Justworks is a popular professional employer organization (PEO) that handles payroll, onboarding, and HR. It has tools for compliance training and paid time off (PTO) tracking and can handle payments for employees, contractors, and vendors. However, its focus is on small businesses, and it lacks some advanced features and benefits found in other PEOs. If you need something more, check out these top Justworks competitors.

- Rippling: Best overall Justworks competitor

- Paychex PEO: Best for companies wanting highly customizable PEO plans

- ADP TotalSource: Best Justworks alternative for growing or large businesses

- XcelHR: Best for businesses looking for robust benefits plans with alternative options

- Papaya Global: Best for companies with a global workforce

- TriNet: Best for midsize businesses needing industry-specific PEO services

All the PEOs on our list, including Justworks, offer full-service payroll, tax filing services, paid time off (PTO) management, and online onboarding and offboarding solutions. Standard benefits are also available, such as medical, dental, 401(k), commuter, workers’ compensation, and HSA/FSA plans.

Top Justworks Competitors Compared

Our Score (out of 5) | Starter Monthly Pricing | Time Tracking | Nonstandard Employee Benefits | |

|---|---|---|---|---|

| 4.88 | $59 per employee | $8 per employee monthly |

|

4.42 | Call for a quote | Paid add-on |

| |

| 4.18 | Call for a quote | Paid add-on |

|

| 4.18 | Paid add-on |

| |

| 4.16 | Call for a quote | Paid add-on |

|

| 4.05 | $599 per employee (Global EOR*) | ✓ |

|

| 4 | ✓ |

| |

*EOR stands for Employer of Record; learn more about what they do in our article. | ||||

PEOs are more expensive than payroll or HR software and could be more than you need. Learn more about PEOs and what they can do for your business, or check out our lists of the best human resources payroll software or the top-recommended payroll services for simpler options.

Justworks is an inexpensive PEO that allows payroll for wage-earning and contract employees. Its tools make it easy to onboard new hires, and it provides compliance training, HR advice and support, and health and retirement benefits. Justworks’ transparent and affordable pricing makes it an excellent PEO for small businesses.

Pros

- It has a user-friendly interface with good customer support.

- It has a Justworks-administered 401(k) program.

- It has Internal Revenue Service (IRS), certified PEO (CPEO), and Employer Services Assurance Corporation (ESAC) certifications.

- It offers standalone payroll for those who don’t want full PEO services.

- It offers global contractor payments in more than 30 countries and EOR services in over 100 countries.

Cons

- Time tracking is a paid add-on.

- Medical, dental, vision, health savings account (HSA), and flexible savings account (FSA) are available only in the Plus plan.

- Paydays must follow preset schedules (every other Friday for nonexempt salaried and hourly workers; every 15th or end of the month for exempt salaried employees).

- The standalone payroll module is not available in all US states (as of this writing).*

*Justworks Payroll is only available in Arizona, Arkansas, California, Colorado, Connecticut, Washington, D.C., Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Iowa, Kansas, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Oklahoma, Oregon, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, and Wisconsin.

Justworks can be found on several of our best-of lists:

Rippling: Best Overall Justworks Alternative

Pros

- It is a flexible PEO—you can easily turn its services on and off with a click.

- It has an intuitive platform with great user ratings.

- It has IT tools for software and hardware onboarding and offboarding.

- It can integrate with 500-plus third-party apps.

- It has global payroll and EOR solutions.

Cons

- HR phone support costs extra.

- It lacks IRS and ESAC certifications.

- You can’t buy its payroll solution (and other modules) without purchasing its core Rippling platform.

- Pricing isn’t all transparent.

Overview

Who should use it:

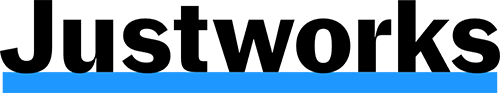

Rippling makes our list of top Justworks competitors because of its PEO services that include a feature-rich platform for managing a wide range of HR processes, including expense management and basic IT tools. Plus, you can upgrade or downgrade from PEO services to using its HR information system (HRIS) platform with a click and not lose any information. No one else offers this simplicity.

