Credit card readers for Android phones and tablets make it easy for merchants to process sales and accept credit cards anywhere, from food trucks to trade shows. With point-of-sale (POS) technology and smartphone apps, you can even use Android card readers in your brick-and-mortar store.

With the advancement of Android smartphones, more Android credit card readers have been launched in recent years. Merchants now have a wider range of providers to choose from, however, the best credit card readers for Android should be affordable, easy to use, reliable, and match your business needs.

Based on my evaluation of over 20 options, the best credit card readers for Android are:

- Square: Best overall

- PayPal Zettle: Best for occasional sales

- Helcim: Best for lowest transaction fees

- SumUp: Cheapest 3-in-1 mobile credit card reader

- Shopify: Best for online businesses

- Chase Payment Solutions: Best if you need free and fast access to funds

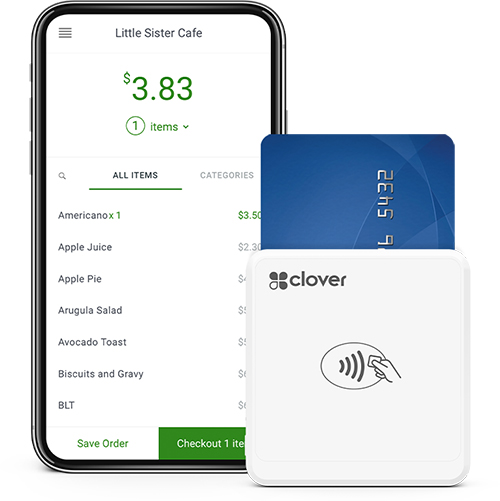

- Clover: Best if you have a preferred payment processor

Best Credit Card Readers for Android Compared

Mobile Card Reader Cost | Monthly Fee | Card-present Rate | Payment Method | Offline Mode | Payment User App review | |

|---|---|---|---|---|---|---|

| $49; First magstripe reader free | $0 | 2.6% + 10 cents | 2-in-1 (Tap, Dip) | ✓ | |

| $79; First reader discounted to $29 | $0 | 2.29% + 9 cents | 2-in-1 (Tap, Dip) | ✕ | |

| $99 | $0 | From Interchange plus 0.15% + 6 cents | 2-in-1 (Tap, Dip) | ✓ | |

| $39–$129 | $0 | 2.75% | 3-in-1 (Tap, Dip, Swipe) | ✓ | |

| $49 | $0–$89 | 2.4%–2.7% | 2-in-1 (Tap, Dip) | Limited | |

| $49.95 | $0–$15 | 2.6% + 10 cents | 3-in-1 (Tap, Dip, Swipe) | ✕ | |

| $49 | $0–$14.95 | 2.6% + 10 cents* | 3-in-1 (Tap, Dip, Swipe) | ✓ | |

*Based on Fiserv rates, fee will depend on your preferred payment processor

If you prefer a hardware-free mobile payment processing solution, check out our list of top credit card payment apps. On top of a credit card reader option, these apps also allow you to process payments using QR codes, card scanners, and even cryptocurrencies straight from your smartphone.

Get a Personalized Card Reader Recommendation

Square: Best Overall Credit Card Reader for Android

PayPal Zettle: Best for Occasional Sellers & PayPal Users

Helcim: Best for Lowest Transaction Fees

SumUp: Cheapest 3-in-1 Mobile Credit Card Reader

Shopify: Best When Starting an Online Businesses

Chase Payment Solutions: Best for Free & Fast Access to Funds

Clover: Best for Merchants With A Preferred Payment Processor

Compare Your Fees

Enter your monthly card-present sales information and your total monthly sales (card-present and card-not-present) to get an estimate of your credit card processing fees for accepting in-person payments with our recommended Android credit card readers.

Don’t have an Android? Check out our recommended credit card readers for iPhones.

How to Choose the Best Android Credit Card Reader

When choosing the best Android credit card reader for your business, your first priority should be the reliability and durability of your device. It needs to be constantly connected to your mobile payment app to minimize failed transactions while on the go. Android card readers should also be compatible with most versions of the operating software.

Afterwards, the next consideration is to ensure that the tools and features available from both the mobile card reader and the payment app are useful to your business type. Value-for-money is also a priority, making sure that you are only paying for card reader functions that your business needs.

