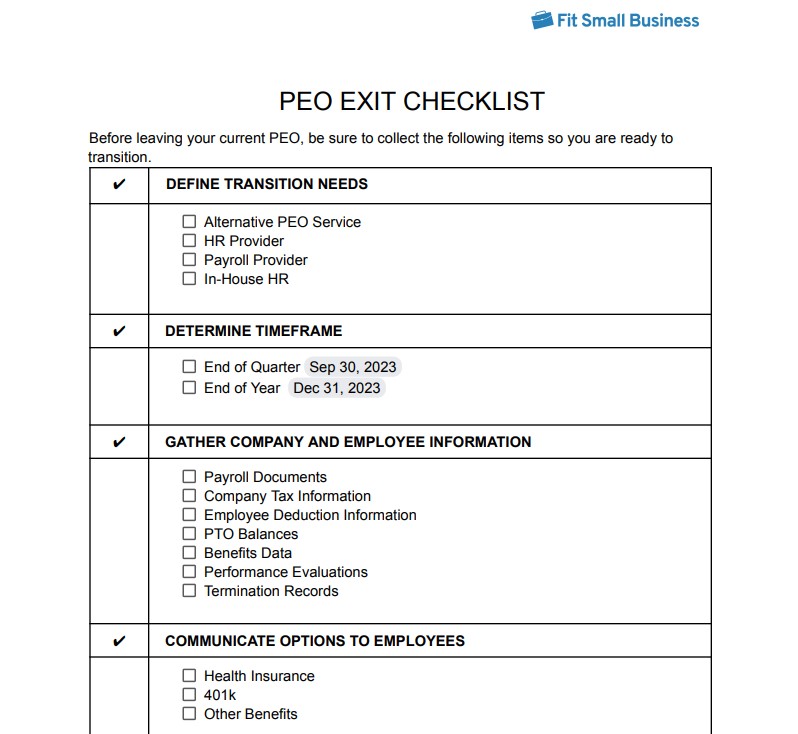

Knowing how to leave a professional employer organization (PEO) can be challenging for small businesses. You have to think about when to notify your PEO provider, what information you need to disclose to your employees, and how to make the transition seamless. We’ve made this task easier with a free downloadable and customizable PEO exit checklist.

Thank you for downloading!

If you are in the process of leaving your current PEO consider Rippling. You can sign up under the PEO or HR services and switch as needed.

To ensure a smooth transition, you need to consistently communicate with both your old and new providers to make sure nothing, like payroll or tax payments, slips through the cracks. You should also perform a thorough analysis of cost changes for both you and your employees—and be sure to notify them of changing health insurance premiums. Follow these steps for a successful transition.

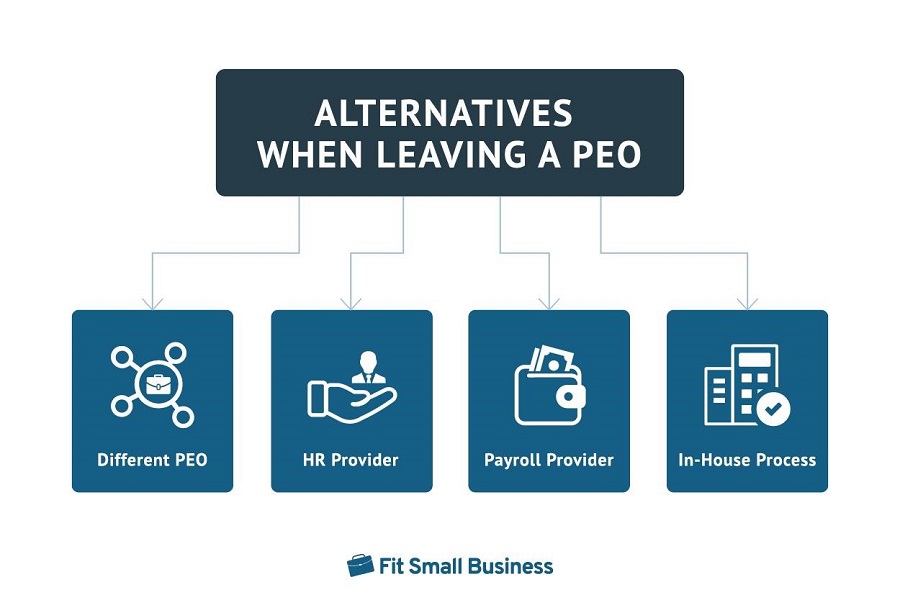

1. Define How HR & Payroll Needs Will Be Met

Before you start the process of leaving your current professional employer organization (PEO), it’s important to know where you are going.

