Learning how to process payroll in Nebraska is a pretty straightforward process. Most of the laws align well with federal laws, and there are no local taxes levied by cities or municipalities in the state as there are in other states.

Key Takeaways:

- Nebraska’s minimum wage is currently $10.50 per hour and set to increase annually

- Nebraska has no income tax reciprocity for workers who live in neighboring states

- Keep an eye on paid sick leave initiatives that are starting to work their way through the legislative process

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Step-by-Step Guide to Running Payroll in Nebraska

It is relatively simple to handle Nebraska payroll because it doesn’t have special taxes or many state-specific forms. Here’s a quick guide on how to do payroll in Nebraska.

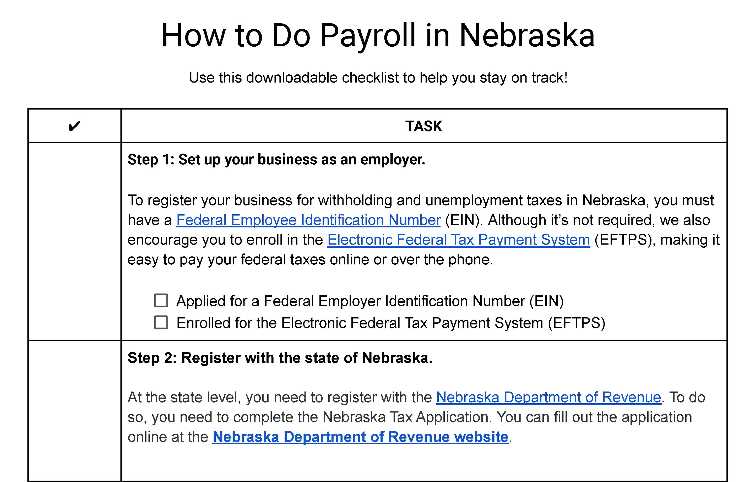

Step 1: Set up your business as an employer. Get your company’s Federal Employer Identification Number (FEIN). If your company is brand new, you may need to apply for a FEIN. This is a simple process that can be completed online via the Electronic Federal Tax Payment System (EFTPS). If your company already has one, keep the FEIN handy. Your company’s FEIN is required to pay federal taxes.

Step 2: Register with Nebraska. Any company that pays employees in Nebraska must register with the Nebraska Department of Revenue. You must also register with the Nebraska Department of Labor. Both registrations are required to accurately withhold payroll taxes.

Step 3: Create your payroll process. When you join an established company, you may have inherited a payroll process. But if your company is new, you will need to create your payroll process from scratch, which includes deciding when and how you’ll pay employees, the payroll forms that need to be collected, and the taxes that need to be paid, among others. Overall, you can opt to do payroll yourself (not recommended), set up an Excel payroll template, or sign up for a payroll service.

Step 4: Have employees fill out relevant forms. You must collect forms from all of your new employees during onboarding. All employees must complete I-9 verification no later than their first day on the job. Every employee must also have a completed W-4 on file. Beginning Jan. 1, 2020, employees must also complete Nebraska Form W-4N. This form was created when the federal W-4 was changed so that employers have more clarity on what allowances employees wanted to take. If you employ non-Nebraska residents, you’ll need to have them complete Form 9N.

Step 5: Collect, review, and approve time sheets. Regardless of how frequently you run payroll, you’ll want to begin this step several days before your payroll is due. If there are any issues with employee time sheets, you have time to coordinate with the employee and get a fix. Whether you use paper time sheets or time and attendance software, review time sheets for accuracy. With paper time sheets, it’s a good idea to have your employees sign them, verifying that they agree on the accuracy of the hours. With electronic time and attendance systems, the software provides options for an electronic signature or other verification methods.

Step 6: Calculate employee gross pay and taxes, and pay employees. You will simplify your life and reduce mistakes if you use a standard process and payroll software to calculate pay and tax withholdings. There are many ways to calculate payroll, and it’s up to you to decide which is best for you. Nebraska has a progressive income tax, so your employees might have deductions at different rates.

Nebraska Income Tax Withholding Rates for 2023

Tax rate | Single or married filing separately | Married filing jointly and surviving spouses | Head of household |

|---|---|---|---|

2.46% | $0–$3,700 | $0–$7,390 | $0–$6,900 |

3.51% | $3,701–$22,170 | $7,391–$44,350 | $6,901–$35,480 |

5.01% | $22,171–$35,730 | $44,351–$71,460 | $35,481–$52,980 |

6.64% | Over $35,730 | Over $71,460 | Over $52,980 |

Important Note: These rates are going to change every year for the top tax bracket as follows:

- 2024 earnings: 6.44%

- 2025 earnings: 6.24%

- 2026 earnings: 6%

- 2027 earnings and beyond: 5.84%

Most companies today use direct deposit to pay their employees, but paying via cash (not the best way) and paper check are also options. Make sure that you are paying your employees at least the Nebraska minimum wage of $10.50 per hour, which is higher than the federal minimum wage.

