Evaluating Stripe vs Shopify can be tricky because it’s not an apples-to-apples comparison. Shopify is an ecommerce platform with integrated payment processing, whereas Stripe is a customizable payment processor that lacks a point-of-sale (POS) system and ecommerce software. Both, however, are easy to use, have excellent user reviews, handle international sales, and don’t require a separate merchant account.

Stripe vs Shopify: Key Differences

|  |

|---|---|

Not Available Yet | |

Leading online payment processor and payment gateway | Leading ecommerce platform and multichannel point of sale |

Best for online sales, B2B, recurring billing | Best for retail, online sales |

Designed to be programmed into websites and other software | Standalone ecommerce software with POS and payment processing (Shopify Payments) |

Wide range of payment scenarios | Limited to Shopify |

Shopify has a native payment processing solution, Shopify Payments, which is actually powered by Stripe. If you’re creating a Shopify store, you can use either Shopify or Stripe as your payment processor. However, Shopify will charge extra to connect any third-party processor—including Stripe.

Continue reading for a comparison of using Stripe vs Shopify Payments in your Shopify store.

Stripe vs Shopify Payments Quick Comparison

| ||

|---|---|---|

Monthly fee | None | None* |

In-person transaction | 2.7% + 5 cents | 2.4%–2.7% |

Keyed-in/online transaction fees | 2.9% + 30 cents–3.4% + 30 cents | 2.4% + 30 cents–2.9% + 30 cents |

Invoicing/Billing | 0.4%–0.5%; 0.5%–0.8% recurring | Invoicing comes free; Recurring billing requires a subscription app from the Shopify App Store |

Shopify Add-on transaction fee | 0.5%–5% | None** |

* There is no fee to use Shopify Payments but you will need to sign up for a Shopify plan. Learn more about Shopify’s pricing and plan options

** Except for merchants in Austria, Belgium, and Sweden

When to Use Stripe

| PROS | CONS |

|---|---|

| Free merchant account | Limited in-person payment processing |

| Highly customizable | Not easy to set up |

| Good for billing, invoicing | Lots of additional fees for features |

| 135+ currencies, 30+ countries | In-person POS requires a custom build or integration |

Stripe is hands-down the best choice for payment processing. First, it’s not tied to any POS or online store system like with Shopify Payments. Second, it offers sales, subscription, invoicing, and billing services; with Shopify, recurring billing and subscription require a subscription app from the Shopify App Store.

Finally, it integrates with a wide range of products, from your own website to POS systems—anywhere you need to collect payments. Stripe is highly secure, works with international currencies and languages, and has no monthly fees.

Stripe ranked in our lists of the

When to Use Shopify Payments

| PROS | CONS |

|---|---|

| Excellent multichannel sales tools | Must have paid subscription to its ecommerce platform |

| User-friendly mobile POS | Charges extra for third-party payment processors |

| Easy to create powerful online stores | Not as versatile as Stripe |

| No programming skills needed | No discounts for high-volume sales |

If you are interested in retail, especially for an online store or multichannel sales, then Shopify is the better option. Its transaction fees are slightly cheaper, and it has a top-of-the-line system for building your own online store.

Shopify also has better native inventory and reporting tools than Stripe. However, all its features are restricted to Shopify’s environment. It does offer thousands of integrations—but with the goal of expanding your store’s reach rather than providing payment processing for a different use.

Shopify ranked in our lists of:

When to Use an Alternative

Stripe and Shopify are terrific in their own right for online sales, but if you need something for in-person POS and payment processing, we recommend Square. It offers a free POS and online store and competitive rates on payment processing. It topped our lists of top-recommended merchant services and leading POS systems.

