We evaluated some of the leading TriNet Zenefits competitors and selected the top five based on pricing, HR and payroll features, ease of use, popularity, and other criteria. Explore our guide to find the best TriNet Zenefits competitor for your business.

6 Best TriNet Zenefits Competitors

This article is part of a larger series on Payroll Services.

TriNet Zenefits (formerly Zenefits) offers an all-in-one HR platform that lets you manage employees from hiring to retiring, with onboarding, scheduling and time tracking, compensation management, performance management, and more. While popular with small businesses, it may not be right for everyone. You may need stronger benefits, a payroll-first solution, or even a full-service professional employer organization (PEO).

In this guide, we examined multiple TriNet Zenefits competitors and chose the top six you should consider.

- Gusto: Best overall TriNet Zenefits alternative and for small businesses needing strong payroll and basic HR tools

- Rippling: Best for high-tech and IT-heavy businesses needing an all-in-one HR payroll solution with IT onboarding tools

- Justworks: Best for employers looking for affordable PEO services to outsource essential HR and payroll tasks

- BambooHR: Best for small businesses requiring supplemental HR tools

- Paychex: Best for startups and small businesses needing dedicated payroll support

- ADP: Best for growing companies that want flexible HR plans and global payroll tools

Streamline your HR needs as you grow your small business. Start your 7-day free trial today with BambooHR. |

|

Top TriNet Zenefits Competitors Compared

TriNet Zenefits and its competitors provide essential features such as new hire onboarding, standard reporting, basic employee information management, and self-service tools for employees to access their pay stubs and personal details. The tables below show how TriNet Zenefits compares with its competitors in terms of pricing, payroll, and HR tools.

At Fit Small Business, our mission is to provide small business owners with the best answers to their small business questions. We are committed to bringing you unbiased evaluations of payroll software and services, as well as comprehensive information about payroll processes and labor regulations that will impact your business and the way you manage employees.

We use product data and a detailed methodology to objectively assess the Payroll solutions we recommend, regardless of whether they are a partner company. Our evaluations and ratings are based on a set of criteria, which includes features, pricing, ease of use, and customer support. We also apply our expert insights and consider real-world user feedback to help you make the best purchasing decision.

Looking for something else?

If you only require payroll, check out our top-recommended payroll software. And if you’re unsure what features to look for, read our guide to finding the best payroll solution for small businesses.

Best TriNet Zenefits Competitors Pricing Calculator

Need a quick way to compare costs? Use our online calculator to compute the estimated monthly and annual fees of TriNet Zenefits vs Gusto and the other competitors on our list.

TriNet Zenefits is found on several of our best-of lists because it offers a great toolset at an excellent price. If you don’t need payroll, it’s the cheapest. Overall, its HR tools get a special notice in these lists:

If you want to learn more about TriNet Zenefits before deciding, check out our TriNet Zenefits review.

Gusto: Best Overall TriNet Zenefits Alternative

Pros

- Multiple employee payment options (manual checks, pay card, direct deposits, and on-demand pay via Gusto Wallet)

- Robust employee benefits plans, includes both standard and non-standard options (like college savings plans)

- Payroll and basic HR tools (like onboarding, benefits, and employee profiles) included in all plans

- Has a low-cost contractor-only payroll package

Cons

- Health insurance limited to 37 states (all states except Alaska, Alabama, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, Vermont, West Virginia, Wyoming)

- Job postings, time and paid time off (PTO) tracking, and performance review tools are available in higher tiers

- Lacks learning management and compensation planning solutions

- Single-state full-service payroll only included in basic Simple plan; you have to upgrade to at least its Plus plan to get multi-state payroll tools

Gusto Overview

Gusto, a top payroll service, excels in processing paychecks for employees and contractors across all US states, helping it earn the top spot in our best payroll services guide. It stands as our top recommended alternative to TriNet Zenefits due to its inclusive platform and payroll packages. Unlike other providers that offer certain solutions as paid add-ons, Gusto includes features like time tracking and hiring tools at reasonable prices for small businesses.

Similar to TriNet Zenefits, Gusto offers a range of benefits such as medical, dental, vision, life and disability insurance, flexible spending accounts (FSAs), and health savings accounts (HSAs). However, Gusto’s health insurance coverage is limited to 38 states (plus D.C), whereas other competitors cover all 50 states.