Step 7: File payroll taxes with the federal and state governments. All Nebraska state taxes need to be made to the applicable state agency on the schedule provided, usually quarterly, which you can do online at the Nebraska Department of Revenue website. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month.

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must deposit employment taxes for payments made Wednesday, Thursday, and Friday by the following Wednesday, and for payments made Saturday, Sunday, Monday, and Tuesday, by the next Friday.

Please note that reporting schedules and depositing employment taxes are different. Regardless of the payment schedule that you are on, you only report taxes quarterly on Form 941 or annually on Form 944.

Step 8: Save your payroll records. As with most business records, you want to keep copies for at least a few years. If you ever need to refer to a pay stub, you want to know where to find it and that you have it readily available. Sometimes former employees might allege they were underpaid and, without proper records, you may not be able to rebut their claims. Nebraska has no additional rules for document storage or retention, so follow federal guidelines.

Step 9: Complete year-end payroll reports. At the end of the year, you will need to first complete all W-2 forms for your employees and 1099 forms for your independent contractors. Both forms must be in the hands of the individuals no later than Jan. 31 of the following year.

Here’s a free checklist you can download and use to make sure you don’t miss any steps doing Nebraska payroll:

Learn more about doing payroll yourself in our guide on how to do payroll.

Nebraska Payroll Laws, Taxes & Regulations

Nebraska mirrors federal regulations. To make sure that your company adheres to all laws and regulations, it’s a good idea to speak with an employment law expert in your area. To ensure you maintain payroll compliance, review the ins and outs of doing payroll in Nebraska below.

Nebraska Taxes

With few exceptions, most employers in the US must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Social Security is 6.2% and 1.45% for Medicare. Beyond federal taxes, Nebraska levies state taxes on businesses and employees. Businesses must calculate and withhold the correct amount of tax from employees and pay a percentage from their own bank accounts.

Employer Unemployment Taxes

All businesses in Nebraska must pay State Unemployment Tax Act (SUTA) taxes. The current rate for negative-rated employers and all new construction employers is 5.4% of the first $9,000 of each employee’s taxable income. For existing businesses not in the construction industry, the rate is 1.25%. Businesses that pay SUTA in full and on time can claim a tax credit of up to 5.4% on their Federal Unemployment Tax Act (FUTA) taxes.

To learn more about FUTA requirements, check out our guide on FUTA and Form 940.

Workers’ Compensation

Nebraska businesses with one or more employees must carry workers’ compensation insurance. Workers’ comp premiums will vary depending on the industry in which your company operates. Exceptions to this requirement include:

- Railroad employees

- Volunteers

- Independent contractors

- Domestic workers

- Some agricultural businesses

- Sole proprietors

Income Taxes

For employees, income taxes are a big item to keep in mind as more employers allow remote work. If an employee lives in Nebraska but works in another state, they may have to pay Nebraska state income tax, as the state does not currently have reciprocity with any other state. This could cause some employees to pay more in taxes. For most employees, you will need to deduct state income taxes from each paycheck.

Nebraska Minimum Wage

Nebraska’s current minimum wage is $10.50 per hour. For tipped employees, companies must pay at least $2.13 per hour. If an employee’s tips plus the cash wage do not equal the existing state minimum wage, the business must make up the difference.

The Nebraska minimum wage is set to increase annually based on the following schedule:

- Jan. 1, 2024: $12.00

- Jan. 1, 2025: $13.50

- Jan. 1, 2026: $15.00

Beginning in 2027, the Nebraska minimum wage will increase based on a cost of living increase as measured by the Consumer Price Index.

Calculating Overtime

If you have employees who are eligible for overtime pay, you must calculate their overtime as 1.5 times their regular rate. An employee is eligible for overtime if they have worked over 40 hours in a workweek.

Paying Employees

Nebraska requires that companies pay employees regularly but does not describe a minimum schedule—and neither does federal law. However, Nebraska law states that if an employer intends to change a pay schedule, they must give all affected employees at least 30 days’ notice.

Regardless of the pay schedule your company uses, you must have regular and consistent paydays. You cannot move the days around to help with your cash flow. As a result, if you pay your employees on alternate Fridays, you must stick to it—unless you provide affected employees with the requisite 30 days’ notice.

