Stripe is a highly secure online payment processing service best known for sophisticated online payment processing, advanced fraud prevention, and dispute management tools—without a high price tag. Best for online, ecommerce, and B2B payments, Stripe took the top spot in our list of online payment processors earning a 4.39 out of 5.

Stripe at a Glance

Stripe is a top consideration for businesses looking for merchant accounts, and it is included in many of our buyer’s guides. In our list of the best merchant services, it came out as the best for online payments because it ticks most of the boxes for features we look for in small business payment providers, particularly for ecommerce and B2Bs.

Its highly customizable nature easily keeps up with fast-growing businesses that process recurring online payments and provides the most flexible and scalable solution for designing checkout carts. It also includes the assurance of strict PCI (Payment Card Industry) compliance—all in a free account.

On the other hand, Stripe may not be the best fit for all types of ecommerce businesses, as some small online businesses do not require a highly customized checkout process. So, while subscribing to Stripe is free, the complexity of its “developer-first” platform setup process affected Stripe’s ranking in our evaluation. For in-person checkouts, most small businesses would be better served with a plug-and-play option that does not require a custom build.

Stripe Fee Calculator

Looking for the lowest rates? The payment processing rates you will pay can vary based on your business’ size, type, and average order value. To find the most affordable option and compare multiple processing rates, read our guide on the cheapest credit card processing.

Stripe offers a free account, so merchants don’t need to worry about upfront costs unless they opt for add-on tools and upgraded features. Transaction fees are competitive, and discounts are available upon request. Card readers can be directly purchased from the Stripe dashboard, and chargeback fees are refundable.

The system lost points for chargeback fees, add-on payment processing cost, volume discounts, and hardware purchasing options.

Stripe supports many integrated payment methods, including card transactions, digital wallets, bank transfers, and international payments. Fees start at 2.7% + 5 cents per successful transaction—and there are no monthly or additional gateway fees for simple online transactions.

- Monthly fee: $0

- Transaction processing fees:

- Ecommerce: 2.9% + 30 cents

- Card-present: 2.7% + 5 cents

- Keyed-in: 3.4% + 30 cents

- Touchless: 2.9% + 30 cents

- Tap-to-pay on mobile: +10 cents per authorization

- Virtual terminal: 2.9% + 30 cents

- ACH: 0.8%, $5 cap

- Invoicing: + 0.4%–0.5%

- Recurring Billing: + 0.5%–0.8%

- International payments: + 1.5% fee, 1% spread for currency conversion

- Stripe Checkout: $10 per month if using custom domain

- Chargeback fee: $15

- Failed transaction fees: $4–$15

- Deposit speed: 2 business days, or 1%, minimum 50 cents for instant payout

In the News:

Beginning in June 2023, Stripe will no longer refund the chargeback fee regardless of the outcome of disputed payments.

Note that merchants need to create an account with Stripe to order the hardware. While setting up my Stripe account, I was directed to the hardware management tab, where I can shop for a Stripe credit card reader.

Unfortunately, Stripe’s credit card readers are not out-of-the-box solutions. You need to use Stripe’s APIs to configure the hardware with your point-of-sale (POS) or with Stripe Terminal (Stripe’s in-person payment processing feature). This means you will need to have access to some coding skills just to get started—a huge downside for simple SMBs. Stripe recommends purchasing a credit card reader from one of their partners for those who prefer a simple code-free setup.

Cost: $59 Stripe SDK for iOS and Android Stripe Reader M2 is Stripe's proprietary Bluetooth-enabled card reader that accepts EMV chip, contactless, and swipe payments. | Stripe Reader M2  |

Cost: $249 Stripe SDK for iOS, Android, Desktop, and Mobile Web The BBPOS WisePOS E is a hybrid countertop and handheld terminal for in-store and curbside payment processing. It features a 5” touchscreen display, end-to-end and point-to-point encryption, EMV chip, contactless and swipe payments processing, and Wi-Fi connectivity. | BBPOS WisePOS E  |

Cost: To be announced Stripe is launching the new S700 Android-based standalone payment terminal in the U.S. this summer. As with other standalone terminals, the S700 comes with pre-built checkout features, but with the added customization tools for payment and point-of-sale options that Stripe is known for. | Stripe S700  |

