A new hire checklist ensures that you don’t miss important steps when adding new employees to your team. Make sure to include all the required documentation and steps on the checklist template you create to make their first days on the job efficient and enjoyable. This includes having their employment paperwork ready, setting up their computer and email, and conducting a detailed and engaging new hire orientation.

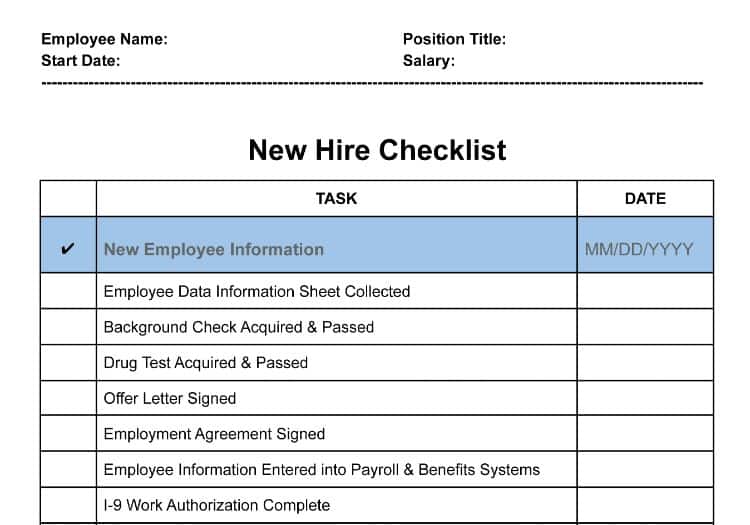

For your convenience, we have created a free, customizable new hire checklist template so you don’t miss any critical steps.

Thank you for downloading!

Consider using Gusto for all your new hire documentation. You can set up your new employee and use Gusto for payroll.

Continue reading for an overview of the required information and important steps you should include as part of an effective new employee checklist.

Basic & Background Information

Much of the information you need for a new hire will have been gathered during the recruitment and interview process; however, including all this on your new hire checklist will ensure nothing falls through the cracks. This information, as well as the forms and policies described in the next section, will form the foundation of your new employee’s personnel file.

Employee Data | Collect the employee’s name, address, phone number, and email address for your records. To ensure your company's payroll and benefits systems are up to date, accurate, and complete, all employee information must be entered into your HR software systems and updated with changes in employee status (e.g., new hire, promotion, transfer, and termination). |

Verification Documentation | Consider conducting post-offer assessments, pre-hire background tests, employment verifications, or drug screening (if legal in your state). It’s best to maintain a confidential personnel file folder to store this data. |

Offer Letter | Include a copy of the signed offer letter in your new hire’s personnel file. This should include an extended job offer to a candidate, as well as the terms and conditions of the offer. |

Employment Agreement | Whether you are hiring a W-2 employee or a 1099 independent contractor, it is also a good idea to have a signed employment agreement in your new hire’s files. An employment agreement spells out the specifics of the position, compensation details, and benefits, as well as requirements, such as a two-week or 30-day termination notice. |

I-9 Form | The I-9 Form verifies an employee’s eligibility to work in the US and must be completed within the employee’s first three days on the job. You do not have to submit a copy of it to the government, although you do have to keep the original on file for three years after the date of hire (or one year after an employee’s termination, whichever is later). |

Payroll providers will collect employee information for you and automatically set up your employee for payroll processing. See our guide to the best payroll services, including our top choice, Gusto.

New Employee Forms & Policies

Along with the offer letter and employment agreement, there are several other new hire forms and signed policies your new hires must have, including tax paperwork. Make sure to take note of these in your new hire documents checklist.

Federal W-4 Form | Have your employee fill out and sign a Federal W-4 form on or before their first day of work. The W-4 is where an employee specifies his or her tax withholding preferences. You can find and download the W-4 form on the IRS website. You do not have to submit a copy of it to the IRS but should keep the original on file. |

State W-4 Form | Some states use the federal W-4 form, while others have their own state W-4 form or don’t collect state taxes at all. You can find your state’s W-4 form or its equivalent on the Federation of Tax Administrators website. Like the federal W-4, obtain this on Day One (if your state requires it). |

State New Hire Reporting | Businesses need to report every new employee to their state’s new hire reporting program within 20 days of their start date. The purpose of this registry is to help the government enforce child support payments, track employment stats, and more. Each state has its own new hire reporting program center, which you can find on the U.S. Department of Health & Human Services website. |

Employee Handbook | Have your new employee sign the company handbook. This ensures they understand the company’s best practices and policies, as well as paid time off (PTO) procedures. Having an employee sign the handbook also confirms that they have received a copy and understand the policies within it. |

Policy Documents | It's not uncommon for businesses to require new employees to sign non-compete agreements and/or non-disclosure agreements as a condition of employment. These documents can help protect a business's trade secrets and other confidential information. Have your new hires sign these documents on or before the first day of employment. Keep the documents in the employee's personnel file. |