While Gusto offers health insurance in 38 states, it lacks HR functions compared to TriNet Zenefits. With Gusto, you’ll need the highest tier plan to get access to HR professionals. Also, Gusto lacks compensation planning and staff scheduling tools, unlike TriNet Zenefits, which provides these functionalities.

Gusto has a “bulk edit” feature that allows you to quickly add other earnings (like bonus amounts) to several employees’ salaries while running payroll. (Source: Gusto)

Read our TriNet Zenefits vs Gusto article for the complete rundown on how they compare.

Rippling: Best TriNet Zenefits Competitor for High-tech & IT-heavy Businesses

Pros

- Offers IT management of employee apps and devices

- More than 500 integration options

- Flexible PEO; you can easily turn its PEO services on and off and still access HR/payroll software

- Has modular solutions; you can choose HR, payroll, and IT modules you need

Cons

- You have to get its core workforce management platform before you can purchase its HR, payroll, and IT modules

- Can get pricey, depending on the number of modules you get

- Phone support unavailable; you have to ask Rippling’s customer rep to convert live chat session into a virtual call

- Lacks compensation planning and performance management tools

Rippling Overview

Rippling has a workforce management platform as its base system that allows you to manage staff information, workflows, and electronic documents. If you need IT tools to streamline onboarding and offboarding processes, Rippling beats out all the TriNet Zenefits competitors in this guide, as its app and device management modules make it easy to assign employees the business software and computer devices needed for their jobs.

Like TriNet Zenefits, Rippling has talent management solutions for hiring and onboarding, as well as a strong learning management module. You can also use its job codes tool to monitor employee time and the cost of that time on a per location, client, and task basis. However, Rippling doesn’t provide online solutions for managing and tracking compensation and employee performance.

Rippling makes onboarding new hires and setting up their payroll, benefits, company-assigned devices, and access to business software easy for HR teams. (Source: Rippling)

Justworks: Best TriNet Zenefits Competitor for PEO Services

Pros

- Enterprise-level benefits from major insurance companies + 401(k)

- 24/7 customer support (via phone, email, SMS, chat, and Slack)

- IRS and ESAC certified

Cons

- Integration options and report customizations are limited

- No applicant tracking function; lacks advanced HR tools (like performance and compensation management)

- Time tracking is a paid add-on Has preset payout schedules for hourly and nonexempt salaried employees (set every other Friday)

Justworks Overview

Justworks is not only one of our recommended alternatives to TriNet Zenefits but also holds the top spot in our best PEO guide. It excels in pricing and offers robust PEO services, including health insurance benefits, payroll management, and compliance support to simplify employee management and payments. Basic HR tools like online onboarding, employee information management, and PTO monitoring are also included.

In terms of features, Justworks’ Basic plan closely compares to TriNet Zenefits, although TriNet Zenefits provides health insurance. However, Justworks’ Plus Plan surpasses TriNet Zenefits in terms of benefits. Similar to ADP and TriNet, Justworks provides access to discounted enterprise-level health insurance.

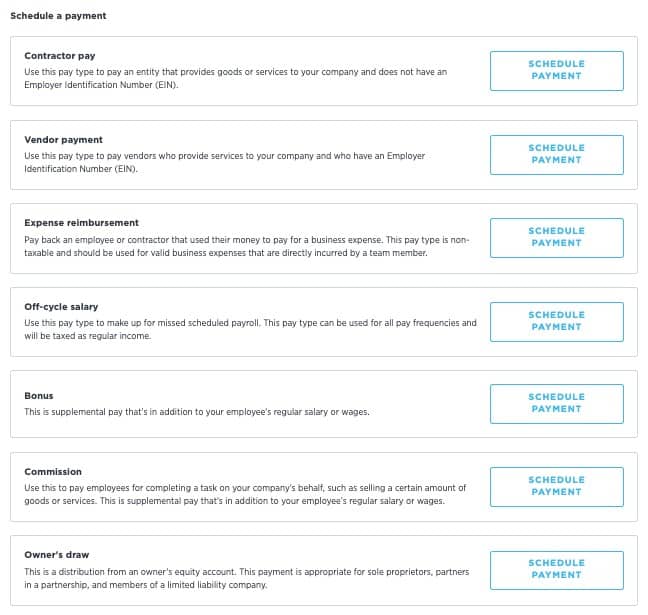

Aside from regular and off-cycle pay runs, Justworks can process expense reimbursements, contractor and vendor payments, bonus payouts, and more. (Source: Justworks)

