Learning how to do payroll in Washington, D.C., is fairly easy because it mostly follows general federal guidelines. You will be required to obtain a federal Employee Identification Number (EIN), state tax and unemployment IDs, and an employment services number. You can take proper precautions to remain in state payroll compliance by following our steps below (and downloading our free checklist to make sure you don’t miss anything).

Key Takeaways:

- The current D.C. minimum wage is $17.00 per hour

- Washington, D.C., has reciprocity with Maryland and Virginia, so your employees won’t be double taxed

- D.C. law mandates employers provide paid sick leave to employees

Running Payroll in D.C.: Step-by-Step Instructions

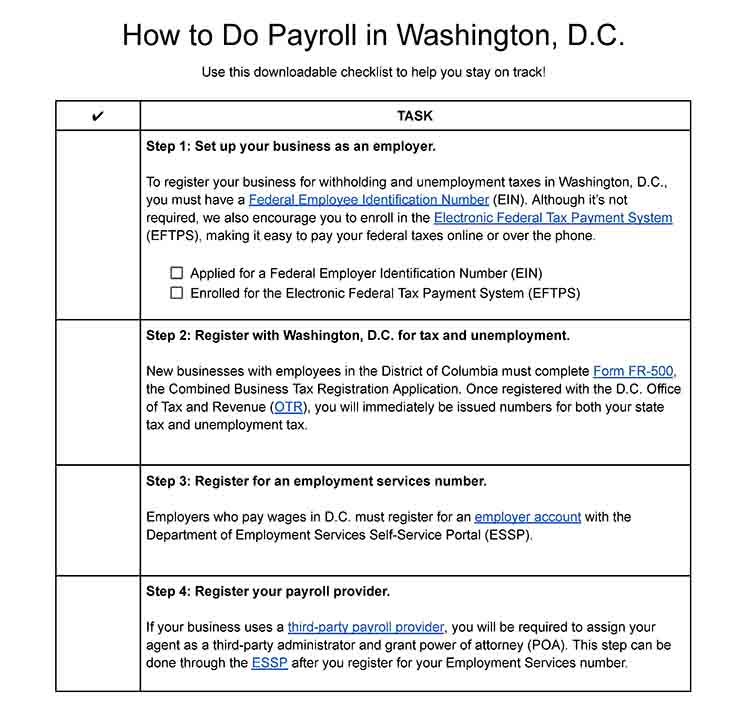

Step 1: Set up your business as an employer. Every employer, regardless of the state in which it resides, must register for an Employer Identification Number (EIN). Also known as a Federal Tax ID number, it is used to identify you as a business. Also, create an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with Washington, D.C., for tax and unemployment. New businesses with employees in the District of Columbia must complete Form FR-500, the Combined Business Tax Registration Application. Once registered with the D.C. Office of Tax and Revenue (OTR), you will immediately be issued numbers for both your state tax and unemployment tax.

Step 3: Register for an Employment Services number. Employers who pay wages in D.C. must register for an employer account with the Department of Employment Services Self-Service Portal (ESSP). After the registration is complete, you will receive an EIN and can begin to file wage reports and maintain your account online.

Step 4: Register your payroll provider. If your business uses a third-party payroll provider, such as Rippling, you will be required to assign your agent as a third-party administrator and grant power of attorney (POA). This step can be done through the ESSP after you register for your Employment Services number (details in Step 3).

To know more about Rippling’s HR and payroll solutions, read our Rippling review.

Step 5: Collect employee payroll forms. Before calculating payroll, you must collect the following forms from your employees, generally during onboarding:

- W-4 tax form

- D-4 tax form

- I-9 paperwork

- Direct deposit bank information

Step 6: Collect, review, and approve time sheets. Whether you pay W-2 employees or 1099 contractors, you must collect and approve their hours worked to submit payroll. Using time and attendance software or our free time card calculator can make this process easier by saving you time and ensuring accuracy—but you can also create your own time sheets using one of our free time sheet templates.

Step 7: Process payroll and send payment to your employees. In D.C., you must pay your employees at least twice a month on a regular schedule. You can calculate payroll on your own, even using Excel, or have a payroll processing service calculate and submit the payroll for you. After processing your payroll, you must remit payment to your employees (cash, check, or direct deposit).

