Payroll compliance refers to the legal obligation businesses have to adhere to local, state, and federal laws related to employee compensation. It’s not just about paying your employees on time, but also ensuring that you’re withholding the correct amounts for taxes, providing the right benefits, and complying with labor laws.

When you have remote workers, you must comply with the payroll laws of their city and state, which may be different from where your business is located. Make sure you’re prepared by understanding the laws you need to follow. You can use this downloadable payroll compliance checklist to help ensure you don’t miss anything important.

1. Payroll Taxes Must Be Calculated Correctly & Paid on Time

When doing payroll, you must withhold the correct amounts of payroll taxes from employee paychecks and pay them as required (monthly, quarterly, or annually). There are federal and state payroll taxes, and you’ll need to determine the appropriate tax rates to ensure your calculations are correct.

Specifically, you need to withhold the following federal taxes from employees’ paychecks (state taxes vary, depending on the state): Income tax, Social Security, and Medicare.

There are also employer payroll taxes you must pay out of your own bank account, something you’ll need to set up as part of your payroll internal controls. You’ll pay the same amount in Social Security and Medicare taxes (often referred to as FICA taxes) as you withhold from employee paychecks. In addition to FICA, employers are responsible for paying FUTA (federal unemployment tax).

2. Workers’ Compensation Insurance Is a Required Purchase in Most States

Another important law that affects your payroll compliance is the workers’ compensation insurance requirement. Most states require you to purchase workers’ comp to cover potential expenses from on-the-job injuries by employees. It’s usually funded through private entities and is regulated and overseen by the state.

There are very few exceptions to the workers’ comp requirement—and Texas is the only state in which employers can opt out of purchasing the insurance. So, if you are a new business that doesn’t operate out of Texas, do not skip this step. Many payroll services give you the option to purchase workers’ comp through one of its partners or its own in-house products.

3. Employers Are Responsible for Managing Court-ordered Garnishments

There may be times when you receive a court order to withhold funds from an employee’s paycheck to cover a debt. This is serious, and you must act quickly, or you could be responsible for paying the funds later.

You’ll typically receive an income withholding order, also called payroll garnishments, if an employee is behind on child support or student loans. You can also receive an earnings withholdings order for other debts that other parties have been awarded in a lawsuit.

4. Tax Forms Must Be Filed by Their Deadlines

Employers must report the taxes they withheld and paid to the IRS and other tax agencies so that they can verify. Some reports must also show total income paid out—in particular, the year-end W-2 forms that are required to be mailed out by January 31.

If you’re using contractors, you’ll need to send 1099 forms. It’s important to make sure that each of your employees is classified properly. To do so, make sure you know the differences between W-2 employees and 1099 contractors. There are many other payroll forms employers may need—some at the beginning of an employment relationship and others more regularly, like quarterly.

5. Payroll Records Must Be Kept on File for Three to Four Years

You are responsible for several recordkeeping requirements for payroll. One best practice many employers follow is to keep all payroll records, like paycheck stubs, year-end tax forms, new hire tax forms, time sheets, and payroll registers, for at least four years. The law allows you to keep some of them for a minimum of three years, but some states may require longer. All of this falls under your payroll accounting, a crucial component of your business operations.

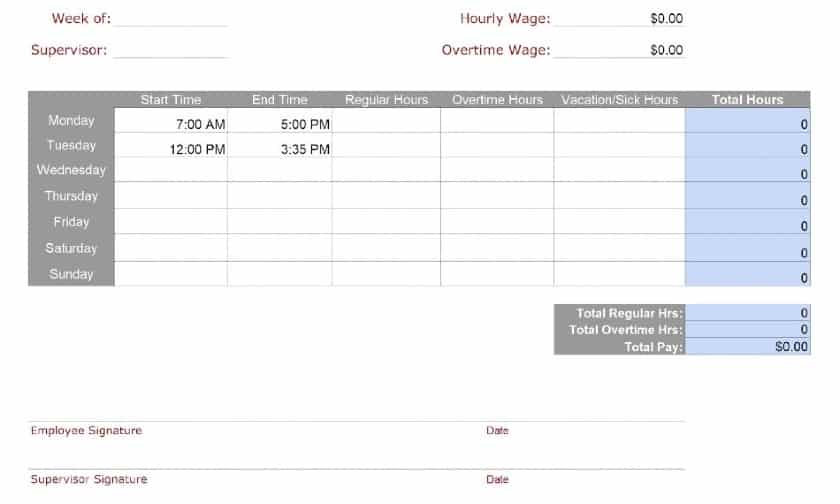

Employers may use any timekeeping method they want to, but records must be complete, accurate, and untampered with by the employer, aside from a supervisor sign-off. Employers may not alter timecards.

