Gusto is an excellent choice for small businesses as it offers reasonably priced plans―starting at $49 per month + $6 per person per month―and has a wide range of payroll and basic human resources (HR) functions. However, it may not fit every company’s needs and budget. A top competitor’s product may be the best option in that case.

For this guide, we evaluated over a dozen payroll software providers using our best payroll software for small businesses rubric and narrowed the list down to the five best Gusto competitors with the closest scoring:

- QuickBooks Payroll: Best for QuickBooks accounting users

- Square Payroll: Best for small point-of-sale businesses

- Rippling: Best for tech-heavy companies

- OnPay: Best for robust tools to delegate payroll tasks and analyze labor costs

- Paychex: Best for scalable payroll solutions

Top Gusto Competitors Compared

If you are looking for an alternative to Gusto that compares in features and functionality, consider the following providers. Just like Gusto, they all offer full-service payroll, automatic tax calculations and tax filings, paid time off (PTO) tracking, and a self-service portal where employees can view pay stubs and access their personal information. Below we compare each software against Gusto.

Our Rating (score out of 5) | Starter Monthly Pricing | Standard Direct Deposit Timelines | Health Benefits Available in 50 States | |

|---|---|---|---|---|

4.81 | $49 per month + $6 per person per month | 2 and 4 days | ✓ | |

4.53 | $50 base fee + $6 per employee | Next day | ✓ | |

4.51 | $35 base fee + $6 per employee | 4 days; instantly with Square payments | ✓ | |

4.51 | 2 days | Costs extra | ||

4.44 | $40 base fee + $6 per employee | 2 or 4 days, depending on risk assessment | ✓ | |

4.31 | Custom-priced | 2 days | ✓ | |

Gusto is among the most affordable on our list, with Square’s starter plan being slightly less expensive. Although the other competitors almost equally compare to Gusto, it may be the best for your company if you need a full-service payroll solution that offers unlimited pay runs and tax filing services. It also offers essential HR tools like employee benefits, hiring, onboarding, and performance management, making it ideal for small businesses that need an all-in-one solution.

Gusto also may also be the right choice if you need a local contractor plan. It includes new hire reporting, something no other provider on our list offers in their contractor plans. They can also handle international payments in over 120 countries, allowing you to onboard, pay, and manage contractors all from one place.

Gusto ranks well in many of our small business buyer’s guides, such as the following:

QuickBooks Payroll: Best for QuickBooks Users & Those Who Need Fast Direct Deposits

Pros

- Offers same- and next-day direct deposits

- Integrates seamlessly with QuickBooks accounting

- Has unlimited and automatic payroll runs

- Offers a tax penalty protection program that covers penalties, up to $25,000 per year, regardless of who makes the mistake

Cons

- Only includes local tax filings in higher tiers

- Only offers tax penalty protection in its Elite plan

- Integrates mostly with QuickBooks products; requires its accounting platform to access third-party software integrations

Overview

Who should use it:

QuickBooks Payroll is a great payroll software for small business owners who are already using or planning to use QuickBooks accounting. Data flows seamlessly between the two solutions, making capturing payroll details for your accounting ledgers easy. QuickBooks Payroll offers online employee onboarding tools, access to employee benefits, and more. However, it doesn’t handle local tax filings automatically unless you upgrade to its higher tiers—a feature that Gusto and the other providers on our list offer in their starter plans.

Why we like it:

Its robust tax penalty protection sets QuickBooks Payroll apart from Gusto and its alternatives. This program, which is included in the premium Elite plan, covers all tax penalty fees and interests up to $25,000 per year, regardless of who made the error. Note that most providers may have a similar penalty protection program, but it’s only for tax filing mistakes that they make.

What users think:

Users agree that QuickBooks Payroll is easy to use. They like the reminders to run payroll each week, as well as how it keeps track of tax and bank information. One user noted that QuickBooks Payroll makes his small business look and feel like a big corporation. However, some users complained that it takes too many steps to run payroll, while others disliked the lack of dedicated customer service.

- Capterra: 4.4 out of 5

- G2: 3.8 out of 5

- Core: $50 per month plus $6 per employee monthly

All pricing listed includes a 30-day trial.