Step 8: File Federal and D.C. payroll taxes. Your federal tax filing will depend on if your business is a sole proprietorship or LLC (Schedule C) or corporation (Form 1120 or 1120-S). Additionally, employers must file an Employer Withholding Tax Return, either FR-900A (annual filing) or FR-900Q (monthly and quarterly filing) with the District of Columbia.

Step 9: Document and store your payroll records. The District of Columbia requires that employers store payroll records for up to three years. When documenting employee payroll you should include the following: employee name, address, Social Security number, rate of pay, exempt status, and the amount paid per pay period.

Step 10: Do year-end payroll tax reports. The final step in payroll processing is to process your annual federal payroll reports. You will need to provide W-2s for all regular employees and 1099s for all independent contract employees. These forms must be sent to all employees by Jan. 31 of the following tax year.

You can also use our free D.C. payroll checklist to make sure you don’t miss any steps.

New to payroll? Read our general articles on how to do payroll and how to ensure your payroll is compliant with regulations.

D.C. Payroll Laws, Taxes, & Regulations

Washington, D.C., employers are responsible for paying payroll taxes, as well as Social Security and Medicare taxes, paid under the Federal Insurance Contributions Act (FICA). The employer pays half of FICA (6.2% for Social Security and 1.45% for Medicare) and the other half is paid from the employee’s wages.

There are also some state-specific payroll regulations to take note of, such as its progressive tax rates depending on salary—which is why it has the highest tax rate in the country.

A few other things to consider include:

- Employers must withhold income taxes from any D.C. resident who works within the District of Columbia.

- D.C. has reciprocal agreements with Virginia and Maryland (these residents who work in D.C. have taxes withheld for their home states only).

- Employers are required to contribute 100% to the Paid Family Leave tax.

Additionally, employers are required to file an Employer’s Quarterly Contribution and Wage Report (Form UC-30) each quarter.

D.C. Income Taxes

D.C. has a progressive income tax with seven brackets ranging from 4% to 10.75%, depending on the annual amount of income.

Income | Tax Rate |

|---|---|

Up to $10,000 | 4% of the taxable income |

Over $10,000 and up to $40,000 | $400, plus 6% of the excess over $10,000 |

Over $40,000 and up to $60,000 | $2,200, plus 6.5% of the excess over $40,000 |

Over $60,000 and up to $250,000 | $3,500, plus 8.5% of the excess over $60,000 |

Over $250,000 and up to $500,000 | $19,650, plus 9.25% of the excess above $250,000 |

Over $500,000 and up to $1 million | $42,775, plus 9.75% of the excess above $500,000 |

Over $1 million | $91,525, plus 10.75% of the excess above $1 million |

Paid Family Leave Taxes

Private employers in D.C. are required to pay a 0.26% Paid Family Leave tax to fund the paid leave benefit. This tax is 100% employer-funded and cannot be deducted from an employee’s paycheck.

The Paid Family Leave Act allows for:

- Two weeks to care for a pregnancy

- 12 weeks to bond with a new child

- 12 weeks to care for a family member with a serious health condition

- 12 weeks to care for the employee’s own serious health condition

Unemployment Insurance (UI) Taxes

Along with federal unemployment insurance taxes (FUTA), employers in D.C. are required to file D.C. unemployment insurance taxes. Unlike federal rules and those in other states, there is no minimum wage amount before UI taxes must be paid. This means that even if you have only one employee, no matter how much you pay them, you are liable for UI taxes.

New employers in the District of Columbia are assigned a standard tax rate of 2.7%. This tax, paid on the first $9,000 of wages paid to each employee, funds the unemployment benefits used to pay workers who are no longer employed. Positive-rated employers will have tax rates ranging from 1.0% to 4.4%, whereas negative-rated employers will range from 6.2% to 7.4%. The experience rating is determined by:

- Whether a claim has been filed against an employer

- The amount of taxes paid

- The average amount of an employer’s taxable payroll (determined in three-year increments)

Did You Know? If you pay your state unemployment insurance taxes fully and on time, you will receive a 90% offset credit against your FUTA taxes.

