Paychex Flex is a cloud-based platform designed to help small businesses to enterprises manage payroll, benefits, and HR processes. It is an ideal payroll software for companies in a rapid growth phase, as it is easily scalable with flexible plans that can handle your growing HR and pay processing needs. It even offers mobile apps (for iOS and Android devices) that let you access payroll and HR tools while on the go.

Monthly fees start at $39 plus $5 per employee, and if you sign up for a Paychex Flex plan, you get three months of free payroll (as of this writing). In our evaluation of the best payroll software for small business users, Paychex earned an overall score of 4.38 out of 5.

Pros

- Flexible plans with a reasonably priced starter tier

- Multiple employee payment options that include paychecks with check signing services

- Has 24/7 support; offers a dedicated payroll specialist to its clients

- Feature-rich platform; offers more than payroll and payroll tax administration solutions

Cons

- Pricing isn’t all transparent

- Recruiting, performance reviews, time tracking, employee benefits, and access to a dedicated HR professional are paid add-ons

- Workers’ compensation payment services cost extra; unavailable in North Dakota, Ohio, Washington, and Wyoming (as of this writing)

What We Recommend Paychex Flex For

The feature-rich platforms of Paychex Flex and other Paychex products make it an ideal HR and payroll option for a wide range of businesses. These solutions are featured in many of our lists for the best:

- Payroll Software for Small Businesses

- HR Payroll Software

- Payroll Services

- HRIS/HRMS Software

- PEO Companies

- Payroll Software for Accountants

- Payroll Apps

- Nanny Payroll Services

- Restaurant Payroll Software

Paychex Flex Deciding Factors

Supported Business Types | Solopreneurs and small to large-size businesses that need solid pay processing solutions with dedicated payroll support |

Free Trial | None, but occasionally offers promos that give new clients up to three months free payroll |

Pricing | Paychex Flex pricing is mostly custom-priced except for its starter Essentials plan, which costs $5 per employee plus a $39 base fee monthly |

Standout Features |

|

Ease of Use | Generally easy to use but learning how to navigate through all of its features may take some time |

Customer Support |

|

Looking for something different? If you need to manage staff data across the employee lifecycle, our guide to the best HRIS software can help you find a service or solution that’s right for your business.

How Paychex Flex Compares With Top Alternatives

Best For | New Client Promotions* | Starter Monthly Fees | Our Reviews | |

|---|---|---|---|---|

Solopreneurs and companies needing dedicated payroll support | Three months free payroll | $39 base fee plus $5 per employee | ||

| Businesses needing full-service payroll and solid HR support | One month free** | $49 per month + $6 per person per month | |

Small companies that use QuickBooks accounting | 50% off monthly base fees for the first three months or a 30-day free trial | $50 base fee plus $6 per employee | ||

Small retail and restaurants businesses | ✕ | $35 base fee plus $6 per employee | ||

*These promotions can change at any time. Visit the providers’ websites to view the latest promos.

**Get one month free when you run your first payroll with Gusto. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

If you’ve narrowed your search down to a few payroll providers but still can’t decide, read our guide on choosing the best payroll solution for help.

In our evaluation of Paychex Flex’s pricing, this provider only earned a 2.88 out of 5. It lost points mainly because it doesn’t offer unlimited pay runs, and not all of its plans have transparent pricing.

Since Our Last Update: Some of the Paychex Flex plan features have changed. For example, hiring and onboarding are now available in the starter tier (previously, these were in the highest plan). The provider has also enhanced its payroll tax administration by including tax filings and payments to its services (this used to cost extra).

With Paychex Flex, you get three plans: Essentials, Select, and Pro. The Essentials plan costs $39 plus $5 per employee, while the other tiers require you to contact Paychex and request a quote. The main difference between the three is access to additional HR tools and services, such as pre-employment screening, learning management, garnishment payments, and SUI services.