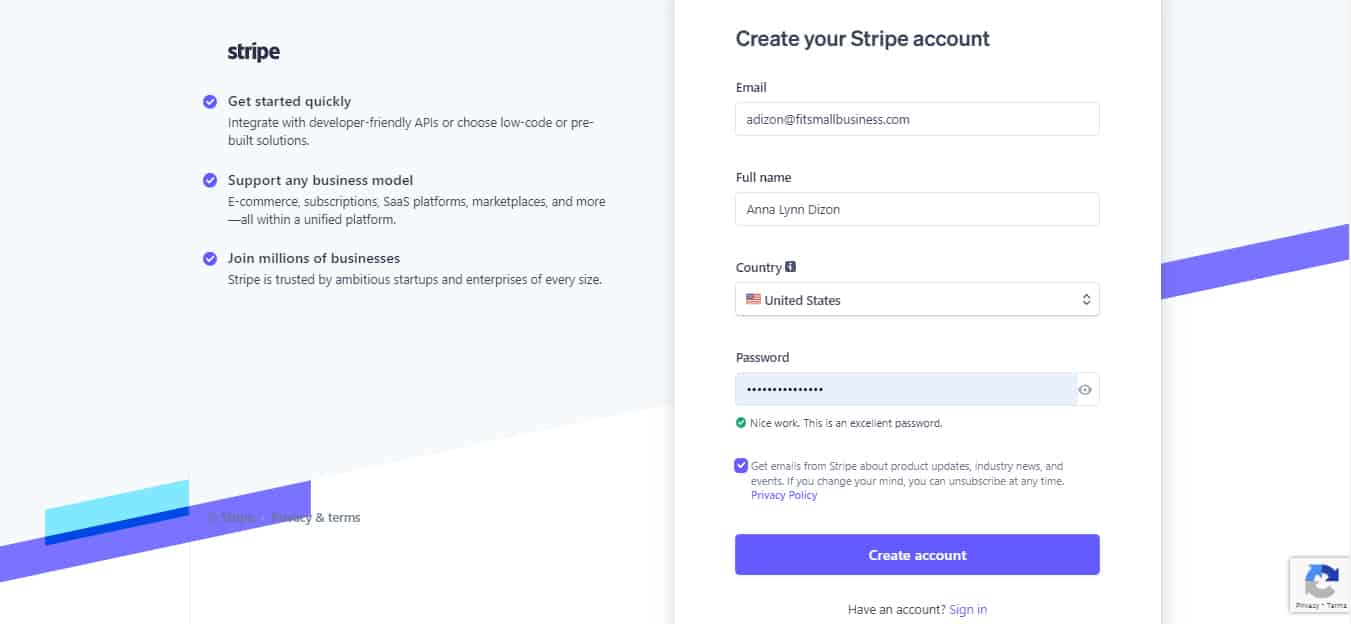

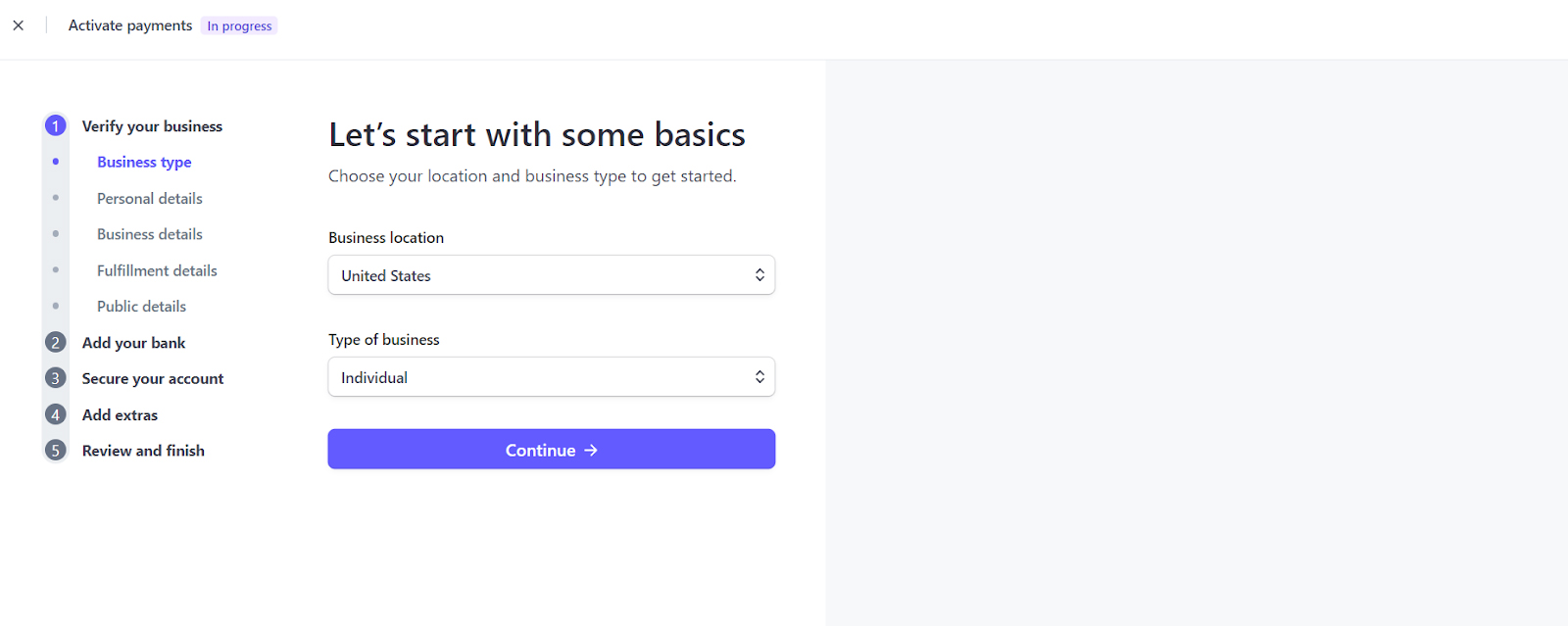

Setting up a Stripe account is not complicated and can be completed in minutes. You will be prompted to activate the payment features by providing information, such as:

- Business or trade name

- Physical address, email, and phone number

- Tax identification number

- Business website URL

- Nature of your business or activities

- Business owner/owners information

- Designated Stripe Account administrator

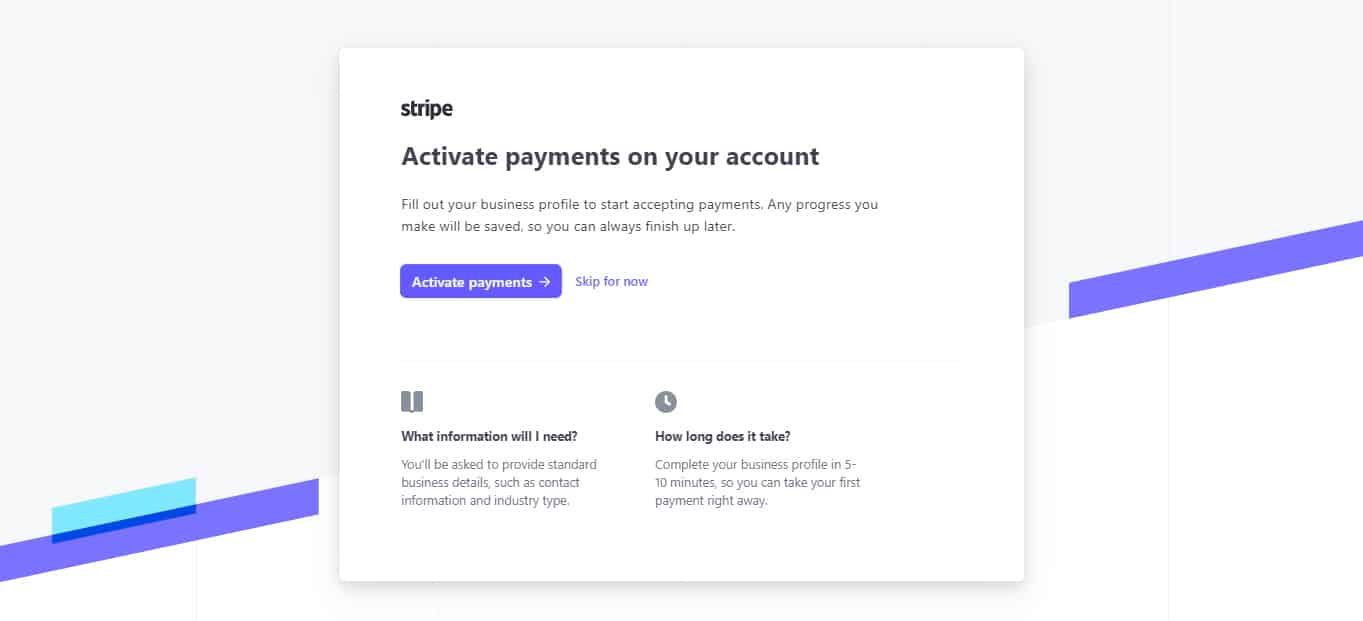

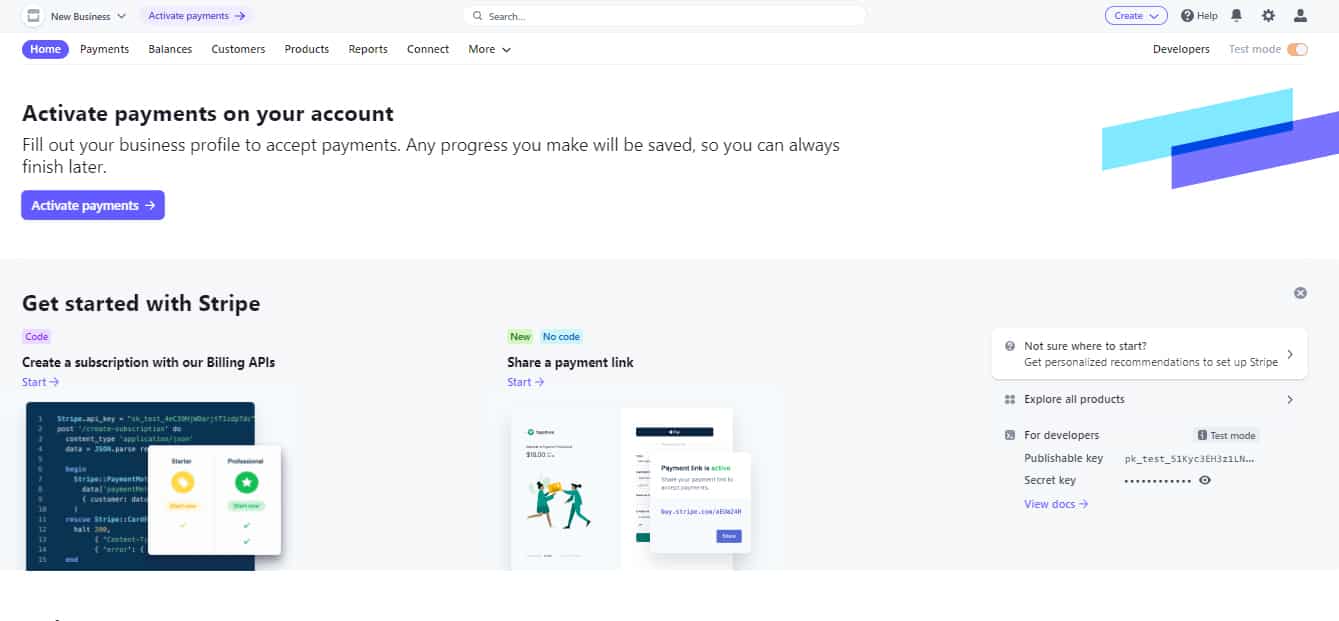

If you would like to test and have a look around Stripe, you can skip providing the information, and you will still be able to create an account and access the Stripe Dashboard. You can provide the needed information when you are ready to activate Payments.