The following is a sample time card format employers can use. Be sure to include the total hours worked, meal and rest times, and the employee’s signature.

Although there are no DOL rules relating to how time sheets should look, it’s important that you include enough information so that the employee, supervisor, payroll/accounting, and any outside auditors can make sense of the record when necessary.

6. Some Employees Must Be Paid Overtime & Minimum Wage Is Required

Federal law requires you to pay employees extra if they work overtime. In addition, there are minimum wage amounts you must pay to each employee depending on which state you’re operating in or, if you have remote workers, the state or city where those employees live and work. There are overtime and minimum wage exemptions, so you’ll need to familiarize yourself with them to ensure the employee situation you’re considering is eligible.

For more information on overtime and minimum wage on a state-by-state basis, check out our state guides to running payroll. Just click on the state you operate in on the map below:

State Payroll Directory

7. Employees Must Be Paid on Time

When you start paying employees, it is important to set a pay schedule on which they’re regularly paid. Weekly, every other week, and twice monthly are the most common pay periods, but some businesses pay out monthly. Each state has its own minimum pay frequency requirements, so be sure to check yours.

Many states also have final paycheck regulations dictating when to pay an employee should they voluntarily leave or be terminated. States like New York and Washington give employers until the next scheduled payday to square up any owed monies, while California requires that all pay due is paid to employees at the time of termination.

8. Multiple Payroll Options Are Sometimes Legally Required

Usually, employers have autonomy in determining their preferences on how to pay employees, whether that be by paper check or direct deposit. There is no requirement that companies must pay their employees via direct deposit. Most employers offer that as it is easier to process payroll and allows employees to get their money faster. Approximately 93% of employees receive their pay via direct deposit. However, since the use of pay cards is starting to increase, some states have passed laws requiring employers to offer an additional pay option beyond just that.

Also, contrary to what some believe, employers can pay employees paychecks in cash. The important thing is to learn how to pay employees cash legally. Proper documentation is one of the most important factors that will help you avoid fines and penalties.

9. Specific Rules on Paying Tipped Employees Must Be Followed

If you operate within the restaurant industry and some of your employees receive tips or are part of a tip pool, then you need to be aware of tip reporting laws. This is incredibly useful if tipping pools are a part of your business.

One common challenge that many foodservice employers encounter is how minimum wage can be governed within jobs that also are eligible for tips. If you have no idea how restaurant payroll works, ask for some legal advice to understand the specifics. For example, many states can pay their tipped employees a tipped minimum wage, which is a rate that is below the state’s required minimum wage, with the concept being that these employees get paid from the restaurant plus their tip “wages.”

Some states do not allow this practice; these states are known as “equal treatment states” and include Alaska, California, Minnesota, Montana, Nevada, Oregon, and Washington. Other tip wage laws differ significantly from state to state, so research your state laws carefully.

Common Small Business Payroll Mistakes

Small businesses can face severe consequences when payroll mistakes occur. Here are a few of the most common errors and their potential costs.

- Employee misclassification: Sometimes businesses misclassify workers as independent contractors instead of employees to save on taxes and benefits. However, this can result in heavy fines and penalties from the IRS. For example, if a worker is misclassified as an independent contractor, the IRS can charge the business $50 for each W-2 the company failed to file, along with payroll tax liabilities and penalties. In many cases, businesses are also responsible for back pay, back overtime, and back taxes for both the company and the employee.

- Incorrect tax withholdings: If a business fails to withhold the correct amount of taxes from an employee’s paycheck, it could lead to underpayment or overpayment of taxes. Underpayment can result in penalties from the IRS, while overpayment can lead to disgruntled employees who may feel cheated out of their hard-earned money.

- Late payroll taxes: If payroll taxes are not paid on time, the IRS can impose a penalty of up to 15% of the unpaid tax. States also have the authority to levy penalties against employers that don’t pay their state payroll taxes on time. This can add up quickly and put a significant financial strain on a small business.

