Doing payroll in Maryland requires knowing local laws, such as the $15.00 state minimum wage, and keeping track of state and local income tax withholding schedules. Maryland has more nuances than the average state—for instance, there are 23 counties that charge local tax.

Key Takeaways:

- Minimum Wage: Effective Jan. 1, 2024, $15.00 per hour

- Overtime: Follows federal overtime rates of 1.5 times the employee’s regular hourly rate

- PTO: Not required for employers to provide paid time off to employees

- Maryland has income tax reciprocity with Pennsylvania, Virginia, West Virginia, and Washington, D.C.

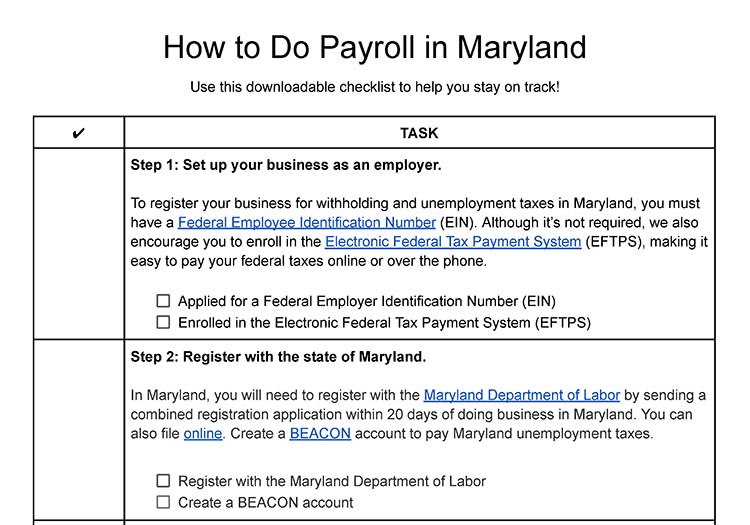

Step-by-Step Instructions for Doing Payroll in Maryland

Step 1: Set up your business as an employer. Get your company’s Federal Employer Identification Number (FEIN). If your company is brand-new, you may need to apply for a FEIN. This is a simple process that can be completed online via the Electronic Federal Tax Payment System (EFTPS). Meanwhile, if you work for a company that already has one, keep the FEIN handy. The FEIN is required to pay federal taxes.

Step 2: Register with Maryland. Register with the state within 20 days of doing business by sending a Combined Registration Application to the Maryland Department of Labor. Alternatively, you may fill out the application online. You will also need to apply for a BEACON account for paying State Unemployment Tax Act (SUTA) taxes.

Step 3: Create your payroll process. You may have inherited a payroll process if you work for an established business. However, if your company is new, you may need to establish your own. Decide how often you’ll be paying employees, when you’ll pay them, and how you’ll track and calculate hourly employees’ work time. You can opt to do payroll yourself by hand, set up an Excel payroll template, or sign up for a payroll service to help you handle your Maryland payroll.

Step 4: Collect employee payroll forms. New employees should submit certain documentation, including payroll forms, during onboarding. All employees must complete I-9 verification no later than their third day on the job. Every employee must also have a completed W-4 form on file. For Maryland, you’ll also need the Form MW507, Maryland’s state withholding form.

Note that Maryland has a Form W-4, but this is only used for employees of the state. If you choose to pay your employees using direct deposit, make sure to collect direct deposit information, as well.

Step 5: Collect, review, and approve time sheets. This step is one you’ll repeat as you do payroll each period. Keeping track of employees’ hours is essential for ensuring accurate payroll. Whether you use paper time sheets, time and attendance software, or a payroll service with a time and attendance system, ensure that you review time sheets for accuracy and discuss any errors or issues with employees right away. Having employees sign their time sheets is a good idea, whether they do so electronically or by pen on paper.

Step 6: Calculate payroll and pay employees. Use a standard process to calculate payroll; take note that using payroll software will reduce errors. Don’t forget to calculate withholdings for non-residents unless you have a bona fide business location in their state. Most companies today use direct deposit to pay their employees, but cash (not the best way) and paper check are also options. You can pay your federal and state taxes online. If you use a benefits provider, it should work with you to make deductions simple, automatic, and electronic.

Step 7: File payroll taxes with the federal government. Federal tax payments must be made via EFTPS. You’ll need to deposit federal income tax withheld, as well as both employer and employee Social Security and Medicare taxes based on the schedule assigned (either monthly or every other week) to your business by the IRS.

- Monthly depositors are required to deposit employment taxes on payments made during a month by the 15th day of the following month.

