It’s simple to learn how to do payroll in South Carolina, as most of its regulations align with federal labor laws. You’ll need an employee identification number and register with the South Carolina revenue and employment departments for withholding and unemployment accounts. Besides tax registrations, there are a few payroll/HR regulations to pay close attention to.

Follow our guide below to ensure correct proper procedures in South Carolina.

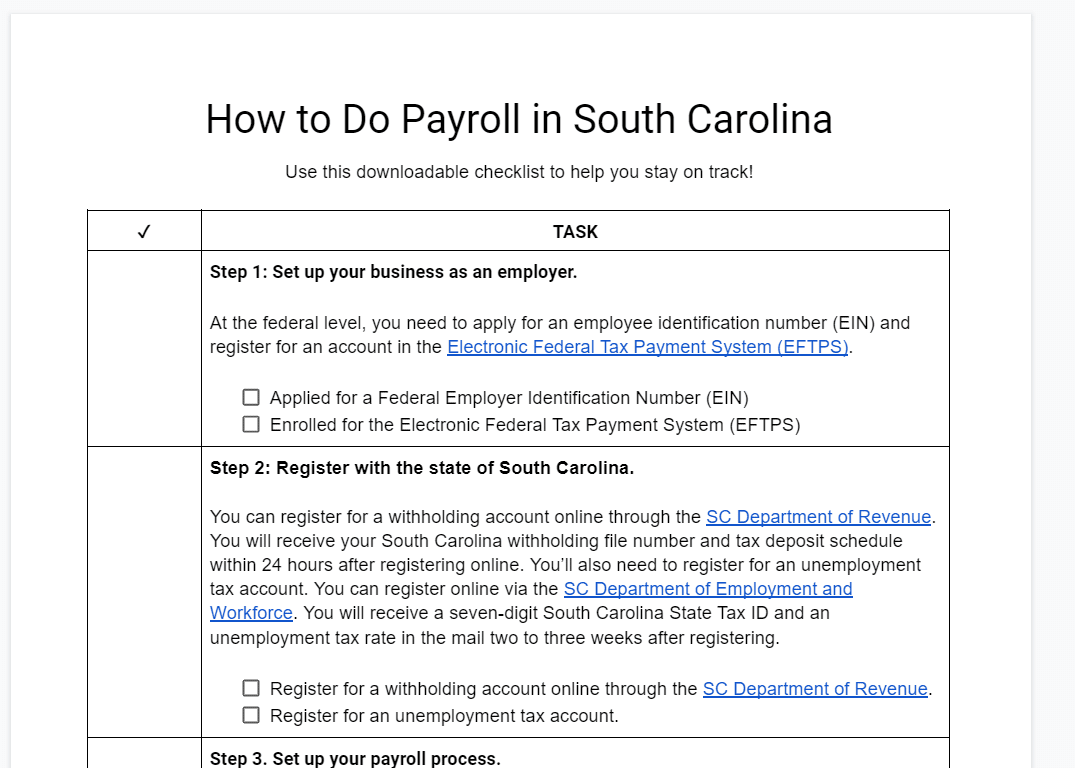

Step-by-Step Instructions to Running Payroll in South Carolina

At the federal level, you need to apply for an employee identification number (EIN) and register for an account in the Electronic Federal Tax Payment System (EFTPS).

When starting a small business in South Carolina, you’ll need to register with the state. You can register for a withholding account online through the SC Department of Revenue. You will receive your South Carolina withholding file number and tax deposit schedule within 24 hours after registering online.

You’ll also need to register for an unemployment tax account. You can register online via the SC Department of Employment and Workforce. You will receive a seven-digit South Carolina State Tax ID and an unemployment tax rate in the mail two to three weeks after registering.

Whether handling payroll yourself or using payroll software, you must establish a payroll process that works best for your business and is compliant with the rules and regulations in South Carolina. Decide when and how you’ll pay employees, collect and submit payroll forms when necessary, when to verify employee time worked, etc.

It’s best to collect employment forms from new hires during the onboarding process. Federal payroll forms include the W-4, I-9, and a direct deposit authorization form. South Carolina also requires employees to fill out an additional document for state withholding called the SC W-4.

South Carolina law requires regular paydays to be provided in writing. To ensure timely payments and compliance, approve timecards a few days before payday. Use one of our free timesheet templates if you lack a time and attendance system.

There are many ways to calculate payroll, and it’s up to you to decide which is best for your business. You can use payroll software, a calculator (use our free time card calculator to do some basic time calculations), or even Excel (we have a free template).

Federal tax payments must be made via EFTPS. Deposit federal income tax withheld, and both employer and employee Social Security (6.2% of each employee’s earnings) and Medicare taxes (1.45% + 0.9% for earnings over $200,000 per year) according to your IRS-assigned schedule. The IRS can assign you to one of the following depositing schedules:

- Monthly depositor: Requires that you deposit employment taxes on payments made during a month by the 15th day of the following month.

- Semiweekly depositor: Requires that you deposit employment taxes for payments made Wednesday, Thursday, and/or Friday by the following Wednesday. Deposit taxes for payments made Saturday, Sunday, Monday, and/or Tuesday by the following Friday.