Paychex Flex Essentials | Paychex Flex Select | Paychex Flex Pro | |

|---|---|---|---|

Monthly Pricing | $39 plus $5 per employee | Call Paychex for quote | Call Paychex for quote |

Full-service Payroll with Tax Filings | ✓ | ✓ | ✓ |

Hiring, Onboarding, and New Hire Reporting | ✓ | ✓ | ✓ |

Financial Wellness and Cashflow Assistance | ✓ | ✓ | ✓ |

Learning Management | ✕ | ✓ | ✓ |

Garnishment Payments and SUI Services | Costs extra | Costs extra | ✓ |

Job Posting and General Ledgers Integrations | ✕ | ✓ | ✓ |

Handbook Builder and Background Screenings | ✕ | ✕ | ✓ |

Employee Paycheck Reviews* | ✕ | ✕ | ✓ |

*This feature allows employees to review their paychecks before paydays to help reduce payroll discrepancies and errors

| |||

NOTE: Paychex is offering 6 months of free payroll for new clients who sign up before 11/30/2023 and run their first payroll by 12/7/2023.

Paychex Flex also offers the following solutions and services as paid add-ons.

- Recruiting and applicant tracking

- Time tracking and scheduling

- Performance reviews

- Document management

- Workers’ compensation payment or report services

- Health benefits

- Benefits administration

- Retirement plan services

- Dedicated HR professional for advisory services

However, these add-ons are custom-priced. You have to contact Paychex to discuss your requirements and request a quote.

Paychex Flex didn’t get a perfect score in this criterion, earning only a 4.75 out of 5 for pay processing. It lost points because its tax penalty guarantee only covers tax filing errors that Paychex reps make. This is unlike similar payroll providers, like QuickBooks Payroll, which covers all tax penalties regardless of who makes the mistake.

Despite some of the limitations of its payroll tax services, its online pay processing tools are designed to help you accurately pay employees and contractors on time. Not only does it have all the tools you need to calculate earnings and deductions, but it also provides compliance support, allowing you to manage tax regulations, workers’ compensation claims, and unemployment reporting with ease.

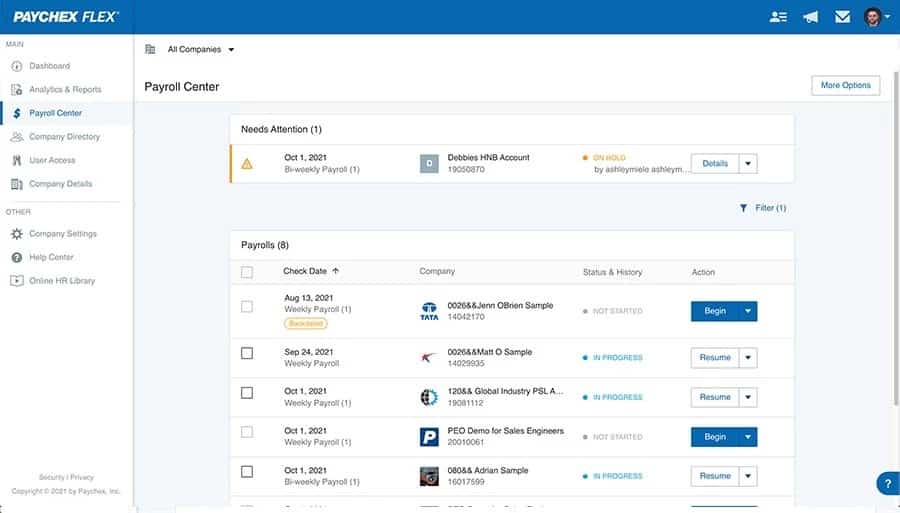

Paychex Flex’s Payroll Center shows your current and future pay periods, allowing you to easily start and resume pay runs. (Source: Paychex)

Online payroll processing is the main feature of Paychex Flex. It can handle pay processing for hourly and salaried employees, including contract workers. It supports employee payments via pay cards, direct deposits, and paychecks.

Wage garnishments are deducted automatically and remitted to the appropriate agencies. If you get a workers’ compensation policy through Paychex, the provider offers payment services for an extra fee. However, this service is not available in North Dakota, Ohio, Washington, and Wyoming (as of this writing).

You can also customize earnings and deductions, and its system will calculate the applicable amounts. Paychex Flex even lets you choose from several pay entry options, including a grid view for easy data entries while running payroll.

