Learning how to do payroll in Kentucky and handling the state’s taxes is pretty straightforward. Unlike in some other states, Kentucky does not have any local taxes and has only one state payroll tax form, making this one of the easiest states in which to run your company’s payroll.

Key Takeaways:

- Kentucky Payroll Tax Form: Kentucky’s Withholding Certificate (Form K-4)

- Mirrors the federal minimum wage of $7.25 per hour

- Has a flat income tax rate of 5%

- Has income tax reciprocity with seven neighboring states: Illinois, Indiana, Michigan, Ohio, Virginia, West Virginia, and Wisconsin

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Step-by-Step Guide to Running Kentucky Payroll

The state makes payroll easy for businesses by generally following federal guidelines. However, attempting to calculate Kentucky payroll and withholding taxes by hand could result in costly mistakes. Here are the basic steps you should follow to run payroll in Kentucky.

Step 1: Set up your business as an employer. New companies may need to create a new Federal Employer Identification Number (FEIN) by accessing the federal Electronic Federal Tax Payment System (EFTPS). Your FEIN is required to pay federal taxes.

Step 2: Register your business with the State of Kentucky. For new businesses, you need to register on the Kentucky Secretary of State’s website. Any company paying employees in Kentucky also needs to register with the Kentucky Department of Revenue.

Step 3: Create your payroll process. This includes deciding how often you’ll be paying employees and when, along with what method you plan to use to issue their paychecks (paper checks vs direct deposit), how to conduct onboarding, and how to update employee information. You can opt to process payroll by hand (not recommended), set up an Excel payroll template, or sign up for a payroll service to help you handle your Kentucky payroll.

Step 4: Collect employee payroll forms. Each company that hires employees in Kentucky must collect certain forms during the onboarding process. Employees must complete I-9 verification no later than their third day on the job. New employees must also have a completed W-4 form on file—and, specifically, the state version of the W-4—Kentucky’s Withholding Certificate or Form K-4.

Step 5: Collect, review, and approve time sheets. You will want to start processing your company’s payroll several days before your payroll is due. During this time, you need to collect and review documented work time from hourly and nonexempt employees so you can check for any mistakes. There are many ways to track employee time—some of which are free.

Step 6: Calculate payroll (including taxes) and pay employees. Kentucky has a flat income tax of 5% statewide. The flat tax helps employees anticipate their payroll and can make your calculations a bit simpler—although calculating payroll by hand is generally not recommended. Learn more about how to calculate payroll if you need assistance.

Step 7: Pay employee wages, benefits, and taxes. Most companies today pay employees through direct deposit. Cash (not the best way) and paper check are also options. Kentucky’s state minimum wage mirrors the federal minimum wage, so make sure that you are paying your employees at least $7.25 per hour. You can pay your federal and Kentucky state taxes online. If you use a benefits provider, it should work with you to make deductions simple, automatic, and electronic.

Step 8: Save your payroll records. Keeping your company’s business records is good practice. Kentucky law also requires that employers keep the following records for at least one year:

- Employee’s name and employee number

- Social Security number

- Home address

- Date of birth

- Sex

- Job title

- Hours worked during each workday, workweek, and pay period

- Regular rate of pay and total earnings

- Total overtime pay

- All bonus payments and deductions from each pay period

- Total wages paid during each pay period and each pay date

Step 9: File payroll taxes with the federal and state government. All Kentucky state taxes need to be paid to the applicable state agency on the schedule provided, usually quarterly, which you can do online at the Kentucky Department of Revenue website. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month.

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must follow these schedules:

- For payments made Wednesday, Thursday, and Friday, deposit employment taxes by the following Wednesday

- For payments made Saturday, Sunday, Monday, and Tuesday, deposit employment taxes by the following Friday

Note that reporting schedules and depositing employment taxes are different. Regardless of the payment schedule you are on, you only report taxes quarterly on Form 941 or annually on Form 944.

Step 10: Process annual payroll reports. Every year, you must complete payroll reports, including all W-2 Forms and 1099 Forms. Be sure to provide these forms to employees and contractors no later than Jan. 31 of the following year.

