Doing payroll in Montana isn’t overly complicated, but it does require you to be on top of state income tax rates. Payroll laws align with federal laws, for the most part, so you won’t have to comply with conflicting rules. We cover how to do payroll in Montana, along with the most important HR laws that affect employee labor and wages.

Key Takeaways:

- Montana’s minimum wage is currently $10.30 per hour but is increasing in January 2025 to $10.55

- Montana does not allow children under 16 to work jobs using power equipment, including lawn mowers

- There are no time off or leave protections for workers beyond the federal requirements

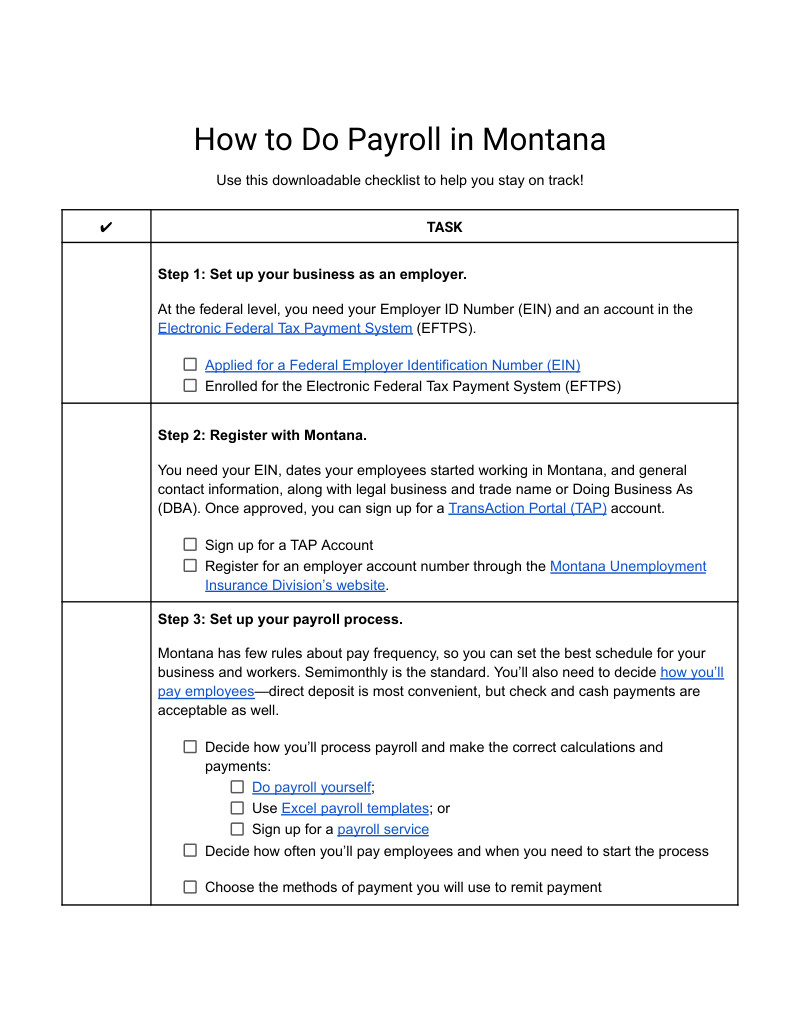

Step-by-Step Guide to Running Payroll in Montana

At the federal level, you need to apply for an Employer ID Number (EIN) and create an account in the Electronic Federal Tax Payment System (EFTPS).

You need your EIN, the dates your employees started working in Montana, and some general contact information, along with legal business and trade names or Doing Business As (DBA). Once approved, you can sign up for a TransAction Portal (TAP) account. You must also register for an employer account number through the Montana Unemployment Insurance Division’s website.

Montana has few rules about pay frequency, so you can set the best schedule for your business and workers. Semimonthly is the standard. You’ll also need to decide how you’ll pay employees—direct deposit is most convenient, but check and cash payments are acceptable as well.

Collecting payroll forms is easiest if you do it during onboarding. These include the W-4 form, I-9 form, and direct deposit authorization. For Montana, you need Form MW-4.

If you have hourly or nonexempt employees, you’ll need a way to track employee work hours. Many small businesses create their own time sheets using a free time sheet template; we recommend using time and attendance software, as this makes it easier. You must pay employees within 10 days of the pay period ending unless a time sheet is turned in late—so it’s important to gather and approve work hours for all employees you’re paying an hourly rate.

To calculate payroll, you’ll need to compute several totals, including total work hours (use our free time card calculator), gross pay, taxes and deductions to withhold, and so on. Using an Excel payroll template and payroll software (find some options in our guide to the best payroll software) can also simplify the work and is more accurate than performing the calculations by hand. When it’s time to pay employees, you can opt for direct deposit, check, cash, or pay card.