Paychex Flex’s customizable pay entry option lets you select the layout, data filters, and how pay items and employee information are organized. (Source: Paychex)

Paychex Flex can manage federal, state, and local payroll taxes. Its payroll tax administration services cover tax calculations, form filings, and payments to the applicable agencies. To help you file accurate taxes, Paychex offers compliance support to ensure you’re up-to-date with the latest regulations and tax rulings. It can even help you find tax credits that your business may qualify for.

Paychex Flex makes running payroll easy with its mobile app (for iOS and Android devices). Rated as one of our best payroll apps for small businesses, it lets you resume pay processing that you started on your computer and submit payroll directly from your smartphone or tablet—provided an internet connection is available.

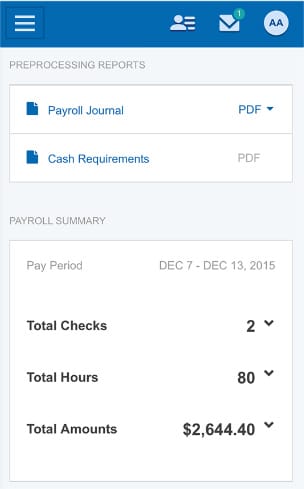

Aside from running payroll, Paychex Flex’s mobile app allows you to access PDF versions of basic payroll-related reports. (Source: Paychex)

Designed to provide payroll flexibility and enhanced user experience to Paychex Flex users, Paychex Voice Assist enables payroll administrators to process payroll via Google Assistant-compatible devices like smartphones, smartwatches, and smart speakers. With the sound of a verified user’s voice, it can help you start a pay period, make adjustments, review pay totals, and resume or submit payroll.

This AI tool is free-to-use for all Paychex Flex customers (as of this writing) and has built-in verifications for user authentication. Aside from a secure voice PIN, its “Voice Match” feature enables you to teach Google Assistant to recognize your voice to verify your identity. Plus, Paychex has taken extra steps to protect your company data by placing account lock checkpoints and linking your secure Paychex Flex login with Google Assistant.

Signing up for Paychex Voice Assist is also easy. Simply download the Paychex Flex and Google Assistant apps to your device. Open Google Assistant, say “Talk to Paychex Flex,” and sign in to your Paychex Flex account. Then, acknowledge the disclosures and choose “Agree and Continue.” You will be asked to create a secure voice PIN. Once done, select “Finish.”

Paychex Flex earned high marks in this criterion, given its solid HR tools for managing new hire reporting, onboarding, and employee benefits. The coverage of its health benefits is also excellent as it is available in all 50 states, unlike that of other payroll providers (like Gusto, which is limited to 37 states, as of this writing). Plus, you’re granted access to Paychex’s other HR services and solutions like learning management and a library of HR documents and business forms that you and your employees can use. However, you have to pay extra for other HR solutions like time tracking, recruiting, and document management.

Offering an attractive benefits package is key if you want to retain employees and attract qualified candidates. Paychex offers comprehensive benefits plans—from health insurance to flexible spending accounts and 401(k) plans. Financial wellness tools are also available, including cash assistance (through short-term loans) for your employees.

It can even help automate your benefits management processes through its benefits administration solution, Flock. You and your employees can access your benefits plans, update dependents list and personal information, and change benefits selections online.

However, this solution is a paid add-on to Paychex Flex. Contact the provider to request a quote.

