Learning how to do payroll in West Virginia can be challenging, partly because West Virginia’s payroll taxes include a progressive income tax withholding requirement for your workers. Plus, some jurisdictions collect local income tax. This means that part of handling the state’s withholding requires each employee to complete a state tax withholding form.

Key Takeaways:

- West Virginia’s minimum wage is $8.75 per hour, increasing to $11.00 per hour on January 1, 2025

- Four cities levy a flat dollar amount for income tax

- West Virginia does not require employers to provide paid leave to employees but employers are free to create their own policies

Step-by-Step Guide to Running Payroll in West Virginia

Learning how to do payroll in West Virginia will not be a difficult process, provided that you follow each of these steps and maintain compliance with relevant employment laws. Calculating West Virginia payroll taxes by hand, however, might result in costly errors.

New companies may need to access the federal Electronic Federal Tax Payment System (EFTPS) to create a new Federal Employer Identification Number (FEIN). Your FEIN is required to pay federal taxes.

If your business is new, you need to register on the West Virginia Secretary of State’s website. Any company that pays employees in West Virginia must also register with the West Virginia State Tax Department.

Having a routine process you follow every payroll run is crucial to ensuring you do not make mistakes. If your company has been around for some time, you likely inherited a process, but you may still want to make changes to fit your needs. You’ll need to decide how often you plan to pay employees and what payment method you’ll use—paper checks and direct deposit are most common. You’ll also need a process in place for collecting payroll forms, documenting tax payments and filings, verifying time worked, and more.

Any company that hires employees in West Virginia must collect certain forms during the new hire onboarding process. Each employee must complete I-9 verification. New employees must also have a completed W-4 form on file and the West Virginia version, Form WV IT-104. And, if you’re offering direct deposit as a payment option, have employees sign and complete a direct deposit authorization form.

Payroll begins several days before your due date when you get employee time sheets. Reviewing the time sheets from your nonexempt employees gives you time to speak with anyone who might have made mistakes. There are many ways to track employee time—some of which are free.

Calculating payroll by hand is not recommended. West Virginia has a progressive income tax, so it’ll be more challenging than necessary to ensure your figures are accurate. You can opt to use Excel—we have a free Excel payroll template—or sign up for a payroll service (check our best payroll services guide for some options).

Most companies today pay all employees through direct deposit. But cash (not the best way) and paper check are also options. West Virginia has a minimum wage of $8.75 per hour, higher than the federal minimum wage of $7.25 per hour. You can pay your federal and West Virginia state taxes online. If you use a benefits provider, it should work with you to make deductions simple, automatic, and electronic.

West Virginia law requires that employers keep payroll documents that include the name and address of each employee, rate of pay, hours of employment, payroll deductions, and amount paid for each pay period for at least two years. The Fair Labor Standards Act (FLSA) also requires businesses to keep payroll records for at least three years and payroll tax documents for four years. We recommend complying with the strictest rules for full compliance.

All West Virginia state taxes need to be paid to the applicable state agency on the schedule provided, usually quarterly, which you can do online at the West Virginia State Tax Department website. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month.

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must deposit employment taxes for payments made Wednesday, Thursday, and Friday by the following Wednesday, and for payments made Saturday, Sunday, Monday, and Tuesday, by the following Friday.

Please note that reporting schedules and depositing employment taxes are different. Regardless of the payment schedule you are on, you only report taxes quarterly on Form 941 or annually on Form 944.

Every year, you will need to complete payroll reports, including all W-2 Forms and 1099 Forms. You must provide these forms to employees no later than Jan. 31 of the following year, and file with the state. You’ll also need to submit individual copies of each, along with an overall summary form to the IRS.

