Washington State does not have state income taxes, but it does have many specific laws concerning payroll. For example, hiring minors requires a special addition to your business permit. The minimum wage is higher than most states, and Seattle and SeaTac have their own minimum wage laws.

Key Takeaways:

- Washington’s minimum wage is currently $15.74 per hour and set to increase to $16.66 per hour on Jan. 1, 2024

- Washington does not levy personal income taxes

- Beginning Jan. 1, 2024, the salary threshold for an employee to be exempt from overtime is $69,305.60.

Step-by-Step Guide to Running Payroll in Washington

When you have everything set up, Washington State payroll is not difficult to process. Below are the steps for how to do payroll in Washington State. If you’d like greater detail on general payroll procedures, consult our article on how to do payroll.

At the federal level, you need your Employer ID Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

When you apply for your business license (or reapply upon hiring your first employee), the state will send you the information you need to start an account. First, you must create a SecureAccess Washington (SAW) account. Then add EAMS (Employer Account Management System) to your list of SAW services. Find full instructions on the Employment Security Department’s website.

You must also get a Workers’ Compensation Account (WCA). When you apply for your business license, a state account manager will contact you to set up your policy.

You must set up pay runs at least monthly, with additional pay runs for overtime if needed, and determine how you’ll pay your employees. See “Minimum Pay Frequency” and “Different Ways to Pay Employees” later in the article.

Another part of your payroll process is determining how you’ll collect and complete payroll forms and other documents you need to maintain compliance.

This is easiest if you do it during onboarding. Forms include the W-4, I-9, and a direct deposit authorization. Washington does not have extra forms.

Washington State is one of the few states that allow up to 10 days from the end of a pay period to pay employees. This can help when calculating hours but also imparts different deadlines. See “Minimum Pay Frequency” below for details.

If you have hourly or nonexempt employees, you’ll need a way to track employees’ work time. It’s common for small business owners to create their own time sheets (consider one of our free templates) or use software (check our roundup of the best time and attendance software).

Aside from compliance, a big part of processing payroll is performing payroll calculations. You must calculate total hours worked (use our free time card calculator to help), gross pay, paycheck deductions, tax withholdings, benefit premiums, etc. As you calculate deductions, especially garnishments, be sure you are not taking more than 50% of an employee’s net pay.

An Excel payroll template (read our guide on doing payroll via Excel) or using software (check our guide to the best payroll software for options) can help automate this step.

Follow the IRS instructions for federal taxes (6.2% of employee paychecks for Social Security and 1.45% for Medicare plus a matching amount from your bank account). Unemployment taxes are also required—both state and federal (6% of the first $7,000 of each employee’s paycheck). Washington does not have state income tax.

For Washington unemployment taxes (SUTA): You must send tax and wage reports each quarter whether you owe taxes that quarter. Even if you have no employees and no payroll for a quarter, you must file a no-payroll report. You can use the Employment Account Management System (EAMS) through SAW to file the reports and pay the taxes.

Alternatively, you can file the report via EAMS and pay via ePay. To report accurately, you’ll need each employee’s name, Social Security number, gross income for the quarter, the number of hours worked in the quarter, and the Standard Occupational Classification.

Unemployment tax reports are due by the following dates:

For Wages Paid During | Due Date | Postmarked No Later |

|---|---|---|

Jan, Feb, Mar | April 1 | April 30 |

Apr, May, Jun | July 1 | July 31 |

Jul, Aug, Sep | Oct. 1 | Oct. 31 |

Oct, Nov, Dec | Jan. 1 | Jan. 31 |

Workers’ compensation reports and premiums are filed quarterly. You can file these reports on the Washington State Department of Labor & Industries website.

Washington State requires you to keep employee payroll records for at least three years, like federal regulations, except for the federal four-year requirement you have to follow for payroll tax forms. Records must include the following:

- Full name

- Home address

- Occupation

- Date of birth (for employees under 18)

- Employment start date

- Time of day and day of the week the employee’s workweek begins

- Actual hours worked on a daily and weekly basis

- Rate(s) of pay

- Total wages earned (including straight time, overtime, piece work units earned, and bonuses)

- Tips and service charges earned

- Addition to or deductions from wages

- Additional records required for paid sick leave

You must keep additional records for employees under 18. Learn more about federal requirements in our article on retaining payroll records.