BambooHR: Best for Businesses Needing Supplemental HR Tools

Pros

- Highly customizable and user-friendly

- Performance management tools

- Centralized employee database

- Wide range of HR integration options with open application programming interfaces (APIs)

Cons

- Non-transparent pricing

- Access to its TRAXPayroll integration requires an additional fee

- Time tracking and performance management tools are paid add-ons

- Advanced workflows and custom access levels are available only in the highest tier

BambooHR Overview

BambooHR is an excellent choice for startups and small businesses seeking efficient HR process management. It offers a seamless onboarding experience and has a short learning curve, making it particularly suitable for organizations without a dedicated HR department.

With its modular approach, BambooHR allows businesses to customize their HR software by adding functionalities like performance management and employee satisfaction for an extra cost. This flexibility makes it an ideal solution for rapidly growing companies that require scalable HR software to keep up with their evolving needs.

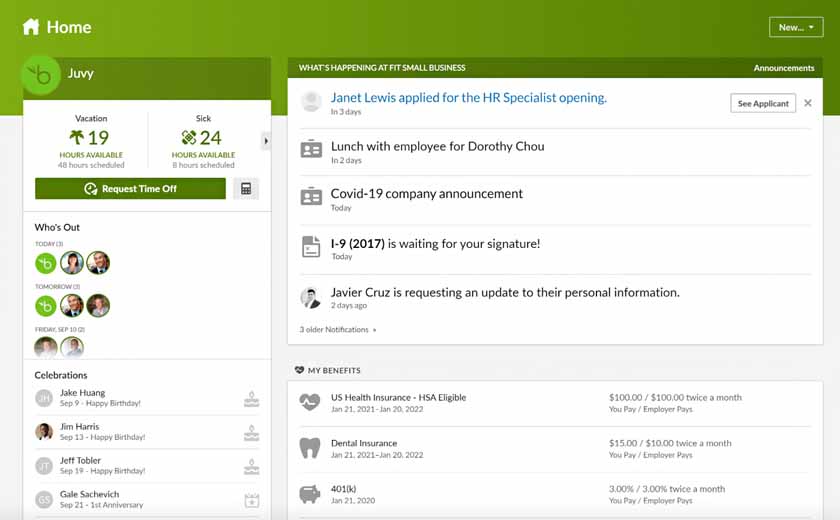

Check the latest updates on your team straight from BambooHR’s dashboard.

Paychex: Best TriNet Zenefits Competitor for Startups & Small Businesses Needing a Dedicated Payroll Specialist

Pros

- Multiple pay options (i.e., paper checks, direct deposits, pay on-demand, and pay cards)

- Intuitive interface

- 24/7 customer support

- Flexible payroll plans

- Assigns a dedicated payroll specialist to its clients

Cons

- Not all of its pricing details are transparent

- Some payroll tax administration services (like year-end reports) cost extra

- Different contacts for different HR and payroll product

- Time tracking is a paid add-on

- Dedicated payroll support is available only in higher plans

Paychex Overview

Paychex is an all-in-one platform for payroll, HR, and benefits. It stands out by providing a dedicated specialist to assist with payroll and payroll tax requirements. Additionally, it offers a robust learning management solution comparable to Rippling’s.

While the Flex plan is basic, Paychex offers over 300 additional tools that can be added to customize your HR program, albeit at potentially higher costs. The platform covers essential features like online onboarding, time and attendance tracking, payroll and tax administration, workers’ compensation, and benefits administration. Similar to Justworks, Paychex also provides 24/7 customer service.

In contrast to TriNet Zenefits, Paychex offers multiple payment options, including direct deposits, paper checks, pay cards, and pay-on-demand. Only Gusto and ADP provide a similar level of payment flexibility.

Apart from multiple pay options, Paychex has customizable pay grids that allow you to select how you want to view and edit pay data. (Source: Paychex)

ADP: Best TriNet Zenefits Competitor for Growing Businesses and Those Needing Global Payroll Tools

Pros

- Feature-rich with a wide range of HR solutions, products, and services; even has PEO and global payroll tools

- Flexible product plans

- 24/7 customer support

- Offers secure paychecks with advanced fraud protection

Cons

- Pricing is not transparent

- Year-end tax reports cost extra

- Benefits, time tracking, and workers' compensation are paid add-ons

ADP Overview

ADP provides flexible product options that cater to businesses of all sizes, from small teams to large enterprises. Its comprehensive HR and payroll offerings surpass those of other providers, including TriNet Zenefits, covering a wide range of solutions and services.

