QuickBooks Desktop Premier, a desktop version of QuickBooks, enables you to perform a wide range of accounting tasks, such as sending and tracking invoices, running payroll, and managing inventory. It’s ideal for businesses that need to keep separate books for multiple companies and have an experienced bookkeeper who rarely needs assistance from an offsite accountant.

Premier has an average rating of 4.4 out of 5 on top review sites. It is moderately priced for a single user at $799 per year but can get expensive if you need five people to access your software. Learn if it’s right for your business through our comprehensive QuickBooks Premier review.

QuickBooks Desktop Premier Plus will no longer be available for new users after September 30 and on October 1 the annual subscription for existing users will increase to $1,399. It has already been removed from the QuickBooks website, so you’ll need to call QuickBooks customer service to subscribe. You can explore QuickBooks Enterprise as an alternative or consider QuickBooks Online, which we believe is the more ideal accounting solution for most businesses.

We understand that selecting the right accounting software is critical to the success of your business, so we live up to the Fit Small Business mission, which is to provide you with accurate and reliable software reviews. To achieve this, we developed an internal case study that allows us to properly evaluate each software we review without any biases. This case study is thoughtfully created to cover key aspects of accounting software, including features, ease of use, and customer support.

Move QuickBooks Desktop Premier to the cloud: Quick Cloud Hosting is our top choice for an affordable hosting service. It will allow you to access your QuickBooks Premier from anywhere on the internet starting at $25 per user, per month. Visit Quick Cloud Hosting to learn more.

Is QuickBooks Premier Right for You?

Is Premier The Best Accounting Software for You?

QuickBooks Desktop Premier Alternatives & Comparison

Are you looking for something else? Read our guide to the best small business accounting software.

Our Comparisons of QuickBooks Premier vs Other Software

- QuickBooks Premier vs QuickBooks Pro

- QuickBooks Premier vs QuickBooks Enterprise

- QuickBooks Premier vs QuickBooks Accountant Desktop

For industry-specific uses of QuickBooks Premier, check out our guides below:

- Best Project Accounting Software: Best for tracking project profitability

- Best Farm Accounting Software: Best desktop accounting software for farmers

Fit Small Business Case Study

We compared QuickBooks Desktop Premier with QuickBooks Online, Enterprise, and Wave across different criteria in our internal case study, and here are the results:

Premier Vs Competitors

Touch the graph above to interact Click on the graphs above to interact

-

QuickBooks Premier From $799 per year for one user

-

QuickBooks Online From $30 per month

-

QuickBooks Enterprise From $1,410 per year for one user

-

Wave Free

QuickBooks Premier stands out in many areas, including banking, inventory, and project accounting. While these features might align with those in QuickBooks Online and QuickBooks Enterprise, our case study takes into account the ease of using these features within the context of QuickBooks Premier, and Enterprise is a more complicated software.

Premier’s mobile app is weak compared to QuickBooks Online and Xero, which isn’t surprising given that QuickBooks Premier isn’t cloud-based software. Additionally, Premier also lost in pricing because it can get expensive for multiple users.

Premier earned a low score in pricing, as we assessed it based on a scenario that includes a five-user subscription, which is a common consideration for businesses with multiple users. This means it can be reasonably priced for a single user or two.

Here’s a detailed breakdown of the QuickBooks Premier pricing structure, along with its key inclusions.

Number of Users | Pricing (Cost per Year) | Access to All Features | 60-day Money-back Guarantee |

|---|---|---|---|

1 | $799 | ✓ | ✓ |

2 | $1,099 | ✓ | ✓ |

3 | $1,399 | ✓ | ✓ |

4 | $1,699 | ✓ | ✓ |

5 | $1,999 | ✓ | ✓ |

QuickBooks Desktop Enhanced Payroll, an add-on, calculates your payroll taxes, lets you run your payroll in minutes, and allows automatic import of your time data. It costs $50 a month plus $5 per employee per month and includes free direct deposit.

QuickBooks Desktop Premier New Features for 2023

- Cash Flow Hub: This helps you track your cash position and your bank and credit card accounts and loans. With Premier 2023, you can now review account balances, see cash balance trends, manage overdue bills and payments, and track cash performance over a specified period.

- Upgraded mileage tracking: QuickBooks Premier 2023 now allows you to track business mileage from your desktop or iOS mobile device automatically and get it approved by your manager or supervisor. You just need to input the start and end trip locations, and the app will calculate the mileage automatically. The previous version tracks business mileage, but you have to record your odometer readings manually.

