Aside from being affordably priced, the best payroll software for small business users calculates employee wages and deductions accurately and pays and files payroll taxes automatically. Most offer unlimited pay runs, paid time off (PTO) tracking, two-day direct deposits, employee self-service portals, and access to employee benefits.

In this guide, I compiled a list of the top seven payroll systems for small business owners.

- Gusto: Best overall small business payroll software

- Square Payroll: Best payroll software for restaurants and retail shops

- Rippling: Best for payroll automation

- QuickBooks Payroll: Best for QuickBooks users and contractor payments

- RUN Powered by ADP: Best for growing businesses

- Patriot Payroll: Best for affordability

- Paychex Flex: Best for payroll services and support

Best Payroll Software for Small Business Compared

Expert Score (out of 5) | Starter Pricing | Contractor-only Payroll Plan | Time Tracking | |

|---|---|---|---|---|

| 4.22 | $49 per month + $6 per person per month | $6 per worker + $35 base fee monthly | Included in higher tiers |

| 3.75 | $6 per employee + $35 base fee monthly | $6 per worker monthly | ✓ |

3.69 | $8 per employee + $40 base fee monthly | No separate plan | Paid add-on | |

| 3.67 | $6 per employee + $50 base fee monthly | $15 monthly for up to 20 workers + $2 per additional worker | Included in higher tiers |

| 3.49 | Call for a quote | No separate plan | Paid add-on |

3.35 | $5 per employee + $37 base fee monthly | No separate plan | $2 per employee + $3 base fee monthly | |

3.31 | Call for a quote | No separate plan | Paid add-on | |

Looking for more than just payroll tools? Consider a professional employer organization (PEO) service like Justworks. It tops our list of best PEOs for small businesses and covers everything from recruiting to retiring. For $59 per employee monthly, it handles payroll, assumes tax liability, and takes HR worries off your hands.

Gusto: Best Overall Small Business Payroll Software

Pros

- Unlimited and automatic pay runs

- Access to Gusto brokered health plans with zero administration fees (pay only for premiums)

- Financial wellness tools available via Gusto Wallet

- Offers international contractor payments and Employer of Record (EOR) services to hire and pay global employees

Cons

- Child support garnishment service isn’t available in South Carolina

- Time tracking, next-day direct deposits, performance reviews, and multistate payroll are available only in higher tiers

- No dedicated payroll specialist

- Priority phone support is reserved for the Premium plan (costs extra for the Plus plan)

Overview

Who should use it:

Gusto ranks high among its competitors as its payroll and HR features enable small businesses to operate with the amenities that some larger companies offer. It ensures payroll compliance with its tax filing services, automatic calculations, and compliance alerts—leaving you with more time to manage your business. It also supports multiple pay schedules and can pay employees via the Gusto Wallet app, direct deposits, and checks you print yourself.

Why I like it:

I appreciate its automatic pay runs and user-friendly interface, which make running Gusto payroll easy even if you have minimal knowledge of paying workers. If you plan to expand your business and are unsure how to handle state regulations, Gusto can assist in registering your company in 50 states. It even supports global contractor payments in more than 120 countries, although its EOR service, Gusto Global, is only available in 12 countries Gusto Global is available in Australia, Brazil, Canada, Germany, India, Ireland, Mexico, Netherlands, Portugal, Spain, the Philippines, and the United Kingdom. (as of this writing).

Its unlimited and full-service payroll, employee benefits options, and wide range of HR tools contributed to its overall 4.22 out of 5 score. However, multi-location business owners might find Gusto a bit pricey because they’ll have to upgrade to at least its Plus plan to unlock multiple state pay runs. If you have a limited budget, any of the other payroll software for small companies on our list can handle your multistate payroll needs (although Patriot Payroll charges $12 monthly for each additional state tax filing).

Gusto plans

- Simple: $49 per month + $6 per person per month

- Plus: $80 base fee + $12 per employee monthly

- Premium: $180 base fee + $212 per employee monthly

- Contractor-only payroll plan: $35 base fee + $6 per contractor monthly (for businesses that only pay contract workers)

Add-ons

- State payroll tax registration: Pricing varies per state

- R&D tax credits: 15% of identified tax credits

- Health insurance and other benefits: Pricing varies by benefit

- International contractor payments: Custom-priced

- Gusto Global): $699 per employee monthly ($599 per employee monthly until 12/31/2025)

Add-ons for the Simple plan only

- Time tracking with scheduling: $6 per employee monthly

- Next-day direct deposits: $15 base fee + $3 per employee monthly

- Performance reviews: $3 per employee monthly

- Priority support: $30 base fee + $4 per employee monthly

- HR resources: $50 base fee + $5 per employee monthly

- Includes access to HR documents, federal and state compliance alerts, and HR advisory services

Add-ons for the Plus plan only

- Priority support and HR resources: $8 per employee monthly

- Simple-to-use payroll interface: You can process payroll in three steps and view or edit employee hours, time off and overtime details, deductions, and earnings on one page.