Direct Deposit Form | Collect a direct deposit form from your new hire. This form authorizes the company to send the employee's pay directly to their bank account and will include the routing number and account number where the new employee wants their paycheck deposited. By collecting this form in advance, you can avoid any delays in the employee's first paycheck. |

Benefits Enrollment Form | Provide benefits information (such as health insurance, dental, vision, life, disability, etc.) to your new hire. Have them complete the required benefits enrollment forms. You may be required to provide these forms to your benefits provider. It is also a good idea to keep them on file. |

New Employee Pre-onboarding

Most organizations have a process in place for bringing new employees on board. New employee pre-onboarding can be a valuable way to ensure that new hires are up to speed on the organization’s culture, goals, and processes. It can also help reduce the learning curve and make the transition smoother.

Several steps can be taken to make pre-onboarding successful:

1. Set Up New Hire Workspace

If your new hire will be working in your office, be sure they have a workspace equipped with a desk, chair, computer, printer, and any other equipment that is necessary to complete their job.

For instance, someone working in a restaurant would require a uniform, order pads, pens, etc. If your employee will be working remotely, this could include a stipend for a new computer or necessary office equipment.

This doesn’t just include hardware—make sure your new hire will have access to any software, apps, and login credentials that they need to do their job.

2. Timecard and/or Entry Card Preparation

Will your new employee punch a timecard? If so, make sure their timecard is prepared before their first day on the job. If your building requires an entry card or ID badge, make sure this is also ready to go.

Related: See our guide to the best employee time clocks.

3. Meet & Greet

Introducing new employees to their co-workers, manager, and supervisor is a good way to start their first day. This allows the new employee to get to know the people they will be working with and ask any questions they may have.

4. Orientation

An effective way to acclimate the new hire to their new environment is to schedule an orientation on the first day on the job. When a new employee is hired, it is important for them to feel comfortable in their new work environment as soon as possible. An orientation gives the new hire a chance to learn about the company and get adjusted to their new surroundings.

Did You Know?

According to a recent Gallup Poll, employees who experience full onboarding and orientation as a new hire are 2.6X more likely to be extremely satisfied with their workplace.

5. New Hire Training

The more productive and efficient your employees are, the more successful your company will be. That’s why it’s important to properly train your new employees during their first week on the job. By providing them with the training and tools they need to be successful, you can help set them up for a long and productive career at your company.

6. Check-ins

Once your new employee has been successfully hired and completed their paperwork, orientation, and training, the work doesn’t stop there. You should onboard your new employee, which goes beyond Day One to include check-ins at the 30-day, 60-day, and 90-day mark. Provide your employee with feedback at each check-in, letting them know what they are accomplishing successfully and what they may need to work on.

Read our article to learn about successfully onboarding new employees.

Steps for New Businesses Before Hiring Employees

If you are a brand-new business and have not yet hired any employees, follow the steps below to be certain you’re prepared for your first employee.

1. Obtain an Employer ID Number

Employer ID Numbers (EINs) are 9-digit numbers assigned and used by the IRS to track business tax information. You probably obtained one when you started your business. If not, before you hire your first employee, you need to apply for an EIN on the IRS website. That allows you to set up your payroll with correct tax information about your business.

2. Register for State and Local Taxes

If not completed already, make sure your business is registered for state and local taxes. Each state will provide you with an ID or number that you will need to set up your payroll processing. This information is also used to notify the state when you hire each new employee so that they can manage business and employee payroll taxes, as well as monitor state employment and unemployment rates.

3. Purchase Workers’ Comp Insurance

Most US states require businesses with one or more employees (besides owners) to purchase workers’ compensation insurance to protect their businesses and employees. This can typically be purchased through a state fund or a private carrier. Most payroll software can help you set up a workers’ compensation plan.

4. Post State and Federal Labor Law Posters

Depending on the state you’re located in and your industry, you’ll likely be required to post labor law posters around the workplace. These posters include information about at-will employment, minimum wage rates, and anti-discrimination laws. Most federal and state agencies will provide them for free.

5. Determine Your State Unemployment Tax Rate

Your state unemployment insurance (SUI) tax rate often varies from year to year, depending on salaries or wages. You should receive your SUI tax rate each year in the mail, or you can log in to your state tax registration website to find it. New businesses will use a default rate since they won’t have any unemployment claims.

If you’re hiring a 1099 contractor instead of a W-2 employee, consider using an independent contractor employment contract. Tasks like state registration, workers’ comp, and other activities may not be required of you if you hire a freelancer or gig worker.

Bottom Line

Following a new hire checklist is important to ensure that you do not miss any steps when adding a new employee to your team. In doing so, you can avoid potential problems and make the process as smooth as possible for both the new employee and your team.

Our downloadable new employee checklist template makes it easy for you to keep track of what’s needed. Once the employee is hired, you can move forward with extended onboarding and training that will further integrate your new hire with their team and the company.