Processing payroll in Rhode Island is a somewhat clear process. Most of the regulations are pretty straightforward and follow general federal guidelines. However, several specific labor law regulations like minimum wage (which is higher than the federal rate) and employer tax funds must be considered to ensure state payroll compliance. Using our guide below will ensure you take the proper steps to correctly do payroll in Rhode Island.

Key Takeaways:

- Minimum wage: $14.00 per hour, increasing to $15.00 per hour on January 1, 2025

- Overtime: Follows the federal guidelines of 1.5 times the regular rate of pay

- PTO: Not required

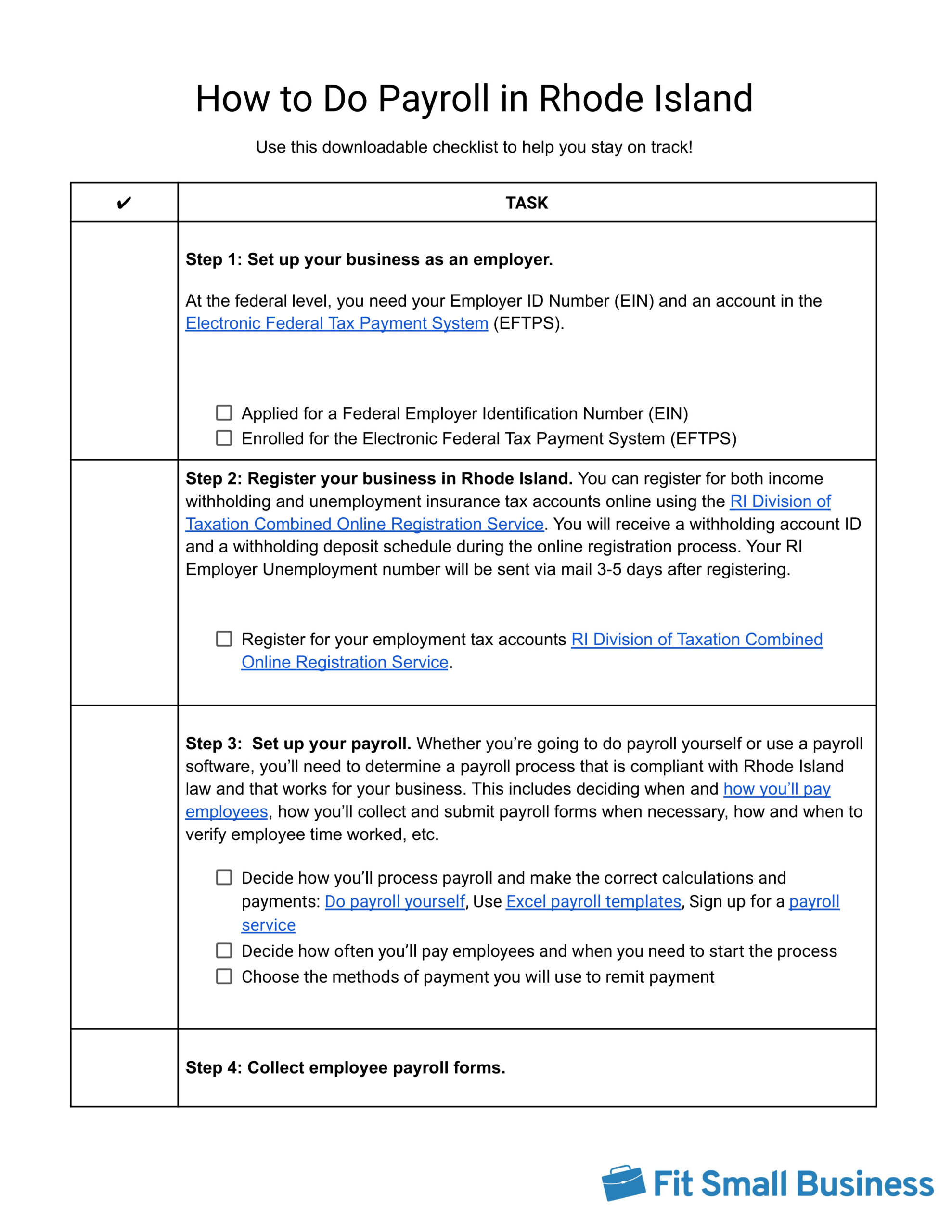

Step-by-Step Instructions to Running Payroll in Rhode Island

At the federal level, you need to apply for a federal employer identification number (EIN) and register for an account in the Electronic Federal Tax Payment System (EFTPS).