Why we like it:

Rippling has the best tools for integrations and onboarding hardware and software. It can even take over your IT duties completely. Its learning system is also exceptional, and users give the platform high praise for ease of use.

However, the provider doesn’t offer straightforward customer support—you have to request a callback via its chat representative. Its PEO service also isn’t IRS- and ESAC-certified. If you require these certifications for PEO reliability and financial assurance, consider Paychex, TriNet, and ADP TotalSource.

Rippling Unity, Rippling’s base platform that all subscribers must purchase, is now called Rippling Platform.

- Rippling PEO: Call for a quote.

Add ons Pricing is based on a quote we received.

- App, device, and computer inventory management: $8 per employee monthly

- Benefits administration: Pricing varies, depending on your insurance broker.

- Time tracking: Call for a quote.

- HR help desk: Call for a quote.

- Rippling can issue company-assigned laptops to new hires, maintain them, and decommission and retrieve them when an employee leaves. It also adds business app access for employees and can even remotely revoke it.

- When it comes to third-party integrations, Rippling takes the lead with over 500 apps—the other Justworks alternatives on our list don’t have a robust software partner network.

- Rippling syncs all the pay data you need, so approving and running it is fast. While it offers international payroll in over 150 countries, Papaya is your best bet for international PEO, as its global payroll services cover more than 160 countries.

- Access 1,000 ready-made online courses, or you can upload your own. You can add built-in quizzes, generate certificates for compliance, and mandate training with automatic courses. It can even withhold clock-ins until a course is complete.

- Customizable workflows with ready-made automation recipes allow you to streamline HR and payroll compliance across various HR functions.

Rippling says it takes as little as 90 seconds to run payroll. (Source: Rippling)

Paychex PEO: Best for Highly Customizable PEO Options

Pros

- It has a dedicated team of experts.

- It offers a financial wellness program for employees.

- It has a wide range of HR solutions and services.

- It is IRS- and ESAC-certified.

Cons

- It has nontransparent pricing.

- Annual contract

- Fees can change each year.

Overview

Who should use it:

Paychex PEO is on our list of best PEO software, particularly because it’s such a flexible program. One reason Paychex gives a custom quote is because it lets you pick and choose from hundreds of tools—from training and time tracking to payroll and professional HR advisers. It also has recruitment and applicant tracking tools, which Justworks lacks.

Why we like it:

Paychex services over 600,000 SMBs, making it one of the popular PEO competitors to Justworks. Its Paychex Flex platform often makes our lists for best HRIS software and top payroll solutions for SMBs. We also rank it among leading Zenefits competitors and ADP competitors. Similar to Rippling and TriNet, it has a feature-rich platform and a wide range of HR functionalities (from applicant tracking to staff scheduling and compensation planning).

While its customizable PEO plan is great for those looking for specific HR and payroll solutions, Paychex doesn’t publish its pricing online. Plus, unlike Justworks, it does not offer unlimited pay runs and vendor payments.

- Call Paychex for a quote.

- Paychex offers two-click payroll if you don’t have changes from pay run to pay run.

- Apart from direct deposits, it can pay with a payroll card and, similar to ADP, will stuff and mail checks for an extra fee. It can pay internationally but through a third-party service. For international payroll, check ADP, Rippling, or Papaya.

- Paychex provides access to standard benefits (like health, retirement, and workers’ compensation plans). It also offers a financial wellness program that includes access to financial counseling, spending and savings accounts, and more.

- You get a team of dedicated experts, each with a specialty in your PEO plan, as well as an HR generalist.

- Its learning management system is set apart from those on our list (even Rippling’s) because it has an artificial intelligence (AI) tool that recommends courses based on employee position and work goals.

- Paychex excels in compliance and risk management tools. It has employment practices liability and cyber insurance, plus a safety rep to help you prevent or deal with Occupational Safety and Health Act (OSHA) risks.