Underwriting will be required to give you access to Stripe’s payment processing services, so expect to be asked for additional information as follows:

- Copies of financial statements, reporting, and other documentation that will help Stripe conduct risk assessment

- Other records to support your ability to comply with the merchant agreement

- Personal or company guarantee

Access to your Stripe account is temporary until underwriting is approved.

Although Stripe’s full potential is maximized with some coding and developer tools, it is easy to start receiving payments even if you confine your activity within the Stripe Dashboard. From my experience testing the platform, the Dashboard takes a bit of getting used to, but it is easy to navigate and explore. Stripe made it easy for new users to try out the Dashboard’s different areas by providing adequate previews and options to go back and redo steps if needed.

Stripe has a variety of products that carry their own service agreements. Its general terms of service detail account setup, approval, maintenance, and fees, among others.

- Stripe reserves the right to revise its fees at any time with at least 30 days’ advance notice before revisions become applicable.

- High dispute rates are described as exceeding 1% of your total sales and can result in the suspension of your access to Stripe’s payment processing services.

- Stripe may suspend your Stripe account as well as your access to funds in your Stripe account after determining, based on its sole discretion, that you are in breach of any provision within the service agreement.

- Stripe also reserves the right to set up and determine terms of a reserve fund in the event that your account is deemed to carry a higher-than-normal risk of doing business.

- Consult Stripe’s list of Restricted Businesses before registering for and opening a Stripe Account.

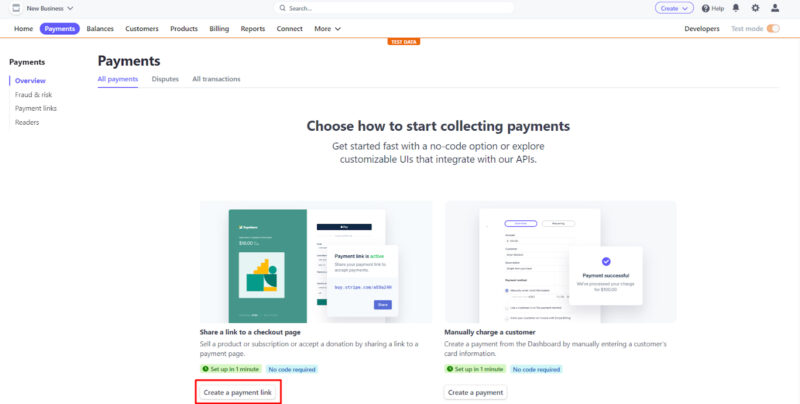

Stripe offers a wide range of online payment methods, including ACH Debit and Credit functions and B2B payment processing. The Stripe Dashboard allows you to create payment links, send invoices, create recurring billing, and manually create and input payment details. However, while a mobile POS is available, you will need custom integration which can take some time to set up.

Did you know?

Stripe now has an embeddable and customizable fiat-to-crypto onramp widget for US users. This allows merchants to directly embed a widget into their platform or app that will enable their users to buy cryptocurrency with their credit, debit, or bank account.

Stripe made our list of the best merchant services specifically for online sales and integrations. It accepts over 135 currencies and dozens of different payment methods, making it perfect for internet sales.

It is also built to accept cross-border payments. You can design your website to process multiple payment methods using local payment services from different countries. Your customers will be billed and can pay in their local currency while you receive the payments already converted to your own.

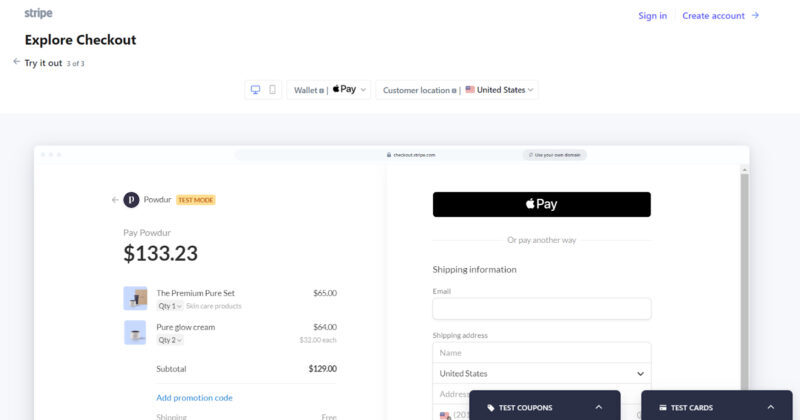

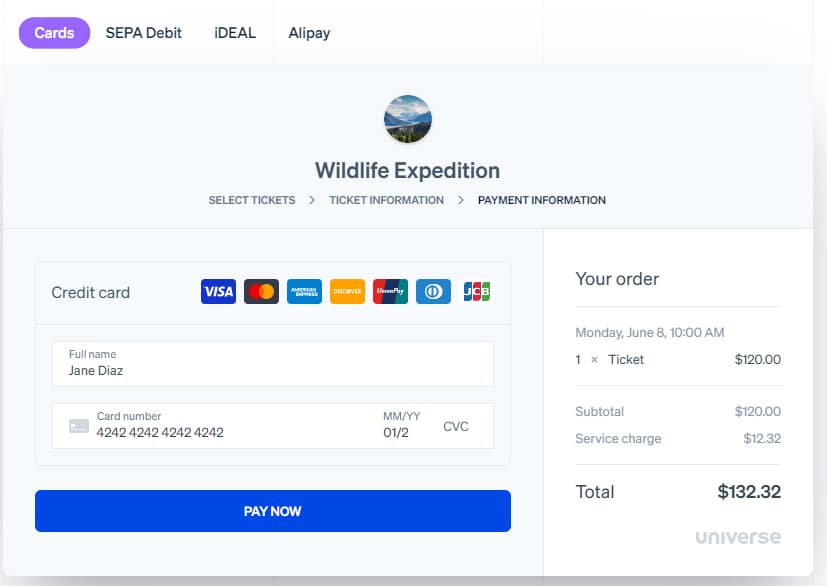

Stripe’s customizable checkout pages make it possible to securely offer local payment methods to your international clients. (Source: Stripe)

Stripe is available in 47 countries, and it took the top slot for our best international merchant account for small businesses. Its fees are excellent compared to other international processors and are country-specific. By accepting over 135 currencies, your customers can pay in their own currency and credit cards, while you get paid in your own currency. It also lets you display prices in the native currency, so there’s no confusion. Even more, it will detect your customer’s version and translate the checkout page into their native language.

Learn more about accepting payments online.