Most Affordable: Stripe

|  | |

|---|---|---|

Monthly fees | Varies (third party) | $5–$399 (Shopify Plus starts at $2,000/month) |

Online transaction fees | 2.9% + 30 cents | 2.4% + 30 cents–2.9% + 30 cents |

In-person transaction fees | 2.7% + 15 cents | 2.4%–2.7% |

ACH transaction fee | 0.8% ($5 cap) | N/A |

Invoice fee | 0.4% | None |

Billing fee | 0.5% | Varies |

Chargeback fee | $15 | $15 |

High-volume discounts | ✓ | None other than lower rates with higher monthly plans |

Hardware | $59–$249 | $49–$399 |

Virtual terminal | Third party (Paytia) | None; uses backend |

Stripe is the more affordable of the two systems. Although the transaction fees are higher, you don’t have to pay monthly fees as you do with Shopify. Take note that with Stripe, you will need to sign up with a different ecommerce platform. With the numerous Stripe integration options, however, you could explore several free ecommerce platforms.

While Stripe accepts ACH payments, Shopify considers it as a manual option—much like when an order is paid for by cash or other means outside of Shopify. ACH transactions with Stripe are cheaper than card payments, so if your customers pay through bank transfer, you will save 1.5% or more (considering 0.4% for the invoice plus 0.8% for the payment).

With Shopify, you may choose to accept bank transfers from customers and just mark it paid when completed without any additional fees. However, keep in mind that this will be a transaction outside of Shopify so it is up to you to guarantee that payment has indeed been made. Stripe offers discounts and interchange-plus pricing for qualifying businesses with high-volume sales; Shopify does not.

One thing to consider, however, is that Shopify’s monthly fee includes POS software; if you need that, you would need to pay for a third-party POS system or build your own using APIs and SDKs with Stripe.

Best for Payment Processing: Stripe

|  | |

|---|---|---|

Payment types | Credit, debit, gift cards, cash, checks, ACH, digital wallets | Credit, debit, PayPal, cash, checks, digital wallets |

Crossborder payments | Yes, 135+ currencies +1.5% fee | Yes, 133 currencies, +1% fee |

Invoices | Simple, recurring | No |

Level 2 and 3 data processing for B2Bs | Custom coding | Upgrade to paid plan |

Virtual terminal for MOTO payments | Limited | Manual or third-party integration |

Alternate payment processors | N/A | For additional fees |

Payout times | 2 business days, per a schedule you set; instant payout for 1%, minimum 50 cents | 1–3 business days, or according to your payout schedule |

Fraud protection | Chargeback protection, advanced machine-learning fraud protection | Chargeback protection, fraud analysis, third-party fraud protection apps |

Stripe’s versatility and security make it the best choice for payment processing. The merchant account is free, and you can use it with just about any system. It processes credit and debit card payments, NFC payments, and ACH and wire transactions; it can also track cash and check payments if needed. Stripe also offers invoices and billing. By contrast, Shopify handles only standard payments (including cash and check tracking) plus PayPal.

Both systems score high on fraud prevention and security, although Stripe boasts more security certificates and compliances. Most notably, Shopify Payments is only available through the Shopify ecosystem, so if you’re not planning on using Shopify ecommerce or POS, you won’t have access to its payment processing tools.

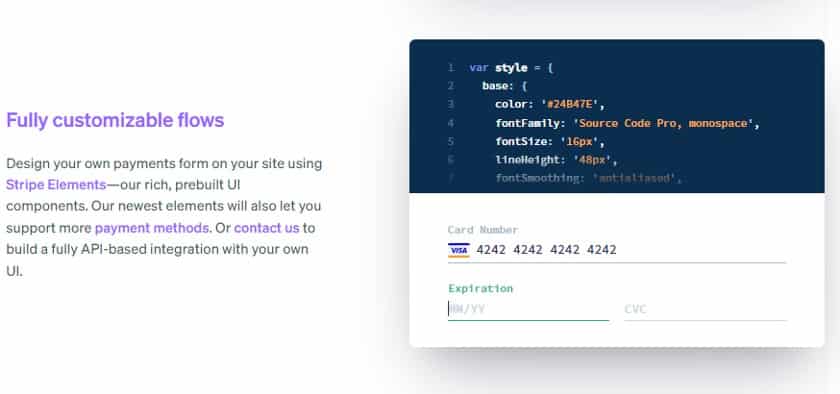

Stripe offers a variety of customizable ways to integrate payments into an online system. (Source: Stripe)

When to use Shopify

If you are planning on using Shopify for your online store and POS, then it makes sense to use Shopify Payments as your payment processor. It’s a secure and efficient system. Plus, Shopify tacks on a 0.5%–5% surcharge if you use a different payment processor.

Best for Multichannel Sales: Shopify

|  | |

|---|---|---|

Sales tax | Default to location | Automated for additional 0.5% per transaction |

Pay in installments | ✓ | Afterpay Klarna |

Online store | Best-in-class | 350+ ecommerce integrations |

One-click checkout | Shop Pay | Using Link with Stripe |

Invoices | Manual “Draft orders” | Simple, recurring |

In-person POS | ✓ | Custom build or connect to existing POS |

POS hardware | Card readers, iPad register systems | Offers precertified card readers only |

Mobile app | POS/Payments | Custom design or sign up to a third-party Stripe app |

Offline mode | Limited | With full features, but still in beta |

Shopify is a powerhouse for multichannel sales giving merchants tools to sell online, on social media platforms, and in person. It also comes with omnichannel selling features so all inventory, sales, and customer data across every selling platform are fully integrated, updated in real time, and accessible from a single platform.

Shopify beats Stripe because it also has its own integrated POS system for in-person sales, whereas Stripe requires a third-party integration or custom development.

Another Shopify advantage is that it works with dropshipping; in fact, it has its own dropshipping program, Oberlo, that you can easily add to your system. Shopify even has a mobile app for payment processing that integrates directly with your other Shopify sales systems. Stripe relies primarily on third-party applications, although it offers a build-your-own checkout, Stripe Terminal.

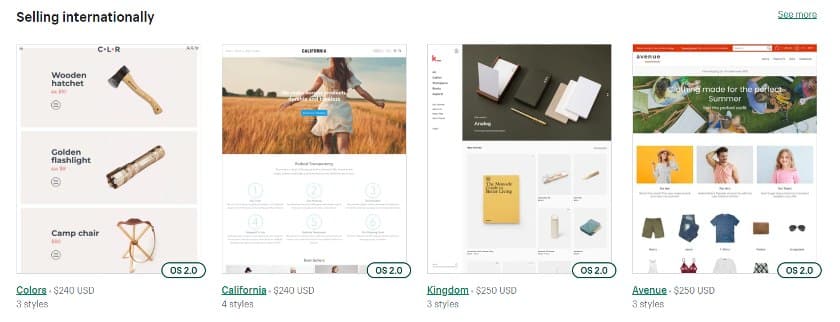

Shopify has premade templates specifically for international sales. (Source: Shopify)

Both have an excellent reach for international sales, being closely matched in currencies and languages. Both offer one-click payments—Stripe through Link, and Shopify with its Shopify Pay app. Their payment features are similar, though Stripe’s may depend on the POS system you use. Stripe, of course, depends on programming and third-party integrations more than Shopify.

When to use Stripe

- If you don’t want to use Shopify’s POS and online store builder: Stripe gives you dozens of POS options, including build-your-own.

- If you need something simple and don’t want to pay fees: Stripe has a customizable interface for online sales, the ability to program buttons for social selling, and third-party card readers for in-person transactions.

- If you are in a service or B2B industry: Shopify only offers subscriptions and recurring billing, such as for a utility company or a landlord, with the use of the Shopify app. Stripe offers this as a native feature.

Best for Ecommerce: Shopify

|  | |

|---|---|---|

Ecommerce platform | Integration w/ third-party providers | Proprietary, free and paid versions |

Marketplace | Payment integration | Tools to build your own |

Payment methods | Credit, debit, ACH,gift cards, digital wallets, BNPL | Credit, debit, PayPal, digital wallets, BNPL |

Checkout features | Simple and custom checkouts | Simple and custom checkouts, PayPal |

When we talk about ecommerce, we want to evaluate Stripe vs Shopify for all ecommerce features. So while Shopify is clearly the more well-rounded ecommerce solution, it’s important to point out that Stripe offers a unique value proposition as a stand-alone payment processor.

For new ecommerce, Shopify’s all-in-one solution is hands down the best choice. Shopify has built an entire ecosystem that provides online merchants with everything they need to grow an ecommerce business from the ground up.

Merchants can use Shopify to build an ecommerce website and accept payments with ease. At the same time, Shopify also provides products for growth and expansion into various sales channels ensuring compatibility and easy integration.

When to use Stripe

Stripe beats Shopify in terms of compatibility so existing ecommerce merchants using a different ecommerce platform should find Stripe a better option. Because Shopify features are exclusive, it’s impossible to integrate any of its tools into your current online store, even if you are willing to pay. Stripe, however, can integrate with most ecommerce platforms.

Best for Ease of Use: Shopify

|  | |

|---|---|---|

Merchant onboarding | Online guided setup | Online guided setup |

Store/restaurant setup | Recommends devs | Recommends devs |

Online help articles | ✓ | ✓ |

Customize checkout | ✓ | ✓ |

Video tutorials | ✓ | ✓ |

Customer support | 24/7 | 24/7 |

Frozen accounts | Very low | Low |

Reserves | Rarely done; Shopify requests first | ✓ |

Premium support | Costs extra | Costs extra |

User ease of use score* | 4.48 out of 5 | 4.53 out of 5 |

*We looked to third-party user review sites like Capterra, taking into account only the scores in the ease of use category.

Stripe earned a slightly higher ease-of-use score than Shopify; however, we still find Shopify the winner for two reasons:

- As an all-in-one solution, merchants can set up and run a small ecommerce business with ease.

- Shopify’s interface is easy to learn and use while some Stripe features like advanced checkout customizations may require programming.

Shopify is a complete solution that provides built-in ecommerce backend tools to manage online and in-person inventory counts, handle variations and modifications, and more. Shopify also has dozens of reports, from sales and inventory to customer behavior and product analytics. Proprietary add-on tools such as loyalty and marketing are also available.

Both Shopify and Stripe offer free merchant accounts, as well as guides and videos to help you through most of the onboarding and setup tasks. Both can also recommend certified experts if you need someone to do the backend work of developing or creating a store for you. Premium support functions are also available, but Shopify does one better with a Merchant Success Program for its Shopify Plus customers.

Stripe vs Shopify Frequently Asked Questions (FAQs)

The choice between Shopify vs Stripe depends on what your business needs. While both are great for online businesses, each provider offers unique features and services that may be useful to some merchants but not for others.

Shopify is a great choice for startup online merchants because it offers tools that help you quickly set up your online store, then provide additional features as your business grows. Meanwhile, Stripe is built for integration and customization so its flexibility is ideal for merchants who prefer (or already are using) a different ecommerce platform.

Yes, using Stripe on Shopify is possible. However, Shopify charges a commission fee for merchants who wish to add a third-party payment processor like Stripe to process payments on a Shopify ecommerce website.

Bottom Line

There’s no disputing the quality of both Stripe and Shopify. When comparing Shopify vs Stripe, you have to consider your needs and use cases.

If you are looking for an easy-to-set-up online store with a mobile or countertop POS solution to augment sales and powerful inventory and reporting, then Shopify is your choice. By contrast, Stripe’s excellent customizability and integrations make it the best option for online businesses that need to add sales to existing websites, handle B2B or recurring billing, or send invoices because they are in a service industry.