ADP is one of the best payroll service providers for businesses planning to expand and hire more employees in the near future. It has advanced HR features, like new hire onboarding and background checks, on top of its full-service payroll and tax services. However, this provider is not ideal for small businesses with a tight monthly budget because it charges for extra payroll runs and year-end reporting. If you don’t need robust HR features or just need to save money, a top ADP competitor may work better for your business.

In this guide, we evaluated multiple ADP competitors and narrowed the list down to the top eight.

- Gusto: Best overall ADP competitor for small businesses

- QuickBooks Payroll: Best for small business QuickBooks accounting users

- TriNet Zenefits (formerly Zenefits): Best for companies in heavily regulated industries

- Paycor: Best fully configurable payroll tool for complex salary calculations

- Paychex: Best for solopreneurs and growing businesses looking for dedicated support

- Square Payroll: Best for restaurants, retail shops, and Square POS users

- Justworks: Best for businesses that need a reasonably priced PEO

- Rippling: Best for tech-reliant companies needing integrated HR, payroll, and IT tools

Top ADP Competitors Compared

Why You Can Trust Fit Small Business

At Fit Small Business, our mission is to provide small business owners with the best answers to their small business questions. We are committed to bringing you unbiased evaluations of payroll software and services, as well as comprehensive information about payroll processes and labor regulations that will impact your business and the way you manage employees.

We use product data and a detailed methodology to objectively assess the Payroll solutions we recommend, regardless of whether they are a partner company. Our evaluations and ratings are based on a set of criteria, which includes features, pricing, ease of use, and customer support. We also apply our expert insights and consider real-world user feedback to help you make the best purchasing decision.

Best ADP Competitor Quiz

Which ADP Competitor Is Right for You?”

Gusto: Best Overall ADP Competitor for Small Businesses

Pros

- Easy to use

- Reasonably priced plans

- Full-service payroll includes unlimited pay runs and tax filing services

- Onboarding, basic hiring, and performance review tools

- Wide variety of benefits options that include health insurance, retirement, and college savings plans

Cons

- Health insurance limited to 39 states

- No dedicated payroll specialist

- Inconsistent customer support quality

Gusto Plans & Pricing

- Simple: $40 per month + $6 per employee monthly

- Plus: $80 per month + $12 per employee monthly

- Premium: Custom-priced

- Contractor-only payroll plan: $35 per month + 6 per contractor monthly

Add-ons

- State payroll tax registration: Pricing varies per state

- HR advisory services for Plus plan only: $8 per employee monthly (this is included for free in the Premium tier)

For small business owners needing help running payroll at a good value, Gusto is the best choice. The software is easy to use—no excess features you don’t need—and you can run unlimited pay runs at no extra cost. It files and pays federal, state, and local taxes, and automatically generates and sends W-2s and 1099s to employees and contractors at no extra cost, unlike ADP. Multiple pricing options are also available, with a starter tier that’s reasonably priced. Setup and migration are free for new users—you have to pay a setup fee with both ADP and Paychex.

Gusto also offers a wide range of employee benefits—from health insurance and 401(k) plans to commuter benefits and tax-advantaged college savings accounts. However, its health insurance coverage is limited to only 37 states (unavailable in Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, Vermont, West Virginia, and Wyoming). If you want health plans that are available across the US, any of the ADP competitors in this guide (except TriNet Zenefits, whose health plans don’t cover Hawaii) are great options, as all provide extensive health insurance coverage.

Since Our Last Update:

Gusto has increased pricing for its contractor-only payroll plan, from $6 per worker monthly to $35 plus $6 per worker monthly. As part of a new promo, new clients who sign up for this plan will get discounted pricing of only $6 per contractor monthly (no base fee) for the first six months. After this period, you will be charged the regular monthly fee. Note that this promotion can end at any time—please check Gusto’s website for the latest promo on offer.