- Financial management tools: The free Gusto Wallet app lets your employees track finances, identify budgets for expenses, split paychecks into different accounts, and automatically set aside money every payday as savings.

- Payroll tax filings: Like most of the payroll software on my list, Gusto calculates, withholds, and pays taxes at the federal, state, and local levels automatically. QuickBooks Payroll, on the other hand, requires you to upgrade to its higher tiers for automated local tax filings. Patriot Payroll may offer tax filing assistance, but only if you sign up for its Full Service plan.

Gusto lets you add employee time data and additional earnings like bonuses directly into its payroll solution. (Source: Gusto)

Want to see how Gusto compares with its competitors and other HR software? Check out these articles:

- Gusto vs Square Payroll

- Wave Payroll vs Gusto

- Gusto vs QuickBooks Payroll

- Rippling vs Gusto

- Gusto vs BambooHR

- ADP vs Paychex vs Gusto

Square Payroll: Best for Small Restaurants & Retail Shops

Pros

- Offers flat pricing with an affordable contractor plan

- Connects easily with Square POS.

- Has two- and four-day direct deposits, including an instant payment option via the Cash App

Cons

- Instant payments require you to store funds in an online Square balance account

- Limited HR tools

- Square Payroll only integrates with QuickBooks Online

Overview

Who should use it:

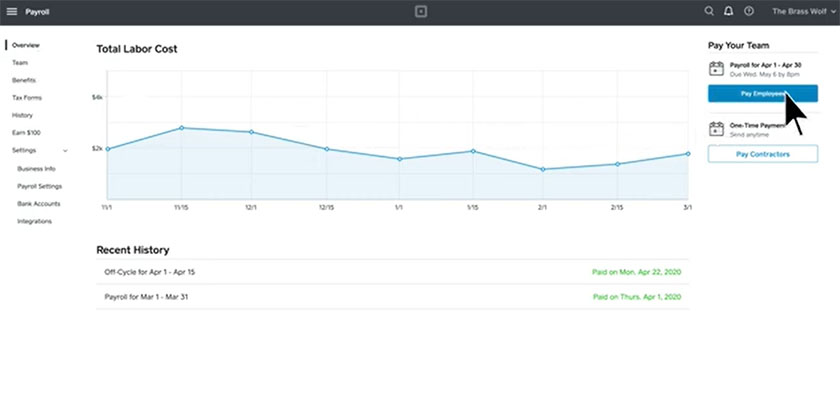

Square Payroll is the best choice for small restaurants and retail shops, especially those already using Square’s POS system. The integration between these two Square products makes it easy to import online timecards, including tips, from Square POS into its payroll tool for pay processing.

Why I like it:

As a small business payroll software for restaurateurs and retailers, Square Payroll saves you time by eliminating the need to manually compute wages, deductions, and taxes. Similar to Gusto, you can set payroll to run automatically and as often as needed at no extra cost. This is unlike big-name providers like ADP that charge per pay run.

In my evaluation, Square Payroll earned a 3.75 out of 5 rating. While I like that you can track employee tips and commissions via Square POS and easily transfer the data to Square Payroll for pay processing, it doesn’t have a wide range of HR solutions. Rippling is a great choice if you want an all-in-one HR payroll software. It even offers corporate cards that your employees can use and has IT tools to manage business apps and devices.

Although Square has an affordable contractor-only payroll plan, it isn’t as low-cost as QuickBooks Payroll’s contractor payment package. QuickBooks will only charge you $15 monthly for 20 workers + $2 for each additional worker, whereas Square will bill you $6 per contractor monthly.

Square Payroll plans

- Pay employees and contractors: $35 base fee + $6 per employee monthly

- Pay contractors only: $6 per person monthly

Add-ons

- Health, retirement, and workers’ comp. plans: Custom-priced

- Mail paper copies of W2s/1099s: $3 per mailed form annually (digital delivery of Form W2s and 1099s is free)

- Payroll amendment service: Custom-priced

- Includes help in correcting errors in reported tax forms and payroll documents, such as amending federal employer identification number (FEIN) tax account issues and correcting an employee’s name or Social Security number

- Smooth integration with Square products: It integrates well with Square POS, which allows for direct tracking of employee work hours and tips on its dashboard and easy importing of attendance and tip data into Square Payroll to pay workers. You can even get money from your Square balance account to fund payroll.