- Includes full-service payroll, next-day direct deposit, federal and state tax filings and payments, and access to 401(k) plans and benefits; includes contractor and employee pay

- Premium: $85 per month plus $9 per employee monthly

- Core plus same-day direct deposit, local tax payments and filings, workers’ compensation administration, and HR support center

- Elite: $130 per month plus $11 per employee monthly

- Premium plus multiple state tax filing, project tracking, personal HR advisor, tax penalty protection up to $25,000 per year, and expert setup

- Contractor payments only: $15 monthly for up to 20 workers plus $2 for each additional contractor

- Efficient pay processing: Running payroll with QuickBooks Payroll is easy—you can even set it to run automatically. Aside from unlimited payroll, it handles tax filings and year-end tax reporting on your behalf. However, you have to get either its Premium or Elite plan if you want the provider to handle local tax filings.

- Affordable contractor payroll plan: QuickBooks Payroll’s “Contractor Payments” plan is great for businesses that hire and pay only contract workers. It’s even more affordable than Square Payroll’s contractor-only package (which is priced at $6 per worker monthly)—QuickBooks’ plan only costs $15 monthly for up to 20 contractors (plus $2 for each additional worker). If you have QuickBooks Accounting, this feature is included in all plans.

- Fast direct deposits: Unlike Gusto, which provides next-day direct deposits in its higher tiers, QuickBooks Payroll offers this in its basic Core package, plus a same-day option included in its premium plans. Square Payroll also offers next-day and instant payouts through its Cash App, but this requires a Square Instant Payments account. Meanwhile, the other Gusto alternatives in this guide have either two- or four-day direct deposit options.

- Seamless integration with QuickBooks: While QuickBooks Payroll doesn’t integrate with many third-party software, its native integration with QuickBooks accounting allows seamless data transfers between Intuit QuickBooks products. This means that your payroll information can flow directly to the general journal, plus you can use wage-related information for analytics and other reports.

- Expert support: You are granted access to payroll experts that you can contact via phone and chat. If you subscribe to its highest tier, you get an HR professional who can provide expert advice. This is unlike Square Payroll, which doesn’t offer access to HR experts, and Rippling, which charges extra for it.

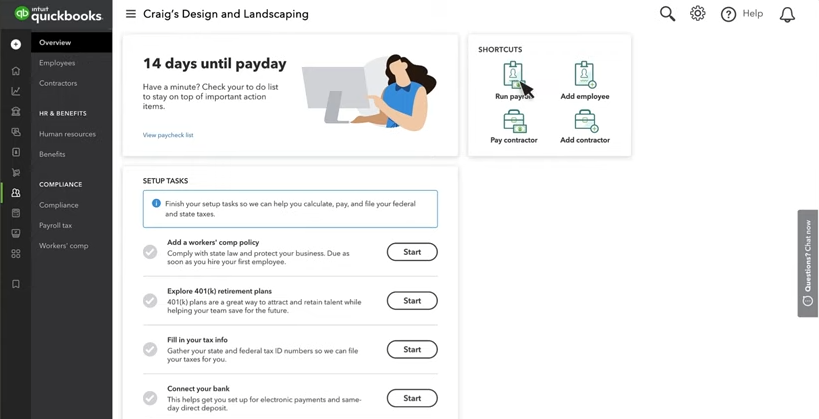

QuickBooks Payroll’s main dashboard includes shortcuts to running payroll, paying contractors, adding employees, and more. (Source: QuickBooks Payroll)

Square Payroll: Best for Small Retail Shops & Restaurants

Pros

- Has automatic and unlimited payroll runs

- Has preps and files tax forms, including year-end W-2/1099 reports

- Integrates with Square POS and provides free time tracking

Cons

- Takes four days for standard direct deposit

- Requires a Square payments account for next-day and instant payout options

- Requires customer code for phone support

- Lacks expert advisors on call

Overview

Who should use it:

Square Payroll is a popular payroll system for small retailers and restaurants, especially those already using Square’s point-of-sale (POS) solution. It handles payroll for both contractors and employees, calculates and files taxes, manages benefits, and has free time tracking—a bonus for those who employ hourly workers. However, its standard four-day direct deposit timeline is slower than Gusto’s and most of the other competitors in this guide.

Why we like it:

The provider made our list of best Gusto alternatives because it offers unlimited pay runs at no extra charge and imports tips and commissions automatically from Square POS into its payroll module for processing. It also syncs seamlessly with QuickBooks Online and other third-party timecard partners. Plus, Square Payroll has a contractor-only payroll plan that’s cheaper than Gusto’s at only $6 per contractor per month.