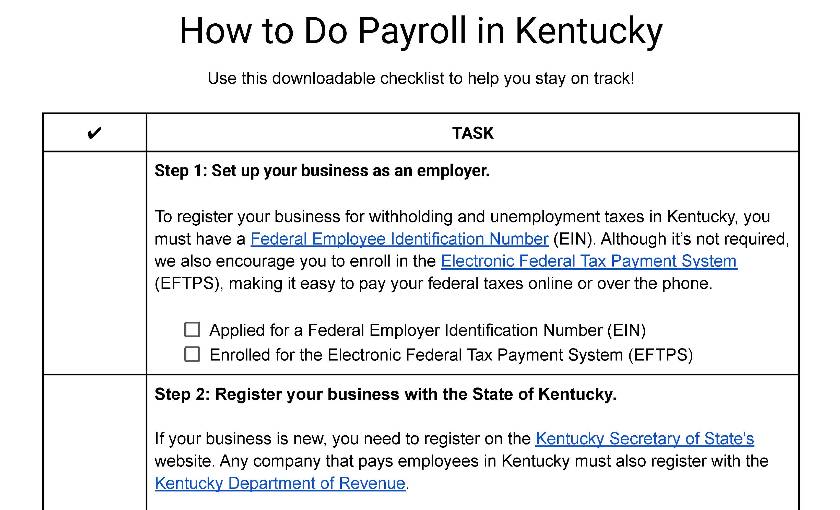

Download our free checklist to help you stay on track while you’re working through these steps:

Check out our guide on how to do payroll to learn more about doing payroll yourself.

Kentucky Payroll Laws, Taxes & Regulations

You need to begin, of course, by following federal law for income taxes, Social Security, Medicare, and Federal Unemployment Tax Act (FUTA) taxes. Most employers in the US must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Social Security is 6.2% and 1.45% for Medicare. Both the employer and the employee will pay these taxes, each paying 7.65% for the combined taxes.

Understanding how to calculate Kentucky payroll taxes and apply the related laws is vital to ensuring accurate payroll. To help you maintain compliance with payroll regulations, review the specific laws, taxes, and regulations involved in doing payroll in Kentucky below.

Kentucky Taxes

Like most states, Kentucky has certain taxes that companies must pay. Kentucky does not levy local taxes, however, so you only need to be concerned with state taxes.

Employer Unemployment Taxes

All businesses in Kentucky must pay State Unemployment Tax Act (SUTA) taxes. The current wage base is $11,100, and rates range from 0.3% to 9.0%. All new employers in Kentucky will pay a SUTA rate of 2.7% for their first year. Businesses that pay SUTA in full and on time can claim a tax credit of up to 5.4% on their FUTA taxes.

Workers’ Compensation

Kentucky businesses with one or more employees must carry workers’ compensation insurance. Workers’ compensation insurance provides benefits to employees who suffer on-the-job injuries.

The state usually starts to pay these benefits a week or two after an employee is out of work because of their injuries and only covers their lost income and medical bills. There are, however, exceptions to this requirement. If your company employs workers who fall into one of the following categories, you may not need to carry workers’ compensation insurance:

- Domestic workers

- Agricultural workers

- Employees of charitable and religious organizations

Income Taxes

Unlike some states, Kentucky has reciprocity laws with Illinois, Indiana, Michigan, Ohio, Virginia, West Virginia, and Wisconsin. These laws allow employees to be taxed in their state of residence and not in the state where they earn wages. This eliminates employees paying double taxes.

Let’s say you have a business in Covington, Kentucky, and you have an employee who lives across the river in Cincinnati, Ohio. Your Ohio employee earns wages in Kentucky, but because these two states have a reciprocity agreement in place, you only need to withhold Ohio taxes from their paycheck. Depending on how much the employee makes, they may pay between 0% and 3.99% in income tax in Ohio while working in Kentucky.

Kentucky Minimum Wage

Kentucky has a straightforward minimum wage that mirrors the federal minimum wage. At $7.25 per hour, the minimum wage was last raised in Kentucky in 2008. Businesses must pay tipped employees at least $2.13 per hour, provided that their tips get them to the hourly minimum wage. If not, the company must make up the difference.

Calculating Overtime

Kentucky overtime rules follow the Fair Labor Standards Act (FLSA) requirements. Under the FLSA, all employers must pay employees 1.5 times their regular hourly wage for hours worked over 40 in a workweek.

Paying Employees

Kentucky law requires that employers pay employees at least twice per month. Companies must also pay employees within 18 days of the end of the pay period in which the wages were earned.

The state of Kentucky specifies how employees must be paid. These include:

If you need help keeping track of your payroll periods, use one of our free pay period calendars.

Pay Stub Laws

Kentucky law requires companies with 10 or more employees to provide each employee with a pay stub. Each pay stub must include the total payment and any deductions for that pay period.

If you do not use a payroll service, download one of our free pay stub templates to help you get started.

Kentucky Paycheck Deductions

Kentucky law prohibits employers from deducting any of the following from an employee’s paycheck:

- Fines

- Cash shortages

- Damages, lost, or stolen company property

The law goes further to say that an employer cannot deduct wages from an employee unless:

- Authorized to do so by a government agency

- The employee has consented in writing

Please note that, according to the Department of Labor, a company cannot make deductions to an employee’s pay if those deductions would cause the employee to earn less than the federal minimum wage ($7.25 per hour) for that pay period.