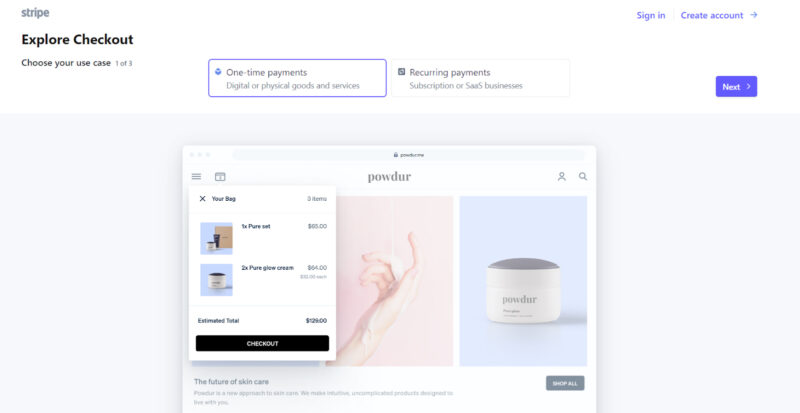

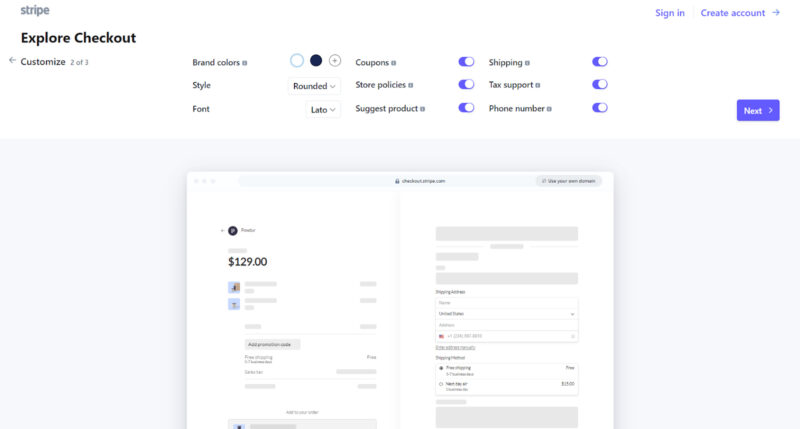

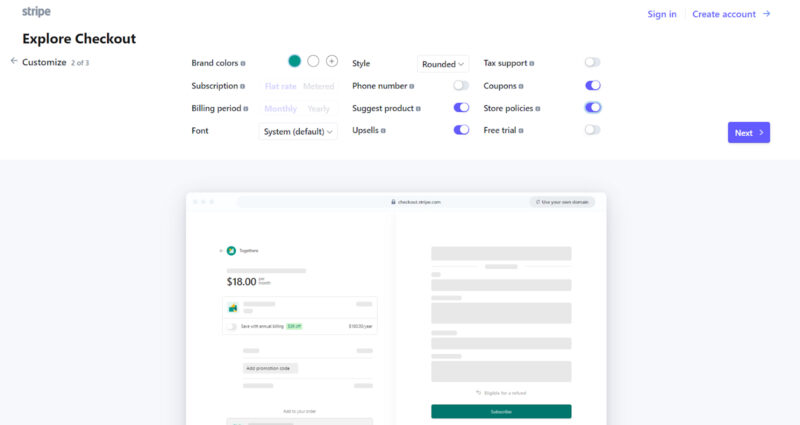

This is Stripe’s hosted checkout page, where you can create customizations and decide on the level of customization you would like to provide your customers. It is optimized for accepting one-time or subscription purchases and can accommodate both local and international payments—all while ensuring key considerations such as page load time, animations, device screen compatibility, and language.

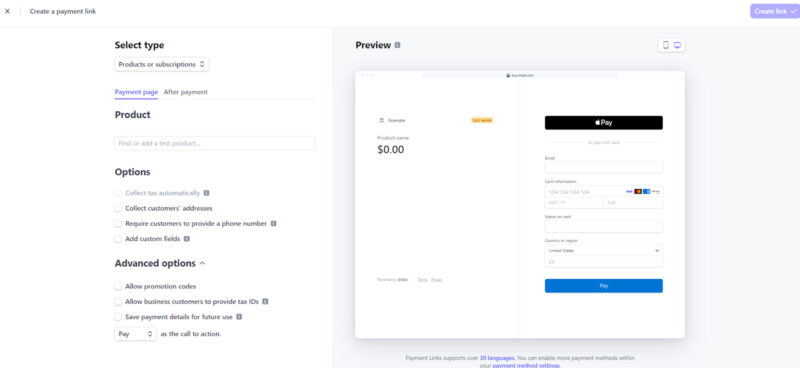

Stripe Checkout offers a simple step-by-step process for creating your own checkout page:

Stripe’s hosted checkout pages help reduce cart abandonment by providing features, such as address auto-complete, one-click payment using Link with Stripe, real-time card validation, descriptive error messages, third-party autofill, and card brand identification. Although you can have your checkout page hosted by Stripe, you also have the option of hosting it on your own domain.

While Stripe is popular for developers, it also provides payment processing solutions that don’t require any coding skills. Stripe lets you create payment links to sell products or services, start a subscription, or collect a donation—which you can post on social media or send to customers via messaging or email.

When someone clicks on your payment link, they will be directed to your Stripe-hosted page that you customized. And once you’ve sent out the links, your Stripe Dashboard will help you track outstanding invoices and notify you of a successful payment.

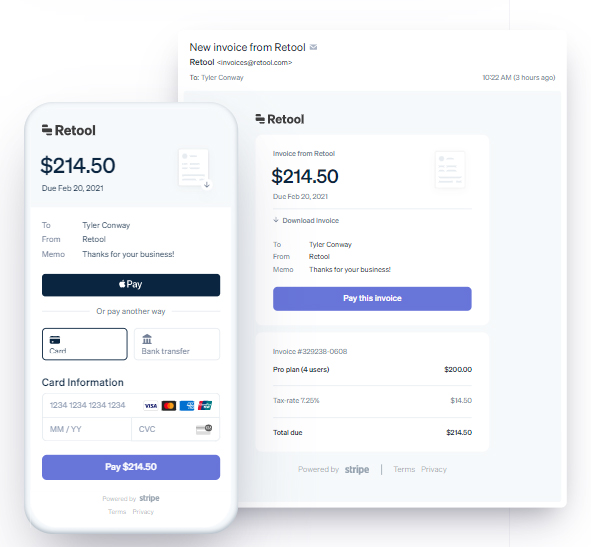

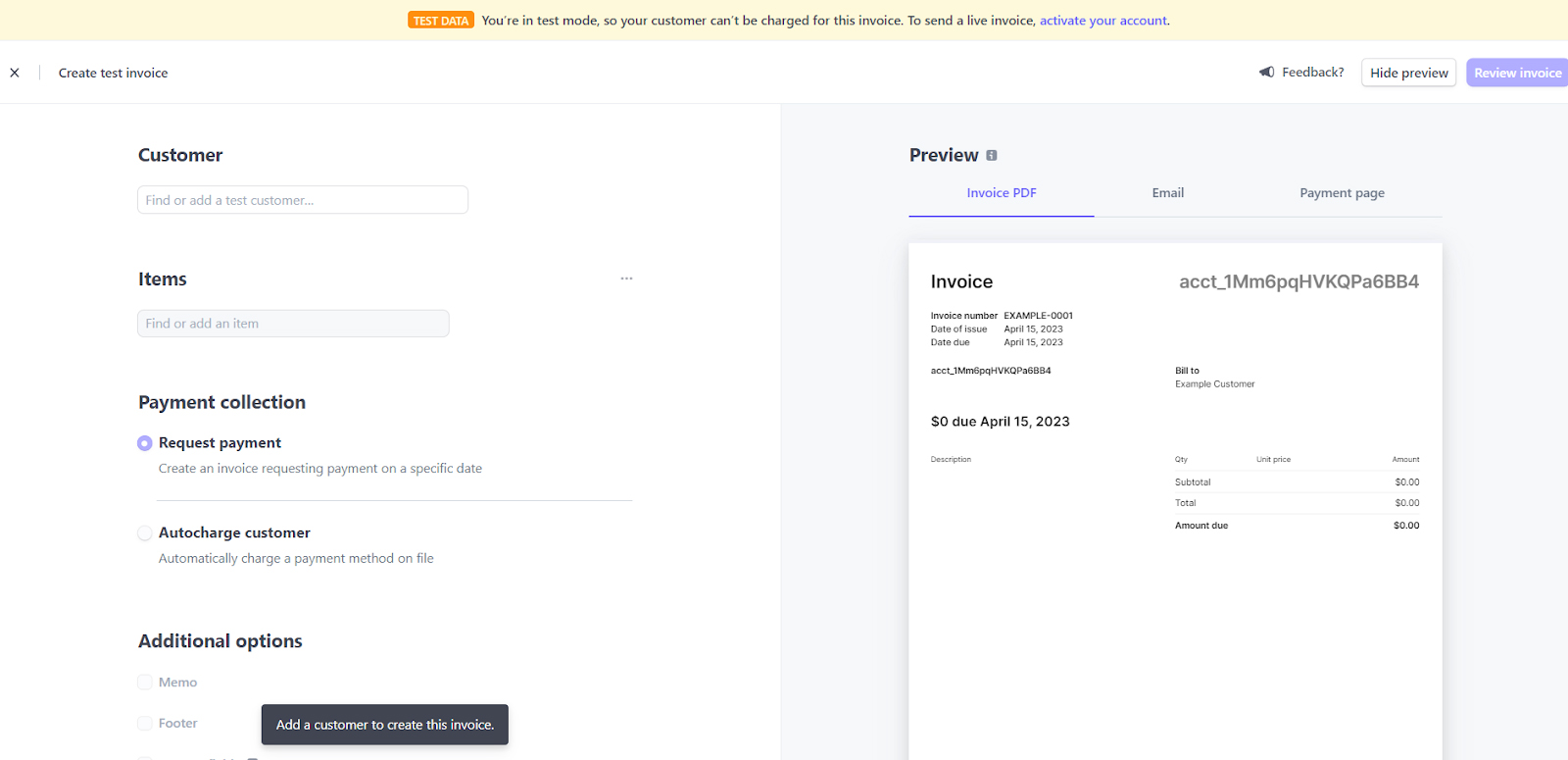

Stripe’s invoicing tool allows you to build custom invoices for any type of pricing model with options for either a Stripe-hosted invoice (no-code required) or API to add more advanced customizations—such as adding automatic email reminders and aging reports generation. You can collect one-time or recurring payments, add line items, specify discounts, and customize tax rates directly to your invoices.

Stripe Invoicing Plans:

- Starter Plan: Costs 0.4% per paid invoice, has 25 free invoices per month, and includes hosted invoice page and insight and analytic tools

- Plus Plan: Costs 0.5% per paid invoice and adds estimate building, automatic collection, and auto reconciliation tools on top of the Starter Plan

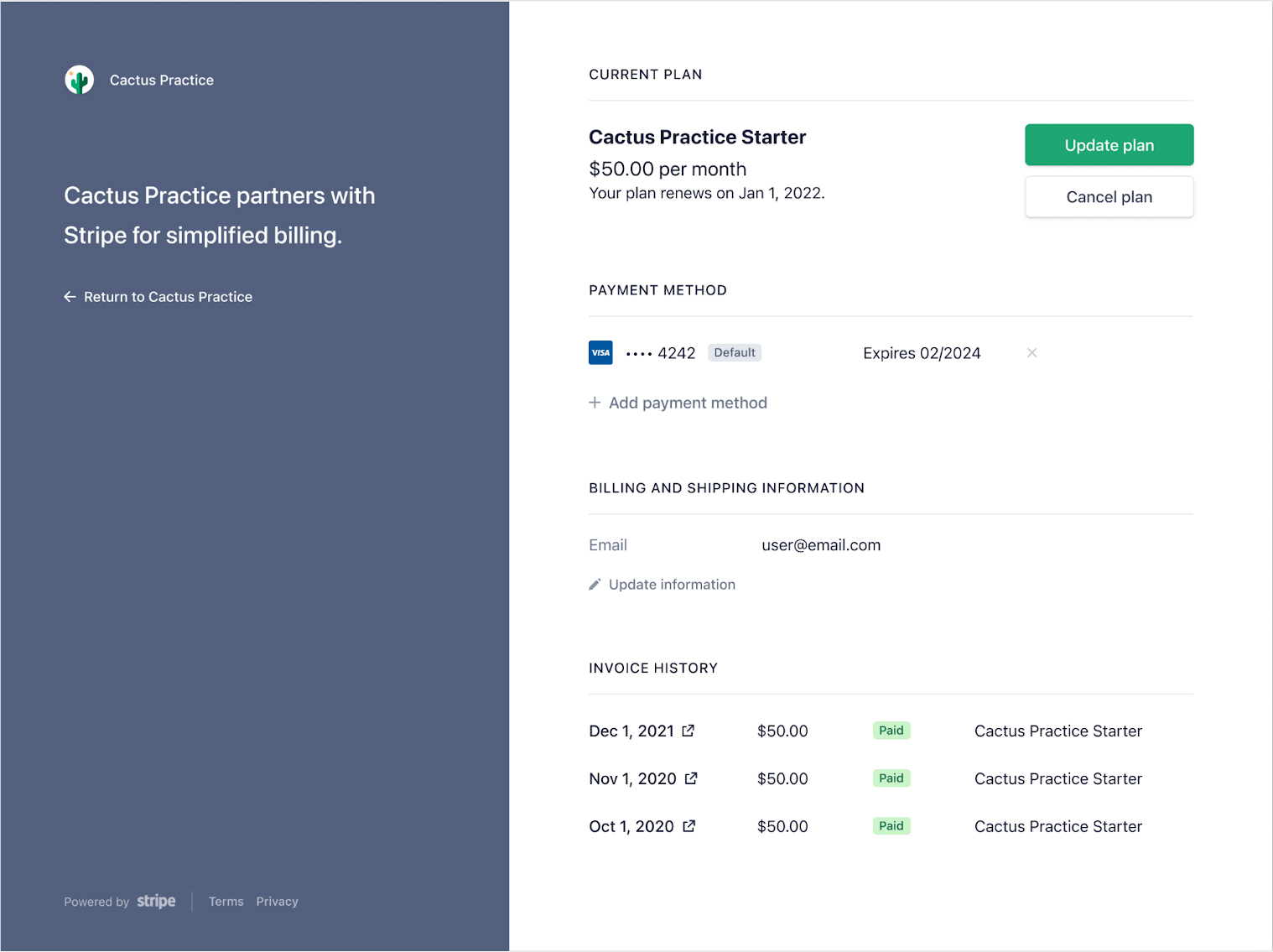

Stripe’s billing feature is especially useful for subscriptions. It lets you design different pricing structures, such as one-time, recurring, usage-based, and tiered pricing. You can also set up billing adjustments if you offer promotions and trial periods and customize the billing frequency.

Stripe offers its billing tools in two plans:

- Starter Plan: Charges 0.5% for paid recurring charges and includes automatic collection and customer portal tools

- Scale Plan: Costs 0.8% on recurring charges and adds estimates building tools and NetSuite integration (through Stripe Connector) on top of the Starter plan

Stripe Billing provides you with a Stripe-hosted customer-facing portal so your customers can manage their own subscriptions. (Source: Stripe)

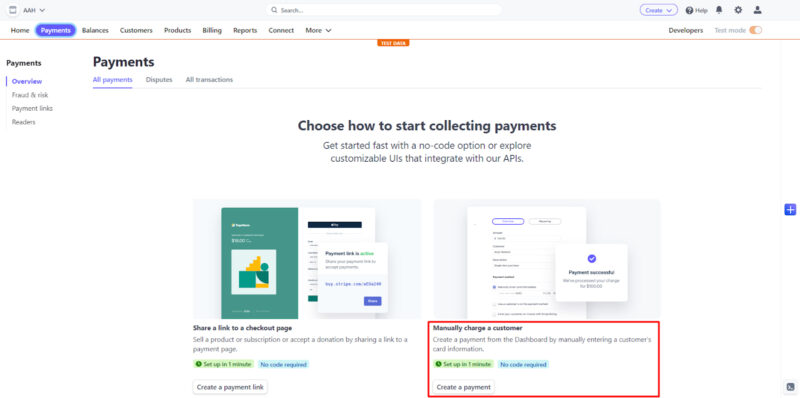

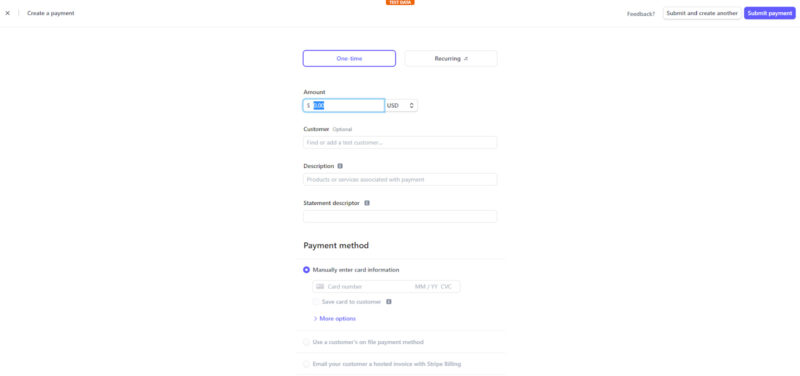

The Stripe Dashboard provides a tool for manually creating payments. Under the Payments section, there is an option to manually charge a customer, which directs to a virtual terminal where card details may be entered. The payment page also gives the option to use a customer’s stored payment details or to email an invoice using Stripe Billing. This option to manually enter a customer’s card details allows merchants to receive payments by phone.

Payments created by typing the card details into the Stripe Dashboard incur a slightly higher transaction fee of 3.4% + 30 cents.

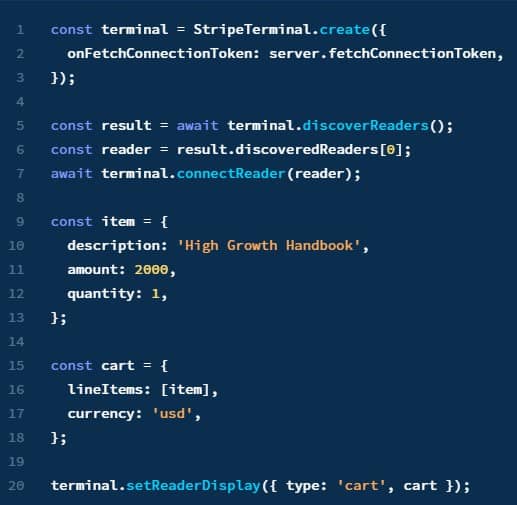

While Stripe integrates with popular POS systems like Lightspeed and WooCommerce, Stripe Terminal enables merchants to build their own in-person payment system, or connect to existing third-party mobile apps. Creating your own payment system requires using Stripe’s software development kits (SDKs) and application programming interfaces (APIs) to integrate Stripe into your own applications and build your point-of-sale (POS) system.

Stripe Terminal is currently available in the US, Canada, the UK, Ireland, France, Germany, and the Netherlands and is in beta in Australia, New Zealand, and Singapore.

There are no extra fees for using Stripe Terminal, except for a different in-person fee of 2.7% + 5 cents per transaction. You will also need to purchase a mobile card reader that starts at $59.

You can manage multiple card readers from your dashboard. (Source: Stripe)

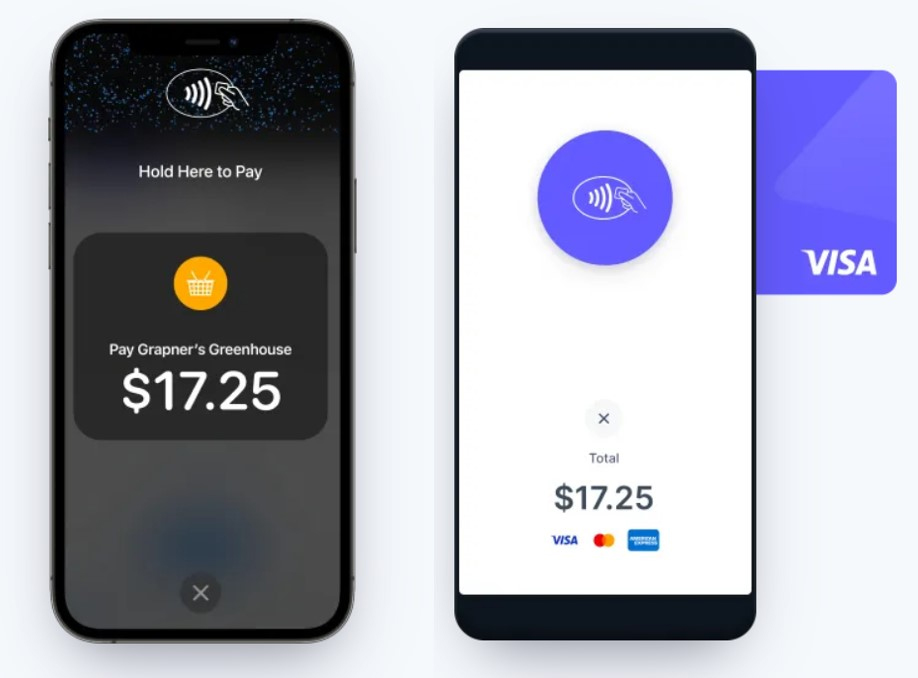

Tap to Pay on Mobile

Stripe allows merchants to receive in-person payments without purchasing any extra hardware. Its Tap to Pay on mobile only requires the Stripe Terminal SDK and compatible iPhones and Android devices for contactless payments. Accepted payment methods are American Express, Mastercard, Visa contactless cards, and NFC-based mobile wallets (Apple Pay, Google Pay, and Samsung Pay).

Stripe Terminal offers a Tap to Pay on iPhone or Android.

In the news:

Stripe launched Tap to Pay on iPhone in February 2022 for merchants in the US and Tap to Pay on Android in February 2023. Tap to Pay on Android is still currently available in beta in six countries (US, Canada, the UK, New Zealand, Australia, and Singapore).

Point-of-Sale (POS)

If you have access to a software developer, Stripe provides you with the tools to create your own POS software. Stripe’s APIs and SDKs will show you how to design your user interface and checkout routines, and even choose to build a system that’s compatible with Android, iOS, and JavaScript or let it run in Stripe’s server-driven integration.

Using Stripe’s API, you can create your own POS system and integrate it into Terminal. (Source: Stripe)

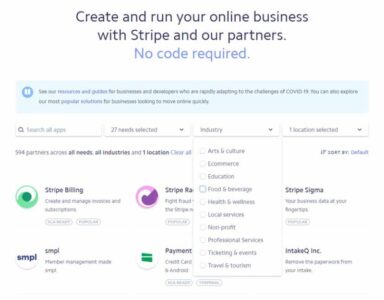

Stripe is among our best payment gateways, specifically for its integration capability. It works with hundreds of applications (we lost count at 660!). In addition, Stripe offers custom APIs and SDKs so that you can integrate it easily into your own custom websites and applications. If you have a need but not the skill, Stripe has a list of verified developers, agencies, and consultants to help.

Stripe stands out from its competitors for making advanced fraud management and data security available to small merchants. It also offers a variety of business management tools.

A few points were docked from Stripe’s score for the add-on fees it charges for certain features like invoicing and recurring billing tools. It also has a fee for same-day fund transfer processing.

Stripe Security & Fraud Protection

Stripe offers the following security features:

- Encryption: Stripe is a certified PCI Service Provider Level 1, the highest level of security under PCI DSS (Payment Card Industry Data Security Standards). To ensure secure connections, Stripe forces HTTPS for all its services, its website, and the Stripe Dashboard. Card numbers are encrypted with AES-256, an encryption algorithm that uses the 256-bit key length (the largest) to encrypt and decrypt a block of information. Aside from these, Stripe has a separate hosting environment for storing, decrypting, and transmitting card numbers.

- Stripe Identity: Stripe provides you with the tools to create different types of identity verification methods. Aside from global ID verification, you can also verify US Social Security numbers and addresses, and even match selfies with the provided ID. Note that this add-on feature requires some coding knowledge and will cost $1.50 for each verification (the first 50 requests are free).

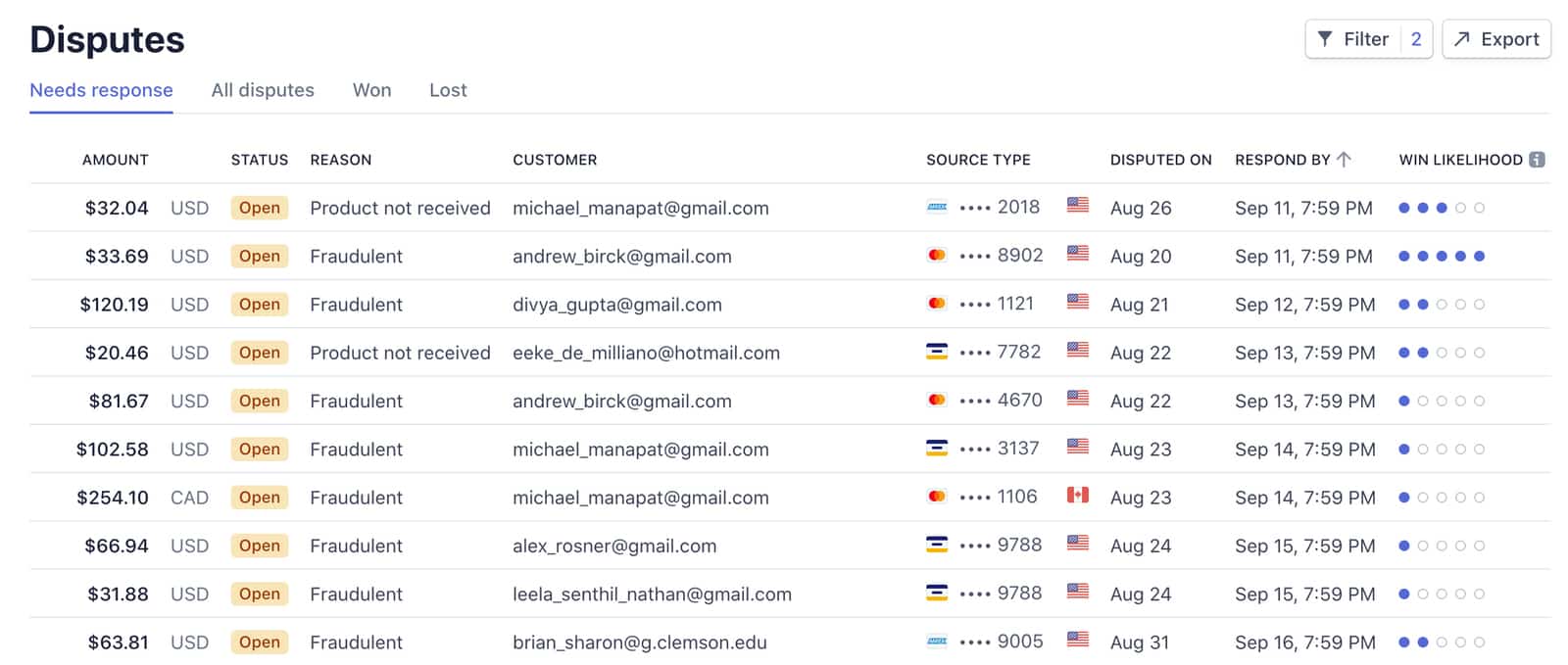

- Stripe Radar: This is Stripe’s machine-learning fraud prevention tool that uses billions of data points to continually adapt to how you do your business. It includes advanced payment, hardware and account protection tools, and secure data migration—so transactions are protected from start to finish. For businesses accepting international payments, Stripe also includes an identification recognition feature that can recognize IDs from over 33 countries.

Manage and resolve disputes with the help of Stripe’s dispute management system. (Source: Stripe)

Stripe charges 5 cents per screened transaction, but this fee is waived for payments that are billed the standard 2.9% + 30 cents transaction fee.

Customization is key for Stripe’s advanced security features. Aside from built-in PCI compliance, chargeback protection, and dispute management, it has developed payment, hardware, and account protection tools that go beyond the standard. For instance, you can customize your acceptable payment risk by setting your own risk level scores. It also offers secure data migration, so you can safely transfer transaction details and customer payment information to and from different payment processors.

Stripe Reporting & Analytics

Stripe also offers an in-depth suite of reporting and analytics tools:

- Sigma: Sigma is Stripe’s advanced reporting function that allows you to create advanced reports based on your actual needs right on the dashboard. It includes ready-made queries that you can customize for your business type, along with quick sidebar access to your sources to easily adjust parameters whenever you need it. You can save, download, and share reports, and even collaborate with your team.

- Revenue Recognition: Stripe’s revenue recognition function is an accounting automation that allows you to gain a comprehensive view of your business. It can track upgrades, downgrades, prorations, refunds, and disputes to help reduce the task of preparing financial statements.

- Data Pipeline: Stripe makes it easy to send data and reports to your data warehouse if you use one. Currently, it only allows data to be exported to two popular data warehouses–Amazon Redshift and Snowflake. This feature will allow you to analyze your sales and revenue data, identify revenue growth opportunities, improve your fraud and risk modeling, and optimize your sales and marketing campaigns. Stripe Data Pipeline incurs an additional fee of 3 cents for every transaction.

Management

Stripe’s platform also comes with a number of management features:

- Unified Dashboard: This is where you can manage roles and permissions, make notes on your collaborations, and take action via the dashboard app on your iOS and Android devices. Stripe’s unified dashboard gives you access to all of its payment processing tools, including risk management, reporting, and advanced integrations. This is also your dispute-handling platform, where you get access to automated evidence submission and monitor all disputes.

- Tax: Stripe Tax is an add-on feature that integrates with Stripe Invoicing, Billing, Checkout, Payment Links, and Connect. It lets you configure your system to automatically calculate tax, VAT, and GST on sales, and even detect customer location and compute the appropriate taxes. You can generate customized tax reports by country so you can confidently file your returns. Note that this feature costs 0.5% per transaction where you’re registered to collect taxes (0.4% for transactions exceeding $100,000/ month).

Integrations

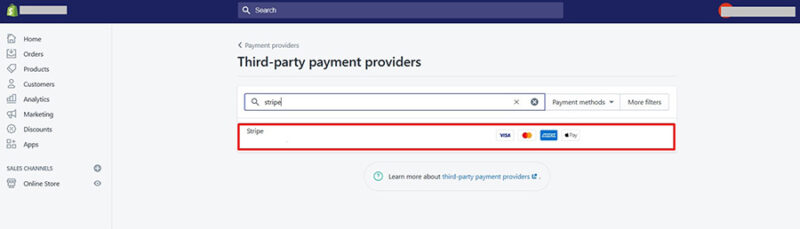

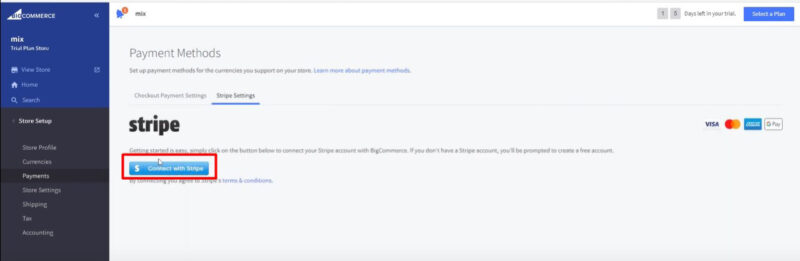

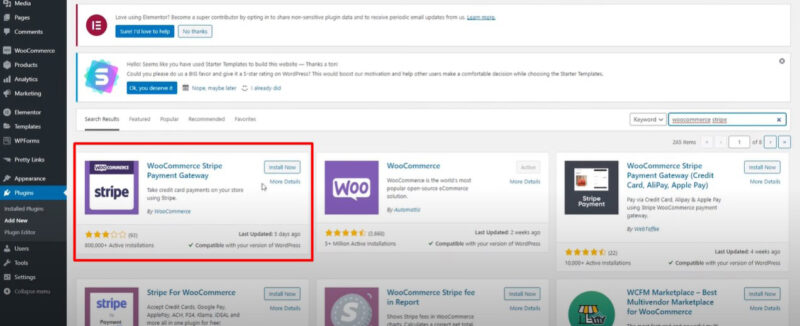

Adding Stripe as a payment processor is easy if you already have your online store. It offers a wide range of plug-and-play integrations for all of its third-party platform partners, so it will only take minutes to set up Stripe as your checkout option. Meanwhile, Stripe is also known for its developer integrations. Experienced coders can utilize comprehensive testing tools, over 450 platforms and extensions, and a dedicated developer dashboard.

Deposit Speed

Stripe deposits your funds into your account in two business days. Meanwhile, Instant Payouts is Stripe’s solution for providing you instant access to your funds by sending them to a supported debit card or bank account (available for a fee).

It comes as no surprise that Stripe gets excellent marks for pricing, popularity, and integrations. At zero monthly fees, Stripe provides advanced payment processing and security features you would often find for larger businesses. It also earns above-average user reviews in spite of the generally complex setup. Stripe has over 660 integrations that go beyond ecommerce tools such as accounting software, CRM platforms, and POS systems, making the system a highly scalable solution that we look for and recommend to small businesses.

On the other hand, ease of use is Stripe’s biggest challenge. For one, requiring merchants to set up code-enabled integration just to start accepting payment in-person is a major inconvenience. And while it offers code-free payment processing tools, Stripe requires several customizations to get set up. Although its many tools and features can be an advantage, it can be overwhelming for small and new merchants who are simply looking for a way to start accepting payments.

Stripe User Reviews

Stripe continues to receive generally positive feedback. Users like Stripe for its seamless integration with popular online platforms. In particular, users found Stripe’s customization and subscription features extremely useful for creating invoices and recurring payments.

- Capterra: Over 2,900 users rated Stripe an average of 4.7 out of 5 stars.

- G2: More than 250 users rated Stripe an average of 4.3 out of 5 stars.

Common negative Stripe reviews include lengthy payment holding time and refunds being provided to customers without prior notice. Users also cite a learning curve in using most of Stripe’s features, so if your business lacks access to a certain degree of software development skills, Stripe may not be the right fit.

| Users Like | Users Don’t Like |

|---|---|

| Dashboard and reporting features | Refunds to customers without notice |

| Handy developer tools | Poor customer service |

| Compatibility with most ecommerce platforms and marketplaces | Extended holding time of payments before being credited to the bank |

Methodology—How We Evaluated Stripe

We test each merchant account service provider ourselves to ensure an extensive review of the products. We then compare pricing methods and identify providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. Finally, we evaluate each according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

20% of Overall Score

We graded based on monthly fees, online rates, chargebacks, and whether or not you could get volume discounts.

30% of Overall Score

Online payments are more than website checkouts. We looked for invoices, recurring billing, and virtual terminals. We also gave points for stored payments and Level 2 and 3 processing for B2B sales. Stripe had a clear lead with 4.63.

25% of Overall Score

This score took into account sales tools like customer management features, BNPL, fraud prevention, and developer tools for customizations. We also considered deposit speed, giving the most points for same-day processing, and customer service. Stripe again took the lead with 4.63 out of 5.

25% of Overall Score

Here, we scored based on our own experience of ease of use, plus research into account stability. The number and ease of integrations contributed to this score. Finally, we gave some weight to the input of real-world users as recorded in third-party user review sites like Capterra. Square also did well in this category.

Stripe Payments Frequently Asked Questions (FAQs)

Stripe leads PayPal and Square in features for accepting credit cards online while Square is the better option if you need a reliable and affordable point of sale. If you are looking for customer-friendly checkout options, choose PayPal.

Learn more in our Stripe vs Square vs PayPal comparison.

Stripe card transactions are processed the next business day but instant payouts are available with access to an eligible debit card. Instant payouts cost an additional 1% and have a minimum fee of 50 cents.

ACH payments are normally processed within three to five business days but Stripe also offers options for two-day settlement at 1.2% fee and $1.50 for instant bank account validation.

Stripe is one of the safest online payment processors in the industry. It supports machine-learning risk management tools and a range of identity verification options to prevent fraudulent transactions and minimize chargebacks.

Learn more about Stripe and its other tools in our guide.

Stripe is versatile and easy to use and can be good for beginners who only need Stripe’s code-free payment processing tools. For those who need more than these code-free options, Stripe requires a bit of coding and developer help which can be overwhelming for some beginners.

Both PayPal and Stripe are good options for payment processors. Stripe is best for tech-savvy startups and growing ecommerce businesses and merchants that need B2B or international payments processing. On the other hand, PayPal is best for small or casual retailers or merchants who only have occasional sales. Read our in-depth comparison of Stripe vs PayPal.

Bottom Line

Stripe is a well-known brand in ecommerce payment processing—and rightfully so. In our Stripe review, we found that it provides a free merchant account with exceptional data security and global payment capabilities that set the standards for other payment processors in the market. And while the system is developer-friendly, Stripe also offers an array of simple customization tools that do not require coding skills.