Arkansas is a unique state when it comes to processing payroll, as you’ll have to factor in its progressive state income tax rate and the more stringent child labor laws—though some of these requirements have recently been loosened—and final pay laws. While some of its regulations are more complicated and will take more time to complete and check, other payroll tasks are simpler because there are no relevant state laws.

Key Takeaways:

- Minimum Wage: $11.00 per hour

- Overtime: Follows federal overtime rate of 1.5 times the employee’s regular hourly rate

- PTO: Not required to offer paid time off to employees in Arkansas

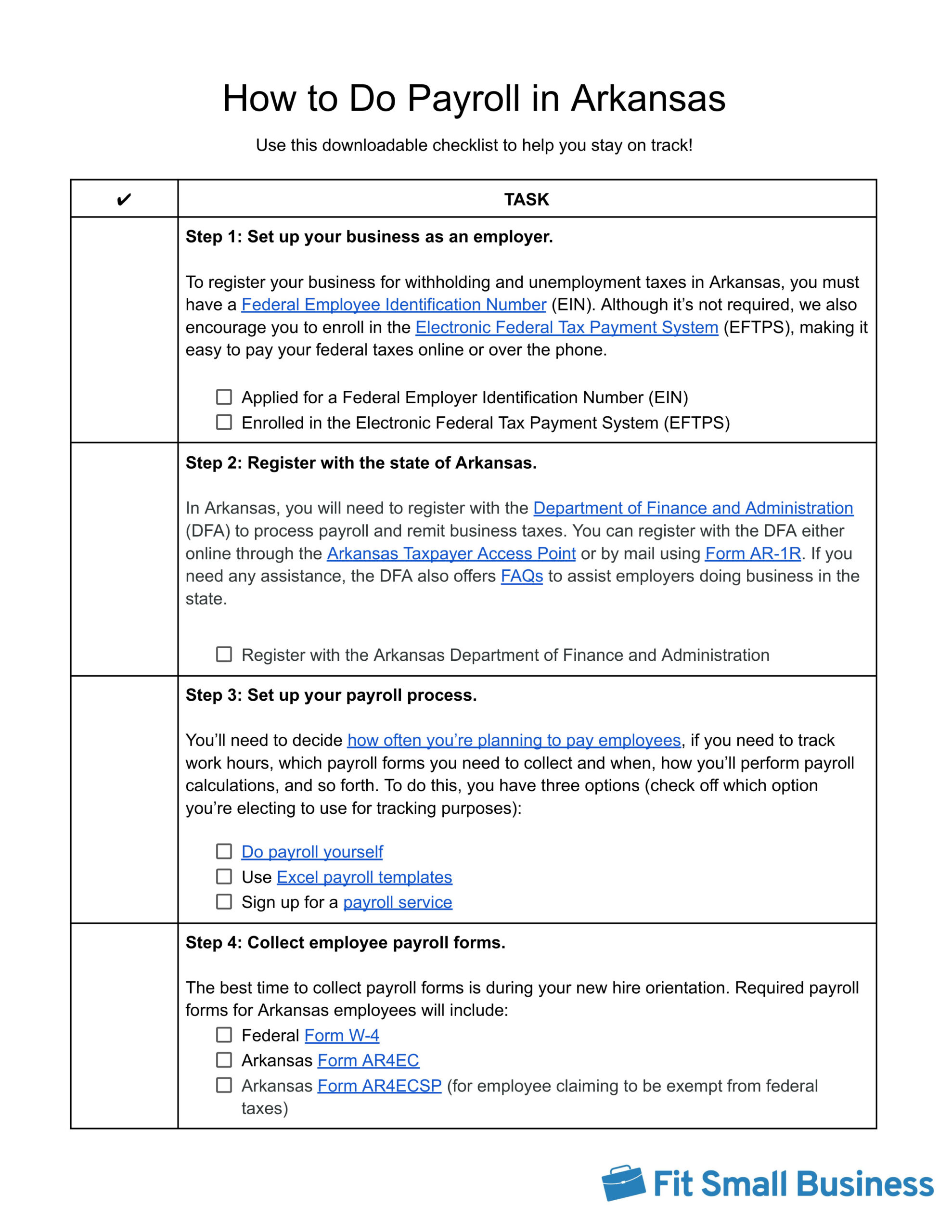

Running Payroll in Arkansas: Step-by-Step Instructions

At the federal level, you need your Employer Identification Number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

If you’re starting a small business, you’ll need to register with the state of Arkansas. You will need to register with the Department of Finance and Administration (DFA) to process payroll and remit business taxes. You can register with the DFA either online through the Arkansas Taxpayer Access Point or by mail using Form AR-1R. If you need any assistance, the DFA also offers FAQs to assist employers doing business in the state.

To set up your payroll, you will need to set a pay schedule and determine a plan for paying employees (i.e., cash, check, direct deposit, pay cards) and processing payroll taxes and deductions.

The best time to collect payroll forms is during new hire orientation. Payroll forms include W-4, I-9, and direct deposit information. Arkansas also requires employees to submit Form AR4EC to withhold income taxes and Form AR4ECSP if the employee is claiming to be exempt from federal taxes.

If you have hourly or nonexempt employees, you’ll need to track employee time. You can use one of our free time sheet templates or choose one of our recommended time and attendance software.

There are many ways to calculate payroll, and it’s up to you to decide which is best for your business. You can use payroll software (choose from our roundup of the best payroll software), a calculator (use our free timecard calculator to do some basic time calculations), or even Excel (we have a free template).

The IRS has forms and instructions on filing federal taxes including unemployment. You can also order official tax forms from the IRS.

To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month.

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must follow these schedules:

- For payments made Wednesday, Thursday, and Friday, deposit employment taxes by the following Wednesday

- For payments made Saturday, Sunday, Monday, and Tuesday, deposit employment taxes by the following Friday

Note that reporting schedules and depositing employment taxes are different. Regardless of the payment schedule you are on, you only report taxes quarterly on Form 941 or annually on Form 944.

For Arkansas withholding taxes, you are required to remit monthly using Form AR941M unless the Arkansas Commissioner of Revenue sends you notification of any change in classification. These payments are due on the 15th of the month.

As with any business record, you want to make sure you have a copy for at least three years. Arkansas law requires companies to keep the following information for at least four years:

- All check stubs and canceled checks

- Cash receipts and disbursement records

- Accounting records (e.g., payroll journal, general journal, and general ledger)

- Copies of federal and state tax reports

- Copies of payroll filings (W-2s and W-3s)

- For each pay period:

- The beginning and ending dates of each pay period

- Total amount and date paid for each pay period

- The day in each week where the most employees worked and how many employees worked on that date

- For each worker, the:

- Biographical information (first and last name, Social Security number)

- Hire information (hire, rehire, and/or return to work dates)

- Termination information (termination date and reason)

- Amount paid to each employee for each pay period and quarterly

- Date and amount of supplemental payments (e.g., bonuses, gifts, and/or commissions)

- Work location

The required federal forms are the W-2 forms (for employees) and 1099 forms (for contractors). These forms need to be provided to employees and contractors by January 31 of the following year. State W-2s are also required for Arkansas and the deadline to provide the forms to employees is also on January 31.

Download our free checklist to help you stay on track while you’re working through these steps.

Learn more about doing payroll yourself in our guide on how to do payroll—it even has a free checklist you can download to make sure you don’t miss any steps. Or, check out our state payroll directory to learn more about the specific guidelines for handling payroll in other states.

Arkansas Payroll Taxes, Laws & Regulations

Federal law requires that you pay income taxes, Social Security, Medicare, and Federal Unemployment Tax Act (FUTA) taxes. Called FICA taxes, Social Security and Medicare are withheld from each employee’s paycheck at 6.2% and 1.45% respectively. You, as the employer, are also required to pay a matching amount out of your bank account. The FUTA rate is 6% on the first $7,000 paid to each employee in that year.

Arkansas Taxes

Arkansas has state income taxes but no local income taxes. The state also has requirements regarding unemployment insurance.

State Income Taxes

Arkansas used to have some of the most complex income tax calculations, along with the highest rates in the country. That has recently changed, with the new highest tax bracket dropping to 4.4%. Here are the current income tax brackets:

Annual Income | Tax Rate |

|---|---|

Up to $5,299 | 0.0% |

$5,300 to $10,599 | 2.0% |

$10,600 to $15,099 | 3.0% |

$15,100 to $24,999 | 3.4% |

$25,000 and up | 4.4% |

State Unemployment Tax

Arkansas’ state unemployment tax (SUTA) rate is 3.1% on the first $7,000 of an employee’s earnings for employers without an established employment record. This is typically for the first three years of your business’ existence. For established companies, your rate is dependent on the size of your payroll and your voluntary termination rate. In short, the more benefits used by former employees the higher your unemployment rate. The current rates for established employers range from 0.1% to 5%.

Workers’ Compensation

You are required to provide workers’ compensation for employees in Arkansas if you have more than three employees, with a few exceptions. For example, farmers, real estate agents, and domestic workers may not be required to have coverage. If in doubt, you should reach out to the Arkansas Workers’ Compensation Commission. Even if it is not required by law, it is good business practice to purchase workers’ compensation insurance to protect against on-the-job injuries.

Workers’ compensation insurance costs around 70 cents for each $100 in payroll you process. For example, a company that processes $500,000 of payroll can expect to pay around $3,500 in insurance.

Minimum Wage & Tips

Most jobs will require you to pay at least minimum wage. Arkansas’ current minimum wage policy is for employers with four or more employees. The 2024 minimum rate is $11.00 per hour for employees with a couple of exceptions, as follows:

- Tipped employees can be paid $2.63 per hour as long as this wage along with their tips equates to $11.00 per hour.

- Full-time students can be paid $9.35 per hour as long as they are working fewer than 20 hours.

Although the federal minimum wage rate is $7.25 an hour, you’ll need to comply with Arkansas’ rate since it’s higher. If you need any assistance with the federal guidelines on exemptions, please use the following: Federal Exemptions for Minimum Wage.

Overtime

Arkansas follows federal overtime law. You’ll need to pay 1.5 times the regular hourly rate for any hours your employees work over 40 in a workweek. Attempting to skirt overtime rules will result in your company underpaying in taxes and facing penalties for noncompliance.

Different Ways to Pay Employees

In Arkansas, you can pay employees by check, cash, pay cards, or direct deposit. However, you cannot require employees to receive their pay via direct deposit. If your company decides to pay all employees electronically and the employee does not agree to provide direct deposit information, you can pay the employee via a pay card. The employee must be able to have one free withdrawal for each payroll deposit.

If you need more information, please see our guide on how to pay employees for more in-depth information.

Minimum Pay Frequency

Arkansas requires that you pay employees at least twice a month. This means you are allowed to pay employees semimonthly, biweekly, or weekly. For companies with an annual gross income of at least $500,000, they may pay exempt management and executive employees monthly.

If you need help to evaluate different pay schedules and which one would be right for your business, use one of our free pay period calendars to help.

Pay Stub Laws

There are no laws regarding pay stubs for employees in Arkansas. However, it is a good business practice to provide employees with an itemized description of wages and deductions.

If you decide on providing pay stubs and would like a template for creating your own pay statements, download one of our free pay stub templates. They’re already formatted, so you can print and use them as needed.

Paycheck Deduction Rules

Arkansas does not have any specific laws stating what can be deducted from an employee’s paycheck. Common deductions include:

- Taxes

- Garnishments and levies

- Benefits

- Reimbursements

Final Paycheck Laws

Arkansas has different rules regarding final pay depending on whether the employee resigned (voluntary termination) or was terminated by the company (involuntary termination).

- Voluntary termination: Must be paid as part of the next regularly scheduled pay cycle

- Involuntary termination: Must be paid on the next regularly scheduled payday

If you find yourself needing to print a check for a terminated employee quickly, you can use one of our recommended free ways to print payroll checks online.

Arkansas HR Laws That Affect Payroll

Arkansas HR laws mostly follow federal guidelines, with the exception of regulations relating to child and youth employment.

Arkansas New Hire Reporting

Arkansas requires you to report new hires or rehires within 20 days of the hire date. You can report using the Arkansas New Hire Reporting Center.

Breaks, Lunches & Time-off Requirements

Arkansas generally follows federal law on breaks, with the exception of youth working in the entertainment industry.

- Breaks and lunches: Arkansas does not require employers to provide breaks to employees except for youths under the age of 16 working in the entertainment industry.

- Vacation and sick leave: Arkansas does not require employers to provide vacation or sick leave.

- Family leave: Arkansas does not have a separate state law regarding family leave. Employers must follow the federal law in the Family and Medical Leave Act (FMLA). This law is for employers that have more than 50 employees for 20 or more weeks in the current or previous year.

- Employees can take FMLA leave if they have worked at the company for at least a year, with 1,250 hours worked in the previous year, and if their physical work location has 50 or more employees in a 75-mile radius. To learn more about FMLA, see the Department of Labor’s guide to FMLA.

State Disability Insurance

Arkansas does not have a state disability program and does not require companies to obtain disability insurance. However, it is a sound business policy, both for your employees and yourself.

Child Labor Laws

In 2023, Arkansas rolled back some child labor protections. Here are the big items that changed:

- Work permits are no longer required for children under 16 (work permits for the entertainment industry are still required)

- Parental consent to work is no longer required for children under 16

- Employers no longer have to verify a child’s age to work

- 14- and 15-year-olds no longer have more restricted work hours during the school year, though federal rules still apply

Youth must be at least 14 years old to be employed in Arkansas with a few exceptions. One exception would be a child working on a family farm.

For all youths under 17, you must maintain accurate records that include their:

- Full name

- Full home address

- Date of birth

- Job title

- Pay rate

- Employer’s certificate and/or work permit

- Hours worked by day including start and end time

- Total hours worked in a week

This is in addition to the required recordkeeping of adult employees.

Click through the tabs below for more information by age:

Minors aged 14 and 15

Fourteen- and 15-year-olds may work provided:

- The employee is working in an occupation not included in the hazardous occupations in the Arkansas Department of Labor’s Guide on Child Labor Administrative Rules. Hazardous occupations include working on a railroad, cooking, and operating power tools.

- Limitations on hours of work:

- Cannot work more than six days per week

- Cannot work more than 48 hours in any week

- Cannot work more than eight hours in a day

- Cannot work before 6 a.m. or after 7 p.m. during school days, and not after 9 p.m. on nights preceding non-school days

Under federal law, they can’t work more than 18 hours during a school week or more than three hours per day.

Minors aged 16

16-year-olds may work provided:

- Employers follow federal law on the jobs and occupations they can perform—those typically considered non-hazardous. These rules can be found in the U.S Department of Labor’s Youth Rules section of its website. Some examples of hazardous occupations include mining jobs and operating power-driven meat or baking machines.

- They do not work:

- More than six days a week

- More than 10 consecutive hours in a 24-hour period

- More than 54 hours a week

- Before 6 a.m.

- After 11 p.m. when there is school the next day

- After midnight when there is no school the next day, with some exceptions listed in Arkansas’ Department of Labor’s Guide on Child Labor Administrative Rules.

Payroll Forms

Listed below are some federal and state forms needed to produce accurate pay for employees and compliant payroll reporting and tax remittance for businesses.

Arkansas Payroll Forms

- Arkansas W-4 Form, AR4EC: To assist employers in calculating tax withholding for employees

- Arkansas Form AR4ECSP: To be given to employees who claim they are exempt from Arkansas state income taxes

- Arkansas Form AR941M: Monthly wage withholding report for employers

Federal Payroll Forms

- W-4 Form: Assists employers with tax withholding calculation for employees

- W-2 Form: Reports total annual wages earned (one per employee)

- W-3 Form: Reports total annual wages and taxes for all employees

- Form 940: Calculates and reports unemployment taxes due to the IRS

- Form 941: Files quarterly income and FICA tax withholding

- Form 944: Files annual income and FICA tax withholding

- 1099 Forms: Provides contractors with pay details that assist them in tax calculation

Arkansas Payroll Tax Resources & Sources

- Arkansas Taxpayer Access Portal: Register a business, access your business tax accounts, file returns, and make payments.

- Arkansas Workers’ Compensation Commission: Obtain more information related to Arkansas workers’ compensation requirements, as well as other laws and rules relating to the protection and well-being of employees.

- Arkansas New Hire Reporting Center: Complete mandated new hire reporting and view frequently asked questions.

- Arkansas Division of Workforce Services: Obtain information relating to the calculation and payment of unemployment taxes.

For more information on payroll laws, please see our payroll compliance guide.

Frequently Asked Questions About Arkansas Payroll (FAQs)

Not as many as there used to be. Effective Aug. 1, 2023, Arkansas rolled back many child labor protections, including work permits, though if you employ children in the entertainment industry, you’ll still need to get a work permit. There are also no longer restrictions on children aged 14 and 15 working during school weeks. Federal laws still apply, however.

Besides mandatory benefits, like workers’ compensation insurance and compliance with FMLA, you’re not required to provide additional benefits in Arkansas. It’s a good idea to go beyond, however, as it can help you attract and retain top talent.

Be proactive. If you make a mistake on payroll, take immediate action to correct the error. If it involves underpaying an employee, make sure you speak with them right away and make an immediate payment to correct the issue.

Bottom Line

Learning how to do payroll in Arkansas is not as hard as it used to be since the state has changed its income taxation practices and rolled back child labor protections, but there are still important nuances to pay attention to. Be sure to follow deadlines and mandates by federal, state, and local governments to avoid any fees or penalties.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.