quarterly income and FICA taxes withheld from paychecks

- Form 944: To report annual income and FICA taxes withheld from paychecks

- 1099 Forms: To provide non-employee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

Nevada Payroll Tax Resources & Sources

- Unemployment Insurance Information: FAQs, schedules, links to forms

- NRS 612: Nevada unemployment compensation statutes

- Nevada Department of Taxation: Forms, online services, and more

- Nevada Department of Business & Industry Industrial Relations: Rules about workers’ comp and more resources for businesses in Nevada

Frequently Asked Questions (FAQs) About Nevada Payroll

No, you must pay the full minimum wage to tipped workers before accounting for any tips they receive. Also keep in mind that on July 1, 2024, Nevada’s minimum wage will increase to $12.00 per hour and eliminate the two-tiered minimum wage system of the past.

It depends. If you have 50 or more employees, you’re required to give up to 40 hours of PTO each year under Nevada law. If you’re under 50 employees and you have a PTO policy, you’ll need to pay employees according to your policy.

If you find a payroll error, take immediate action. If the error relates to a missed or incorrect tax payment, contact the tax agency immediately to understand your next steps. If you’ve underpaid an employee, speak with them and keep them updated about what you’re doing to correct the mistake.

Bottom Line

In Nevada, close attention to minimum wage and the lack of a tip credit are crucial. Learning how to do payroll in Nevada is straightforward but make sure you adhere to these nuances.

If you need help running your Nevada payroll, consider using payroll software like QuickBooks Payroll. It files and pays your payroll taxes and covers any penalties you are charged if its reps make a mistake (it’ll cover your mistakes too if you opt for a premium plan). You can pay employees via direct deposit or check, and same-day payment options are available as well. Sign up for a free trial or discounted rate.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.