- Will you be using another PEO service?

- Will you be transitioning to an HR outsourcing provider?

- Will you be transitioning to a payroll services provider?

- Will you be taking over the process in-house?

You should determine this early to ensure you won’t experience a gap in services. For instance, PEOs handle payroll; if you’re switching to a DIY payroll provider that doesn’t file taxes in your state, you’ll need to set up a process in-house to ensure you don’t miss any deadlines. Or, you can weigh your options and consider a full-service provider.

For some options, check out the following guides:

- Best PEO Companies

- Best HR Outsourcing Services

- Best Payroll Services

- In-House Payroll vs Outsourcing

Also, determine how much HR expertise your company has access to under your PEO. If you find yourself calling for labor law guidance every other week, you’ll need to consider how you will work around that should you sign up with a provider that doesn’t have certified HR experts.

2. Figure Out the Best Time to Make the Change

Typically, the best time to change providers that perform payroll services for you is either at quarter-end or year-end. It helps you make a clean cut when it comes to taxes; if you switch providers at any other time during the year, you’ll need to ensure that none of your tax liabilities slip through the cracks. Make it a point to work with your PEO representative to send any related tax and payroll paperwork over to your new provider, and make sure that the new provider is clear on what it should do with them.

When you make the switch, you’ll need to verify your year-to-date payroll numbers. Sometimes, new providers don’t transfer all of your prior period data over, which can cause issues. Payroll records will be incorrect, including your year-end tax forms, if the software pulls the data from payroll entries. However, most payroll and HR software companies will assist you in uploading the information before your first pay run is complete.

Regardless of when you choose to change HR payroll providers, give yourself enough lead time to perform all of the tasks on your to-do list.

3. Gather Stored Company & Employee Information

Many PEOs will still allow you to access your data after you leave, but it can be challenging if you’re not able to freely login and navigate their software. Therefore, be sure to collect copies of the following payroll documents:

- Company tax information

- Employee payroll tax information

- Employee deductions

- PTO balances

- Benefits data

- Performance evaluations

- Termination records

You should also consider where you will store the information when you have it. Will you use your own network? Will you print them and save them as paper files (which isn’t very efficient if you’re a growing company)? Or, are you able to upload them directly to your new provider’s database?

4. Communicate Health Insurance Option Changes to Employees

One of the primary benefits of using a PEO is the competitive health insurance rates—and unless you’re leaving for a different PEO, your employees will likely experience a rise in coverage costs. It’s important to get clear details on what those new options are and how much these will cost, so you can communicate it to your employees as soon as possible. Dropping the ball in this area could lower morale and cause employee turnover.

If there’s going to be a significant increase in insurance rates (and it’s a big possibility), do your best to explore as many options as possible. If you are no longer offering company-sponsored health insurance, consider offering credit to your employees’ paychecks so they can use it to purchase insurance on the Marketplace.

5. Request Updated Information on Employees’ FSA/HRA Accounts

As part of your health coverage, you may currently be offering your employees a flexible spending account (FSA) or health reimbursement arrangement (HRA). However, you need to understand that all funds associated with these accounts stay with the PEO company when you leave—meaning the PEO (as the employer of record) retains the right to all funds contributed, not you, the employer.

When you leave your PEO, you will need to determine if those accounts will remain open with the PEO or get closed and reopened with another provider. Ask if the PEO will continue to process claims until the end of the FSA and HRA period or if you need to transition that responsibility to another administrator. You may have to pay a fee for the PEO to maintain this service.

Employees will also need to be made aware of their current balances and how much time they have remaining to spend it. If the PEO will not continue to manage the funds until the renewal period, then your employees may need to go ahead and spend their balances (likely within 30 days of leaving the PEO).

6. Check HR & Payroll Compliance Obligations

Because your PEO functioned as a co-employer, you will be transitioning to fully employ your workers on your own. And, as a somewhat new employer, there are certain factors you’ll need to consider and prepare for:

- Ensure you have a federal and state tax ID number to file taxes under: PEOs file employer taxes under their own IDs, so you may not have had to be concerned with this if you’ve been using a PEO since your business started. Check for both withholding and unemployment tax accounts. You can learn more about your state and federal payroll tax rates in our comprehensive article.

- Time workers’ compensation so there’s no gap in coverage: Workers’ comp insurance is a requirement in all states except Texas, so you’ll likely need to maintain it. Check that your new provider offers it, and be sure the start date is immediately after the end date with your PEO.

