If you are considering Clover vs Square, it is hard to go wrong. Both offer excellent cloud-based point-of-sale (POS) systems for small businesses, with in-house hardware solutions, key POS features, and add-ons to support your growth.

The biggest difference between the two POS systems is that Clover can operate with thousands of merchant services, giving you a choice of payment processor. Square, meanwhile, does its own payment processing and, unlike Clover, offers free POS software.

Both Square and Clover are on our top POS systems for small businesses list. Clover earned a score of 4.35 out of 5 in our evaluation, while Square topped the list with an impressive 4.51 out of 5. In this article, we compare Clover POS vs Square for pricing, management tools, register features, ease of use, and expert score.

Clover vs Square Quick Comparison

|  | |

|---|---|---|

Overall Score | 4.51 out of 5 | 4.35 out of 5 |

Best For | New and small business | Mid- to large-sized businesses wanting flexibility in choice of payment processor |

Monthly Software Fee | $0-$89 | $14.95-$129.85 |

Hardware Cost | $0-$799 | $49-$1,799 |

Payment Processor | Square Payments | Fiserv (default) Third-party resellers |

Industry-specific Software | ✓ | ✓ |

Supported Sales Channels |

|

|

Customer Support | Extended business hours | 24/7 |

Business Software Integration | Native and third party | Native and third party |

When to Use Square

Pros

- Free software and online store

- Easy-to-use, intuitive system

- Works for solopreneurs but has tools and add-ons to grow with your business

- Easy chargeback dispute procedures

Cons

- Limited support hours

- Flat payment processing is not cost-effective for large businesses; no option to use an alternate merchant account

- No purchase and vendor management tools in free plan

- Does not process age-restricted products online

Square is a favorite at Fit Small Business, and for good reason. It offers industry-specific POS systems, completely free POS software, including an online store and in-house payment processing, and tons of add-ons and advanced paid features.

Overall, Square is better for startups or smaller businesses looking for an affordable, all-inclusive POS system option that can also support them as they grow.

Square routinely makes our lists for:

- Best POS systems

- Best multichannel POS systems

- Best POS systems for inventory management

- Best retail POS systems

When to Use Clover

Pros

- Offline mode

- $100,000 in liability protection in case of a data breach

- Sales reports plus insights on your sales activities vs your competitors

- May work with high-risk businesses, depending on the reseller it's purchased through

Cons

- Cannot change merchant account after initial set-up

- Little oversight of third-party resellers means contracts vary in quality

- No invoicing function, vendor management

- No free option for businesses on a budget

Clover is a better choice for medium and large businesses that do steady business and don’t want to be tied to a single, flat-rate payment provider. Clover integrates with thousands of merchant services, giving you the ability to use the most economical payment processing option for your business. It can also handle high-risk sales by using a high-risk merchant account, such as PaymentCloud, as the processor.

Clover and Square are popular and highly rated POS systems. Find them both on our lists for:

Clover vs Square Pricing

|  | |

|---|---|---|

Pricing Scores | 4.5 out of 5 | 4.75 out of 5 |

Monthly POS Subscription | $0-$89 (Bespoke options also available) | $14.95-$114.85 |

Monthly Ecommerce Subscription | $0-$79 | Depends on provider |

Online Store | Square Ecommerce (included free in all plans) | Integrate with BigCommerce, Ecwid, Shopify, WooCommerce, Magento, and more |

Hardware Cost* | $0-$799 | $49-$1,799 |

Card-present Processing Fees | 2.6% + 10 cents | 2.3%-2.6% + 10 cents |

Online Processing Fees | 3.5% + 15 cents | 3.5% + 10 cents (Based on Fiserv rates) |

Loyalty Program | $60-$140/month | Included in all plans |

Scheduling | $0-$35/month/location | Included in all plans |

Marketing | $15-$35/month | Included in all plans |

Gift Card Management | Included in all plans; cards are 80 cents-$2 | Included in all plans; cards are $0-$2 |

*Both Square and Clover offer financing options in lieu of upfront payment. | ||

Why Clover Is Better for Pricing

Clover edged Square in terms of pricing for several reasons but a major factor for this result is Clover’s ability to work with a number of payment processors. Unlike Square, Clover allows merchants the flexibility to choose among the cheapest credit card payment processors in the market to run payments on the Clover hardware. Our comparison table also clearly shows that Fiserv’s rates for card-present transactions are lower compared to Square’s. Users can also access Clover’s various business management tools, such as scheduling, marketing, and loyalty programs, at no extra cost.

