Ohio is one of the easiest states for employers because it has so few rules on payroll, time off, and breaks. However, pay close attention to income tax calculations, as Ohio’s income taxes include school district income taxes. Below, we cover the basics of how to do payroll in Ohio.

Key Takeaways:

- Minimum Wage: $10.45 per hour (if your company grosses over $385,000 a year), $7.25 per hour (if it doesn’t)

- Tipped Minimum Wage: $5.25 per hour

- Overtime: Ohio follows federal regulations of 1.5 times the employee’s regular pay

- Ohio has income tax reciprocity with Indiana, Kentucky, Michigan, Pennsylvania, and West Virginia

Running Payroll in Ohio: Step-by-Step Instructions

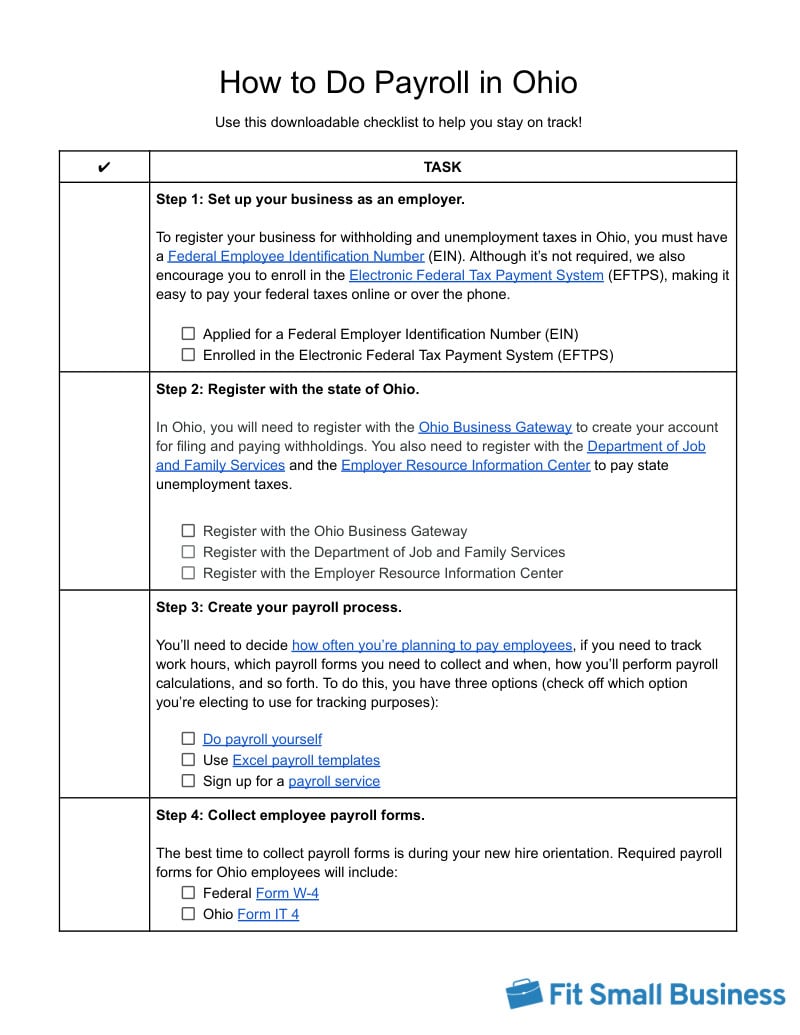

For the federal level, you need your employer identification number (EIN) and an account in the Electronic Federal Tax Payment System (EFTPS).

You need to register with the Ohio Business Gateway online, at which time you’ll also set up your account for filing and paying withholdings. Alternatively, you can fill out a paper form, but it takes weeks to process. You must also register with the Department of Job and Family Services and the Employer Resource Information Center (ERIC) to pay State Unemployment Tax Act (SUTA) taxes.

You may have inherited a payroll process if you work for an established business. But if your company is brand-new, you may need to start your payroll process, which means deciding how often you’ll be paying employees, when you’ll pay them, how you’ll track and calculate hourly employees’ work time, and how to administer benefits. Overall, you can do payroll yourself by hand, set up an Excel payroll template, or sign up for a payroll service to help you handle your Ohio payroll.

This is easiest to do during onboarding. Forms include W-4, I-9, and direct deposit information. For Ohio, you need the IT 4 (employee withholding exemption certificate).

You may use a paper time sheet, sign up for free or low-cost time and attendance software, or subscribe to a payroll service that has a time and attendance system.

Use a standard process to calculate payroll—but using payroll software will reduce errors. Don’t forget to calculate withholdings for non-residents unless you have a bona fide business location in their state. Most companies today use direct deposit to pay their employees, but cash (not the best way) and paper check are also options. You can pay your federal and state taxes online. If you use a benefits provider, it should work with you to make deductions simple, automatic, and electronic. Keep in mind, manually calculating Ohio payroll taxes could lead to problems. Calculations are complex, so errors are easy to make.

