Wyoming is one of the easiest states in which to run payroll. With no state income tax, your calculations of Wyoming payroll tax will be simple. That doesn’t mean you can just zip through payroll, however, as you still need to ensure that you’re following federal and state HR laws.

Key Takeaways:

- Wyoming has no state or local income taxes.

- Wyoming follows the federal minimum wage of $7.25 per hour—unless your business is exempt (extremely rare), then your minimum wage is $5.15 per hour.

- Certain employer categories are required to pay employees twice a month, such as railroad, mining, refinery, factory, mill, workshop, oil, and gas.

- Wyoming has no leave requirements beyond federal law, except that businesses must provide one hour of paid time off for employees to vote.

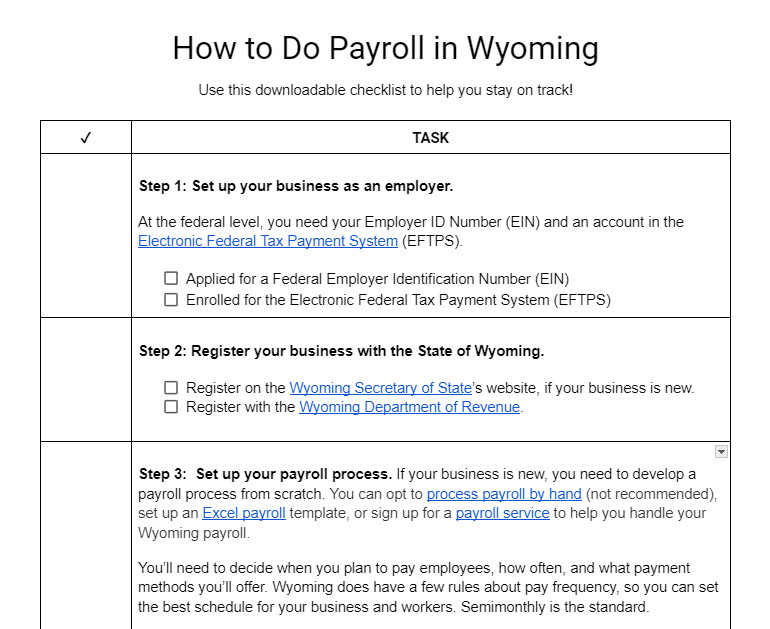

Step-by-Step Guide to Running Payroll in Wyoming

Here is a basic guide to running payroll in Wyoming.

Step 1: Set up your business as an employer. New companies may need to access the federal Electronic Federal Tax Payment System (EFTPS) to create a new Federal Employer Identification Number (FEIN). Your FEIN is required to pay federal taxes.

Step 2: Register your business with the State of Wyoming. If your business is new, you need to register on the Wyoming Secretary of State’s website. Any company that pays employees in Wyoming must also register with the Wyoming Department of Revenue.

Step 3: Set up your payroll process. When you have a new business, you’ll need to create your payroll process from scratch. It’s important to decide how you’ll pay your employees, and when. However, a business that is already established probably has a process that you inherit, but it may need to be altered to better fit your needs. You can opt to process payroll by hand (not recommended), set up an Excel payroll template (check out our Excel payroll guide—we offer a free template), or sign up for a payroll service (pick one of our top recommended payroll services) to help you handle your Wyoming payroll.

Step 4: Have employees fill out relevant forms. Your business must have every employee complete payroll forms during their onboarding process. Every employee must complete I-9 verification. New employees must also have a completed W-4 form on file, plus a direct deposit authorization form if applicable.

Step 5: Collect, review, and approve time sheets. A critical component of your payroll process includes collecting time sheets before your payroll due date. Reviewing the time sheets from your nonexempt employees before the day your payroll is due gives you time to speak with anyone who might have made mistakes. There are many ways to track employee time—some of which are free.

Step 6: Calculate employee gross pay and taxes. Even though Wyoming has no state income tax, you’ll still need to calculate some taxes, including unemployment. These can be complex, and even innocent mistakes can cause costly fines and penalties. Learn more about how to calculate payroll if you need help. You can also use our free time card calculator if you need help calculating total employee hours worked.

Step 7: Pay employee wages, benefits, and taxes. The most convenient way to pay your employees is through direct deposit. But cash and paper checks are also options. Wyoming does not have a state minimum wage, so the federal minimum wage of $7.25 per hour applies. You can pay your federal and Wyoming state taxes online. If you use a benefits provider, it should work with you to make deductions simple, automatic, and electronic.

Step 8: Document and store your payroll records. Keeping your company business records is good practice. Wyoming requires businesses to keep records of all hours worked and wages paid to each employee, including their name, address, and date of birth, for at least two years. For reference, if your business is subject to the Fair Labor Standards Act (FLSA), it requires you to keep these records for at least three years and payroll tax records for four years.

Step 9: File payroll taxes with the federal and state government. All Wyoming state taxes need to be paid to the applicable state agency on the schedule provided, usually quarterly, which you can do online at the Wyoming Internet Filing System for Business website. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month.

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must deposit employment taxes for payments made Wednesday, Thursday, and Friday by the following Wednesday, and for payments made Saturday, Sunday, Monday, and Tuesday, by the following Friday.

Please note that reporting schedules and depositing employment taxes are different. Regardless of the payment schedule you are on, you only report taxes quarterly on Form 941 or annually on Form 944.

Step 10: Complete year-end payroll reports. Doing payroll in Wyoming requires more than just paying employees on a regular schedule. Every year, you will need to complete payroll reports, including all W-2 Forms and 1099 Forms. You must provide these forms to employees no later than Jan. 31 of the following year.

Download our checklist to make sure you don’t miss any steps.

Learn more about doing payroll yourself in our guide on how to do payroll. It has a free checklist you can download to make sure you don’t miss any steps.

Wyoming Payroll Laws, Taxes, & Regulations

Doing payroll in Wyoming will require that you calculate Wyoming payroll taxes and ensure compliance with all federal and state employment laws. To help you maintain compliance with payroll regulations, review Wyoming’s relevant regulations below.

With few exceptions, most employers in the US must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Social Security is 6.2% and 1.45% for Medicare. Both the employer and the employee will pay these taxes, each paying 7.65% for the combined Social Security and Medicare taxes.

Wyoming Taxes

Like most states, Wyoming has certain taxes that companies must pay. However, since Wyoming does not have a state income tax, you will not need to withhold taxes from employee paychecks. Wyoming does not levy local taxes on employees.

Income Taxes

Wyoming does not have a state income tax nor local taxes.

Employer Unemployment Taxes

All employers in Wyoming must pay State Unemployment Tax Act (SUTA) taxes. The current wage base is $30,900 and rates range from 0.09% to 8.5%. New Wyoming businesses must submit documentation to have their rate calculated, considering their industry. If a business does not complete these forms, the state will give them a rate of 8.5%. Businesses that pay SUTA in full and on time can claim a tax credit of up to 5.4% on their Federal Unemployment Tax Act (FUTA) taxes.

To learn more about FUTA requirements, check out our guide on FUTA and Form 940.

Workers’ Compensation

Wyoming requires every employer with one or more employees to carry workers’ compensation insurance. Workers’ compensation insurance provides benefits to employees who suffer on-the-job injuries and covers the cost of medical treatment and lost wages. This protects you from potential lawsuits in the future. You’ll need to pay this out of your business bank account; you can’t withhold funds from employee paychecks to cover workers’ comp.

Wyoming Minimum Wage

Wyoming’s state-mandated minimum wage is $5.15 per hour, which is below the federal minimum wage of $7.25 per hour. Unless you qualify for an exemption (i.e., earn <$500,000 annually in revenue and don’t perform any services for out-of-state customers), you should stick to paying employees at least $7.25 per hour.

For tipped employees, companies must pay at least $2.13 per hour, provided that their tips get them to $7.25. If not, the company must make up the difference. There are some exemptions, i.e., minors and interns, for whom you may be allowed to pay less.

Calculating Overtime

Wyoming overtime rules follow FLSA requirements. Under the FLSA, all employers must pay employees 1.5 times their regular hourly wage for hours worked over 40 in a workweek.

Paying Employees

There is no broad Wyoming law that requires you to pay workers a certain number of times per month. However, Wyoming law does require employers in the following categories to pay employees at least twice per month:

- Railroad

- Mine

- Refinery

- Factory

- Mill

- Workshop

- Oil

- Gas

Employers in these areas of work must pay employees for work done from the first through the 15th of the month by the first day of the following month. They must then pay employees for work done between the 16th and the last day of the month by the 15th day of the following month.

Wyoming also allows you to pay workers by one of the following methods:

- Cash

- Paper check

- Direct deposit, only if authorized by the employee in writing

Wyoming law does not address whether a company can pay an employee by payroll card, but if you get authorization from the employee in writing, it may be safe to do so.

If you need help keeping track of your payroll periods, use one of our free pay period calendars.

Pay Stub Laws

You must give each employee a pay stub with every paycheck. The pay stub can be paper or electronic and must show all deductions made from the employee’s wages.

If you do not use a payroll service, download one of our free pay stub templates to help you get started.

Wyoming Paycheck Deductions

You can deduct wages from an employee’s paycheck, provided the deduction meets the specific reasons listed below:

- Cash shortages

- Broken, damaged, or destroyed company property

- Required tools and uniforms

- Other necessary items required for employment

Terminated Employees’ Final Paychecks

When employees quit, resign, or are discharged, fired, or laid off, you must pay them no later than the next regular payday. Wyoming does not address how to handle final paychecks for employees who are suspended or resign due to a labor dispute, so it’s best to assume that you need to pay them no later than the next regular payday, or sooner.

If you need to pay an employee right away and aren’t currently using a service, use one of our recommended ways to print a free payroll check.

Wyoming HR Laws That Affect Payroll

Wyoming has a few state-specific HR laws that you need to know. The state mostly follows federal guidelines, so if you are familiar with those, you should have no issues understanding the additional Wyoming HR laws.

Wyoming New Hire Reporting

Every employer in Wyoming must report new hires and any rehired employees to the Wyoming New Hire Reporting Center within 20 days of their hire date. This information is used to enforce child support orders and must include the employee’s name, address, and Social Security number.

Meals and Breaks

Wyoming has no law requiring employers to provide workers with meal or other types of breaks. So, the federal rule would apply, which does not require any employer to give workers a break. However, if given, breaks of less than 20 minutes must be paid, while breaks or meal periods over 30 minutes generally do not need to be paid.

Wyoming Child Labor Laws

Wyoming does not restrict the working hours or days of children aged 16 and 17, provided that they are given at least one break if they are scheduled to work more than four and a half consecutive hours. However, minors aged 14 and 15 can only work up to three hours on school days. On non-school days and when school is not in session, they can work up to eight hours per day and 40 hours per week.

Check out our guide to hiring minors for more insight into federal child labor laws.

Time Off and Leave Requirements

Wyoming generally follows federal regulations when it comes to time off and paid leave. Click through the tabs below to learn more about your responsibilities as an employer.

Payroll Forms

Because Wyoming does not have state income tax, there are no state-specific payroll forms.

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need.

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees; summary form of W2

- Form 940: To calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for non-employee contract work

For a more detailed discussion of federal forms, check out our guide on the federal payroll forms you may need.

Wyoming Payroll Tax Resources

- Wyoming Department of Revenue provides many forms, information on the latest laws and regulations, and other employer-specific information.

- Wyoming Department of Workforce Services offers support and resources to help businesses ensure compliance with unemployment and workers’ compensation, plus other labor laws.

Doing Payroll in Wyoming Frequently Asked Questions (FAQs)

No, it’s one of a few states that does not levy income tax on workers. Wyoming also doesn’t have a corporate income tax, either.

If you’re starting a new business in Wyoming, you’ll need to establish a payroll process from the ground up. This involves registering with the state, implementing a system for tracking employee hours and calculating wages, and determining how often you’ll pay your workers, and more. Following the guide above is a great place to start.

Completing year-end payroll reports requires careful recordkeeping all year. This includes tracking all hours worked, wages paid, and deductions. These records are necessary for accurate reporting and compliance with federal and state laws.

Bottom Line

Wyoming has no state income tax and just a few state-specific HR laws. Combined, this makes the state one of the easiest in which to run payroll. However, this doesn’t mean you should calculate your company’s payroll taxes by hand, as that could lead to costly errors.