- Inventory categorization: You can now organize item lists by categories or groups so that you can shorten the list and easily find what you need.

- Improved bank feeds: Premier 2023 now connects to many banks that were previously unavailable. Also, you can set up the frequency of automatic downloads of banking data.

QuickBooks Desktop Premier Industry-specific Features

As mentioned earlier, Premier comes in five-industry specific editions: manufacturers and distributors, contractors, retailers, professional service firms, and nonprofits. You can toggle between these editions if needed or just stick with the general business edition.

Each of the industry-specific editions comes with specialized features and reports tailored to the unique demands of that particular business sector. For instance, the Premier Retail edition comes with an advanced sales reporting feature that allows businesses to generate detailed insights into their sales performance. The Manufacturing and Wholesale edition offers an enhanced bill of materials (BOM) cost tracking that helps manufacturers track inventory and supplies to build a product.

We discuss the industry-specific features and reports available in each edition in our:

- QuickBooks Manufacturing and Wholesale review

- QuickBooks Contractor review

- QuickBooks Retail review

- QuickBooks Professional Services review

- QuickBooks Nonprofit review

QuickBooks Desktop Premier Features

QuickBooks Desktop Premier offers a wide range of tailor-made features specially designed for your industry. Whether you’re a general contractor, nonprofit organization, or professional service provider, you’ll find many useful functionalities in the QuickBooks Desktop Premier software. Below is a list of some of its key features.

QuickBooks Desktop Premier would have hit all the right notes if not for its inability to track activity by location, which is a popular feature of its cloud-based counterpart, QuickBooks Online. However, as with QuickBooks Online, setting up QuickBooks Desktop Premier is easy and detailed. You can input company information and set entity type. After setting up basic information, you can also modify or import a chart of accounts, close prior period accounts, and input beginning balances.

When it’s time to share your books for tax with an offsite accountant, like a certified public accountant (CPA), you create an electronic file called the Accountant’s Copy. When creating it, you must choose a dividing date. For instance, if you’re sending a CPA the information for your 2022 tax return, you’ll choose a dividing date of Dec. 31, 2022. Your accountant can then work on transactions on or before Dec. 31, 2022, to prepare your return.

Meanwhile, you can continue working on 2023 information but will be unable to change any information prior to 2023. This allows both you and the CPA to work on the company file simultaneously without interfering with each other. When the accountant is done, they’ll send you an Accountant Changes file that you’ll import to record the changes made and release the divide date.

The only downside of this feature is that you have to send the Accountant’s Copy every time you need a CPA to check your books. This is inconvenient compared to cloud software, which allows your accountant direct access to your books with a simple invite.

While QuickBooks Desktop has strong A/P features, the A/P module isn’t easy to use. Users without experience in bookkeeping and accounting software programs will have a hard time navigating. In terms of features, it allows you to create recurring expenses, convert purchase orders (POs) into bills, create service items, and record e-payments.

The bill tracker will show you the progress of upcoming payments, which is helpful in projecting your cash flow. The bill tracker follows expenses from purchases, open bills, and paid bills.