What users think:

Square Payroll scored well among users on third-party user review sites (G2 and Capterra) citing an easy-to-use interface and excellent customer service. They also liked how simple it was to convert timesheets for payroll year-end W2 preparations. Although Square Payroll scored very well, some users complained that the software didn’t work for their specific industry (making it too niche) and there was no option for splitting pay into multiple bank accounts.

- Capterra: 4.7 out of 5

- G2: 4.2 out of 5

- Pay employees and contractors: $35 per month plus $6 per employee monthly

- Includes unlimited pay runs, full-service payroll, tax payments and filings, year-end tax reporting, time tracking, pay-as-you-go workers’ compensation plans, and new hire reporting

- Pay contractors only: $6 per contractor monthly

- Low-cost contractor-only plan: If you’re a Square POS user and only need to process contractor payments, Square Payroll won’t bill you its base monthly fee of $35 and will only charge you a per-person monthly rate of $6 per contractor. This is great for companies that primarily contract work out vs hiring employees.

- Multiple employee payment options: Square Payroll lets you pay employees and contractors through manual checks, aside from four-day direct deposits. You can also pay employees via Square’s Cash App, which allows you to process two-day direct deposits and even send payments instantly—provided you use Square’s Instant Payments feature.

- Import tips and commissions: A unique feature that Square Payroll offers, which Gusto and the eight other competitors in this guide don’t, is that tips and commissions import from Square POS automatically into its payroll solution. This makes it easy for you to process employee payments without extracting and uploading tip and commission data from one system to another manually.

- Seamless payroll tool integration: Aside from unlimited and automatic pay runs for both employees and contractors, Square Payroll integrates seamlessly with Square products, such as Square POS and Square Team Management. It also connects with third-party software, such as QuickBooks Online and partner timecard solutions.

With Square Payroll, you can process employee payments through desktop computers, laptops, or mobile devices.(Source: Square Payroll)

Rippling: Best for Tech-heavy Businesses Needing HR, IT & Payroll Tools

Pros

- Has unlimited pay runs with global payroll capabilities

- Allows separate and as-needed purchase of its robust HR and IT products

- Integrates with 500-plus third-party software

- Offers a flexible professional employer organization (PEO) option

Cons

- Requires the purchase of Core Workforce Management solution before any other product

- Only offers payroll and benefits as paid add-ons

- Gets pricey as you add features

- Requires extra fees for HR help desk option with phone and email support

Overview

Who should use it:

Rippling offers a wide range of integrated and modular HR, payroll, and IT products, making it perfect for tech-heavy companies. Its core platform is a workforce management solution, wherein payroll and other modules like benefits, app management, and HR help desk are paid add-ons. It offers an excellent payroll feature set with automatic tax calculations, tax filing services, and year-end tax reporting. It also has online tools to help you handle onboarding and offboarding, time and attendance, document management, and benefits administration.

Why we like it:

The program also has essential IT solutions for managing business apps and company computers assigned to employees, and it can store units in its warehouse for you. The downside of using Rippling is that you have to pay for each module, so it can get expensive as you get more features. You also have to pay for its HR help desk feature, which lets you call or email HR professionals if you need expert support. Its live chat function has been praised by users though, and the company now shows the customer service wait time live on its site.

What users think:

Real-world users like Rippling, scoring it near perfect marks for its functionality and robust payroll capabilities. Users like how you can track PTO and have employees clock in and out through the software, then import that data directly to payroll. The few complaints it received were related to slow app loading and the need to purchase additional features, making it less affordable than others on our list.

- Capterra: 4.9 out of 5

- G2: 4.8 out of 5

- $35 plus $8 per employee monthly

Pricing is based on a quote we received. Must contact rep for custom pricing.

- Includes Rippling’s core workforce management platform, employee onboarding and offboarding, full-service payroll, time tracking, and software integrations

Other Per-Module Costs Pricing is based on a quote we received. Must contact rep for custom pricing.

- App, device, and computer inventory management: $8 per employee monthly

- Includes IT tools to manage business apps and computer provisioning and deprovisioning processes

- Benefits administration: Pricing varies depending on your insurance broker

- HR help desk: Custom-priced

- One-on-one email/phone support from HR experts

- Unified platform: Rippling has an integrated HR platform in which all of its solutions connect with each other automatically. It lets you manage your employees’ payroll, benefits, devices, and apps on just one platform. Although the other Gusto alternatives in this guide also offer similar HR and payroll features, the comprehensive app and device management tools are unique to Rippling.