- Every other week depositors are required to deposit employment taxes for payments made Wednesday, Thursday, and/or Friday by the following Wednesday. Taxes on payments made Saturday, Sunday, Monday, and/or Tuesday are due by the following Friday.

It’s important to note that the schedules for depositing and reporting taxes are different. Employers who deposit both monthly and semiweekly should only report their taxes quarterly or annually by filing Form 941 or Form 944.

Step 8: File payroll taxes with the state of Maryland. File and pay these online via bFile Maryland. You can also bulk upload W-2s. Ensure that you withhold by the following schedule:

If you paid: | You must pay: |

|---|---|

Over $15,000 in the preceding calendar year and have $700+ accumulated withholding | Within 3 days of payroll date |

Less than $700 withholding per quarter | Quarterly (April 15, July 15, Oct. 15, Jan. 15) |

More than $700 in a quarter | Monthly (15th of the following month) |

Less than $250 in a calendar year | Annually (Jan. 31 of the following year) |

SUTA: Pay your SUTA by automated clearing house (ACH) or credit card via BEACON. State unemployment insurance (UI) tax reports and payments are due by the following dates:

For Wages Paid During | Calendar Quarter Ends | Must be Filed & Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

If the due date for a report or tax payment falls on a Saturday or Sunday, reports and payments are due the following business day.

Step 9. Document and store your payroll records. In Maryland, you’re required to keep your payroll documents for at least three years. For complete information, read our article on what payroll documents to keep or check out Maryland’s recordkeeping requirements.

Step 10: Complete year-end payroll reports. At the end of the year, you will need to first complete all W-2 forms for your employees and 1099 forms for your independent contractors. These forms must be provided to employees and contractors no later than Jan. 31 of the following year.

Use this checklist to make sure you follow every step when doing Maryland payroll.

Learn more about doing payroll yourself in our guide on how to do payroll—it even has a free checklist you can download to make sure you don’t miss any steps. Or, check out our state payroll directory to learn more about the specific guidelines for handling payroll in other states.

Maryland Payroll Laws, Taxes & Regulations

Begin by following federal law for income taxes, Social Security, Medicare, and Federal Unemployment Tax Act (FUTA) taxes.

Social Security and Medicare are called Federal Insurance Contributions Act (FICA) taxes and are withheld from each employee’s paycheck at respective rates of 6.2% and 1.45%; you’ll also pay a matching amount out of your bank account.

Maryland Taxes

Maryland has state and local taxes, making it more complicated to manage. You’ll need to know where each employee lives so that you’re aware of which tax agencies you’re responsible for paying.

State Income Taxes

Maryland has a graduated income tax rate of a flat amount plus a percentage over a specific income, like most states. You can find the tax tables on the Maryland Taxes website to help you determine how much you should withhold.

You need to withhold taxes for all employees except the following:

- Those making less than $5,000 annually

- Domestic workers in a private home, college club, fraternity, or sorority

- Clergy

- Nonresident maritime workers

- Certain other nonresidents

- Single and student employees with total income less than specific amounts, such as $234.62 weekly or $12,200 annually. See the chart on Page 9 of the Maryland Withholding Guide for a full list.

- Military spouses claiming exemption under the Military Spouse Residency Relief Act (be sure they fill out a Form MW507M).

Local Income Taxes

In addition, Maryland’s 23 counties and Baltimore City also levy local income taxes; rates range between 0.0225 and 0.0320 (2.25%–3.2%). There are taxes for nonresidents as well.

The latest rates by county are below:

Maryland Resident Employees Who Work in Delaware & Reciprocity

If you have offices in Delaware, your employees who are Maryland residents are taxed at different rates. Find the rates table on Page 10 of the Maryland Withholding Guide.

Maryland has income tax reciprocity agreements with Pennsylvania, Virginia, West Virginia, and Washington, D.C. This means your employees may only need to pay income tax in their resident state if they live in one of those neighboring states.

Unemployment Insurance (UI)

Maryland charges SUTA taxes, which are based on a taxable wage base of $8,500. The standard rate for new employers is 2.6%. New employers in the construction industry and those headquartered in another state pay an initial rate of 3.30%. Rates range from 0.3% to 7.5% for experienced employers and are noted in Rate Table A.

An employer’s UI benefit ratio is computed by dividing their experience rate by the amount of taxable wages paid to employees in the prior three fiscal years ending June 30. The experience rate is the dollar amount of UI benefits paid to former employees.