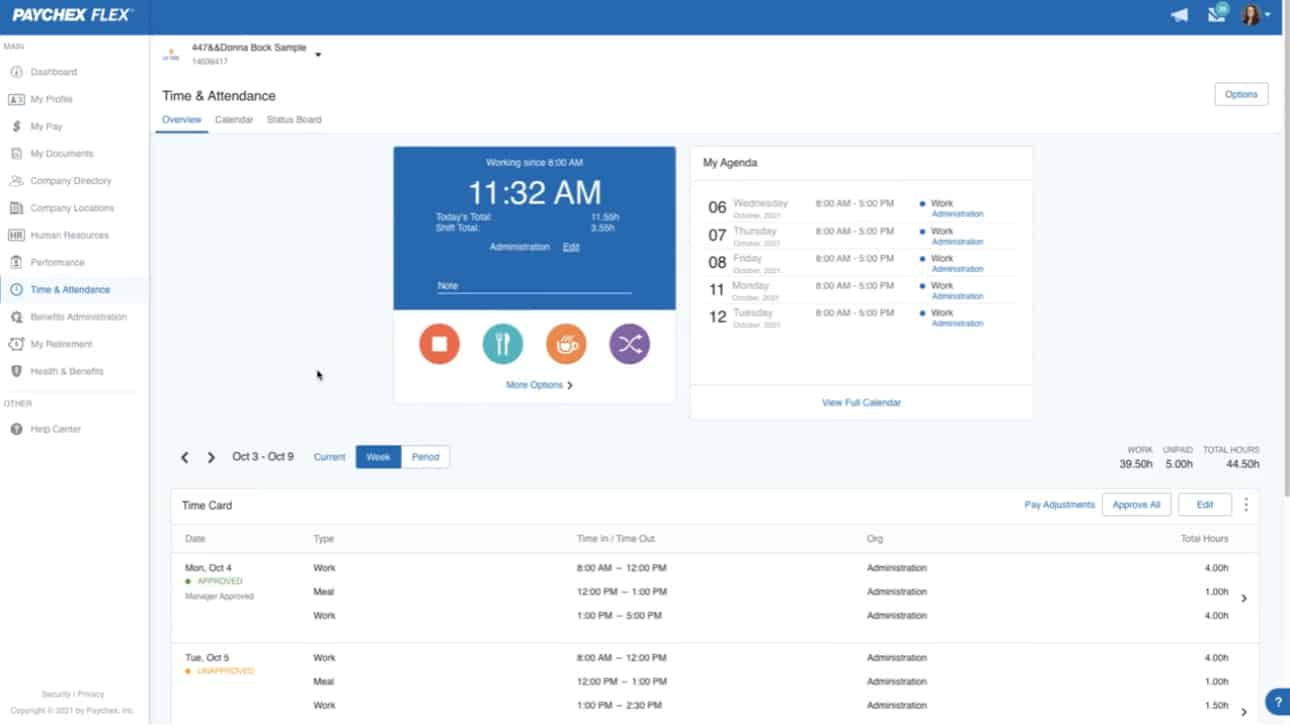

Paychex Flex Time, which is available as a paid add-on, captures employee clock-ins/outs, manages staff schedules, and tracks paid time off (PTO). Its biometric and facial verification time collection methods prevent buddy punching and time theft.

It also has a mobile app, Paychex Time, through which employees can clock in/out, switch jobs or assignments, and request PTO. For those tracking the hours worked by field staff, its geolocation feature can help you check the location of employees who are clocking in, while its geofencing capabilities allow you to set up virtual perimeters around designated areas where your staff are allowed to punch in.

With Paychex Flex Time, employees can send time cards and time-related pay adjustment requests to their manager for approval. (Source: Paychex)

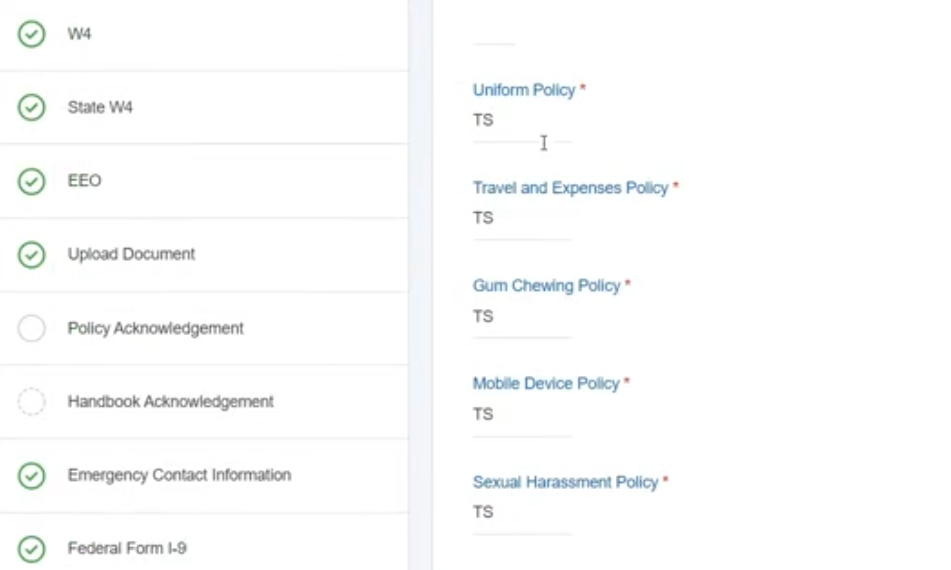

Paychex Flex’s HR solutions include a digital library of HR and business forms that you can use. In addition to new hire reporting, you get onboarding tools that enable your new hires to complete required documentation online, such as direct deposit and tax forms. If you need to run pre-employment checks on qualified candidates who meet your hiring requirements, the Paychex Flex Pro plan comes with background screens.