These are the federal Forms W-2 (for employees) and 1099 (for contractors.) Employees and contractors must have these by Jan. 31 of the following year. In addition, you must send copies of each along with a summary form that totals them all to the IRS. Washington does not require additional state-specific year-end forms.

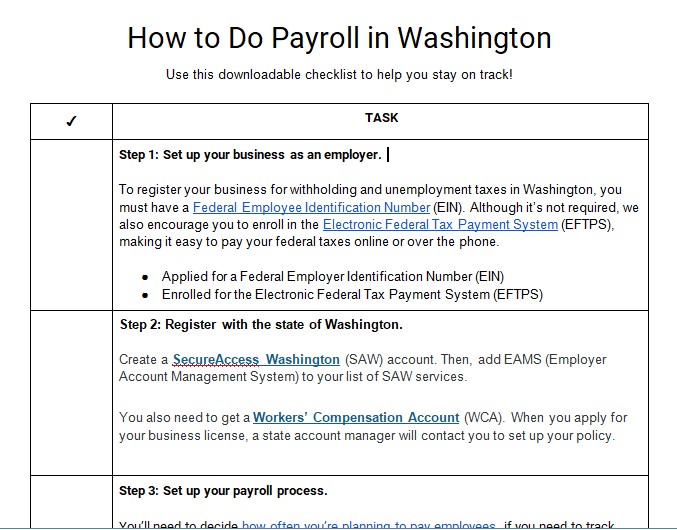

Download our free checklist to help you stay on track while you’re working through these steps:

Washington Payroll Taxes, Laws & Regulations

In addition to state laws, you are still responsible for federal income taxes, Social Security, FICA taxes, and Federal Unemployment Taxes (FUTA). Social Security is 6.2% of each employee’s paycheck and Medicare is 1.45%. Both the employer and the employee will pay these taxes, each paying 7.65% for the combined Social Security and Medicare taxes.

Washington State Taxes

Washington does not have local or state income taxes. That makes things easier, but be sure to calculate unemployment insurance and workers’ comp.

Did you know?

Washington automatically recalculates and mails updates whenever tax rates change. Missed it? Check your EAMS account for your latest rates.

Unemployment Insurance

Washington SUTA ranges from 0.0% to 5.4%. Taxes are against wages up to $72,800.

You must file unemployment insurance on your hourly and salaried employees, including domestic workers earning more than $1,000 in a quarter. Below are general exemptions, but they almost all have specific circumstances.

- Small farms making less than $20,000 annually can exempt workers who attend school

- Appraisal practitioners

- Barbers, cosmetologists, massage therapists

- Yard workers

- Outside salespeople

- Musicians, entertainers, small performing artists

- Corporate officers

- Nonresident aliens

- Family employees

- Newspaper vendors

- Travel services

- Churches

- Work relief/work training

- Patients working in a hospital

- Students or spouses of students working in the university in exchange for financial assistance

- Work-study

- Nongovernment preschool

There are 40 UI tax rates based on the cost of all employment benefits charged to you in the past four years divided by your taxable payroll for the same period. Then, they add a social-cost rate. You can calculate your total tax rate via the Washington State UI tax calculator.

Workers’ Compensation Insurance

You must purchase workers’ comp through the Department of Labor & Industries (L&I). This will be set up when you apply for your business license. It’s no-fault insurance, protecting you from lawsuits for a work-related injury or illness. Your rates are based on the risk classification assigned to your business, the base rates for the classification, and the experience factor. The average employer cost is reported to be $1.34 per $100 covered in payroll.

Minimum Wage Laws in Washington State

The minimum wage for the state in 2025 is $16.66 per hour, with a potential cost of living increase that is announced each September. Unlike many other states, Washington does not allow a tip credit against the state minimum wage.