Check out our review of the best merchant services for small businesses to find a reputable Clover reseller.

Clover rivals Square as an all-in-one POS solution, but if your goal is to save on upfront costs, then Square is your best choice. Square makes it possible for merchants to set up a complete POS system with little to no upfront cost. Merchants get the most value for money with Square’s feature-rich and multichannel free POS plan. Download the Square POS app on your iPad, build your store, receive the free magstripe card reader, set up tap to pay and you’re ready to go.

Accept payments anywhere customers are: In-person, Online, Remote, Buy Now Pay Later |

|

Clover vs Square Hardware

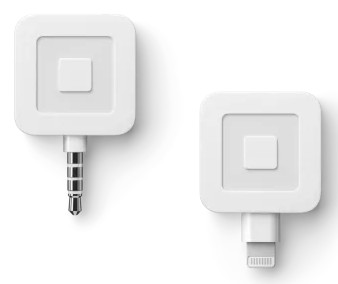

Square

Square Reader for Magstripe | Square Reader for Contactless and Chip | Square Terminal | Square Register | Square Stand |

|---|---|---|---|---|

|  |  |  |  |

First free, additional $10 | $49 | $299 (or $27 per month for 12 months) | $799 ($39/month) | $149 ($14/month) |

Available with lightning or audio jack input; accepts payments via magstripe (Swiped) | Connects via Bluetooth; accepts payments via EMV (chip), or NFC (Apple Pay, Google Pay) | All-in-one credit card machine with POS, card reader, and receipt printer | A dual-screen POS terminal; includes iPad | A branded stand for holding your tablet on your cash wrap; iPad and scanner not included |

Clover

Clover Go | Clover Flex | Clover Mini | Clover Station | Clover Station Pro |

|---|---|---|---|---|

|  |  |  |  |

$49 | $499 (or $35/month) | $799 (or $60/month) | $1,349 (or $120/month) | $1,799 (or $130/month) |

Connects via Bluetooth; accepts chip or tap payments. | Handheld terminal that includes chip, tap, and swipe payments and tracks sales | Full POS system in a compact package; accepts chip, swipe, or tap payments | Full POS with Clover software included; includes receipt printer and cash drawer | Full POS with Clover software included; includes receipt printer, customer-facing terminal, and cash drawer |

Since our last update:

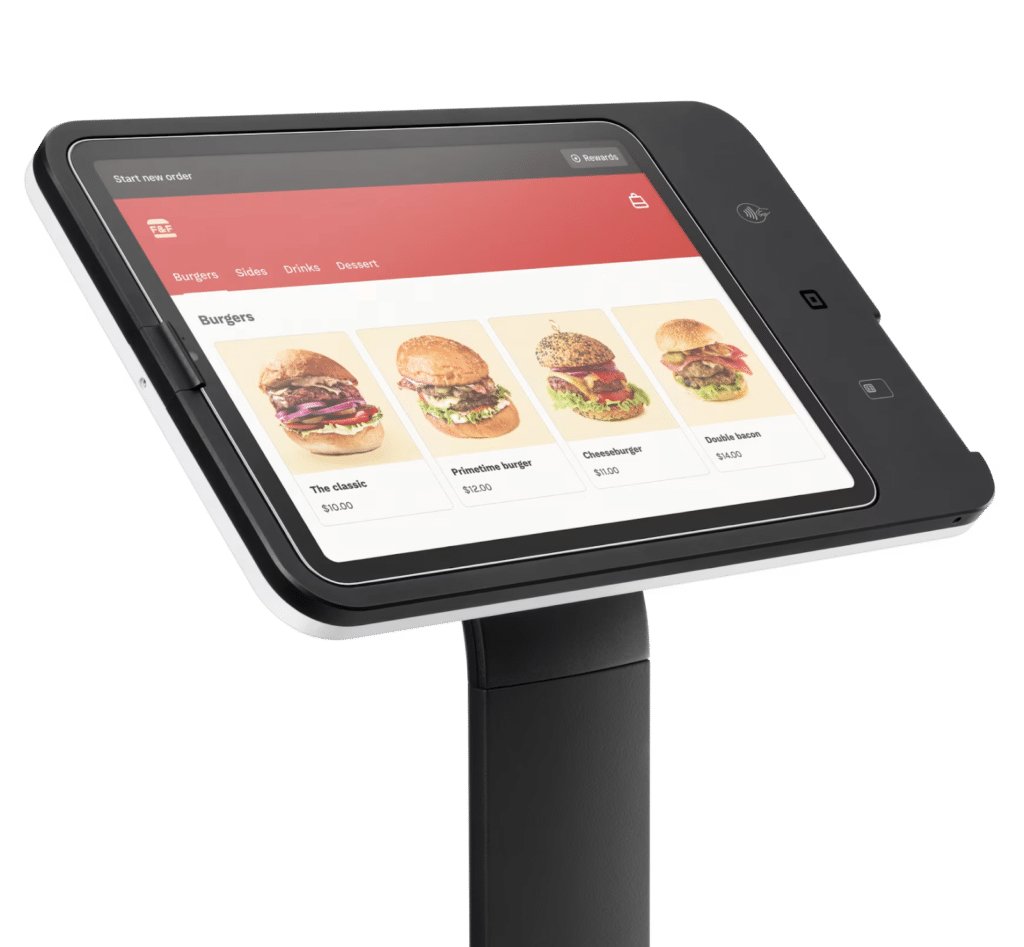

Both Square and Clover released their Kiosk hardware. See how they compared below.

|  |

|---|---|

Square Kiosk $149 + $50/mo per device | Clover Kiosk $3,499 + $34.95/mo per device |

|

|

Clover vs Square Register Features

|  | |

|---|---|---|

Register Features Score | 4.75 out of 5 | 4.38 out of 5 |

Checkout Features |

|

|

Customer Relationship Management |

|

|

Loyalty Program | Add-on ($60-$140/month) | Included |

Mobility |

|

|

Online Ordering |

|

|

Invoicing | Included (all plans, $0) | Included (all plans) |

Virtual Terminal | Included (all plans, $0) | Third-party integration |

While both Square and Clover score very well in the register features category, Square came out just ahead of Clover, with 4.75 out of 5 in our evaluation. Both POS systems can accept all forms of modern payments (mobile, card, cash, invoice, check), have virtual terminals, and can conduct basic sales. However, Square has more advanced features and an easier-to-use interface.

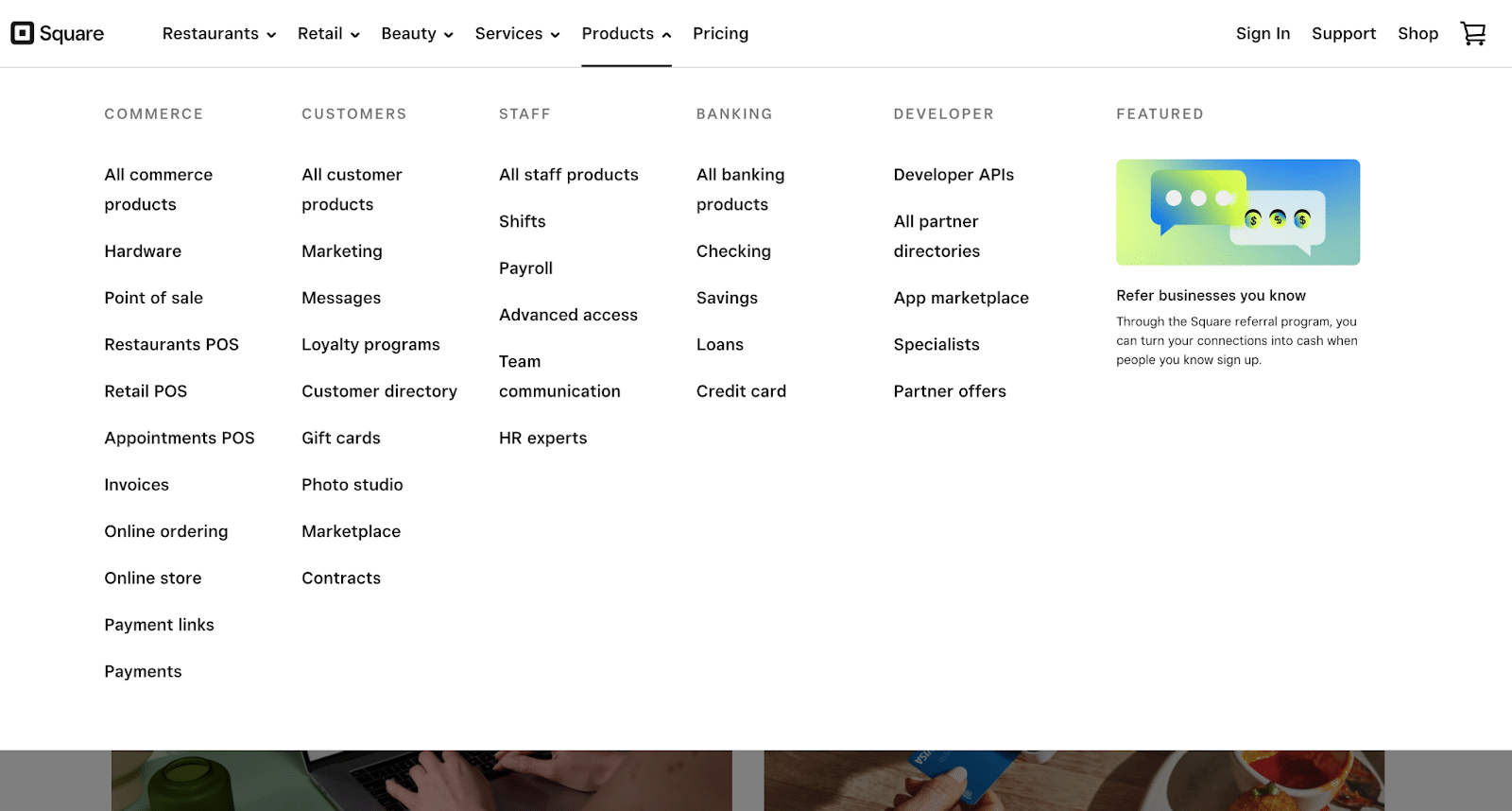

Square offers a greater number of customization options, can integrate with social channels without a third-party integration and manage BNPL payments, and includes more marketing tools—all things that Clover lacks. Additionally, Square has business management features that allow you to manage sales, track products, connect with customers, and view reports.

As our top pick for the best retail POS system, Square is ideal for newer and brick-and-mortar businesses that want a flexible, all-in-one POS and payment processor that is easy to use and includes all the register features you could need.

Square is a highly versatile and feature-rich system. (Source: Square)

If you are already working with another merchant account and want to keep processing transactions with them, then Clover is going to be your best bet, as it allows you to choose your own processor.

Additionally, Clover was designed for its own hardware (except for the mobile version, Clover Go), whereas Square is primarily meant for iOS and Android. So, if you want to purchase proprietary hardware, Clover will have more options. Finally, while Clover costs more, both in terms of upfront and ongoing costs (because it requires a monthly subscription), it has more advanced employee management features than Square.

Both Clover and Square rank on our list of best mobile POS (mPOS) applications. Read the article to learn more.

Clover vs Square Management Features

|  | |

|---|---|---|

Management Features Score | 3.56 out of 5 | 4.25 out of 5 |

Time Card Management | Included in all plans | Included in all plans |

Payroll | Add-on ($35/month + $5 per person paid) NEW: Square Payroll integration with Cash App Taxes | Integrations with ADP, Paychex, and Gusto |

Reporting |

|

|

Inventory Management |

|

|

Marketing Tools |

|

|

Why Clover Is Better for Management Features

In the management features category, Clover edged out Square with a score of 4.25 out of 5. For the most part, Clover leads because it offers better inventory management tools, particularly in industry-specific POS software. Clover also provides more customizable reporting features with higher subscription plans. Like Square, Clover also offers excellent marketing tools and functionalities that make inventory counts easier to do.

While Square offers a one-stop shop for a complete POS solution, Clover is a much better option if there are certain providers that you want to use. The software can easily work with any integration partners of Clover’s resellers, clearly making it the more robust option. You can even shop directly on Clover as you sign up, so everything is integrated when you get started.

When to Choose Square

If you are after ease of setup and ease of use, Square is the better choice. For every subcategory, it offers an in-house option that is preloaded or easily added to each Square POS account. Square provides everything small businesses need to run their business on one easy-to-use platform that users can start selling with immediately. With Clover, businesses need to add third-party tools, leading to a more demanding management experience.

Square offers a long list of native products for every industry it serves. (Source: Square)

Clover vs Square Ease of Use

|  | |

|---|---|---|

Ease of Use Score | 4.5 out of 5 | 4.44 out of 5 |

Setup | Self-setup | Personalized and concierge-level assistance |

Store/Restaurant Setup | Excellent | Excellent |

Customizable Screens | ✓ | ✓ |

Product Images | ✓ | N/A |

Personal Assistance | No | ✓ |

Support Options | Monday-Friday (6 a.m.-6 p.m., PST) phone support, 24/7 automated chat support, seller community, and resource library | 24/7 customer support by phone or email, resource library online |

User Reviews* | 4.69 out of 5 | 3.95 out of 5 |

Mobile App Reviews | 4.8 out of 5.0 | 4.6 out of 5.0 |

*Averaged across multiple sites | ||

Why Square Is Better for Ease of Use

Square is our choice for ease of use not only because you can do the setup yourself, but also the intuitive user experience, overall—for you, your customers, and your staff. While Square does not provide personalized assistance (like Clover does), users generally don’t need it, and the how-to section on Square’s website is thorough and includes illustrations and videos. Square’s mobile app also scored higher among users (and experts).

Square’s biggest ease of use drawback is its limited support hours, with live support available Monday to Friday, 6 a.m. to 6 p.m., Pacific Standard Time.

If you have a large inventory with many modifiers or have multiple locations, then Clover—with its concierge-level installation and onboarding help—may be a better option for you. It also offers personalized help (though it may charge for it).

Clover vs Square Expert Score

Expert Score | 5 out of 5 | 3.75 out of 5 |

Value | High, especially for small and solo entrepreneurs | Medium, POS monthly fees plus additional fees for ecommerce and other necessary integrations makes this a less cost-effective choice |

Popularity | High, found commonly across retail and restaurants | High, found commonly across retail and restaurants |

Firsthand experience | Very positive, intuitive and pre-integrated with most tools | Somewhat positive, requires integrations for some tools |

Full review |

Why Square Got a Better Expert Score

Overall, Square scored higher than Clover in the expert score section because of our experience using the software, its popularity, and the overall value it provides to customers. Clover also did well in these areas. However, it is more expensive than Square and requires more integrations (and leg work).

When to Choose Clover

While needing to integrate with third-party platforms for things like ecommerce and marketing might mean more work, Clover also allows you to choose your own providers. This, especially when it comes to payment processors, might actually allow you to save money, if you are a large enough company.

How We Evaluated Clover vs Square

In our evaluation of the best POS system software, we looked at five main categories: pricing, register features, management tools, ease of use, and expert score. Then, we compared how Square and Clover performed in these categories for this side-by-side review.

Click through the tabs below for an in-depth look at our criteria:

30% of Overall Score

20% of Overall Score

Businesses need speedy and customizable checkout tools, easy customer management, mobility to sell anywhere, a process to track orders, and a way to process online orders. Because the way businesses operate has changed so much in recent years, we also considered contactless payments, integrated online ordering, and online store features.

15% of Overall Score

15% of Overall Score

20% of Overall Score

Frequently Asked Questions (FAQs)

Click through the questions below to get answers to some of your most frequently asked Square vs Clover questions.

This depends on what you need. Square is better for small businesses that need an all-inclusive, affordable POS system with great mobile options and a user-friendly interface.

On the other hand, Clover gives you more opportunities to customize your POS system with third-party app integrations for things like your merchant account and ecommerce store. Clover does come at a higher price than Square, and the additional app add-on fees make it a more expensive solution. However, Clover is a great solution for larger, more complex businesses, especially those needing high-risk or interchange-plus processing.

With its free, industry-specific POS system, Square is a better option for quick-service restaurants and cafes. Clover, on the other hand, offers tools for managing a full-service restaurant.

Square is cheaper than Clover. Square starts at $0/month, while Clover starts at $60 for retailers and $90 for restaurants.

Bottom Line

A Square vs Clover comparison shows that both offer user-friendly POS systems, online ordering, and payment processing solutions. Square has more flexibility and a free mPOS that makes it great for solopreneurs and startups looking to grow. It’s also more affordable, so if you’re just launching your business, it’s a good option. Clover’s comprehensive POS and programmable hardware make it the best choice for established businesses that already have a merchant account or that want to shop around for one that offers interchange-plus pricing.