Federal tax payments must be made via EFTPS. You’ll need to deposit federal income tax withheld and both employer and employee Social Security and Medicare taxes based on the schedule assigned (either monthly or every other week) to your business by the IRS.

- Monthly depositors are required to deposit employment taxes on payments made during a month by the 15th day of the following month.

- Every other week depositors are required to deposit employment taxes for payments made Wednesday, Thursday, and/or Friday by the following Wednesday. Taxes on payments made Saturday, Sunday, Monday, and/or Tuesday are due by the following Friday.

It’s important to note that the schedules for depositing and reporting taxes are different. Employers who deposit both monthly and semiweekly should only report their taxes quarterly or annually by filing Form 941 or Form 944.

You’ll need to file withholding taxes, and you can do so online at the Ohio Business Gateway (OBG). You need to pay online through the Ohio Business Gateway or using electronic funds transfer through the Ohio Treasurer of State. You only need to file for the quarters in which you withheld taxes. How often you must file depends on the combined amount of income and school district taxes withheld in a 12-month period ending June 30.

Combined withholdings during the look-back period | File and Pay By |

|---|---|

$2,000 or less | Last day of the month following the end of the quarter |

Between $2,000 and $84,000 | 15th of the following month |

> $84,000 | Within three banking days from the end of each partial-weekly period |

> $100,000 | First banking day after payroll is issued |

- SUTA: For any quarter that you don’t have employees and paid no SUTA, you can file by phone at 1-866-44-UC-TAX. Otherwise, you can file online using The SOURCE, Ohio’s Unemployment Insurance Tax System. Payments are due by the following dates:

For Wages Paid During | Calendar Quarter Ends | Must be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

If the due date for a report or tax payment falls on a Saturday or Sunday, reports and payments are considered on time if they are received on or before the following business day.

As with most business records, you want to keep copies. If you ever need to refer to a pay stub, you want to know where to find it and that you have it. The compliance of your business depends on maintaining records for all employees, including those who have left. Ohio, for instance, requires you to keep records on employees for at least five years. Learn more in our article on retaining payroll records.

Send the federal Forms W-2 (for employees) and Form 1099 (for contractors). You also need to submit the IT3 Transmittal of Wage and Tax Statements, and, of course, any reconciliation of taxes, like the IT 942 (through the OBG).

Download our free checklist to help you stay on track while you’re working through these steps:

Ohio Payroll Laws, Taxes & Regulations

As with any state, you should follow the federal law for income taxes, Social Security, Medicare, and Federal Unemployment Tax Act (FUTA) taxes. You’ll need to withhold 6.2% of each employee’s earnings for Social Security and 1.45% for Medicare, then you’ll also pay a matching amount. Income taxes vary and are paid by the employee.

Ohio Taxes

Ohio taxes are a little more complex than in many states. Besides the state income tax, there are school district taxes you must calculate withholdings for and reciprocity agreements that affect workers who live in neighboring states.

Starting with 2024 taxes, employees will only have two tax brackets, reduced from three:

- Annual income of $26,051 to $100,000: 2.75%

- Annual income over $100,000: 3.688%

Ohio has several withholding tables depending on whether you want to hold by percentage, weekly, biweekly, etc. You can find these on the Ohio Department of Taxation website.

Ohio conforms to federal law concerning compensation and qualifying employees. The following employee types are exempt:

- Those exempt under federal law, such as certain agricultural and domestic workers

- Individuals earning less than $300 in a calendar quarter

- Newspaper or shopping news delivery persons who are under 18

- Civilian spouses of military members who have the same state of residency, which is not Ohio

Ohio has a complex schedule for when withholdings are due. There are also fines for failure to file of $50 or 5% per month, and 10% of the delinquent payment per month for failure to pay. Withholdings withheld but not remitted incur a penalty of 50% of the delinquent payment plus double the interest charged.

Ohio has reciprocity laws with Indiana, Kentucky, Michigan, Pennsylvania, and West Virginia. If you have employees who live there but work in Ohio, they will pay income taxes for their own state.

Some local school districts have income taxes. If an employee lives in such an area, you must withhold the income taxes for that school district as well. You can find the school district tax rates on the Ohio Department of Taxation website. You can find the 2024 rates on this document, but they change from year to year.

Ohio charges SUTA based on a taxable wage base of $9,000. It defines wages as “all money, the value of meals and lodging, or other goods and services provided to an employee as payment for personal services.”

SUTA rates run from 0.4% to 10.1% for experienced employers and up to 13.3% for delinquent employers. New employers are charged 2.7%—unless they are in construction, which is 5.6%. The state sends you your contribution rates for the following calendar year by December 1.