- Figure out COBRA obligations: Since the PEO’s relationship is being terminated, they will be responsible for sending COBRA notices to your employees; double-check that they do, however. You might also be charged a hefty fee if the PEO has to manage any COBRA accounts.

- Review any garnishment orders: If your PEO was managing any garnishments (i.e., earnings withholding orders) for you, you’ll need to assume responsibility for it. Ask for copies of the garnishment order, so you have it for your records. It’s best to be proactive and communicate the employer change to the applicable court that issued the order (contact information should be on the withholdings order) and set up a process to start withholding and sending funds as soon as the PEO stops.

- Set up your own payroll: When you leave a PEO, you also leave your current payroll process. Be sure to set up payroll with another provider before leaving so that you have everything in order when the switch happens. This includes making sure that your payroll is run on the same schedule, letting your employees know what deductions to expect from their new payroll, and how their pay will be distributed (i.e., direct deposit, pay card, or paper check). This is especially important if any of these will be changing (i.e., moving from pay card to direct deposit).

7. Create New Employee Paperwork

If this is your first time fully employing workers, you’ll need to put together an onboarding packet. This packet should include:

- Direct deposit form

- Form W-4

- Form I-9

- Employee handbook

- Leave policies

- Non-discrimination policy

- Sexual harassment policy

Be sure to take a close look at the policies your PEO required and confirm that you want to maintain those once the relationship ends. You might need to create new documents with these policies in them if you’re unable to make a copy of the PEO’s documents or if they are very specific to the PEO. Also, communicate any changes to employees—have them sign a new acknowledgment form for good measure.

Top Reasons Companies Leave a PEO

Companies quit a PEO for a few reasons. In most cases, it is a reaction to growth due to hiring or expanding locations and an increased desire to utilize resources in-house and control the company culture and benefits.

- Benefits choices: While PEOs can often help smaller companies obtain better benefit rates, as a company grows, it may earn competitive rates on its own from a broader choice of providers.

- Corporate culture and industry expertise: Companies striving to create a specific yet evolving corporate culture may find that they can control it better by utilizing an in-house team with industry experience.

- Misalignment or duplicate resources: Some companies find that their in-house teams and PEO resources are misaligned and not working well together, or they may be paying for duplicate resources. In some cases, it becomes a harmful “us and them” type of situation.

- Fast growth: As companies grow and hire, they may find that their current PEO cannot provide services to the new locations. So, they may choose to move those services in-house rather than contracting with multiple PEOs. Or, the company is growing so big that using a PEO is more expensive than hiring an in-house HR team.

Before Leaving PEO

Before migrating away from your PEO service, you’ll need to consider all contingencies carefully to ensure a smooth transition. Also, assemble your team leaders to discuss how the changes may affect their processes and resource needs, and bring on additional resources, such as HR and accounting team members, if needed.

Consider the following:

- Costs: Before, during, and after the change

- Time: When to start the process, how long it will take, how long to implement and onboard the new PEO or HR team

- HR management: How will HR processes be managed during and after the change

- Business interruptions: How to keep processing running during the process

After Leaving PEO

After running the first round of payroll once leaving your PEO, work with team leaders and managers to determine the next steps. Discover roadblocks and problem areas to relieve. Hopefully, the change went well, but if not, now is the time to fix any issues.

Your situation will be unique, but it may help to consider the following actions:

- Schedule the HR team to follow up with the “new employees” to help them navigate the changes.

- Consider adding benefit choices.

- Create culture-building materials and team-building activities.

- Use the key components of performance management to build new performance plans.

- Share company information, such as new organizational charts. You can use org chart software to help create one if you don’t already have one.

- Remove redundant resources if needed.

- Review technologies and consider new additions if helpful.

- Audit compliance, tax, and legal requirements to ensure payroll compliance.

Frequently Asked Questions (FAQs)

When the PEO is no longer meeting the needs of your business it may be time to move on. This may be because you have a stronger in-house HR staff that can now handle everything the PEO was handling for you. Additionally, if you have an increase in employees and your PEO charges by the employee, budget may be the cause for leaving a PEO.

Because a PEO acts as the employer-of-record and pays your employees’ taxes under their federal ID number, if you leave your current PEO and do not sign up for a new PEO service, you will be liable for paying your employees’ payroll taxes. This may require you to set up a tax ID number in each state in which you have employees and then submit payments monthly, quarterly, or yearly.

Bottom Line

Leaving a PEO service is a positive step for many growing businesses looking to pull in costs and control their workforce. However, successful change depends on careful planning and management of a long list of details. With a good team and thoughtful planning, leaving your PEO can go smoothly. Download our leaving a PEO checklist to make sure you have everything in place.