Gusto is a full-service payroll software that many new and small business owners use to pay their employees. Besides providing automatic and unlimited pay runs, Gusto handles all your payroll tax payments and filings, including year-end reporting.

Its reasonably priced plans, solid HR tools, and user-friendly interface make it an ideal payroll software for small businesses. Plus, it’s easy to set up, so you can start using it in minutes. Gusto pricing has monthly fees that start at $40 plus $6 per employee, and if you’re paying contractors, fees are only $35 plus $6 per contractor monthly.

In our Gusto review, we evaluated it as the best payroll software for small businesses, where it earned an overall score of 4.81 out of 5.

Since Our Last Update

Gusto has added the following products and features. Since they were just released, they were not considered in our original evaluation.

- Beneficial Ownership of Information Report (BOIR): This report is required from all businesses to disclose information about beneficial owners. Paperwork will now be filed to the government for you.

- Streamlined state tax registration: For all tax registrations handled at the state and local level, users won’t have to search for state tax information online and handle registration themselves.

- Compliance courses: Over 40 new courses to help your team with compliance, from anti-harassment training to HIPAA compliance.

- Shift Scheduling: Available in the Plus and Premium plans, and as an add-on to the Simple plan, Gusto’s new scheduling features allow managers and admins to create, adjust, and share work schedules.

Gusto Overview

Pros

- Reasonably priced plans with a contractor-only payroll option

- Full-service payroll with unlimited pay runs and tax filing/payment services

- Offers essential HR tools like employee benefits, hiring, onboarding, and performance reviews

- Offers Global EOR services

Cons

- Time tracking, hiring, and performance review tools are unavailable in the starter Simple plan

- Access to customer service via a direct line with priority support is available only in the highest tier (lower plans only include basic phone, email, and chat support)

- Global EOR services available in only 12 countries at this time

- Supported business types: Self-employed business owners and small companies needing online tools to pay employees/contractors and manage HR processes

- Pricing:

- Simple: $40 base fee plus $6 per employee monthly

- Plus: $80 base fee plus $12 per employee monthly

- Premium: $180 base fee plus $22 per employee monthly

- Contractor-only payroll: $35 base fee plus $6 per worker monthly

- Discounts: Discount offers vary, depending on the promotion Current discounts (at the time of this writing) include 25% off for the first 3 months on Plus and Premium plans and $0 base fee for the first 6 months on Contractor-only payroll

- Key features:

- Full-service payroll with unlimited and automatic pay runs

- Tax payment and filing services with year-end tax reporting

- Cross-border contractor payments in over 120 countries

- Multiple direct deposit options (standard is two and four days; next-day also available in higher plan levels and as an add-on on the Simple plan)

- Wide range of HR solutions to manage hiring, job postings, onboarding, benefits, time tracking, and performance reviews

- State tax registration and R&D tax credit services

- Free Gusto Wallet app lets your employees track time, save, spend, and receive payroll funds

- Ease of use: Online platform is generally easy to learn and use, but you need basic knowledge of how to run payroll

- Software setup:

- You can easily create a Gusto account online; its setup wizard will also guide you through the process of adding your company, employee, and payroll details

- Those on the Premium plan get full-service payroll migration, account setup help, and a dedicated customer success manager (Simple and Plus plans receive priority support as a paid add-on)

- Customer support:

- Online FAQs and how-to guides

- Chat, phone, and email support

- Access to HR advisory services

Aside from offering reasonably priced monthly plans, Gusto provides an intuitive payroll platform for employers and employees. Its features are easy to learn, and you can run payroll quickly.

Tax penalties are covered if Gusto ever makes a mistake, and year-end W-2 and 1099 preparation are included in all plans at no extra cost. Its direct deposit option is also a favorite for many users. They can switch between it and manual checks anytime, and there’s HR support.

- Mom-and-pop businesses looking for an affordable payroll solution: Gusto’s affordability is one of the reasons it is our leading payroll software for small businesses. Its starter Simple plan comes with all the essential tools you need to process employee pay, manage benefits, and onboard new hires, and it now includes time tracking and performance reviews. Plus, you can run payroll, off-cycle payments, and bonus payouts as often as you want.

- Businesses with 50 and more full-time equivalent (FTE) employees: Once companies reach 50 full-time employees, they’re no longer considered a mom-and-pop business. Gusto, which also topped our list of best payroll software for small businesses (scoring 4.72 out of 5), can help small employers streamline and automate payroll and basic HR processes. It enables you to provide employees access to a self-service portal, offer major benefits (like health insurance, which is required at 50 FTE), and even electronically track employee work hours.

- Companies that use contract help: Gusto, one of our best contractor payroll software (scoring 4.43 out of 5), is great for small businesses that only hire and pay contract workers. It has a reasonably priced contractor-only plan and even offers special promotions for new clients As of this writing, it waives the $35 monthly base fee for the first six months and will only charge $6 per month for each contractor. . It also preps and files 1099 year-end reports (essential for contractors) and submits new hire reports for contractors if this is required in your state.

- Self-employed business owners: Gusto is our top-recommended self-employed payroll provider for business owners or sole proprietors who only need to pay themselves. It includes full-service payroll, automatic tax filings and payments, and two-day direct deposits.

- You are a large enterprise: Businesses with over 1,000 employees may not find all the support they need under Gusto. HR needs tend to increase as companies grow. Providers like ADP or Paychex, with plans that include payroll plus robust HR features such as learning management and compensation planning, would be more suitable.

- Your business needs professional employer organization (PEO) services: Gusto is not a PEO, so if you need a service that handles payroll and HR for you, consider the best PEO providers.

Gusto’s full-service payroll and solid HR tools make it a great choice for various business types, organizations, and users. It even ranks in several of our buyer’s guides.

- Best Restaurant Payroll Software

- Best Payroll Software for Mac

- Best HRIS/HRMS Software

- Best Payroll Software for Accountants

- Best Payroll for Nonprofits

- Best Church Payroll Services

- Best Trucking Payroll Software

- Best Construction Payroll Software

Looking for something different? Read our guide to the best payroll services for small businesses to find a payroll service or software that’s right for your business.

How Gusto Compares With Top Alternatives

Gusto earned perfect marks for pricing, given its zero setup fees, reasonable and transparent prices, and multiple plan options. Plus, all Gusto pricing plans come with unlimited pay runs, which lets you process payroll (including off-cycle payments) as often as you need in a month without paying extra.

Monthly fees start at $49 per month + $6 per person per month, which is considered reasonable for small businesses, and you get three pricing options: Simple, Plus, and Premium. All plans come with full-service payroll, tax payments and filings at all levels (federal, state, and local), basic new hire onboarding, employee benefits, time tracking, next-day direct deposits, performance reviews, priority support, HR advisory services, and self-service tools.

Subscribing to higher tiers will unlock additional functionalities, like multistate payroll, paid time off (PTO) management, job postings and enhanced applicant tracking, and employee surveys.

Simple | Plus | Premium | |

|---|---|---|---|

Monthly Fees | $49 per month + $6 per person per month | $80 base + $12 per employee | $180 base + $22 per employee |

Full-service Multistate Payroll | Single state only | ✓ | ✓ |

Tax Payments, Filings, and Year-end Forms | ✓ | ✓ | ✓ |

Employee Profiles and Self-service Portal | ✓ | ✓ | ✓ |

Health Benefits Administration | ✓ | ✓ (health insurance broker integration costs $6 per eligible employee) | ✓ (free health insurance broker integration) |

Job Postings and Applicant Tracking | ✕ | ✓ | ✓ |

Offer Letters and Onboarding Checklists | Standard | Customizable | Customizable |

Email/Software Provisioning and Deprovisioning | Email only | ✓ | ✓ |

Time, Project, and PTO Tracking | $6 per employee monthly | ✓ | ✓ |

Performance Review and Employee Surveys | $3 per employee monthly (performance reviews only) | ✕ | ✓ |

✓ | ✓ | ✓ | |

Payroll Migration With Dedicated Customer Success Manager | ✕ | ✕ | ✓ |

Need help deciding which Gusto plan is best for you?

With Gusto, you can change your plan at any time. However, if you’re downgrading your subscription, the new pricing will only take effect at the start of the next billing period, which is the first of the month. If you upgrade your plan, the new pricing will take effect for the current month, and you’ll get instant access to the new plan’s additional features.

If you employ only contractors, Gusto has a reasonably priced contractor plan that’s $35 plus $6 per person. It comes with unlimited pay runs, Form 1099-NECs at year-end, four-day direct deposits, and new hire reporting.

While Gusto can handle international contractor payments in over 120 countries, this functionality isn’t included in its contractor-only option. You have to subscribe to one of its three plans (Simple, Plus, or Premium) and then you can add on this service.

Gusto also allows you to find both international contractors and global team members. They will help you hire, pay, and manage your team while ensuring compliance within each country. It’s also an add-on to one of Gusto’s main plans. Pricing varies depending on factors like foreign exchange rates and bank fees.

Gusto offers a wide range of add-on solutions, including benefits plans, health insurance broker integrations, and priority support.

Gusto Add-ons | Features | Pricing |

|---|---|---|

Workers’ Compensation | Pay-as-you-go plans through AP Intego | Pay only for premiums; no admin fees |

Health Insurance Plans | Access to Gusto’s licensed brokers for medical, dental, and vision plans | Pay only for premiums; no Gusto admin fees |

Life and Disability Insurance | Access life and (short- or long-term) disability plans via Gusto’s partner providers | Pay only for premiums; no Gusto admin fees |

Broker Integration | Integrate your existing broker and eligible health plans into Gusto | $6 per eligible employee monthly; free with Premium plan |

401(k) Retirement Savings | Access affordable 401(k) plans through partner providers (such as Guideline and Human Interest) | Pricing varies, depending on the provider selected |

Priority Support | Enhanced support hours (5 a.m. to 5 p.m. PT) | $6 per person per month |

HR Resources | Compliance alerts and HR advisory services | $50 per month plus $5 per employee per month |

R&D Tax Credits | Scan payroll data to save up to $250,000 in annual payroll tax offsets | Up to 15% of identified tax credits + fees; discounts available with the Premium plan |

Gusto Global | International contractor payments in 120+ countries; plus EoR services to hire full-time international team members | Contact Gusto for a quote |

State Tax Registration | State and local tax registration services if you need to file payroll taxes in a new state | Contact Gusto for a quote; pricing varies by state |

Sponsored Job Postings | Job posting boosts (through Upward) to reach a wider audience or target specific job boards (like veteran job sites) | Campaigns start at $25 per sponsored job post |

Gusto earned high marks (4.38 out of 5) in payroll features given its solid pay processing tools, tax filing services, and multiple payment options (such as direct deposits, paychecks, and pay on-demand). It didn’t get a perfect rating because its penalty-free guarantee only covers tax filing mistakes that its representatives might make. QuickBooks Payroll, for example, offers a separate program for its premium plan subscribers, covering all tax filing penalties regardless of who made the mistake.

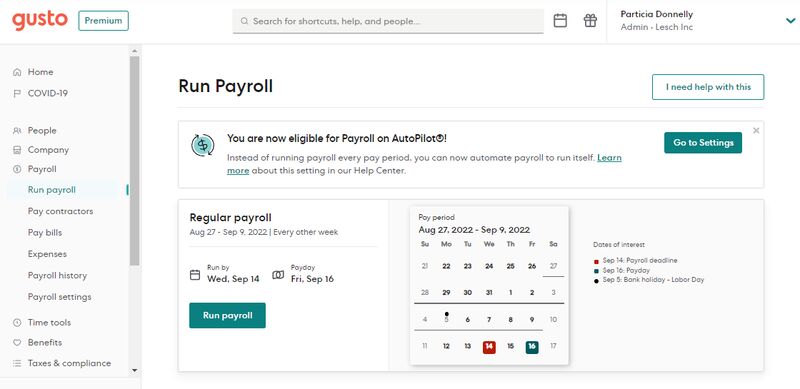

Gusto’s online pay runs follow a four-step process. (Source: Gusto)

Gusto payroll for small business owners can handle single and multiple state pay runs (although, you have to upgrade to at least its Plus plan to get multistate payroll). Gusto also allows you to set employees up on different pay schedules—some weekly and others semimonthly.

If you need to add a bonus, commission, or reimbursement to an employee’s weekly or monthly salary, Gusto’s payroll module has fields for customizing payment amounts. If you’re paying salaried employees and don’t expect any changes to pay runs, you can set Gusto to run automatically. You can also do the same for hourly workers with fixed working hours.

Easily turn automatic pay runs on and off through Gusto’s payroll settings. (Source: Gusto)

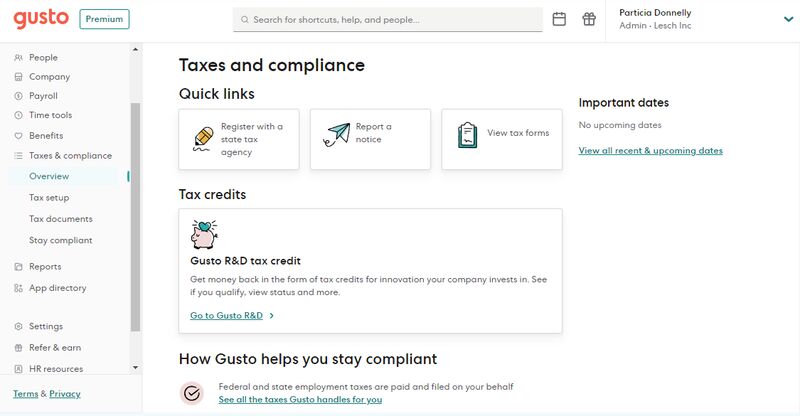

Gusto calculates, files, and pays all taxes (federal, state, and local), which is notable because some services require you to know which local payroll taxes you’re responsible for paying. It also promises to pay any penalties resulting from its mistakes. And, to top it off, year-end tax forms come with each plan at no extra cost. This is unlike some of the payroll providers that charge you an additional per-employee fee to prepare and distribute W-2s and 1099s.

If an employee has an IRS levy or child support garnishment, Gusto can withhold the applicable amount from the employee’s payroll. It even sends the funds to all states, except South Carolina, at no additional charge.

Gusto’s taxes and compliance dashboard has helpful links to tax forms, tax credit claims, and important filing dates. (Source: Gusto)

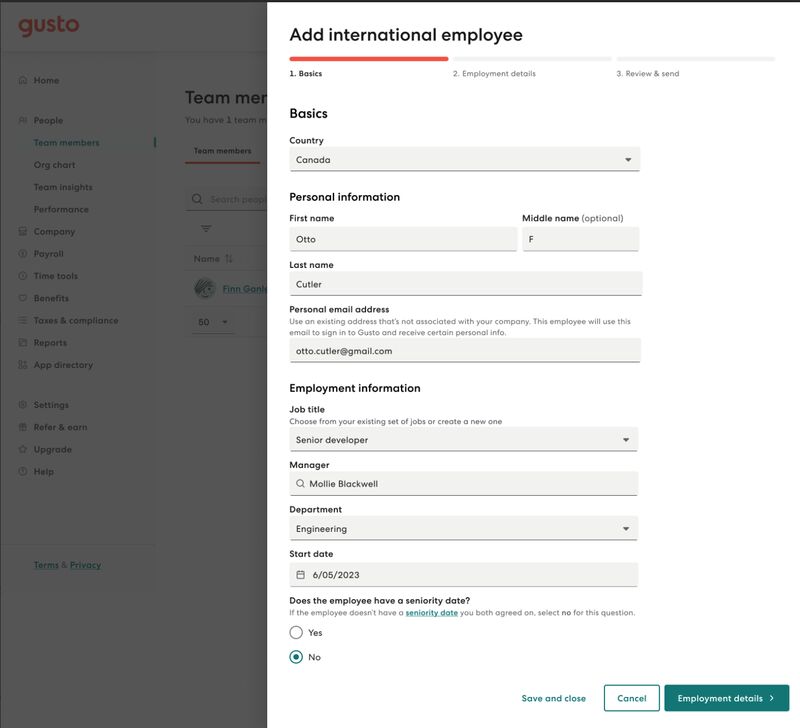

With Gusto Global you can hire and pay full-time talent all over the world. It’s an EOR service powered by Remote, has autopay run capabilities, and comes with built-in compliance. However, it’s limited to only 12 countries, as of this writing: Australia, Brazil, Canada, Germany, India, Ireland, Mexico, the Netherlands, the Philippines, Portugal, the United Kingdom, and Spain.

Gusto makes hiring international employees easy. (Source: Gusto)

In our evaluation of Gusto’s HR features and tools, the provider earned 4.88 out of 5 given its robust selection of both standard and non-standard employee benefits, including a solid set of recruiting, new hire onboarding, performance review, and employee survey tools.

Employee benefits is an area where Gusto shines. Small businesses that otherwise wouldn’t be able to offer perks to their employees can easily sign up for one of the many benefits Gusto offers.

- Medical insurance

- Dental insurance

- Vision insurance

- Life and disability insurance

- 401(k) retirement savings plans

- Health and flexible savings accounts

- Workers’ comp (via AP Intego)

- Commuter benefits

- Financial management app called Gusto Wallet

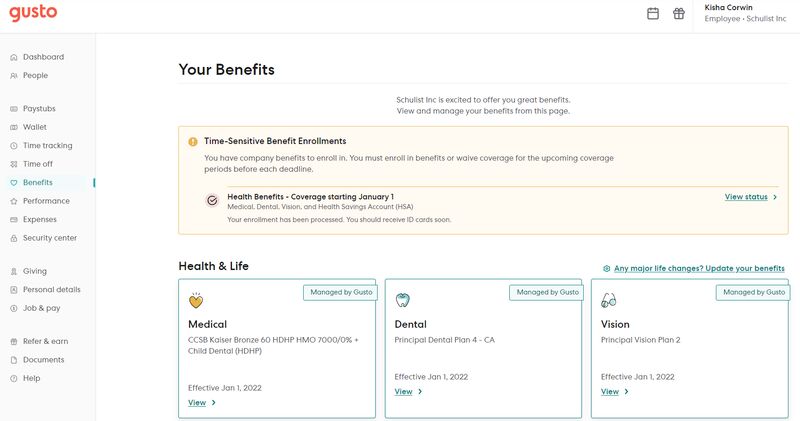

Employers and employees can manage benefits online through Gusto’s one-stop-shop online portal. (Source: Gusto)

Gusto has its own time and attendance solution that hourly employees can use to enter hours worked. Employees can also download Gusto Wallet, its free financial management app, as it has time tracking capabilities. However, as of this writing, your contractors won’t be able to use Gusto Wallet to track their time.

The platform can also help track your PTO policies, making it easier to manage leave accruals and balances. If you want your employees and people managers to raise and approve PTO requests online, you have to sign up for either its Plus or Premium plans.

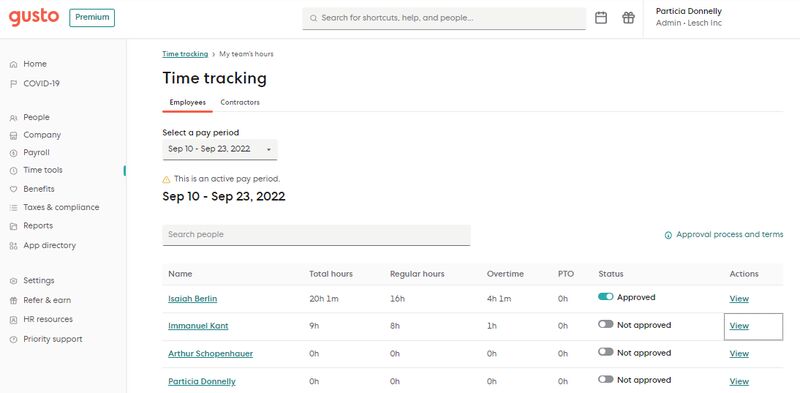

With Gusto, all approved employee hours automatically sync to its payroll tool for processing. (Source: Gusto)

Available to Plus and Premium plan holders, Gusto’s recruiting solutions are great for creating a company job board and sharing your job postings to attract qualified candidates. You can even share your job board across social media sites (like Facebook and Twitter) and add it to your company website.

If you want to reach a wider audience, Gusto offers sponsored job postings through its partner, Upward. For as low as $25 per campaign, you can select the job boards where you want your job posting to appear. Or you can use Upward’s algorithm to identify where to distribute and publish your open job.

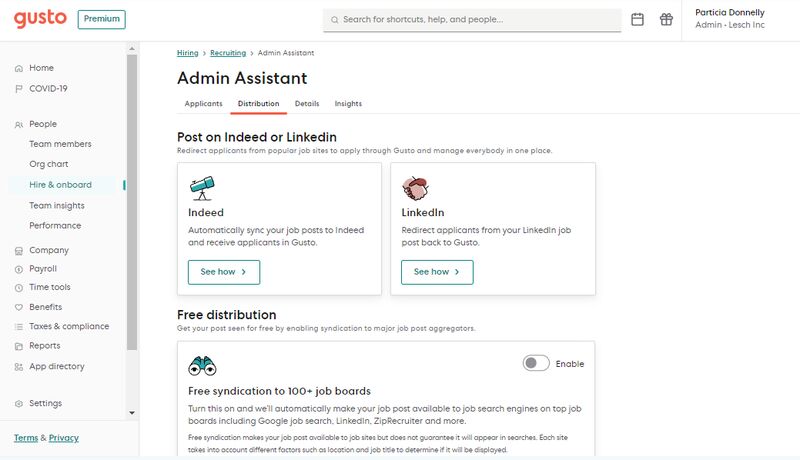

If you don’t want to pay extra to promote your job listings, Gusto can post your jobs for free to job search engines (such as Google Jobs) and more than 100 job boards (like ZipRecruiter and LinkedIn). However, you have to manually turn on Gusto’s “Free Distribution” option so that it can automatically post your jobs. You may opt to leave this off if you only want to distribute your open jobs via Gusto’s custom job boards.

Gusto’s job postings will remain live on job search engines and job boards for 30 days from the day you enable the “free distribution” option for the job post. (Source: Gusto)

Creating job posts in Gusto is relatively easy, provided you have all the information you need, like the job description and skills required. While it allows you to copy job descriptions from another file and then save them directly in the job post, the process would be more efficient if the system offered sample job descriptions you can customize as you create the job post.

To automate hiring tasks, Gusto also allows you to add members of the hiring team (such as the hiring manager and other stakeholders) to job posts. Apart from serving as interviewers for the role, hiring team members can view applicant information, complete interview scorecards, leave comments on applications, and move candidates through the pipeline.

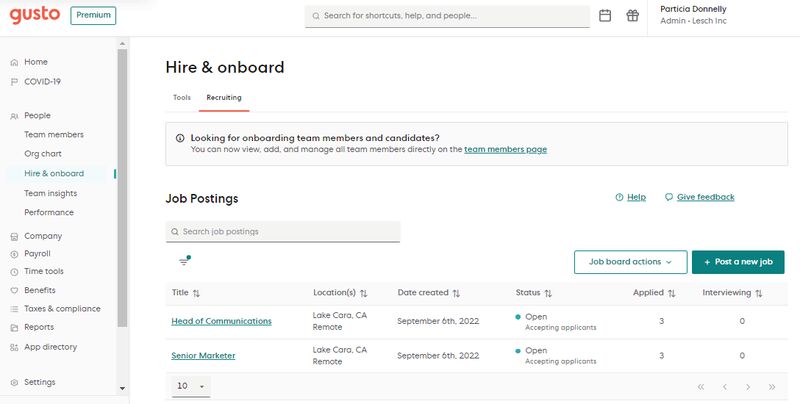

If you want to see all job postings, Gusto has a “recruiting” dashboard that shows your open jobs, including when it was created. It also provides the numbers of applicants who applied for each role and are moving to the interview process.

Gusto’s job posting dashboard. (Source: Gusto)

With Gusto, you can add application screening questions that require applicants to provide free-form or multiple-choice responses. While you can create your own screening questions, Gusto has pre-set questions that ask about the applicants’ years of work experience, desired salary, work eligibility in the US, and more.

Gusto’s screening questions are included in its job post creation process. (Source: Gusto)

Gusto now has enhanced applicant tracking features in its Plus and Premium plans that include creating a company job board, adding job postings, sharing your job board, and hiring the right candidate.

Once applicants submit their applications online, members of the hiring team can view their resumes and track where they are in the hiring pipeline. Gusto also allows you to move candidates through various stages, such as “interviewing,” “hired,” “not hired,” and “dropped out.” However, only the system administrator can move candidates who passed the selection and interview process to the “hired” stage.

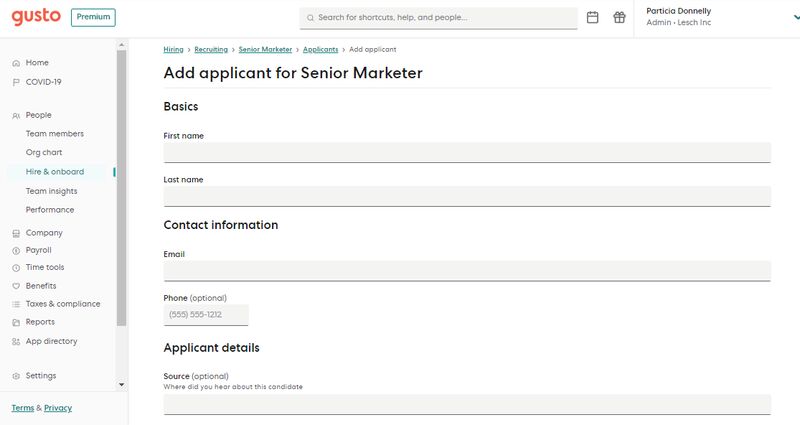

While job seekers can submit their applications through online job postings, you can manually add applicants and upload their resumes into Gusto if you’re a system administrator. (Source: Gusto)

Gusto’s hiring support helps set it apart from basic providers. Small businesses looking to manage payroll and taxes appreciate the paperless onboarding process they can use to bring on new hires. Once you set up the new employees in the software, Gusto will send an email prompting them to start their online accounts where they can fill out all new hire forms (including Forms I-9 and W-4). It even submits new hire reports to the state—all at no extra cost.

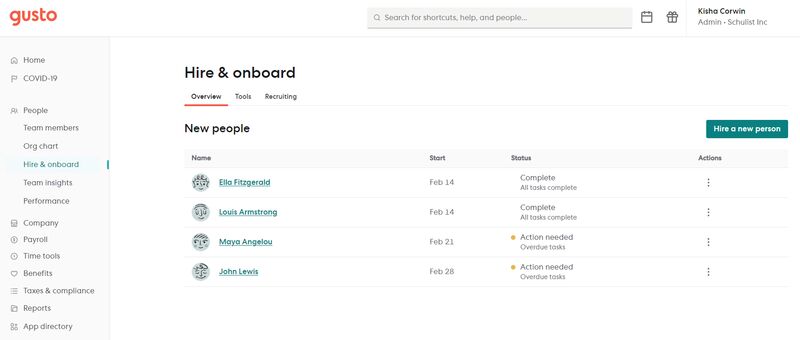

Aside from letting you add new hires into its system, Gusto’s “Hire & onboard” module shows the status of each employee’s onboarding tasks. (Source: Gusto)

While the Simple plan comes with standard offer letters and onboarding checklists, upgrading to Gusto’s higher tiers will allow you to customize these tools. You can even assign, delegate, and track tasks, which helps streamline onboarding processes. If you need other HR documents, its online resource center has job description templates, labor law policies, hiring best practices, termination requirements, and an employee handbook builder.

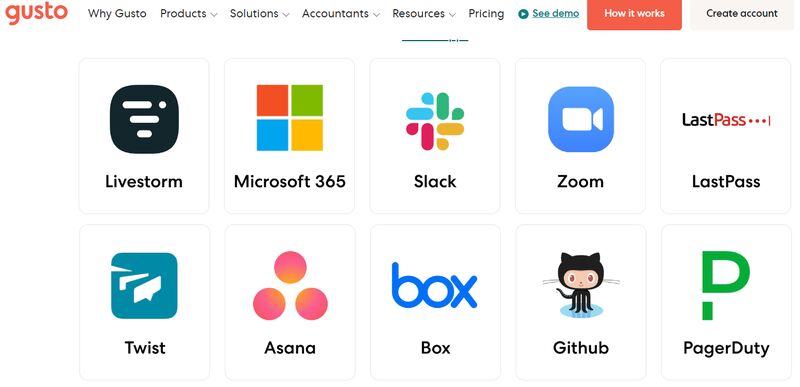

Gusto comes with email and software provisioning/deprovisioning tools that enable you to create, remove, and manage employee accounts with more than 20 business software. This is helpful if you want to set up the online tools that new hires need while ensuring that resigning employees can only access their software accounts until their last working day.

Business systems included in Gusto’s software provisioning solution. (Source: Gusto)

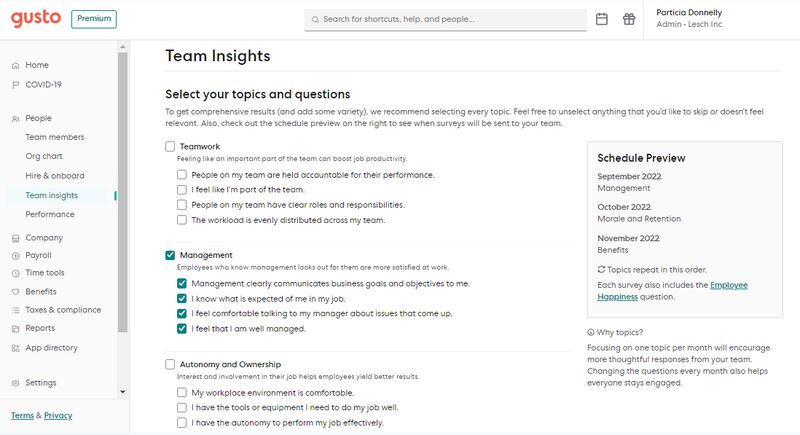

With Gusto’s Plus and Premium plans, you can send out anonymous monthly surveys to help you understand employee sentiment, gauge staff happiness, and identify areas for improvement. It’s also a good tool for deploying surveys that tackle specific topics, such as learning and growth opportunities, benefits, morale and retention, and work autonomy.

Gusto even lets you select the survey topics and questions for each month. Aside from getting insights on a variety of topics, this helps keep employees engaged and improve survey participation rates (because of non-repeating survey topics and questions).

Gusto’s survey topics and questions now available in Plus plan. (Source: Gusto)

Plus, all of Gusto’s survey topics include an “employee happiness” question or statement, such as “I recommended this company as a great place to work.” To respond to this statement, survey respondents can rate responses according to how much they agree or disagree. This is great for getting valuable insights into your employees’ sentiments about work and your company.

For new Gusto users, the system will automatically release your selected survey the Wednesday after you turn on this feature. Then, it will automatically send new surveys every month following the same schedule as your first one. Your employees have a week to complete the survey. After the survey closes, you can view the responses through Gusto’s “Team Insights” dashboard.

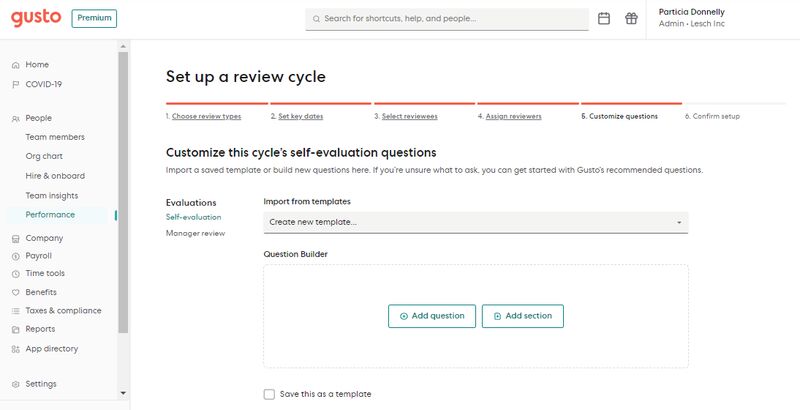

Gusto’s performance review module (which is available free for Plus and Premium plan holders, and as an add-on for Simple plan users) is designed to help you assess whether or not employees are meeting their goals at work.

You can use it to identify your employees’ development opportunities and highlight skills they excel in. It also lets you create performance review cycles, track the progress of reviews in real time, share feedback, set completion deadlines, add manager review summaries, and gather insights.

Gusto has a question builder for creating simple employee self-evaluation and manager review templates. (Source: Gusto)

Gusto earned perfect marks in this category with its built-in reports that tackle a wide range of subjects: payroll summaries, tax forms, and workforce costings to contractor information, employee work hours, and benefits elections.

It even offers an employee and payroll report builder that allows you to add filters and select the data you need. Creating report templates that you can customize is also very easy, plus you can choose the report file format (either CSV or PDF).

Gusto’s report builder has data columns you can drag and drop to customize reports. (Source: Gusto)

Gusto received high marks (4.75 out of 5) in this criterion because of its easy-to-use software that small businesses can use to start processing payroll quickly. It also offers strong HR support through its HR advisory services and online help center, as well as access to a support team you can contact through email, chat, and phone. However, it lost points due to its limited customization options—you can’t rearrange its dashboard to fit your requirements.

Guto excels in the following areas in regard to ease of use:

- Intuitive dashboard

- Guided onboarding and setup

- Email and live phone support; in-app chat

- Online help center with HR documents and forms; how-to guides

- Priority phone support and access to HR advisors

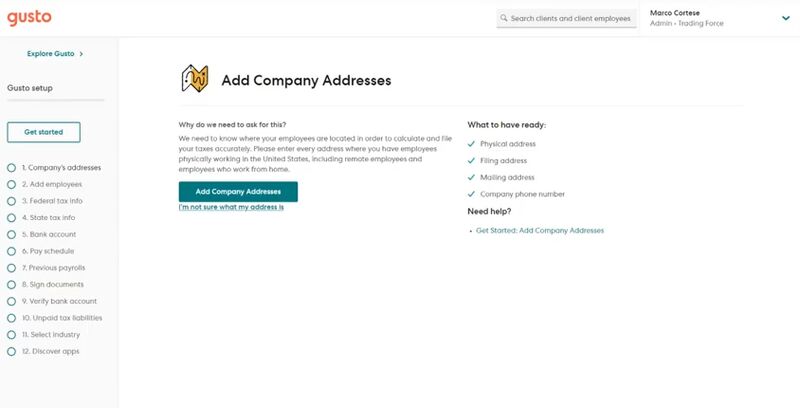

You can completely set up Gusto in less than 24 hours if you have all of your business and employee information on hand, plus you can link your bank electronically. The dashboard layout makes it easy to set up and run payroll with Gusto. If you’re on the Premium plan, its customer representatives will walk you through the process for free and help you transfer your payroll data into Gusto so that your annual records are complete.

Gusto has an online wizard to help new users through the setup process. (Source: Gusto)

Gusto’s main dashboard is also user-friendly, with a menu placement on the left-hand side of the display that’s easy to follow. And, since Gusto provides the services that a small business would need versus trying to serve all employers, the interface is not overwhelming, and there’s no steep learning curve.

When problems do arise, it has an online help center with answers to frequently asked questions. Live phone support is also available for all plan holders from Mondays to Fridays, 9 a.m. to 4 p.m. (PT), and you can now contact the Gusto customer service team via a direct line for priority support with extended weekday hours (from 5 a.m. to 5 p.m. PT), however, it is an add-on for its Simple and Plus plans. Gusto also offers chat and email assistance.

If you use third-party systems to manage your business processes, such as accounting and team collaboration, Gusto integrates with a wide range of software.

- Accounting: FreshBooks, QuickBooks, Xero, and ZipBooks

- Collaboration tools: Asana, Box, monday.com, Google Workspace, Microsoft 365, Slack, Dropbox, Trello, and Zoom

- Expense management: Expensify and Dext Prepare

- Hiring: ApplicantPro, BreezyHR, Greenhouse, JazzHR, Lever, Recruitee, and Teamtailor

- Learning management: EasyLlama, Ethena, Trainual, and Traliant

- POS: Shopify, Clover, Upserve, and SpotOn

- Time tracking: 7shifts, ClockShark, Homebase, When I Work, Deputy, Sling, Ximble, and QuickBooks Time (formerly TSheets)

With Gusto, you don’t have to worry about data and system security. Gusto’s production servers, databases, and supporting services are hosted in Amazon Web Services (AWS), with data encrypted using AES-256 key encryption to protect data.

In addition, its platform is equipped with multi-factor authentication and fraud monitoring tools. Manager permissions also allow you to provide limited-access permission to user accounts. Gusto even has a dedicated team that conducts system vulnerability tests and responds to security issues.

Gusto scored perfect marks in this criteria, given its solid pay processing tools and reasonably priced plans that make it a great payroll software partner for a wide range of small businesses (such as restaurants, payroll accounting firms, and retail shops). Its feature-rich platform not only handles payroll and payroll taxes but can also manage essential HR processes like hiring, time tracking, benefits administration, and performance reviews.

While Gusto may have these HR tools, its core platform is still payroll—which means that it lacks the advanced solutions that other HR software may offer. So, if you need to manage learning sessions and create compensation plans in addition to handling payroll and basic HR, you may be better off with more robust HR systems like Paycor and TriNet.

| Users Like | Users Don’t Like |

|---|---|

| Solid and reasonably priced payroll tools | Inconsistent customer support quality; service wait times can be long |

| Software that is easy to set up and use | Features like benefits coverage and report customization need to be improved |

| Software that manages payroll, tax compliance, and onboarding | Occasional software lags and glitches |

Overall, Gusto payroll reviews on third-party sites are positive. It also earned perfect marks in our user popularity criterion, given its ratings of 4 and up on G2 and Capterra and the high number of average user reviews (more than 1,000).

Gusto reviews earned the following scores on popular user review sites:

- Capterra: 4.6 out of 5 based on more than 3,900 reviews

- G2: 4.5 out of 5 based on about 2,000 reviews

Many reviewers said it has an intuitive and user-friendly interface that helps simplify payroll, tax filings, and onboarding processes. They also like that it is easy to set up and has payroll plans that provide the best value for money, given the wealth of features included in each package.

However, there are mixed reviews about its customer support. While many users mentioned that they received excellent service, several others are unhappy with the support provided by the Gusto payroll customer service team, mainly because of long wait times and some reps that aren’t always responsive.

A few Gusto small business users also complained about its limited customization options and having experienced software glitches (like being logged out of the software) from time to time.

Additionally, reviewers on Reddit are mixed, with some stating they have had a partnership with Gusto for more than two years with no incidents. Others claim Gusto was the worst decision they’ve made because of missed paychecks and shifting blame.

Methodology: How We Evaluated Gusto

When we evaluate payroll software for small businesses, we look at pricing and ease of use. We also check the provider’s customer support and whether it offers unlimited pay runs, multiple pay options, full-service payroll, and tax filing services.

Access to third-party integrations and basic HR tools like employee benefits and onboarding are also important. We even consider the feedback that actual users post on popular user review sites.

20% of Overall Score

We checked to see if the provider has transparent pricing, zero setup fees, and multiple plan options with unlimited pay runs. Providers priced at $50 or less per employee monthly were also given extra points.

20% of Overall Score

We gave priority to those that offer multiple pay options, two-day direct deposits, tax payments and filings, year-end reporting (W-2s and 1099s), and a penalty-free tax guarantee.

20% of Overall Score

Payroll service and software should be simple to set up, customizable, and have a user-friendly interface. We also looked at whether the provider offers live support and integration options with online tools that most small and medium businesses (SMBs) use, such as accounting, time tracking, and scheduling software.

15% of Overall Score

Online onboarding, or giving employees the option to fill out forms like W-4s electronically, is the top criterion, followed by state new hire reporting and the availability of a self-service portal where employees can view pay stubs, edit information, and access forms. Extra points were also given to providers that offer expert HR support, benefits options, time tracking, and health insurance plans that cover all US states.

15% of Overall Score

In this criterion, we assess whether the software’s ease of use, pricing, and the width and depth of its payroll and HR tools are ideal for SMBs.

5% of Overall Score

We considered user reviews, including those of our competitors, based on a five-star scale; any option with a four-star average is ideal. Also, any software with over 1,000 reviews on any third-party site is preferred.

5% of Overall Score

Preference was given to software with built-in basic payroll reports and customization options.

Frequently Asked Questions (FAQs)

Gusto doesn’t offer a free trial, as of this writing. However, it has a demo that you can access on its website for free. It also follows a month-to-month pricing scheme with no annual contracts. You can cancel your Gusto plan at any time.

Gusto has a financial management app, Gusto Wallet, that your employees can use to receive payroll, view payslips and tax forms (W-2s), track and save funds, and even clock in/out for work. It’s free to download on Android and iOS devices. Apart from Gusto Wallet, the provider doesn’t have a mobile app.

Pay-as-you-go workers’ compensation plans are available via Gusto’s partner, AP Intego. You can apply online, sync to your payroll, and spread your payments over the year to ease financial burdens.

Bottom Line

Gusto earns top marks as a popular full-service payroll software that manages payroll taxes, offers Global EOR services, and has hiring and onboarding tools for both US and international contractors and employees. Its multiple payment options and variety of benefits (now offered in all 50 states) give you some flexibility, helping you provide attractive perks to potential new employees.