To pay federal taxes, you can pay online using the EFTPS. Montana has other rules to take note of.

- Montana Income Taxes: The state will send you the schedule for payments. However, you are welcome to pay withholdings every pay period if you prefer.

- State unemployment insurance taxes (SUTA): You must pay these taxes online. Reports and payments are due by the following dates:

For Wages Paid During | Calendar Quarter Ends | Must be Filed and Paid By |

|---|---|---|

Jan, Feb, Mar | March 31 | April 30 |

Apr, May, Jun | June 30 | July 31 |

Jul, Aug, Sep | Sept. 30 | Oct. 31 |

Oct, Nov, Dec | Dec. 31 | Jan. 31 |

If the due date for a report or tax payment falls on a Saturday, Sunday, or legal holiday, reports and payments are considered on time if they are received on or before the following business day.

Per Montana Rule 42.17.203, you must keep records for all of your employees, even those who have been terminated, for at least five years. Learn more in our article on retaining payroll records and refer to the Montana rule for details on exactly what information to keep.

Send the federal Forms W-2s (employees) and 1099s (for contractors) by Jan. 31 of the following year. You can file MW-3, W-2s, and 1099s to the state through your TAP account by Feb. 28 or send by mail to:

Montana Department of Revenue

P.O. Box 5835

Helena, MT 59604-5835

Download our free checklist to make sure you don’t miss any important steps:

Montana Payroll Taxes, Laws & Regulations

Naturally, you need to begin by following federal law for income taxes, Social Security and Medicare (FICA taxes), and federal unemployment insurance (FUTA). You’ll pay FICA taxes of 6.2% (Social Security) and 1.45% (Medicare). You should withhold those amounts from each employee’s paycheck and pay the same amount from your business bank account.

Montana Taxes

State and Local Income Taxes

Individuals who earn wages by performing services in Montana are subject to Montana state income tax (falling between 4.7% and 5.9% of the employee’s income), which you must withhold.

The following people are exempt:

- Spouses of US military

- North Dakota residents

- Workers subject to the Interstate Commerce Commission laws

- Native Americans

- Foreign agricultural workers with H-2A visas

You can find a complete chart of specific cases in the Montana Withholding Tax Guide. There are no local income taxes.

The guide also has the tax withholdings table for how much to withhold per paycheck based on income and withholdings.

Your Montana state income tax withholding schedule is determined by the amount you held during the previous year’s look-back period; you’ll be notified by Nov. 1 of any changes to your payment schedule.

The Montana Department of Revenue determines your schedule based on these parameters:

Amount withheld in look-back period | Payment schedule |

|---|---|

New employers | Pay monthly on 15th of the following month |

$12,000 + | Pay per federal schedule |

$1,200 - $11,999 | Pay monthly on the 15th of the following month |

$1,999 or less | Pay annually on Jan. 31 of the following year |

There are three primary ways to pay taxes. Get more information on payment options at the Montana DOR website.

Online TransAction Portal | Mail Check |

|---|---|

Need a TAP account | Can’t use if paying >$500,000 |

Pay with e-check (free) or credit/debit card (fee) | Pay monthly or annually |

Pay Taxes On Time! There is a late penalty of 1.5% per month on unpaid taxes, not to exceed 15%. Failure to furnish W-2s by Jan. 31 incurs a penalty of $50 or 5% per W-2, whichever is greater.

Unemployment Insurance

Montana charges state unemployment insurance taxes (SUTA). The SUTA is based on a taxable wage base of $43,000 for 2024. Rates range from 0.00% to 1.42% for eligible (positive-rated) employers and 2.92% to 6.12% for deficit (negative-rated) employers. Your rating is based on your reserve ratio, which is contributions paid minus benefits paid out to ex-employees over the last three federal fiscal years. New employers pay the average contribution rate for employers in the same industry classification. You can find your exact rates in the Montana unemployment insurance table.

There is also an administration fee for experience-rated employers of 0.18% of taxable wages which is also due each quarter.

If you pay less than $1,000 in wages in a current and previous year, you do not need to pay unemployment insurance taxes.

You must pay SUTA if:

- Your annual gross wage payroll equals or exceeds $1,000 in the current or previous calendar year

- You acquired a business subject to SUTA

- You are subject to FUTA

- You employed agricultural workers and paid $20,000 or more in cash during any quarter or the current or previous calendar year

- You employed 10 or more workers in agricultural labor in 20 different weeks during the current or previous calendar year

- You employed domestic workers and paid $1,000 or more in cash for domestic services in any quarter of the current or preceding calendar year

Did You Know? When you pay SUTA in full and on time, you may qualify for up to a 5.4% discount on your FUTA taxes. FUTA is 6% of the first $7,000 of each employee’s paycheck, so you can be discounted to 0.6%.