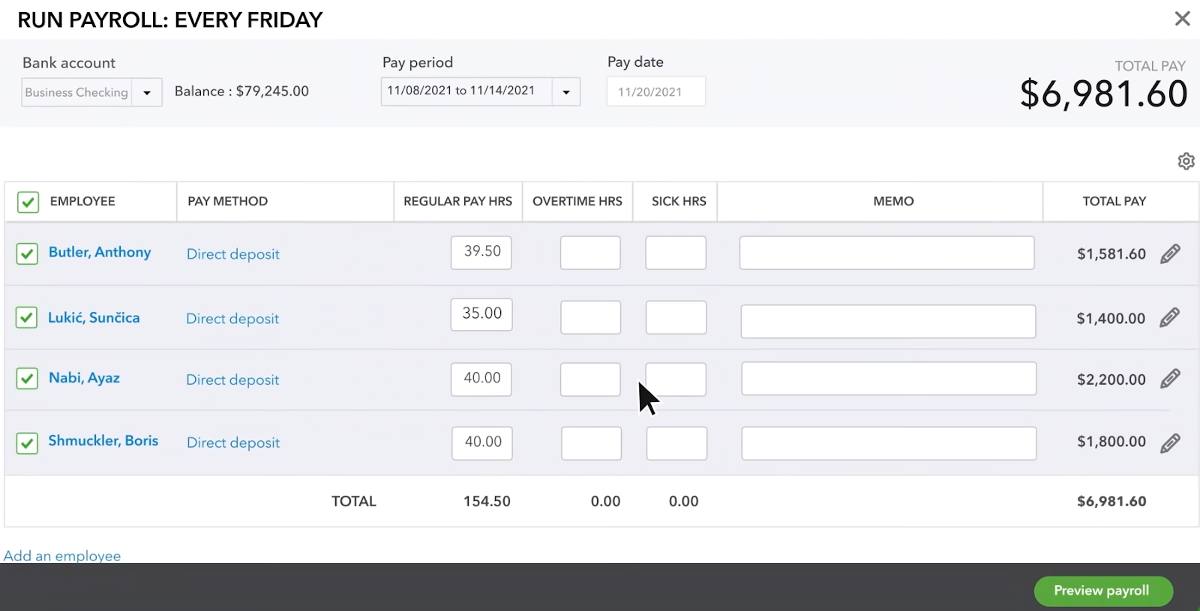

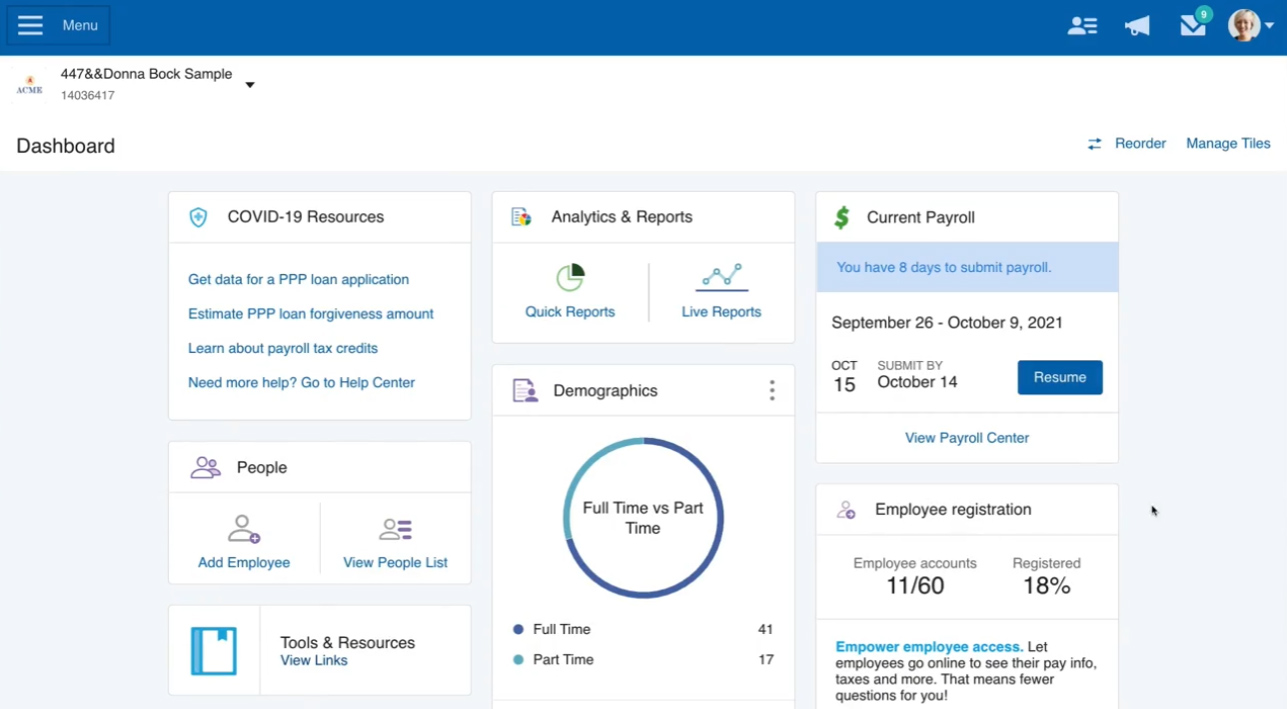

Gusto runs payroll in four easy steps. (Source: Gusto)

Gusto Key Features

- Ease of use: Gusto is easy to set up and use—plus, it has an intuitive interface that allows you to process payroll in just a few clicks. Compared to Paychex and ADP, Gusto is more user-friendly, and you can start using its online tools without any training required—provided you have a good background on how payroll works. If you need assistance, it provides how-to guides and unlimited phone, email, and chat support.

- Multiple pay options: Gusto lets you pay employees and contractors through direct deposits, checks, pay cards, and pay on-demand (QuickBooks Payroll, TriNet Zenefits, Justworks, and Rippling don’t have this feature). You get four-, two- and next-day processing timelines for direct deposits, depending on your chosen plan. For check payments, Gusto’s software gives you the capability to cut paychecks using your printer, but the service won’t process checks for you or give you the option to have them delivered to employees. If this is something you need, then go with Paychex (or ADP itself).

- Full range of payroll and basic HR features: Aside from payroll, Gusto has solutions for hiring, onboarding, health benefits administration, PTO management, and simple time tracking. It also offers a robust selection of benefits such as medical, dental, vision, retirement, flexible spending accounts (FSAs), health savings accounts (HSAs), college savings plans, and pay-as-you-go workers’ compensation.

- Expert HR support: If you subscribe to its highest tier, you are granted access to HR professionals who can give expert advice on how to handle payroll and HR issues. And while Gusto doesn’t assign a dedicated specialist to its clients like Paychex does, it offers unlimited chat, phone, and email support to all its users.

QuickBooks Payroll: Best for Small Business QuickBooks Accounting Users

Pros

- Unlimited payroll runs

- Integrates seamlessly with QuickBooks accounting

- Same- and next-day direct deposits

- Robust tax penalty protection program, wherein QuickBooks will cover tax filing penalties (up to $25,000/year) regardless of who makes the mistake

Cons

- Tax penalty protection available only in its Elite plan

- Automated local tax filings included in higher tiers only

- Basic HR features only

- Inconsistent customer support quality

QuickBooks Payroll Plans & Pricing

- Core: $45 per month + $6 per employee monthly

- Premium: $80 per month + $8 per employee monthly

- Elite: $125 per month + $10 per employee monthly

- Contractor payments: $15 per month for up to 20 workers; plus $2 for each additional contractor

QuickBooks Payroll can handle most employee pay processing functions, from payroll onboarding to tax preparation, although it doesn’t report new hires to the state—a feature that other solutions in this guide (as well as ADP) offer. Aside from paying contractors and employees, you can run auto payroll with either next- or same-day direct deposits (provided you sign up for at least its Premium plan).

Since Our Last Update:

QuickBooks Payroll has released a “Contractor Payments” plan, which is optimal for businesses that hire and pay only contract workers. It costs $15 monthly for up to 20 contractors (plus $2 for each additional worker). If you have QuickBooks Accounting, this feature is included in all plans.

It also automatically calculates, files, and pays federal and state taxes (local tax filings available in premium tiers), including submission of year-end W-2s/1099s. And unlike ADP, QuickBooks Payroll has an internal accounting program specifically for small businesses—QuickBooks—that integrates seamlessly with its payroll system.

QuickBooks Payroll lets you add overtime and sick leave details directly into its payroll platform. (Source: QuickBooks Payroll)

QuickBooks Payroll Key Features

- Intuitive interface: The software has intuitive controls that allow you to set up and run payroll in a few easy steps. It doesn’t have a complicated-looking interface, and if you have questions about its functionalities, QuickBooks Payroll has how-to articles that can guide you through its features. Plus, compared to Paychex and ADP, this software doesn’t have a steep learning curve.

- Tax accuracy guarantee and tax penalty protection: All plans are covered by a tax accuracy guarantee, where QuickBooks will file and pay payroll taxes correctly and on time. In case there are penalties due to late submissions, QuickBooks will pay for all fees—provided that you forwarded the correct tax details well beyond the submission deadlines and have sufficient funds in your account to pay taxes. In addition, signing up for its Elite plan entitles you to its tax penalty protection (wherein QuickBooks will pay all tax penalties, max of $25,000 per year) that covers tax errors that you make. Neither ADP nor the other providers in this guide offer a similar program that includes client tax filing mistakes.

- Fast direct deposits: QuickBooks Payroll is the only software in this article that provides next-day direct deposits in its basic plan. Aside from a next-day option, it offers same-day direct deposits—provided you subscribe to either its Premium or Elite tier.

- Seamless integration with QuickBooks: While QuickBooks Payroll doesn’t integrate with a lot of third-party software, its native integration with QuickBooks Accounting allows for seamless data transfers between Intuit QuickBooks products. This means that your payroll information can flow directly to the general journal, plus you can use wage-related information for analytics and other reports using QuickBooks.

TriNet Zenefits: Best for Businesses in Highly Regulated Industries

Pros

- Simple to use

- Unlimited pay runs

- Robust integration options

- Wide range of HR solutions

Cons

- Payroll and HR/payroll expert advising cost extra

- Base plans and add-ons require a minimum of five employees

- Customer support quality is inconsistent

- Health insurance limited to 49 states

- Lacks a dedicated payroll specialist

TriNet Zenefits Plans & Pricing*

- Essentials: $10 per employee monthly

- Growth: $20 per employee monthly

- Zen: $27 per employee monthly

Add-on tools and services*

- Payroll: $6 per employee monthly

- Advisory services: $10 per employee monthly

- Benefits administration using own broker: $5 per employee monthly

- Recruiting: Starts at $62 monthly

*All plans and add-ons require at least five employees

TriNet Zenefits (formerly Zenefits) offers an end-to-end employee management solution that streamlines and automates HR, payroll, and benefits administration. It’s best for businesses in highly regulated industries because it has robust compliance tools to help keep them up to date with the latest regulations. Aside from built-in overtime safeguards and pay stubs that conform with most state requirements, its online “Compliance Assistant” monitors your HR, payroll, and benefits compliance status and the unique form submission deadlines that are critical to your business.

Unlike ADP and the other software in this guide (except Rippling), which provide payroll as a base product and have no minimum user requirements, TriNet Zenefits offers its employee pay processing solution as an add-on tool and requires a five-employee minimum. However, if you need time tracking tools, all its plans come with a time and attendance solution at no extra cost; under ADP, this is a separate product.

Since Our Last Update:

TriNet Zenefits has increased the monthly pricing of its Growth plan—from $18 to $20 per employee. Note that there are no pricing changes to its starter Essentials tier and its premium Zen package.

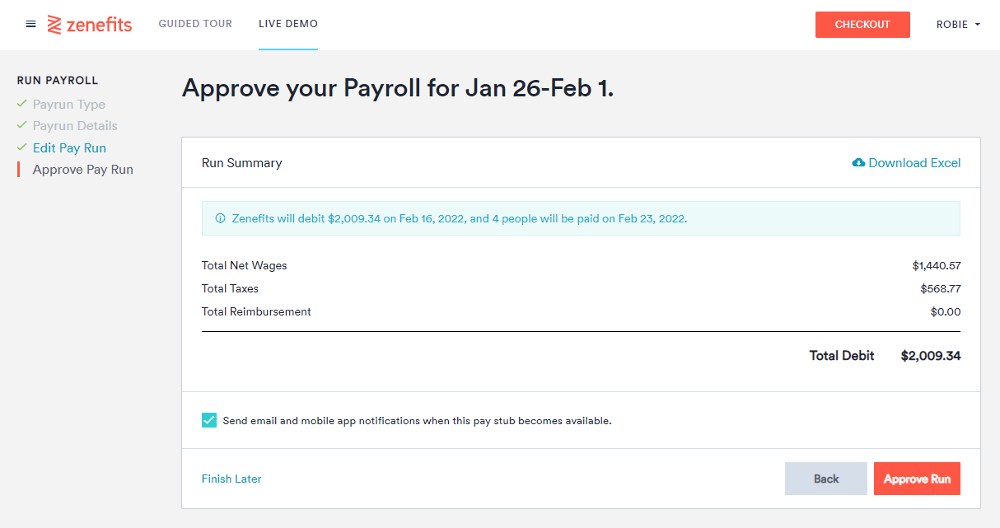

With TriNet Zenefits, you can run payroll with just a few clicks. (Source: TriNet Zenefits)

Did you know?

In February 2022, Zenefits was acquired by TriNet, which offers full-service HR solutions and professional employer organization (PEO) services to small and midsize businesses. The acquisition comes with some changes to the company, including its name.

TriNet Zenefits Key Features

- Feature-inclusive: While ADP and most of the providers in this list (except Justworks and QuickBooks Payroll) have a wide range of HR solutions, TriNet Zenefits’ platform is more robust, helping you manage the entire employee lifecycle—from hiring to retirement. In addition to payroll, it offers hiring, onboarding, time tracking, benefits, compensation planning, performance reviews, employee information management, engagement surveys, compliance support, and even communication tools through its “TriNet Zenefits People Hub.”

- Efficient pay processing: From employee and contractor payments to tip reporting and wage garnishments, TriNet Zenefits has all the essential tools you need to accurately process payroll and payroll taxes. Tax payments and filings are also automatic, with TriNet Zenefits handling all federal, state, and local tax submissions on your behalf. It even has dynamic pay stubs (accessible through its mobile apps) where you can add messages in case there are salary changes and special payouts (none of the providers in this guide, or ADP, offer this feature).

- Robust integrations: TriNet Zenefits connects to 40+ popular applicant tracking, time and attendance, accounting, productivity, legal, and learning software. Some of its integration partners include Greenhouse, JazzHR, Deputy, QuickBooks, Xero, Lessonly, Slack, and Asana. However, if you want a wider integration network, consider Rippling as it can connect to 500+ business apps.

Paycor: Best for Businesses Needing a Fully Configurable Payroll Tool

Pros

- Customizable pay grids

- Easy to set up and use

- Wide range of HR solutions (such as scheduling, time tracking, learning management, compensation planning, and engagement surveys)

- Unlimited and automatic pay runs

Cons

- Pricey for small businesses

- Starter plan has basic HR tools

- Phone support unavailable during weekends

Paycor Plans & Pricing

Small business plans (those with up to 49 employees)

- Basic: $99 per month + $5 per employee monthly

- Essential: $149 per month + $7 per employee monthly

- Core: $199 per month + $8 per employee monthly

- Complete: $199 per month + $14 per employee monthly

Mid-market plans (businesses with 50 and more employees): Custom-priced

Paycor, like ADP, has a robust suite of HR and payroll tools that can cater to all business sizes. It’s great for those with complex payroll needs because you can configure its pay grid to fit your requirements. It even lets you create customized pay slips, although TriNet Zenefits allows the inclusion of pay messages to its online pay stubs. And, like many of the providers in this guide, it offers automatic tax calculations, payments, and filings, including W-2 and 1099 processing.

However, Paycor isn’t great for those with very limited budgets. With a starter plan for small businesses (up to 49 employees) priced at $99 plus $5 per employee monthly, Paycor is one of the most expensive ADP alternatives on our list (Justworks is the other, mainly because it offers PEO services and not just payroll software).

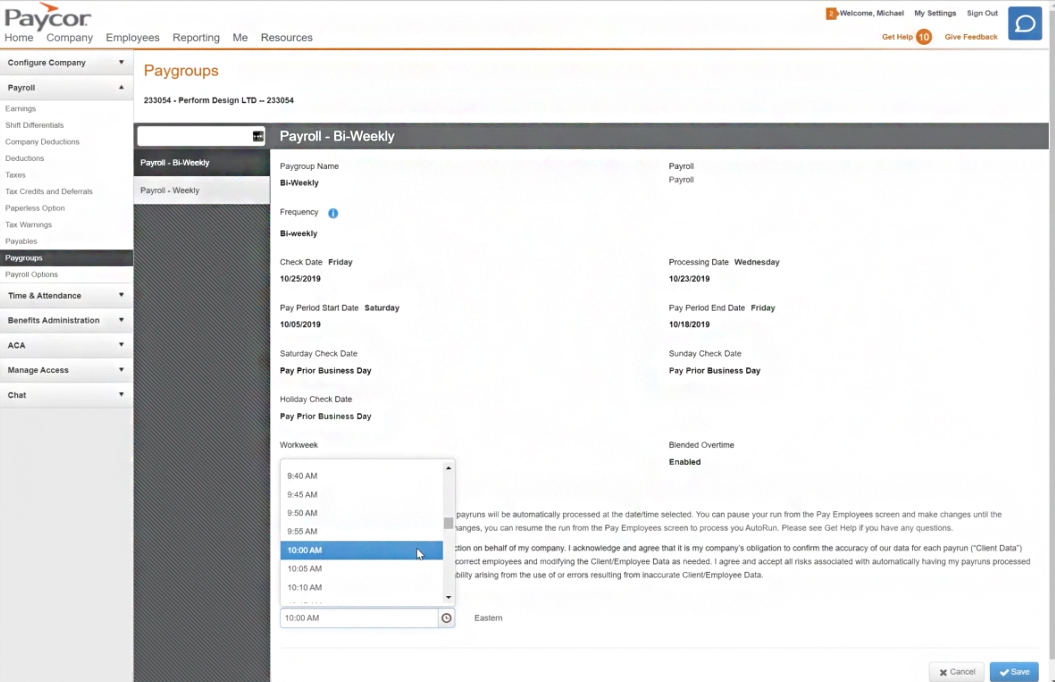

Paycor allows you to select the time you want it to run payroll automatically for salaried employees. (Source: Paycor)

Paycor Key Features

- All-in-one HR platform: Paycor’s all-in-one platform combines several HR tools together, from hiring and time tracking to payroll and performance management. ADP competitors like Justworks and QuickBooks Payroll don’t have a robust HR solution suite.

- Flexible payroll: Run payroll the way you want it with Paycor’s customizable pay grids. You can add and remove earning/deduction columns that you need, including selecting whether or not you want its system to display the applicable amount or hours per earning/deduction type. It even offers multiple payment options—from pay-on-demand to direct deposits and even check stuffing services.

- Payroll tax compliance: Aside from year-end reporting and payroll tax filings (federal, state, and local taxes), Paycor has a team of tax experts to keep you compliant and up-to-date with the latest tax regulations.

Paychex: Best for Solopreneurs & Growing Businesses Looking for Dedicated Payroll Support

Pros

- Two-day direct deposits

- US-based 24/7 customer support

- Suite of integrated HR solutions (new hire reporting, onboarding, background checks, time and attendance, etc.)

- Flexible plans for solopreneurs and businesses of all sizes

Cons

- Pricing isn’t all transparent

- Access to a dedicated payroll specialist available only in premium plans

- Payroll tax administration and W2/1099 year-end reporting cost extra

- Doesn’t offer unlimited pay runs

Paychex Plans & Pricing

- Paychex Flex Essentials: $39 per month + $5 per employee monthly

- Paychex Flex Select: Custom-priced

- Paychex Flex Pro: Custom-priced

Paychex Plan for Solopreneurs and the Self-employed

- Paychex Solo: Custom-priced

- Includes incorporation services, payroll, and access to 401(k) plans

NOTE: Paychex is offering 6 months of free payroll for new clients who sign up before 11/30/2023 and run their first payroll by 12/7/2023.

Like ADP, Paychex is a full-featured payroll system that provides different packages for small to enterprise-level businesses, including solopreneurs and the self-employed—an option none of the other solutions in this list offer. If you want a single point of contact for your employee pay processing and payroll tax requirements, sign up for one of Paychex’s premium plans to get a dedicated payroll specialist.

Aside from payroll and payroll tax filing services, it has several HR solutions for managing new hire onboarding, background screening, and employee training. While both ADP and Paychex offer workers’ compensation and employee benefits plans, only Paychex provides access to a financial wellness program with access to short-term loans, educational resources, and other tools to assist employees in achieving their financial goals.

You can start and resume pay runs directly from Paychex’s main dashboard. (Source: Paychex)

Paychex Key Features

- Flexible system: Paychex allows you to review, edit, and submit payroll from desktop computers and mobile devices (for iOS and Android). You can start running payroll on your smartphones/tablets and then resume it on your computer, and vice versa. Unlike Gusto, Square Payroll, and QuickBooks Payroll, Paychex and ADP can grow with your business, providing you with efficient pay processing tools and robust HR solutions, regardless of whether you have 10 employees or more than 500.

- Multiple pay options: You can pay employees through pay cards, direct deposits, and paper checks. Like ADP, Paychex also offers check signing and stuffing services. If your staff requests early access to earned wages before a payroll date, you can use its pay-on-demand feature to help employees with their financial needs.

- Robust reporting: The reporting options of other providers in this guide aren’t as robust as Paychex’s. Aside from offering customizable reports, it has over 60 options that you can use for payroll and analyzing HR data.

- Full range of HR and payroll features: In addition to payroll, it has a full-featured HR solution suite that includes new hire onboarding, time and attendance, employee benefits, garnishment payment services, workers’ compensation, learning management, and hiring tools. QuickBooks Payroll, Square Payroll, and Justworks don’t offer a wide variety of HR solutions.

- Dedicated support: Paychex has a team of compliance experts, HR professionals, and payroll experts who can provide knowledgeable advice on labor regulations and HR-related issues. Similar to Justworks, you also get 24/7 phone and chat support. And, if you get one of its higher tiers, Paychex will assign you a dedicated specialist to help you handle HR and payroll issues.

Square Payroll: Best for Small Restaurant & Retail Businesses

Pros

- Seamless integration with Square POS

- Low-cost contractor-only payroll plan

- Offers next-day direct deposits and instant payments

- Unlimited pay runs

Cons

- A Square Payments account is needed for next-day direct deposits and instant payments

- Standard direct deposit has a four-day processing timeline

- Basic HR features only

- Phone support requires a customer code

Square Payroll Plans & Pricing

- Pay employee and contractors: $35 per month + $6 per employee monthly

- Pay contractors only: $6 per person monthly

What makes Square Payroll an ideal option for restaurant and retail business owners is its seamless integration with Square POS, making it easy for you to capture, track, and process tip and commission payments. If you use Square POS to capture employee clock-ins/outs, then you can import time data into Square Payroll with just one click. ADP may integrate with several POS systems, but it doesn’t connect with Square (as of this writing). Plus, you have to pay extra to access ADP’s time tracking solution.

Apart from restaurants and retail shops, Square Payroll is great for small businesses that mostly hire contract workers, mainly because of its low-cost contractor-only plan. QuickBooks Payroll and Gusto may have a similar payroll package, but Square’s is slightly cheaper, costing only $6 per contractor monthly (Gusto’s is priced at $35 plus $6 per contractor monthly, while QuickBooks’ contractor plan is priced at $15 per month for up to 20 workers plus $2 for each additional contractor). ADP and the other providers in this guide don’t have a separate contractor payroll plan.

A look at Square Payroll’s pay runs (Source: Square Payroll)

Square Payroll Key Features

- Multiple payment options: With Square Payroll, you can pay employees either through paychecks, direct deposits, or pay on-demand. While its standard direct deposit processing timeline is four days, Square’s “Instant Payment” feature enables you to offer next-day and even instant payments through its “Cash App”—provided you have a Square Payments account. However, if you’re not a Square user and need fast direct deposits, consider QuickBooks Payroll, as it provides next- and same-day options.

- Payroll tax filing and reporting: Apart from automatic payroll tax calculations, Square Payroll will handle all tax payments and filings for you. It also generates W-2/1099 forms at year-end and will even file annual 1099-NEC forms on your behalf. All these are available at no extra cost, unlike ADP and Paychex.

- Built-in time tracking: Square Payroll comes with free online timecards that you can use to track employee attendance either through Square POS or the Square Team app. With ADP and the other ADP competitors on our list (except TriNet Zenefits), you have to either purchase time tracking as an add-on or upgrade to the higher tiers to unlock the said functionality.

- Employee benefits: Square Payroll’s partnership with insurance carriers enable it to offer employee benefits like health insurance (via SimplyInsured), retirement plans (through Guideline), and pay-as-you-go workers’ comp (via Next Insurance). However, it doesn’t have non-standard benefits options, like ADP’s employee discounts, Paychex’s financial wellness tools, Gusto’s college savings plans, and Justworks’ fitness membership and health advocacy services.

Justworks: Best for Businesses Looking for Affordable PEO Services

Pros

- User-friendly interface

- Reasonably priced PEO services

- Enterprise-level benefits packages from major health insurance companies

- 24/7 customer support via phone, email, chat, text, and Slack

Cons

- Medical, dental, and vision plans are available only in Plus plans

- Time tracking is a paid add-on

- Limited third-party integrations

Justworks Plans & Pricing

- Basic: $59 per employee monthly

- Plus: $109 per employee monthly

Add-on solution

- Justworks Time Tracking: $8 per employee monthly

For business owners with limited HR and payroll experience, Justworks is a co-employer providing PEO services to help you efficiently manage day-to-day HR administrative tasks. Similar to ADP’s PEO solution, ADP TotalSource, it offers full-service payroll, tax payments and filings, essential HR tools, and access to HR experts. Its employee benefits even include fitness and wellness perks in addition to the usual health and retirement plans. What’s also great about this provider is its reasonably priced plans and flexible pricing matrix, wherein monthly fees go down as you add more employees to your business.

However, it lacks the hiring solutions that Gusto, Rippling, and Paychex offer. Further, its platform isn’t as full-featured as TriNet Zenefits, which even has compensation management tools and robust employee engagement tools.

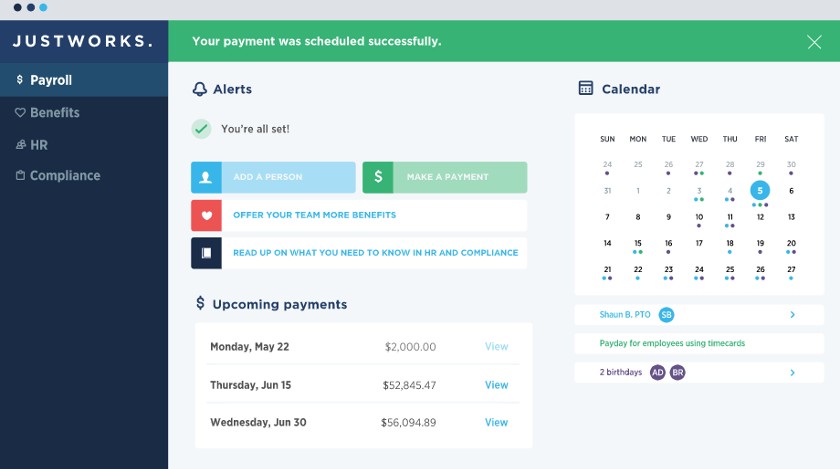

A screenshot of Justworks’ payroll dashboard (Source: Justworks)

Justworks Key Features

- Solid payroll tools: Justworks’ simplified payroll process makes paying employees easy for payroll administrators. It can handle payments for hourly and salaried employees, including contractors and vendors. And, like the other ADP competitors in this guide (except Paychex), Justworks lets you run off-cycle payroll at no extra cost. However, if you prefer biweekly and weekly pay runs, note that Justworks only pays employees on Fridays; for semimonthly payroll, it pays on the 15th and last day of the month (or the closest business day before each date). Plus, it only supports payments via paper checks and direct deposits. If you want multiple pay schedule options, consider Gusto, Paychex, and Paycor.

- Robust employee benefits options: Apart from workers’ compensation, health, and retirement plans, Justworks has a wide range of non-standard benefits options like health advocacy services, wellness perks, and fitness memberships. Although it doesn’t have Gusto’s college savings plans and ADP’s employee discount program.

- Customer and HR support: Justworks may not have Paychex’s dedicated payroll specialists, but it has a team of HR professionals that can provide expert advice. Plus, you don’t need to pay for HR advisory services (as you would with Rippling and TriNet Zenefits) because this feature is included in all of Justworks’ plans. It even offers 24/7 support, with customer reps you can contact either through email, phone, chat, SMS, and Slack.

Rippling: Best for Tech-reliant Companies Managing HR, Payroll & IT

Pros

- Robust HR and IT products can be purchased separately and as needed

- Pricing is a bit more transparent compared to ADP

- Integrates with 500+ third-party software

- IT tools simplify the company computer/app provisioning and deprovisioning processes

Cons

- Core Workforce Management solution must be purchased before any other product

- Limited employee payment options

- Gets pricey as you add features

- HR help desk option with phone and email support costs extra

Rippling Plans & Pricing

- HR payroll plan*: $35 plus $8 per employee monthly, which includes access to Rippling’s core workforce management platform plus full-service payroll and time tracking solutions

- Rippling PEO services: $65 per employee monthly

Add solutions*

- IT tools (such as device, app, and computer inventory management) cost an additional $5 per user monthly

- Benefits administration costs extra, pricing is based on your insurance broker

*Pricing is based on a quote we received

Rippling is the only provider in this guide with IT solutions for managing company-issued computers and apps. It even integrates with more than 500 apps. This makes it ideal for companies that want to automate their computer provisioning and deprovisioning processes while streamlining essential HR and payroll tasks.

However, you have to pay for each HR, payroll, and IT module in addition to its core employee management platform, which is a required solution. Further, it doesn’t have free live phone support like there is with ADP. If you want one-on-one HR support, then subscribe to Rippling’s HR Help Desk module, which comes with phone and email support.

Like TriNet Zenefits, Rippling’s payroll product comes as an add-on to its HR platform. Aside from IT and HR management tools, it offers an extensive payroll feature set with automatic tax calculations and filings and direct deposit payment options. You can also print manual checks, but there are no payroll cards and on-demand pay options that you would get with ADP, Paychex, or Gusto. It does automatically sync your HR data with payroll, though, which can be a time saver.

Since Our Last Update:

Rippling has added global payroll and employer of record (EoR) services to its suite of solutions. These features allow businesses to compliantly hire and pay international employees. Aside from global solutions, Rippling also released several finance-related products, such as expense management and corporate credit cards to help your employees manage business spending and reconcile expenses.

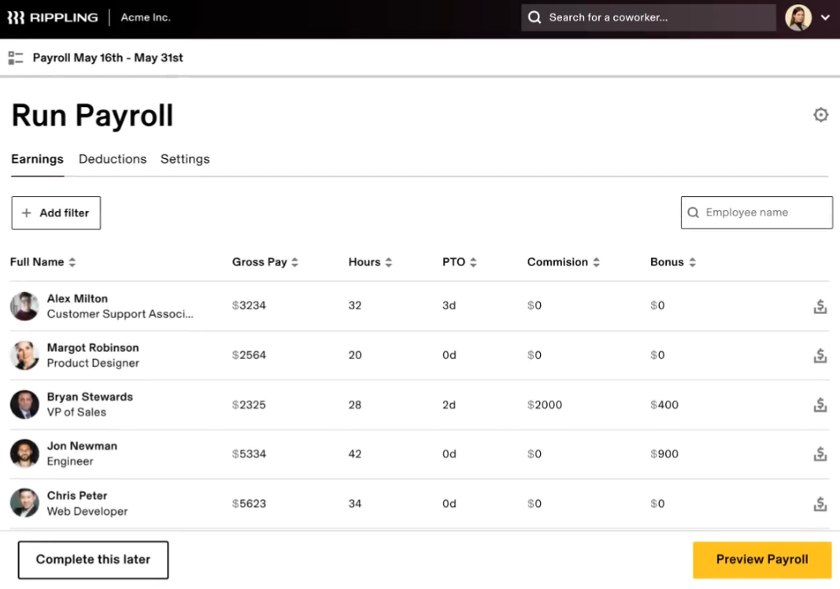

Rippling syncs all employee attendance, benefits, and pay-related data into its payroll module for easy processing. (Source: Rippling)

Rippling Key Features

- Full range of HR and IT features: You get a full HR suite with robust employee management, benefits administration, time and attendance, and applicant tracking. It also has onboarding/offboarding automation and IT management tools. Note that none of the software in this list, including ADP, have IT functionalities.

- Efficient pay processing: Rippling offers full-service payroll that lets you pay employees and contractors in just a few clicks. It also provides your staff easy access to online pay stubs and tax forms through its mobile apps (for iOS and Android devices). You don’t have to worry about payroll taxes because it automatically calculates and files federal, state, and local taxes for you. And, compared to competitors like Gusto and Zenefits, Rippling’s pay processing capabilities are a bit more robust since, like ADP, it can handle international payroll.

- Robust integrations: In addition to application programming interface (API) access, you can connect Rippling to more than 500 third-party systems that include accounting, expense management, recruiting, training and onboarding, and office management software, among others. ADP and the other providers in this article don’t integrate with as many third-party solutions.

- Flexible PEO: For businesses that need expert assistance in managing day-to-day HR and payroll tasks, Rippling offers PEO services. You can even turn it on and off directly from your account and easily transition to using Rippling’s platform again. While ADP, Justworks, and Paychex provide PEO services, neither have a flexible program like Rippling.

For a wider range of payroll service options, check out our buyer’s guides on the best online payroll services and best payroll software.

How We Evaluated the Top ADP Competitors

To determine the ADP alternatives you should consider, we compared several options and focused on software that offers a robust set of payroll and HR tools vs just low-budget solutions. Note that ADP isn’t the cheapest payroll service on the market, and neither are many of its top competitors.

We also looked at several low-cost payroll software just in case you don’t need all of the features ADP offers or anticipate needing a huge upgrade soon. Then, we chose the top eight software most similar to ADP, yet better in some aspects to help you decide which payroll solution is best for your company.

Frequently Asked Questions (FAQs)

In selecting the right payroll provider, you have to consider several factors, like your budget, business location, and the size of your company. It is also important to take stock of the payroll features (such as direct deposit payments and payroll tax filing services) that your business needs.

For example, if your business is located in several states, look for a system that can handle multistate payroll. If you employ only hourly workers, it’s best to get a payroll software with time tracking capabilities or can integrate with third-party time and attendance solutions. This prevents you from having to manually enter employee time data into payroll for processing.

Lastly, do extensive research and compare the pricing and features offered by payroll service providers. And if you find one that offers a free trial period, take advantage of it. This provides you with an opportunity to see how its online tools work and whether its interface is easy to learn and use.

If you don’t have an in-house HR staff or payroll accountant, then outsourcing your payroll makes sense. Most business owners who are not familiar with how to run payroll also opt to get payroll outsourcing services as it helps them save time while ensuring accurate payments to employees and compliance with pay-related laws.

In terms of years of experience, business size, and customer base, ADP is considered one of the largest payroll companies in the US. It has around 60,000 employees and more than 70 years of experience handling payroll and HR. ADP also has more than 1 million clients—from small businesses to midsize companies and large enterprises. In addition, its product portfolio covers a wide range of HR solutions, such as US and global payroll, benefits administration, time and attendance, talent management, and PEO services.

The other providers on our list, like Gusto and Paychex, don’t have a big client base as ADP, servicing only 200,000+ and 680,000+ customers, respectively. Both also lack the decades of HR and payroll experience that ADP offers (70+ years), with Gusto having only 10 years of experience and Payroll with 45+ years of industry expertise.

Bottom Line

ADP is an excellent payroll service, but there are also several other great options to choose from depending on your requirements. All the ADP competitors in this list offer full-service payroll with tax filing services, direct deposits, onboarding and employee self-service, and tax and benefits calculations. Some primarily cater to small businesses, while others are more suited to a range of business sizes. HR support is included with most options but is limited under the most affordable plans.

Overall, we found Gusto to be the best ADP competitor for payroll services. It has the essential features that small businesses need, such as full-service payroll, multiple pay options, and expert HR support. It even has a variety of employee benefits you may want to offer, plus a reasonably priced plan for paying contractors—an option that ADP doesn’t offer. Sign up for a Gusto plan today.