QuickBooks Desktop Premier bill tracker

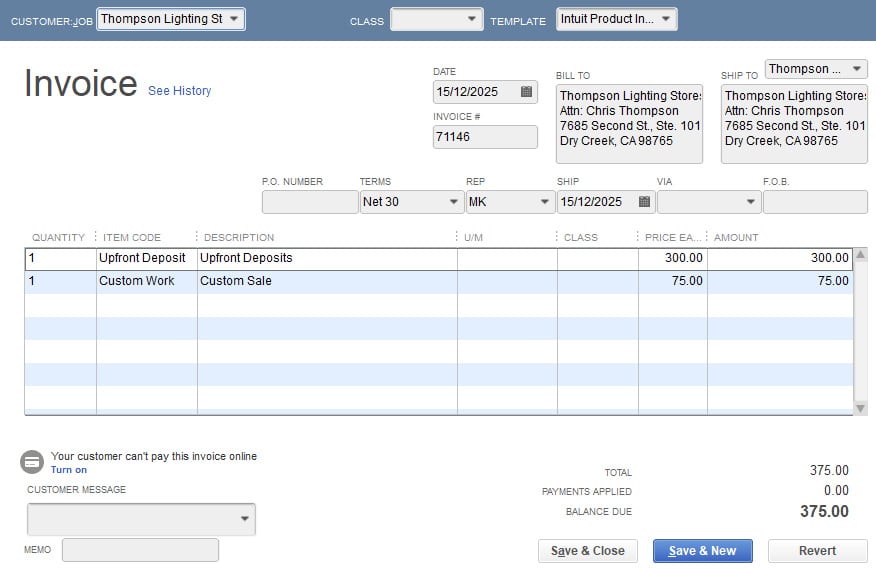

As with its A/P module, the A/R module could have been easier to use, which explains the slight deduction in its score. However, invoice creation in QuickBooks Desktop Premier is excellent because it allows users to select invoice templates and change invoice colors for branding purposes. You can also print or email invoices to customers after recording them. Another great feature worth considering is adding service items for services provided to minimize data entry when billing frequently for the same service.

Invoice creation screen in QuickBooks Desktop Premier

The collections center provides a list of invoices that are overdue or almost due. It also provides the customer’s phone number and a place to keep notes on your contact with the customer. You can view the income tracker to see the status of your future cash flow, which is helpful for projections. In addition to unpaid invoices, the income tracker shows you unbilled estimates, sales orders, time, and expenses.

QuickBooks Desktop Premier income tracker

The A/R module is full of useful features that are adaptable to different industries. However, we still find it difficult and confusing to use. QuickBooks Desktop Premier’s interface isn’t as minimal as QuickBooks Online. If you plan to self-manage your books, you’ll have a hard time using QuickBooks Desktop Premier—unless you’re willing to take tutorial and training courses.

You can set up a feed from your bank for checking, savings, and credit card accounts. Transactions will be loaded into QuickBooks automatically for you to classify. You can create rules, so QuickBooks will classify transactions from certain vendors automatically.

With or without bank feeds, you can account for cash transactions and reconcile bank accounts just by entering the bank statement balance. Other accounting software programs require a bank feed connection to reconcile accounts. With QuickBooks Desktop Premier, you can still perform reconciliation even if you choose not to connect your bank accounts.

QuickBooks Premier has a great “undeposited funds” account that allows you to combine checks and cash into a single deposit. By grouping checks and cash properly with QuickBooks, your bank deposits will match your bookkeeping deposits, making bank reconciliation much easier. You can learn more about the undeposited funds account in our guide on how to record bank deposits in QuickBooks Online.

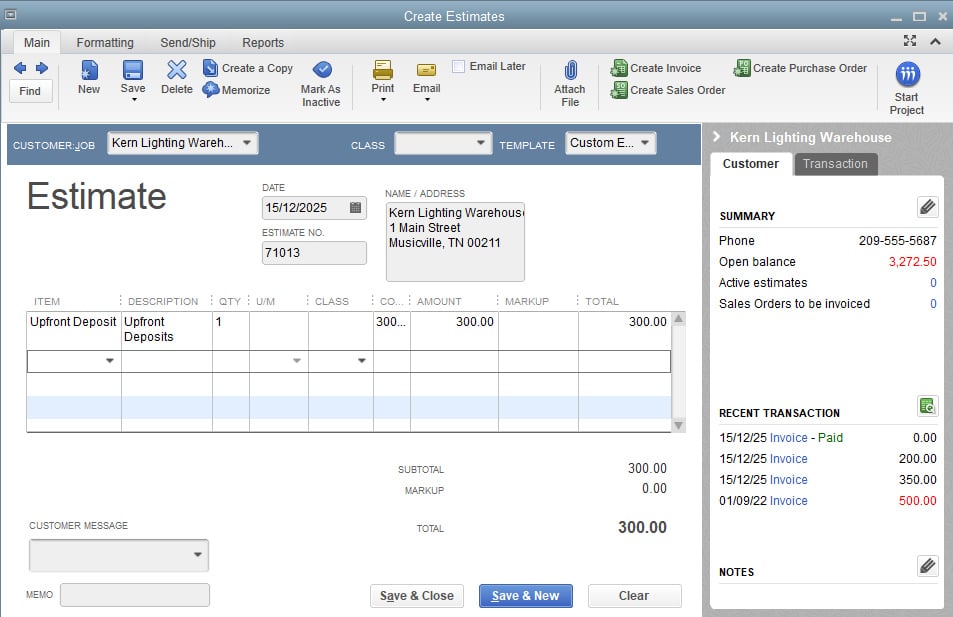

QuickBooks Desktop Premier aces project accounting. That’s why this version of QuickBooks is great for project-based businesses like contractors and designers. Advertising and marketing firms will also make good use of these features for keeping track of client projects. It has all the vital features, such as assigning estimates and costs to projects and comparing budget-to-actual costs, which QuickBooks Online doesn’t do.