If you’re a new business, you’ll need to set up your new business first. You can register for both income withholding and unemployment insurance tax accounts online using the RI Division of Taxation Combined Online Registration Service. You will receive a withholding account ID and a withholding deposit schedule during the online registration process. Your RI Employer Unemployment number will be sent via mail three to five days after registering.

Whether you plan to do payroll yourself or use payroll software, you’ll need to determine a payroll process that is compliant with Rhode Island law and that works for your business. This includes deciding when and how you’ll pay employees, how you’ll collect and submit payroll forms when necessary, how and when to verify employee time worked, etc.

It’s best to collect employment forms from new hires during the onboarding process. Federal payroll forms include the W-4, I-9, and a direct deposit authorization form. Unlike some states, Rhode Island also requires employees to fill out an additional document for state withholding called the RI W-4.

Make sure to do this a couple of days before payday, as Rhode Island payday laws require employers to establish a regular payday within nine days from the end of the payroll period. Use one of our free time sheet templates to help if you don’t yet have an established time and attendance system.

There are many ways to calculate payroll, and it’s up to you to decide which is best for your business. You can use payroll software (choose from our roundup of the best payroll software), a calculator (use our free time card calculator to do some basic time calculations), or even Excel (we have a free template).

Federal tax payments must be made via EFTPS. Generally, you must deposit federal income tax withheld and both employer and employee Social Security and Medicare taxes based on the schedule assigned to your business by the IRS. It could be one of the following depositing schedules:

- Monthly Depositor: Requires you to deposit employment taxes on payments made during a month by the 15th day of the following month.

- Semiweekly Depositor: Requires you to deposit employment taxes for payments made Wednesday, Thursday, and/or Friday by the following Wednesday. Deposit taxes for payments made on Saturday, Sunday, Monday, and/or Tuesday by the following Friday.

It’s important to note that schedules for depositing and reporting taxes are not the same. Employers who deposit both monthly and semiweekly should only report their taxes quarterly or annually by filing Form 941 or Form 944.

All state tax payments must be made directly to Rhode Island’s Division of Taxation. All filings and payments are due at the same time, weekly, monthly, or quarterly based on how much has been withheld.

It’s essential to keep records for all your employees, even those terminated, for at least three to four years. Learn more in our article on retaining payroll records.

You will need to complete W-2s for all employees and 1099s for all independent contractors. Both employees and contractors must have received these documents by January 31 of the following year.

Download our free checklist to help you stay on track while you’re working through these steps:

For a more general overview of what you should know when doing payroll according to federal standards, check out our guide on how to do payroll.

Rhode Island Payroll Taxes, Laws & Regulations

While you won’t need to worry about local taxes, there are certain aspects you need to keep in mind with RI to ensure compliance with your payroll. All Rhode Island employers are responsible for paying payroll taxes, in addition to Social Security (6.2% of each employee’s pay), Medicare (1.45% of each employee’s pay), and unemployment taxes (6% of the first $7,000 of each employee’s pay for federal unemployment) for each of their employees.

You will need to pay Social Security and Medicare (FICA tax) amounts from your business bank account, in addition to withholding the required amounts from employee paychecks, which in total will match what you’re responsible for paying. Federal unemployment (FUTA) is all on you.

Rhode Island Payroll Taxes

There are no local or city taxes in Rhode Island, which makes the process of filing payroll taxes much simpler than states that do.

State Income Tax

Rhode Island has three different state income tax brackets, with the lowest income earners paying the lowest rates. For the 2024 tax year, the income tax rates are as follows:

- 3.75% on the first $77,450 of taxable income

- 4.75% on taxable income between $77,450 and $176,050

- 5.99% on taxable income over $176,050

Employers are required to withhold state withholding from an employee’s income and remit it on their behalf. Filings are required based on the following schedules:

- Weekly: If an employer withholds $600 or more for a calendar month, the employer must report and remit the taxes withheld weekly. Payments are due the next banking day following the end of the week (generally Monday, unless Monday is a holiday). If there was no tax withheld in a particular week, a return for the period is not required.

For weekly depositors, all filings and payments must be made via Online Wage Tax Filing.

- Monthly: If an employer withholds $50 or more but less than $600 for any calendar month, the employer must report and remit taxes monthly.

- For nonquarter-ending months, Form 941M must accompany the payment. Both the return and payment are due.

- Returns for March, June, September, and December should be filed on or before the last day of the following month using Form RI-941.