- Efficient pay processing: Rippling can handle both your US and global payroll needs while providing your employees easy access to online pay stubs and tax forms through a self-service portal. It also calculates and files payroll taxes automatically and provides year-end tax reporting. Note that QuickBooks Payroll requires you to upgrade to its higher tiers if you need local tax filings, while OnPay and Paychex charge extra for some of their tax services.

- Robust integrations: When looking for a more solid set of HR features with robust third-party integrations, you can choose Rippling over Gusto since the former integrates with more than 500 systems. Rippling is also the only provider in this guide with an extensive partner network, which includes accounting, time and attendance, expense management, recruiting, training, and office management solutions.

- Flexible PEO: In case your HR needs have grown but you don’t want to hire or expand your HR team, Rippling and Paychex offer PEO services to help you manage day-to-day HR and payroll operations. Gusto and the other alternatives in this guide don’t have this option. However, unlike Paychex, Rippling allows you to turn its PEO services on and off and switch back to using its software again easily.

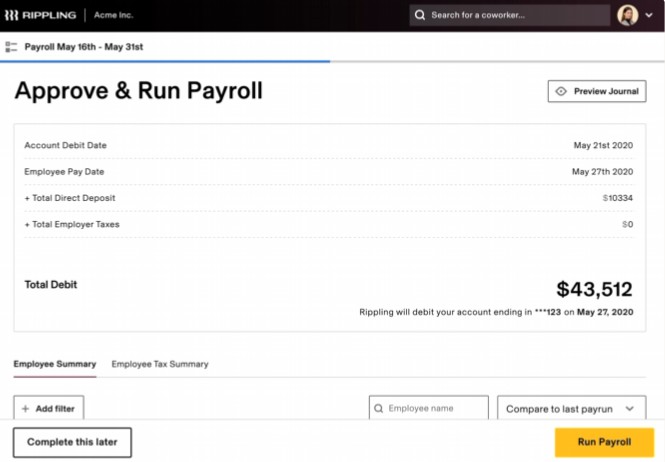

With Rippling, you can preview your current pay period’s payroll journal and compare it to your last pay run before finalizing payroll. (Source: Rippling)

OnPay: Best for Delegating Payroll Tasks & Analyzing Labor Costs

Pros

- Is affordably priced

- Has unlimited pay runs

- Has six-level system permissions for controlling access and assigning HR/payroll tasks

- Offers special payroll and tax filing services for niche industries, such as agricultural and farm businesses

Cons

- Bases its direct deposit turnaround time―either two or four days―on OnPay’s risk assessment

- Has limited integration options

- Doesn’t offer multiple plan options like Gusto does

Overview

Who should use it:

OnPay is a good Gusto alternative, especially for small companies (with up to 200 employees) that need an efficient way to view and analyze labor costs. In addition to its premade reports, it has a report designer for creating custom payroll reports. This allows you to set up filters, add or remove 50-plus data points, and save report templates. The other providers on our list may have customizable reports, but OnPay’s is more robust.

OnPay even has customizable checklists and onboarding workflows, including six levels of system permissions for delegating tasks and controlling HR and payroll access. Aside from providing a modern interface that rivals Gusto’s, OnPay offers unlimited pay runs, manages employee benefits, and files payroll taxes on your behalf.

Why we like it:

While Gusto and most of the providers in this guide require you to upgrade to higher tiers to get all of their tools, you get full access to all of OnPay’s functionalities for a flat monthly fee of $40 plus $6 per employee. This makes OnPay an affordable alternative for Gusto, with sample annual fees costing $1,200 for a company with 10 employees.

However, its tax penalty guarantee only covers mistakes OnPay representatives make—unlike QuickBooks, which covers any tax errors. Plus, its direct deposits have a longer turnaround than some of its competitors—with either a two- or four-day option depending on OnPay’s risk assessment.

What users think:

OnPay received consistent user scoring across both Capterra and G2, both with high marks. They liked the friendly, available support staff, as well as the cost-effectiveness for their small business. They also liked the number of features available both online and through its mobile app. However, some users disliked that they only have an Apple mobile app and no presence on Android. Another complaint was its lack of integration with some HR systems.

- Capterra: 4.8 out of 5

- G2: 4.8 out of 5

- $40 per month plus $6 per employee monthly

- Includes payroll processing, multiple payment options, payroll tax management, onboarding and new hire reporting, PTO management, employee benefits, self-service portal, reporting tools, and third-party integrations

Add-ons

- Efficient payroll features: OnPay supports multiple pay rates and schedules, including multistate payroll with no extra cost. It also enables you to pay employees through direct deposits, manual checks, and pay cards. However, you can’t choose the direct deposit turnaround time of two or four days because OnPay will identify this for you following the results of its risk assessment. If you want to choose a direct deposit that fits your payroll needs, consider any of the providers in this guide or Gusto.

- Special payroll services: OnPay caters to specific niches, including churches and nonprofits, restaurants, and farms. It calculates wages and tip payments (for restaurants) and processes the applicable tax filings for these particular industries at no extra cost. For small agricultural companies with workers on H-2A visas, OnPay can handle the applicable tax calculations in addition to Form 943 reporting.

- Report designer: The other providers on our list may offer customizable reports, but OnPay’s reporting tools are more robust. It has a report designer that lets you add and remove over 50 data points. You can set up filters, select date ranges, and move columns to fit your reporting requirements. It also lets you save custom reports, and if you don’t want to create your own, OnPay has over a dozen built-in payroll reports to help you analyze and plan labor costs.

When running payroll with OnPay, you can filter employees by business location and select the workers who should be included in the pay run. (Source: OnPay)

Paychex: Best for Businesses That Need a Scalable Payroll Solution

Pros

- Offers multiple pay options, such as direct deposits, paper checks, pay cards, and pay on-demand

- Includes 24/7 customer support in all plans

- Has a suite of integrated HR solutions and services like new hire reporting, onboarding, background checks, time and attendance, and PEO

Cons

- Pricing isn’t all transparent

- Requires extra fees for payroll tax administration and W2/1099 year-end reporting

- Only has check signing and stuffing services and access to a dedicated payroll specialist in premium plans

- Doesn’t offer unlimited payroll and off-cycle runs

Overview

Who should use it:

Paychex is a full-featured payroll system with different packages to meet the needs of small and large businesses. Its plans and HR products are flexible enough to handle your growing HR requirements, and it even has a PEO option for when you need expert help in handling day-to-day HR and payroll tasks.

Why we like it:

In addition to paying employees and contractors, it can handle online onboarding, staff benefits, and payroll tax administration. Subscribing to its premium plans even grants you access to a dedicated payroll specialist and check signing and stuffing services.

However, Paychex doesn’t list full pricing on their websites. Plus, with Paychex, you need to pay additional fees for some of its quarterly and annual payroll tax filings. Note that these are available for free in almost all the other options we reviewed—except for QuickBooks Payroll, which requires you to upgrade to its higher tiers for local tax filings.

What users think:

Paychex users like that it takes care of filing taxes for your small business, as well as its direct deposit capabilities. They also mentioned that it was affordable and that the interface was customizable. While some users praised the customer service at Paychex, others complained they were not responsive.

- Capterra: 4.2 out of 5

- G2: 4.2 out of 5

- Paychex Flex Essentials: Custom-priced

- Includes full-service payroll, tax filing services, direct deposits, new hire reporting, garnishment payments, and a financial wellness program

- Paychex Flex Select: Custom-priced

- Essentials plus check logo and signing services, learning management, and access to a dedicated payroll specialist

- Paychex Flex Pro: Custom-priced

- Select plus onboarding, background checks, state unemployment insurance (SUI) services, and an employee handbook builder

- Scalable system: Compared to Gusto and the other providers listed in this guide, only Paychex has a system that can grow with your business. It provides efficient pay processing tools regardless of whether you have 10 employees or more than 1,000 workers. You just need to reach out to a Paychex representative who can recommend a package that fits the changing HR needs of your business.

- Multiple pay options: Like Gusto, you can pay employees through pay cards, direct deposits, and paper checks. Furthermore, Paychex is the only provider that offers check signing and stuffing services among all the Gusto alternatives on this list. However, it doesn’t have QuickBooks Payroll’s fast direct deposit options and Square Payroll’s instant payments.

- Full range of HR features and services: In addition to payroll, Paychex has a suite of HR solutions and services to help you manage hiring, new hire onboarding, time and attendance, workers’ compensation, garnishment payments, business insurance, employee benefits, and a financial wellness program. None of the Gusto competitors we reviewed have financial wellness tools you can offer your employees.

- Dedicated support: Aside from its team of compliance and HR professionals who can provide expert advice, you get dedicated support from a highly trained payroll specialist who will help you with your payroll and tax needs. While the other Gusto competitors in this article may offer HR advisory services, they don’t provide dedicated payroll support.

