When processing Michigan payroll, there are a couple of items to be aware of—the required local and state taxes that need to be remitted and the application of the Michigan Paid Family Leave Law. Below are the basic steps to processing payroll (along with a handy checklist so you don’t miss anything), with an emphasis on Michigan regulations.

Key Takeaways:

- Michigan’s minimum wage is currently $10.33 per hour and increasing to $12.48 per hour on February 21, 2025.

- Dozens of cities in Michigan levy income taxes.

- Michigan has its own Family and Medical Leave Act that has requirements beyond federal law.

Running Payroll in Michigan—Step-by-Step Instructions

At the federal level, you will need your Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

- State Registration: Fill out Form 518 and submit it to the Michigan Department of Treasury by mail or online. If you need assistance, use the Michigan Business Tax Registration Guide, which also includes Form 518. Note that all employers must fill out the Liability Questionnaire (UIA Schedule A) and Successorship Questionnaire.

- Local Registration: Michigan is currently one of 17 states that requires you to pay local taxes. You should contact the local city office for business registration and income tax registration each time you need to register in one of the following municipalities: Albion, Battle Creek, Benton Harbor, Big Rapids, East Lansing, Flint, Grayling, Hamtramck, Hudson, Ionia, Jackson, Lansing, Lapeer, Muskegon, Muskegon Heights, Pontiac, Port Huron, Portland, Springfield, and Walker.

Detroit, Grand Rapids, Highland Park, and Saginaw also levy local taxes—at different rates for residents and non-residents.

- You will need to register if the following is true in these locations:

- You hire an employee or one of your employees moves

- You have a new physical office location

- You conduct business in a new city

You have three options:

- You can do payroll yourself. This is the most time-consuming of the three options, with the highest possibility of payroll errors—but it can help lower costs if done right.

- Set up an Excel payroll template. Using a template is still a manual process (albeit less so than by hand); however, it does provide you with more structure that will limit common payroll errors.

- Sign up for a payroll service. We highly recommend using a payroll service, as it’s the least time-consuming of all processes. It also gives you a support system to contact if you need specific assistance. Check our roundup of the best payroll services to find some options that fit your needs and budget.

The best time to collect payroll forms is during onboarding. These include the W-4 form, I-9 form, and direct deposit information—check our guide to learn what other payroll forms employers need. Michigan also requires you to submit MI-W4. This would be a perfect time to use your employee’s address to see which Michigan locality you are required to remit taxes to.

You’ll need to collect timesheets for all hourly employees and non-exempt salaried workers. You have three options for tracking time:

- Use a paper time sheet.

- Use free or low-cost software—check our best time and attendance software guide for options.

- If using a payroll service, ask your payroll service to add on their time and attendance system.

You’ll need to calculate gross pay, as well as FICA (Social Security and Medicare), federal unemployment taxes (FUTA), and income taxes to withhold. Perform any other payroll calculations, i.e., for expense reimbursement, and then pay your employees.

You are able to pay employees in several ways (i.e., cash, check, direct deposit).

Follow the IRS instructions for federal taxes, including unemployment taxes. You can order official tax forms from the IRS.

- Michigan State Taxes: You must report withholding tax to Michigan on an annual basis. You also must report withholding tax either monthly or quarterly. Use Form 5080 for your monthly or quarterly filing, and use Form 5081 for annual filing. Michigan has moved to online service only, so you must file these forms electronically.

- You must pay on the following schedule, according to your filing frequency requirement:

Filing Frequency | Due Date for Return and Payment |

|---|---|

Monthly | On or before the 20th day of the following month |

Quarterly | On or before the 20th day of the month following the quarter end |

Annual | Due Feb. 28 of the year following the tax year reported |

- Michigan Local Taxes: You need to keep track of the localities for which you have remitted employer and employee taxes. For each one, you will need to contact the local government business office to determine payment options.

It is vital to keep records for all employees for several years, including those who have been terminated. If you need help with which records to keep, please read our article on retaining payroll records. Michigan requires employers to keep payroll records for at least three years.

The federal forms that need to be completed include the W-2 form (for employees) and 1099 form (for contractors). These should be distributed to employees and contractors by Jan. 31 of the following year, and W-2 forms must be submitted to the Social Security Administration by the same date. State W-2s are required for Michigan, and these forms are due by the last day of February the following year.

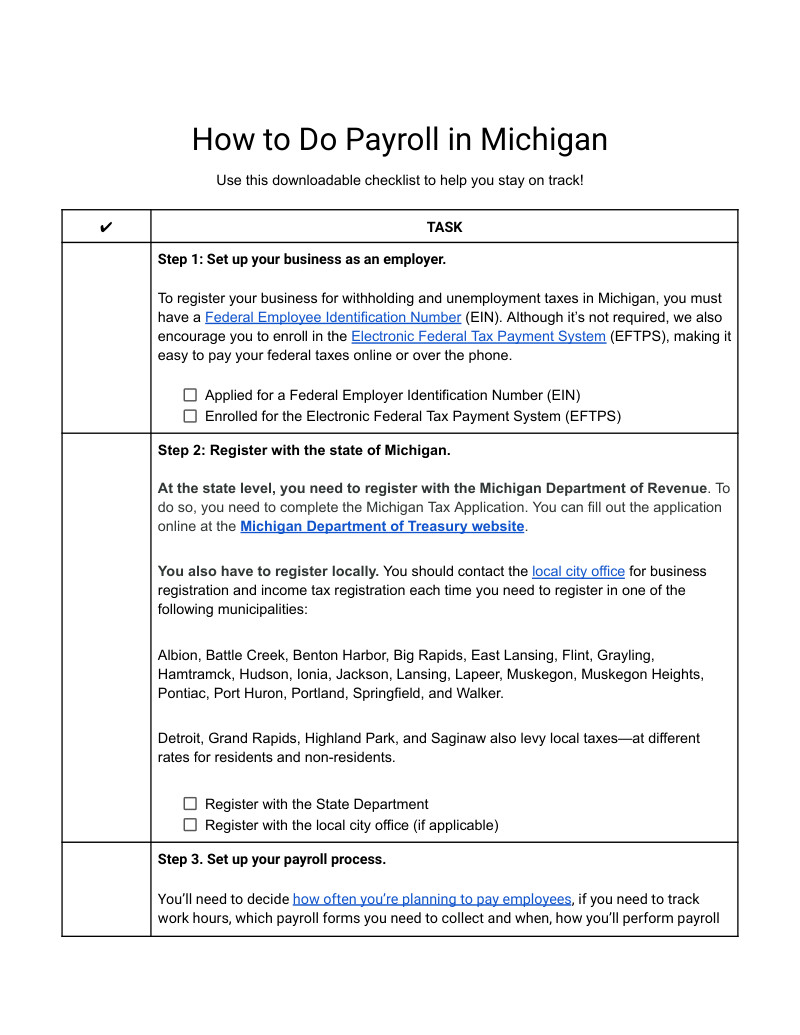

Here’s a free downloadable checklist that will help guide you through the process and make sure you don’t miss any steps:

Michigan Payroll Taxes, Laws & Regulations

This section will explain in detail what you need to know about Michigan taxes, laws, and regulations. There are a few items that differ from federal regulations.

Michigan does have both state and local income taxes. These tax amounts are flat rates compared to the federal income tax rate, which changes with increases in personal income. The state also has a separate minimum wage rate for minors, as well as additional requirements for overtime.

You are also required to remit taxes for FICA taxes (Social Security and Medicare). The total amount required to be withheld is 15.3%—half of the amount is paid by the employer, and the other half of the amount is taken out of the employee’s net pay. Both amounts need to be remitted to the IRS.

Michigan Taxes

There are several payroll taxes that employers are required to remit in addition to federal taxes. These include state income taxes, local income taxes, and state unemployment tax.

Income Taxes

Michigan is a flat-rate tax state. Michigan revises its tax rate regularly and sometimes it goes down. For all wages paid starting Jan.1, 2024, state taxes should be withheld at a rate of 4.25%.

There are also local income taxes to consider. Tax rates depend on the local jurisdiction on where the employee works. A list of localities and their corresponding tax rate is shown below. These rates can change, so for the most updated rate, please contact the local city government.

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 2.4%

Nonresident Rate: 1.2%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1.5%

Nonresident Rate: 0.75%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 2%

Nonresident Rate: 1%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1.5%

Nonresident Rate: 0.75%

Resident Rate: 1%

Nonresident Rate: 0.5%

Resident Rate: 1%

Nonresident Rate: 0.5%

Unemployment Tax

As an employer, you are required to pay unemployment taxes. These taxes are used to fund benefit programs for employees who are involuntarily terminated.

Michigan’s unemployment tax wage base is $9,500 for 2024. Rates range from 0.06% to 10.3%. New non-construction employers pay a rate of 2.7%. New employers in construction pay the average construction employer rate for the first two years, which typically ranges from 5.3% to 8.1%.

Workers’ Compensation

In almost all cases, even for public employers, you are required by law to carry workers’ compensation insurance for your employees.

