Learning how to do payroll in Minnesota can be a bit challenging. Minnesota payroll tax withholdings are complex, with special taxes for entertainers, a different rate for supplemental pay, and more. It also varies rates according to the portion of salary for which you’re calculating taxes, with part of a salary (the first $30,000+ for some filers, for example) under one rate and the remainder under different rates. It has state unemployment insurance and workers’ compensation requirements as well.

Key Takeaways:

- Minnesota has income tax reciprocity with Michigan and North Dakota so your employees won’t be double-taxed

- The current Minnesota minimum wage is $10.85 per hour, set to increase to $11.13 per hour on Jan. 1, 2025

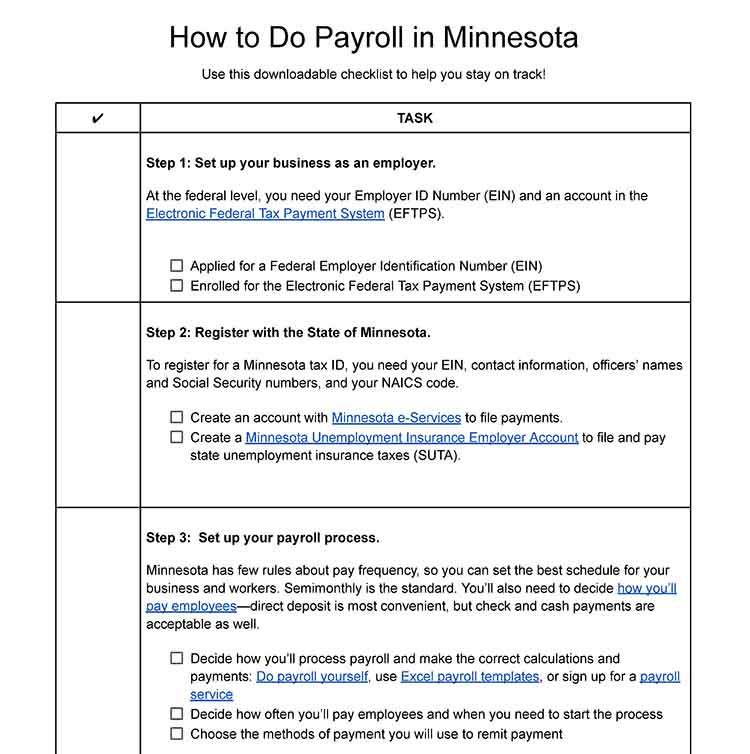

Step-by-Step Guide to Running Payroll in Minnesota

At the federal level, you need your Employer ID number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

To register for a Minnesota tax ID, you need your EIN, contact information, officers’ names and Social Security numbers, and your NAICS code. Then, create an account with Minnesota e-Services to file payments. You need a Minnesota Unemployment Insurance Employer Account to file and pay state unemployment insurance taxes (SUTA).

You’ll need to decide on a payday schedule that ensures employees are paid at least monthly—although semi-monthly is the standard. You’ll also need to determine how you’ll pay employees, the process you’ll follow to collect and submit payroll forms, and when you’ll start processing payroll before payday.

These forms are best filled out during employee onboarding. These include the W-4 form, I-9 form, and direct deposit authorization forms. For Minnesota, employees need to fill out a Form W-4MN. North Dakota and Michigan residents need to file a Form MWR if they’d like to be exempted.

It’s important to track employee hours if you have hourly or nonexempt employees. Be sure overtime is accurately recorded, as this is taxed at a different rate.

When it comes to calculating payroll, you can use software (check our best payroll software guide for some options), do it manually with a calculator, or even download a preset Excel template. When you finish determining gross and net pay, deductions, taxes, etc., you’ll be ready to pay employees; direct deposit and paper check are the most common methods.

Follow the IRS instructions for federal taxes, including unemployment.

Most often, you will need to file and pay Minnesota taxes and unemployment insurance electronically.