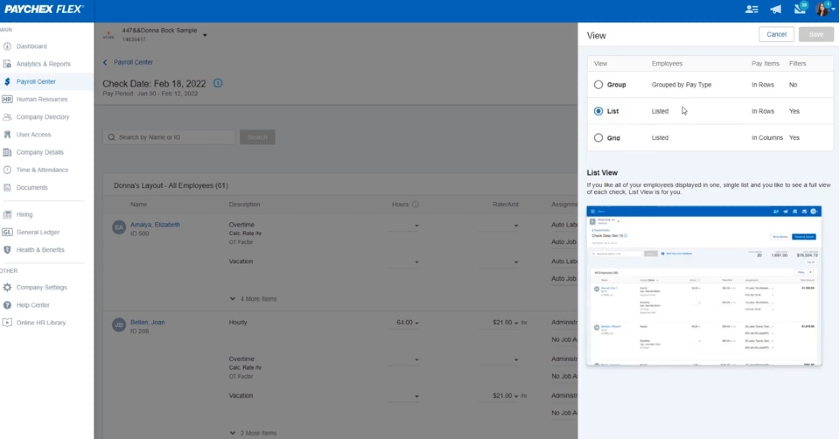

Paychex offers customizable payroll views, allowing you to display the employees’ wage data by pay type, in a grid, or as a single list.(Source: Paychex)

Methodology: How We Evaluated the Best Gusto Competitors

To find the best Gusto competitors for this article, we considered a dozen top payroll services, looking at how they competed with Gusto. Apart from comparing each software’s pricing, we looked for features and HR tools that are most important to small businesses. Finally, we chose the top five Gusto competitors to help you decide which payroll software is best for your business.

Our scoring system consists of a range of five stars in the categories of pricing, HR features, popularity, reporting, payroll features, expert review, and ease of use. Click through the tabs below to learn how each category was weighted and how we evaluated each.

20% of Overall Score

In terms of pricing, we looked at each software provider to determine if they were affordable for small businesses while maintaining robust HR and payroll features. We evaluated each for transparent pricing, whether it charges a setup fee, if it offers unlimited pay runs at a low price, and if multiple plans are available.

15% of Overall Score

The best payroll software is also equipped with sound HR features, such as online onboarding, time tracking tools, benefits options, and health insurance in all 50 states. We looked at each provider in terms of these features, plus compliance experts on staff and if it files state new hire reporting forms on behalf of the client.

5% of Overall Score

To determine how popular our payroll software providers are, we looked at third-party user review sites, such as G2 and Capterra, to see what users had to say. Those with a user rating of 4 or above (on a scale of 5) and with 1,000-plus reviews earned top marks.

5% of Overall Score

Our reporting score took into consideration how detailed internal reports are in showing payroll data, as well as if those reports were customizable.

20% of Overall Score

A payroll provider must have excellent payroll features in order to be the best for small businesses. We looked at the ability to run payroll on mobile, fast turnaround on direct deposit (within 2 days), whether the software processes payroll taxes, and the ability to pay both employees and contractors.

15% of Overall Score

Our expert review of each software determines affordability for small businesses, whether the software is easy to navigate, and how detailed the HR and payroll features are for each.

20% of Overall Score

Payroll software that isn’t easy to use can make paying your employees difficult. We evaluated each software to see what type of learning curve it had and if its interface was intuitive and customizable. Additionally, extra points were given to software that integrates with other HR software, like time and attendance, accounting, and scheduling.

Gusto Competitors Frequently Asked Questions (FAQs)

Gusto is a popular and highly rated payroll software for small businesses. It is affordable for even the smallest of businesses, such as mom-and-pop shops, and offers all-in-one HR and payroll features.

For a payroll software company, Gusto provides more than just pay processing solutions. Its intuitive platform has recruiting, new hire onboarding, time tracking, benefits administration, performance reviews, and HR management features (similar small business payroll providers don’t have a solution suite that’s as wide as Gusto’s).

Yes, Gusto offers global payroll tools to help you manage cross-border payments in over 120 countries. However, this is a paid add-on.

Bottom Line

Gusto is an excellent payroll service, but there are several other great options that you can explore depending on your needs. Like Gusto, its competitors automatically run payroll and offer paycheck and direct deposit services, onboarding and employee self-service, tax and benefit calculations, and HR support. They are all competitively priced as well.