- Tax amendment services: While this is a paid add-on, this service includes adding missing payroll history from a previous payroll provider that was not submitted on time. It also covers amendments for contractors that should have been reported as W-2 employees and vice versa. These services are crucial if you’re new to paying employees and need help managing the intricacies of amending payroll reports submitted to local authorities.

- Online forum or community: You get access to Square’s online community where you can meet other Square users, ask them questions about the payroll platform or other Square products, and even solicit advice on how to tackle small business operations, like launching a digital marketing campaign.

Aside from letting you run payroll, Square Payroll’s main dashboard shows your pay run history and an overview of your total labor costs. (Source: Square Payroll)

Rippling: Best for Payroll Automation

Pros

- Modular HR, payroll, expense management, and IT features integrate with each other

- It offers global payroll, EOR services, and a professional employer organization (PEO) solution if you want to outsource day-to-day HR and payroll tasks

- PEO services can be easily switched on and off

- Integrates with over 600 business software

Cons

- Pricing isn’t all transparent; difficult to find on its website

- You have to purchase its core Rippling Platform before you can buy other modules

- HR help desk option with phone and email support costs extra

- Can get pricey as you add more features

Overview

Who should use it:

What makes Rippling a good payroll option for small businesses is its payroll automation and highly customizable workflow tools. It streamlines the process by eliminating manual steps, such as calculating wages and taxes, downloading time data into payroll, and going through all pay details to check for errors. Rippling also provides compliance alerts, which help ensure that you’re always up-to-date with federal regulations and labor laws.

Why I like it:

Rippling stands out from the rest given its feature-rich platform, PEO and EOR services, and global payroll capabilities. What impressed me is its workflows and automation tools that allow you to streamline various HR tasks, from sending reports to assigning tasks. I gave it an overall score of 3.69 out of 5 but couldn’t go higher than that because it lacks phone support. Pricing is also a concern. It can get a bit expensive, depending on the number of features or modules you want. Plus, it’s difficult to find monthly fee details on Rippling’s website. It isn’t on the pricing page—it’s on Rippling’s small business page (at least that’s where I found it, as of this writing).

Rippling’s core platform may also be too much if you only need basic pay processing tools. You won’t likely use its robust software integrations and extensive permission settings. For simple pay runs, try Patriot Payroll. It has all the essential tools you need to run payroll and is more affordable than Rippling ($37 + $4 per employee monthly vs $40 + $8 per employee monthly).

Rippling works with you to create a custom package that fits your needs. Monthly fees start at $8 per employee plus a $40 base fee. However, you have to purchase its core Rippling Platform before getting any of its modules.

Here are some of its custom-priced add-on tools and services:

- Global payroll

- EOR services

- PEO services

- Benefits administration

- Expense management

- Headcount planning

- Learning management

- Performance reviews

- Applicant tracking

- HR help desk: HR advisory services via phone and email

- Easy-to-use workflows: Customizable workflows require no coding experience, as they come with if-then logic to automate processes. Plus, it works across Rippling modules. For example, you can set up a workflow that automatically notifies applicable employees to prepare items that new hires need based on their position and job levels, such as company laptops or corporate credit cards.

- Modular tools: Rippling lets you choose the HR and payroll tools you want, and you can easily add other features as your employee management needs grow. It even has an expense management module, as well as IT tools to monitor business software access and company computer devices. This lets you manage HR, basic finance, and IT solutions from one platform.

- Pay run comparisons: Rippling pulls your last payroll numbers automatically when you begin processing a new payroll cycle, so you can compare the two easily. It helps you identify any obvious errors quickly to prevent you from having to backtrack to correct them later.

Rippling claims that it can run payroll in as fast as 90 seconds. (Source: Rippling)

QuickBooks Payroll: Best for QuickBooks Users and Contractor Payments

Pros

- Integrates seamlessly with QuickBooks accounting software

- Next-day deposits are included in the starter plan; a same-day option available in higher tiers

- Low-cost plan for processing contractor payments

- Tax penalty protection covers all tax filing mistakes, regardless of who made the error.

Cons

- Automated local tax filings and time tracking are available only in higher plans

- Lacks mobile apps for employee self-service (offers a workforce portal you can access online)

- Tax penalty protection only for the Elite plan; lower tiers get an accuracy guarantee that only covers mistakes made by QuickBooks representatives

Overview

Who should use it:

QuickBooks Payroll is the best option for most QuickBooks accounting users. It integrates easily—you access it within the same system with the click of a button—and all information flows throughout both systems so you don’t have to enter twice. Payroll runs are made easy with automatic pay calculation and tax payment/filing features. Plus, its affordable contractor payment plan is ideal for budget-constrained small companies that only hire and pay contract workers.

Why I like it:

Unlike most of the other providers in this guide, QuickBooks Payroll’s standard direct deposit timeline is a next-day option. And if you upgrade to its Premium and Elite tiers, you get same-day direct deposits. It’s also the only payroll software for small businesses on my list that provides both tax accuracy and tax penalty protection programs.

Its automatic and unlimited pay runs, coupled with its fast payments contributed to its overall score of 3.67 out of 5. However, if you want advanced HR tools to manage performance reviews and learning courses, consider Rippling, ADP, and Paychex. QuickBooks Payroll also doesn’t have the job posting and hiring tools that most of the software on my list offers. While its contractor payment plan includes next-day direct deposits, it lacks Square Payroll’s flexible options that allow you to pay contract workers via check, direct deposit, or its Cash App.

QuickBooks Payroll plans

- Payroll Core: $50 base fee + $6 per employee monthly

- Payroll Premium: $85 base fee + $9 per employee monthly

- Payroll Elite: $130 base fee + $11 per employee monthly

- Contractor payments package: $15 monthly for 20 workers + $2 for each additional contractor

- Low-cost contractor-only payroll: QuickBooks Payroll contractor payments package is the cheapest among our list of best payroll software for small business owners. For $15 per month, you can process payments for up to 20 workers—with Square Payroll, paying 20 contractors will cost $120 per month (computed as $6 × 20 workers = $120).

- Additional tax penalty protection: On top of its tax accuracy guarantee that only covers mistakes that its representatives make, QuickBooks has tax penalty protection. This will cover the penalty and interest for any payroll tax error for up to $25,000 a year, regardless of who made the mistake. Note that you must purchase its Elite plan to have your errors covered. The other providers on my list only offer a tax accuracy guarantee.

- Online community: Similar to Square, it has an online forum where you can connect with other QuickBooks users if you have queries about using QuickBooks Payroll or need advice on how to run a small business.

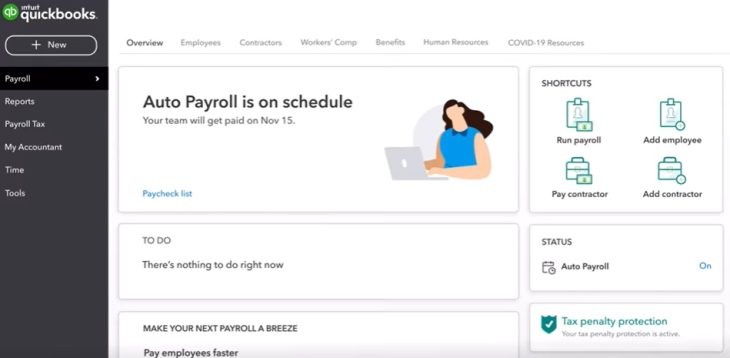

Aside from a “to-do” list, QuickBooks Payroll’s main dashboard contains shortcuts for running payroll and adding employees. (Source: QuickBooks Payroll)

RUN Powered by ADP: Best for Growing Businesses

Pros

- Built-in compliance tools that flag potential pay errors

- Has a wide range of HR features

- Offers PEO services and global payroll tools

Cons

- Pricing isn’t transparent

- Applicant tracking, salary benchmarks, and learning management reserved for higher plans.

- Benefits, time tracking, and workers' compensation are paid add-ons

Overview

Who should use it:

ADP stands out with its extensive selection of HR and payroll products. Businesses with plans to grow can choose from its multiple tiers and HR tools to manage employees. If you’re a small company with up to 49 employees, you can start with RUN Powered by ADP, or ADP RUN, to pay workers. Then, upgrade to ADP Workforce Now if you grow your workforce to over 50 workers, or get ADP TotalSource if you want PEO services.

Why I like it:

Aside from payroll and tax management, ADP RUN comes with several HR features like new hire reporting and background checks. Its higher tiers include extra HR support and more advanced HR tools like ZipRecruiter job postings, applicant tracking, and salary benchmarks to help you assess the competitiveness of your employee compensation package. It also makes it easy to transition from one plan to the next if your company scales and you need additional HR tools. Given these functionalities, I gave ADP RUN a 3.49 out of 5 score.

However, time tracking is a paid add-on. If you don’t want to pay extra or upgrade to a higher tier, consider Square Payroll. Pricing is also non-transparent, and getting a quote takes a bit of time. Based on my previous experience getting ADP RUN pricing details, two different sales reps gave me quotes for the payroll platform and for the time tracking add-on. Some reps also aren’t responsive while others prefer scheduling a call, which can be frustrating if you only want to get starter fees for a quick cost comparison.

ADP Run plans

- Essential: Custom-priced

- Enhanced: Custom-priced

- Complete: Custom-priced

- HR Pro: Custom-priced

- Multiple payment options: With ADP Run, you can pay your employees via direct deposit and paychecks and through the Wisely Direct Debit Card. It also offers check signing and stuffing services and will even deliver the envelopes to your office before payday. Unlike Paychex, ADP provides secure paychecks with 10 advanced fraud protection features.

- Certified payroll: ADP supports certified payroll reporting, enabling you to provide weekly payroll reports required by the US Department of Labor for contractors working on federally funded projects.

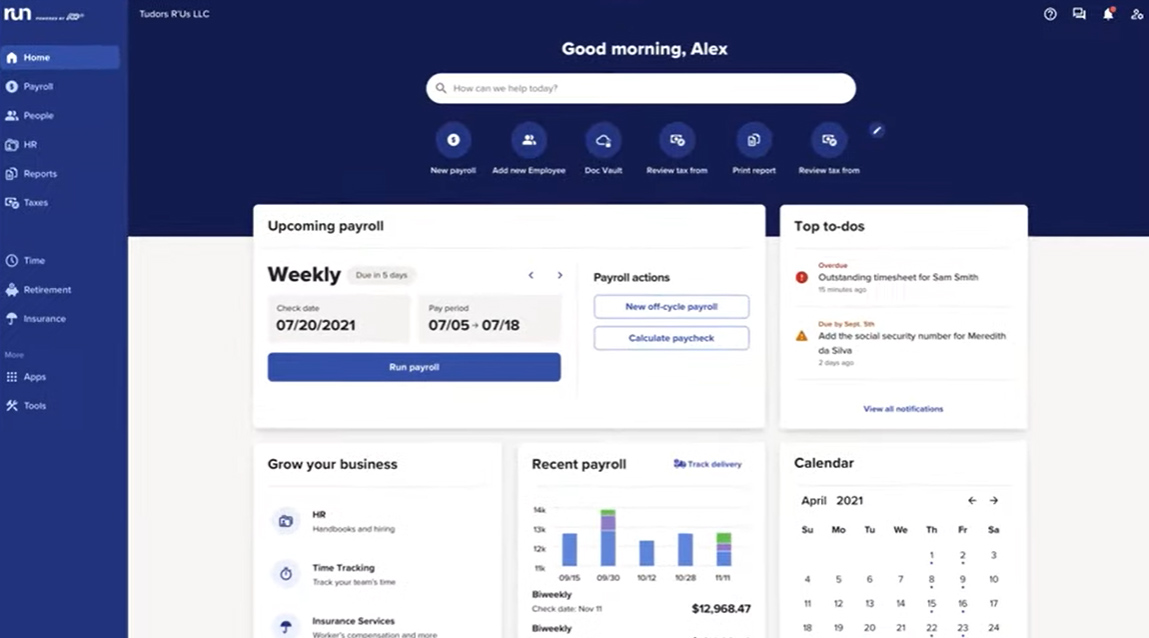

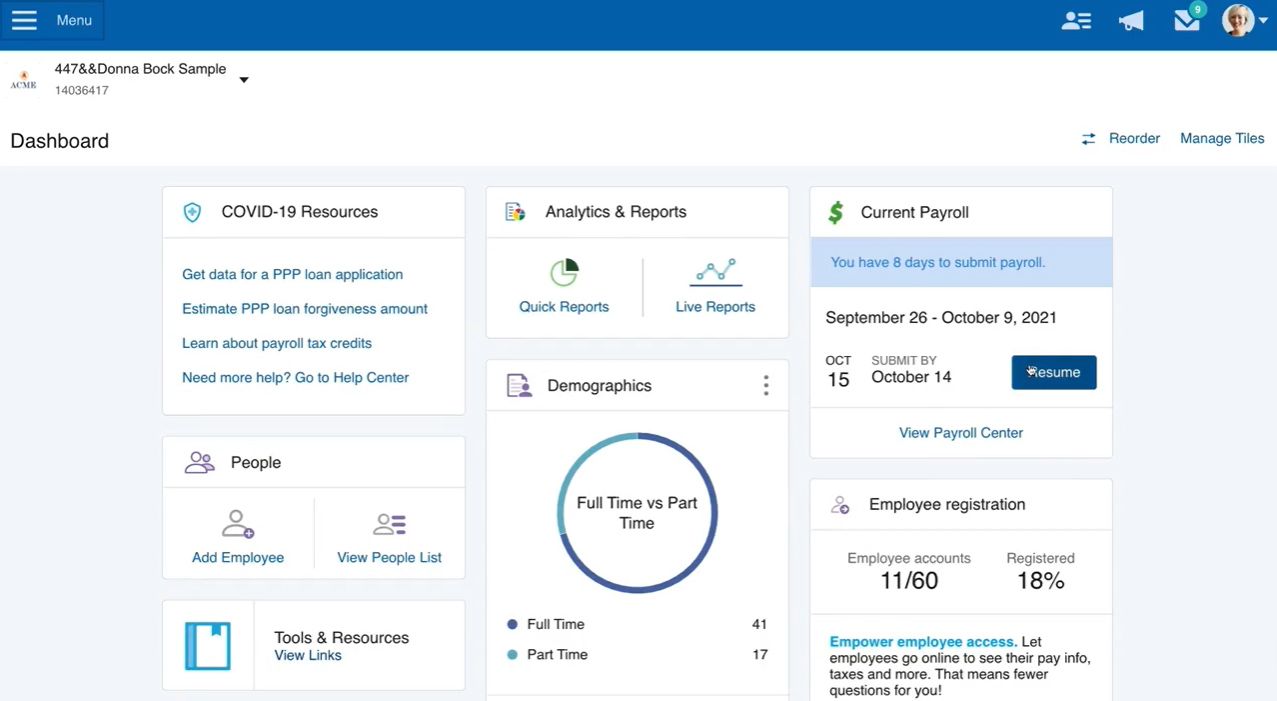

ADP Run’s dashboard shows payroll analytics, important notifications, and pay processing tasks. (Source: ADP)

Patriot Payroll: Best for Affordability

Pros

- Offers a full-service payroll plan and a basic tier with do-it-yourself (DIY) tax filings

- Connects easily with other Patriot products, such as accounting, time tracking, and an HR module with document management, compliance, and reporting tools

Cons

- Multistate tax filings and time tracking costs extra

- Lacks benefits options.

- Standard lead time for direct deposits is four days; two-day direct deposits are reserved for qualified clients

Overview

Who should use it:

Patriot Software offers an inexpensive solution for paying employees and contract workers. If you prefer to handle payroll tax filings yourself, you can use Patriot Payroll’s basic tier, which costs only $17 monthly + $4 per employee—a viable option if you have a handful of employees. And even if you sign up for its full-service plan, it’s slightly cheaper than Square ($37 + $5 per employee monthly vs $35 + $6 per employee monthly).

Why I like it:

Patriot Payroll offers a flexible option that others in this guide don’t: a choice between full-service payroll and a more affordable DIY version. Both come with unlimited payroll runs, multiple pay rates, automated PTO accrual calculations, and customizable deductions and contributions. You can pay employees through direct deposit or manual checks, and if you choose its full-service plan, Patriot will pay and file all federal, state, and local taxes.

I gave it a 3.35 out of 5 because of its efficient payroll tools and affordable pricing. However, Patriot Payroll only offers its two-day direct deposit feature to qualified clients. If you want fast direct deposits, try QuickBooks Payroll (its basic plan comes with next-day options) or Square Payroll (its Cash App feature lets you pay employees instantly). And while Patriot can handle multistate pay runs, it charges a $12 fee for each additional state tax filing. If you don’t want to pay extra, consider the other providers on my list (except Gusto as it offers multi-state pay runs in higher tiers).

Patriot Payroll plans

- Basic Payroll with DIY tax filings: $17 base fee + $4 per employee monthly

- Full Service Payroll: $37 base fee + $5 per employee monthly

Add-ons

- Multistate tax filings: $12 monthly for each additional state

- 1099 e-filings (for Basic Payroll subscribers only): $20 for up to five 1099 e-filings; an additional $2 per 1099 is required for six to 35 filings (no additional charge for 36 or more)

- Time tracking: $6 base fee + $2 per employee monthly

- HR/employee data management tools: $6 base fee + $2 per employee monthly

- Accounting: $20 monthly for the basic option; $30 monthly for the premium version

- Easy pay rate changes: Patriot allows employee hourly pay changes during pay runs. You don’t need to cancel the payroll or leave the system’s pay processing page to make the salary updates.

- Net-to-gross payroll tool: With this feature, you simply input the bonus amounts you want your employees to receive, and Patriot Payroll will automatically gross it up for taxes. This saves you time and helps prevent errors from manually calculating grossed-up bonus data for payroll tax processing.

Patriot Payroll has a three-step pay run process. (Source: Patriot Payroll)

Paychex Flex: Best for Payroll Services and Support

Pros

- Offers dedicated payroll support

- Has a wide suite of HR tools, such as recruiting, time tracking, and learning management

- Payroll and business services include a PEO solution, tax management across multiple states, and tax credit claims assistance

Cons

- Pricing isn’t transparent

- Garnishment payment and state unemployment insurance (SUI) services available only in higher tiers

- Time tracking, benefits, recruiting, new hire onboarding, and learning management are paid add-ons

Overview

Who should use it:

While Paychex’s payroll software, Paychex Flex, comes with full-service payroll and automatic tax filings, you also get a wide range of services. It offers startup/incorporation assistance for solopreneurs and the services of a dedicated payroll specialist to help small to midsized businesses (SMBs) with their payroll needs. Paychex can also help you apply for tax credits and even build an audit trail to support your claim. None of the providers on my list have an extensive list of services as Paychex’s.

Why I like it:

Paychex Flex has a simple-to-learn and-use platform that lets you pay employees in just a few clicks. I like that you can start payroll through its mobile app and then pick up where you left off on your laptop or desktop computer. It makes processing employee payments easy, and if you’re busy using both hands, you can use its Voice Assist feature to run payroll. You can submit payroll online or even via the phone to your dedicated payroll specialist. The other small business payroll software on my list don’t have similar or as many payroll services.

In my evaluation, Paychex Flex scored a 3.31 out of 5. Its multiple payment options, tax and compliance support, and wide range of HR tools contributed to its overall rating. However, its non-transparent pricing knocked off several points. Budget-constrained small business owners may also find Paychex Flex a bit expensive given its add-on fees for time tracking and onboarding—features that most of the providers I reviewed offer at no extra cost or in higher tiers.

Paychex Flex plans

- Select: Custom-priced

- Pro: Custom-priced

- Enterprise: Custom-priced

- Paychex Voice Assist: This feature offers a hands-off experience in processing, reviewing, updating, and submitting payroll. This voice-activated tool, which works on any Google Assistant-compatible device, comes with built-in verification and artificial intelligence (AI) solutions for user authentication. You can start a new pay period, make adjustments, or continue a pay run that’s already in progress without having to log in to your Paychex Flex account manually.

- Paystub previews: Reduce payroll discrepancies with Paychex Pre-check, which allows your employees to review their payroll in advance and notify you of any pay errors that you may need to address.

Paychex Flex’s dashboard provides easy access to reports, pay runs, and employee lists. (Source: Paychex)

For more payroll software options, check out our buyer’s guide on the best payroll services to help you find a payroll software or service that fits your business’s needs.

How to Choose the Best Small Business Payroll Software

When searching for the best payroll system for your small company, you should consider the following factors:

- Business needs: Take a look at what your business needs in paying employees. This includes considering your location, the size of your workforce, and the complexity of your payroll requirements to determine the features and payroll system to get.

- Budget: It’s important that the payroll software fits your budget. I suggest looking for those that offer unlimited pay runs. This can save you money especially if you pay employees several times a month or have plans to increase the size of your workforce.

- Scalability: Look for a flexible payroll platform that can handle basic to complex payroll. It should also have HR tools to help you manage employee attendance, benefits, hiring, and performance reviews—features you will likely need as you add more employees. While these functionalities may likely cost extra, you should already take note of them for future budget plans.

- Compliance: Choose a payroll software that offers compliance solutions like automated alerts, tax filing assistance, and HR advisory services.

- Automation: Check the system’s workflows and automation tools as these can help reduce payroll errors and minimize processing time. Are they customizable? Does it allow you to assign specific users to specific tasks?

- Reviews: Don’t forget to look at what other users are saying about the product. You can do this by reviewing feedback that actual users left on popular sites like G2, Capterra, and Reddit.

Methodology: How I Evaluated the Best Payroll Software for Small Business

To evaluate the top payroll systems for small businesses, I collaborated with Irene Casucian, one of our expert research analysts, where we used a new rubric with several criteria to compare seven payroll software, as follows:

- Gusto

- Rippling

- QuickBooks Payroll

- Square Payroll

- Patriot Payroll

- Paychex Flex

We looked for unlimited pay runs, automatic tax filings and remittances, and other features to help streamline the payroll process. We also checked pricing, user reviews, customer support options, reporting functionalities, integration options, and basic HR information system (HRIS) features for easy onboarding and staff data management.

I also added my expert rating to each criterion, where I looked at the general effectiveness of that feature. While I wasn’t able to test all of the software on my list, I looked for key payroll features, watched video tutorials if available, and checked user reviews for feedback about the system’s overall ease of use and functionality.

To view the full evaluation criteria, click through the tabs in the box below.

25% of Overall Score

We gave priority to those that offer multiple pay schedules, two-day direct deposits, wage garnishments, tax payment and filing services, and year-end reporting (W-2s and 1099s). We also checked if it supports multiple payment types, contractor payroll, and pay processing in all US states.

25% of Overall Score

We looked for transparent pricing, free trial and discount offers, unlimited payroll, and each platform’s “value for money,” which determines whether the number of features in the basic plan is competitive with other vendors in the space. We also gave points to software that only cost up to $350 monthly to run payroll for 50 employees.

20% of Overall Score

We looked for HRIS functionalities to help with employee data storage, recordkeeping, onboarding and offboarding, and new hire reporting. We also gave points to software that offer employee self-service portals, customizable reports and payroll templates, benefits plans that are available in all US states, and org charts or a company directory that employees can access online

15% of Overall Score

In this criterion, we considered the platform’s mobile app functionality, including its time tracking and benefits administration features. We also checked the system’s data security protocols, permission, and access controls, and whether it integrates with an accounting system.

10% of Overall Score

We looked for payroll services and the support options available, such as the support hours and if customer representatives can be reached via phone, email, or chat. We also checked the types of help resources offered, such as an online knowledge base and a community forum.

5% of Overall Score

We considered user reviews from third-party review sites like Capterra, G2, and TrustRadius. We also checked the ratings and the number of reviews, wherein those with 500 or more reviews got higher points.

Meet the Experts

The experts who contributed to this article’s rubric assessment include:

| Robie Ann Ferrer is an HR expert writer at Fit Small Business, focusing on small business HR and payroll software content. Her software product recommendations are based on more than five years of experience writing about and evaluating HR systems for SMBs. She also has 10 years of expertise handling different facets of human resources, including managing HRIS, time tracking, and pay processing software. These allowed her to provide insights to help business owners determine which platform best fits their needs. |

| Irene Casucian is a research analyst for Fit Small Business. With sufficient experience as an HR writer, she has developed a profound understanding of various business needs that inform her research and analysis of HR platforms. Irene specializes in HR software evaluation and draws on her experience as a research assistant to provide in-depth assessments. Irene conducts objective research by gathering data to evaluate HR software performance across various HR functions, such as payroll, ATS, and onboarding, using carefully defined criteria to assess each platform’s effectiveness. |

| Jessica Dennis is the HR lead writer at TechnologyAdvice and also lends her expertise in reviewing content for Fit Small Business. She has B.A. in English Literature from the University of Michigan and over six years of experience in onboarding, payroll, benefits, compliance, and workforce management as an HR generalist. Since joining TA, she’s covered additional topics like DEI, engagement, training, communication, hiring, and performance management best practices. Her expertise, in-depth research, and hands-on experience with HR software ensure she provides the best people operations and technology insights to readers. When she’s not writing, you can find her obsessing over her labrador retriever, crocheting, or jumping into the nearest body of water. |

Frequently Asked Questions (FAQs) About Small Business Payroll

A payroll system can accurately calculate employee wages (such as salaries, overtime, and deductions for required payroll taxes) and pay workers either through direct deposits, pay cards, or paychecks. Many payroll providers also offer tax payment and filing services. Others even provide access to basic HR tools like time and PTO tracking, allowing you to easily capture employee attendance data for pay processing.

The best payroll software for small business users should meet your budgetary needs while providing the essential tools you need to compute and process employee payments and payroll taxes.

A payroll software can cost anywhere from $30 to $50 per employee monthly. Note that this includes the base software and per-employee fees. You should expect to pay more if you want additional functionalities like time tracking, employee benefits, and HR advisory services.

Basic HR tools like employee data management, PTO and time tracking, and new hire onboarding are essential as these help small businesses streamline day-to-day HR tasks. Having access to benefits plans and benefits administration tools is also important. These allow you to manage workers comp, health insurance, and other employee benefits through your payroll software.

Aside from calculating earnings and deductions, payroll processing software for small business users help automate processes given its workflow and compliance tools. This helps you save time, enables you to manage payroll easily, and ensures you remain compliant with federal regulations and labor laws.