Meanwhile, private employers are required to carry workers’ compensation if both of the following occur:

- You have at least one employee who works over 35 hours a week for 13 weeks or longer in a yearlong period. This includes homeowners who hire domestic workers.

- You have at least three employees at one time—including part timers.

The one exception is the agricultural industry. Businesses in this industry are required to carry workers’ compensation insurance if they have three employees who work over 35 hours a week for 13 weeks or longer in a yearlong period.

The cost of workers’ compensation insurance is around 70 cents for each $100 payroll you processed. For example, a company that processes $500,000 of payroll can expect to pay around $3,500 in insurance.

Minimum Wage & Tips

Most jobs will require you to pay at least minimum wage for your employees. If you have any questions on the federal guidelines on exemptions, read our guide to federal exemptions for minimum wage.

Michigan’s current minimum wage is $10.33 per hour increasing to $12.48 per hour on February 21, 2025. For tipped employees, the current minimum wage is $3.93 per hour, which is set to increase to $5.99 per hour on February 21, 2025. The state allows employers to pay 16- and 17-year-olds at a rate of 85% of the regular minimum wage rate, as long as you do not replace an adult employee to hire a minor.

In the News: Michigan’s previously blocked proposal to increase the minimum wage and eliminate tip credits has now moved forward on the following schedule:

Date | Minimum Wage | Minimum Cash Wage | Tip Credit |

|---|---|---|---|

February 21, 2025 | $12.48 | $5.99 (48%) | $6.49 |

February 21, 2026 | $13.29 | $7.97 (60%) | $5.32 |

February 21, 2027 | $14.16 | $9.91 (70%) | $4.25 |

February 21, 2028 | $14.97 | $11.97 (80%) | $2.99 |

February 21, 2029 | TBD | 90% of Minimum Wage | TBD |

February 21, 2030 | TBD | 100% of Minimum Wage | Prohibited |

Overtime

Michigan follows federal guidelines on paying employees overtime—any hours worked over 40 in a workweek should be paid at 1.5 times the employee’s regular hourly rate. However, Michigan has additional guidelines on which employers are required to pay overtime. The federal government requires employers to pay overtime (if applicable) if they have a gross income of over $500,000. Michigan also requires any employer that has two or more employees to pay overtime regardless of gross income.

Pay Stub Laws

In Michigan, you must provide each employee a wage statement that shows the amount of wages paid, the period that is being paid, and a detailed list of what deductions were taken out. You may do this electronically or on paper. If you provide an electronic version, you must give employees access to print their pay stub, if they so desire. Consider using a free pay stub template to ensure you maintain compliance.

Minimum Pay Frequency

Michigan allows you to pay employees either weekly, biweekly, semimonthly, or monthly. You can decide what works best for your company—consider industry standards—but regulations require you to be consistent with the frequency.

It is a good policy to tell your employees with plenty of time in advance if you are deciding to change your pay frequency policy. To keep track of payroll dates and determine the effects of changing pay frequency, consider using a designated payroll calendar. We have some free pay calendars that include the pay schedules listed above. The most common schedules are biweekly and semimonthly.

Paycheck Deduction Rules

The most common paycheck deductions in Michigan are payroll taxes, garnishments, and the employee’s portion of benefits payments (i.e., medical insurance).

You are also allowed to deduct overpayments from an employee’s check without written permission from the employee if the following is true:

- The deduction is made within six months of the overpayment.

- The overpayment was caused by human error or miscalculation.

- The employee is given a written explanation of the deduction at least a pay period in advance.

- The deduction is less than 15% of the employee’s gross wages.

- The overpayment does not reduce the employee’s hourly rate below the minimum wage.

Final Paycheck Laws

Michigan requires you to pay final wages for terminated employees by your next scheduled payday. You are not required to offer vacation days for employees or pay employees’ unused vacation days in Michigan. However, you are required to follow your company’s policy on vacation payouts.

Michigan HR Laws That Affect Payroll

Almost all of Michigan’s HR laws are in line with federal labor laws. Two items to note because of the differences with federal law are Michigan’s Paid Family Leave law and Michigan’s Child Labor Laws.

Michigan New Hire Reporting

You must report new hires in Michigan within 20 days of the employee’s hire date. You can report by mail, fax, or electronically via the Michigan’s Child Support Website.

Breaks, Lunches & Time-off Requirements

Michigan’s rules for paid time off (PTO) are somewhat more stringent than federal law as it relates to sick leave.

Minors (under 18) must have a 30-minute break for every five continuous hours worked. Michigan does not require employers to provide breaks to workers 18 and over. If you do provide a break, the employee must be relieved from all work obligations during that time for the break to be unpaid.

