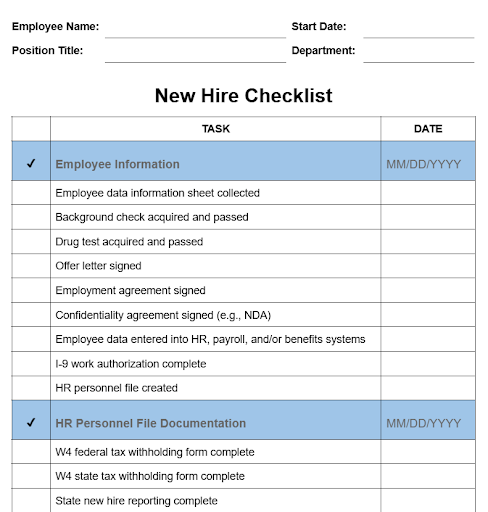

A new hire checklist ensures that you don’t miss important steps when adding new employees to your team. It should list all the required documentation and pre-onboarding tasks, as these contribute to making your new hires’ first days on the job efficient and enjoyable. This includes having their employment paperwork ready, setting up their computer and email, and conducting a detailed and engaging new employee orientation program.

There are different ways to prepare this form. Some new hire checklist examples or templates feature a list of the tasks and requirements needed, while others group the steps based on specific timelines, such as before the expected onboarding date, the new hire’s first week, and after the first 30 or 90 days.

If you’re looking for a basic document, here is a new hire checklist template you can customize and download for free.

Thank you for downloading!

Consider using Gusto for all your new hire documentation. You can set up your new employee and use Gusto for payroll.

Below is also a breakdown of the important steps and information you should include.

Basic and background information

Much of the information you need would have been gathered during the employee hiring process. However, including all this on your new hire checklist will ensure nothing falls through the cracks. This information, as well as the forms and policies described in the next section, will form the foundation of your new employee’s personnel file.

Employee data sheet | Collect the employee’s full legal name, address, phone number, and email address for your records. Enter data into your HR information software (HRIS) or payroll system. |

Verification documentation | Conduct post-offer assessments, such as background tests, employment verifications, or drug screenings (if legal in your state). Don’t forget to get the employee authorization forms for applicable assessments. |

Offer letter | Include a copy of the signed offer letter in your new hire’s personnel file. |

Employment agreement | Whether you are hiring a W-2 employee or a 1099 independent contractor, a signed employment agreement spells out the specifics of the position and pay details. |

I-9 form | The I-9 Form verifies an employee’s eligibility to work in the US and must be completed within the employee’s first three days on the job

Keep the original on file for three years after the date of hire (or one year after an employee’s termination, whichever is later).

. For help in completing this, check out our I-9 form guide. |

Confidentiality agreement | If you require new employees to sign a non-disclosure agreement (NDA) to protect confidential company information, keep the form in the employee’s personnel file. |

New employee forms and policies

Along with the offer letter and employment agreement, there are several other new hire forms and signed policies your new hires must have, including tax paperwork. Make sure to take note of these in your new hire documents checklist.

Federal W-4 form | Have your employee fill out and sign a Federal W-4 form on or before their first day of work

This document specifies the employee's tax withholding preference. You do not have to submit a copy of it to the IRS but should keep the original on file.

. To ensure you’re using the most updated version, download the W-4 form from the IRS website. |

State W-4 form | Some states use the federal W-4 form, while others have their own state W-4 form or don’t collect state taxes at all. You can find your state’s W-4 form or its equivalent on the Federation of Tax Administrators website. Like the federal W-4, obtain this on Day One (if your state requires it). |

State new hire report | You must report every new employee within 20 days of their start date

This registry helps the government enforce child support payments, track employment stats, and more.