The following employee types are exempt from UI coverage in certain conditions, which you can find in the Maryland Employer’s Quick Reference Guide:

- Taxicab drivers

- Owner-operated tractor drivers in certain E & F classifications

- Maritime employment

- Election workers

- Church employees and clergy

- Railroad employment

- Newspaper delivery

- Insurance and real estate sales

- Messenger service

- Direct sellers

- Foreign employment

- Work-relief and work-training

- Family members

- Hospital patients

- Student nurses or interns

- Yacht salespersons who work for a licensed trader on solely a commission basis

- Services of aliens who are students, scholars, trainees, teachers, etc., who enter the US solely to pursue a full course of study at certain vocational and other non-academic institutions

- Recreational sports officials

- Home workers

- Casual labor, such as yardwork

Workers’ Compensation Insurance

Employers who have one or more employees, full- or part-time, must provide workers’ compensation insurance. You can purchase it from a licensed insurance company or the Chesapeake Employers’ Insurance Company, which is Maryland’s state-operated fund.

Minimum Wage Laws in Maryland

The Maryland minimum wage applies to workers 18 and older. Employees under 18 must earn at least 85% of the minimum wage. As of January 1, 2024, Maryland’s minimum wage is $15.00 per hour for all employers.

The following exemptions apply:

- Immediate family

- Certain agricultural employees

- Executive, administrative, and professional employees

- Outside sales agents

- Commissioned employees

- Employees who are trainees in a public school special education program

- Non-administrative camp employees

- Restaurants and bars earning less than $400,000 gross annually

- Drive-in theaters

- Food canning establishments

If an employee earns more than $30 per month in tips, they must be paid the state minimum wage. Tips can count for all but $3.63 per hour.

Maryland Overtime Regulations

Employees in Maryland must be paid 1.5 times their hourly rate if they work over 40 hours in a workweek, which mirrors federal overtime rules.

The following exemptions apply:

- Cab drivers

- Agricultural workers (60 hours allowed)

- Bowling establishments (48 hours allowed)

- On-premise care (other than hospitals) for sick, aged, or disabled (48 hours allowed)

- Auto sales and repair establishments

- Nonprofit concert promoters, theaters, or music festivals

- Seasonal amusement and recreational establishments

Different Ways to Pay Employees

You can pay employees by cash, check, or direct deposit. However, you cannot require an employee to use direct deposit. This means you’ll need to offer at least two payment options if direct deposit is one payment method you plan to use.

Maryland Pay Stub Laws

Maryland requires that you provide employees with a pay stub each pay period with the following information:

- Gross earnings

- Deductions

- How wages are earned (salary, hourly, or commission)

- Net wages

- Overtime

- Piece rates

- Net pay

You can learn more from the Pay Stub Transparency Act of 2016.

Minimum Pay Frequency

Employees who are not in executive, professional, or administrative roles must be paid every two weeks or twice a month. They must be paid on time; if a payday falls on a non-workday like a weekend or a holiday, they must be paid on the preceding workday, not after.

Paycheck Deduction Rules

You can deduct money from an employee’s pay for the following:

- Taxes

- Court-ordered deductions such as child support garnishments

- Something of value an employee received, such as an advance or loan

- Something the employee had expressly agreed to, such as health benefits or to recompense for damages or theft caused by the employee

- Uniforms with the company logo

Final Paycheck Laws

Final paychecks must be paid on or before the employee’s regular payday. You do not need to allow an employee to work two weeks before termination or pay them for the time they were not allowed to work. Unused PTO may or may not be paid out, depending on written company policy. Unused sick leave does not need to be paid out unless written in company policy.

Maryland HR Laws That Affect Payroll

Maryland has some state-specific HR laws—some of which affect payroll:

Maryland New Hire Reporting

You must report new hires through the Maryland New Hires Reporting portal within 20 days of their hire or rehire date. If you cannot access the portal, you can fill out the New Hires Form and mail it in.

Lunch & Other Break Time Requirements

The only break laws in Maryland apply to minors and retail workers.

- Breaks for retail workers: Retail workers must receive lunch and short breaks. This applies to stores or franchises employing over 150 people working each day in the last 20 or more calendar weeks. If an employee earns more than half their earnings from commissions, and they earn more than 1.5 times the minimum wage for each hour worked, then they are exempt from this rule.

Qualifying employees receive the following entitlements:

Break Requirements Per Hours Worked | |

|---|---|

Employee Works: | Break Required: |

4 to 6 consecutive hours | 15-minute break* |

More than 6 consecutive hours | 30-minute break |

8 or more consecutive hours | 30-minute break plus a 15-minute break for every additional 4 consecutive hours.** |

*For employees working less than six consecutive hours, the 15-minute break requirement may be waived by written agreement between the employer and employee.