For monthly depositors, if withholding is more than $200 but less than $600, all filings and payments must be made via Online Wage Tax Filing. If withholding is more than $50 but less than $200, filing and payment are not required to be filed online.

- Quarterly: If an employer withholds less than $50 for any calendar month, the employer must remit taxes quarterly. Form RI-941 must accompany the payment. Both the return and payment are due on or before the last day of the month following the close of the quarter.

For quarterly depositors, online filings and payments are not required.

Unemployment Insurance Tax

Rhode Island has a state Employment Security (UI) fund that provides benefits to workers during periods of unemployment. Contributions collected from Rhode Island employers are used exclusively to pay benefits to unemployed workers. Employers are charged between 1.1% and 9.7% of the first $29,200 each employee earns in a calendar year.

A contribution tax rate is computed and mailed to each employer at the end of December for the following year. The first time you pay wages in Rhode Island, you will be considered a “new employer” and assigned a contribution rate of 1%.

In addition to the Employment Security fund, there is an additional Job Development fund that is also fully funded by employer contributions.

Job Development Fund Tax

Employers pay 0.21% of the first $29,200 that each employee earns in a calendar year ($30,700 for employers with an experience rate of 9.49 or higher) to support the Rhode Island Human Resource Investment Council (HRIS). The HRIC assists Rhode Island employers by funding different projects that work to improve and upgrade the skills of the existing workforce.

Each employer’s Employment Security tax rate is reduced annually by 0.21% to ensure that this program does not result in a tax increase.

Workers’ Compensation Insurance

Workers’ compensation insurance covers medical bills, rehabilitation costs, and lost wages for employees who get injured or experience a work-related illness. Coverage is mandatory under the Workers’ Compensation Act for most employers with one or more employees under Rhode Island law. Individual owners and partners are exempt.

Employers should obtain coverage through their own private insurance broker. In Rhode Island, Beacon Mutual Insurance Company, the administrator of Rhode Island’s insurance pool, is the carrier of last resort. This means that if an employer cannot obtain workers’ compensation insurance from another carrier, Beacon Mutual should provide the coverage.

The state-required poster naming the employer’s insurance company or adjusting company must be displayed in the workplace. This poster is provided to employers by their insurance company.

Rhode Island has strict penalties for any employer who is not compliant with the state’s regulations for workers’ compensation coverage. These penalties include the following:

- An employer failing to display the workers’ compensation poster faces a fine of $250.

- An employer failing to provide the required workers’ compensation insurance may be fined $1,000 per day for each day without workers’ compensation insurance. An employer may also be subject to a felony charge and, upon conviction, face a $10,000 fine and two years in prison.

- A business operating without the required workers’ compensation insurance may be closed.

Rhode Island Minimum Wage

As of January 2024, the minimum wage rate in Rhode Island is $14.00 per hour.

Rhode Island’s minimum wage for tipped employees is $3.89. If employees are not paid the standard minimum wage when tipped wages earned are combined with tips received, the employer must pay the difference.

Rhode Island’s minimum wage is scheduled to rise again on January 1, 2025, to $15.00 per hour.

Exceptions to Minimum Wage:

- Full-time students under 19 years of age working in nonprofit religious, educational, librarial, or community service organizations: 90% of applicable minimum wage

- Fourteen- and 15-year-olds who do not work more than 24 hours a week: 75% of the applicable minimum; for any week in which a 14- or 15-year-old works more than 24 hours, the higher applicable minimum rate must be paid for all hours worked in that week

- Workers employed in domestic service in or about a private home; federal service; voluntary service in educational, charitable, religious, or nonprofit organizations where employer/employee relationships do not exist; newspaper carriers on home delivery; shoeshine persons; caddies on golf courses; ushers in theaters; traveling or outside sales occupations: no specific regulations

Rhode Island Overtime Regulations

Rhode Island labor laws require an employer to pay overtime to employees, unless otherwise exempt, at the rate of one and a half times the employee’s regular rate of pay for all hours worked over 40 hours in a workweek.

Exceptions to Overtime:

- Any summer camp employee when it is open no more than six months of the year

- Police officers, firefighters, and rescue service personnel

- Employees of the state or political subdivisions of the state

- Executive, administrative, and professional employees

- Drivers, mechanics, and carriers

- Salespeople, parts persons, and mechanics primarily engaged in sales

- Agricultural employees

Different Ways to Pay Employees in Rhode Island

While there are many different ways to pay employees, Rhode Island Wage and Hour Laws specifies that an employer must pay wages by either of the following:

Payroll cards can be a great option for unbanked employees. If you’re interested in learning more, check out our guide to the best pay card providers for small businesses.