You also have several options for paying your employees:

- Cash

- Paper Check

- Direct Deposit

- Pay Card

If you need to pay an employee and aren’t currently using a service, use one of our recommended ways to print a free payroll check.

Pay Stub Laws

Nebraska law requires employers to provide employees with a pay stub on each regular payday. Employers may provide the pay stubs to the employee by mail, email, paper copy, or through a payroll software. The pay stub must clearly state:

- Company name

- Hours the employee worked

- Wages earned

- Deductions made

To create your own pay stubs, use our free pay stub template to help you get started.

Nebraska Paycheck Deductions

Besides the deductions listed above, your company cannot deduct additional amounts from an employee’s paycheck unless an employee approves the deduction in writing and the deduction is:

- Mandated or permitted by local law or approved by a court

- Required costs for tools, uniforms, or other necessary equipment

- To repay loans made by your company to the employee

- To recover stolen property of the business

Terminated Employees’ Final Paychecks

Many states distinguish between paying an employee’s final paycheck after they quit versus after they resign. Nebraska does not, making your job easier and less confusing. For any employee who was fired, laid off, or quit, you need to pay them their final paycheck on the next regular payday or within two weeks of their last day, whichever comes first.

Nebraska HR Laws That Affect Payroll

Nebraska’s HR and employment laws align with federal regulations. For your company to remain compliant, consider some specific requirements regarding your employees.

Nebraska New Hire Reporting

Nebraska requires that employers submit new hire information to the Nebraska Department of Health and Human Services. You must report within 20 days the employee’s name, address, and Social Security number. You must do this for all new employees and rehired or recalled employees, including temporary and seasonal staff.

Nebraska Child Labor Laws

Nebraska generally follows the Fair Labor Standards Act (FLSA) child labor laws. Under the FLSA, there are restrictions for workers under the age of 18.

Nebraska allows for people as young as 14 to work up to eight hours per day and 48 hours per week, provided that they have obtained an Employment Certificate from the school district in which they reside. Stricter limitations exist around school days, where children 14 and 15 cannot work before 6 a.m. or after 10 p.m. and not more than three hours per day and 18 hours per week.

See our article on hiring minors for more information.

Breaks

Nebraska follows federal guidelines and does not require meal or rest breaks for employees, but the state does require payment for brief breaks. These would include getting water or going to the restroom. The exception to this rule is for employers who operate assembly plants, workshops, or mechanical businesses. These employers must provide one paid 30-minute break to all employees working eight hours or more in a day.

Time Off & Leave Requirements

Family Leave

Nebraska follows the Family and Medical Leave Act (FMLA). The state does not provide for any additional maternity, paternity, or family leave, paid or unpaid.

Paid Time Off

Nebraska does not have a law requiring employers to offer employees paid time off (PTO). Employers are free to create paid time off policies and must abide by them. If an employer provides PTO to employees, an employee who resigns or is terminated must be paid out the value of their earned and unused PTO in their final paycheck.

Paid Sick Leave

Nebraska does not have a law requiring sick leaves. Employers may offer sick leave if they want, and they do not have to pay out accrued sick leave when the employee leaves the company.

In the news: There is a push by an employer-advocate group in Nebraska to get legislation on the books providing for paid sick leave, as many other states have recently done. While this initiative has no chance of making new law in the short term, be aware that by 2025, paid sick leave could be a reality in Nebraska, and something you’ll need to prepare for.

Voting Leave

Employees who do not have two consecutive hours to vote based on their work schedule and poll hours are entitled to up to two hours of paid leave to vote, provided that the employee gives notice at least one day in advance. The employer may set the time the employee can go to vote.

Nebraska Payroll Forms

Payroll forms can vary from state to state, and some have their own W-4. Fortunately, Nebraska only has two state-specific forms:

- W-4N: Employee withholding form for Nebraska residents

- 9N: Employee withholding form for nonresidents

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need.

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees

- Form 940: To calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for non-employee contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

Nebraska Payroll Tax Resources

- Nebraska Department of Revenue provides many forms, information on the latest laws and regulations, and other employer-specific information.

- Tax withholdings often trip up employees processing payroll; reviewing comprehensive information on Nebraska’s income tax withholding requirements may help you.

- For answers to questions about workers’ compensation coverage, Nebraska’s Workers’ Compensation Court offers guidance.

Bottom Line

Nebraska payroll is relatively easy compared to some states. There are only two state-specific forms and no local taxes, so you’ll just have to stay informed of state-specific payroll and HR laws.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more: