Doing payroll in Florida isn’t complex, especially if you stay abreast of federal regulations. Florida has few state-specific laws, and its laws are generally business-friendly. Florida also doesn’t have a state income tax, but employers are required to pay state unemployment insurance tax (SUTA) or reemployment taxes.

Key Takeaways:

- Minimum Wage: $12.00 per hour, increasing to $13.00 per hour on Sept. 30, 2024

- Tipped Minimum Wage: $8.98 per hour, increasing to $9.98 on Sept. 30, 2024

- Florida follows federal overtime rules of 1.5 times the employee’s regular rate of pay

- Florida does not collect individual income taxes

Running Payroll in Florida—Step by Step Instructions

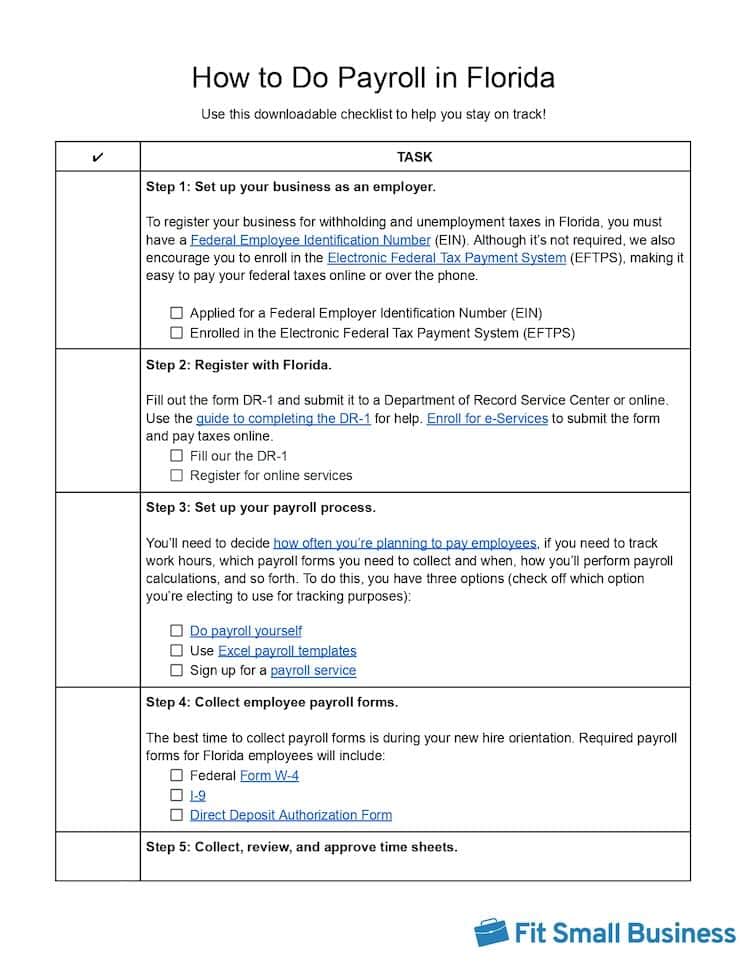

Below are the basic steps to handling payroll in Florida, with emphasis on the state’s regulations. For greater detail on general payroll procedures, consult our article on how to do payroll.

Step 1: Set up your business as an employer. For the federal level, you need your Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register with Florida. Fill out the form DR-1 and submit it to a Department of Record Service Center or online. Use the guide to completing the DR-1 for help. Enroll for e-Services to submit the form and pay taxes online.

Step 3. Set up your payroll process. If you work for an established business, you may have inherited a payroll process. But if your company is new, you may need to start your payroll process, which means deciding how often you’ll be paying employees, when you’ll pay them, how you’ll track and calculate hourly employees’ work time, and how you’ll verify all your data. Overall, you can opt to do payroll yourself by hand, set up an Excel payroll template, or sign up for a payroll service to help you handle your Florida payroll.

Step 4: Collect employee payroll forms. New employees should submit certain documentation, including payroll forms, during onboarding. All employees must complete I-9 verification no later than their third day on the job. Every employee must also have a completed W-4 on file. Florida does not have a separate W-4 form, so you can use the federal version. Employees should also provide you with direct deposit information.

Step 5: Collect, review, and approve time sheets. You can use a paper time sheet or sign up for free or low-cost time and attendance software.

Step 6: Calculate payroll and pay employees. You can pay employees several ways (like cash, check, or direct deposit). You will be able to simplify your life and reduce mistakes if you use a standard process and payroll software to calculate pay. There are many ways to calculate payroll, and it’s up to you to decide which is best for you.

Step 7. File payroll taxes with the federal government. Follow the IRS instructions for federal taxes, including unemployment. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month.

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must deposit employment taxes for payments made Wednesday, Thursday, and Friday by the following Wednesday, and for payments made Saturday, Sunday, Monday, and Tuesday, by the following Friday.

Step 8. File payroll taxes with Florida: Fill out the Form RT-6. If you had 10 or more employees in any calendar quarter of the past fiscal year, you need to file electronically. Otherwise, you can file via paper, but the forms need to be color copies. You can print them if you have a color printer. You can pay your quarterly amount all at once or choose to pay in installments for a $5 fee.

Reemployment (also known as unemployment) tax reports are due by the following dates, even if you have no employees or wages to report:

For Wages Paid During | Due Date | Postmarked No Later Than |

|---|---|---|

Jan, Feb, Mar | April 1 | April 30 |

Apr, May, Jun | July 1 | July 31 |

Jul, Aug, Sep | Oct. 1 | Oct. 31 |

Oct, Nov, Dec | Jan. 1 | Jan. 31 |

Step 9. Document and store your payroll records. It’s important to keep records for all employees, even those terminated, for several years. Learn more in our article on retaining payroll records. Florida has no additional rules for document storage, so follow federal guidelines.

Step 10. Complete year-end payroll tax reports. These are the federal Forms W-2 (for employees) and 1099 (for contractors). Employees and contractors must have these by Jan. 31 of the following year. Florida has no additional forms.

Download our free checklist to help you stay on track while you’re working through these steps:

Learn more about doing payroll yourself in our guide on how to do payroll—it even has a free checklist you can download to make sure you don’t miss any steps. Or, check out our state payroll directory to learn more about the specific guidelines for handling payroll in other states.

Florida Payroll Laws, Taxes & Regulations

In general, Florida follows federal regulations. Its minimum wage is slightly higher than other states, and it has a corporate income tax.

To ensure you maintain compliance with payroll regulations, review the ins and outs of Florida tax and labor laws. You can also check out the Florida state website for more details.

Florida Taxes

With few exceptions, most employers in the US must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rates for Social Security and Medicare are 6.2% and 1.45%, respectively. While Florida does not charge personal income tax, there are several taxes that companies need to pay, from corporate income taxes to sales tax. The only payroll tax is SUTA.

Florida does not charge personal income taxes nor do any of its localities, which makes payroll easier and puts more money into your employees’ pockets.

As of 2024, Florida’s minimum reemployment tax—also known as state unemployment tax, or SUTA—ranges from 0.10% to 5.4%. When new employers become liable for reemployment tax, the initial rate is 0.0270 (2.7%). The maximum tax rate allowed is 0.0540 (5.4%), which can be earned or assigned to employers who have delinquencies greater than one year. The state charges SUTA on the first $7,000 of an employee’s wages.

You need to pay this tax if you have paid at least $1,500 in total wages in a calendar quarter, had at least one employee for any part of a day in 20 different weeks in a calendar year, or are liable for federal unemployment tax (FUTA). There are three special circumstances with different requirements:

- Agriculture: If you paid at least $10,000 in total wages in a calendar quarter or had at least five employees for any part of the same day in 20 different weeks in a calendar year

- Nonprofits: If you had four or more employees in any portion of the same day in 20 different weeks in a calendar year

- Domestics (household): If you paid at least $1,000 in any calendar quarter

Workers not covered are employees of a church, a sole proprietor, partners or members of an LLC, students employed by the college they are enrolled in, insurance agents, real estate agents, barbers who are paid by commission only, and persons under 18 delivering newspapers.