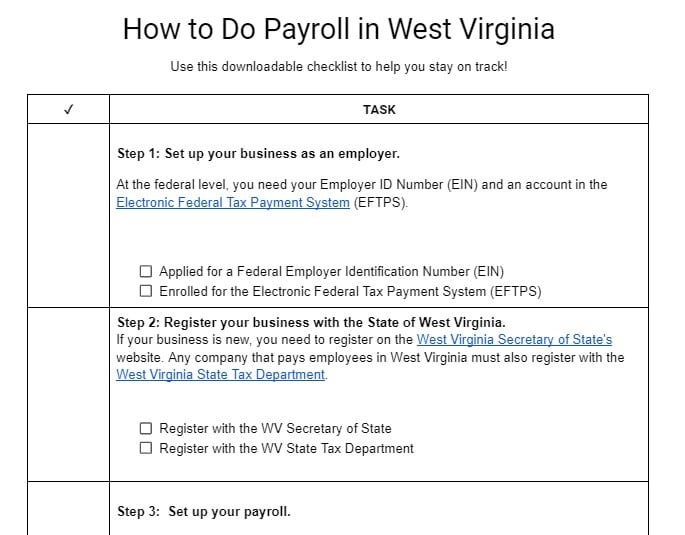

You can also get our free checklist on how to do payroll in West Virginia to help you stay on track while you’re working on the above steps.

West Virginia Payroll Laws, Taxes & Regulations

When calculating West Virginia payroll taxes, ensuring compliance with all federal and state employment laws is crucial to ensure a correct payroll on every occasion. To help you maintain compliance with payroll regulations, review laws, taxes, and regulations related to doing payroll in West Virginia below.

With few exceptions, most employers in the US must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Social Security is 6.2% and 1.45% for Medicare. Both the employer and the employee will pay these taxes, each paying 7.65% for the combined Social Security and Medicare taxes.

West Virginia Taxes

Like most states, West Virginia has certain taxes that companies must pay. None of its cities or localities levy local taxes on companies, but the state does have a progressive income tax, which means rates increase as income goes up, and some jurisdictions levy local income tax.

Employer Unemployment Taxes

All businesses in West Virginia must pay State Unemployment Tax Act (SUTA) taxes. The current wage base is $9,521 and rates range from 1.50% to 8.50%. All new employers in West Virginia will pay a SUTA rate of 2.7%. Out-of-state construction companies start at 8.5%.

Businesses that pay SUTA in full and on time can claim a tax credit of up to 5.4% on their Federal Unemployment Tax Act (FUTA) taxes. FUTA is generally 6% on the first $7,000 of each employee’s income—applying a 5.4% discount would bring that down to 0.6%.

Income Taxes

West Virginia uses a progressive income tax system. Rates range from 2.22% to 4.82%, depending on how much each employee earns. You’ll need to use West Virginia’s withholding tables to calculate how much you should withhold for state income taxes.

There are four localities in West Virginia that levy a flat dollar amount in income tax:

- Charleston: $6.00 per pay period

- Huntington: $10.00 per pay period

- Parkersburg: $5.00 per pay period

- Weirton: $2.00 per pay period

West Virginia Workers’ Compensation

West Virginia requires every employer with one or more employees to carry workers’ compensation insurance. Workers’ compensation insurance provides benefits to employees who suffer on-the-job injuries and covers the cost of medical treatment and lost wages.

There are, however, exceptions to this rule, and your company does not have to carry workers’ compensation insurance if you fit into one of the following categories:

- Your business has fewer than three temporary employees

- Your business has fewer than six agricultural workers

- You employ domestic workers only

- Your business is a church

- Your business employs longshore and harbor workers

West Virginia Minimum Wage

If your business has at least six employees, West Virginia requires you to pay a minimum wage of $8.75 per hour—if it’s less, you can pay the federal minimum wage of $7.25 per hour. For tipped employees who work for a company with at least six workers, West Virginia mandates that an employer can take a tip credit of 70% against the existing minimum wage, paying the tipped employees a rate as low as $2.62 per hour, provided that their tips get them to the hourly minimum wage. If not, the company must make up the difference.

Calculating Overtime

West Virginia overtime rules follow the FLSA, which says all employers must pay employees 1.5 times their regular hourly wage for hours worked over 40 in a workweek.

