Xero is online accounting software for self-employed individuals, small businesses, and growing companies. It can help you track and pay bills, manage inventory and invoices, claim expenses, and store files. It even integrates with Gusto for your payroll needs. You can try Xero for free for 30 days and then subscribe to any of the three paid plans, which run from $20 to $80 per month for unlimited users.

While Xero is both affordable and easy to use, it only allows one subscription per email address, with no option to add more. It also lacks telephone support, so you are limited to making contact via email. See if it fits your business’ needs by reading my in-depth Xero review and evaluation.

Pros

- Ideal for project accounting

- Easy-to-understand bank reconciliation

- Robust integration with third-party apps via the Xero App Store

Cons

- Lowest plan is limited to 20 invoices and five bills

- A subscription can only be used to keep a single set of books

- No discounted annual billing

- Xero Advisor network is small, especially compared with the QuickBooks ProAdvisor network

Monthly Pricing |

All plans include unlimited users. |

Discount | 95% off for six months |

Free Trial | 30 days; regular pricing applies after the trial |

Payroll | Via Gusto integration (read our Gusto review) |

Standout Features |

|

Ease of Use | Is easy to use for experienced accountants but may require some training for users without prior experience in accounting software |

Customer Support | Chatbot, email, and self-help library |

- Businesses seeking an alternative to QuickBooks: Xero’s named one of our best QuickBooks alternatives because it has features very similar to QuickBooks but is considerably less expensive and even includes unlimited users.

- Ecommerce businesses: Its inventory tracking feature is ideal for ecommerce operations because it calculates your COGS automatically and maintains a list of customers. You can also monitor customer payments and orders with Xero, making it suitable for online transactions.

- Businesses managing fixed assets: Xero has a fixed asset manager that keeps fixed asset records and calculates depreciation expense automatically. It’s the only general bookkeeping program in this price range that we’ve reviewed that has a fixed asset management feature.

Xero’s Featured Industry Uses on Fit Small Business

- Best Cloud Accounting Software for Small Businesses: Best for those needing inventory features and unlimited users

- Best Ecommerce Accounting Software: Best for unlimited user access

- Best Fixed Asset Management Software for Small Businesses: Best within a full cloud-based bookkeeping software

- Best Small Business Budgeting Software: Most affordable accounting software with budgeting features

- Best Accounting Software for Amazon Sellers: Best overall accounting software for Amazon sellers

- Best Bank Reconciliation Software: Best bank reconciliation software for scalability

- Best FreshBooks Alternatives: Best for unlimited users or tracking fixed assets

Xero Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Easy to setup and use | Issues with foreign exchange translations |

| Integration with many useful third-party apps | Each Xero subscription is good for one organization, with no option to add more |

| Affordable and transparent pricing | No telephone support |

Those who reviewed Xero on third-party websites shared plenty of positive feedback, often accompanied by high ratings. I agree that Xero is easy to use, though users without accounting software experience may need training.

Many reviewers highlighted that they switched to Xero because it’s more user-friendly than similar platforms like QuickBooks Online, which others find overwhelming. Some also appreciated its ability to integrate seamlessly with third-party apps essential for their business operations like Gusto, Hubdoc, and Stripe.

On the downside, some negative reviews focused on specific niche issues, such as challenges with forex translations and limited customization options.

Here are the Xero review scores from third-party sites:

- Software Advice: 4.4 out of 5 based on around 3,100 reviews

- G2.com: 4.3 out of 5 based on around 700 reviews

Fit Small Business Case Study

Using Fit Small Business accounting software study, I compared Xero with QuickBooks Online and Zoho Books using criteria that I, together with the other accounting software experts, developed.

Xero vs Competitors Fit Small Business Case Study

Touch the graph above to interact Click on the graphs above to interact

-

Xero Starts at $20 per month

-

Zoho Books Starts free

-

QuickBooks Online Starts at $35 per month

Zoho Books, QuickBooks Online, and Xero—which are all among our best small business accounting software programs—are tight competitors in the US accounting software market. Xero beats QuickBooks Online’s Plus plan in terms of overall value, as Xero offers similar accounting software at a lower price point. However, considering all other competitors, Zoho Books appears to be the most flexible option because you can choose among its six plans.

In my expert opinion, your choice would highly depend on your priorities. If you’re drawn to QuickBooks for its popularity and wide network of ProAdvisors, it’s a strong contender, especially in the US. Meanwhile, Zoho Books is an excellent choice if affordability and mobile-friendliness matter most, whereas Xero is great for unlimited user access and robust fixed asset management.

Xero’s pricing is among the most affordable on the market, offering unlimited user seats at a lower cost than its competitors. In my assessment, it provides excellent value, particularly for large accounting teams.

I could’ve awarded it a higher value score if there were no invoicing and billing limits in the Early plan. Growing small businesses may find themselves compelled to upgrade to the Growing or Established tier to avoid these limits.

