In contrast to states like New York, with challenging payroll rules that can change often, Colorado’s payroll is relatively straightforward, though it does have some laws protecting employees that other states don’t have. Taking time to learn how to do payroll in Colorado will help ensure you feel more comfortable as you begin to manage payroll taxes and employee payments.

Key Takeaways:

- Minimum Wage: $14.42 per hour

- Tipped Minimum Wage: $11.40 per hour for tipped employees

- A few local jurisdictions have higher minimum wages

- Colorado doesn’t require employers to offer PTO

- Colorado mandates 48 hours of paid sick leave per year

- Overtime: Follows federal standards of 1.5 times the employee’s regular rate of pay

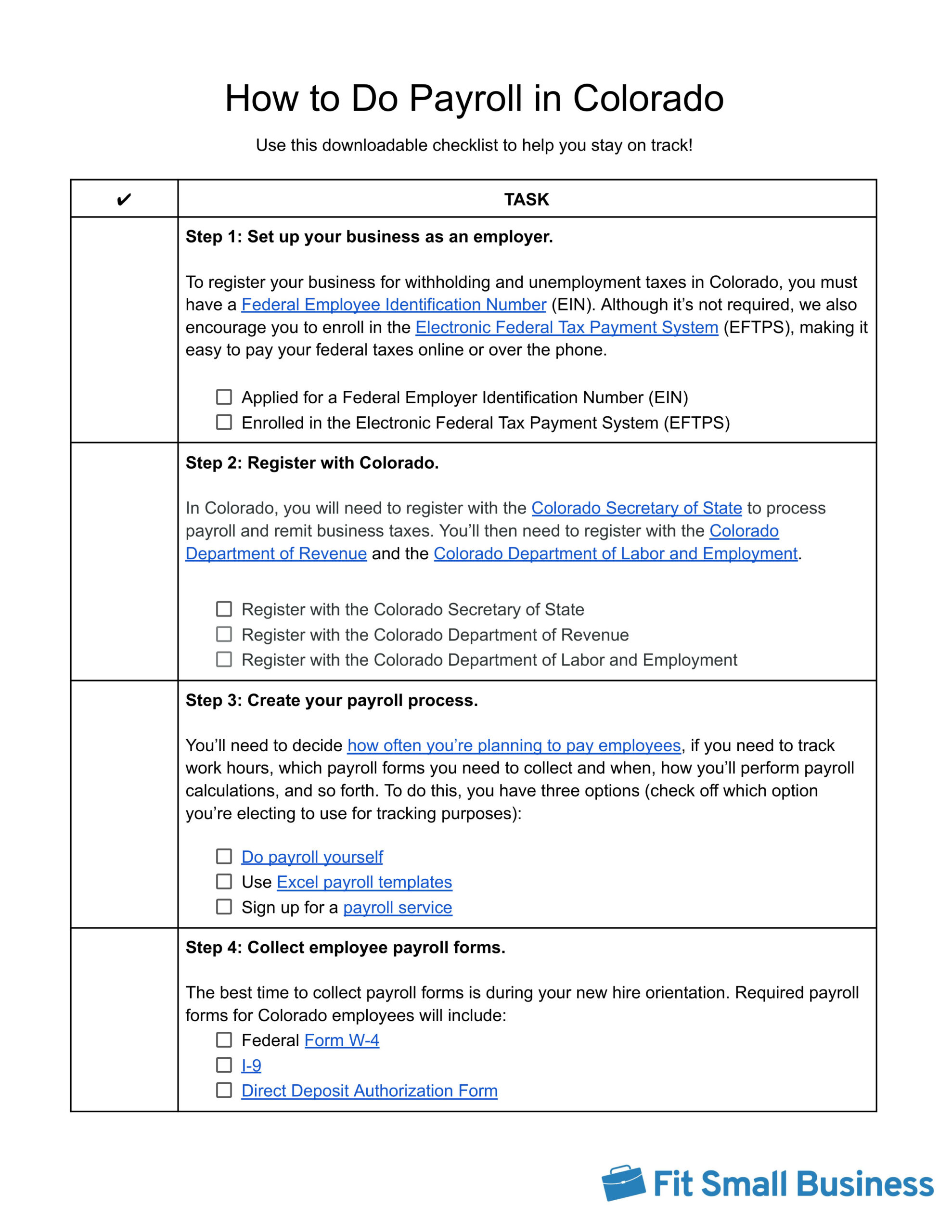

Step-by-Step Guide to Running Payroll in Colorado

It is relatively simple to handle payroll in Colorado because it doesn’t have special taxes or many state-specific forms. Here are your basic steps for running payroll in Colorado:

Step 1: Set up your business as an employer. Get your company’s Federal Employer Identification Number (FEIN). If your company is brand-new, you may need to apply for a FEIN. This is a simple process that can be completed online via the Electronic Federal Tax Payment System (EFTPS). If you work for a company that already has one, keep the FEIN handy. The FEIN is required to pay federal taxes.

Step 2: Register with Colorado. Any company that pays employees in Colorado must register with the Colorado Secretary of State. You must also register with the Colorado Department of Revenue and the Department of Labor and Employment so you have an account to credit your withholdings.

Step 3: Create your payroll process. If you work for an established business, you may have inherited a payroll process. But if your company is brand-new, you may need to start your payroll process, which means deciding how often you’ll be paying employees, when you’ll pay them, how you’ll track and calculate hourly employees’ work time, and how to handle any employee benefits you offer. Overall, you can opt to do payroll yourself by hand, set up an Excel payroll template, or sign up for a payroll service to help you handle your Colorado payroll.

Step 4: Collect employee payroll forms. New employees should submit certain documentation, including payroll forms, during onboarding. All employees must complete I-9 verification no later than their third day on the job. Every employee must also have a completed W-4 form on file. Colorado does not have a separate W-4 form so you can use the federal version. Employees must also provide you with direct deposit information.

Step 5: Collect, review, and approve time sheets. This step is one you’ll repeat as you do payroll each period. Keeping track of employees’ hours is essential for ensuring accurate payroll. Whether you use paper time sheets (not recommended) or time and attendance software, review time sheets for accuracy and discuss any errors or issues with employees right away. Having employees sign their timesheets is a good idea, whether they do so electronically or by pen on paper.

Step 6: Calculate payroll and pay employees. Use a standard process to calculate payroll. A payroll software will reduce errors. Don’t forget to calculate withholdings for non-residents unless you have a bona fide business location in their state. Most companies today use direct deposit to pay their employees, but cash (not the best way) and paper check are also options. You can pay your federal and state taxes online. If you use a benefits provider, it should work with you to make deductions simple, automatic, and electronic.

Step 7: File payroll taxes with the federal government. Federal tax payments must be made via EFTPS. You’ll need to deposit federal income tax withheld and both employer and employee Social Security and Medicare taxes based on the schedule assigned (either monthly or every other week) to your business by the IRS.

- Monthly depositors are required to deposit employment taxes on payments made during a month by the 15th day of the following month.

- Every other week depositors are required to deposit employment taxes for payments made Wednesday, Thursday, and/or Friday by the following Wednesday. Taxes on payments made Saturday, Sunday, Monday, and/or Tuesday are due by the following Friday.

It’s important to note that the schedules for depositing and reporting taxes are different. Employers who deposit both monthly and semiweekly should only report their taxes quarterly or annually by filing Form 941 or Form 944.

Step 8: File payroll taxes with the State of Colorado. All Colorado state taxes need to be made to the applicable state agency on the schedule provided, usually quarterly, which you can do on the Colorado Department of Revenue website. If you operate in a Colorado jurisdiction with local taxes, you will also need to remit those taxes to the correct agency on the schedule provided to you.

Step 9: Document and store your payroll records. As with most business records, you want to keep copies. If you ever need to refer to a pay stub, you want to know where to find it and that you have it. The compliance of your business depends on maintaining records for all employees, including those who have left. Colorado has no additional rules for document storage, so follow federal guidelines.

Step 10: Complete year-end payroll reports. At the end of the year, you will need to first complete all W-2 forms for your employees and 1099 forms for your independent contractors. These forms must be provided to employees and contractors no later than Jan. 31 of the following year.

Download our free checklist to help you stay on track while you’re working through these steps:

Colorado Payroll Laws, Taxes & Regulations

Colorado generally follows federal regulations. To make sure that your company adheres to all laws and regulations, it’s a good idea to speak with an employment law expert in your area. To ensure you maintain compliance with payroll regulations, review the ins and outs of doing payroll in Colorado below.

Colorado Taxes

With few exceptions, most employers in the US must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Social Security is 6.2% and 1.45% for Medicare. Beyond federal taxes, Colorado levies state taxes on businesses and employees. Businesses must calculate and withhold the correct amount of tax from employees and pay a percentage from their own bank accounts.

All businesses in Colorado must pay State Unemployment Tax Act (SUTA) taxes. The wage base for 2024 is $20,400. The state provides additional information and a premium calculator online. The unemployment rate for new non-construction employers is 1.53%, general construction is 1.56%, heavy construction is 5.7%, and trades is 1.56%. Ongoing rates range from 0.64% to 8.68%.

You’re also responsible for federal unemployment taxes (FUTA). The standard rate is 6% on the first $7,000 of each employee’s taxable wages. The maximum tax you’ll pay per employee is $420 ($7,000 x 6%).

Did You Know?

When you pay SUTA, you may qualify for up to a 5.4% discount on your FUTA. This can greatly reduce what you owe the IRS—from 6% to 0.6%. In addition, if you pay your terminated employees’ benefits, you may qualify for a discount on your UI taxes.

Colorado businesses with one or more employees must carry workers’ compensation insurance. Maintenance or repair work, as well as domestic work are exceptions to this requirement. Workers’ compensation premiums will vary depending on the industry in which your company operates.

For most employees, you will need to deduct state income taxes from each paycheck. Colorado has a flat income tax of 4.40%. Pay close attention to where employees live because several cities and municipalities in Colorado require additional income tax withholdings. Colorado has five jurisdictions that levy a flat dollar amount per month in income tax:

Jurisdiction | Per Month Income Tax Rate |

|---|---|

Aurora | $2.00 |

Denver | $5.75 |

Glendale | $5.00 |

Greenwood Village | $2.00 |

Sheridan | $3.00 |

Colorado Minimum Wage

Colorado’s minimum wage is currently $14.42 per hour—more than the $7.25 federal minimum wage. The tipped minimum wage is $11.40 per hour. If an employee’s tips plus the cash wage do not equal $14.42 per hour, the business must make up the difference.

Three jurisdictions in Colorado have their own, higher minimum wage:

- Denver: $18.29 per hour ($15.27 per hour for tipped employees)

- Edgewater: $15.02 per hour ($12.00 per hour for tipped employees)

- Unincorporated Boulder County: $15.69 per hour ($12.67 per hour for tipped employees)

Calculating Overtime

If you have employees who are eligible for overtime pay, you must calculate their overtime as 1.5 times their regular rate. An employee is eligible for overtime if they have worked:

- Over 40 hours in a single workweek

- Over 12 hours in a single workday

- Over 12 consecutive hours regardless of the start and end time of the workday

Paying Employees

Colorado requires that employers pay employees at least once per month. You are free to run payroll more frequently. Regardless of the pay schedule your company uses, you must have regular and consistent paydays. You cannot move the days around to help with your cash flow. As a result, if you pay your employees alternate Fridays, you must stick to it.

You also have several options for paying your employees:

- Cash

- Paper check

- Direct deposit

- Pay card

Pay Stub Laws

When you pay your employees, Colorado law states you must give them a written or printed pay stub. The pay stub must clearly state:

- Gross wages

- All withholdings and deductions

- Net wages

- Pay period dates

- Business name and address

- Employee name or Social Security number

Colorado Paycheck Deductions

Besides traditional deductions, such as for taxes, Social Security, and benefits, your company cannot deduct additional amounts from an employee’s paycheck unless the deduction is:

- Mandated by local law or approved by a court

- To repay loans made by your company to the employee

- To recover stolen property of the business

- Approved by an employee for a legal reason

Terminated Employee’s Final Paychecks

If an employee quits, your job is easy. You must pay them for the hours they worked on the next regular payday after their departure.

If an employee is fired, you must pay the employee immediately. If you are not able to cut the employee’s final paycheck on the same day they are terminated, you need to send it the next business day.

Colorado HR Laws That Affect Payroll

Colorado’s HR and employment laws align with federal regulations. For your company to remain compliant, though, you must consider certain nuances.

Colorado New Hire Reporting

Colorado requires that employers submit new hire information to the Colorado State Directory of New Hires within 20 days of their first day of work. The state uses this information to locate parents who may owe child support. Employers in Colorado must also submit new hire information when they partner with an independent contractor or freelancer.

Breaks, Lunches & Nursing Mothers

Colorado law requires that every business provide paid 10-minute breaks for every four hours an employee works. Employers and employees may agree in writing to modify this break period to two five-minute breaks.

When an employee works over five consecutive hours in a day, their employer must provide them with a meal break of at least a half-hour. This meal break may be unpaid, unless the employee cannot step away from their duties. If an employee needs to keep working, they must be allowed to eat during this time and must be compensated.

Employers must provide mothers with an unpaid nursing break for up to two years after giving birth. The company must also make reasonable efforts to give the mother a private space to nurse. This break time does not have to be paid unless the employee elects to use paid break or meal time.

Colorado Child Labor Laws

Colorado generally follows the Fair Labor Standards Act (FLSA) child labor laws. Under the FLSA, there are restrictions for workers under the age of 18.

It is illegal for minors to work more than 40 hours in a week or more than eight hours in a 24-hour period in Colorado. Besides this requirement, no minor can work between the hours of 9:30 p.m. and 5 a.m., unless the minor is working as a babysitter or the next day is not a school day.

Retirement Savings Plan

The Colorado Secure Savings program has now gone into effect. Businesses with five or more employees who have been in business for at least two years must offer a qualified private retirement plan or join the state’s savings program.

Time Off & Leave Requirements

Colorado Payroll Forms

Payroll forms can vary from state to state, and some have their own W-4. Fortunately, Colorado has no required state-specific forms, though it does offer the Form DR 0004, if employees want to use it.

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need.

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees

- Form 940: To calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for non-employee contract work

Colorado Payroll Tax Resources

- Colorado Department of Revenue provides many forms, information on the latest laws and regulations, and other employer-specific information.

- Tax withholdings often trip up employees processing payroll; reviewing Colorado’s comprehensive information may help you.

- For extensive information on how to get workers’ compensation coverage, Colorado’s Department of Labor and Employment offers guidance.

Frequently Asked Questions About Colorado Payroll (FAQs)

Some, yes. You don’t have to provide PTO, but you do need to provide sick leave and retirement access, among others. Make sure you adhere to state requirements to stay compliant.

Yes, but it is not required. An employee may use the Colorado Employee Withholding Certificate, Form DR 0004, if they choose. If an employee submits this form to your company, you must use the amounts the employee entered. If they don’t use this form, you withhold based on IRS guidelines.

Act swiftly. If your payroll error relates to a withholding issue, contact the tax agency to discuss your options. If the error relates to employee pay, speak with the employee immediately and let them know you’re taking steps to resolve the matter.

Bottom Line

Colorado payroll is fairly easy compared to some states. There are no required state-specific forms; you’ll just need to stay abreast of state-specific payroll and HR laws.

If you need help running your Colorado payroll, consider using payroll software like QuickBooks Payroll. It files and pays your payroll taxes and covers any penalties you are charged if its reps make a mistake (it’ll cover your mistakes too if you opt for a premium plan). You can pay employees via direct deposit or check, and same-day payment options are available as well. Sign up for a free trial or discounted rate.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.