Paying Employees

You must pay employees at least twice every month with no more than 19 calendar days between pay periods. You may choose to pay employees more than twice per month, but if you do, you’ll need to establish regular pay days and notify employees of any changes in advance. If you need help keeping track of your payroll periods, use one of our free pay period calendars.

West Virginia allows you to pay workers by one of the following methods:

Pay Stub Laws

West Virginia requires companies to provide employees with a pay stub. The pay stub must include:

- Employee’s hourly rate or salary

- The number of hours the employee worked during the pay period

- Any overtime rates

- Any bonus or commission

- Itemized deductions

If you do not use a payroll service, download one of our free pay stub templates to help you get started.

West Virginia Paycheck Deductions

West Virginia allows authorized deductions from employee’s pay, such as those required by court order, allowed by law, or related to benefit plans. A company can only withhold unauthorized money from a paycheck if the employee consents in writing through a notarized wage assignment.

Terminated Employees’ Final Paychecks

When an employee quits, resigns, is terminated, or is discharged, West Virginia law mandates that the employee be paid their last paycheck no later than the next regular payday. We recommend processing payment as soon as possible to avoid possible lawsuits and litigation.

West Virginia HR Laws That Affect Payroll

West Virginia has few state-specific HR laws. You still need to ensure that you are following the federal guidelines, which West Virginia law mostly follows.

New Hire Reporting

Every employer in West Virginia must report new hires and any rehired employees to the West Virginia New Hire Reporting Center within 14 days of their hire date (take note of this because many states allow 20 days). This report is used to enforce child support orders and must include the employee’s name, address, and Social Security number.

Meals & Breaks

West Virginia law requires businesses to provide employees with a break of at least 20 minutes if the employee is scheduled to work six or more consecutive hours. Provided that this break is at least 20 minutes and the employee can completely disconnect from work duties, the break does not have to be paid. Any meal or break period of fewer than 20 minutes must be paid.

Child Labor Laws

Children under the age of 16 who want to work must get a West Virginia Employment Certificate—those aged 16 and 17 do not need to have this certificate to work. Children under 16 can work up to eight hours per day and 40 hours per week when school is not in session. When school is in session, they are limited to working three hours per day and 18 hours per week. There are no restrictions on working hours for children aged 16 and 17.

Time Off & Leave Requirements

There aren’t many state-specific paid time off requirements, so you’ll mostly follow federal law. You will need to provide employees with time off to vote—doesn’t have to be paid—and ensure your PTO policy aligns with your process.

Payroll Forms

West Virginia only has one state payroll form: Form WV IT-104. This is its state W-4, called the Employee’s Withholding Exemption Certificate.

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need.

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees; summary form of W2

- Form 940: To calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for nonemployee contract work

State Payroll Tax Resources

- West Virginia State Tax Department provides many forms, information on the latest laws and regulations, and other employer-specific information.

- West Virginia One Stop Business Portal has many great resources for new and existing businesses to help them navigate licensing, taxes, and employer requirements.

- West Virginia Department of Labor offers support and resources to help businesses ensure compliance with unemployment and workers’ compensation, plus other labor laws.

West Virginia Payroll Frequently Asked Questions (FAQs)

To set up your West Virginia payroll, register your business with the relevant state agencies. You’ll also need to determine your employee withholding and payroll schedule. For the easiest and least-error-free option, I recommend using a payroll system that can make accurate deductions and payments.

If you miss a payroll tax deadline, you may face penalties and interest. The state may also impose fines for late filing. It’s important to file as soon as possible to minimize additional costs and avoid further action.

The records you should keep include employee names, addresses, wages, hours worked, tax withholdings, payment dates, and net pay. Keeping accurate records ensures compliance with state and federal laws and helps in case of audits.

Bottom Line

Learning how to do payroll in West Virginia is fairly straightforward—just ensure that you’re following relevant employment laws and have a detailed process to follow. Besides that, make sure you’ve factored in all the state-specific requirements to comply with and have your payroll checked by a certified professional.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.