Rhode Island Pay Stub Laws

Rhode Island requires that employers provide their employees with a pay stub every regular payday. These pay stubs need to include the following:

- A statement of the hours worked by that employee during the applicable pay period

- A record of all deductions made from that employee’s gross earnings during the pay period (with an explanation or reason for any irregular deductions)

Employers are allowed to provide these statements digitally; however, they must be able to provide all employees with a printed or handwritten copy at no cost to them if the employee requests one.

Minimum Pay Frequency

Like many other states, Rhode Island has guidelines for employers that mandate how frequently their employees need to receive pay for work completed. Rhode Island’s Guide to Wage and Workplace Laws states that all employees with fixed compensation (salaried employees) can be paid biweekly or semimonthly as long as every employee is paid a minimum of twice per month.

Hourly employees or employees without fixed payments should be paid on a weekly basis. A few exemptions to this include the following:

- State employees or employees of political subdivisions

- Religious, literary, or charitable corporations

The RI Department of Labor and Training may permit an employer, upon written request, to pay employees less frequently than weekly for the following cases:

- Its average payroll exceeds 200% of the state minimum wage.

- The employer ensures regular payments to employees—no less than 2× per month.

- The employer provides proof of a surety bond or other sufficient demonstration of security in the amount of the highest biweekly payroll exposure in the preceding year.

Notice of any changes in a scheduled payday needs to be given to all employees at least three paydays in advance of the change.

If you need help understanding pay periods or deciding which pay period is best for your organization, check out our article on pay periods and download one of our free payroll calendars.

Paycheck Deductions

Except for federal taxes, state taxes, and FICA, Rhode Island employers are not permitted to make any deductions from their employees’ wages without their consent. There is a list of deductions, however, that are permitted with written authorization from the employee. Those deductions include the following:

- Union dues

- Health insurance, pension plan deductions, welfare, annuity of life

- Prepaid legal services

- A loan or advance against future earnings or wages (if there is a statement)

It’s important to note that deductions for damage to an employer’s property or rent due are prohibited under all circumstances.

Severance Pay in Rhode Island

As a Rhode Island employer, you don’t have to provide your employees with severance pay if they are terminated or voluntarily leave.

Rhode Island law will only enforce that you pay severance payments to your employees if there is a signed, written agreement in place between an organization and an employee.

Final Paycheck Laws

Rhode Island requires that any unpaid wages or compensation for a terminated employee be paid on the next regular payday and payable at the usual place of payment (direct deposit, pay card, etc.).

Separating from an employee can often be a difficult process for business owners, often starting with notifying them of their termination. For guidance and a free template, check out our guide to termination letters.

Accrued PTO Payouts

Rhode Island requires that if an employee has been with a particular employer for at least one year, any vacation pay accrued should become wages and be payable in full or on a prorated basis with all other due wages on the next regular payday for the employee.

Since Rhode Island requires PTO payouts for employees employed for over a year, you must have a reliable way to track balances. For help with this, check out our article on how to calculate vacation accruals, which even has a free PTO calculator.

Rhode Island HR Laws That Affect Payroll

Rhode Island has quite a few HR laws, but many align with federal labor laws. When processing payroll in Rhode Island, paying close attention to required meal breaks and approved jobs for children in the workforce will be necessary.

Rhode Island New Hire Reporting

Rhode Island requires that newly hired employees be reported within 14 days of their hire date. This includes all full-time, part-time, and temporary employees. Employers can report all new hires online via the Rhode Island New Hire Reporting Directory.

Employers must report rehires or employees who return to work after 60 days of being laid off, furloughed, separated, granted leave without pay, or terminated from employment. This also includes recalled employees—those who remain on the payroll during a break in service or gap in pay and then return to work, such as teachers, substitutes, and seasonal workers.

Meal Breaks

Meal breaks are not required by federal law, but they are mandatory for Rhode Island employees. A 20-minute meal period must be given during a six-hour shift, and a 30-minute meal period must be given during an eight-hour shift. These breaks do not need to be paid. This doesn’t apply to employees of licensed healthcare facilities.

Employers are only required to provide these mandated meal breaks if they have at least five employees. In addition, employers need not provide a meal break if fewer than three employees work on a given shift.

Paid Sick Leave

The Healthy and Safe Families and Workplaces Act gives Rhode Island employees the right to take time off from work to care for themselves when they are too sick to work, injured, or have a routine medical appointment. They may also use earned leave to deal with the impact of domestic violence, sexual assault, or stalking. Plus, earned leave may be used to assist their child, spouse, domestic partner, or other household members for the same purposes.

If you have 18 or more employees, you will be required to offer paid sick and safe leave. Employers with fewer than 18 employees must provide sick and safe leave time, although it does not need to be paid.

Employees can accrue up to 40 hours per calendar year to use however they see fit. You can only ask for documentation for employees to use this time off in limited circumstances. For example, if an employee misses more than three work days in a row, employers have the right to ask for a doctor’s note. However, you are not allowed to ever ask for information about illness or details of domestic violence.

Child Labor Laws

The Department of Labor and Training (DLT) of Rhode Island has a list of permitted jobs for minors who want to work in the state. These approved jobs include office and clerical work, cashiering, bagging and carrying out orders, delivery work, and kitchen work.

In addition to approved jobs, it also has a list of prohibited occupations that minors are not allowed to engage in under any circumstances. These prohibited occupations include manufacturing and mining jobs, coal mining, and roofing operations.

For the full list of all approved and prohibited occupations, check out the labor standards page of the website.

The DLT has also set forth regulations regarding how much work a child can complete and the hours they are allowed to work. These regulations are as follows:

Those aged 14 or 15 cannot work: |

| EXCEPTION: An exception is provided for minors employed pursuant to a Work Experience and Career Exploration Program (WECEP). |

|---|---|---|

Those aged 16 or 17 cannot work: |

| EXCEPTION: There are no hour limitations during school vacations. There are no limitations on hours or a curfew for 16- and 17-year-olds who have left school. |

Payroll Forms

Rhode Island has its own form for state income tax withholding, as well as other withholding forms. Here are some of the important forms you will want to make sure you have on hand when processing payroll in Rhode Island.

Rhode Island State Forms

Rhode Island requires that you have all employees complete a federal W-4 form to determine what their federal withholding is. Additionally, you will also need to have all employees complete an RI W-4, Rhode Island’s withholding form for state income tax.

On top of the state withholding form, there are also a few other withholding forms for employers to be aware of:

- RI-W3: Transmittal of Wage and Tax Statements

- 941M: Monthly Withholding Return, used by monthly depositors for the months of January, February, April, May, July, August, October, and November

- RI-941: Employer’s Quarterly Tax Return and Reconciliation, used by quarterly filers and monthly filers for quarter-ending months (March, June, September, and December)

- 941Q: Quarterly Withholding Return, for use for periods on or before 12/31/2019

Federal Payroll Forms

-

- Form W-4: To help employers calculate taxes to withhold from employee paychecks

- Form W-2: To report total annual wages earned (one per employee)

- Form W-3: To report total wages and taxes for all employees to the IRS (summary of W-2s)

- Form 940: To report and calculate unemployment taxes due to the IRS

- Form 941: To file quarterly income and FICA taxes withheld from paychecks

- Form 944: To report annual income and FICA taxes withheld from paychecks

- Form 1099-MISC: To provide nonemployee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide to federal payroll forms you may need.

Rhode Island Payroll Resources & Sources

- Rhode Island Department of Labor and Training: Employers can get information on unemployment insurance, paid sick and safe leave, and even post-job openings.

- Rhode Island Division of Tax—Employer Tax Section: This website is where employers will file and report all payroll taxes, if they are not using a payroll provider or filing via mail. There is also an employer tax handbook that can be referenced for any questions, and plenty of information regarding employer funds.

- A Guide to Wage and Workplace Laws in Rhode Island: This guide was published by the Rhode Island Department of Labor and Training Workforce Regulation and Safety Division. It is a guide to all labor law regulations in the state of Rhode Island, including child labor, lunch periods, payroll record requirements, and more.

- Rhode Island New Hire Reporting Directory: This is an online service that allows employers to log in and easily report all new hires and rehired employees.

Frequently Asked Questions (FAQs)

Rhode Island mandates weekly pay for nonexempt employees, but there are exceptions. For exempt employees, they can be paid twice monthly.

No. If you have employees working in Rhode Island but living in another state, you must withhold Rhode Island state income tax from their wages. The employee’s home state may provide a tax credit for them during tax time.

Yes. Rhode Island has several payroll taxes employers must manage, like SUTA. These taxes must be paid according to the schedule assigned to your business.

Bottom Line

Processing payroll in Rhode Island is a pretty simple process. You’ll need to take note of the higher minimum wage and specific tax rates when calculating payroll. Overall, though, most of the regulations align with federal standards, so you don’t have to worry about conflicting rules.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.