Did You Know?

When you pay SUTA, you may qualify for a discount on your FUTA. This can reduce your 6% FUTA tax rate to 0.6%. In addition, if you pay your terminated employees’ benefits, you may qualify for a discount on your unemployment insurance taxes.

Any employer with four or more employees—including public organizations, employment agencies, and employee leasing companies—is liable for workers’ compensation.

Construction workers with even one employee must provide workers’ comp insurance.

Exceptions include:

- Domestic workers

- Agricultural labor of a bona fide farmer with fewer than six regular employees or 12 seasonal employees

- Professional athletes

- Labor mandated as part of a sentence

- State prisoners or county inmates

- Homeowners employing someone for construction work not related to the sale or lease of the property

Minimum Wage & Tips

Florida’s current minimum wage:

$12 per hour for non-tipped employees

$8.98 per hour for tipped employees

Florida allows employers to apply up to $3.02 per hour tip credit for tip-earning employees. These minimum wage amounts follow federal guidelines on exemptions for minimum wage requirements.

Note: Florida is changing its minimum wage to reach $15 per hour by 2026. After that, it will adjust based on the Consumer Price Index for Urban Wage Earners and Clerical Workers.

New Wage As Of | Non-Tipped Employees | Tipped Employees |

|---|---|---|

Sept 30, 2023 | $12/hour | $8.98/hour + tips |

Sept 30, 2024 | $13/hour | $9.98/hour + tips |

Sept 30, 2025 | $14/hour | $10.98/hour + tips |

Sept 30, 2026 | $15/hour | $11.98/hour + tips |

Overtime

Florida follows federal overtime laws and does not have any state-specific exemptions, meaning all nonexempt employees must be paid overtime pay of time and a half for any hours worked over 40 during a workweek.

Federal law exemptions apply in Florida overtime rules—below are the most common exemptions:

- Professional Employees

- Executive Employees

- Computer Employees

- Administrative Employees

Different Ways to Pay Employees

You may pay employees electronically, by check, or in cash. You can even pay with coupons, punch-outs, tickets, tokens, or other devices in lieu of cash, as long as those items are redeemable in full in the US. However, employees should be able to get their wages without discount. So, for example, paying via PayPal—which charges recipients a 2.9% transaction fee—is not allowed.

Pay Stub Laws

Florida does not have specific laws concerning pay stubs for most employees. However, if you operate a labor pool, you must provide day laborers with an itemized statement showing deductions made from wages. This is simply good practice for any employee, however.

Want to give out pay stubs anyway? Download one of our free pay stub templates.

Minimum Pay Frequency

Florida is one of only two states that does not mandate you pay employees at a minimum frequency, although paydays must be regularly scheduled. Once you determine a pay schedule and post it, you must stick with it. Most companies pay employees either every other week or twice monthly.

Paycheck Deduction Rules

Florida does not have any laws specifying what can or cannot be deducted from an employee’s paycheck. It also allows you to require employees to pay for uniforms, so you could deduct that cost from pay. While there’s no requirement, it is good practice to get deduction approval for less common deductions in writing from employees so there’s no dispute.

The most common deductions include:

- Taxes and SUTA

- Garnishments mandated by legal actions

- Employee share of benefits payments

- Uniform or tool reimbursements

- Reimbursement for damages or loss caused by an employee

Final Paycheck Laws

Florida does not have specific laws about when or how you must pay final wages to an employee. It’s recommended that you pay terminated employees or employees who have resigned on the next scheduled payday.

To learn more about payroll laws small businesses must comply with, check out our guide to payroll compliance.

Florida HR Laws That Affect Payroll

Most of Florida’s HR laws align with federal labor laws. You’ll need to pay attention to the child labor laws though, as there are some variations.

Florida New Hire Reporting

Florida requires you to report new hires within 20 days of the employee being hired. Report them using the Florida New Hire Reporting Form, which you can mail or fax to the address on the form or electronically on the Department of Revenue Child Support Services for Employers website.