- Minnesota Income Taxes: If you paid less than $500 in withholdings in the previous year, you can submit your returns as an annual filer by Jan. 31 of the following year, or by the last day of the month in which you exceed $500. Otherwise, follow the quarterly schedule, just as you do for SUTA. Your payments, however, are due more frequently, depending on how much you owe.

You must pay | If you withheld | Must be Paid By |

|---|---|---|

Semiweekly | >$1,500 in the previous quarter and the IRS requires you to deposit semiweekly | Wednesday after payday (if your payday is Wed., Thur., or Fri.) or Friday after payday (if your payday is Sat., Sun., Mon., or Tue.) |

Monthly | >$1,500 in the previous quarter and the IRS requires you to deposit monthly | 15th of the following month |

Annually | Less than $500 before Dec. 1 (or whenever withholdings exceed $500) | Jan. 31 |

Exception/Quarterly | $1,500 or less in the previous quarter and you filed that quarter's return on time | April 30, July 31, Oct. 31, and Jan. 31 |

If you are a seasonal employer, check the Minnesota Dept. of Revenue for your options.

- SUTA: These payments are due quarterly. File them through the Employer Self-Service System. Log on to the Minnesota UI website to get instructions on file formats.

For Wages Paid During | Calendar Quarter Ends | Must be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

If the due date for a report or tax payment falls Saturday, Sunday, or a legal holiday, reports and payments are considered on time if they are received on or before the following business day.

Minnesota requires you to keep records on employees for at least three years. Information should include contact information for you and your employee, pay stub information, a record of free meals, and proof of age of minors. Federal law requires you to keep payroll tax records for at least four years.

Send the federal Forms W-2 (for employees) and 1099 (for contractors) to your workers by Jan. 31 after the year for which you’re reporting. You’ll also have to send copies and summary pages of each to the IRS.

You can download our free checklist on how to do payroll in Minnesota to help you stay on track while you’re working through these steps.

Minnesota Payroll Taxes, Laws & Regulations

No matter what state you are in, most businesses must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Social Security is 6.2% and 1.45% for Medicare. Both you and the employee will pay these taxes, each paying 7.65% for the combined taxes. Federal unemployment taxes are 6% of each employee’s check, up to the first $7,000—employees don’t pay this, you do.

Minnesota Taxes

Part of learning how to do payroll in Minnesota is understanding taxes. Minnesota’s state income taxes are a little more complex, as the rate changes for portions of an employee’s income. However, it supplies withholding forms, formulas, and an online calculator to help you determine how much to pay.

State Income Taxes

If you withhold federal taxes, you must withhold state taxes. Minnesota requires you to withhold for family members, students, and agricultural workers as well if they are employees. If you give wages in the form of goods or services, then that counts as income for withholding. Corporate officers are also subject to withholdings.

There are exceptions for interstate carrier companies and interstate air companies. Nonresident entertainers are subject to a special tax that requires withholdings. There are also special considerations for royalties from mining companies, pensions, surety deposits, and construction contractors. Get the details in the Minnesota Income Tax Withholding and Tax Tables booklet.

Minnesota’s state income taxes run from 5.35% to 9.85%, depending on filing status and wages. You may end up applying different rates to the same employee. For example, an employee earning $50,000 a year is taxed 5.35% on the first $43,950 (for married filing jointly), and 6.8% on the rest.

Tax rate | 5.35% | 6.8% | 7.85% | 9.85% + |

|---|---|---|---|---|

Married Joint | Up to $46,330 | $46,331-$184,040 | $184,041-$321,450 | Over $321,450 |

Married Separate | Up to $23,165 | $23,166-$92,020 | $92,021-$160,725 | Over $160,725 |

Single | Up to $31,690 | $31,691-$104,090 | $104,091-$193,240 | Over $193,240 |

Head of Household | Up to $39,010 | $39,011-$156,760 | $156,761-$256,880 | Over $256,880 |

You’ll calculate withholdings based on status and allowances as noted in the Form W-4MN. Do not use the Federal W-4 form. If an employee does not complete the state W-4MN, withhold taxes at single filing status with zero allowances.