Workers’ Compensation Insurance

Montana requires you to carry workers’ compensation insurance if you have even one employee. Minors and aliens, legal or otherwise, count as employees. There are a few exceptions that include domestic employees, family members, sole proprietors, and certain people working for aid only.

You can purchase workers’ compensation insurance from a private agency, through the Montana State Fund, or by self-insuring. You can apply for the state fund on its website or through one of its agents, which you can also find on the website. Self-insuring requires setting aside money to cover claims and may not be the best choice for small businesses.

Minimum Wage Laws in Montana

The Montana minimum wage is $10.30 per hour in 2024—but is set to increase to $10.55 on January 1, 2025. This amount does not allow tip credit, meal credits, or training wages. The amount can change each Sept. 30 and is not to go below the current state minimum or the federally mandated minimum ($7.25 an hour)—you’re not allowed to pay tipped employees less.

The Montana Department of Labor & Industry calculates the next minimum wage each August to adjust for cost of living increases as applicable and rounds the amount to the nearest five cents.

Businesses not covered by the Fair Labor Standards Act with gross annual sales of less than $110,000 per year may pay $4 per hour. The only exception is certain farmworkers—see Montana Code 39-3-404 for details.

Montana Overtime Regulations

Employees working over 40 hours in a workweek must receive compensation of at least 1.5 times their hourly wage. Exceptions include:

- Farmworkers

- Students at amusement or recreational areas that operate on a seasonal basis who get board or lodging; their workweek can be 48 hours before overtime applies

- Firefighters and law enforcement officials, who then fall under the rules of the Fair Labor Standards Act

Different Ways to Pay Employees

Montana does not limit how you pay employees, as long as it is in lawful US money that they can receive at full value. Employees cannot be forced to be paid electronically, so if you offer direct deposit, you should also provide an additional option, like paper check or cash. Payroll cards are also an option—they just shouldn’t be the sole method of payment.

Pay Stub Laws

Employers must supply employees with an itemized statement of wages and deductions each payday. You should include basic information about the employee, like the name and job title. You should also list their pay rates, hours worked, if applicable, gross pay, total taxes and deductions withheld, and final net pay amount.

For help creating your own, download one of our free pay stub templates.

Minimum Pay Frequency

Employees must be paid within 10 days of the end of the pay period unless the employee is late in turning in a time sheet. In that case, the employer may pay the employee those wages on the subsequent payday.

Montana payroll law does not set a minimum pay frequency, but it states that unless otherwise agreed upon, it should be semimonthly.

Paycheck Deduction Rules

Employers can deduct taxes and federally mandated garnishments from employee paychecks. You can also deduct for board, lodging, or incidentals of benefit to the employee, but these should be listed in writing. However, you’re restricted from deducting an employee’s wages for the following:

- Cash shortages

- Stolen, lost, or damaged property

- Claimed indebtedness from employee to employer

Montana law does not prohibit employers from requiring workers to purchase uniforms, tools, or other items needed for employment.

Final Paycheck Laws

Final paychecks are due by the next payday or 15 days from separation, whichever comes first. Employees can request a check instead of other payment methods—and you must mail the payment if requested.

If an employee is fired or laid off, the unpaid wages are due and payable immediately unless the employer had a previously agreed-on written policy. Then, the maximum time is by the payday or within 15 days, whichever comes first. Final paychecks should be the full amount owed. However, you are not required by law to pay severance or for unused paid sick leave or paid time off.

Employers may withhold the final paycheck to cover expenses from theft of property or funds by the employee if the employee agrees in writing or the employer has filed a police report within seven business days of the separation. Read Montana Code 39-3-205 for details.

Montana HR Laws That Affect Payroll

Montana’s HR laws generally follow federal guidelines. This makes it easy to comply since there are no conflicting rules.

Montana New Hire Reporting

You must report new hires to the Department of Health and Human Services within 20 days of the first day of work. You’ll need the employee’s legal name, date of hire, SSN, and mailing and home address. You can do this online if you have an ePass account. Alternatively, you can fill out the New Hire form and mail it to:

Montana New Hire Reporting

P.O. Box 8013

Helena, MT 59604-8013

Lunch & Other Break Time Requirements

Montana does not have laws that mandate lunch breaks or other rest breaks. If a break is offered, however, it is considered paid time. If a mealtime is longer than 30 minutes, and the employee is completely relieved of duty, it’s not considered paid time.

Hiring Minors

Montana defines a minor as anyone 18 or younger, except those with a high school diploma or GED, or people 16 or older enrolled in a registered state or federal apprenticeship program.

Similar to federal law, Montana doesn’t allow minors to work in hazardous jobs. Minors 14 or 15 have additional restrictions, with some exceptions if they have a 4-H certificate for specific equipment. Some prohibited jobs include manufacturing, processing work, warehouse, communications, and construction.

Minors 14 and 15 may not work:

- During school hours, except where provided as public instruction

- Between 7 p.m. and 7 a.m., except outside the school year, in which case they may work until 9 p.m.

- More than three hours on school days

- More than 18 hours in a school week

- More than eight hours on a non-school day

- More than 40 hours in a non-school week

- In a job where they operate power-driven equipment including lawnmowers

Also, minors receive minimum wage just like adults.

Child labor laws are exempted for:

- Minors doing lawn care and residential or domestic chores on a casual basis

- Minors working in the family business (except for manufacturing, mining, and hazardous occupations)

- Farm work with the consent of parents on the family farm or farm where the parent or guardian is employed

- Newspaper delivery

- Volunteer work

- Child actors, models, or performers

- Legislative aids

- Officials or referees in nonprofit athletic organizations

- Student learners or apprentices

Time Off Rules

Montana does not have any laws concerning paid time off. Unlike some states, there is no required time off for voting leave or jury duty. You must, however, follow federal laws concerning family leave and sick leave. And if you do offer paid time off through a PTO policy, you cannot mandate a “use or lose” policy. You can set a maximum accrued amount after which more cannot be accrued until the existing amount is used.

Federal Family and Medical Leave

There is no state family and medical leave program, but you may be required to comply with the federal Family and Medical Leave Act (FMLA). It requires certain employers with at least 50 employees for a minimum of 20 weeks during the current or prior year to provide up to 12 weeks of unpaid time off to eligible employees who are:

- Birthing/adopting/fostering a new child

- Caring for a sick family member

- Handling military duties

Jury Duty Leave

You’re not required to offer paid time off for jury duty. However, you can’t discriminate or terminate an employee who is summoned to appear.

Montana Payroll Forms

Montana State MW-4 Form

MW-4: Montana has its own W-4 form for state tax withholdings. The following people need to fill it out:

- New employees

- Current employees who have not filled one out yet may use the information on their existing federal W-4 unless they need to make changes to it, in which case they need to fill out the MW-4 as well.

- Employees who previously used Form MT-R, MSR, or had a Native American Request for Exemption. (This was effective in the 2019 tax year and should already have been done.)

Other Montana State Payroll and Tax Forms

- MW-1 Montana Withholding Tax Payment Voucher: for paying income tax withholdings by check

- MW-3 Montana Annual W-2 1099 Withholding Tax Reconciliation: the annual form sent to employees for state tax filing

For other Montana state forms that apply to business, including requests for credits and exemptions, visit the Montana DOR forms library under Business. For SUTA forms, go to the Montana Department of Labor and Industry.

Federal Payroll Forms

- W-4 Form: To help employers calculate taxes to withhold from employee paychecks

- W-2 Form: Reporting total annual wages earned (one per employee)

- W-3 Form: Reports total wages and taxes for all employees

- Form 940: Reports and calculate unemployment taxes due to the IRS

- Form 941: Filing quarterly income and FICA taxes withheld from paychecks

- Form 944: Reporting annual income and FICA taxes withheld from paychecks

- 1099 Forms: Providing non-employee pay information that helps the IRS collect taxes on contract work

Montana Payroll Tax Resources/Sources

- Montana Withholding Tax Guide: All the information you need on state income taxes, including tables to determine how much to withhold

- Montana Department of Revenue: Links to information on withholdings, forms, getting a withholding account, and more

- Montana Wage and Labor Law Guide: Codes, Acts, and other information on wage law

- Montana UI eServices for Employers: To register for accounts, get information, handbooks, and forms

- Workers’ Compensation Regulations: Information and contacts for workers’ comp in Montana

- Montana’s Child Labor Law Reference Guide: Rules and exemptions for minors

Frequently Asked Questions (FAQs) About Montana Payroll

In Montana, you must pay employees according to your regular payroll—and, if it’s not noted in your handbook or other policy documents, you should pay at least twice per month. In any situation, you must pay employees within ten days of them submitting their time sheets.

Montana employers pay federal taxes like Social Security, Medicare, and federal unemployment. You’ll also contribute to state unemployment and must comply with the workers’ compensation requirements.

If you’ve made a payroll error, speak with the employee right away and let them know what actions you’re taking to correct the mistake. Also, work with any state agencies to ensure you update and remit the correct withholdings.

Bottom Line

Although it is less restrictive in its labor and wage laws, there are specific regulations and penalties for noncompliance to take note of when learning how to do payroll in Montana. It has a state income tax, SUTA, and workers’ comp requirements. It’s important to understand the payroll laws and apply them from when you first hire an employee until the last paycheck.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.