Similar to Rippling and Justworks, ADP offers a full-scale PEO service, enabling businesses to outsource payroll and HR functions. It also serves as a Global PEO, facilitating payroll processing and compliance support in over a hundred countries. ADP collaborates with partners to act as an Employer of Record (EoR) when necessary.

For small businesses, ADP offers ADP Run, a pay processing system that encompasses full-service payroll and HR solutions. This includes benefits management, employee information handling, and new hire onboarding. Additionally, ADP provides performance, compensation, and attendance management solutions, although these are available as add-on products, akin to TriNet Zenefits and Paychex.

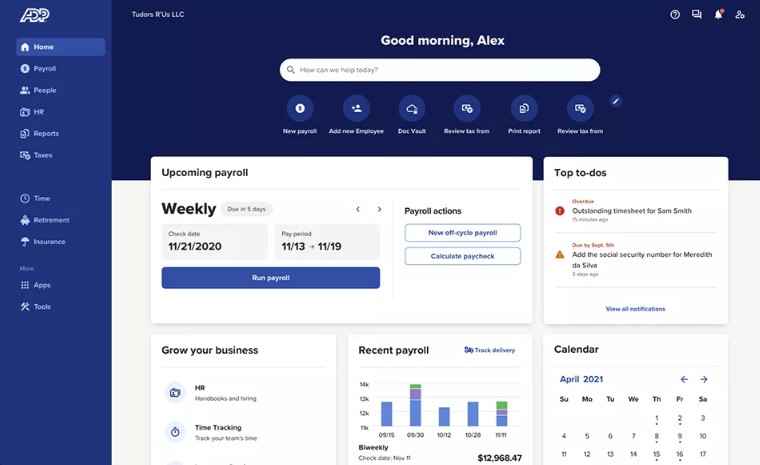

ADP Run’s main dashboard contains helpful links for running payroll, viewing notifications, tracking your staff’s attendance, and more. (Source: ADP)

Read our ADP Run review to learn more about ADP’s payroll solution for small businesses. If you are interested in ADP as a PEO, check out our ADP TotalSource review.

How We Evaluated the Top TriNet Zenefits Competitors

To identify the top five TriNet Zenefits competitors, we looked at several platforms that provide nearly the same set of HR, benefits, and payroll features. We then ranked them according to how similar they are to TriNet Zenefits but highlighted the different functionalities to help you decide which software is best for your company. We evaluated each using the following criteria:

25% of Overall Score

Aside from the low or high cost of monthly subscriptions (wherein anything below $50 per employee is best), we looked at whether the provider offered multiple plan options, unlimited payroll runs, zero setup fees, and discounts on annual plans.

30% of Overall Score

HR tools that allow online onboarding, new hire reporting, time and attendance monitoring, compensation and performance management, and employee benefit options that are available in many US states are a must. Plus, having access to HR experts and a self-service portal are also ideal.

10% of Overall Score

20% of Overall Score

Apart from having an interface that’s intuitive and easy to learn, the provider’s system should be able to integrate with commonly used business programs such as QuickBooks, Homebase, and TSheets. Users should also have access to how-to guides and live phone support that’s reliable and quick when it comes to problem resolution.

10% of Overall Score

As much time as we spend on research, it cannot replace the experiences of real-world users. Here we consider scoring on popular review sites like Capterra and G2.

5% of Overall Score

Users should be able to access payroll summaries and customize reports, as well as create new reports within the system.

Bottom Line

While TriNet Zenefits is a strong contender for businesses seeking an integrated platform with HR, payroll, and benefits tools, there are other viable alternatives. These alternatives not only offer similar functionalities but also provide additional features such as employee device and app management, learning management, and PEO services.

Gusto is an excellent choice if you’re looking for cost-effective HR and payroll tools. It secured the top position among TriNet Zenefits competitors due to its comprehensive payroll service and reliable set of HR solutions that cover the entire employee lifecycle, from hiring to retirement. Comparing TriNet Zenefits vs Gusto in terms of pricing, Gusto offers better affordability since its plans already include payroll, whereas TriNet Zenefits charges extra for this feature. This makes Gusto a more cost-efficient option, especially for businesses with a larger employee count.

Sign up for a Gusto plan today and get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.