Processing payroll in Louisiana is relatively straightforward. Louisiana has only one state-specific payroll form and no local taxes. Its income tax system is progressive, with rates ranging from 1.85% to 4.25%—so the more an employee makes, the more they will pay in taxes.

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

Key Takeaways:

- Louisiana follows the federal minimum wage of $7.25 per hour

- Louisiana does not have income tax reciprocity with other states meaning some workers may face double taxation

- Louisiana provides very few mandatory benefits

Step-by-Step Guide to Running Payroll in Louisiana

Processing Louisiana payroll is not a complex process, but attempting to calculate Louisiana payroll tax by hand could result in costly mistakes. Here are your basic steps for running payroll in Louisiana.

Step 1: Set up your business as an employer. New companies may need to access the Electronic Federal Tax Payment System (EFTPS) to create a new Federal Employer Identification Number (FEIN). Your FEIN is required to pay federal taxes.

Step 2: Register with Louisiana. If your business is new, you need to register on the Louisiana Secretary of State’s website. Any company that pays employees in Louisiana must register with the Louisiana Department of Revenue.

Step 3: Set up your payroll process. You’ll need to decide how often you’re going to pay employees and how (cash vs direct deposit vs check). In addition, setting up a system that governs how you’ll collect and manage payroll forms will help you stay organized as you grow.

Step 4: Collect employee payroll forms. When your company hires new employees, there are certain payroll forms you must collect to stay in compliance. Every employee must complete I-9 verification, and you’re required to submit the form within three days of their hire date. New employees must also have a completed W-4 on file. Louisiana also requires employees to complete Louisiana Form L-4 for its state taxes.

Step 5: Collect, review, and approve time sheets. If you have hourly or nonexempt employees, you’ll need to track their work hours. Most small business owners create their own time sheets using a time sheet template or upgrade to time and attendance software. Either way, you’ll need to allot enough time to review your employees’ time sheets for accuracy well in advance of payday, so you have time for processing and correcting any errors if needed.

Step 6: Calculate employee gross pay and taxes. Doing payroll requires many payroll calculations, starting with calculating total work hours, if you’re paying hourly, and overall gross pay. Using a time card calculator can help make things easier, whereas an Excel payroll template or payroll software can automate this step.

Step 7: Pay employee wages and benefits. Most companies today pay all employees through direct deposit—but cash (not the best way) and paper check are also options. Louisiana does not have a state minimum wage, so make sure that you are paying your employees at least the federal minimum wage of $7.25 per hour. If you use a benefits provider, it should work with you to make deductions simple, automatic, and electronic.

Step 8: File payroll taxes with the federal and state government. All Louisiana state taxes need to be paid to the applicable state agency on the schedule provided, usually quarterly, which you can do online at the Louisiana Department of Revenue website. To pay federal taxes, you can make those payments online using the EFTPS on one of the following two schedules:

- Monthly: When the IRS assigns you a monthly schedule, you need to deposit employment taxes on payments made during a calendar month by the 15th of the following month

- Semiweekly: When the IRS assigns you a semiweekly schedule, you must deposit employment taxes for payments made Wednesday, Thursday, and Friday by the following Wednesday, and for payments made Saturday, Sunday, Monday, and Tuesday, by the following Friday.

It’s important to note that reporting schedules and depositing employment taxes are different. Regardless of the payment schedule that you’re set up on, you should only report taxes quarterly on Form 941 or annually on Form 944.

Step 9: Document and store your payroll records. Keeping your company business records is good practice. Louisiana law requires companies to keep the following information for at least one year:

- Each employee’s name, address, and job title

- The daily and weekly hours worked by each employee

- The wages paid to each employee for each pay period

Federal law however requires you to maintain payroll records for at least three years and payroll tax records for four.

Step 10: Do year-end payroll tax reports. Every year, you will need to complete payroll reports, including all W-2 forms and 1099 forms. These forms need to be in the hands of employees and contractors no later than Jan. 31 of the following year.

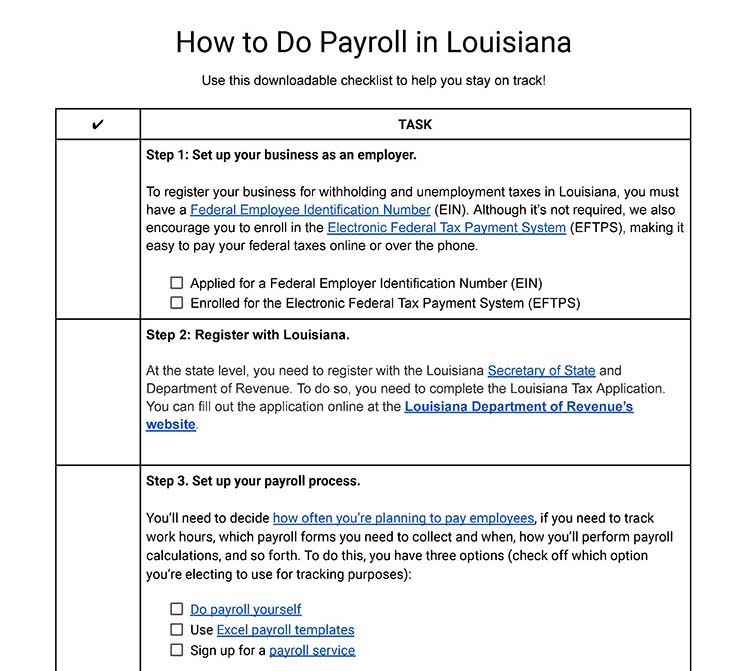

Download our free checklist to help you stay on track while you’re working through these steps:

For more general information on doing payroll for your small business, follow our guide on how to do payroll. It has a free checklist you can download to make sure you don’t miss any steps.

Louisiana Payroll Laws, Taxes, and Regulations

To ensure accuracy every time you run payroll, you must understand how to calculate Louisiana payroll taxes and the applicable laws and regulations. With few exceptions, most employers in the US must pay Federal Insurance Contributions Act (FICA) taxes. The current FICA tax rate for Social Security is 6.2% of each employee’s paycheck and 1.45% for Medicare; you’ll deduct the amounts from everyone’s gross pay and pay a matching amount out of your business bank account.

Louisiana Taxes

Louisiana does not levy local taxes, but you are responsible for state income and unemployment taxes. Workers’ comp, although not exactly a tax, is also required for most employers.

Income Taxes

You’ll need to withhold state income taxes from each employee’s paycheck. To calculate, you’ll use the state W-4 forms they provide at the time of hire and Louisiana’s withholding tax tables.

One thing to note is that Louisiana does not have tax reciprocity with any other state. This means employees who work and pay taxes in Louisiana but live in a neighboring state may end up paying double tax; to avoid this, you should recommend they complete Louisiana’s Form L-4, the Employee Withholding Exemption Certificate.

Employer Unemployment Taxes

All businesses in Louisiana must pay State Unemployment Tax Act (SUTA) taxes. The current wage base is $7,700 and rates range from 0.09% to 6.20%. All new employers in Louisiana will pay a SUTA rate ranging from 1.16% to 2.89%.

Did you know? Employers are also responsible for paying federal unemployment taxes (FUTA), up to 6% of the first $7,000 of each employee’s paycheck. However, if you pay SUTA on time, you can earn up to a 5.4% discount on FUTA, leaving you with only 0.6% to pay.

Workers’ Compensation

Louisiana businesses must carry workers’ compensation insurance to ensure they’re covered if an employee becomes hurt or ill on the job or as a result of work performed on the job. There are, however, exceptions. If your company falls into one of the following, you may not be required to carry workers’ compensation insurance:

- Your business has no employees (only partners or co-owners)

- You employ only domestic workers or real estate salespeople

Louisiana Minimum Wage

Louisiana has a straightforward minimum wage that mirrors the federal minimum wage. At $7.25 per hour, the minimum wage was last raised in Louisiana in 2008. Businesses must pay tipped employees at least $2.13 per hour, provided that their tips get them to the hourly minimum wage. If they don’t, you’ll need to pay the difference.

Calculating Overtime

Louisiana overtime rules follow the Fair Labor Standards Act (FLSA) requirements. Under the FLSA, all employers must pay employees 1.5 times their regular hourly wage for hours worked over 40 in a workweek.

Paying Employees

Louisiana law requires that employers in four specific industries pay employees at least twice per month and within 10 days of the end of the pay period. The four industries are:

- Oil and gas

- Mining

- Manufacturing

- Public service

There is no pay frequency requirement for any other industries. This leaves other companies free to choose the frequency with which they want to pay their employees. However, to comply with federal laws, the cadence must be consistent.

Louisiana also does not specify how employees must be paid. The most common ways to pay your employees include:

If you need to pay an employee right away and aren’t currently using a service, use one of our recommended ways to print a free payroll check.

Pay Stub Laws

Louisiana does not have any law requiring employers to provide employees a regular pay stub. However, we recommend you provide one anyway. As a best practice, it should include your employee’s basic information (name, job title, hours worked, etc.), the covered pay period, pay rate, total gross pay, taxes and other deductions withheld, and final pay.

For help creating your own, use our free pay stub generator.

Louisiana Paycheck Deductions

To comply with Louisiana payroll rules, you cannot deduct wages from an employee unless:

- The employee knowingly and willfully damages or breaks company property or items for sale

- The employee is convicted or pleads guilty to theft of company money or property

To be clear, this means that Louisiana businesses cannot deduct anything from employee paychecks for the following reasons:

- Cash shortages

- Required uniforms

- Required tools

- Other items necessary for employment

Employees’ Final Paychecks

If an employee is terminated or otherwise leaves the company, you must pay them their final paycheck on the next regular payday following their last day of work or within 15 days, whichever comes first. It does not matter how the separation occurred; the time to pay the employee’s final paycheck is the same.

Louisiana HR Laws That Affect Payroll

Louisiana HR laws generally follow federal guidelines. Pay close attention to state-specific filing requirements to ensure that your company adheres to all Louisiana payroll laws.

Louisiana New Hire Reporting

Every employer in Louisiana must report new hires and any rehired employees to the Louisiana Directory of New Hires within 20 days of their hire date. This is used to enforce child support orders and must include the employee’s name, address, and Social Security number.

Meals & Breaks

Louisiana does not require companies to provide employees 18 years of age or older breaks. The state does, however, mandate that any employee under 18 who is scheduled to work five consecutive hours must be given an unpaid meal break. The time for the meal break must be at least 30 minutes.

Louisiana Child Labor Laws

In Louisiana, children under the age of 14 are prohibited from working. Children aged 14 and 15 may work a job (but not in manufacturing, mining, or other hazardous industries), provided that:

- The child does not miss school

- The child only works three hours on a school day or 18 hours in a school week

- The child only works eight hours on a non-school day or 40 hours in a non-school week

There are no restrictions placed on children aged 16 or 17 who wish to work, other than the break requirement listed above.

For more information on federal child labor laws, check out our guide to hiring minors.

Time Off & Leave Requirements

Generally, Louisiana does not have any state-specific time off and leave requirements; however, it does offer a few additional leaves under its Family Leave law.

Payroll Forms

Payroll forms can vary from state to state, and some have their own W-4, like Louisiana. Fortunately, that’s the only one.

- L-4: Employee withholding form

Federal Payroll Forms

Here is a complete list and location of all the federal payroll forms you should need.

- W-4 Form: Provides information on employee withholdings so you can properly calculate and withhold federal and state income taxes

- W-2 Form: Used to report total annual wages for each employee

- W-3 Form: Used to report total annual wages for all employees

- Form 940: To calculate and report unemployment taxes due to the IRS

- Form 941: Used to file quarterly income tax

- Form 944: Used to file annual income tax

- 1099 Forms: Provides information for non-employee contract work

For a more detailed discussion of federal forms, check out our guide on federal payroll forms.

Louisiana Payroll Tax Resources

- Louisiana Department of Revenue provides many forms, information on the latest laws and regulations, and other employer-specific information.

- Setting up a new business can present unique challenges. Louisiana GeauxBiz provides guidance.

- Louisiana’s Department of Labor offers support and resources to help businesses ensure compliance with unemployment and workers’ compensation.

Bottom Line

Louisiana payroll is more straightforward than many states and the applicable laws and regulations generally follow federal guidelines. There is only one state-specific form and no local payroll taxes.

Other State Payroll Guides

Need to know how to pay employees in another state? Click on the state in our interactive map below to learn more.