Create Estimate form in QuickBooks Desktop Premier

If QuickBooks Desktop offered a tax filing service for its users, then that would have earned it a perfect score. However, despite this weakness, it still provides a convenient way of tracking taxes. QuickBooks will monitor the accrual and payment of sales tax separately for each taxing authority. You can define which types of sales should have sales tax collected.

QuickBooks will track both the quantity on-hand and the average cost of all your inventory items. You can access information regarding each inventory item through the Inventory Center. We like the level of detail that QuickBooks Desktop Premier gives users because it can help in making decisions. Moreover, inventory features are integrated into A/R and A/P, and QuickBooks handles purchases, cost of goods sold (COGS), and ending inventory automatically.

Despite the inability to track income and expenses by location, you can define class lists to departmentalize your financials in whatever way you find useful. For example, a property manager might create a class for each of its managed buildings. By assigning every transaction to a class, the property manager can generate profit and loss reports and balance sheet reports by building. Classes can be used creatively to develop highly customized software.

QuickBooks didn’t do great in mobile accounting as it has a very limited mobile app, which is designed to only capture expense receipts, with an added feature for tracking business mileage (for iOS users). If you need to send invoices, accept payments, and view reports on the go, then we recommend choosing QuickBooks Online especially if you plan to stay within the QuickBooks product line.

If you want a full-featured mobile app that offers more features, like the ability to record time worked, then check out Zoho Books, our overall best mobile accounting app.

QuickBooks Desktop Premier integrates with more than 200 third-party software, including leading ecommerce platforms, like WooCommerce, Shopify, BigCommerce, eBay, and Amazon. It also connects to popular business apps, such as Gusto, Expensify, and BILL.

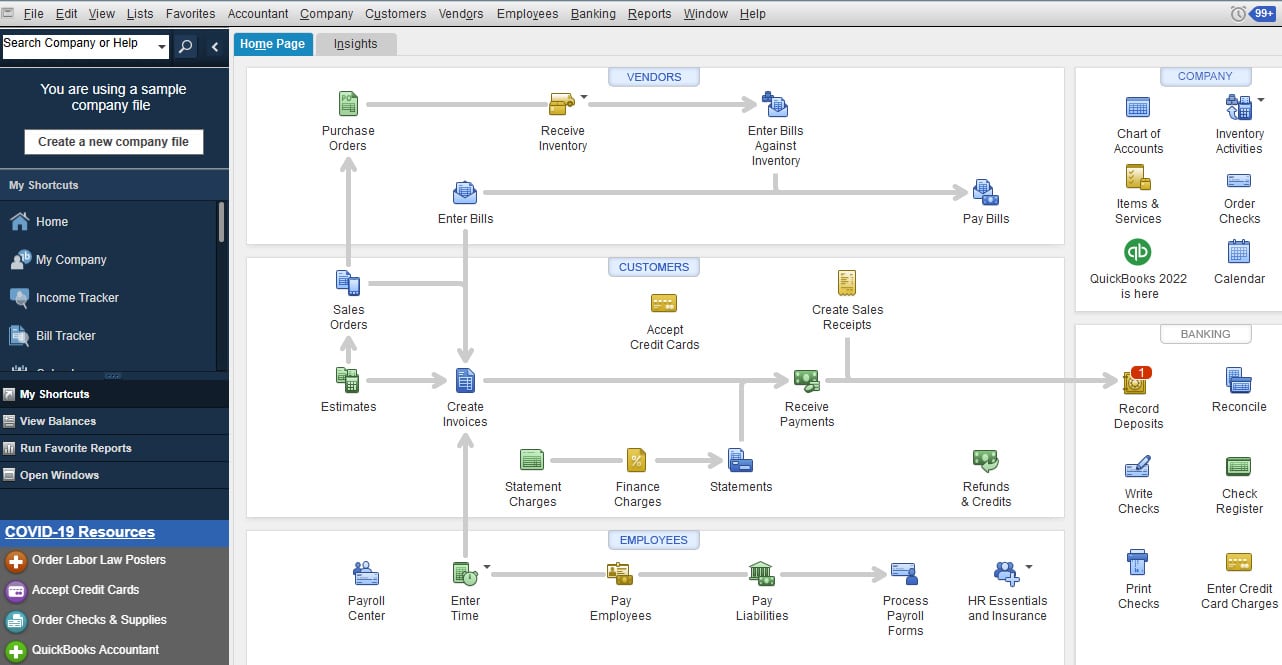

While QuickBooks Desktop Premier has a streamlined desktop interface, you must have at least basic knowledge of accounting to understand the workflow process. The company homepage within QuickBooks lays out the workflow process so that you can click on whichever form needs to be created. Alternatively, all the necessary actions are available through the top menu.