The following workers may be exempt from minimum wage:

- Minors 14 to 15, though they must make at least 85% of the stated minimum wage

- Jobs exempt from the minimum wage act

You can apply for a subminimum wage certificate for the following workers:

- On-the-job learners, though they must make at least 85% of the stated minimum wage

- Certified student workers and student learners, though they must make at least 75% of the stated minimum wage

- Certified workers with disabilities

- Certain apprentices

Washington State Overtime Regulations

Employees who work over 40 hours in a seven-day workweek must get overtime pay at 1.5 times their regular hourly rate. Employees cannot waive their right to overtime pay. There are no limits on employer size. The following are exempt:

- Bona fide executive, administrative, or professional workers

- Outside sales

- Newspaper vendors or carriers

- Those engaged in forest protection and fire prevention

- Certain child care at nonprofits

- Maritime workers

- Ice hockey players between 16 and 21 years old

At an employee’s request and with their agreement, an employer may provide an employee with time off in lieu of overtime pay. This time off must be provided at a rate of one and a half hours off for each overtime hour worked, and the employee must still be paid the regular base wage for the overtime hours. Upon separation of employment, any unused and accrued time must be paid to the employee. For more details, check the Minimum Wage Act.

Overtime for Medical Workers: The following medical workers cannot be made to work more than 12 consecutive hours without the option of at least eight consecutive hours of uninterrupted time off:

- RNs

- LPNs

- Surgical Technologists

- Diagnostic Radiologic Technologists

- Cardiovascular Invasive Specialists

- Respiratory Care Practitioners

- Certified Nursing Assistants

This may be waived in emergencies or other specific circumstances.

Overtime in Seattle: If you own a large retailer, food service company, or full restaurant in the City of Seattle, you may be subject to different scheduling and overtime rules. For example, if an employee works both closing and opening, and the shifts are within 10 hours, they get overtime pay for the hours worked within that 10.

Different Ways to Pay Employees

You may pay employees by cash, paper check, direct deposit, or payroll card, as long as employees are not charged to access their wages. In some cases, meals or room and board can be used as a portion of wages. Learn more on the L&I website.

Pay Stub Laws

You must provide employees with a pay stub each payday, and it must contain the following information:

- The pay basis (e.g., hours or days worked, piece-rate basis, or salary)

- Rate or rates of pay

- Gross wages

- All deductions for that pay period

- All records required for paid sick leave

Agricultural employers have additional pay stub and record-keeping requirements.

Minimum Pay Frequency

You must pay employees at least once a month unless federal law specifies a more frequent schedule. You must pay employees no later than 10 days after a pay period ends. If you pay monthly, by the end of the month, you must pay wages for hours worked from the first through the 24th. Wages earned after that may be folded into the next paycheck.

Overtime: If you cannot reasonably calculate overtime in time to make the regular payday, then you may establish a separate payday for overtime wages. Below is an example for a semiweekly pay period.

If pay period is: | And if payday for regular wages is: | Then payday for overtime wages must be no later than: |

|---|---|---|

First-15th of the month | 25th of the month | 10th of the following month |

16th-30th/31st of the month | 10th of the following month | 25th of the following month |

Paycheck Deduction Rules

You cannot withhold more than 50% of an employee’s net income. In the case of federal deductions exceeding this amount, follow state law.

You may deduct federal income taxes, FICA, unemployment insurance, child support, union dues, retirement deductions, and other federal or state-mandated withholdings. Tips and gratuities are subject to collection action. Convert housing, rent, and other benefits paid in lieu of wages to dollar amounts and count them as part of net wages.

Child Support: The state issues the child support withholdings notice, and you must answer within 20 days and pay the withheld amount within seven working days of each payday.

Final Paycheck Laws

Final paychecks must be paid on or before the next regularly scheduled payday. It cannot be withheld if employees do not turn in equipment, keys, uniforms, or other due items. However, you may be able to deduct money for court-ordered garnishments, deductions that benefit the employee (payroll advance), or deductions for medical, surgical, or hospital care. As an employer, you can choose to pay voluntary benefits like severance, personal holidays, or vacation in the final paycheck or separately.