Minnesota also requires that you apply a 6.25% withholding rate to supplemental payments like overtime, commissions, or bonuses.

You need to pay electronically if:

- You withheld $10,000 or more in Minnesota income tax during the last 12-month period ending June 30

- You are required to electronically pay any other Minnesota business tax to the Minnesota Department of Revenue

- You use a payroll service company

If you’re required to pay business taxes electronically for one year, you must continue to do so for all future years.

Reciprocity Agreements

Minnesota has reciprocity agreements with Michigan and North Dakota. If you have employees that are residents of these states, they need to fill out a Form MWR, Reciprocity Exemption/Affidavit of Residency. Then, you do not need to withhold taxes for Minnesota but rather their home state.

Seasonal Businesses

If you consistently withhold taxes in the same three quarters but not in all four in a calendar year, you may qualify for a seasonal deposit and filing option. This will allow you to only pay during the quarters in which you pay wages. You need to apply to the state to qualify. Learn more on the Minnesota Department of Revenue website.

Unemployment Insurance

Minnesota charges SUTA taxes. Any employer with one or more employees doing paid work needs to pay unemployment insurance. Most wages, including paid time off, are included. Excluded wages include retirement, sick pay under some circumstances, reimbursements, and royalties. Excluded employees include corporate officers (including family members) with more than 25% ownership and employees of churches and religious organizations.

Minnesota’s unemployment taxes are complex and determined each year. The taxable wage base is 60% of Minnesota’s average annual wage, and in 2024, that’s $42,000. The base tax rate runs 0.1% to 8.9%. New employer rates vary from 1% to 8.9%, depending on the industry.

Workers’ Compensation Insurance

Minnesota requires you to pay workers’ compensation insurance, even if you have only one part-time employee. This includes minors and noncitizens. You must purchase through an insurance company. Minnesota does not allow private companies to pay medical bills directly for a workers’ compensation-qualifying injury.

Minimum Wage Laws in Minnesota

Minnesota rates for large employers ($10.85 per hour) are higher than those of smaller employers ($8.85 per hour)—but the training wage is the same for both at $8.85 per hour. There are no tip credits toward the minimum wage, and wages apply to all hours worked. Large employers are those with gross revenue of more than $500,000 in a year.

Exemptions include:

- Executive, administrative, or professional workers

- Babysitters

- Volunteers of nonprofit organizations

- Farmworkers on a salary of a certain amount or who are under 18 in certain situations

- Taxi drivers

- Employees subject to the provisions of the U.S. Department of Transportation, like drivers, drivers’ helpers, mechanics, and loaders

Overtime Regulations

Overtime starts for hours in excess of 48 in a workweek and is 1.5 times the employee’s regular rate of pay. Hours spent on call and employee waiting time count as hours worked for overtime requirements. The exemptions are the same as for minimum wage.

Different Ways to Pay Employees

You can pay wages by cash or check. If an employee agrees, you can pay by direct deposit or payroll card. Payroll cards must meet the requirements outlined in Minnesota Statute 177.255.

These include such things as:

- The employee must own the card account.

- The card cannot be linked to a form of credit.

- Neither you nor the card issuer can deduct any amounts from the card.

- You must receive authorization from the employee to electronically deposit the funds.

- You must give the option for them to have the money deposited without requiring a fee for them to access.

You cannot pressure an employee to take direct deposit or pay cards. In addition, you need to provide the employees (upon request) with the records of deposits.

Pay Stub Laws

Pay stubs must be issued each payday and include:

- Employee name

- Hourly rate of pay (if applicable)

- Total number of hours worked by the employee

- Total amount of gross pay earned by the employee during that period

- Deductions

- Net pay after deductions

- Date the pay period ends

- Legal name (and the operating name, if different) of the employer

If you need help creating your own pay stubs, download one of our free pay stub templates to help you get started quickly.

Minimum Pay Frequency

Employees in Minnesota must be paid at least once every 31 days, and all commissions must be paid at least once every three months. You need to pay new employees on the first regular payday if the wages are earned during the first half of a 31-day pay period. Public service corporations like utilities need to pay employees at least semimonthly.

Paycheck Deduction Rules

You can deduct money for the following reasons:

- Union-agreed deductions

- Payback for employer loans

- Court-ordered withholdings

- Pension or retirement funds

- Retirement

- Health benefits

- Uniforms or equipment (up to $50), must be paid back when the employee leaves

You cannot deduct wages for broken equipment, lost money, or other losses, unless the employee has been found liable in court or has authorized you to deduct from their wages.

Final Paycheck Laws

If an employee is fired or laid off, you must pay them within 24 hours of the employee’s demand for payment. If the employee was in charge of money or property, you may take up to 10 days after the separation to audit accounts before paying.

If an employee quits, then you must pay all the wages due by the next payday, unless the next payday is less than five days after the employee quits. Then, you have until the second payday or 20 days after the employee quits.

Accrued Paid Time Off

You are not required to provide paid vacation time, but if you do, it should be agreed upon in the employment contract or described in your employee handbook. You’re not required to pay out any accrued and unused time off to departing employees.

Minnesota HR Laws That Affect Payroll

Unlike its tax withholdings, Minnesota’s HR laws are not that difficult. Below are the highlights:

New Hire Reporting

You need to report newly hired, rehired, and returning-to-work employees to the Minnesota Department of Human Services within 20 days of hire. There are three ways to file:

- Online at Minnesota New Hire Reporting Employer Registration. If you choose to report electronically, you need to do this twice a month, not more than 16 days apart.

- Mail to Minnesota New Hire Reporting Center, P.O. Box 64212, St. Paul, MN 55164-0212

- Fax to 800-692-4473

Lunch & Other Break Time Requirements

You must provide your employees with restroom breaks within every four hours of work, and a meal break of at least 20 minutes for lunch every eight hours of work. Breaks less than 20 minutes must be counted as hours worked and need to be paid.

Hiring Minors

When you hire minors, you must keep a copy of their proof of age as part of your payroll records. Proof can be a birth certificate, driver’s license or permit, an age certificate issued by the school, or a Form I-9.

Children under 14 cannot be employed except as newspaper carriers (if over 11), in agriculture (if over 12 and with parent permission), as actors or models, or as referees in youth athletics (if over 11 and with parent permission).

Per Minnesota law, children under 16 cannot work over 40 hours a week or eight hours a day, except in agricultural operations. They cannot work before 7 a.m. or after 9 p.m. or during school hours on school days (unless they have an employment certificate from the school). To maintain compliance with federal law, however, don’t schedule them to work past 7 p.m. on a school day.

Rules for large employers: If you generate annual sales revenue of over $500,000, you cannot employ minors under 16 later than 7 p.m., more than three hours a day, or more than 18 hours a week.

Minors 16 and 17 cannot work later than 11 p.m. on evenings before school days or before 5 a.m. on school days unless they have their parent’s permission. With permission, they can work as late as 11:30 p.m. or as early as 4:30 a.m.

Minors cannot work:

- Serving alcohol

- With hazardous materials or explosives

- Operating power-driven machinery

- On or near construction sites

Minnesota Family Leave Act

Minnesota does not have a state family leave act, yet—more on this below this section. You must, however, comply with the federal Family and Medical Leave Act (FMLA). The FMLA requires you to provide up to 12 weeks of unpaid leave in a 12-month period for bonding with a new child, dealing with serious health conditions, or, in some cases, dealing with emergencies from a family member in military duty. The federal FMLA applies to employers who had at least 50 employees in 20 weeks of the current or previous year. Learn more about FMLA in our article about federal labor laws.