Android credit card reader features to consider should therefore include:

- Reliable and compatible connectivity: Bluetooth is the most commonly used connectivity feature but make sure the card reader specs match that of your Android phone.

- Variety of payment methods: If you are looking to use a mobile credit card reader, you likely intend to accept a wide variety of credit card payment methods. EMV (chip) and NFC (contactless) payments are the most popular way of accepting card payments and you want to make sure that your choice of Android credit card reader supports these methods.

- Useful mobile payment app features: Most mobile credit card readers are linked to your payment processor’s mobile payment app. Be sure to evaluate the payment app features (you can download them for free) for functions that your business needs before purchasing the mobile credit card reader.

- Affordable hardware pricing: Most mobile credit card readers for Android and iOS are very affordable. You can find top payment processors that offer their mobile card readers for less than $50 while others can go as high as $130 with more sophisticated functions. Make sure that you invest in a mobile credit card reader and app that’s most useful to your business type.

On top of these Android mobile credit card reader-specific criteria, you also need to consider your overall choice for a payment processor. Monthly account fees and credit card processing rates will make up most of your cost of accepting payments. Contract terms will determine how easy it will be for your business type and size to work with a provider.

How We Evaluated Credit Card Readers for Android

For this update I evaluated more reputable payment processors with mobile payment apps that rank highly in the Google Play store for consideration. I compared each payment processor’s transaction rates, card reader cost, and reliability, as well as security measures in place to protect merchants from failed payments and fraud. I also evaluated for overall pricing structure, flexible and scalable features, and how quickly you could get your payments to determine the best options.

As with the best card readers for iOS, Square ranked as our No. 1 for Android systems. Square’s credit and debit card reader performed well on all the criteria we set, providing the best overall value-for-money features.

Click through the box below for our full evaluation criteria:

25% of Overall Score

For pricing, we looked into the fees associated with the use of credit card readers. This includes the cost of the hardware, card-present transaction rates, and other incidental costs such as chargeback and cancellation fees. We also gave points for payment processors that do not charge a monthly account fee.

30% of Overall Score

This evaluates both the card reader hardware and mobile app which includes the variety of payment types, reliability and real-life user reviews, digital receipts, and availability of offline transactions.

25% of Overall Score

This criteria looks into the payment processor’s features such as contract terms, deposit times, customer support quality, payment processing features, as well as range and flexibility of omnichannel features.

20% of Overall Score

This score combines our overall judgment of price, value-for-money, and ease-of-use, with ratings from real-world users on trusted third-party review sites.

Credit Card Readers for Android Frequently Asked Questions (FAQs)

Popular payment service providers often support both iOS and Android credit card readers. Square, for example, can work for both and offers the most reliable payment processing—meaning you don’t have to worry too much about failed transactions while accepting payments with your mobile device. Read our Square POS review.

There are a number of options available for an affordable magstripe credit card reader:

- Square: Offers a free card swipe/magstripe reader for every Square account. Additional magstripe readers cost $10 each.

- PayPal Zettle: Offers the first purchase of its pin pad-enabled 3-in-1 credit card reader discounted at $29. Additional readers cost $79 each.

- SumUp: Also offers a pin pad-enabled 3-in-1 card reader at $35 each.

Browse our list of top mobile card readers for more card swipe/magstripe card reader options.

Square, PayPal Zettle, and SumUp are the most affordable hardware for merchants with low-volume sales. For larger, more established businesses, Payment Depot offers the cheapest card reader at $49. To help you decide, you also need to consider reliable mobile payment apps and the most affordable transaction fees.

Mobile credit card readers are generally secure. It employs encryption features such as EMV (chip) and PIN pad security, which means hackers will only get random letters and numbers instead of your customer’s actual credit card information.

Bottom Line

Most people think of iPads when they think of mobile POS systems, but many payment processors offer great options for Android too. Some also have their own merchant accounts.

Each provider in our list has features and pricing structures that make it better for specific business types and sizes. However, with the wide variety of Android devices, it’s also important to make sure that the credit card reader you prefer is compatible with your smartphone.

Lastly, consider user reviews to get a concrete idea from merchants with actual experience running their businesses with the mobile app.

All things considered, Square topped our evaluation as the best credit card reader for Android, earning the best scores for pricing and features, including outstanding user reviews. Sign up for a free Square POS account.