State HR Laws That Affect Payroll

Washington State has quite a number of HR laws that you must know when doing payroll.

State New Hire Reporting

If you are hiring employees for the first time, you must refile your business license application with the state. Then the Employment Security Department will get you the information to set up your state unemployment tax account, and the L&I will contact you to start your workers’ compensation insurance account.

You must report new employees within 20 days of hire. To report, you need the employee’s W-4, birth date, and hire date.

Lunch and Other Break Time Requirements

Rest Breaks: Employees must get a paid rest break of at least 10 minutes every four hours. Youth under 16 get 10 minutes every two hours, and 16- to 17-year-olds, every three hours. This should be close to the midpoint of the work period and definitely before the third hour ends. They are considered hours worked when calculating paid sick leave and overtime. In some cases, employees can take minibreaks that add up to 10 minutes. You must allow employees reasonable access to restrooms outside of rest breaks as well.

Paid Meal Breaks: You must give employees working over five hours a 30-minute paid meal break (every four hours for employees under 16). It must start between the second and fifth hours of the shift. You must pay them during the meal break if they are on-duty, on-call, or have their break interrupted to return to work. Any work done during meal break counts for hours worked when calculating paid sick leave or overtime.

Unpaid Meal Breaks: If the employee has no duties during their meal break, you do not need to pay them, nor do you count it as hours worked.

Additional Meal Breaks: If an employee works more than three hours after their scheduled shift, they deserve an additional meal break within five hours of the last meal break. They can waive this requirement if desired but cannot waive rest breaks.

Emergency Workers: If you have 20 or more employees and any serve as Volunteer Firefighters, Reserve Peace Officers, or Civil Air Patrol Members, you must allow them to arrive late or be absent from work if they are working at or returning from an emergency call.

Child Labor Laws

Washington State defines a minor as anyone under 18. To hire a minor, you must do the following:

- Get a minor work permit endorsement on your business license

- Have a completed parent/school or summer authorization form for the employee

- Verify the minor’s age and keep proof on file

Certain age groups are restricted from specific jobs. Check the L&I website for a full list. Immediate family members on the family farm are exempted from these restrictions.

Jobs deemed appropriate for various age groups include the following:

- 12 and 13 years old: Hand-harvesting berries, bulbs, cucumbers, or spinach (may need court permission to work)

- 14 and 15 years old: Retail, creative, some food service jobs, and foot- or-bike delivery

- 16 and 17 years old: Construction, manufacturing, sign-waving, landscaping, some food service jobs

The number of hours allowed depends on whether school is in session and the age of the employee.

14 & 15 years old

Schedule | Hours/day | Hours/week | Days/week | Start-End time |

|---|---|---|---|---|

School week | 3 hours * | 16 hours | 6 days | 7 a.m.-7 p.m. |

Non-school week | 8 hours | 40 hours | 6 days | 7 a.m.-7 p.m. ** |

*Eight hours Saturday through Sunday **9 p.m. June 1 to Labor Day | ||||

16 & 17 years old

Schedule | Hours/day | Hours/week | Days/week | Start-End time |

|---|---|---|---|---|

School week | 4 hours * | 20 hours | 6 days | 7 a.m.-10 p.m. ** |

Non-school week | 8 hours | 48 hours | 6 days | 5 a.m.-Midnight |

6 hours * | 28 hours | 6 days | 7 a.m.-10 p.m. *** | |

*Eight hours Friday through Sunday **Midnight Friday through Saturday or the day before a school holiday ***Midnight Friday through Saturday | ||||

Time Off

Washington State does not require you to pay for holidays, vacations, or bereavement leave. In addition, it does not enforce any agreements made between you and an employee concerning such leaves. There are exceptions for leave taken under the Family Care Act, and some local municipalities may have different rules.

If you grant paid holidays, they are not included when calculating overtime.