You must pay SUTA in the following circumstances:

- You employed one or more people in Ohio on any one day within each of the 20 or more calendar weeks of any calendar year

- Your annual gross wage payroll equals or exceeds $1,500 in a quarter

- You employed agricultural workers and paid $20,000 or more in cash during any quarter of the current or previous calendar year

- You are a nonprofit organization exempt from income tax under federal law but employ more than four people on any one day within each of the 20 or more calendar weeks of any calendar year

- You employed domestic workers and paid $1,000 or more in cash for domestic services in any quarter of the current or preceding calendar year

Ultimately, if you have an employer-employee relationship with a person, then you need to pay SUTA on them.

Workers’ Compensation Insurance

You must have workers’ compensation insurance if you have at least one employee. Ohio provides workers’ compensation insurance through the Bureau of Workers’ Compensation. There are multiple plans depending on the type of business and who you are covering, from mine operators to emergency service volunteers. Rates are set by an industrywide classification and the employer’s work experience. It costs $120 to apply, after which, your employees are covered. You may also elect to self-insure.

Minimum Wage Laws in Ohio

If your company grosses over $385,000 a year, you need to pay Ohio’s minimum wage, which is $10.45 per hour. If it grosses less than that, you may pay employees at the federal minimum wage, $7.25 per hour.

In Ohio, tipped employees must be paid $5.25 per hour plus tips to at least the minimum wage. In addition, employees under 20 can be paid a training wage of $4.25 per hour for the first 90 days of employment, and full-time high school or college students may be paid 85% of the minimum wage for up to 20 hours of work per week at certain employers, such as work-study.

The following exemptions apply:

- Federal government employees

- Babysitters

- Certain agricultural employees

- Outside salesperson

- Family members

- Certain employees of motor carrier companies

- Baseball players in minor leagues under certain conditions

- Camp employees under certain conditions

Ohio Overtime Regulations

Overtime rules apply to employers grossing over $150,000 in a year. You need to pay employees at least time-and-a-half overtime pay if they work more than 40 hours in a workweek—and that’s per federal and state law.

The following exceptions apply:

- Agricultural workers

- Executive, administrative, and professional employees who earn over $107,432

- Some developmentally disabled persons, where full wages might impact their ability to be hired

- Babysitters or live-in companions to a sick, convalescing, or elderly person

- Camp employees under certain conditions

- Family members

- Newspaper delivery persons

- Outside salespersons

- Certain motor vehicle operators

Different Ways to Pay Employees

Ohio does not have any laws concerning the way you pay employees. Keep in mind, however, that over 7 million people in the US don’t have a bank account, which means direct deposit does not work for them. In these cases, checks or pay cards are good options. Some payroll systems even provide special accounts, like Gusto’s Gusto Wallet. Explore the options in our article on paying employees.

Pay Stub Laws

Ohio does not have any pay stub laws, but you must keep payroll records for each employee for five years and include:

- Name, address, and occupation

- Rate of pay

- Amount paid each pay period

- Hours worked each day and workweek

If your software does not create pay stubs, you can download one of our free pay stub templates.

Minimum Pay Frequency

You must pay wages at least twice a month. You can pay on a set schedule, such as on the 1st and 15th, every two weeks, or even weekly or daily. So, for example, all hours worked from the 1st to the 15th of the month are paid on the 1st of the following month. There may be some exceptions according to the standard of the trade or profession, but Section 4113.5 of the Ohio State Code does not specify specific exemptions.

Paycheck Deduction Rules

Ohio law provides for the usual allowable deductions from an employee’s pay, like taxes and healthcare premiums. It also lists what deductions are allowed but which you must first get employee approval in writing:

- Savings accounts or similar plans

- Purchase of US defense stamps or savings bonds

- Repayment of loans to or purchase shares in credit unions

- Contributions to government or quasi-government agencies

- Charitable donations

- Union dues

- Political contributions

Final Paycheck Laws

If an employee is fired or leaves, you need to pay them the final paycheck on the next scheduled payday or within 15 days, whichever is earlier. You cannot withhold the paycheck for any reason, but Ohio makes no rules on whether you need to compensate for accrued but unused paid time off (PTO)—so unless your company has a policy to pay out accrued and unused PTO, you won’t need to pay this benefit. Be sure that’s spelled out in your company policy.

Ohio HR Laws That Affect Payroll

Ohio HR laws are limited, except when it comes to minors. When hiring minors, you need to be concerned with breaks, as well as what jobs and hours they work.

Ohio New Hire Reporting

You must report new hires to the Ohio Department of Job and Family Services within 20 days of hire. Do this through the New Hire Reporting Center online.

Lunch & Other Break Time Requirements

Ohio law requires two 15-minute paid rest periods during each eight-hour shift. These breaks can be scheduled by a supervisor or manager.

Minors need a 30-minute rest period every five hours. You must keep careful records of start, stop, and rest period times. These records need to be kept for two years.

Paid Time Off

Ohio has no laws concerning holiday, vacation, or sick time. Federal law does not require you to give paid time off for vacations, but the Family Medical Leave Act requires you to provide up to 12 weeks of unpaid sick leave for personal illness or caring for a sick member of the employee’s immediate family. Learn more from the Department of Labor’s sick leave breakdown.

Hiring Minors

The Ohio child labor laws cover minors under 18 years old. Minors 14 to 17 years old require a work permit, and employers should require all minors to have employment certificates.

Minors 16 and 17 years old who are required to attend school cannot work before 7 a.m. on a school day or 6 a.m. otherwise. They cannot work after 11 p.m. on a night preceding a school day.

Minors under 16 years old can work up to three hours during school days, and up to 18 hours per week during school weeks, only between the hours of 7 a.m. and 9 p.m. They cannot work more than eight hours per day or over 40 hours per week when school is not in session.

Minors are not permitted to work in the following areas:

- Manufacturing, mining, or processing

- Work in freezers or meat coolers or in meat preparation except for wrapping and packaging meat for sale

- Transportation, loading of trucks

- Warehouse or storage work except clerical

- Construction or repair

- Boiler or engine rooms

- Outside window washing that requires ladders or scaffolding

- Cooking or baking under certain conditions

- Vehicle repair that involves pits, racks, or lifting apparatuses

- Door-to-door sales except under specific conditions

The list is more general for those aged 16 and 17 but mostly includes prohibitions against power-driven machinery, from circular saws to bakery machines. Also prohibited are jobs such as chemical manufacturing, explosives, and logging.

Payroll Forms

For the most part, Ohio requires you to file payroll and withholding forms electronically through the Ohio Business Gateway. You’ll pay electronically as well. While you can find these forms online, you need an exemption from the state if you want to file by mail.

Ohio State IT 4 Form

Ohio’s withholding exemption form is the IT 4. It must be filled out within 10 days of hiring an employee or if the number of exemptions changes. Employees must also fill out a new one if they change school districts.

Other Ohio State Payroll & Tax Forms

- IT 1 Application for Registration as an Ohio Withholding Agent: While the paper copy exists, it can take up to six weeks to process. It’s best to go to the Ohio Business Gateway and apply there. At the same time, you’ll set up your account to file and pay electronically.

- IT 501 Employer’s Payment of Ohio Tax Withheld: For filing and paying quarterly taxes. Unless you filed for an exemption, you must file this electronically according to the schedule.

- IT 941 and 942 Income Tax Withheld: These must be filed electronically at the Ohio Business Gateway.

- SD 501 Employer’s Payment of School District Income Tax Withheld: Must be filed electronically at the Ohio Business Gateway with your withholdings.

- WT 8655 Withholding Tax Payroll Service Company Authorization and Release: To allow a payroll service to file and pay your tax withholdings.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculates unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing non-employee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms you may need.

Ohio Payroll Tax Resources & Sources

- Ohio Minimum Wage Poster: Information you can download and post for employees

- Ohio Department of Taxation Website: Links for forms, tax tables, FAQs, and more concerning income and school district taxes

- Ohio Bureau of Workers’ Compensation: For learning more about workers’ comp and getting a policy.

- Ohio Laws & Administrative Rules: Searchable database of the laws, with the exact wordings

- Ohio Labor Law FAQs: Quick answers to employee questions about wages and pay

- Ohio Department of Job and Family Services: For information about SUTA, new hires, and more

- Ohio State Minor Labor Laws: Employer flier on labor laws for people under 18

Ohio Payroll Frequently Asked Questions (FAQs)

If your business grosses at least $385,000 per year, you’ll need to pay your employees at least $10.45 per hour or $5.25 per hour for tipped employees. If your business doesn’t gross that amount annually, then you need to follow federal guidelines of $7.25 per hour.

Yes. Ohio has income tax reciprocity with Indiana, Kentucky, Michigan, Pennsylvania, and West Virginia. This means if you have employees who live in those states but physically work for you in Ohio, they won’t pay Ohio income tax. They’ll only pay income tax in their home state.

If you make a payroll mistake in Ohio, make sure you work to correct the issue right away. If you missed or made an incorrect tax payment, contact the agency and work out your next steps. If you’ve paid an employee incorrectly, speak with them and let them know you’re correcting the issue right away.

Bottom Line

Ohio does not have rules mandating breaks, time off, or pay deductions. For most employment laws, you can follow federal law. However, income taxes must be paid according to a schedule that’s different from many states, and Ohio requires you to withhold school district taxes. Be sure you understand your obligations so that you don’t incur fines.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.