Paychex is one of the most popular choices for payroll and human resources (HR) support for businesses of all sizes—and with good reason. It has scalable and customizable plans and performs a vast range of functions to help you manage the entire employee lifecycle, from hiring to retiring. However, its pricing can grow quickly as a result.

Thus, it’s not always the best choice. If you are on a tight budget, require software and device provisioning tools, or need global support, consider these top Paychex competitors.

- ADP: Best overall Paychex competitor

- Gusto: Best for small businesses that primarily require payroll software

- QuickBooks Payroll: Best for QuickBooks users and low-cost contractor payments

- Paycor: Best all-in-one HR platform with a configurable payroll solution

- Rippling: Best for HR automation and hardware/software management

- Square Payroll: Best for retailers and Square users

Paychex Competitors Compared

Our Score (out of 5) | Starter Pricing | Unlimited Pay Runs | Hiring & Onboarding | Professional Employer Organization (PEO) Option* | |

|---|---|---|---|---|---|

4.61 | ✕ | ✓ | ✓ | ||

4.60 | ✕ | ✓ | ✓ | ||

4.57 | $49 per month + $6 per person per month | ✓ | ✓ | ✕ | |

4.35 | $50 base fee + $6 per employee monthly | ✓ | Onboarding only | ✕ | |

4.28 | ✓ | ✓ | ✕ | ||

4.20 | ✓ | Onboarding; hiring tools cost extra | ✓ | ||

4.13 | $35 base fee + $6 per employee monthly | ✓ | Onboarding only | ✕ | |

*A PEO is a co-employment service that helps manage your day-to-day HR, payroll, and benefits processes. Read our PEO guide to know more about its features and what it can do for your business. | |||||

ADP: Best Overall Paychex Competitor

Pros

- Feature-rich platform with a wide range of HR solutions

- PEO and global payroll available

- Highly experienced PEO that’s IRS and ESAC certified

- Dedicated reps are helpful

Cons

- Pricing isn’t transparent

- Customer service isn’t always easy to contact

- Year-end tax reporting, time tracking, and access to benefits plans cost extra

Overview

Who should use it:

ADP is one of the largest HRIS, payroll, and PEO companies, serving small businesses and large corporations with local and global payroll solutions. Like Paychex, ADP can create a custom package with specific tools to best fit your needs, making it a great option for companies with plans to grow.

Why I like it:

ADP has a wide range of products that can meet your business’ HR requirements. Its ADP Run solution includes payroll and HRIS capabilities, while its ADP TotalSource product is a full-service PEO for companies that need expert assistance in handling day-to-day HR tasks.

However, similar to Paychex, ADP doesn’t list pricing information on its website. It can also be a bit pricey, depending on how often you process payroll in a month. Unlike Gusto, Rippling, QuickBooks Payroll, Paycor, and Square Payroll—which all offer unlimited pay runs—ADP charges fees based on your pay period and employee count.

- Free trial: Occasionally offers free trial promos, such as free payroll for three months Check the provider's website for the latest promotions.

- Free plan: None

- Paid plans (for ADP Run):

- Essential: Call for a quote

- Enhanced: $81.66 per weekly pay run for 25 employees*

- Complete: Call for a quote

- HR Pro: Call for a quote

- Other products:

- ADP TotalSource (PEO services): Call for a quote

- Global payroll: Call for a quote

- Annual subscription option: None

- Paid add-ons:

- Year-end W2 tax filings: $54.95 base fee + $7.50 per employee*

- Health insurance and retirement plans: Call for a quote

- Workers’ compensation: Call for a quote

- Time tracking

- Mobile timekeeping via smartphones: $6 per employee monthly*

- Time clock kiosk app for iPad devices: $62.50 per iPad (unit is provided by your company) + $6 per employee monthly*

*Pricing is based on a quote we received

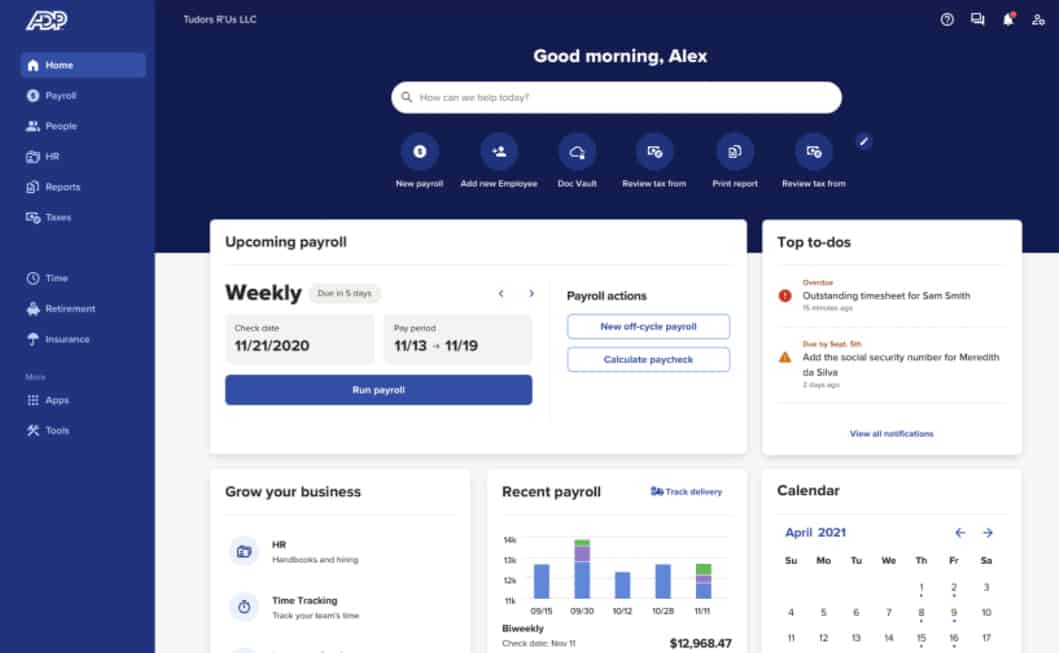

A snapshot of ADP Run’s main dashboard (Source: ADP)

- Multiple payment options: You can pay workers via direct deposit and the Wisely debit card. It also supports on-demand pay, enabling your employees to access earned wages before pay days. Similar to Paychex and Paycor, ADP offers check signing and stuffing services and will deliver the paychecks to your office in time for you to hand them out to employees.

- International payroll: If you have global staff, ADP (like Rippling and Gusto) can handle your international payroll needs via its global payment products, such as ADP GlobalView Payroll and ADP Celergo. In contrast, Paychex offers global payroll services via its partner, FMP Global.

- Employee benefits: ADP provides you access to a wide variety of enterprise-level benefits plans—from life insurance to retirement plans. And unlike Gusto, ADP’s health insurance options are available in all 50 states. However, it lacks the financial wellness tools that both Paychex and Gusto offer.

- Hiring support: ADP Run provides hiring solutions for posting jobs on ZipRecruiter and over 100 job boards, conducting background checks, and tracking applicants. In comparison, Paychex and Rippling offer hiring services as an add-on. Gusto also has applicant tracking and job posting capabilities to LinkedIn and ZipRecruiter, but you have to pay extra if you want to boost your job posts and for those to remain live for over 30 days.

- PEO services: Similar to Paychex, ADP TotalSource PEO services include strong compliance support and access to Fortune 500-level benefits. However, it isn’t as flexible as Rippling, which allows you to turn its PEO service off and switch to its HR platform easily.

- HR tools: Aside from employee information management, ADP offers basic learning management tools, such as courses for HR record keeping and sexual harassment prevention training. Like Paychex and Rippling, it charges for time and attendance tracking; whereas, Gusto, Paycor, and QuickBooks Payroll all have time and attendance tools in higher tiers.

Users like how ADP Run makes payroll and tax calculations less stressful for them. Several reviewers also appreciate its user-friendly platform and chat feature, which allows them to connect with the support team in case they need help or have tax-related inquiries.

However, some users said that it can be pricey for small businesses. Others wished for more report customization and filter options.

As of this writing, ADP Run earned the following scores on popular review sites:

- G2: 4.5 out of 5 based on over 1,400 reviews

- Capterra: 4.5 out of 5 based on nearly 800 reviews

Gusto: Best for Small Business Payroll

Pros

- Unlimited and automatic pay runs

- Has a separate contractor-only payroll plan

- Supports US and global payroll; pays international contractors in over 120 countries

- Employer of Record (EOR) service, called Gusto Global, can help you hire and pay international employees

- Wide range of HR features (such as recruiting, time tracking, and performance reviews)

Cons

- Health insurance limited to 38 states + DC only

- Time tracking, job postings, applicant tracking, and performance reviews reserved for higher tiers

- Starter plan only covers single state pay runs; you have to upgrade to at least its Plus plan for multistate payroll

- Gusto Global is available in only 12 countries (as of this writing); requires partnership with Remote to extend coverage to over 75 countries

Overview

Who should use it:

Small businesses can rely on Gusto to process employee payments accurately and compliantly. Its reasonably priced plans and efficient payroll tools are some of the reasons why it ranks in many of our buyer’s guides, such as best small business payroll software and best HR payroll software.

Why I like it:

Gusto is easy to use and has HR payroll tools that are well-suited for small and growing businesses. The provider continuously upgrades its platform and product offerings, introducing new features to help companies not only with their US payroll needs but also their global pay processing requirements.

However, its Achilles’ heel is that it only provides health insurance in 38 states + DC—fewer than the other Paychex competitors we reviewed, including Paychex. Its HR services are not as extensive as the other providers on this list, lacking the compensation planning tools that Paycor offers and the information technology (IT) onboarding tools that Rippling has, although it does help with app management. Plus, Gusto does not work as a PEO like Paychex, ADP, and Rippling do.

- Free trial: Occasionally offers free trial promos, such as one month free when you run your first payroll, wherein the offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled. Check the provider's website for the latest promotions.

- Free plan: None

- Paid plans:

- Simple: $49 per month + $6 per person per month

- Plus: $80 base fee + $12 per employee monthly

- Premium: $180 base fee + $22 per employee monthly

- Contractor plan: $35 base fee + $6 per US contractor; for contractor-only businesses

- Annual subscription option: None

- Paid add-ons:

- Priority support and HR resources: $8 per employee monthly only for the Plus plan (this is free for Premium plan holders)

- State tax registration: Pricing varies by state

- Health insurance: Pay only for premiums

- Workers’ comp: Pay only for premiums

- Retirement plan: Pricing varies based on provider/retirement integration

- Gusto Global: $699 per employee monthly

- Global contractor payments: Pricing varies based on foreign exchange rates

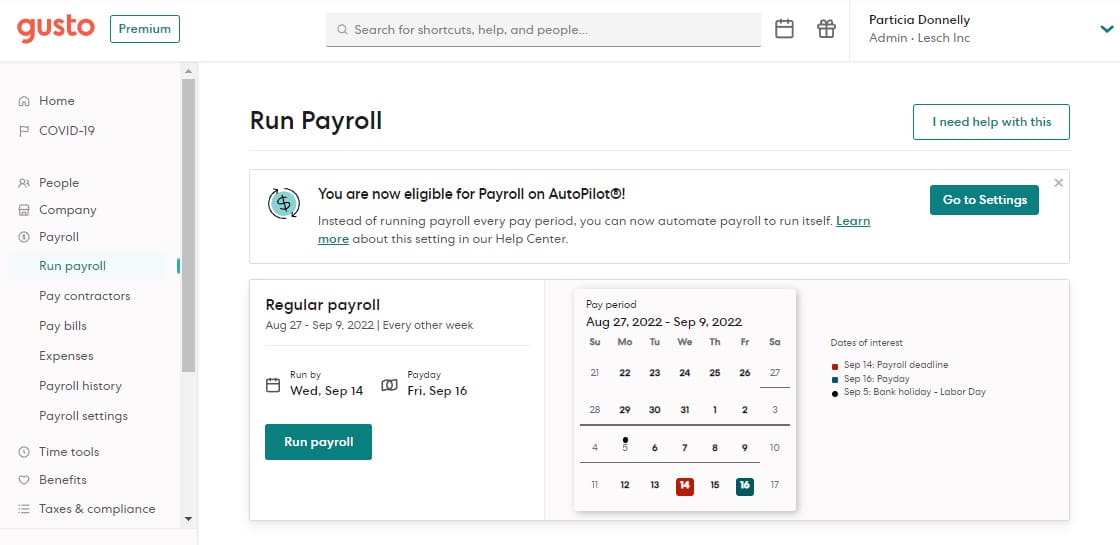

Gusto’s automatic pay run feature can be easily turned on/off via its payroll settings. (Source Gusto)

- Contractor-only plan: Apart from unlimited pay runs, you get year-end 1099-NEC tax reports and state new hire reporting (if required) for US contractors. While Square and QuickBooks also have contractor plans, both cannot handle international contractors like Gusto and the other Paychex alternatives on our list.

- Employee benefits and a financial management program: Gusto’s health insurance plans are unavailable in 12 states These states are Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, West Virginia, and Wyoming. , but it includes benefits administration in all of its plans (others charge for this.) Similar to Paychex, it offers financial management tools via its Gusto Wallet app, although it lacks ADP’s discount program that lets employees enjoy lower rates when purchasing items from ADP’s partner shops and retail stores.

- Hiring solutions: Gusto had a basic applicant tracking system, which others charge extra for. It posts jobs to popular job sites and you can add job listings to your company’s career website via shareable links. Gusto also has basic IT provisioning and deprovisioning tools, but not as robust as Rippling’s, which can handle the entire process—from computer issuance and software access control to device inventory tracking and remotely locking computers of resigning employees at the end of their last working day.

- Unlimited payroll: Gusto beats ADP and Paychex in that it allows unlimited pay runs. Year-end tax reporting (W-2s and 1099s) is free unlike Paychex and ADP, which charge extra for this. It also offers multiple ways to pay employees such as through checks, pay cards, and direct deposits. Direct deposit services are two and four days, with a next-day option included in its higher tiers. Meanwhile, Paychex, ADP, and the other providers here (except QuickBooks Payroll and Square Payroll) only offer two-day direct deposits.

Users like Gusto’s easy-to-use platform and extensive payroll capabilities, which helps streamline HR and employee pay processes. They also appreciate its integration options, allowing them to connect Gusto’s platform to the accounting and time tracking systems that they use.

However, some users find its fees a bit expensive, especially for very small businesses. Several reviewers also mentioned that its customer support quality isn’t always ideal. They explained that while some support reps are helpful, there are instances when the wait times are long or the support reps aren’t responsive.

As of this writing, Gusto earned the following scores on popular review sites:

- G2: 4.5 out of 5 based on more than 2,000 reviews

- Capterra: 4.6 out of 5 based on over 3,900 reviews

QuickBooks Payroll: Best for QuickBooks Users and Low-cost Contractor Payments

Pros

- Same- and next-day direct deposits

- Has an affordable contractor payment plan

- Integrates with QuickBooks accounting software seamlessly

- Elite plan includes an additional tax penalty coverage of up to $25,000 per year, regardless of who makes the mistake

Cons

- Automated local tax filings and payments available only in the Premium and Elite plans

- No mobile apps for employee self-service; only offers a workforce portal you can access online

- Basic HR features; lacks job posting, applicant tracking, performance reviews, and learning management tools

Overview

Who should use it:

QuickBooks Payroll’s native integration into QuickBooks Accounting makes it a great choice for QuickBooks users. Payroll information flows directly to the general journal, and you can use wage-related information to run reports using QuickBooks. Plus, its low-cost contractor payments plan also makes it the best Paychex competitor if you only pay contractors.

Why I like it:

QuickBooks Payroll can work as a standalone system, but when purchased with QuickBooks Accounting, data transfers between these Intuit products are seamless—helping remove errors from manual data inputs and when transferring data to your general ledger. And, unlike ADP and Paychex, it lets you run payroll as many times as you need in a month. It also supports multiple pay rates and offers payroll tax payment and filing services, but you’ll need to upgrade to at least its Premium plan if you want QuickBooks to remit and file local taxes for you.

- Free trial: New clients can choose from a 30-day free trial or 50% off base fees for the first three months Check the provider's website for the latest promotions.

- Free plan: None

- Paid plans:

- Payroll Core: $50 base fee + $6 per employee monthly

- Payroll Premium: $85 base fee + $9 per employee monthly

- Payroll Elite: $130 base fee + $11 per employee monthly

- Contractor payments: $15 monthly for up to 20 contractors + $2 per additional worker; for contractor-only businesses

- Annual subscription option: None

- Paid add-ons:

- Multistate tax filings: All plans include one state filing; $12 monthly for each additional state if on the Core and Premium plans (no add-on fees for Elite plan holders)

- Health and retirement plans: Call for a quote

- Workers comp: Call for a quote

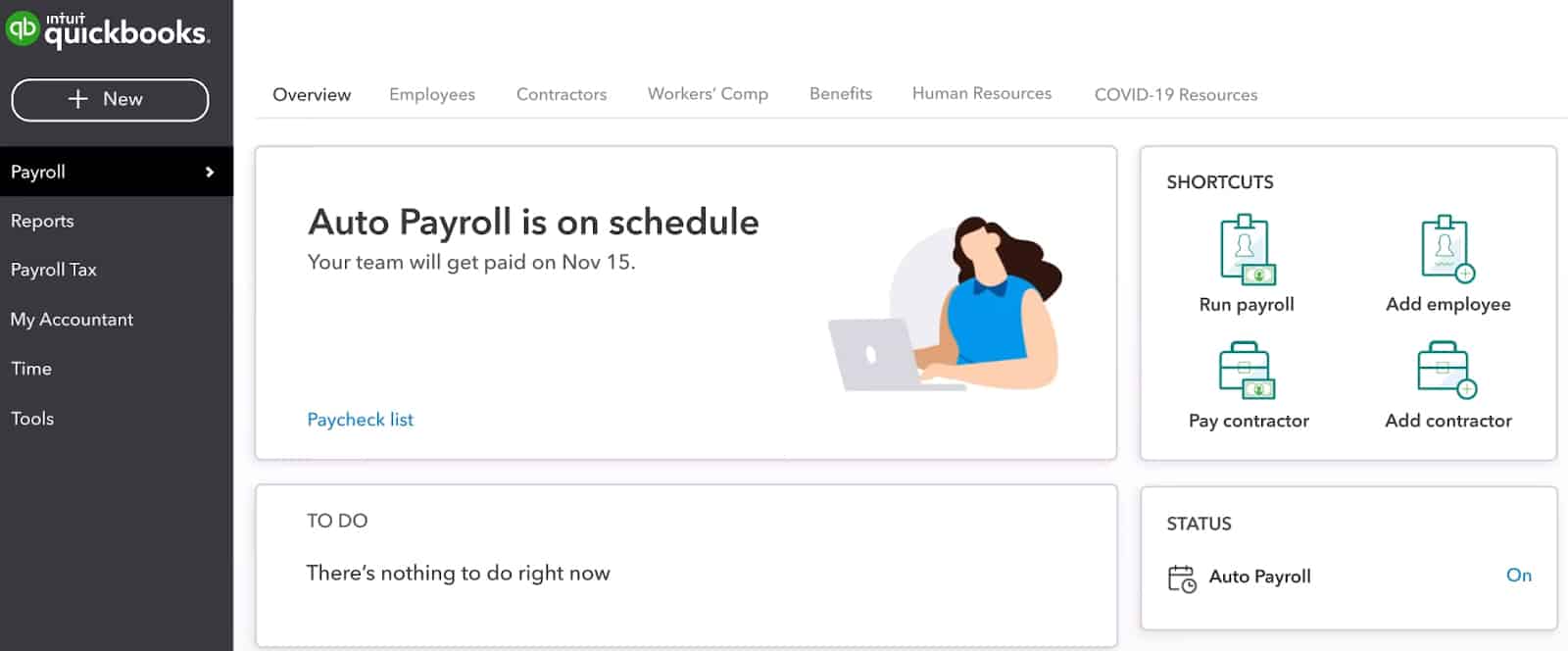

QuickBooks Payroll’s dashboard contains helpful links for running payroll, paying contractors, and adding employees. (Source: QuickBooks Payroll)

- Contractor payments: QuickBooks offers the lowest contractor payroll package on our list. For 20 workers, you only pay $15 per month. With Gusto, you have to shell out $155 monthly to process payments for 20 workers. And, while Square Payroll also has an affordable contractor plan ($6 per worker monthly), it’s only less expensive than QuickBooks if you need to pay two contractors each month.

- Fast direct deposits: QuickBooks Payroll is the only software in this article that provides next-day direct deposits in its starter tier. Those who subscribe to its higher plans get a same-day option. This is faster than any other Paychex competitor on this list, except for Square Payroll’s instant deposits via its Cash App.

- Tax accuracy guarantee and tax penalty protection: Unlike Paychex and the other providers in this guide, QuickBooks Payroll’s Elite plan will pay tax penalties―to a maximum of $25,000 per year―arising from tax errors and filing mistakes that either you or its representatives make. All other plans include a standard tax penalty coverage that pays penalties due to its tax filing mistakes.

Users like its ease of tracking employee time and reporting payroll and taxes. They also appreciate its easy integration with QuickBooks Accounting. On the other hand, some reviewers complained about its pricey plans, especially if you get other Intuit products. A few others also said that contacting its support team can be tedious at times.

As of this writing, QuickBooks Payroll earned the following scores on popular review sites:

- G2: 3.8 out of 5 based on over 60 reviews

- Capterra: 4.4 out of 5 based on nearly 900 reviews

Paycor: Best All-in-One HR Platform With Configurable Payroll

Pros

- Payroll and HR features are integrated

- Customizable pay grid and pay stubs

- Wide range of features; includes time tracking, recruiting, learning management, performance reviews, and compensation planning

Cons

- Pricing isn’t transparent

- Pricey for small businesses (based on the quote we received)

- Starter plan has basic HR tools

- Onboarding and HR tools are available only in premium plans

Overview

Who should use it:

Paycor is an all-in-one payroll and HR solution that gives you everything in a single system. While it has pricing for small businesses, we especially recommend it for midsize companies that need more HR support—mainly because its price tag can be a little hefty for small businesses that don’t need all the features. It also has a flexible payroll module that lets you customize paystubs and add or remove paydata columns from its pay grid.

Why I like it:

Paycor is one of the most expensive on our list, but its starter tier includes features that some providers offer in their higher plans. For example, with Paycor, you get the wage garnishment services that Paychex offers for free if you sign up to its higher tiers. Paycor’s starter plan also includes the check stuffing service that ADP Run only offers through its Enhanced to HR Pro packages.

However, if you don’t require these features, Paycor starter tier may not be right for you. For those with simple pay processing needs, consider either QuickBooks Payroll, Square Payroll, or Gusto. Rippling is also a great option, especially if you require payroll automations and customizable workflows to streamline processes across various HR tasks.

- Free trial: None

- Free plan: None

- Paid plans:

- Basic: $99 base fee + $6 per employee monthly*

- Essential: Call for a quote

- Core: Call for a quote

- Complete: Call for a quote

- Annual subscription option: None

- Paid add-ons:

- Time and scheduling: Call for a quote

- Workers comp: Call for a quote

- Benefits administration: Call for a quote

*Pricing is based on a quote we received

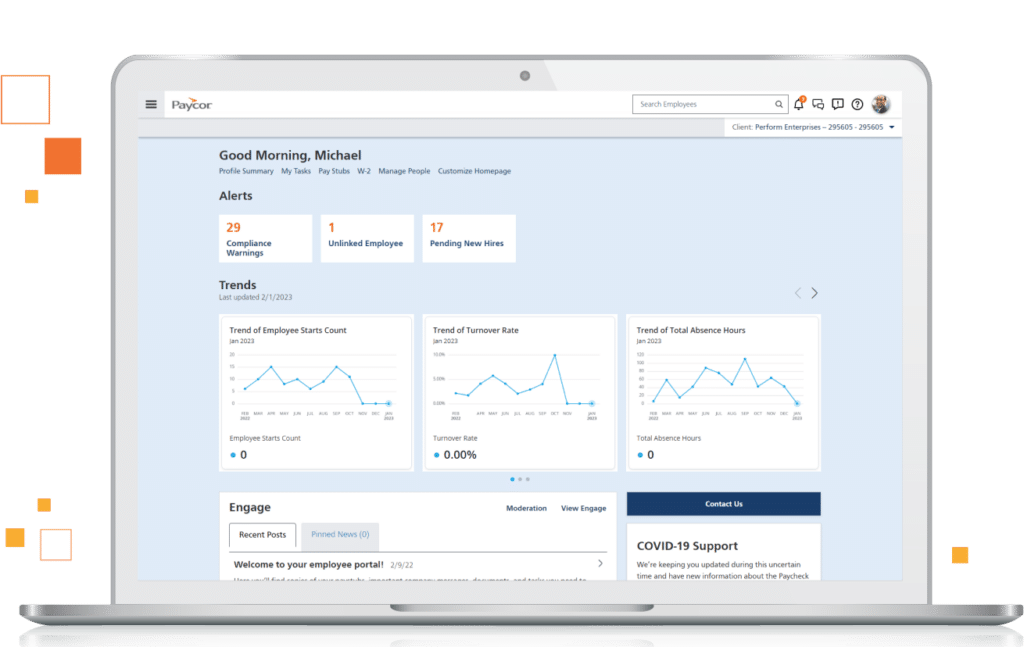

Paycor’s dashboard lets you view compliance alerts, access reports, manage employees, and more. (Source: Paycor)

- All-in-one HR platform: Paycor combines payroll with a wide suite of HR tools—from recruiting and employee scheduling to performance reviews and compensation planning. Its smart tools also automate HR tasks, such as its Virtual Sourcing Assistant feature that helps you find the best candidates for your open roles. Other Paychex alternatives, such as Square Payroll and QuickBooks Payroll, don’t have a robust offering of HR solutions and AI tools.

- Payroll and tax processing: Paycor stands out from Paychex and ADP in that it offers unlimited payroll. It also doesn’t charge extra for year-end tax reporting like ADP does. Pay employees through pay cards and two-day direct deposits. If you prefer to paycheck payments, Paycor (like ADP and Paychex) provides check-stuffing services.

- HR support: Similar to Paychex, Paycor provides a variety of HR support tools and services to help keep you compliant while streamlining processes. Its Core and Complete plans include access to HR professionals who can provide expert advice in handling employee issues. Rippling and Square Payroll charge extra for HR advisory services.

Reviewers described Paycor’s platform as user-friendly, with features that are generally easy to navigate through. Some users like that it has many HR functionalities that allow them to manage applicants, employee records, performance reviews, and learning programs.

Meanwhile, some users said that the customer support response time can sometimes be slow. A few others wished for more reporting options, better integration with third-party solutions, and a less glitchy mobile app.

As of this writing, Paycor earned the following scores on popular review sites:

- G2: 3.9 out of 5 based on more than 750 reviews

- Capterra: 4.4 out of 5 based on nearly 3,000 reviews

Rippling: Best for HR Automation and Hardware/Software Onboarding

Pros

- Excellent integration capabilities with over 600 options

- Can easily turn PEO on and off and still access HR and payroll software

- Intuitive interface

- Supports US and global payroll; also offers EOR services

- Modular solutions allow you to select HR, payroll, IT, and expense management features you need

Cons

- Pricing isn’t transparent

- Can get pricey as you add functions

- You have to purchase its core workforce management solution, Rippling Platform, before you can buy other modules

- Offers chat and email assistance only; no direct way to contact support via phone (you raise a chat request to schedule a phone call)

Overview

Who should use it:

Rippling is the best Paychex competitor for companies that heavily use technology and third-party software because it can integrate with more than 500 business apps and has the capability to assign laptops to employees, manage business system access, and track computer inventory. Its automation tools and customizable workflows also make it a great option for businesses that want to streamline processes across various HR functions.

Why I like it:

Aside from its intuitive interface, Rippling shines with its automations that help reduce the likelihood of labor law violations by automating HR compliance requirements. For example, you can set up training programs or certification requirements for employees holding specific positions. If they’ve yet to complete the required training, the system won’t allow them to clock in for work. The compliance controls also extend to other functions, such as access to role-based benefits like a car allowance for managers or a higher spending limit on Rippling corporate cards for C-suite staff.

However, pricing might be an issue, especially if you get several Rippling modules. That said, Rippling works with you to create a custom plan, depending on the functionalities you want. It also offers unlimited payroll, so you don’t have to worry about paying for each pay run as you would with ADP and Paychex.

- Free trial: Occasionally offers free trial promos, such as the first month free for new clients Check the provider's website for the latest promotions.

- Free plan: None

- Paid plan:

- Rippling doesn’t have multiple plans, instead it offers one customizable package. You can select modules or features you want—provided you get the core Rippling Platform.

- For Rippling Platform with time tracking, full-service payroll, tax filings, and onboarding/offboarding tools, we were given a quote of $35 + $8 per employee monthly.

- Annual subscription option: None

- Other modules/products:

- App access, device, and inventory management: $8 per employee monthly*

- Includes IT tools to manage business apps and computer provisioning and deprovisioning processes

- Benefits administration: Call for a quote

- Recruiting: Call for a quote

- Learning management: Call for a quote

- Corporate credit cards: Call for a quote

- Expense management: Call for a quote

- HR advisory services: Call for a quote

- PEO services: Call for a quote

- Global payroll: $20 per employee monthly*

- International contractor payments: $20 per worker monthly*

- EOR services: $599 per employee monthly*

- App access, device, and inventory management: $8 per employee monthly*

*Pricing is based on a quote we received

Rippling automatically syncs employee attendance, PTO, and benefits deduction data from its other modules into its payroll solution for processing. (Source: Rippling)

- Workflow management: Rippling’s workflow tools help simplify your people operations, from new hire onboarding to employee offboarding. It lets you set up and automate workflows that work across Rippling’s modules and partner apps. None of the providers on this list have the robust integrations and workflows that Rippling offers.

- US and global payroll: Rippling offers full-service US payroll and tax filing services, including year-end tax reporting, which some charge extra for. Even more, it can pay employees and contractors in more than 185 countries.

- Flexible PEO: Its PEO option has an on/off switch that no other providers on the list offer. This means you can turn off its PEO service from your account settings and easily transition to using its HR platform. While ADP and Paychex have similar products, the process of leaving the PEO service is more complicated than Rippling.

- HR tools: Rippling has a wide offering of HR tools, including time and attendance, applicant tracking, and job posting. Its learning management add-on includes prebuilt compliance courses or build-your-own training programs. Paychex may have similar HR features, but it lacks Rippling’s compensation management tools, which help you track salary bands and compa-ratio rates across various positions.

- IT solutions: Rippling’s app management module lets you set up and manage the business software that employees will use, while its device management solution lets you assign and track computer devices. Rippling can also store, set up, send, and retrieve devices for you, something we did not find with the other alternatives to Paychex on our list (including Paychex).

Many users highlighted Rippling’s user-friendly tools and feature-rich platform as its best features. They like that they can access several HR solutions, such as payroll, benefits, and time tracking, in one system. However, a few reviewers said that learning to navigate through all of its features can take time. Several users also complained of poor customer support, occasional software bugs, and app login issues.

As of this writing, Rippling earned the following scores on popular review sites:

- G2: 4.8 out of 5 based on more than 3,300 reviews

- Capterra: 4.9 out of 5 based on over 3,000 reviews

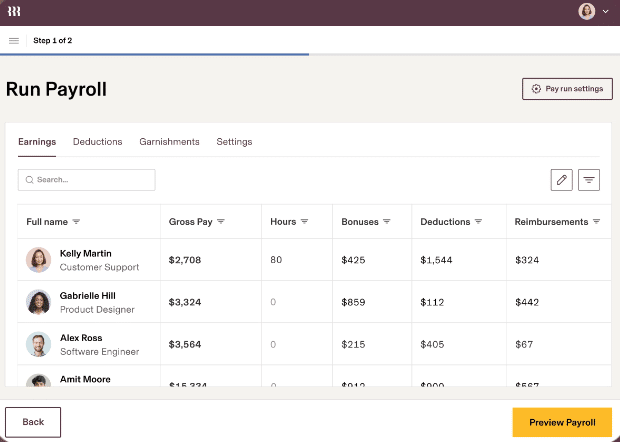

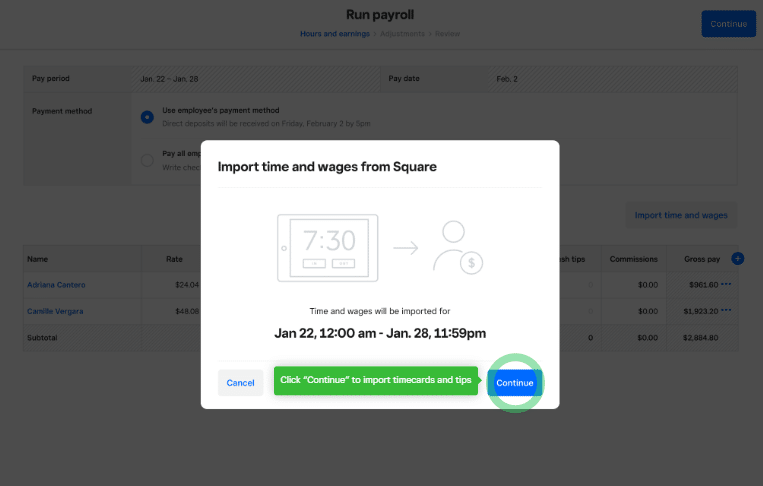

Square Payroll: Best for Retail Shops and Square Users

Pros

- Easy to use

- Contractor-only plan

- Integrates with Square POS and other Square product

- Instant and next-day payment options via its Cash App

Cons

- Limited HR features (PTO and time tracking only) with simple onboarding tools

- Standard direct deposit timelines are two- and four-day options

- HR advisory services and benefits plans are paid add-ons

- Phone support on weekdays only

Overview

Who should use it:

Square Payroll offers a highly competitive price for the features it offers—you get payroll that includes tips and commissions, PTO and time tracking, and the ability to pay out instantly. While not limited to Square users, its payroll module integrates fully with the Square system, making it a great choice for retailers.

Why I like it:

While Square Payroll may have the fewest HR tools compared to Paychex and the other Paychex alternatives I reviewed, it offers the least expensive full-service payroll plan on our list, costing only $35 plus $6 per employee monthly. And, if you’re a retailer using Square POS or Square Teams, then all the applicable information on those modules are integrated into payroll seamlessly for tracking time, tips, commissions, and more.

However, if you’re looking for a payroll system with more advanced HR tools, consider the other providers on this list (except QuickBooks Payroll). If you require global payroll solutions, Paychex, ADP, Rippling, and Gusto are great options.

- Free trial: None

- Free plan: None

- Paid plans:

- Full-service Payroll: $35 base fee + $6 per employee monthly

- Contractor-only Payroll: $6 per worker monthly

- Annual subscription option: None

- Paid add-ons:

- Mail paper copies of W2s/1099s: $3 per mailed form annually; note that online year-end tax forms are free to access to download

- Health and retirement plans: Call for a quote

- Workers’ comp: Call for a quote

- HR advisory services: Call for a quote

You can upload timecards from Square and other sources or input the information manually. (Source: Square Payroll)

- Multistate payroll: Similar to Paychex, Square includes multistate payroll in its basic price. This is unlike Gusto, which only offers single-state pay runs in its starter plan. QuickBooks Payroll may also support multistate pay runs, but it charges per-state fees for tax filings in more than one state.

- Pause billing: If you have seasonal workers or shut your doors for specific times of the year, Square lets you turn off your payroll. You don’t pay for unused months but, when you start up again, it starts right back with you. None of the others on our list offer this feature.

- Cash App: If your employees sign up for the Square Cash App, you can deposit salary payments into their accounts. The Cash Apps allows them to withdraw their pay via the ATM, transfer amounts to other accounts instantly, or use their funds to pay for items with other Square POS-using retailers. Cash App is insured to $250,000 by the Federal Deposit Insurance Corporation (FDIC) under certain conditions.

- Instant or next-day payouts: If you require fast employee payouts, you can use Square Instant Payments to pull money from your Square balance and pay workers via direct deposit the next business day or instantly through the Cash App. This service works on weekends as well. Aside from QuickBooks Payroll, the other Paychex competitors on our list don’t offer similar payout schedules.

Users appreciate its simple-to-use interface and efficient payroll tools that help cut the processing time in half. Some reviewers also said that Square’s integration with other Square products makes it easy to convert timecard information into data that can be used to pay employees.

Meanwhile, the common complaint among several users is about its support team. They shared their difficulties contacting support, adding that some customer reps are not responsive at times.

As of this writing, Square Payroll earned the following scores on popular review sites:

- G2: 4.2 out of 5 based on 30 reviews

- Capterra: 4.7 out of 5 based on more than 600 reviews

Paychex Flex—which is Paychex’s core payroll platform—is best for solopreneurs and small companies with plans to scale, given its flexible HR and pay processing tools. It also offers the services of a dedicated payroll specialist who can work with you to ensure compliance and identify pay errors you may have missed.

With its wide range of features, it can handle simple to complex HR processes. One Paychex representative told us it has more than 300 functions it can put into a plan, covering everything from time tracking to health benefits. Of course, this leads to more contract obligations, a larger price tag, and the need to negotiate the price when the contract is renewed.

For other Paychex Flex pros and cons, check out the box below.

Pros

- Flexible, customizable plans

- Check signing and stuffing services available

- 24/7 support with dedicated payroll specialist

- Access to various HR tools, such as recruiting, time tracking, performance reviews, and learning management

Cons

- Pricing isn’t transparent

- Need to upgrade to the highest plan for performance reviews

- Recruiting, onboarding, benefits plans, learning management, and time tracking are paid add-ons

Overview

What we like:

Paychex is best for solopreneurs and small companies with plans to scale and looking for flexible payroll and HR solutions that can grow with their business. One representative told us it has more than 300 functions it can put into a plan, covering everything from time tracking to health benefits. Of course, this leads to more contract obligations, a larger price tag, and the need to negotiate the price when the contract is renewed.

To create a rubric for comparison, we considered tools that put Paychex in its best light. Thus, it has 4.63 out of 5. It took hits for lacking a free trial and for its user reviews, which were good but nonetheless lower than its competitors.

- Free trial: Occasionally offers free trial promos, such as free payroll for three months Check the provider's website for the latest promotions.

- Free plan: None

- Paid plans (for Paychex Flex):

- Select: $128.50 per weekly pay run for 25 employees*

- Pro: Call for a quote

- Enterprise: Call for a quote

- Setup fees:

- Payroll: $200

- Time tracking: $300 (if timekeeping add-on is purchased)

- Annual subscription option: None

- Paid add-ons:

- Paycheck mailing services: Fees range from Time trac: $54.95 base fee + $7.50 per employee*

- Health insurance and retirement plans: Call for a quote

- Workers’ compensation: Call for a quote

- Time tracking

- Mobile timekeeping via smartphones: $6 per employee monthly*

- Time clock kiosk app for iPad devices: $62.50 per iPad (unit is provided by your company) + $6 per employee monthly*

*Pricing is based on a quote we received

Given its robust suite of HR tools, Paychex often ranks high on our best-of articles. See how it compares with other providers on our lists of:

How To Choose the Best Paychex Alternative

Regardless of whether you’re looking for a payroll software or trying to find the best alternatives to Paychex, consider the following factors:

- Budget: Aside from looking for affordable options, check if the provider offers unlimited payroll in a month. This feature helps you save money since you don’t need to pay for each pay run or off-cycle payroll.

- Business location: Some payroll services don’t work with local taxes or don’t provide benefits in certain states, so ensure that you ask about the providers’ payroll coverage. If you’re a multi-location business, check if there are additional fees to run multi-state payroll or file multistate taxes.

- Company size: Most payroll software providers charge per-employee fees aside from a base fee per month. Depending on the size of your workforce, you can end up with high payroll software costs. Also, if you have a large team, you may require more advanced HR features, which are usually available in the providers’ higher tiers.

- Features: What features do you need? Do you only need a payroll tool or do you require HR solutions as well? Consider time tracking, integrations, and tax filing services to streamline payroll. Access to hiring, benefits plans, and onboarding tools will also help simplify employee management processes.

- Software review and testing: Do your research not only through articles like this one but also by checking online review sites (such as G2 and Capterra) and by calling the payroll provider and getting a full demo. If they offer a free trial, use it to explore the tools and see how intuitive they are for you.

Methodology: How We Evaluated the Top Paychex Alternatives

Paychex can fill a lot of business needs: payroll, HRIS, and PEO services. Therefore, we considered software and services that compete with Paychex in some or all of these categories. We also looked at several reasonably priced payroll software just in case you don’t need all the features Paychex offers. In our evaluation, we compared 13 solutions and narrowed the list down to the top six Paychex competitors.

Click through the tabs below for a more detailed breakdown of our evaluation criteria:

15% of Overall Score

We looked for multiple plan options and whether the providers offer a free trial period. We also gave the most points to software with pricing that doesn’t exceed $90 monthly for 10 employees.

25% of Overall Score

In this criterion, we considered the basics: employee portals, hiring and onboarding, and benefits plans. We also looked for access to HR advisory services.

30% of Overall Score

This was the key area we considered, where we looked at automatic and unlimited payroll, the variety and speed for paying employees, and the coverage of payroll tax payments and filings. We also checked how well it performed its duties by checking user reviews for claims of paycheck errors.

5% of Overall Score

Here we looked at the number and variety of reports, including customization and report export options.

10% of Overall Score

In this criterion, we took into account real-world user feedback as found on popular reviews sites, such as G2 and Capterra. We considered user review scores, based on a 5-star scale, wherein an average of 4.5 and up is ideal. Also, any software with 1,000-plus reviews is preferred.

15% of Overall Score

We checked whether the payroll software has an intuitive platform with features that are simple to learn. We also looked for live phone assistance, integration options, and other support tools, such as how-to guides.

Paychex Competitors Frequently Asked Questions (FAQs)

While Paychex is an excellent service for most types of businesses, some may not find it the best for their particular situation. Also, many customers are drawn in by the discounted fees and receive a shock in the second year when the fees go up. This is for custom quotes and plans other than the most basic Paychex Flex.

Sometimes, doing your own payroll makes sense, such as if you already have an HR staff or if you have a small employee base. You may also find a free payroll service to take care of calculations.

However, if you don’t have the staff, have complex payroll needs, such as multiple states or wage types, or want someone else to take responsibility for the tax calculations and filing, then outsourcing your payroll might be your best course of action.

Outsourcing your payroll has some advantages:

- Saves you time

- Calculations are done automatically

- Often, taxes are filed and paid for you

- Most payroll services include compliance tools

- Most payroll services have a no-fault guarantee if they miscalculate; a few have a full no-fault that will cover your errors too