Paid Sick Leave

You must give employees at least one hour of paid sick leave for every 40 hours worked. Up to 40 hours can carry over into the next accrual year. Paid sick leave can be used for mental or physical illness, injury, or medical care. It can also be used for caring for family members if your workplace or child’s school or place of care has been closed for health-related reasons or for qualifying reasons listed in the state’s Domestic Violence Leave Act. Doctors, lawyers, and executive managers on salary are exempt.

Note the following updates to this law, taking effect January 1, 2025:

- “Family” now includes any individual who regularly resides in the employee’s home and any individual for whom the relationship creates an expectation that the employee will care for the person.

- “Child” now includes the spouse of an employee’s child.

- For school closures, eligible reasons now also include closure due to a declaration of emergency, even if unrelated to health issues.

Paid Family and Medical Leave

Employees are allowed up to 12 weeks of paid leave to bond with a newborn or adopted child, deal with a serious health condition, help with the serious health condition of a qualifying family member, or for certain military events. In certain circumstances, employees may be eligible for an additional four weeks.

Find the full details on Washington’s Paid Family and Medical Leave website.

Family Care Act Leave

Employees may take any kind of paid leave, including paid sick leave, PTO, or personal holidays, to:

- Provide treatment or supervision for a child with a health condition

- Care for a qualifying family member with a serious or emergency health condition

This leave does not apply to the employee’s own illness, however.

Military Spousal Leave

An employee whose spouse is called to active duty/deployment during a period of military conflict may take up to 15 days of job-protected leave. This applies to the armed forces or National Guard. Leave can be any combination of paid PTO or unpaid leave and must be taken before or during the deployment. The employee must work an average of 20 hours per week to qualify and should give you notice within five days of receiving the deployment order.

Domestic Violence

Victims of domestic violence, sexual assault, or stalking must be allowed time off from work. It is not limited to available PTO and can be unpaid leave. Time off can be requested for the following:

- Legal, law enforcement, or court proceedings

- Medical or psychological help

- Social service program help

- Safety planning

- Relocating

Employers must also accommodate requests for safety, such as job transfer, changing work phone or email, or implementing safety procedures where it does not cause undue hardship.

Payroll Forms

You’ll need numerous federal forms and at least one state form for SUTA.

Washington State W-4 Form

No state income tax, so no state W-4 form. One less thing to worry about!

Washington State Unemployment Taxes Forms

- Amended Tax & Wage Report (Form 5208D): For reporting state unemployment taxes each quarter

- Quarterly Unemployment Insurance—Wage Detail (Form 5208B): The payment coupon to accompany unemployment insurance taxes. Note: This form is used for PEOs only.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculate unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing nonemployee pay information that helps the IRS collect taxes on contract work

State Payroll Tax Resources/Sources

- Washington State Department of Labor & Industries: You can find the information for labor laws, workers’ rights, and more. Much is written for employees rather than employers.

- Administrative Policies Page: The L&I page that lists all applicable salary and labor laws, from minimum wage to industrial welfare.

- Washington State Department of Social and Health Services: This is where you get information on employer resources, including new hire reporting.

- Washington State Unemployment Taxes Forms and Publications Page: Offers links to all the forms, plus publications and handbooks regarding unemployment taxes.

Payroll in Washington State Frequently Asked Questions (FAQs)

Yes, Washington requires employers to provide one hour of sick leave for every 40 hours worked. Employees can use this time for health-related reasons for themselves or family members. If your company provides a more generous PTO policy, you are compliant.

If you make a mistake on payroll, take corrective action immediately. If you’ve paid an employee incorrectly, notify them of the mistake and how you will correct it. If you’ve made a mistake on payroll taxes, notify the appropriate Washington tax agency and discuss how to correct it with them.

There is no law in Washington requiring employers to pay out PTO to employees when they leave. However, if you have a company policy or history of doing so, you must follow that policy.

Bottom Line

While Washington State does not charge state income tax, you are still responsible for SUTA and paying workers’ compensation insurance. It has some specific rules on overtime, exemptions to UI, and pay frequency, so be sure you understand the regulations when setting up your payroll. In addition, you must comply with HR laws, including required break time and sick leave plus nuances for certain groups of employees, like military members.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more: