ADP Run is a cloud-based payroll and human resources (HR) software that helps small businesses manage payroll, taxes, and basic hiring and onboarding. It features an intuitive platform with built-in compliance tools. It even offers access to HR professionals, employee benefits, workers’ compensation, and time tracking solutions.

In our evaluation of the best payroll software for small businesses, ADP Run earned an overall rating of 4.06 out of 5. Growing startups and companies needing scalable HR solutions will benefit from ADP’s multiple HR payroll packages for different business sizes. However, pricing isn’t published on its website—you must contact the provider to request a quote. For a small business with 25 employees, we were quoted per-employee fees of $2.50 per weekly pay run plus a $49 base fee.

Pros

- Multiple plans to choose from

- Automatic quarterly and annual tax filings

- HR tools include ZipRecruiter job postings, applicant tracking, salary benchmarks, and training tools

- Advanced HR support available

- Access to a Wisely direct debit card for receiving direct deposits

- Check signing and delivery services; paychecks come with advanced fraud protection features

Cons

- Pricing isn’t transparent

- Setup fee required (but this may be waived)

- Year-end tax reporting costs extra

- Benefits, workers’ comp, and time tracking are add-on products

- HR tools and check signing services are available only in higher plans

- No state unemployment support for its basic Essential package

Aside from our list of best payroll software for small businesses, ADP Run ranked in several of our payroll and HR buyer’s guides. ADP’s chat-based mobile payroll solution, Roll by ADP, even made it to our top payroll apps list.

- Best Restaurant Payroll Software

- Best Construction Payroll Software

- Best Payroll Software for Mac Users

- Best Payroll Software for Trucking Companies

- Best Human Resources Payroll Software

- Best Payroll Software for Nonprofits

- Best HRIS for Small Business Owners

ADP Run Deciding Factors

Supported Business Types | Small businesses and growing startups that need scalable HR payroll solutions. |

Free Trial | None, but it has an online interactive, self-led demo if you want to explore its payroll features. |

Pricing | ADP Run small business plans (for up to 49 employees)

|

Discounts | Promotion-based; ADP sometimes offers discounted pricing or three months or more of free payroll |

Standout Features |

|

Ease of Use | Relative simple to learn and use; comes with an intuitive platform—although, having basic knowledge of how to run payroll will help you navigate its payroll solution more easily |

Customer Support |

|

Looking for something different? Read our guide to the best payroll services for small businesses to find a service or software that’s right for your business.

How ADP Run Compares With Top Alternatives

Best For | Free Trial | Starter Monthly Fees | Our Reviews | |

|---|---|---|---|---|

Best for growing companies that want scalable HR payroll plans | None, but offers three months free payroll* | $42.20 base fee plus $2.50 per employee, per weekly payroll** | ||

Businesses needing full-service payroll and solid HR support | 1 month*** | $49 per month + $6 per person per month | ||

| Small companies that use QuickBooks accounting | 30 days | $50 base fee plus $6 per employee | |

Companies looking for an all-in-one HR, payroll, and IT solution | ✕ | $35 base fee plus $8 per employee** | ||

*Note that this promotion can change at any time.

**Pricing is based on a quote we received.

***Get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

Want to know more about other ADP Run alternatives? Check out our ADP Run competitors guide.

ADP didn’t get a high rating in this criteria, scoring only 1.38 out of 5, mainly because of its non-transparent pricing and the lack of unlimited pay runs. For its payroll products, pricing is based on the frequency of pay runs and the size of your business. With ADP Run, small companies with up to 49 employees can choose from four options: Essential, Enhanced, Complete, and HR Pro. Getting ADP Run pricing details requires contacting the provider for a custom quote. In the quote we received, a business with 25 employees will have to pay $2.50 per employee, per weekly pay run plus a $49 base fee.

Depending on when you are switching, the provider may offer three to five months of free payroll in the first year (as of this writing, new clients get three months of free payroll). ADP may also waive the setup fee, which I’ve been told is around $200. This is terrific for the first year but be aware that prices might increase for the next year.

Essential | Enhanced | Complete | HR Pro | |

|---|---|---|---|---|

Monthly Pricing* | $2.50 per employee, per weekly pay run plus $49 base fee* | Custom-priced | Custom-priced | Custom-priced |

Full-service Payroll and Tax Filings | ✓ | ✓ | ✓ | ✓ |

Year-end Tax Reporting | Costs extra | Costs extra | Costs extra | Costs extra |

Direct Deposits and Wisely Direct Debit Card | ✓ | ✓ | ✓ | ✓ |

Check Delivery and Signing | Check delivery only | ✓ | ✓ | ✓ |

New Hire Reporting and Onboarding | ✓ | ✓ | ✓ | ✓ |

State Unemployment Insurance Management | ✕ | ✓ | ✓ | ✓ |

ZipRecruiter Job Postings | ✕ | ✓ | ✓ | ✓ |

Salary Benchmarks and HR Forms | ✕ | ✕ | ✓ | ✓ |

Online Employee Handbook Wizard | ✕ | ✕ | ✓ | Comes with handbook creation assistance |

Applicant Tracking and Employee Training | ✕ | ✕ | ✕ | ✓ |

HR HelpDesk Support | ✕ | ✕ | ✓ | Includes scheduled, proactive check-ins |

*Pricing is based on a quote we received.

To enhance ADP Run’s functionality, you can purchase some of its products as paid add-ons (custom priced).

- Time and attendance

- Workers’ compensation (pay-as-you-go plans)

- Health insurance

- Retirement plans

Running payroll with ADP Run requires several steps, but the software is overall easy to use, and ADP does the setup for you. That’s one factor that makes it a valuable solution for small business owners looking for an easy yet efficient way to pay both employees and contractors. Its full-service payroll, automatic payroll tax payments and filings, and multiple pay options are just some of the reasons ADP Run earned a high score in this criterion. However, its paid year-end tax reporting cost this provider some points.

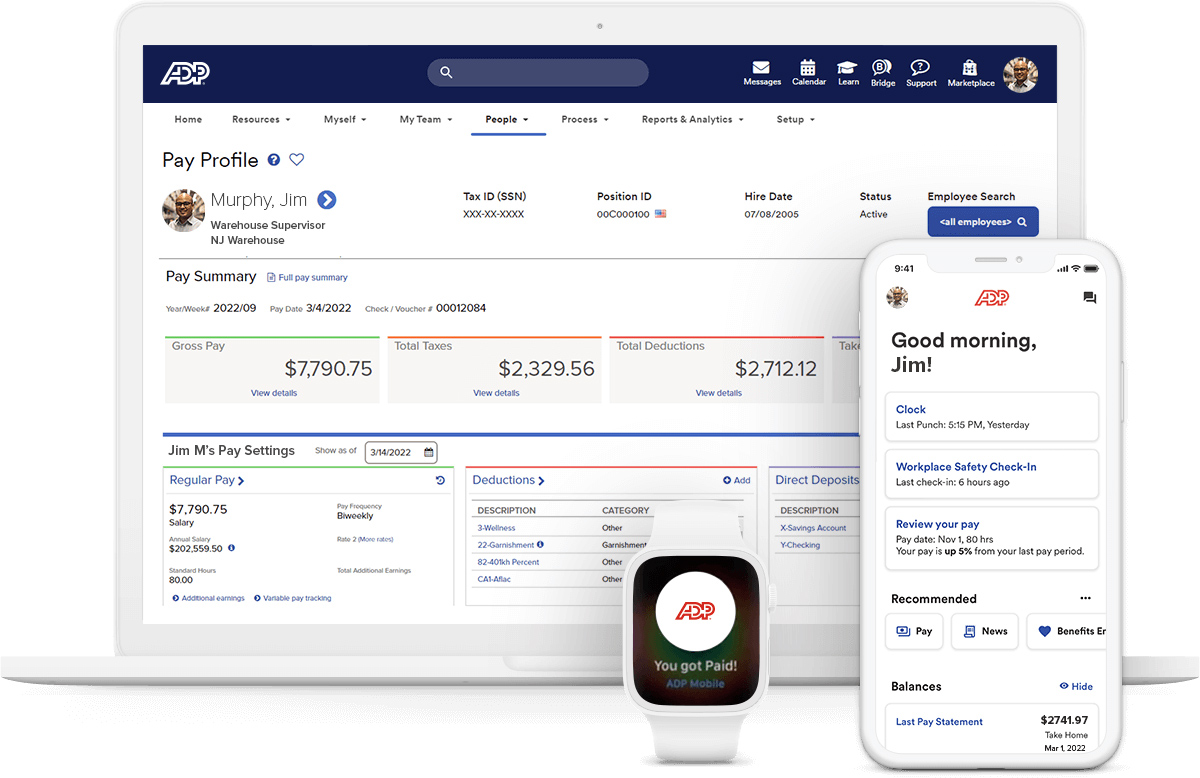

With ADP Run, it’s easy to process payroll each pay period, or you can set it on automatic. (Source: ADP)

ADP Run provides the payroll features you would expect, such as automatic pay runs and the ability to run payroll on computers and mobile devices. Its system can handle computations for hourly, salaried, and contract workers. It automates compliance rules and warns you if there is an issue.

Sending employees their pay is also very easy given ADP Run’s multiple payment options—salaries can be sent via direct deposits and through the Wisely Direct Debit Card. You can approve payroll as late as 4:30 p.m. the day before to have employees paid by direct deposit the next day. If you prefer paychecks, ADP can stuff and seal them in envelopes and deliver them to your office so that you can hand them out to employees.

Check signing services are also available in ADP Run’s higher tiers, where either the signature of your company’s authorized representative will be used or that of an ADP officer—provided you’re using ADP’s TotalPay feature. Plus, you’re assured that the checks ADP uses are highly secure as they come with 10 advanced fraud protection features.

ADP processes tax-compliant payroll deductions and sends your payments and tax forms to the correct federal, state, and local tax entities. Its representatives will respond to tax agency notices for you, and if ADP makes a tax filing mistake, it will cover all the penalties and fines imposed by the tax authorities. Note, however, that with ADP Run, W-2/1099 year-end reporting costs extra.

For state unemployment insurance (SUI), ADP will manage this for you—provided you sign up for at least its Enhanced plan. Aside from managing SUI claims, ADP will review and audit your account to ensure no erroneous charges. It will even handle all correspondence from the states where you pay unemployment insurance.

Aside from helping you stay compliant with tax regulations, payroll requirements, and wage laws, ADP will provide the latest updates so that you are on top of all the regulatory changes across all 50 states constantly. ADP Run also has a smart system that notifies you if it spots potential payroll errors.

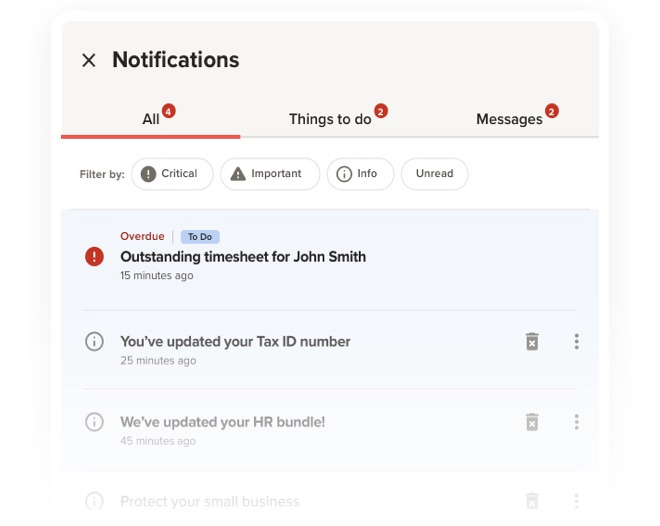

ADP alerts you to compliance and other errors. (Source: ADP)

Employees can access pay stubs through ADP Run’s online portal, including up to three years of W-2/1099 forms. In addition to viewing their pay history, your staff can manage their retirement accounts, benefits, garnishments, and profile information online.

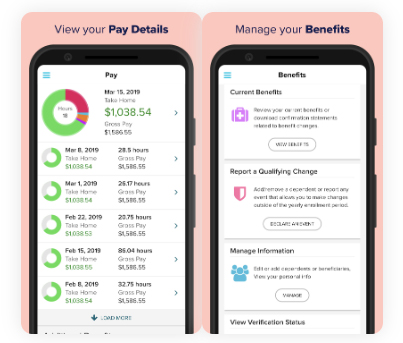

ADP Run’s self-service portal works on online and mobile devices. (Source: ADP)

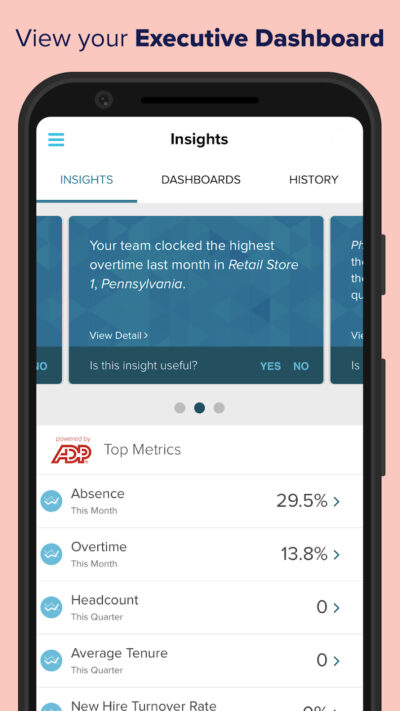

ADP’s mobile app lets users view their pay and W2s, request time off, track time and attendance, view pay card accounts, make changes to benefits, and contact co-workers. There is a timeclock function if you purchase it. Managers can also approve time cards and time off, see team calendars, view employee stats, and more. The app is available in more than 25 languages.

What’s great about ADP Run is that it comes with HR tools that other small business payroll software don’t offer. Its wide range of solutions for managing the entire employee lifecycle contributed to this provider’s high ratings in this category. It would have received a perfect score if its time tracking module isn’t a paid solution. Here are some of its key features.

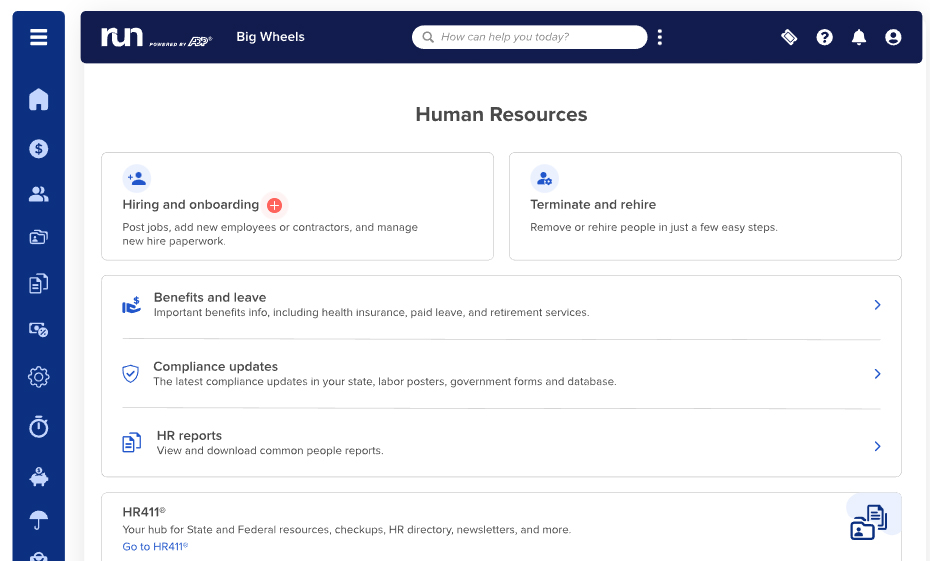

ADP Run’s HR dashboard lets you access hiring, onboarding, benefits, and reporting tools. (Source: ADP)

Processing payroll involves a lot more than just cutting a paycheck. Most businesses also need to process deductions. ADP Run also aids in processing unique deductions, such as court-ordered wage garnishments, including responding to unemployment claims, which can save you a lot of hassle and help keep your business compliant.

If you need assistance in supporting workers’ compensation, retirement plans, and health insurance, ADP offers those services for a fee. It has various other benefits, including legal and an advice line, LifeCare. Finally, it can enroll employees in its program that offers discounts for everything from gym memberships to vacations.

With ADP Run, employees can monitor garnishments and add supporting documents. (Source: ADP)

With its higher plans, ADP offers two revolving job postings with ZipRecruiter, one of the best job boards. You can post jobs straight from the ADP dashboard and track applicants as they go through the hiring pipeline. In addition, ADP has background checks, state new hire reporting, new hire onboarding, and salary benchmark tools. Overall, it makes growing your workforce easier.

Access ZipRecruiter from your ADP dashboard. (Source: ADP)

ADP provides a library of HR forms and documents, basic employee/employer training, and sexual harassment prevention training (if you sign up for its highest plan). If you need help handling HR issues, you can call its dedicated team of HR experts for advice. You also have access to state-specific experts to get the best local information. ADP Run even has a simple-to-use employee handbook wizard to help you create one that complies with federal employment regulations.

If you require legal assistance, ADP’s partnership with Upnetic Legal Services provides prepaid legal services. You can also contact Upnetic for legal advice on contract reviews, debt collection, and employment matters.

While ADP Run connects seamlessly with other ADP products, it also integrates well with a variety of third-party solutions. Here are some of its partner systems:

- Accounting: QuickBooks, Wave, and Xero

- Enterprise resource planning (ERP): SAP SuccessFactors, Workday, Oracle, and Sage Intacct

- Time and attendance: QuickBooks Time, ClockShark, Deputy, When I Work, and 7shifts

- Recruiting and onboarding: GoodHire, Greenhouse, iCIMS, JazzHR, TempWorks, and ZipRecruiter

- Learning management: SAP Litmos, Brainier, Cornerstone, and Absorb LMS

- Benefits administration: Flock, PlanSource, Decisely, and Employee Navigator

- Employee benefits: LifeMart, PayActiv, FinFit, Gift of College, HealthEquity, and KrowdFit

- POS: Aloha, Clover, Micros, PosiTouch, Revel, and Toast

- Collaboration and productivity tools: Docufree, signNow, OrgChart Now, Pingboard, Slack, and Microsoft Teams

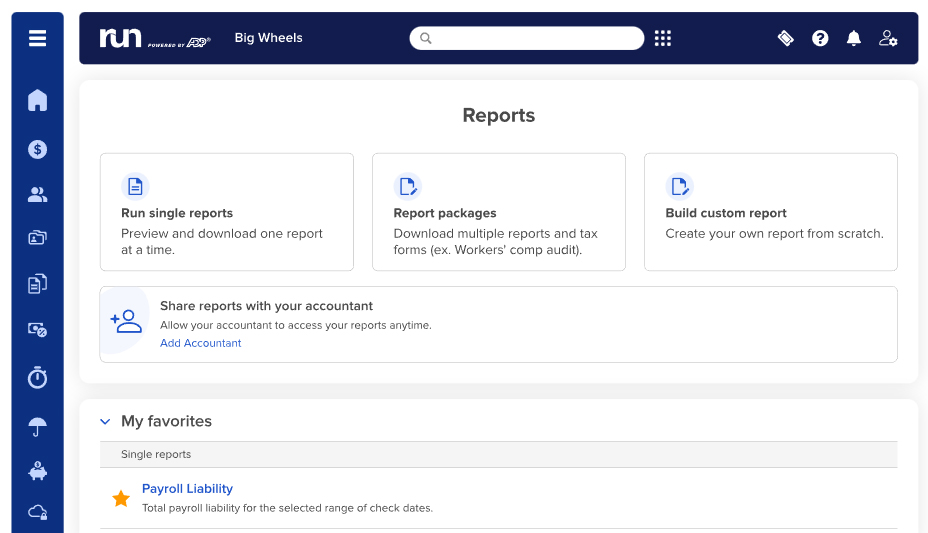

ADP Run earned perfect marks in this criterion with its solid reporting tools and wide variety of built-in reports. It even has a custom report option, allowing you to create your own report. If you run ADP reports, you can download these as CSV files and even generate multiple reports at a time (although, it can also run single reports).

ADP Run lets you add specific reports to the “My favorites” list for easy access. (Source: ADP)

- Simple setup process

- Employee self-service onboarding

- Phone and chat support

- Free webinar training courses

- Help center with how-to guides

- Online library of HR forms

- Access to HR advisers

- Compliance tools

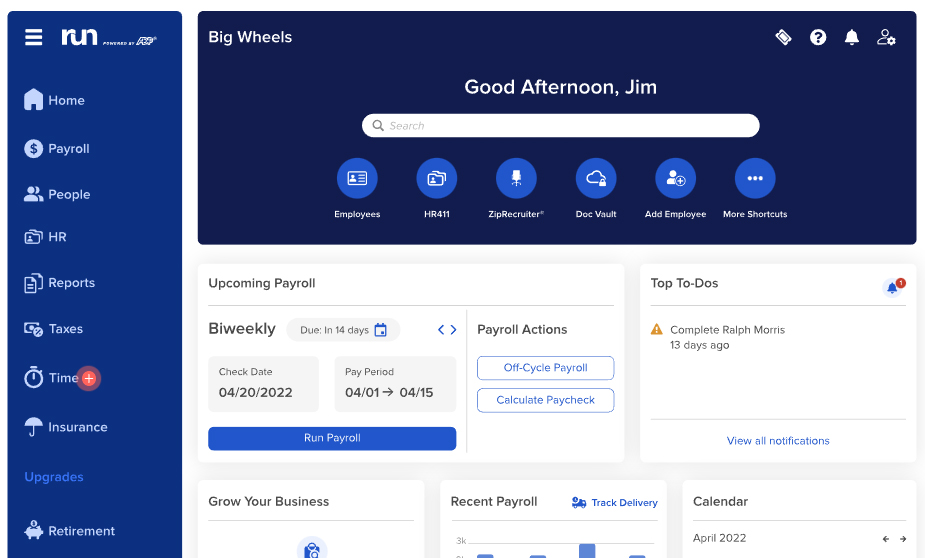

Considering how much this payroll software can do, we found the interface simple to navigate. Its intuitiveness, integration options, and 24/7 support contributed to ADP Run scoring high for ease of use. Plus, if you have a small company with a handful of employees, you should be able to set up your business in ADP Run in less than 20 minutes. If you have a lot of data to migrate into the system and need help with setup, ADP can assist you with implementation. This support is not free but likely worth it if you need help setting up the payroll services correctly. Sometimes, it waives this fee for new customers.

ADP Run’s main dashboard provides easy access to all of its features—from running payroll to viewing reminders and notifications. (Source: ADP)

If you need help from HR experts, ADP Run provides access to a dedicated team of HR professionals who can help guide you through the complexities of managing payroll and employees. Its online help center is also available 24/7 if you need to access how-to guides. ADP even has separate support options for employees and employers, including its various products.

We’ve conducted ADP Run reviews for many of our best-of lists and it invariably impresses with its easy interface, depth of functionality, and variety of use cases. While ADP offers solutions to fit the HR needs of all business sizes, the ADP Run online tools are designed specifically for small businesses with up to 49 employees. Aside from full-service payroll, automated tax payments and filings, and multiple payment options, the ADP Run platform has robust tools to help you comply with payroll and tax regulations.

In our expert assessment, ADP Run earned a perfect rating given its feature-rich platform and relatively user-friendly tools. While pricing is transparent and follows a pay-per-run, per-employee scheme, small startups with only a handful of employees will find it reasonably priced given the wealth of payroll and HR functionalities that it offers.

ADP also has products for different business sizes. Let’s say your workforce will exceed 49 employees, you can upgrade to its mid-market product, ADP Workforce Now. It has a more comprehensive suite of HR solutions than ADP Run. You may also look for other software that can handle the HR payroll needs of growing businesses, like Paychex or Rippling.

Many ADP Run reviews on third-party review sites like G2 and Capterra are positive. In our evaluation for user popularity, ADP Run scored 4.38 out of 5 given its average rating of 4 and up on online review sites. It would have earned perfect marks in this category if its average number of user reviews reached 1,000.

In terms of user feedback, those who left positive ADP Run reviews like its ease of use and how its payroll tools help them save time and simplify processes. Several others appreciate its integration options and HR tools that make onboarding new hires and managing staff information easy for both employees and employers.

While most reviewers commended the customer service team for being helpful, some users complained about having experienced long wait times when contacting support. Others also said that ADP Run can be a bit pricey for small businesses and that its reports are not as easy to access or as robust as they’d hoped.

| What Users Like | What Users Don’t Like |

|---|---|

| Easy to use | Can be expensive for small businesses |

| Simplifies payroll processes | Would like better reports |

| Support team is generally helpful | Occasional long wait times when contacting support |

At the time of publication, ADP Run reviews earned the following scores on popular user review sites:

- Capterra: 4.5 out of 5 based on 750 reviews

- G2: 4.5 out of 5 based on about 1,200 reviews

How We Evaluated ADP Run

When we evaluate payroll software for small businesses, we look at pricing and ease of use. We also check the provider’s customer support and whether it offers unlimited pay runs, multiple pay options, full-service payroll, and tax filing services. Access to third-party integrations and basic HR tools like employee benefits and onboarding are also important. We even consider the feedback that actual users post on popular user review sites.

Click through the tabs below for a more detailed breakdown of our evaluation criteria:

20% of Overall Score

We checked to see if the provider has transparent pricing, zero setup fees, and multiple plan options with unlimited pay runs. Providers priced at $50 or less per employee monthly were also given extra points.

20% of Overall Score

We gave priority to those that offer multiple pay options, two-day direct deposits, tax payments and filings, year-end reporting (W-2s and 1099s), and a penalty-free tax guarantee.

20% of Overall Score

Payroll service and software should be simple to set up, customizable, and have a user-friendly interface. We also looked at whether the provider offers live support and integration options with online tools that most small and medium businesses (SMBs) use, such as accounting, time tracking, and scheduling software.

15% of Overall Score

Online onboarding, which means giving employees the option to fill out forms like W-4s electronically, is the top criterion, followed by state new hire reporting and the availability of a self-service portal where employees can view pay stubs, edit information, and access forms. Extra points were also given to providers that offer expert HR support, benefits options, time tracking, and health insurance plans that cover all US states.

15% of Overall Score

In this criterion, we assess whether the software’s ease of use, pricing, and the width and depth of its payroll and HR tools are ideal for SMBs.

5% of Overall Score

We considered user reviews, including those of our competitors, based on a 5-star scale; any option with an average of 4-plus stars is ideal. Also, any software with 1,000-plus reviews on any third-party site is preferred.

5% of Overall Score

Preference was given to software with built-in basic payroll reports and customization options.

Bottom Line

ADP Run is a good option for small businesses with up to 49 employees—as long as the company has decent profit margins because it’s not the cheapest option. It helps you pay employees and manage payroll taxes and has a variety of HR solutions (like new hire onboarding, job postings, and access to basic employee training programs) that other small business payroll software providers don’t offer. It even provides expert HR support so you can get professional services easily to help you better manage your employees and complicated HR issues.

Our ADP Run review touches on its many features, but sign up for an ADP Run demo today to get a true feel for its functionalities.