Paychex sets you up with an entire team of dedicated specialists. (Source: Paychex)

ADP TotalSource: Best for Growing or Large Businesses

Pros

- It is a highly experienced PEO that’s IRS- and ESAC-certified.

- It has a wide range of HR features and services, with global payroll solutions.

- It has a dedicated support specialist.

Cons

- Pricing isn’t transparent.

- Customer service isn’t always easy to contact.

Overview

Who should use it:

If you’re on the cusp of moving from an SMB to a large business or have plans to grow that big, ADP TotalSource is a great choice for PEO. It is a top PEO service and often makes our competitor lists, like the best Paychex competitors.

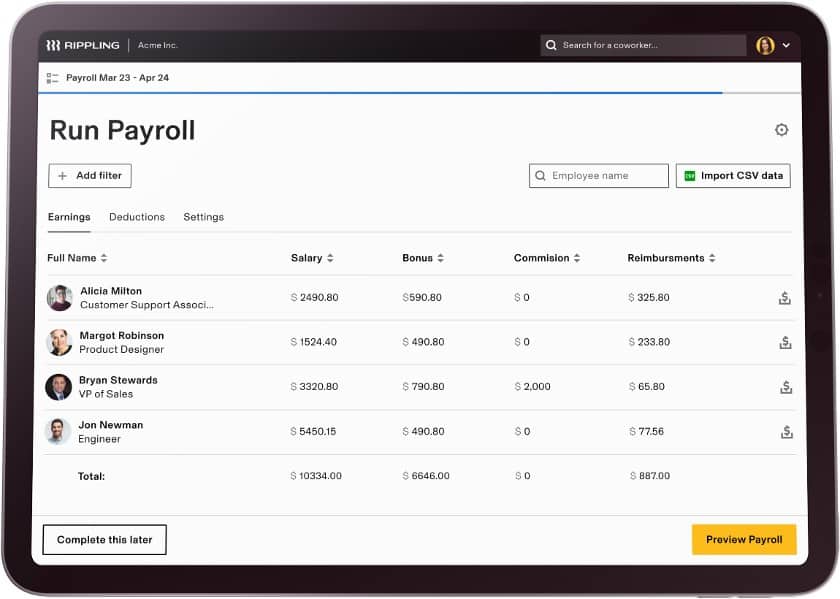

Why we like it:

Its non-PEO programs, such as ADP Run, can be found on our lists for the best payroll and best HR software. That means you can start with a simpler platform and grow as needed, or jump right into PEO services. Its starting price is competitive, but costs will grow as your needs do.

While ADP TotalSource has efficient HR administration and solid pay processing solutions, it doesn’t publish pricing information on its website. It also lacks the vendor payment feature that Justworks offers.

- Similar to Paychex, ADP can provide check signing and stuffing services, whereas Justworks simply requires you to print and send checks yourself. It also pays by direct deposit, like all PEOs, as well as with pay cards.

- If a PEO is more than you need, you can outsource your HR services to ADP, which sets it apart from Justworks and Papaya. Employees can contact ADP’s HR experts to get help with choosing the best benefits plan as well as dealing with technical issues on the app.

- ADP offers strategic HR services through online tools, while TriNet offers advisers. You can conduct a compensation analysis, run an engagement survey, train leaders through online programs, and more. If you need help, it has talent specialists that you can contact for an extra fee. Paychex has many similar tools, charging for each one you add to your plan.

- Like Justworks, Papaya, and Rippling, ADP works with international companies; however, it requires these organizations to have over 50 employees spanning three countries. Papaya, however, is more flexible and overall better for international businesses.

ADP has tools that not only work on desktop and mobile but also with smartwatches. (Source: ADP)

XcelHR: Best for Companies Needing Robust Employee Benefits

Pros

- It has a wide range of benefits, including home insurance and an employee assistance plan.

- It has a dedicated representative and live support.

- Compliance support includes workplace safety inspections and policy help.

Cons

- It has nontransparent pricing.

- Its interface looks dated.

- It doesn’t have IRS and ESAC certifications.

Overview

Who should use it:

If providing employee benefits is important to you, XcelHR is a great choice because of its robust offerings of both standard and nonstandard options. Aside from the usual options (such as health and retirement plans), you are granted access to staff discounts, pet insurance, and an EAP to help your workers who need legal or financial advice or are struggling with employee burnout or stress.

Why we like it:

XcelHR has a PEO service that covers a wide range of HR processes—from onboarding to payroll tax administration and even recruiting assistance (this costs extra). Similar to ADP and Paychex, it can pay employees by check, direct deposit, and pay card.

Its platform is also generally easy to learn and use, although the software looks dated. While it can manage basic to advanced HR tasks, it doesn’t offer vendor payments and unlimited pay runs. Plus, it isn’t IRS- and ESAC-certified like Justworks, ADP, Paychex, and TriNet.

- Call XcelHR for a quote.

- In addition to payroll and tax compliance assistance, XcelHR has advisers who can help you write job descriptions, create policies, review applicant resumes, and facilitate workplace safety audits and inspections. The HR compliance services of the other providers on our list, including Justworks, aren’t as robust.

- XcelHR may not have a full learning management system (LMS) like Rippling, TriNet, ADP, and Paychex, but the training sessions it offers are slightly more extensive than Justworks. Aside from the standard discrimination and harassment prevention sessions, XcelHR provides supervisor training programs to help eligible workers improve their interviewing skills and coach them on how to handle the employee termination process.

XcelHR offers a wide range of benefits options for SMBs. (Source: XcelHR)

Papaya Global: Best for Multinational Companies with Global Teams

Pros

- It is an international payroll for wage earners or contractors.

- It has transparent pricing.

- It pays in local currency.

- It has EOR services in 160-plus countries.

Cons

- EOR service is a bit pricey.

- It has no domestic-only PEO service.

- It doesn’t have IRS and ESAC certifications.

- It collects an onboarding fee and a refundable deposit.

Overview

Who should use it:

Justworks may offer global contractor payments in more than 30 countries and EOR services in over 100 countries (as of this writing), but its coverage isn’t as extensive as Papaya Global. Ranking No. 1 on our list of best international payroll services, it’s an ideal option for businesses that need help hiring and paying global workers in over 160 countries.

Why we like it:

It stands out from the other Justworks competitors on our list because it provides solid international PEO (employer of record) services, has transparent pricing, and works through local HR services, so your people have in-country support. It also has an intuitive platform with excellent compliance support.

However, it isn’t IRS and ESAC certified. Plus, its services are geared toward global companies, lacking the local PEO support that the other providers on list (including Justworks) offer.

- EOR: Starts at $599 per employee monthly

- Includes tools and services to help you pay and hire international employees

- Agent of Record (AOR): Starts at $200 per contractor monthly

- This has similar functionalities as an EOR service, but specifically for paying and hiring global contractors; also comes with contractor misclassification services.

- Contractor Payments & Management: Starts at $30 per worker monthly

- This is similar to the AOR but without the contractor misclassification service.

- Payroll Plus: Starts at $25 per employee monthly

- Requires at least 101 employees

- Includes global payroll services only (without international hiring support)

- Payments: Starts at $2.50 per transaction

- This is a global workforce payments solution for processing international salary payouts and paying local authorities, such as tax agencies.

- An employer of record, Papaya hires and pays employees on your behalf. Like a PEO, it can provide enterprise-level benefits. Unlike ADP, there is no minimum size or country limit to use its services.

- Papaya pays in any of 160-plus local currencies.

- Unlike ADP or TriNet, Papaya works with partners located in-country to handle HR issues. Papaya says this lets them work with the most knowledgeable resources globally. They can provide advice on labor laws, compensation, and other HR needs.

- Papaya surpasses ADP, TriNet, and Ripping in its immigration services. It can obtain work permits for expatriates and short-term assignments. It also obtains permits for families.

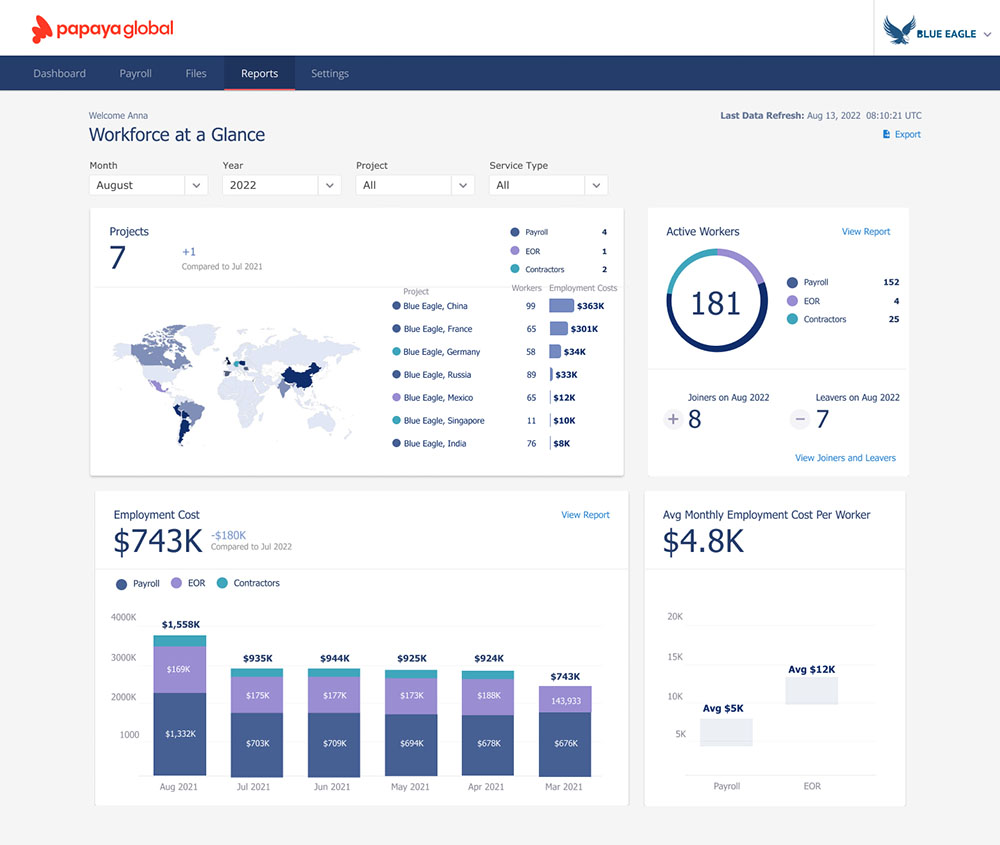

Papaya Global has workforce reports that allow you to see headcount numbers and employment costs. (Source: Papaya Global)

TriNet: Best for Midsize Businesses Needing Industry-specific PEO Services

Pros

- It has a flat, per-employee fee.

- Prices decrease after specific goals are reached.

- It tracks industry regulation changes to ensure compliances are met.

- It is IRS- and ESAC-certified.

Cons

- Pricing is not transparent.

- It can be expensive.

- It has dedicated reps for larger businesses only.

- Annual contract

Overview

Who should use it:

Among the Justworks competitors we reviewed, we found TriNet a good PEO option for midsize companies needing industry-specific HR support. While it offers general compliance solutions to help you manage payroll and tax regulations, it has tailored plans that monitor compliance and labor rules for over a dozen specific industries, such as retail, entertainment, finance, life sciences, and manufacturing.

Why we like it:

TriNet is more expensive than most on our list (based on the quote we received)—and certainly more than Justworks—but it’s also more complete in its offerings, with comprehensive payroll, scheduling, and strategic HR services. However, it doesn’t handle vendor payments and lacks unlimited pay runs. Justworks is still the best option for these two functionalities. Although, if you want a PEO service that can run unlimited payroll, consider Rippling.

- TriNet offers strategic HR assistance (such as compensation advice to ensure your salaries are competitive) and manages claims against you for employment practices, including pre-negotiated legal fees and caps with external counsels.

- It has employee engagement tools like ADP and Paychex but goes further with team-building functions that can help develop employee talent and strengthen teams.

- TriNet offers a streamlined expense management solution that lets workers upload scanned receipts, track mileage (by map or by entering miles), and categorize expenses. This makes it easy for managers to approve expenses, after which they seamlessly transfer to payroll. ADP, by contrast, requires a third-party app for expense management, while Rippling (and Justworks) doesn’t track mileage.

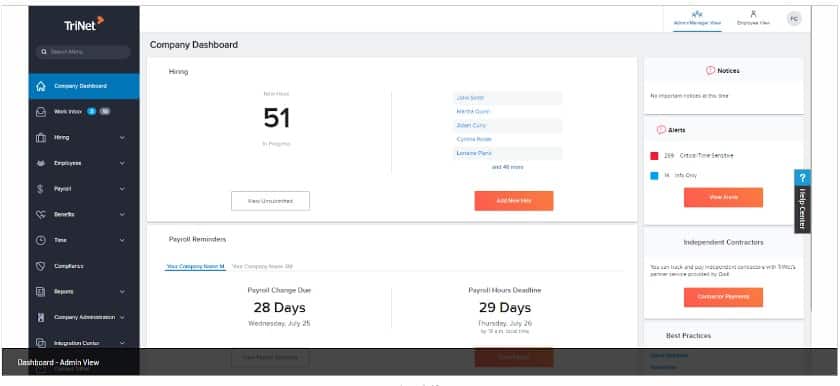

TriNet has a clean, easy-to-use interface. (Source: G2)

Methodology: How We Evaluated the Best Justworks Alternatives

When looking for the top Justworks alternatives, we naturally chose top-rated PEO solutions, many of which you can find in our other reviews. We also looked for standouts in price, ease of use, and features like payroll, onboarding, and compliance tools.

To see our full evaluation criteria, click through the tabs in the box below.

20% of Overall Score

We looked for providers with transparent pricing, zero setup fees, and charges on a per-employee basis.

20% of Overall Score

We looked for robust HR administrative support, from hiring to retiring, including assistance with employee career development, compliance tracking, and benefits offerings that are available across the US.

5% of Overall Score

The IRS and the Employer Services Assurance Corporation (ESAC) both certify PEOs for adherence to strict standards and ethical practices, so we checked whether these providers are certified. We also considered customized reports as these are often for compliance issues.

25% of Overall Score

We looked for automatic payroll runs, direct deposits, paper check options, W-2 reporting, and payroll tax processing (federal, state, and local taxes).

15% of Overall Score

While all the products on our list offer great features, this criterion looked at how well they worked for the needs of small businesses, especially those on a budget.

15% of Overall Score

In addition to having helpful features like how-to guides, dedicated representatives, and customer support options, we looked at user reviews from third-party sites like G2 and Capterra. Then, we averaged the ratings on a 5-star scale, wherein an average of 4-plus stars is ideal.

Bottom Line

Justworks is an excellent PEO for small businesses, but it has some limitations. Its global contractor payments option is only available in over 30 countries, while the coverage of its international PEO (or EOR service) isn’t as extensive as some of its competitors.

These top six Justworks competitors are great alternatives. These providers can cater to various needs like international HR (Papaya Global), flexible PEO with software or hardware onboarding (Rippling), extensive benefits options (XcelHR), industry-specific compliance (TriNet), or if you want room to grow in size or toolset (ADP and Paychex) without having to switch providers. Regardless of your choice, the PEO services listed here are top-notch in quality.