. You can find your state's new hire reporting program center on the U.S. Department of Health & Human Services website. |

Employee handbook | Have your new employee sign the acknowledgment form for the company handbook. This form ensures that the new hire has read and understands the company’s rules and regulations. |

Policy Documents | If you have a separate document containing important HR policies, such as the staff attendance policy or flexible work schedule policy, have your employee sign the acknowledgment form for this as well. |

Direct Deposit Form | Collect this form as it authorizes your company to send the employee’s pay directly to the specified bank account

This form includes the routing number and bank account number where the new employee's pay will be deposited.

. If you’ve yet to set this up, read our direct deposit guide, which will walk you through the process. |

Benefits Enrollment Form | Have the new hire complete the enrollment forms for the types of benefits you offer (e.g., dental, vision, or health plans). You may be required to submit these forms to your benefits provider. |

Pre-onboarding logistics and other tasks

You can track essential pre-onboarding logistics requirements in this part of the new hire checklist sample. You can customize this to fit specific working conditions and positions, such as shipping company devices to fully remote workers or scheduling in-depth product training for sales and marketing employees.

1. Set up new hire tech and workspace

Depending on the new hire’s job and level, you should prepare the necessary tools, devices, and workspaces.

- Office furniture and peripherals: Desk, chair, office phone, and basic office supplies

- Devices and tech requirements: Desktop computer or laptop, mobile phone, email account, and logins for business software and company computer

You may also need to prepare other requirements, such as a uniform for those working in a restaurant. If your new employee will be working remotely, this could include a stipend for a new computer or necessary office equipment, provided your company offers this benefit.

2. Prepare time cards and/or entry cards

Does your office building require an entry card? Is the new hire entitled to a parking space, and should show an ID badge or parking pass for it? Will your new employee punch a time card?

If yes, ensure these are available before the employee’s first day on the job. Don’t forget to prepare the new hire’s company ID, too.

3. Plan the orientation program

An effective way to acclimate the new employees to their new work environment is to schedule an orientation on the first day on the job. To ensure everything will go smoothly, prepare the orientation plan in advance and identify the specific activities, such as an office tour, including the key individuals involved and how long the orientation will run (e.g., one or three days).

4. Arrange meet-and-greet sessions

Introducing new employees to their co-workers, manager, and supervisor is a good way to start their first day. This allows them to get to know the people they will be working with and ask any questions they may have.

5. Set up new hire training

The more productive and efficient your employees are, the more successful your company will be. That’s why it’s important to properly train your new employees during their first week or month on the job.

This includes workplace safety training and learning sessions to ensure HR compliance, such as harassment and discrimination prevention programs. Note that the types of employee training needed will also depend on the workforce skills required for specific roles or positions.

6. Prepare new employee welcome emails

Consider preparing a new hire announcement so the rest of the organization knows that a new team member is joining the company. In addition to the employee’s name and position, it can include a fun fact or two and previous work accomplishments. Don’t forget to release this via email several days before the new hire’s first day at work.

Similar to the company-wide announcement, you should send a welcome email, this time to your new hire. Not only does this make the employee feel included immediately, but it’s also a good way to showcase your workplace culture and provide instructions on what to expect during the orientation program.

7. Schedule employee check-ins

Onboarding doesn’t end after the first day or week. Schedule check-ins at the 30-day, 60-day, and 90-day mark. Use those meetings to provide clear feedback on where the employee is doing well and on areas that need improvement.

New hire checklist frequently asked questions (FAQs)

The 5 C’s of new hire onboarding are Compliance (legal requirements), Clarification (job expectations), Culture (organizational values), Connection (relationships), and Check-back (feedback loops). Implementing these in an onboarding program helps new hires feel welcomed, informed, and connected — setting the foundation for their success and alignment with company goals.

You can download our new hire checklist template to build a custom template for your company. You can also create your own using Google Sheets or Google Docs. If you have an HR system, check if it comes with an onboarding tool with task lists you can customize.

A new hire check-in is a scheduled conversation between a new employee and a manager (or HR professional) to assess progress, gather feedback, address concerns, and ensure alignment with expectations. You can schedule this at intervals, such as after the new employee’s first 30, 60, and 90 days.