Michigan requires employers to provide employees with at least one hour of paid time off for every 35 hours worked. If your PTO policy meets or exceeds this requirement, there’s nothing else you need to do. You must also allow employees to carry over up to 40 hours of earned and unused PTO from year to year.

In 2019, Michigan was one of the first states to enact paid medical leave. Under this law, employers must provide employees with at least one hour of paid medical leave per 35 hours worked and provide at least 40 hours annually.

Starting on February 21, 2025, that law is being replaced by the Michigan Earned Sick Time Act. This new law will expand coverage to all Michigan employers and provide one hour of sick time for every 30 hours worked. Employers with fewer than 10 employees can cap this accrual at 40 hours of paid sick time per year while employers with 10 or more employees can cap the accrual at 72 hours.

One way to stay compliant with the law is to give each eligible employee 40 hours of leave—72 hours if you have 10 or more employees—(vacation, sick, PTO, or discretionary time off) at the beginning of each year.

Note that you’ll also need to comply with the Family and Medical Leave Act (FMLA). FMLA is a federal law that applies to businesses that employ 50 or more employees and allows eligible employees up to 12 weeks of time off under certain circumstances. To learn more about FMLA requirements, see the Department of Labor’s guide to FMLA.

State Disability Insurance

Michigan does not require employers to purchase disability insurance, but it does have a state disability program. It is good practice to provide employees with any resources that are available and beneficial to them.

Child Labor Laws

There are federal child labor laws governing when minors can and cannot work (i.e., 14- and 15-year-olds can’t work during school hours, or before 7 a.m. or after 7 p.m., except during the summer) and state regulations. Michigan’s rules tend to be less restrictive, so it’s best to adhere to federal regulations.

Federal law doesn’t allow minors to work more than three hours on a school day, including Fridays, more than eight hours on a non-school day, more than 18 hours weekly during a school week, or more than 40 hours during a non-school week.

Michigan also doesn’t allow minors to be employed during the time when they have school—this can vary based on the individual student’s schedule. Minors also can’t work more than six days in a week, over 10 hours in a day, or have 48 hours in a week committed to school instruction and work. Some exceptions are made for minors who perform farm work.

When Minors Are Not Allowed to Work in Michigan*

Age | Regular School Days | Fridays, Saturdays, and School Breaks |

|---|---|---|

Under 16 | Not before 7 a.m. or after 9 p.m. | Not before 7 a.m. or after 9 p.m. |

16- and 17-year-olds | Not before 6 a.m. or after 10:30 p.m. | Not before 6 a.m. or after 11:30 p.m. |

*Note the differences in time that minors aren’t allowed to work per Michigan law vs federal. | ||

Payroll Forms

Listed below are some federal and state forms needed to produce accurate pay for employees and compliant payroll reporting and tax remittance for businesses.

Michigan Payroll Forms

- Michigan W-4 Form: This assists employers in calculating tax withholding for employees.

- UIA 1028, Michigan Quarterly Tax Report: This is used for filing unemployment taxes.

- Form 5080: This is used for monthly or quarterly filing for sales/use and withholding tax

- Form 5081: This is used for annual filing for sales/use and withholding tax.

Federal Payroll Forms

- W-4 Form: Helps employers calculate tax withholding for employees

- W-2 Form: Reports total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Calculates and reports unemployment taxes due to the IRS

- Form 941: Files quarterly income and FICA taxes that you withhold from paychecks

- Form 944: Reports annual income and FICA taxes that you withhold from paychecks

- 1099 Forms: Provides contractors with pay information that helps them calculate the taxes they owe the IRS

Michigan Payroll Tax Resources and Sources

- State of Michigan Business Website: Access and submit forms, view the latest laws and regulations, and get information on various taxes and employer and employee issues.

- Michigan Department of Treasury: Information on payroll tax rates, tax returns, etc.

Michigan Payroll Frequently Asked Questions (FAQs)

You must first register your business with Michigan, then create a Michigan Treasury account for income tax withholding. You’ll also need to create an account for Michigan unemployment insurance remittance.

Employers in Michigan are responsible for paying unemployment taxes and remitting employee income taxes at the federal, state, and local levels. Remember that Michigan levies local income taxes so you’ll need to ensure you’re withholding the right amounts for your employees, depending on where they live.

Michigan has a flat tax. It’s currently 4.25% but it does change, both up and down, from time to time. Employers are responsible for withholding this amount from employees’ paychecks and remitting it to the correct state agency.

Bottom Line

Michigan payroll differs from other states because of its local and state income taxes requirements as well as the Family and Medical Leave Act. Be sure to adhere to deadlines and requirements of federal, state, and local governments.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.