Paid Sick & Parenting Leave

Minnesota earned sick and safe time went into effect on January 1, 2024. This law requires employers to provide employees with paid leave to care for their own illness, a sick family member, or for personal safety reasons. An employee is eligible for time off under this law if they work at least 80 hours in a year for a Minnesota employer and are not an independent contractor. Employees earn one hour of time off for every 30 hours worked, up to a maximum of 48 hours per year.

Under this law, employees can use the time for:

- The employee’s own mental or physical illness, and treatment or prevention

- A family member’s mental or physical illness, treatment, or prevention

- Domestic abuse, sexual assault, or stalking of the employee or a family member

For parenting leave, Minnesota requires employers to provide employees with up to 16 hours in a calendar year of unpaid time off to attend school conferences and activities for the employee’s child. Note that when the Minnesota paid family and medical leave takes effect in 2026, this time off must be paid.

Minnesota recently updated this law to include protections for workers. Employers who fail to provide for or allow use of sick and safe time are liable to their employees for the time that should have been provided. This will include wages, overtime, as well as additional damages.

Voting & Jury Leave

You need to provide employees enough time off, with pay, to vote in elections. Elections include primaries and general elections for national or state officials, and apply to early voting days as well. You do not have to pay employees for time spent on jury duty, but you cannot penalize or fire an employee for complying with a summons or serving on a jury.

Payroll Forms

Like most states, Minnesota has online filing for most of its tax and payroll forms. However, it does have some options for mailing in limited cases.

Minnesota State W-4 Form

Starting in 2020, Minnesota uses its own form for income tax allowances. Employees need to fill out a Form W-4MN in addition to the federal W-4. You need to send copies of the W-4MN to the Minnesota Department of Labor and Industry if:

- Your employee claims more than 10 withholdings

- Your employee claims to be exempt from Minnesota withholding and you reasonably expect the wages to exceed $200 per week (this does not apply to North Dakota or Michigan residents filing the Form MWR)

- You believe your employee is not entitled to the number of allowances they’ve claimed

Other Minnesota State Payroll and Tax Forms

- Form MWR: For Michigan and North Dakota residents working in Minnesota who want to waive withholding Minnesota state taxes

- Minnesota New Hire form: If you do not file online

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculates unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing non-employee pay information that helps the IRS collect taxes on contract work

State Payroll Tax Resources

- Unemployment Insurance Employer Handbook: Takes you through the laws and procedures from registering to reporting, plus who is covered and how benefits work

- Checklist for Hiring an Employee: All the steps for hiring a new employee, from registering an employer to filing withholdings

- Minnesota Department of Revenue Business Page: Lists the tasks and links for withholding as well as business tax resources

- Workers’ Comp webpage: Information about workers’ compensation, including resources, training, and insurance carrier lookup

- Minnesota Income Tax Withholding Booklet: Takes you from registering your business to amending returns, plus has a formula for programming withholdings into your payroll program

Frequently Asked Questions (FAQs)

Yes. The state requires you to provide one hour of paid sick leave for every 30 hours worked, up to 48 hours in a year. You can provide more if you choose.

No, Minnesota does not allow tip credits. This means you need to pay your tipped employees at least the minimum wage before tips.

That depends on the state. If the employee lives in Michigan or North Dakota, you’ll need to have them fill out Form MWR. This will let them avoid double taxation and you’ll only deduct income taxes in their home state, not Minnesota.

Bottom Line

Minnesota taxes incomes on a graduated basis, with different rates on different portions of an employee’s salary. It also has separate rates for overtime, and even for non-resident entertainers. This can get intimidating, but the state offers tax tables, formulas, an online calculator, and even free courses to get you on the right track.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.