Early | Growing | Established | |

|---|---|---|---|

Monthly Cost | $20 | $47 | $80 |

Number of Monthly Invoices | 20 | Unlimited | Unlimited |

Number of Monthly Bills | 5 | Unlimited | Unlimited |

Set Up Bank Feeds | ✓ | ✓ | ✓ |

Reconcile Transactions | ✓ | ✓ | ✓ |

Manage Inventory | ✓ | ✓ | ✓ |

Generate Reports | ✓ | ✓ | ✓ |

Send POs | ✓ | ✓ | ✓ |

Bulk Reconcile Transactions | ✕ | ✓ | ✓ |

Multiple Currencies | ✕ | ✕ | ✓ |

Project Tracking Tools | ✕ | ✕ | ✓ |

Expense Claims | ✕ | ✕ | ✓ |

Advanced Analytics Tools | ✕ | ✕ | ✓ |

I really like how easy it is to set up your business on Xero, which is why it aced my assessment of general features. The chart of accounts comes with default accounts already set up, but you can easily modify them or add new ones to suit your needs.

One of the most convenient features is the user-friendly conversion balances window. This is where you can input your beginning balances with clear labels showing whether you’re entering a debit or credit.

Plus, you can invite additional users and customize their access levels. This gives you more control over who sees what.

Xero’s banking and cash management features nearly nailed my evaluation, offering check printing, transaction recording, live bank feeds, and an intuitive side-by-side reconciliation layout. Users can easily match transactions and upload bank files to streamline reconciliation.

However, Xero has notable limitations, such as requiring imported transactions for manual reconciliation and preventing users from entering ending balances without a bank statement. Deposit handling is another drawback. While Xero provides an account for undeposited checks, it lacks tracking for deposited checks and does not allow cash to be included in deposits. This makes it difficult for users who rely on grouped deposits to reconcile transactions efficiently.

Xero’s A/R management aced my review of the basics, as it covers all essential features like creating and saving customers, printing and emailing invoices, and issuing credit memos. While it supports short payments and integrates COGS and inventory adjustments into invoices seamlessly, its invoice customization options could be improved.

You can upload a logo, create personalized messages, and choose which fields to include, but Xero doesn’t offer advanced customization like changing colors, layouts, or adding custom fields. This limits personalization for businesses wanting to reflect their brand more prominently.

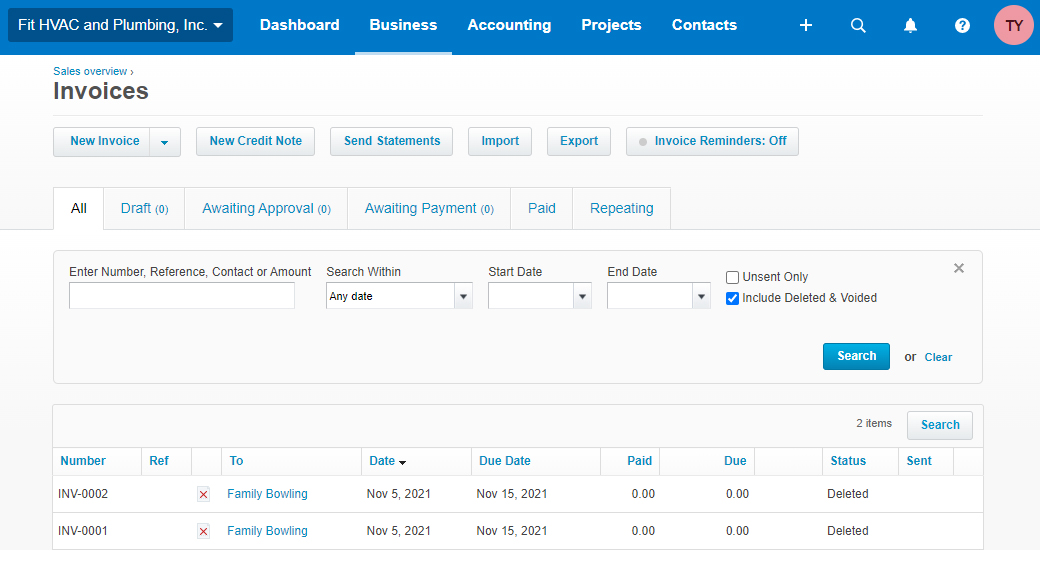

Invoice window in Xero (Source: Xero)

In terms of advanced A/R features, the invoices window—similar to the billing window—is user-friendly with an advanced search feature that allows filtering by multiple fields. There are also robust tools like for setting default sales prices, tracking labor and expenses for invoices, and issuing credit refunds without manual journal entries. However, Xero falls short with no customer portal or ability to issue sales receipts for immediate payments.

