Wave is cloud-based accounting software that allows you to manage your bookkeeping, invoicing, and payment processes in one place. What I like most about it is that it is easy to set up and that it has a free plan with all the basic features that many businesses need. However, I wish it had more advanced accounting features, like project management and inventory accounting.

If you’re interested in the program after reading my detailed Wave review, you can sign up for the free plan (Starter) or upgrade to the paid tier (Pro) for $16 monthly.

Pros

- Free option for businesses with a single user and basic accounting needs

- Paid plan for only $16 monthly for unlimited users and bank feeds

- Straightforward to set up and use

- Easy to manage unpaid bills—even in the free version

- Good basic accounting reports

- Live chat and email support in paid tier

Cons

- Can’t connect your bank accounts with the free subscription

- Only one user in the free plan

- Not a good fit for large businesses or businesses with inventory

- Can’t set up separate income and expenses by classes or locations

- Can’t reconcile bank statements when timing differences exist

- Unprofessional-looking reports

Pricing |

|

|---|---|

Free Trial |

|

Payment Processing |

|

Payroll | Deeply integrates with Wave Payroll (read our review of Wave Payroll for more information) |

Assisted Bookkeeping | Wave Advisors (starts at $149 monthly) will classify transactions, reconcile accounts, and provide monthly financial statements. |

Standout Features | |

Scalability |

|

Customer Support |

|

Average User Review Rating |

- Small service businesses: I find Wave, our top-recommended free accounting software, suitable for small service businesses needing to invoice customers, track unpaid bills, and compile their income and expenses for a tax return. It also allows users to print a balance sheet, which is important for LLCs, partnerships, and corporations.

- Business with many in-person purchases: Wave’s affordable receipt scanning option allows users to take a picture of receipts, categorize the expenses, and upload them to Wave—all on the mobile app.

- Businesses with lots of small credit card sales: Pro subscribers don’t have to pay a per-transaction fee on credit card sales, making it profitable to accept even the smallest credit card charge.

- Small businesses with employees: Wave Payroll is an affordable integration to pay your employees and all have the accounting entries automated.

- Best accounting software for freelancers: Best free accounting software

- Best startup accounting software: Best free for startups during their organizational stage

- Best restaurant accounting software: Best free software for food trucks and carts

- Best farm accounting software: Best free for part-time and hobby farmers

- Best real estate accounting software: Best free for property managers

- Best church accounting software: Best free for very small churches

- Best nonprofit accounting software: Best free for nonprofits with less than $50,000 in gross receipts

- Best ecommerce accounting software: Best for Zapier for ecommerce integrations

- Best multicompany accounting software: Best free for up to 15 companies

- Best Mac accounting software: Best free cloud-based Mac accounting software

- Best QuickBooks alternatives: Best free QuickBooks alternative

- Best cloud accounting software: Best free or low-cost software for service-based companies

- Best business expense tracker apps: Best free simple expense tracking and accounting

Wave Alternatives & Comparison

| PROS | CONS |

|---|---|

| Easy to set up | Invoices are not that customizable |

| Great basic accounting features | No live support in the free plan |

| Includes payroll | Reports are poorly structured and lack customization |

Below, I summarized the Wave reviews I gathered from users and shared my expert opinions:

- Easy to set up and use: Some reviewers mentioned that Wave has a nice and user-friendly interface and layout, making it easy to set up even for those without accounting experience. I also find Wave extremely easy to set up and use, even for the paid Pro version.

- Great basic accounting features: Many users are satisfied with the basic accounting features offered in the free tier, including invoicing and income and expense tracking. However, it’s a bit of a letdown that Wave no longer lets you connect bank accounts in the free plan.

- Payroll is included: One reviewer likes that Wave includes built-in payroll. I agree that it’s a great integration, but I want to note that it’s excluded from the price. While it’s very affordable, you will need to pay extra.

- Invoices are not that customizable: One user wishes that they could customize the invoices—but they’re pretty much limited. Wave allows you to upload your company logo and choose the theme color, and I believe you can still make decent invoices out of this. Invoices in the paid plan have more customization features than the free tier.

- Limited customer support in the free plan: Some dislike that Wave has no customer support options in the free version—unless users enroll in a paid service. I’m happy that Wave includes free live chat and email support in its paid plan. Overall, users on Software Advice awarded Wave 4 out of 5 stars for customer support—which I think is pretty good considering the limited support channels available.

- Reports are poorly structured and lack customization: Some users don’t think the reports are very good—and I completely agree. They’re functional in that you can get the numbers you need to prepare your tax return or fill out a loan application; however, they are very unprofessional-looking, and, honestly, I’d be a bit embarrassed to give them to a vendor or bank.They don’t allow for any customization other than you can specify the period covered. Worst of all, the balance sheet excludes beginning and ending numbers—which is a pretty sure sign it wasn’t designed by an accountant.

Here are Wave’s average scores from third-party review sites:

- Software Advice[1]: 4.4 out of 5 based on over 1,600 reviews

- G2[2]: 4.3 out of 5 based on around 300 reviews

Using our internal case study, I compared Wave with my top recommended alternatives—QuickBooks Online, Zoho Books, and FreshBooks. I summed up the results in the chart below.

Wave vs Competitors

Touch the graph above to interact Click on the graphs above to interact

-

WAVE PRO $16 PER MONTH

-

QUICKBOOKS ONLINE PLUS $99 PER MONTH

-

ZOHO BOOKS PRO $50 PER MONTH

-

FRESHBOOKS PREMIUM $60 PER MONTH

As seen in the chart above, Wave’s strength lies in value. It earned a higher score than QuickBooks Online but is slightly behind Zoho Books. Despite having a free plan, Wave lost to Zoho Books and FreshBooks because my Value evaluation is based on cost and the value it provides to users.

While Zoho Books and FreshBooks cost more than Wave, they deliver extra features that justify their price. Additionally, Wave lost to its competitors in all the feature-specific categories, like A/P and A/R management, inventory, and project accounting.

Wave Pricing

Wave would have nailed this category if cost were the only basis of my evaluation, which isn’t the case. As mentioned earlier, I also considered the value and quality it provides to users. I docked a few points because the free plan only supports a single user—plus, you can’t connect your bank accounts unless you upgrade to the paid version. Also, there is no introductory discount or free trial for those interested in the paid plan.

The free (Starter) and paid (Pro) tiers offer basic features, such as invoicing, income and expense tracking, and payment processing. Pro has additional inclusions, as outlined in the Wave pricing table below.

Pricing & Features | Starter | Pro |

|---|---|---|

Our Value Score (out of 5) | ||

Monthly Pricing ($/Month) | $0 | $16 |

Annual Pricing ($/Year) | $0 | $170 |

Credit Card Processing |

| |

Maximum Number of Users | 1 | Unlimited |

Wave Receipts (Unlimited Receipt Scanning) | $8 per month or $72 per year | ✓ |

Access Live Chat & Email Support | Requires any paid add-on | ✓ |

Issue Unlimited Invoices | ✓ | ✓ |

Track Bills | ✓ | ✓ |

Print Financial Statements | ✓ | ✓ |

Upload Bank Statement Transactions | ✓ | ✓ |

Connect Bank & Credit Card Accounts | ✕ | ✓ |

Automated Overdue Invoice Reminders | ✕ | ✓ |

Recurring Invoices and Credit Card Charges | ✕ | ✓ |

Attach Files to Customer Invoices | ✕ | ✓ |

Track 1099 Payments for Independent Contractors | ✕ | ✓ |

Add-ons:

- Wave Payroll: Fixed monthly cost of $40 for tax service states Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin or $20 for self-service states; there’s also an additional $6 per month, per active employee or independent contractor (read our Wave Payroll review for more information)

- Wave Advisor: Starting at $149 a month for bookkeeping support, including classifying transactions, reconciling accounts, and providing financial statements

- Accounting and payroll coaching: One-time fee of $379 for two hours of live coaching and 30-day email access to your coach

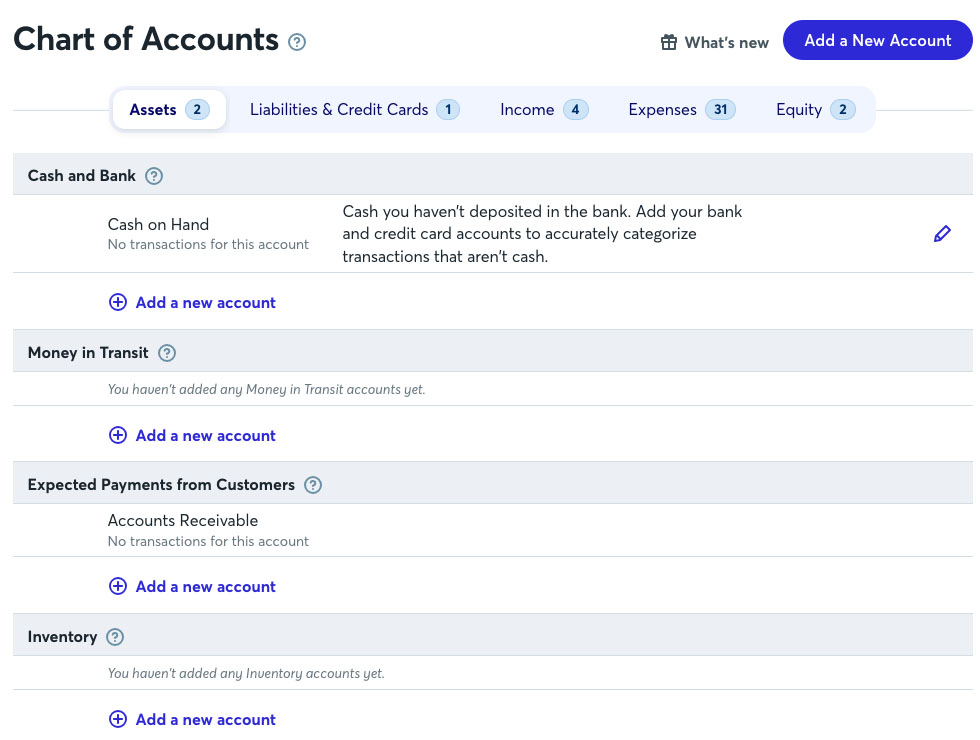

Wave took a hit in my assessment of general features primarily due to its weak transaction management features. For example, it doesn’t let me classify transactions by class or location or create custom tags to attach to transactions. Additionally, I can’t set a closing date to lock prior-year transactions, which would help prevent unauthorized changes to my financial data.

Another useful feature I wish it had is the ability to use account numbers in the chart of accounts. For freelancers and solopreneurs, account numbers probably aren’t necessary; but for companies with a bigger chart of accounts, account numbers can help organize the accounts and make data input much faster.

Nevertheless, Wave still provides plenty of ways to properly set up and organize your data. For instance, I can set up my chart of accounts based on common accounts and categories, but I can add other accounts if necessary.

Adding a new account in Wave

Wave scored poorly for banking and cash management because it doesn’t allow users to print checks, and I don’t find the bank reconciliation feature as functional as those in other software like QuickBooks Online. The reconciliation doesn’t allow for entries in the books that have not yet cleared the bank, like outstanding checks. This presents a challenge if I need to write many paper checks as I will be unable to reconcile my account until all outstanding checks have cleared the bank.

Additionally, the free Starter plan does not allow me to connect a live feed to my bank or credit card accounts. However, it’s a good thing that I’m able to upload my bank statements from CSV or Excel files and perform bank reconciliations.

During the reconciliation process, Wave attempts to match manually inputted transactions to transactions imported from your bank and does a pretty good job. However, if it fails, it doesn’t allow you to manually match the imported transaction to the manually inputted transaction. You’ll need to watch for this carefully and then delete the imported transaction to avoid duplication. It’s not ideal, but Wave does clearly indicate imported transactions that have to be dealt with.

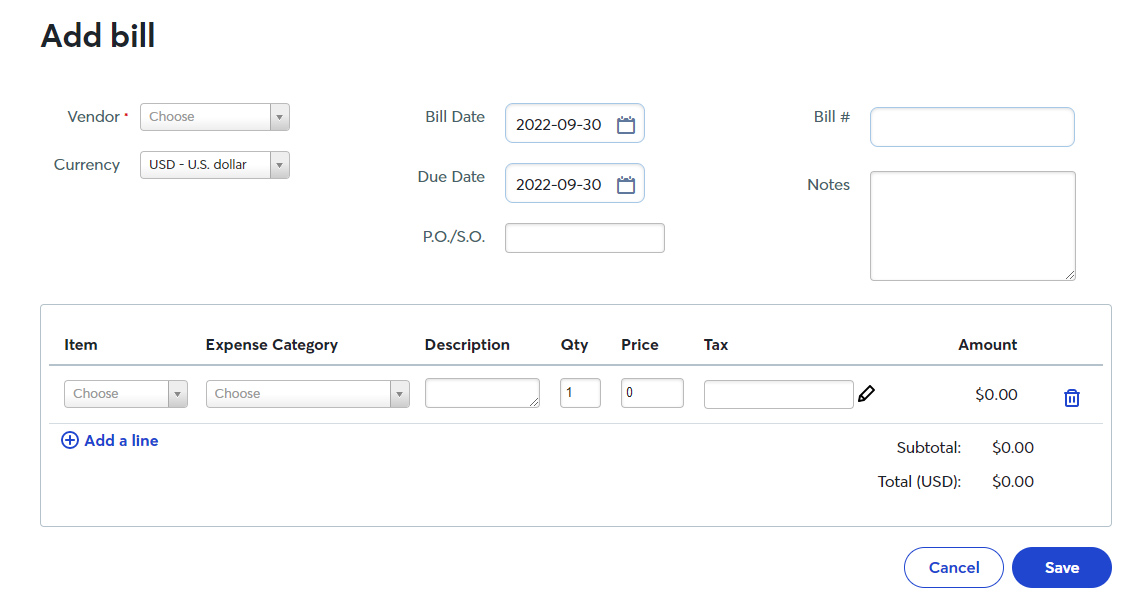

Wave is one of our best A/P software because of its ability to record unpaid bills, even with the free Starter plan. I couldn’t award it a higher mark, though, because I found some weaknesses, such as the inability to input vendor credits, create purchase orders, track transactions by vendor, and attach receipts to unpaid bills.

Nevertheless, I am impressed with how easy it is to manage unpaid bills in Wave. I can easily manage my A/P transactions from the Purchases menu, which consists of all the features I need to record purchases: Bills, Vendors, and Products and Services.

Depending on your subscription, you can snap a photo of your expense receipt and upload it to Wave through the mobile app. All users can attach a receipt to transactions in the desktop interface, although you can’t attach them to unpaid bills.

To record a bill in Wave, click on the Create a Bill button, and then the Add bill screen will appear:

Creating bills on Wave

Unfortunately, Wave doesn’t allow users to create a recurring transaction directly from the bill, which is possible in other software like QuickBooks. It also won’t let you set up recurring expenses and create and send purchase orders.

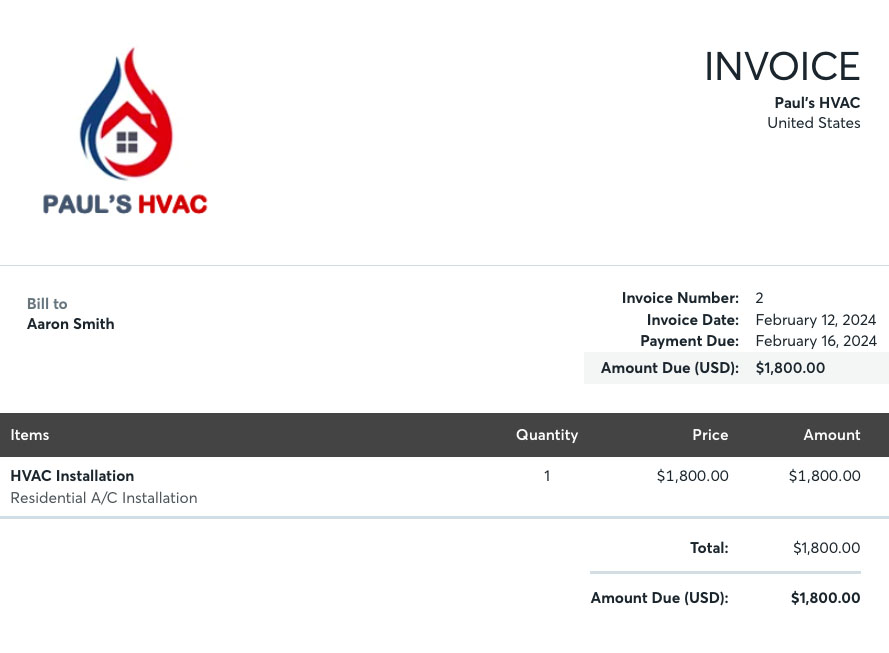

The program did fairly well in A/R management. It provides decent invoicing features, but I hope to see some advanced A/R functionality in the future.

Invoicing

I find Wave adequate for basic invoicing, and I like that the invoices in the paid version can be customized to look professional. My only concern is that it doesn’t allow me to add custom fields to my invoices.

Sample Invoice from Wave

Once an invoice is created, you can email it directly to your customer in the paid tier. The free plan doesn’t let you do that, but it provides you with a link to your invoice so that you can include it in your own email.

Another benefit of the paid Pro tier is that you can attach documents to your customer’s invoice. With a subscription to Wave Payments, you can include a payment link in your customer’s invoice.

Advanced A/R Management

The lack of advanced A/R features is mainly what cost Wave points in my assessment of A/R. For instance, I can’t issue a sales receipt for an immediate customer payment and track and add labor and expenses to my invoices. I also hope the provider considers adding a customer portal where customers can easily track their invoices and process their payments.

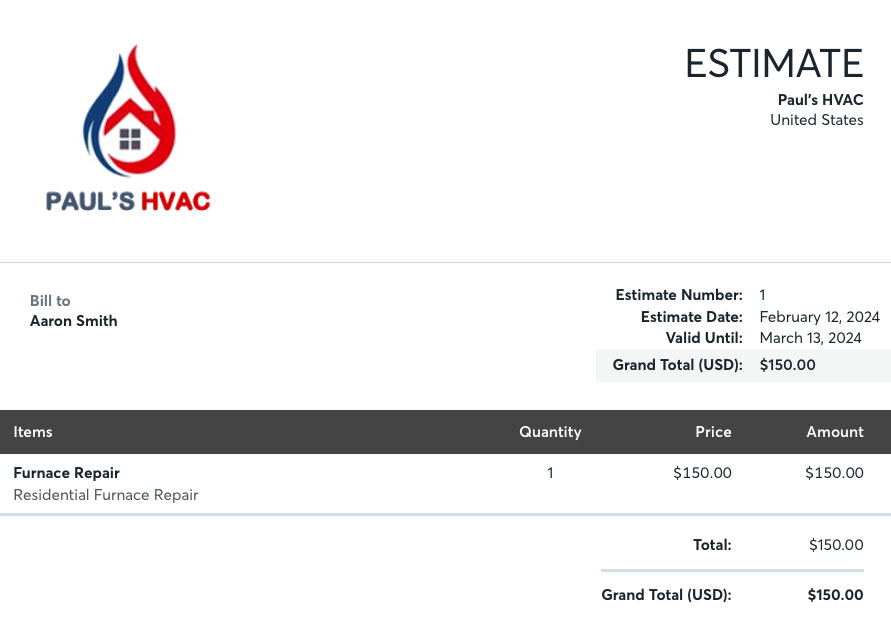

Wave lacks a feature to accumulate costs by project, so it’s not great for project-based businesses. It allows me to create customized estimates for project bids, but there is no way to compare actual costs to the estimate automatically. These are why I couldn’t award Wave more points in this criterion.

Sample estimate in Wave

You might find Wave’s estimate feature helpful, but I recommend you check out our roundup of the best project accounting software for more comprehensive project accounting features.

Wave provides the basics, like adding sales taxes to invoices, estimates, and invoice transactions. Whenever I enter a transaction with a sales tax, it records the amount automatically in the sales tax liability account. However, there’s no way to file tax returns, which explains its low score in this category.

On the bright side, I like that Wave allows users to track payments and generate 1099s for their independent contractors. However, this feature requires either the Pro plan or a subscription to Wave Payroll. Another key functionality missing in Wave is the ability to automatically calculate sales tax rates based on the customer’s location—a feature I really appreciate in QuickBooks Online.

Note: The sales and income tax features are evaluated across our other categories, so there is no dedicated video.

Wave lacks inventory management features, so if you’re a product-based business, consider QuickBooks Online. You can add a product or service but not the quantity purchased or sold. This means that Wave can’t calculate your COGS, which is important if you deal with inventory.

Note: I examined Wave’s inventory management feature across the other categories, mostly in A/R and A/P, so there is no separate video for inventory.

Wave received a relatively good score in this category because it provides all the basic financial reports users need to file their tax returns. Specifically, you can generate the following:

- P&L statement

- cash flow statement

- A/P aging

- A/R aging

- general ledger

- trial balance

- transaction list by customer

- expense by vendor

However, while the reports are accurate, I don’t find them very professional looking—especially the balance sheet that doesn’t provide a beginning and an ending balance. The reports also lack any customization options.

As seen in my rubric score, the Wave app is pretty limited, especially for Starter subscribers. The most useful features are the ability to send invoices and estimates and collect payments. Users can also add customers and items to their products and services list.

Pro subscribers, as well as Starter subscribers with a Receipts add-on, can scan receipts and classify income and expense transactions directly within the app. There are some basic overview charts to see the financial status of your company, but no complete reports.

If having a good mobile app is important to you, I highly recommend Zoho Books—which aced our mobile app category.

Wave took a hit in my integration evaluation because I can’t connect it to time tracking and electronic bill pay processors. For comparison, QuickBooks actually has electronic bill pay and time tracking built into all its plans except Simple Start.

Wave has some useful integrations, like Google Sheets and BlueCamroo, but all others must be made through Zapier. If you have a Zapier subscription, you can integrate many other apps—but it will be more difficult than having a deep integration, such as those offered in other accounting software.

On the positive side, Wave integrates with its payroll and payment processing services, Wave Payroll and Wave Payments, which are crucial functions for most businesses.

I assessed Wave’s usability based on these four major aspects:

A lot of manual data entry is required to set up a company file for existing businesses. When I set up my sample company for our case study, I had to manually input the chart of accounts, service items, and beginning account balances. Even worse, the only way I found to enter beginning account balances was with a large journal entry. None of these really matter if you’re setting up a brand new company—but it can take considerable time for established companies.

I did find a few bright spots in setting up my company, though. Wave lets you import a CSV file of customers and vendors. It also has a new company wizard that walks you through the setup process and prompts you for the basic information needed.

Wave is easy to use and has a shallow learning curve, whether you’re using the free or paid version. The interface is clean and not overwhelming, and you can easily find your way around. The dashboard includes shortcut buttons so that you can easily create new transactions, like bills, estimates, and invoices. Even if you don’t have accounting experience, you can familiarize yourself with the features of Wave in less than a week.

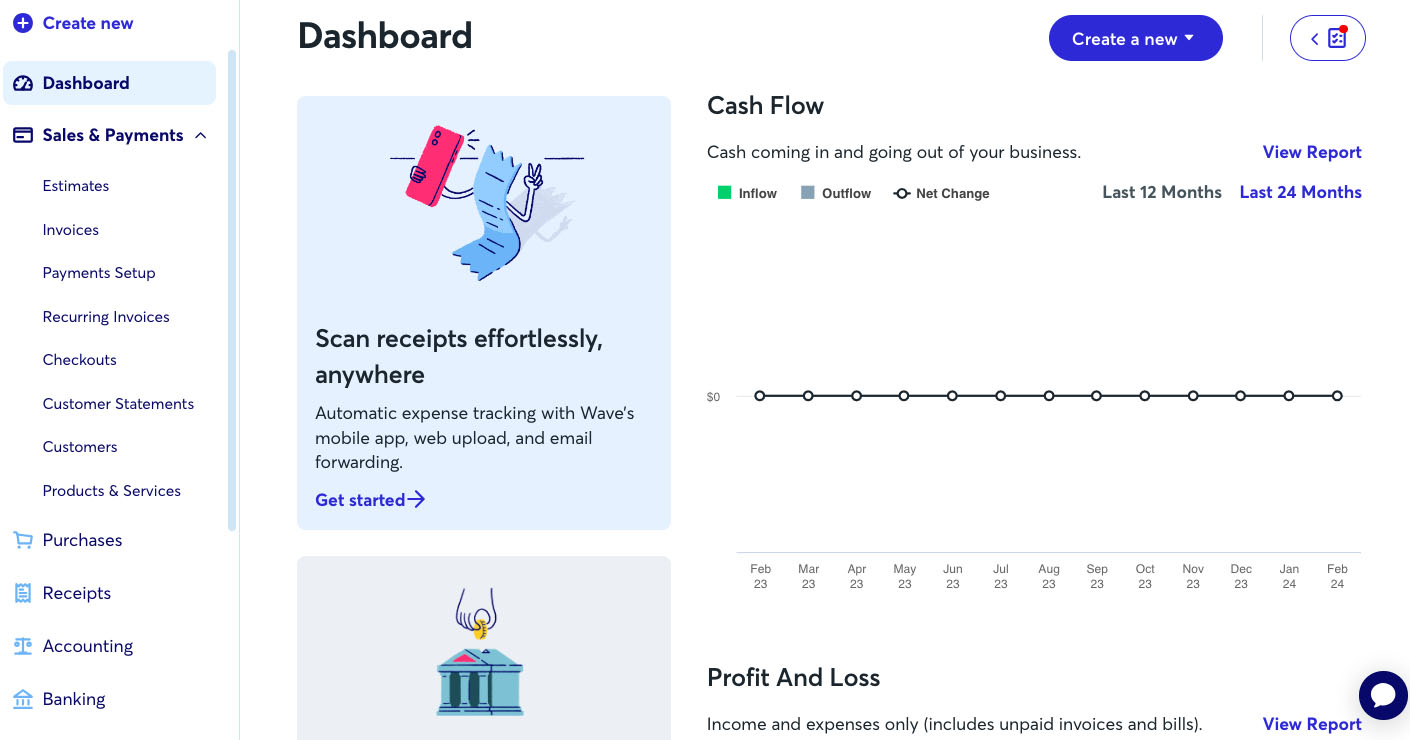

Wave’s dashboard

Wave has limited customer service in the Starter plan. Your only support is through an automated chatbot or self-help resources. If you need access to email and live chat support, you must purchase any add-on—like Payroll or Payments—or upgrade to the paid Pro tier.

You can access personalized support through the Wave Advisor program, where you can get coaching and year-round advice from a Wave expert starting at $149 a month. While that is very reasonable for the services delivered, it’s only a starting price—and Wave doesn’t publish any additional pricing information.

The Wave Advisor program is an in-house bookkeeping, accounting, and tax service from Wave. The advisors are trained employees of Wave who will assist you with your bookkeeping needs.

The program has two options:

- Bookkeeping support: This package starts at $149 per month. Bookkeeping pros from Wave manage your bank fees, classify transactions, reconcile your accounts, and produce monthly financial statements. Basically, they’ll do everything you need except invoice your customers.

- Accounting and payroll coaching: This is available with a one-time payment of $379, unlike bookkeeping support, which is a month-to-month contract. This program is ideal for business owners or freelancers wanting to learn Wave so that they can do their own bookkeeping. Your payment provides you with two hours of one-on-one training and 30 days of follow-up support via email.

How I Evaluated Wave Accounting

I was able to assess and rate Wave using our rubric. The criteria are as follows.

5% of Overall Score

We first determined a pricing score by assessing the software’s price for one, three, and five users. We also considered whether there was a free trial, monthly pricing, and a discount for new customers. After determining the pricing score, we assigned a value score based on the pricing score and the solution’s total score across all categories except Value.

5% of Overall Score

We evaluated general features like the flexibility of the chart of accounts, the ability to add and restrict the rights of users, and how your information can be shared with an external bookkeeper. We also searched for ways to provide more granular information like class and location tracking and custom tags.

10% of Overall Score

This assessed the ability to print checks, establish live bank feeds, and import bank transactions from a file. We also looked closely at the bank reconciliation feature. We wanted to see the ability to reconcile bank accounts with or without imported bank transactions and a list of book transactions that have not yet cleared the bank.

10% of Overall Score

In addition to the basics of issuing invoices and collecting customer payments, we evaluated the software’s ability to create customized invoices. We also assessed whether it could handle non-routine transactions like short payments, credit memos, and the refund of credit balances in customer accounts.

10% of Overall Score

The A/P score consisted of the basics like tracking unpaid bills, recording vendor credits, and short-paying invoices, but it also included some more advanced features—such as paying bills electronically, creating recurring expenses, and working with purchase orders. Receipt capture and the ability to automatically generate bills from captured receipts were also part of our A/P evaluation.

10% of Overall Score

10% of Overall Score

At the very least, we looked for software that could create multiple projects and separately assign income and expenses to those projects. We also searched for the ability to create estimates and assign those estimates to projects. Ideally, the program would then compare the actual expenses to the costs on the original estimate.

5% of Overall Score

Software should be able to track sales tax for multiple jurisdictions with varying tax rates. It’s helpful to have a function to easily record the remittance of the sales tax by jurisdiction. The very best tool will also help determine which jurisdictions sales are taxable to based on the address of the customer or delivery.

10% of Overall Score

I evaluated basic financial reports (such as a balance sheet, income statement, and general ledger) and common management reports (like A/R and A/P aging).

5% of Overall Score

Ideally, a mobile app should have all the same features as the computer platform, including the ability to capture receipts, send invoices, receive payments, enter and pay bills, and view reports.

5% of Overall Score

While it’s nice to have as many integrations as possible, we focused our evaluation on the four integrations we believe are most critical for small businesses: payroll, online payment collection, sales tax filing, and time tracking.

10% of Overall Score

The largest component of usability is the ability to find bookkeeping assistance when users have questions. This could be in the form of a bookkeeping service directly from the software provider or from independent bookkeepers familiar with the program. Other components of usability include customer service and ease of use.

5% of Overall Score

Our user review score is the average user review score reported by Capterra and G2. Other review sites might be used if a score from Capterra or G2 is unavailable.

Frequently Asked Questions (FAQs)

Yes—and it still has the best of all free accounting software that I’ve reviewed. It also has a paid version that you’ll need if you want to connect your bank account, have multiple users, and scan receipts, plus a few other nice features.

Yes. Wave uses 256-bit transport layer security (TLS) encryption for data security, and all accounting data are stored in servers monitored 24/7. Your credit card numbers are also not stored in Wave.

Yes, Wave offers payment processing through Wave Payments. You only need to pay for the processing fees: 2.9% plus 60 cents per transaction for Visa, Mastercard, and Discover; and 3.4% plus 60 cents for American Express. When you upgrade to the Pro tier, the 60 cents per transaction is waived.

Yes, Wave includes a sales tax tracking feature. You can set up multiple sales tax rates, apply them to invoices, and generate reports to help with tax compliance.

Bottom Line

Despite several limitations, Wave has plenty to offer small businesses. It offers essential functionality that will help you pay bills, invoice customers, and track your expenses—even in the free Starter plan. You’ll need to upgrade to the Pro tier for $16 a month if you want live customer support and more features like bank feeds, recurring invoices, and automated invoice reminders.

User review references:

[1]Software Advice

[2]G2