Workers’ Compensation Insurance

Any business operating in Washington, D.C., with one or more employees is required to carry workers’ compensation insurance to cover injuries or illnesses that are a direct result of an employee’s job. This coverage also applies to part-time staff, minors, and domestic workers who work a minimum of 240 hours in a quarter.

Workers’ compensation is overseen by the Department of Employment Services, which issues certificates of compliance and enforces penalties on any company found to be noncompliant.

Sole proprietors and partners are exempt from D.C.’s workers’ compensation insurance requirements; however, they can purchase self-employed workers’ comp.

Minimum Wage Laws in D.C.

The minimum wage in the District of Columbia (as of July 1, 2023) is set at $17.00 per hour. The base minimum wage for tipped workers (such as restaurant employees) is $8.00 per hour, although if an employee’s tip earnings plus their base minimum wage do not equal the full minimum wage of $17.00 per hour (based on a full workweek), the employer must pay the difference. Salaried employees are entitled to receive pay equal to or higher than the minimum hourly wage requirement (minimum of $35,360 per year).

The following jobs and groups are exempt from minimum wage requirements:

- White Collar—includes executive, administrative, and professional workers

- Outside Sales—any sales employee who works away from the office

- Child Care—applies only to those who babysit on an intermittent basis

- Minors—those under 18 years of age may be paid the federal minimum wage

For a detailed list of those exempt from minimum wage regulations under D.C. Code § 32-1003 visit the Office of the Attorney General for D.C.

Overtime Regulations

Employers are required to pay overtime at the rate of time and a half after 40 hours of work in a seven-day workweek.

The following workers are exempt from overtime regulations:

- Salaried Exempt Employees—includes executive, administrative, or professional

- Airline Employees—those who trade work days with other employees for the sole purpose of using the travel benefits provided

- Automobile Dealership Employees—any employee engaged in the selling of automobiles

- Parking Lot Attendants—any employee who works in a parking lot or garage

- Live-In Domestic Workers—any worker employed in a private household who lives on the premises

Different Ways to Pay Employees in D.C.

Employees in D.C. can be paid by the following payment methods:

Note: Employees may be paid by pay card so long as they have full access to their wages at a bank close to work without incurring a fee.

Pay Stub Laws

Under D.C. law, employers must provide a written statement (pay stub) to employees on or before each payday. The pay stub should include, at minimum, the following information:

- Net wages paid and hours worked

- Gross wages paid

- List of wage deductions

Check out our free pay stub template for assistance in creating your own pay stubs.

Minimum Pay Frequency

Employers are required to pay their employees at least two times per month (biweekly or semimonthly) on designated paydays. Payment can be made more frequently (daily, weekly) at the discretion of the employer. Additionally, payment must be made within 10 days of the end of the pay period, except where a written agreement between the employer and a labor organization is in place.

To help you keep track of your pay periods and dates, download one of our free pay period calendars.

Paycheck Deduction Rules

An employer is required to include itemized deductions taken from the worker’s wages on every written pay statement (pay stub). Some deductions are required by law (garnishments, child support). No employer, however, may charge or deduct from an employee’s wages for the following:

- Breakages

- Walkouts

- Mistakes on customer checks

- Fines

- Assessments

- Charges, if the payment reduces the employee’s wage below the minimum wage requirement

Uniforms

Employers in D.C. are responsible for the cost of purchase, maintenance, and cleaning of uniforms required by the employer or by law, or they must pay the employee 15 cents per hour in addition to the minimum wage for the care of washable uniforms.

Final Paycheck Laws in D.C.

In Washington, D.C., if an employee is terminated, they must be paid by the next working day. If an employee quits, the employer must pay them by the next regular payday or within seven days of the resignation date, whichever is earlier. Because D.C. is an employment-at-will state, neither party is required to give notice of termination.

If you need to pay an employee quickly and are not using a payroll service, use our guide to printing payroll checks free.

D.C. Severance Pay Laws

Washington, D.C., law does not require severance pay. However, if your company handbook or employment contract allows for severance pay, it must be paid out according to your company policy.

D.C. HR Laws That Affect Payroll

Most Washington, D.C., human resources laws follow federal guidelines. However, you should pay special attention to child labor laws, as they may differ from federal rules. Additionally, as part of the Tipped Wage Workers Fairness Amendment Act, businesses with tipped employees are required to work with a third party to process payroll.

New Hire Reporting

D.C. law requires that all employers report new hires, rehires, and temporary employees to a state directory within 20 days of hire. One exception to this is any Federal or District employee who performs intelligence or counterintelligence functions.

New hires can be reported online with the Office of the Attorney General of D.C.

Lunch & Other Break Time Requirements

The District of Columbia does not have any meal or break time requirements in place. This means that an employer does not have to provide breaks to any employees.

Accrued Paid Time Off (PTO)

Employers are not required to provide paid (or unpaid) time off in the form of vacation or personal leave to employees. If a company chooses to provide PTO, it must abide by the regulations outlined in its paid time off policy, including how PTO is accrued and if it falls under a use-it-or-lose-it schedule. Unless otherwise stated in a company policy, an employer in D.C. is also not required to pay out accrued PTO or sick leave at the end of employment.

Paid Sick Leave

The Accrued Sick and Safe Leave Act requires all employers in the District of Columbia to provide paid sick leave to employees for their own or their immediate family members’ illnesses. The paid leave provided is based on the size of the employer’s business and is accrued as follows:

# of Employees | Minimum Accrual | Maximum # of Days |

|---|---|---|

1-24 Employees | 1 hour for every 87 hours worked | 3 days per year |

25-99 Employees | 1 hour for every 43 hours worked | 5 days per year |

100+ Employees | 1 hour for every 37 hours worked | 7 days per year |

Tipped Employees | 1 hour for every 43 hours worked | 5 days per year |

Transportation Benefits

Employers with 20 or more employees in D.C. must comply with the Parking Cashout Law. To comply, employers must:

- Offer employees a clean air transportation benefit, which could include free transportation to work, mass transit passes, or other reimbursements

- Pay to D.C. a $100 per employee fee to cover free or subsidized parking

- Develop a transportation demand management plan, outlining the company’s reduction of employee personal vehicle usage

Child Labor Laws

When employing minors under the age of 18 in Washington, D.C., several rules must be followed:

Age | Restrictions |

|---|---|

Under 16 years of age |

|

Age 16-17 |

|

Additional laws include:

- Minors 14 and 15 years of age may not be employed in the following:

- The operation of any power machinery or the oiling, wiping, or cleaning of machinery

- Any construction site work, including office work performed on the actual construction site

- Minors under the age of 18 may not be employed in the following:

- Working in any quarry, tunnel, or excavation

- Operating any freight or nonautomatic elevator

- In any establishment that serves alcoholic beverages

Work Permit for Minors

When hiring minors, a D.C. Public Schools Office of Youth Engagement Official Work Permit and Child Labor Application must be obtained by the minor. Typically these are available at any public high school within the District. The minor will fill out the form, and once you’re ready to hire, simply fill out Section C of the application and provide a letter of intent to employ. The minor will then return the application to the school for authorization. The permit will be mailed to your office.

Payroll Forms

Payroll forms in the District of Columbia, beyond the federally required forms, consist of the D-4 form and Form UC30 for unemployment taxes.

District of Columbia W-4 Form

Employers in D.C. should collect W-4 forms from their employees. These are federally required forms used to determine the number of withholding allowances. Additionally, employers should collect a D-4 form from each employee.

If an employee does not provide you with a D-4 form, then you are required to set the withholding allowances at zero for this employee.

D.C. Unemployment Tax Forms

Employers are required to file an Employer’s Quarterly Contribution Wage Report each quarter. Those with household help have the option to file annually.

- Form UC30 Employer’s Quarterly Contribution Wage Report

- Form UC30-H, Employers Annual Contribution Wage Report

Reports are due on the last day of the month following the end of each quarter (April 30, July 31, Oct. 31, and Jan. 31). Annual reports are due on or before April 15.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculate unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing non-employee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms.

State Payroll Tax Resources

- Office of Tax and Revenue

- Department of Employment Services

- MyTax DC

- Department of Employment Services (Workers’ Compensation)

Bottom Line

Learning how to do payroll in Washington, D.C., is fairly simple, however, there are rules that must be followed to stay in compliance such as contributing to the Paid Family Leave tax, and certain labor laws that should be taken into consideration. Remember to register your business, establish your payroll accounts, and pay your employees promptly.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.