**An employee who is entitled to a 30-minute break is not entitled to the 15-minute break as well. The additional consecutive hours begin following the employee’s previous break. For example, if an employee works a 10-hour shift and is given a 30-minute break at hour 5, the employee would be entitled to a 15-minute break at hour 9.

- Breaks for Minors: Minors under 18 must receive a 30-minute break for every five hours worked.

Paid Time Off

Maryland does not require paid time off, vacation, or sick leave. Follow federal standards. The exception is for retail workers, who can request a religious day of rest each week, as long as they do so in writing.

2024 Update: Maryland paid family leave is set to take effect in 2026. Employer contributions for the paid family leave program begin in 2025, but employees will not be eligible for benefits until 2026. Employees will be able to use benefits to take up to either 12 or 24 weeks of paid leave per year for the following reasons:

- To care for a child during the first year after birth or the placement of the child through foster care, kinship care, or adoption

- To care for a family member with a serious health condition

- Because the covered individual has a serious health condition that results in the covered individual being unable to perform the functions of the covered individual’s position

- To care for a service member who is the employee’s next of kin

- Because the covered individual has a qualifying exigency arising out of the deployment of a service member who is a family member of the employee

All employers in Maryland with at least one employee must participate in this program. For an employee to be eligible, they must have worked at least 680 hours in the previous 12 months.

Hiring Minors

Minors under 18 are required to have a work permit to work in Maryland. If under 14, minors cannot get work permits. Also, minors cannot work hazardous jobs as defined by federal law.

Student learners have other rules. Learn more on the DOL website or download the Minor Fact Sheet.

Minors aged 14 and 15 may not work:

- During school hours

- More than three hours a day or 18 hours a week when school is in session

- More than eight hours a day or 40 hours a week when school is not in session

- Work between 7 p.m. and 7 a.m. (between 9 p.m. and 7 a.m. from June 1 to Labor Day)

For minors 16 and 17, they must:

- Not work more than 12 hours of combined school and work in a day

- Have eight consecutive non-work/non-school hours every 24 hours

Payroll Forms

Maryland has several state-specific forms that may be applicable to your business. The state W-4 form is one all employers need; the others will depend on the type of organization you have and the type of employees.

Maryland State W-4 Form

MW507: Maryland’s state income tax withholding form. If not filled out, then you use the deductions listed in the federal W-4.

Other Maryland State Payroll and Tax Forms

- MW507M: For military spouses requesting a waiver from tax withholdings

- MW508: Annual Employer Withholding Reconciliation Form

- MW508CR: For nonprofits claiming income tax credits

- Maryland State Directory of New Hires Form: For use if you cannot report your new hire online

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculate unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing non-employee pay information that helps the IRS collect taxes on contract work

Maryland Payroll Tax Resources and Sources

- Maryland Department of Labor: Information on labor laws and UI, plus access to forms

- Maryland Employment Standards Service Page: Links to notices you’re required to post for employees, plus information on minimum wage, guidelines, and questions (much is written for employees rather than employers)

- Maryland Comptroller: Information on business taxes and where you can register your business

- Employer’s Quick Reference Guide for Unemployment Insurance: Who pays, how much to pay, how to pay, and other important information about SUTA

- Maryland Withholding Guide: Maryland employer withholding forms, plus all relevant tax tables for employers

- Maryland Workers’ Compensation Commission: Information about workers’ compensation, mostly from an employee POV

Frequently Asked Questions About Maryland Payroll (FAQs)

Yes. Maryland has income tax reciprocity with Pennsylvania, Virginia, West Virginia, and Washington, D.C. This means your employees won’t be double taxed if they live in one of those states. There are separate taxation rules for your workers who live in Delaware.

Not yet, unless you have a company policy that says you do. Starting in 2026, however, there will be a statewide paid family leave program which employees can tap into so they can receive a portion of their pay while out on leave.

Take swift action to correct the error. If your payroll mistake involves a tax payment, contact the agency immediately to discuss the issue and determine your next steps. If the mistake involves an employee’s pay, make sure you speak with them and let them know you’re working to correct the issue as quickly as possible.

Bottom Line

Maryland not only has state income tax but local income taxes as well. It charges unemployment taxes, has a higher minimum wage, and a separate minimum wage for Montgomery County. Be sure you understand the laws affecting payroll, not only for the state but also for your local area.

If you need help running your Maryland payroll, consider using payroll software like QuickBooks Payroll. It files and pays your payroll taxes and covers any penalties you are charged if its reps make a mistake (it’ll also cover your mistakes if you opt for a premium plan). You can pay employees via direct deposit or check, and same-day payment options are available as well. Sign up for a free trial or discounted rate.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.