- Inaccurate payroll records: Keeping inaccurate payroll records can lead to lawsuits from employees claiming unpaid wages. These lawsuits can cost businesses a lot in legal fees, settlement, and damage to their reputation, which can indirectly lead to high turnover rates.

How to Remain Current With Payroll Compliance Laws

According to the National Small Business Association (NSBA), the top two burdens on small businesses are income and payroll taxes. These administrative and financial-related burdens can be time-consuming and complex due to their evolving nature. Because of this, small business owners often find themselves spending an excessive amount of time completing them.

If you have chosen not to employ a payroll service to assist you with these regulatory responsibilities, you’ll need to learn how to do payroll yourself. Plus, you’ll have to stay on top of payroll laws that change frequently.

We recommend that you take the following actions on an annual basis:

- Hire an auditor to review your payroll records, processes, and procedures. You can also conduct your own payroll audit and should regularly do payroll reconciliation.

- Sign up for the e-newsletter from the Small Business Administration (SBA).

- Visit the Department of Labor (DOL) website, which offers useful, easy-to-find payroll regulatory information on the FLSA and other payroll-related laws.

- Although you will need to maintain an annual membership, check the Society of Human Resource Management (SHRM), which retains a wealth of knowledge regarding payroll compliance laws, including details of the FLSA. An annual SHRM membership starts at $264.

- See the American Payroll Association (APA), which provides solid resources listed that no small business owner should be without. For example, we like the Compliance Calendar, which outlines critical payroll filing dates that are challenging to find anywhere else. It is a great tool that can help your team stay on top of the many evolving tax filing rules and their dates throughout the year.

Agencies That Regulate Payroll Laws: IRS & DOL

The institutions that govern payroll law nationwide, the Internal Revenue Service (IRS) and the Department Of Labor (DOL), are what we look to as payroll laws evolve. The IRS is responsible, in large part, for the taxation portion of payroll compliance. Meanwhile, the DOL manages aspects that differ from state to state, but more specifically, how the Fair Labor Standards Act (FLSA) impacts payroll processing.

International Payroll Considerations

The globalization of business has opened up a world of opportunities for small businesses to outsource work internationally. However, with these opportunities come complex challenges in paying international employees.

Employee classification: Just as in domestic operations, proper classification of employees is crucial. However, the standards for classifying workers may vary greatly across different countries. For instance, the criteria for deciding who is an employee versus a contractor can differ from the US standards. Misclassifying workers can lead to penalties and fines, so it’s essential to understand local labor laws.

Common geography-specific challenges: Businesses often face difficulties when dealing with different time zones, languages, and cultures. You must also consider salary, benefits options, and leave entitlements—not just for compliance, but for competitiveness as well.

Compliance with local payroll laws: When employing staff overseas, businesses must comply with the local payroll laws of the respective country. This includes understanding and adhering to tax withholdings, contributions, and Social Security requirements. For example, in some countries like Brazil, Switzerland, and Germany, employers are required to contribute to a worker’s healthcare and retirement funds. Failure to comply with these laws can result in severe financial penalties.

Small Business Payroll Compliances FAQs

Understanding employee classification is crucial because it determines how you withhold taxes, pay overtime, and provide benefits. Misclassifying workers (such as treating an employee as an independent contractor) can lead to severe penalties, including back taxes, fines, and even lawsuits.

Tax regulations can change frequently, so it’s recommended to review tax regulations at least once a year during tax season. However, staying updated quarterly can help you catch changes as they occur. Subscribing to updates from the IRS or a trusted financial news source can be helpful.

Ensuring accurate and timely payroll involves meticulous record-keeping, regular audits, and using reliable payroll software. Consider training your payroll staff on the latest best practices, or outsourcing to a professional payroll service provider, especially if you’re operating in multiple states or countries.

Employee classification can vary significantly between countries. In some places, factors such as the number of hours worked, the nature of the work, or the level of control over the worker might determine classification. It’s crucial to understand the local labor laws of the country where you plan to outsource work. For complex situations, consider consulting with a local legal expert or a Professional Employer Organization (PEO).

Bottom Line

Payroll processing and its related compliance requirements can be complicated to manage in the long run due to a multitude of payroll laws that are complex and ever-evolving. Helpful resources and payroll partners can help.

Although the IRS and DOL offer copious amounts of resources, they each are somewhat unforgiving regarding oversights and poor practices; you can face expensive penalties for even unintentional lapses, so it’s important to stay abreast of changes.