Its platform also lets you store documents like company policies and forms (but you have to pay extra for document management tools). And if you subscribe to Paychex Flex’s highest tier, you get an online employee handbook builder with options to create Microsoft Word or PDF file documents for easy distribution. It even comes with access to federal and state policies that you can add to your handbook.

Your new hires can access documents, forms, and policies that they need to fill out or review from within Paychex Flex’s onboarding tool. (Source: Paychex)

Paychex Flex offers online learning courses designed to help your staff enhance skills they need to succeed at their jobs. Aside from boosting employee development, this feature can aid in improving employee engagement and retention.

Read our guide on employee engagement to learn more about what it is and check out some of our top strategies for employee retention.

If you want to outsource your business’ essential HR functions, then you may want to consider Paychex’s PEO services. Ideal for growing companies with limited HR support and at least five employees, it comes with a comprehensive range of HR services—most notably its large group benefit rates and HR experts who help you stay compliant with laws and regulations. Let’s look at its key services.

- HR experts: These professionals can deliver personalized recommendations and advice depending on your business’s objectives, risk tolerance, and needs. They can also assist in updating your company policies, including creating and managing a company culture strategy to boost employee engagement. If you’re regulated by OSHA (such as manufacturing and chemical companies), you’ll find having a dedicated safety representative handy. This service will help you handle OSHA regulations and manage your workers’ compensation insurance.

- Employee benefits and insurance plans: With Paychex PEO, you get access to employee benefits programs like health insurance, dental, vision, 401(k) plans, and health benefits accounts (such as FSA, HSA, HRA). Paychex will also assist you in managing these benefits through Paychex Flex, so deductions and premium contributions flow smoothly. Employment practices liability insurance (EPLI), cyber liability insurance, and SUI administration are also available.

Note that Paychex PEO’s pricing varies depending on your location and number of employees. It charges a flat rate per employee vs a percentage of payroll, which can be more affordable if you have high-salaried employees on staff.

Reporting is one of the criteria in our evaluation where Paychex Flex earned a 5 out of 5 rating. It provides you with more than 160 standard reports and analytics—payroll journals, employee turnover rates, headcount reports, labor cost summaries, and more. Aside from letting you create custom reports, it has data visualization capabilities so you can view the information in various graphs and pie charts.

You can customize your Paychex Flex dashboard to show data and analytics that are important to your business. (Source: Paychex)

- Data migration services for new clients are available

- 24/7 customer support with US-based specialists

- Phone and chat support

- Access to a dedicated payroll specialist

- Library of HR forms and business documents

- How-to guides and help articles

Paychex Flex received high ratings (4.75 out of 5) in ease of use because of its intuitive platform. Its online tools are relatively simple, but learning to navigate through all of its features may take some time.

While it provides guided onboarding and setup to new clients, this is available only in higher tiers. However, signing up for a Paychex Flex account online and adding your employee and company information is fairly straightforward—provided you have all the data available and only a handful of employees.

You also have the option to work with a dedicated payroll support specialist. This means you can contact a payroll expert who knows about your business’ pay processing needs and can answer your phone and email queries in a timely manner. And, if you have questions about its features, you can either access its how-to guides or contact Paychex’s 24/7 support (via phone and chat).