Terminated Employee’s Final Paycheck

Whether an employee quits or is terminated from employment by some other means, Kentucky law requires that companies pay an employee’s final paycheck on the next regular payday after their final day of work or within 14 days of separation, whichever occurs last.

If you need to pay an employee right away and aren’t currently using a service, use one of our recommended ways to print a free payroll check.

Kentucky HR Laws That Affect Payroll

Kentucky does not have many state-specific HR laws. That doesn’t mean you can ignore the following sections, however, because you will still need to ensure that you follow the federal guidelines, which Kentucky law mostly follows.

Kentucky New Hire Reporting

Every employer in Kentucky must report new hires and any rehired employees to the Kentucky New Hire Reporting Center. Every employer must report new hires within 20 days of the hire date. This report is used to enforce child support orders and must include the employee’s name, address, and Social Security number.

Meals & Breaks

In Kentucky, every employer is required to provide employees with a rest period of at least 10 minutes for every four hours of work. According to the Kentucky Labor Cabinet, this rest period is a paid break.

Companies must also provide a reasonable amount of time for workers to take a meal break no sooner than the third hour of a work shift and no later than the fifth hour of a work shift. The meal break does not have to be paid so long as the employee is fully relieved of their work duties.

Kentucky Child Labor Laws

Kentucky law allows minors aged 14 and 15 to work up to 40 hours per week when school is not in session. When school is in session for the entire week, they can only work up to three hours per day and 18 hours per week.

Minors aged 16 and 17 can work up to six hours per school day and 30 hours per school week. To work more than 40 hours weekly when school is in session, their parents have to request that the school complete a Certificate of Satisfactory Academic Standing Form and fill out the Parent/Guardian Statement of Consent Form. When school is not in session, there are no working hour restrictions.

Check out our guide to hiring minors for more insight into federal child labor laws.

Time Off & Leave Requirements

Providing employees with time off and leave to care for themselves after an injury or a sick family member has different requirements in different states. There are federal guidelines you will need to follow. Kentucky generally follows these guidelines, making your job simpler than if your business was located in other states.

Kentucky Family Leave

Kentucky follows the Family and Medical Leave Act (FMLA), which requires that all eligible employers provide up to 12 weeks of unpaid leave for employees who fall under a covered disability. This can include pregnancy and caring for an ill family member.

The FMLA does not require that companies pay employees for this time out of work but does require that employers keep the employee’s job, or a substantially similar one, available for them when they return. Kentucky does not provide for any additional leave under state law.

Paid Time Off (PTO)

Kentucky has no laws requiring employers to provide employees with paid time off, including sick leave. Companies in Kentucky are free to create PTO policies and may include whether they pay out accrued and unused PTO when an employee leaves.

The state does not require that companies do, so it’s a good practice to have this clearly defined in your company policy. It’s important to follow the guidelines in your policy so you’re not held liable.

Holiday Leave

Kentucky does not have any laws requiring private companies to pay employees for holidays or an increased rate for working a holiday. A company may choose to do so and must comply with the FLSA.

Voting Leave

Kentucky law requires employers to provide employees with at least four hours of time off to vote or get a vote by mail ballot. An employee must request this time at least one day in advance, and the employer can specify when the employee should go vote.

Kentucky law doesn’t specify that employers must pay employees for time worked. As long as their job is protected for at least four hours and the employee actually casts a vote, they should be able to return to work as normal.

Jury Duty Leave

An employer in Kentucky is not required to pay an employee for time spent serving on a jury. However, under Kentucky law, an employer cannot terminate, penalize, threaten, or coerce an employee to ignore jury duty service.

Bereavement Leave

There is no requirement in Kentucky for businesses to provide employees with bereavement leave. Companies are free to create a policy if they choose and must abide by it.

Payroll Forms

Payroll forms can vary from state to state, and some have their own W-4, like Kentucky. Fortunately, that’s the only one.

Kentucky Payroll Forms

- Kentucky’s Withholding Certificate (K-4): Employee withholding form; should be completed upon hire

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need.

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees; summary form of W2

- Form 940: Used to calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for non-employee contract work

To learn more about federal forms, check out our guide on the federal payroll forms you may need.

Kentucky Payroll Tax Resources

- The Kentucky Department of Revenue provides many forms, information on the latest laws and regulations, and other employer-specific information.

- The Kentucky One Stop Business Portal provides excellent resources for existing and new businesses.

- The Kentucky Labor Cabinet offers support and resources to help businesses ensure compliance with unemployment and workers’ compensation plus other labor laws.

Bottom Line

One of the most straightforward states in which to run payroll, Kentucky has only one state-specific payroll form and no local taxes to calculate. Most of the payroll and HR laws governing employers in Kentucky align with federal regulations, so you don’t have to worry about complying with complex overlapping laws.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.