QuickBooks Desktop Premier homepage

We highly recommend looking for accounting advisors who can coach you in bookkeeping using QuickBooks. Also, we don’t recommend learning QuickBooks Desktop Premier on the job because mistakes can create very messy books quickly.

In terms of customer service, QuickBooks Premier offers phone support, but you have to submit a ticket first and wait for a call from an agent. Other ways to seek help include live chat, a chatbot, and some self-help resources.

The good thing about QuickBooks Premier is that it has a vast network of QuickBooks Desktop ProAdvisors. This means you can easily find a local ProAdvisor in your area who can provide bookkeeping support for your business.

| Users Like | Users Dislike |

|---|---|

| Easy to use | Not cloud-based |

| Efficient task automation | Expensive |

| Customizable reports | Unresponsive customer support |

One user who left a positive QuickBooks Premier review commented that it’s easier to use than their previous accounting software. Some reviewers said that they like that it can automate many financial tasks, like invoicing, payment reminders, and expense tracking, while others are pleased with its customizable reports.

However, one dislikes that it’s not cloud-based and shared that they are considering switching to QuickBooks Online. Others also complained that it’s a bit expensive and that its customer support is difficult to reach.

As of this writing, here are QuickBooks Desktop Premier’s ratings on top review websites:

- Capterra[1]: 4.4 out of 5 based on 100 reviews

- TrustRadius[2]: 8.2 out of 10 based on over 400 reviews

How We Evaluated QuickBooks Desktop Premier

We used the following scoring rubric in evaluating QuickBooks Desktop Premier.

5% of Overall Score

In evaluating pricing, we considered the billing cycle (monthly or annual) and number of users.

7% of Overall Score

This section focuses more on first-time setup and software settings. The software must be quick and easy to set up for new users. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

7% of Overall Score

The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash.

7% of Overall Score

The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments.

7% of Overall Score

This takes into account customer management, revenue recognition, invoice management, and collections. The software must have A/R features that make it easy for users to collect payments from customers, remind customers of upcoming or overdue invoices, and manage customer obligations through analytic dashboards or reports.

10% of Overall Score

Businesses with inventory items should choose accounting software that can track inventory costs, manage cost of goods sold (COGS), and monitor inventory units.

10% of Overall Score

Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits. The software must have tools to track time, record billable hours or expenses, send invoices for progress billings, or monitor project progress and performance.

4% of Overall Score

In this section, we’re looking at sales tax features. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

4% of Overall Score

Reports are important for managers, owners, and decision-makers. The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see.

30% of Overall Score

Ease of use gets the highest weight in this case study because we want to give more credit to easy accounting software. For this section, we considered customer service, support network, and a subjective expert opinion score. Users must have easy access to customer service channels in case of problems, questions, or assistance.

Support network refers to a community of software users that can extend professional help to businesses. Having an independent software expert perform the bookkeeping is good for overall ease of use. Lastly, our expert opinion score is our subjective rating based on our experience in trying the software.

5% of Overall Score

The software must also have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops.

4% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

Frequently Asked Questions (FAQs)

QuickBooks Desktop Premier is right for you if you work with an in-house bookkeeper, have complex inventory accounting needs, or are in a specialized industry, including retail, general contractor, manufacturing and wholesale, retail, nonprofit, and professional services.

QuickBooks Desktop and Online are designed to serve different business purposes. For instance, Desktop Premier is great for multi-company accounting and inventory, while QuickBooks Online is better for companies whose accounting tasks are done remotely.

Yes, there are, and the right one depends on your needs. For example, if you need access to more than five users, you need to upgrade to QuickBooks Enterprise, whereas if you want a free alternative, consider Wave.

Bottom Line

QuickBooks Desktop Premier is powerful accounting software with many advanced features and reporting capabilities that take time and patience to learn. Full-time bookkeepers will love it for its quick data input and fast navigation compared to cloud-based software. However, inexperienced bookkeepers might be served better by cloud-based software, such as QuickBooks Online, if they need frequent help from an offsite bookkeeper.

[1]Capterra

[2]TrustRadius