Breaks, Lunches & Time-off Requirements

Florida’s rules for paid time off (PTO) align with federal guidelines, which are minimal. We give a brief overview below, but you can get more in-depth information as well as help create a time off policy in our guide to PTO.

State Disability Insurance

Florida does not have a state disability program or require employers to purchase disability insurance. However, it is a good idea both for your employees and you.

Child Labor Laws

Neither Florida law nor federal law allows minors who are 14 and 15 to work during school hours—but they can work up to 15 hours per week, with no more than three hours a day on school days. Minors 16 and 17 may work 30 hours per week and not during school hours.

There are some exceptions for educational learning, but Florida specifically doesn’t allow 16- and 17-year-olds to work before 6:30 a.m. or after 11 p.m. If they’ve graduated from high school or work for their parents, there are exceptions.

In the news: There’s currently a bill working its way through the Florida legislature that, if it becomes law, would remove restrictions on 16- and 17-year-old workers who have school the next day, allowing them to work a full eight hours. The bill would also allow these same children to work more than 30 hours per week during the school year, so long as parents sign a form.

Employment Law Posters

Every year, employers must update their employment law posters. The state updates these posters and will include midyear changes in them, like Florida’s September minimum wage increases. Importantly, updated posters include a “Know Your Rights” section with a QR code to learn more about filing a workplace discrimination claim.

Not posting these notices may subject your business to fines and penalties. Unfortunately, the state does not provide these posters to employers, so you’ll need to buy them or get them from your payroll provider or HR vendor.

Payroll Forms

Florida W-4 Form

Florida does not collect personal income taxes, so that’s one less thing to worry about—no state W-4.

Other Florida Withholding Forms:

- RT-6, Employers Quarterly Report: Use this for filing reemployment tax withholding. You must do this every calendar quarter if you are liable for SUTA, whether you have anything to claim that quarter. Use the RT-6A, if you need more room, and find instructions on the RT-6N.

- Florida New Hire Reporting Form: Used for all Florida employers to report new hires.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: To report total annual wages earned (one per employee)

- W-3 Form: To report total wages and taxes for all employees

- Form 940: To report and calculate unemployment taxes due to the IRS

- Form 941: To file quarterly income & FICA taxes withheld from paychecks

- Form 944: To report annual income & FICA taxes withheld from paychecks

- 1099 Forms: To provide non-employee pay information that helps the IRS collect taxes on contract work

For more information about the federal forms, read our guide on federal payroll forms.

Florida Payroll Tax Resources/Sources

- Florida Department of Revenue: Access forms, view the latest regulations, and get information on all types of taxes, as well as child support resources and other employer-specific issues.

- Tutorial: Florida Reemployment Tax Basics for Employers: Covers liabilities, worker classification, filing requirements, and more.

Frequently Asked Questions About Florida Payroll (FAQs)

Florida voters approved a steadily increasing minimum wage a few years ago. This minimum wage increases every September 30th. Right now, you’ll need to pay your employees at least $12.00 per hour—and starting Sept. 30, 2024, $13.00 per hour. If you have tipped workers, you’re allowed to use a tip credit of up to $3.02 per hour.

Yes, you’ll still need to withhold federal income taxes, plus any other approved deductions. You’ll also need to make sure you’re withholding all applicable Florida payroll taxes and remitting those from your business.

Move fast. If you’ve underpaid or missed a state tax payment, reach out to the tax agency right away to discuss your options. Be prepared to pay a penalty. If you’ve underpaid an employee, make a corrected payment immediately. Also, discuss this with the employee so they know you’re on top of the issue.

Bottom Line

Florida payroll guidelines are among the easiest to follow because Florida only has the reemployment tax to consider, and most of its HR rules follow federal guidelines. Be sure to file accurately and on time, and don’t forget that there are other taxes for businesses too.

Even though Florida’s payroll laws aren’t complex, there’s still a possibility of errors. QuickBooks Payroll automatically calculates employee pay and your payroll taxes; it also files and pays your payroll taxes for you. As a bonus, QuickBooks Payroll will cover any penalties your company faces if it makes a mistake. You can pay employees via direct deposit or check, and same-day payment options are available. Sign up for a free trial or discounted rate today.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.