Overall, while Xero’s A/R management is competitive against tools like QuickBooks and FreshBooks, improvements in invoice customization and advanced features would enhance its appeal further.

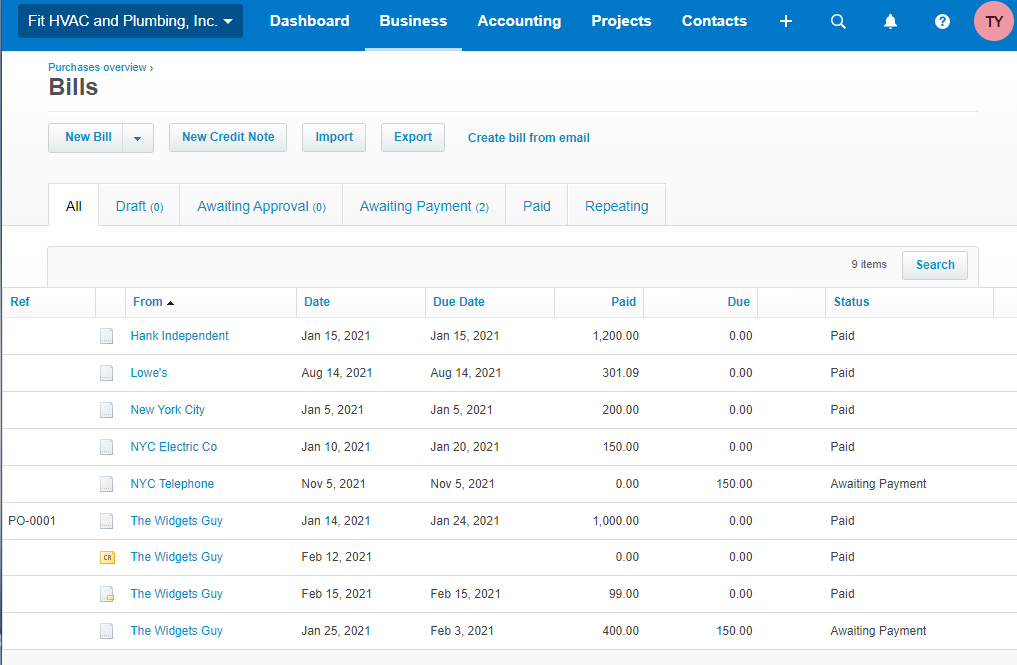

A/P management is one of Xero’s strongest features in my evaluation. From creating and saving vendors to recording payments, Xero excels in keeping billing systems organized. Its outstanding PO system allows you to convert POs into bills, track unpaid bills, record e-payments, and apply vendor credits seamlessly.

The bills window is user-friendly, presented in a clean, tabular format that displays key details such as vendor, invoice date, due date, amount paid or due, and bill status. Xero also includes features like attaching copies of bills to transactions and summarizing unpaid bills by vendor, making it easy to manage accounts payable efficiently.

Bills window in Xero (Source: Xero)

However, there are a few limitations I noticed. While Xero supports creating recurring bills, it doesn’t allow recurring expenses to be deducted automatically from your checking account, requiring manual entry for payments.

Additionally, its handling of POs and inventory needs improvement. Inventory on a PO isn’t automatically reduced when only part of a PO is received, requiring manual adjustments that don’t leave a clear paper trail or change log.

Despite these minor drawbacks, Xero still earned a high score in my review of A/P management due to its robust features. These include the ability to initiate e-payments and track contractor payments, making Xero a comprehensive and reliable tool for managing payables.

Xero performed well in my assessment of inventory management, and it even aced the subcriteria for basic features. It includes key functionalities like tracking inventory costs and quantities, viewing total inventory costs and units on hand, and using a perpetual inventory system to automatically calculate COGS. These, combined with minor tools like inventory cost information and POs, make it a solid choice for businesses needing comprehensive inventory tracking.

One notable shortcoming is its inability to view inventory directly on POs, as mentioned in the A/P section. This limitation affected the advanced inventory features score, which reflects gaps such as the lack of multiple flow assumption options like FIFO or LIFO. Despite these areas for improvement, Xero’s inventory features integrate seamlessly into its A/P and A/R workflows, offering strong functionality for most business needs.

I evaluated Xero’s reporting features against 17 essential reports and found that it includes 15, and the missing reports’ absence doesn’t significantly impact the overall functionality. Xero still provides robust tools for effective financial analysis.

Reports Included | Missing Reports |

|---|---|

|

|

Xero nailed my assessment of project accounting. I placed greater emphasis on features like assigning project estimates, tracking labor costs, and recording inventory used in projects—and Xero delivered on all fronts. These tools allow you to effectively monitor income, expenses, and profitability for each project, providing clear insights into performance.

Key project management capabilities include assigning actual expenses, recording inventory usage, and creating estimates with sales tax and linking them to projects. Xero also offers reporting that compares actual results to estimates, making it a reliable solution for managing project-based financials.

Xero’s sales tax basics are well-covered, allowing users to separately track multiple sales tax items, add sales tax on a line-by-line basis for invoices, and view detailed sales tax liability reports. Additionally, Xero simplifies compliance by enabling users to record sales tax liability payments without the need for manual journal entries.

On the advanced side, Xero offers equally robust functionality. It lets you designate whether sales items are taxable by default, calculate sales tax based on customer addresses, and include tax adjustments on credit memos. Filing sales tax returns is also fully supported, making Xero an excellent choice for businesses needing comprehensive, automated sales tax management.

In evaluating Xero’s mobile app, available on both Android and iOS devices, I looked for comprehensive features like sending invoices, entering bills, receiving payments, and handling vendor payments.

The app scored well for features like sending invoices, capturing receipts, and categorizing expenses in the bank feed. It fell short on recording unpaid bills and other advanced tasks; for instance, users can’t receive customer payments, record time worked, assign billable time, or generate reports, which limits its utility for mobile users.

Overall, Xero’s mobile app is functional but far from comprehensive. It’s better suited for basic on-the-go accounting tasks rather than full-scale mobile financial management.

Xero excels in integration capabilities, which is why it aced my evaluation of this category. Through its App Store, Xero offers seamless connections with numerous third-party applications, enhancing its functionality across various business processes. Some notable integrations include

- Gusto for payroll services, enabling efficient employee compensation management

- MinuteDock and Tradify for time-tracking, allowing accurate monitoring of billable hours

- Stripe and GoCardless for electronic payments, facilitating smooth paymen

I evaluated usability by looking at ease of use and setup, bookkeeping assistance, and customer service.

Xero proved to be highly user-friendly in my evaluation. The interface is intuitive, with features like one-click transaction creation and automatic invoice numbering simplifying daily accounting tasks.

I appreciate how users can view outstanding invoices and A/R balances directly without needing to generate reports. And while the dashboard isn’t fully customizable and has some minor design flaws, Xero’s cloud-based accessibility and Mac compatibility make it a convenient tool for most users.

I reviewed Xero’s setup process and found it straightforward for businesses transitioning from other platforms. It supports importing a chart of accounts, beginning balances, customers, vendors, and service items, which makes the migration process seamless.

However, I noticed the absence of live onboarding support or a setup wizard. This could leave some users reliant on self-help materials during the initial setup phase, which may not be the best experience for those needing a quick setup process.

In my assessment of bookkeeping support, Xero doesn’t have a robust network of independent advisors in the US, which may be crucial for users to outsource bookkeeping.

When evaluating customer support, I found Xero to be lacking in key areas. There’s no live phone or chat support, which could be a drawback for users needing immediate assistance. Instead, Xero relies on email support, a user community, and extensive self-help resources. While these options are helpful, the absence of real-time options limits the overall usability for those who prefer direct, hands-on assistance.

How I Evaluated Xero

I evaluated Xero using the Accounting team’s scoring rubric. The Fit Small Business accounting software case study provides a more detailed description of our methodology.

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

How to Get Started With Xero

If you have decided that Xero is a good fit for your business, get started by visiting the Xero website and clicking on “Try Xero for free” or “Pricing & plans” to explore Xero’s features and subscription options. Choose a plan that best suits your business needs and budget. You can sign up for a free trial by entering your contact and business information, including your business name, email address, and password.

Once subscribed to the free trial, I encourage you to check out our series of Xero tutorials, which will walk you through the basics.

Frequently Asked Questions (FAQs)

Xero has a moderate learning curve. It’s not extremely easy to use, but if you get some training or guidance, you can navigate and use its features in no time.

Users can try Xero for 30 days before signing up for a subscription. However, accountants and bookkeepers can register in the Xero Partner program to get it for free. If your business isn’t offering accountancy services, you are ineligible for the free Xero account.

No, you can use Xero without hiring an accountant. However, as the need arises, you may hire a Xero-certified accountant to help you keep your books of accounts accurate and organized.

Yes, you can, as Xero has Android and iOS mobile apps that allow you to access your account and manage your finances. However, it is not the most comprehensive mobile app because it doesn’t allow you to generate reports, receive payments from customers, or record time worked.

Yes, Xero offers customer support via email. It also has extensive help resources, including a knowledge base, community forum, and video tutorials.

Xero offers a choice of three subscription plans, which range in price from $20 to $80 per month.

Bottom Line

Xero is one of the best QuickBooks alternatives, specifically for budget-conscious small businesses. With its relatively affordable price points, you get features that you’ll see only in higher-priced plans of other accounting software. Overall, it’s ideal for daily accounting, inventory keeping, and project management. I recommend it for project- and product-based companies because of its flexible features.