Processing payroll in Hawaii requires you to register for an Employee Identification Number (EIN) with the IRS. You’ll need to register with the Hawaii Department of Taxation and Department of Labor & Industrial Relations for withholding and unemployment accounts. While Hawaii’s income tax rates are high, most payroll and HR regulations align with federal labor laws and don’t require much extra attention.

Key Takeaways:

- Minimum wage: $14.00 per hour

- Overtime: Follows the federal overtime law of 1.5 times the employee’s regular rate of pay for hours worked over 40 in a workweek

- PTO: Not required by law

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Step-by-Step Instructions to Running Payroll in Hawaii

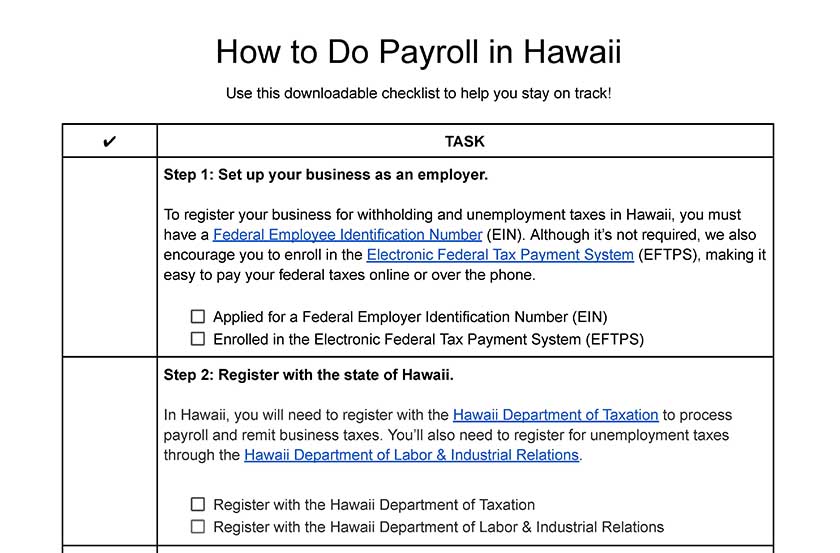

At the federal level, you must apply for a federal employer identification number (EIN) and register for an account in the Electronic Federal Tax Payment System (EFTPS).

If you’re starting a new small business, make sure you start by setting it up correctly. You can register for an income tax withholding account through the Hawaii Department of Taxation. You will receive your withholding ID immediately upon completing the registration online. Employers also have the option to register via mail (with a three-week processing period) or in person at a local Hawaii Department of Taxation office. Hawaii withholding IDs will be in the format of WH-000-000-0000-01/02.

You’ll also need to register for an unemployment tax account through the Hawaii Department of Labor & Industrial Relations (DLIR). Employers are required to register with the DLIR within 20 days of hiring their first employee. You should receive your account number and contribution rate via email immediately after completing the online registration.

Whether you’re going to do payroll yourself or use payroll software, you’ll need to determine a payroll process that works best for your business and is compliant with the rules and regulations in Hawaii. This includes deciding when and how you’ll pay employees, how you’ll collect and submit payroll forms when necessary, how and when to verify employee time worked, etc.

Collecting employment forms from new hires during the onboarding process is best. Federal payroll forms include the W-4, I-9, and a direct deposit authorization form, if applicable. Hawaii also requires employees to fill out an additional document for state withholding called the HW-4.

Hawaii law states that regular paydays need to be established and provided to all employees in writing upon hire. To be sure your team is always paid on time to remain in compliance, collect and approve timecards a couple of days before payday. Use one of our free time sheet templates to help if you don’t yet have an established time and attendance system.

There are many ways to calculate payroll, and deciding which is best for your business is up to you. You can use payroll software (choose from one of our recommended payroll software), a calculator (use our free time card calculator to do some basic time calculations), or even Excel (we have a free template).

Federal tax payments must be made via EFTPS. Generally, you have to deposit federal income tax withheld and both employer and employee Social Security and Medicare taxes based on the schedule assigned (either monthly or semiweekly) to your business by the IRS.

- Monthly depositors are required to deposit employment taxes on payments made during a month by the 15th day of the following month.

- Every other week depositors are required to deposit employment taxes for payments made on Wednesday, Thursday, and/or Friday by the following Wednesday. Taxes on payments made on Saturday, Sunday, Monday, and/or Tuesday are due by the following Friday.

It’s important to note that the schedules for depositing and reporting taxes are different. Employers who deposit both monthly and semiweekly should only report their taxes quarterly or annually by filing Form 941 or Form 944.

Hawaiian employers need to file and pay taxes withheld from employee wages. It’s important to know that filing and payment due dates are different. Return filings are quarterly and due on the 15th of the following month. Payments are due every other week, monthly, or quarterly, depending on how much withholding tax liability an employer has for the prior year.

It’s important to keep records for all of your employees, even those terminated, for at least six years.

The payroll data should include the following:

- Employee name

- Regular rate of pay

- Hours worked for each pay period

- Regular earnings

- Overtime earnings

- Deductions

- Authorization for deductions

- Total wages per pay period

- Tax withholding forms

Learn more in our article on retaining payroll records.

You must complete Form W-2s for all employees and Form 1099s for all independent contractors. Both employees and contractors must have received these documents by January 31 of the following year.

Here’s a checklist for you to follow so you don’t miss any steps:

For a more general overview of what you should know when doing payroll according to federal standards, check out our guide on how to do payroll.

Hawaii Payroll Taxes, Laws & Regulations

Processing payroll in Hawaii is generally an easy process. There are no local taxes to worry about; however, Hawaiian residents are required to pay state income tax on their earnings.

To remain compliant, you’ll need to withhold and remit those taxes accurately and timely—but no need to worry, as it’s a pretty simple process and all online. A few other things regarding payroll stand out as well (like Hawaii’s temporary disability insurance). Below, we break down all the payroll taxes and regulations that will be important to know.

Hawaii Payroll Taxes

Employers in Hawaii are responsible for paying payroll taxes, in addition to Social Security, Medicare, and federal unemployment taxes (FUTA). Social Security and Medicare (FICA taxes) are both employee and employer taxes, meaning that the employee portion will be withheld from paychecks and the employer portion will be your responsibility.

As an employer, you will be responsible for the following rates for each of these federal tax amounts:

- Social Security: 6.2% of each employee’s pay

- Medicare: 1.45% of each employee’s pay

- FUTA: 6% of the first $7,000 of each employee’s pay

In addition to federal tax liabilities, you’ll also need to be sure that you comply with withholding and remitting state taxes.

State Income Tax

Hawaii has progressive income tax rates, meaning that residents pay more in tax as they earn more money. Taxpayers living in Hawaii pay tax rates from 1.4% to 11% depending on their income. You’ll need to use Hawaii’s Withholding Tax Guide and related tables to determine how much you should withhold from each employee’s paycheck (have their W-4 forms handy when calculating totals).

The progressive tax rates are as follows:

Income Tax Rate | Single and Married Filing Separately | Head of Household | Married Filing Jointly |

|---|---|---|---|

1.40% | $0 to $2,400 | $0 to $3,600 | $0-$4,800 |

3.20% | $2,401 to $4,800 | $3,601 to $7,200 | $4,801 to $9,600 |

5.50% | $4,801 to $9,600 | $7,201 to $14,400 | $9,601 to $19,200 |

6.40% | $9,601 to $14,400 | $14,401 to $21,600 | $19,201 to $28,800 |

6.80% | $14,401 to $19,200 | $21, 601 to $28,800 | $28,801 to $38,400 |

7.20% | $19,201 to $24,000 | $28,801 to $36,000 | $38,401 to $48,000 |

7.60% | $24,001 to $36,000 | $36,001 to $54,000 | $48,001 to $72,000 |

7.90% | $36,001 to $48,000 | $54,001 to $72,000 | $72,000 to $96,000 |

8.25% | $48,001 to $150,000 | $72,001 to $225,000 | $96,001 to $300,000 |

9.00% | $150,001 to $175,000 | $225,001 to $262,500 | $300,001 to $350,000 |

10.00% | $175,001 to $200,000 | $262,501 to $300,000 | $350,001 to $400,000 |

11.00% | Over $200,000 | Over $300,000 | Over $400,000 |

Employers are required to withhold the appropriate amount of income tax based on an employee’s earnings and remit it to the state in a timely manner. Filings are due for all employers quarterly, with the schedule as follows:

- Quarter 1: Due by April 15

- Quarter 2: Due by July 15

- Quarter 3: Due by October 15

- Quarter 4: Due by January15

Payments are due based on the amount of withholding, as required by the Hawaii Department of Taxation:

Withholding Tax Liability | Payment Frequency | Due Date |

|---|---|---|

Greater than $40,000 | Semiweekly | Wednesday: If taxes are withheld for wages paid the preceding Wednesday, Thursday, or Friday Friday: If taxes are withheld for wages paid the preceding Saturday, Sunday, Monday, or Tuesday |

$5,000-$40,000 | Monthly | On the 15th day of the month following the close of the preceding monthly period |

Less than $5,000 | Quarterly | On the 15th day of the month following the close of the preceding quarter (04/15, 07/15, 10/15, 01/15) |

Unemployment Insurance Tax

Hawaii has a statewide unemployment insurance (UI) fund that provides benefits to workers experiencing periods of unemployment. Contributions collected from employers are used exclusively to pay benefits to unemployed workers.

Employers are charged for the first $59,100 of wages for each employee. Contribution rates are determined on an annual basis with a maximum tax rate of 5.8%. New employers registering with the state of Hawaii always start at a standard “new employer rate” of 3%.

In addition to the standard unemployment rate, employers also need to pay an employment and training assessment (E&T) rate of 0.01%. The Employment and Training program is a statewide work program that helps able-bodied adults become a part of the workforce. It provides the participants with assistance in finding employment, gaining work experience, and getting training.

If you plan to use a payroll software, here are a few things you’ll want to pay special attention to as a Hawaiian employer:

- Your UI rate determination will include an E&T rate (0.01%) and an experience rate. When entering your rate into your payroll software, pay special attention to whether or not the E&T rate is already built into its system, or if you’ll need to provide that information.

- You’ll need to add your payroll provider as your TPA (Third-Party Administrator) with the DLIR. You can do this online via your Hawaii DLIR online profile. Failure to do this will cause issues when the payroll provider attempts to file returns on your behalf and can cause late filings and penalties.

Workers’ Compensation Insurance

The Hawaii workers’ compensation (WC) law provides wage loss compensation and medical care to employees who suffer from a work-related injury. All employers that have one or more employees (whether full-time or part-time, permanent or temporary) are required to have workers’ compensation coverage through a private carrier of their choice. Coverage is 100% employer-funded, and employers are explicitly prohibited from requiring employees to contribute toward WC insurance premiums.

Benefits for injured employees include the following:

- Medical benefits: All medical treatment, including surgical and hospital services and supplies related to the injury

- Temporary total disability benefits: Wage loss benefits paid as long as certified disabled from work by a treating physician

- Permanent partial disability benefits: Payments due an employee when an injury results in a percentage loss of use of specified portions or functions of the body

- Permanent total disability benefits: Payments due an employee if the injured employee cannot return to work because of the injury

- Disfigurement payments: Due to an employee for scars as a result of laceration or surgery, can include deformity and discoloration

- Death payments: Due to a surviving spouse and dependent children in work-related death cases

- Vocational rehabilitation: If unable to return to usual occupation, an injured employee may receive career counseling, testing, training, and job placement

While there are no explicit industries or workplaces that are exempt from this statewide requirement, there is a detailed definition provided in the HRS Chapter 386 of what the state of Hawaii considers “employment.” Check it out for a full list of situations in which work is not considered employment and therefore would not require an employer to be covered.

Temporary Disability Insurance

In addition to UI, you are also required to provide temporary disability insurance (TDI) for eligible employees to help cover non-work-related injuries and illnesses. If an employee cannot work because of an off-the-job injury or sickness, they will be paid disability or sick leave benefits to partially replace the wages lost.

It’s important to note that unlike unemployment insurance, TDI does not cover medical care. You can choose to cover the entire cost or share the cost equally with your employees. However, the employee’s contribution cannot exceed 0.5% of the employee’s weekly wages.

Some employees are excluded from this law, including:

- Employees of the federal government

- Domestic workers

- Insurance agents and real estate salespersons paid on a commission basis

- Individuals under 18 that deliver or distribute newspapers

- Family employees

- Student nurses or hospital interns

Minimum Wage Laws in Hawaii

Hawaii is incrementally increasing its minimum wage until it hits $18 per hour in 2028. The minimum wage is currently $14 per hour and will increase to $16 per hour on January 1, 2026, and $18 per hour on January 1, 2028.

Tipped employees can be paid lower than the minimum wage, provided that their hourly rate plus tips is at least $7.00 more than the minimum wage. In 2024, this means tipped employees may be paid up to $1.25 less per hour if their wages plus tips equal at least $21.00 per hour. Keep in mind that both the minimum wage and the tipped minimum wage will increase again in 2026 and 2028, so these numbers will change.

You must have the Hawaii Wage and Hour Law Notice to Employees posted in a place that is accessible to all of your employees.

Hawaii Overtime Regulations

Hawaii’s overtime regulations are pretty general compared with some other states in the US. The State of Hawaii’s Wage Standards Division requires that an overtime rate of 1.5× an employee’s normal rate (time and a half) be paid for hours worked over 40 in a workweek.

Four employment classifications are exempt from overtime pay; therefore, those employees are not protected by Hawaii overtime regulations. These include the following:

- Executive employees: Includes management of two or more employees (as an employee’s full responsibility)

- Administrative employees: Includes business operations, management policies, and administrative training

- Professional employees: Includes artists, certified teachers, and skilled computer professionals

- Outside sales employees: Includes those making sales or taking orders outside of the employer’s main workplace

Misclassification is a serious issue and can get companies into expensive trouble with government agencies. Make sure your classifications are correct by checking with your employment attorney.

Different Ways to Pay Employees in Hawaii

While there are many ways to pay employees, the Hawaii Office of Wages and Child Labor specifies that an employer must pay wages by any of the following:

Hawaii Pay Stub Laws

You are required to provide your employees with pay stubs for each pay period. These pay stubs can be either printed or handwritten as long as they are legible.

Pay stubs can also be provided electronically to be accessed by employees as long as all employees provide written consent.

Hawaii law mandates that all pay stubs include the following:

- Employer’s name, address, and telephone number

- Employee’s name

- Payment date and pay period covered

- Salary rate or hourly rate

- Total hours worked (regular hours, overtime hours, etc.)

- Total gross pay

- Amount and purpose of all deductions

- Total net pay

Minimum Pay Frequency

Hawaiian employers are required to process payroll for their employees at least twice a month. Paydays need to be designated in advance, and all employees need to be notified of the frequency of payments upon hire. While monthly payroll is not an option for Hawaiian employers, you can still choose between weekly, every other week, and twice monthly payments.

Paycheck Deduction Rules

An employer can only make deductions from an employee’s paycheck when authorized by federal or state laws, such as for taxes and garnishments. The only exception to this that allows employers to make other deductions is if an employee gives written consent.

Hawaiian pay law explicitly states that employers cannot deduct the following items from an employee’s paycheck, even with written consent from the employee:

- Fines or fees (including for breakages in the workplace)

- Cash shortages from common money (cash box or register)

- Losses due to accepting a bad check if the employee is given discretion to accept or reject checks

- Losses due to faulty workmanship, lost or stolen property, damage to property, default of customer credit, and nonpayment for goods or services

- Medical or physical examination or medical report expenses of an employee or prospective employee required by the employer or by law

Severance Pay in Hawaii

Employers in Hawaii are not required to provide their employees with severance pay. However, if you do choose to provide severance pay to terminated employees, it needs to be explicitly written in their employment documentation.

Final Paycheck Laws in Hawaii

Under Hawaiian law, employers must pay an employee all earned wages in full at the time of termination or the next business day.

Accrued Paid Time Off Payouts

Employers in Hawaii are not required to pay accrued vacation to any employee upon termination.

It’s important to note that if an employee’s policy or contract explicitly states that they will be paid for all unused paid time off at their time of termination, you will be required to follow through. For this reason, it’s important that you pay close attention to what’s included in your policy to avoid any unnecessary costs to your business.

Hawaii HR Laws That Affect Payroll

HR is an important part of the payroll process, and many states have specific regulations regarding employees that need special attention. Hawaii state laws, however, mostly align with federal labor laws.

Hawaii New Hire Reporting

All Hawaiian employers are required to report all newly hired employees to the State of Hawaii Department of the Attorney General Child Support Enforcement Agency within 20 days of the employee’s first day of work. Hawaii defines a “new hire” as an employee who has not previously been employed by the employer or was previously employed by but has been separated from the employer for at least 60 days.

If you’d prefer to file via mail, employers have the option to fill in the employer section of an employee’s completed IRS Form W-4 and send it to the following address:

Child Support Enforcement Agency

New Hire Reporting

Kakuhihewa Building

601 Kamokila Blvd., Suite 251

Kapolei, HI 96707

These completed W-4 forms can also be faxed to (808) 692-7001.

The following information needs to be provided:

- Employee’s name

- Employee’s address

- Employee’s Social Security number (SSN)

- Date of hire

- Employer’s name

- Employer’s address

- Employer’s federal EIN

There is a $25 fee for late filing and a $500 fee for failure to file as a result of conspiracy between the employer and employee to not report the accurate information.

Meal Breaks

In Hawaii, there is no law that requires employers to provide any rest or meal breaks for their employees. The one exception to this rule is as follows:

- An employer must provide minors (14 or 15) with a 30-minute rest or meal break after five consecutive hours of work.

If an employer in Hawaii chooses to provide breaks to their staff, there will be certain regulations they’ll need to follow to stay compliant. The regulations to pay attention to are as follows:

- Meal breaks (30 minutes or more): Unpaid as long as the employee is completely relieved of their duties

- Rest breaks (20 minutes or less): Counted as hours worked and need to be paid

Paid Sick Leave

There is no Hawaii law that requires private employers to grant their employees paid or unpaid sick leave.

Paid Time Off

Hawaiian law does not require employers to provide paid time off to employees. However, if you have a set policy, you need to follow it for every eligible employee. The same goes for whether you pay out any earned but unused time.

Jury Duty Leave

There are also no laws that require employers to pay employees while serving on a jury; however, employers cannot discharge, penalize, threaten, or otherwise coerce an employee who receives a jury summons or serves on a jury.

Voting Leave

After switching to voting by mail for all elections in 2020, Hawaii repealed its voting leave law.

Parental Leave

Employers with at least 100 employees must provide workers with up to four weeks of unpaid parental leave. The leave may be taken in chunks or all at once and may be taken at any point in the calendar year when the child was born or adopted.

Domestic Violence Leave

Hawaiian law requires an employer with at least 50 employees to allow an employee suffering from domestic violence or sexual abuse to take up to 30 days of unpaid leave per calendar year. Employers with fewer than 50 employees must allow workers to take at least five days of unpaid leave per calendar year. This leave is available to victims of domestic violence and sexual abuse, as well as workers whose minor child is a victim.

Break Time to Express Milk

The Hawaii Breastfeeding in the Workplace Act prohibits discrimination against an employee who breastfeeds. The law requires employers to give break time and a private space, other than a bathroom, to breastfeed. Employers with fewer than 20 employees may be exempt if the employer can show they would suffer an undue hardship by complying with this law.

It’s important to remember that even though Hawaii does not have many specific rules or regulations regarding time off or leave, employers still need to adhere to all federal regulations. For more information, check out our article on federal labor laws.

Child Labor Laws

The Hawaii Child Labor Law has information regarding child labor that depends on the age of the child seeking employment. These regulations cover both paperwork needed to obtain work and restrictions on hours worked.

Payroll Forms

Hawaii has its own form for state income tax withholding that all employees are required to complete to determine their withholding amount. In addition, there are a number of other withholding forms and unemployment forms that are required in Hawaii.

Hawaii State Forms

Withholding Forms:

- HW-4: State of Hawaii Employee Withholding Allowance Certificate

- HW-2: Statement of Hawaii Income Tax Withheld and Wages Paid

- HW-14: Quarterly Withholding Tax Return

- VP-1: Tax Payment Voucher

Unemployment Forms:

- UC-1: Report to Determine Liability Under the Hawaii Employment Security Law

- UC-B6: Quarterly Wage, Contribution and Employment and Training Assessment Report

- UC-25: Notification of Changes

- UC-86: Waiver of Employer’s Experience Record

- UC-347: Notification of Acquisitions or Transfers

Federal Payroll Forms

- Form W-4: To help employers calculate taxes to withhold from employee paychecks

- Form W-2: To report total annual wages earned (one per employee)

- Form W-3: To report total wages and taxes for employees to the IRS (summary of W-2s)

- Form 940: To report and calculate unemployment taxes due to the IRS

- Form 941: To file quarterly income and FICA taxes withheld from paychecks

- Form 944: To report annual income and FICA taxes withheld from paychecks

- Form 1099-MISC: To provide non-employee pay information that helps the IRS collect taxes on contract work

Hawaii Payroll Resources & Sources

- Department of Labor and Industrial Relations: Hawaii Employers can find all things UI here, from filing for a new UI account number to managing rate changes and employee claims. Information and all necessary documentation for temporary disability insurance and workers’ comp can also be found here.

- Wage Standards Division: It provides information on unpaid wages, family leave policies, laws regarding unlawful termination, minors work permits, and more.

- Department of Taxation: Employers can log in to the Hawaii Department of Taxation online website to file returns and make payments. New employers can register their businesses here, gather information about compliance, and search for business licenses.

Also, check with your payroll software or service for resources and state-specific features—look through our roundup of the best payroll software if you need some options.

Frequently Asked Questions (FAQs)

Employers in Hawaii are responsible for paying payroll taxes, like in other states. These payroll taxes include unemployment insurance, temporary disability insurance, and workers’ compensation.

Employers in Hawaii must keep detailed payroll records for each employee. These records include the following:

- The employee’s full name and social security number

- The hours worked each day and total hours worked each workweek

- Regular pay rate

- Total daily regular earnings and overtime earnings

- Additions and deductions

- Total net wages paid, date of payment, and pay period dates

Under the Hawaii Prepaid Health Care Act,[1] employers are required to provide health insurance to employees who work at least 20 hours per week for four consecutive weeks. Employers must cover at least half the premium. Agricultural workers, seasonal workers, and most workers paid solely on commission are exempt.

Bottom Line

Overall, processing payroll in Hawaii is very similar to that in many other states. You’ll need to take note of the higher minimum wage and specific tax rates when calculating payroll. Most of the regulations align with federal standards, though, so you don’t have to worry about conflicting rules. Since not all the required processes are available online, it’s important to be diligent and make sure you are thinking about registrations and filings well before they are due.