In addition to setup assistance and 24/7 customer support, Paychex Flex offers application programming interface (API) integrations with various third-party software. It works with accounting, HR, banking, insurance, retirement, and time clock systems. Here are some of its partner solutions:

- Hiring and HR: Glassdoor, Indeed, SimplyHired, BambooHR, HireRight, and TalentReef

- Time and attendance: Deputy, OnShift, TIMECO, and QuickBooks Time

- Retirement and health benefits: Aetna, AIG, Ameritas, Cigna, Charles Schwab, Fidelity, Merrill Lynch, and Vanguard

- Finance and accounting: QuickBooks Online, Sage Intacct, SAP, and Xero

- POS: Clover

- Banking institutions: Chase, Capital Bank, Bank of America, and US Bank

Paychex Flex received perfect marks in this category given its solid payroll tools, efficient HR services, and reasonably priced starter plan. Startups and small businesses with plans to scale can rely on its feature-rich platform and wide range of HR solutions to handle their growing employee management needs. Paychex can even provide PEO services should you need HR professionals to help you run day-to-day HR tasks while ensuring compliance with federal and labor regulations.

| PROS | CONS |

|---|---|

| Relatively simple to learn and use | Can get expensive (given add-ons) |

| Ease of running payroll | Software is laggy and runs slow at times; mobile app has glitches |

| Efficient onboarding and employee self-service tools | Customer support is hit or miss; some reps are helpful while a few others are unresponsive or difficult to contact (due to long wait times) |

| Has a wide range of HR and payroll tools | |

This provider scored perfect marks in our popularity criterion because many Paychex Flex reviews on third-party sites are positive. It received 4 and up user ratings on G2 and Capterra, as well as a high number of average user reviews online (more than 1,000).

Reviewers said that Paychex Flex is generally easy to use and simple to set up. They added that its system is intuitive on the employee side and convenient to access due to it being hosted online. A few others appreciate that they have access to a variety of HR tools (like learning programs and time tracking) and a dedicated payroll specialist who can answer all their payroll and tax queries.

However, some users reported they had difficulties connecting with a customer service representative to help them with specific problems, such as tax issues. A few users shared that they dislike connecting with separate support teams; depending on the Paychex Flex module (such as payroll, benefits, or time tracking) they had problems with.

At the time of publication, Paychex Flex reviews earned the following scores on popular user review sites:

- G2: 4.2 out of 5 based on nearly 1,500 reviews

- Capterra: 4.1 out of 5 based on more than 1,400 reviews

How We Evaluated Paychex Flex

When we evaluate payroll software for small businesses, we look at pricing and ease of use. We also check the provider’s customer support and whether it offers unlimited pay runs, multiple pay options, full-service payroll, and tax filing services.

Access to third-party integrations and basic HR tools like employee benefits and onboarding are also important. We even consider the feedback that actual users posted on popular user review sites.

Click through the tabs below for a more detailed breakdown of our evaluation criteria:

20% of Overall Score

We checked to see if the provider has transparent pricing, zero setup fees, and multiple plan options with unlimited pay runs. Providers priced at $50 or less per employee monthly were also given extra points.

20% of Overall Score

We gave priority to those that offer multiple pay options, two-day direct deposits, tax payments and filings, year-end reporting (W-2s and 1099s), and a penalty-free tax guarantee.

20% of Overall Score

Payroll service and software should be simple to set up and customizable and have a user-friendly interface. We also looked at whether the provider offers live support and integration options with online tools that most small and midsize businesses (SMBs) use.

15% of Overall Score

Online onboarding, which means giving employees the option to fill out forms like W-4s electronically, is the top criterion, followed by state new hire reporting and the availability of a self-service portal where employees can view pay stubs, edit information, and access forms. Extra points were also given to providers that offer expert HR support, benefits options, and health insurance plans that cover all US states.

15% of Overall Score

In this criterion, we assess whether the software’s ease of use, pricing, and expansiveness of its payroll and HR tools are ideal for SMBs.

5% of Overall Score

We considered user reviews, including those of our competitors, based on a 5-star scale; any option with an average of 4-plus stars is ideal. Also, any software with 1,000-plus reviews on any third-party site is preferred.

5% of Overall Score

Preference was given to software with built-in basic payroll reports and customization options.

Bottom Line

Whether you’re a solopreneur or a small business planning to expand to a midsize or large operation soon, Paychex Flex can grow with you. With over 45 years of providing HR and payroll solutions and services, it has the experience and resources to help your company scale. It has a wide range of HR solutions for managing the entire employee lifecycle, from hiring to retiring. Sign up for a Paychex Flex plan today.