It’s important to note that schedules for depositing and reporting taxes are not the same. Employers who deposit both monthly and semiweekly should only report their taxes quarterly or annually by filing Form 941 or Form 944.

South Carolina employers must file and pay taxes withheld from employee wages quarterly. Payments are due:

- Quarterly: If the total withholding amount is less than $500 per quarter, and the remittance is due by the last day of the month following the end of the quarter.

- Monthly: If the total withholding amount is more than $500 per quarter, and the remittance is due by the 15th of the following month.

Returns and payments can be sent via mail to the appropriate mailing address or filed electronically via the MyDORWAY website. Employers who withhold $15,000 or more per quarter or who make 24 or more withholding payments in a year must file and pay electronically.

Return due dates are as follows:

Quarter | Due Date |

|---|---|

1st Quarter (January-March) | April 30 |

2nd Quarter (April-June) | July 31 |

3rd Quarter (July-September) | October 31 |

4th Quarter (October-December) + Annual Filings | January 31 |

It’s important to keep records for all of your employees, even those terminated, for at least three years as stated by SC Code of Laws. Learn more in our article on retaining payroll records.

Complete W-2s for all employees, and 1099s for all independent contractors, distributing them by January 31 of the following year. Also, submit individual copies for each worker to the IRS with a summary form. (W3 Form summarizes all W2 forms, and Form 1096 summarizes all 1099 forms).

Download our free checklist to help you keep track as you do the steps.

For a more general overview of what you should know when doing payroll according to federal standards, check out our guide on how to do payroll.

South Carolina Payroll Law, Taxes & Regulations

Processing payroll in South Carolina is straightforward, but be aware of specific laws and regulations. Unlike some of the other states that are less complicated, South Carolina does in fact have personal income taxes that will need to be withheld and remitted on time to ensure that you’re not in violation of payroll compliance. There are a few other notable payroll requirements.

Here’s everything you’ll need to know.

South Carolina Payroll Taxes

Employers in South Carolina are responsible for paying payroll taxes, in addition to Social Security and Medicare (FICA) and federal unemployment (FUTA) taxes. Social Security and Medicare are both employee and employer taxes, meaning that the employee portion will be withheld from their paychecks and the employer portion will be your responsibility.

Workers’ Compensation Insurance

In South Carolina, all companies with four or more employees, including part-time workers and family members, are required to have workers’ comp coverage from any private insurance provider.

There are a few exemptions to this rule, including:

- Licensed real estate agents working for a broker

- Federal employees of the state

- Casual employees, meaning that they don’t work regularly or only work when needed

- Employers with less than $3,000 in annual payroll from the previous year

- Agricultural employees or people selling agricultural products

- Railroad or railway express company employees

- Drivers who hold a bona fide lease-purchase or installment-purchase agreement on a vehicle they use while serving as a driver to a motor carrier

Minimum Wage

South Carolina does not have a statewide minimum wage. Instead, it follows the federal minimum wage of $7.25 per hour, which was last raised in 2008.

Businesses must pay tipped employees at least $2.13 per hour, provided that their tips get them to the hourly minimum wage. If not, the company must make up the difference.

Overtime Regulations

Employees in South Carolina are entitled to overtime pay at 1.5x their regular pay rate for any hours worked over 40 in a “single workweek.” Based on the Fair Labor Standards Act (FLSA), a single workweek is any seven days worked consecutively.

While some states have daily overtime limits that require employers to pay overtime for a certain amount of hours worked in a single day, South Carolina does not.

Different Ways to Pay Employees in South Carolina

While there are many ways to pay employees, the South Carolina Office of Wages and Child Labor specifies that an employer must pay wages by either:

- Cash

- Paper check

- Direct deposit

Pay Stubs

Many states have regulations that require employers to provide documentation with payroll that includes certain details regarding the payment. South Carolina employers are required to provide each employee with an itemized statement showing the following:

- The employee’s gross pay

- All deductions made from his wages

Final Paycheck

South Carolina requires employers to pay an employee all wages due them within 48 hours of the day of separation or on the next regularly scheduled payday. The period of time between separation and the final paycheck may not exceed 30 days. If you terminate a sales representative, you need to pay them all their accrued commissions per the terms of the contract.

Separating from an employee can often be a difficult process for business owners, often starting with notifying them of their termination. For guidance and a free template, check out our guide to termination letters.

Minimum Pay Frequency

In South Carolina, there are no regulations specifying mandatory paydays. Private employers can choose pay frequency; most choose biweekly or semimonthly. State government employees must be paid semimonthly (two times per month). Federal law just requires you to be consistent.

Employers with five or more employees must provide written notice upon hiring that detail wages to be paid, expected hours of work, and the time and place of payment (whether the payments will be made via cash, direct deposit, or check).

Paycheck Deduction Rules

Employers in South Carolina are not allowed to withhold any portion of an employee’s wages unless:

- It is permitted by state or federal law (Social Security, income taxes, etc.)

- The employer has given the employee written notice of the deduction at the time of hire

- The employer has given the employee at least seven days written notice of the deduction

Severance Pay in South Carolina

As an employer in South Carolina, you don’t have to provide your employees with severance pay if they are terminated or voluntarily leave. There are no legal requirements that mandate severance pay after a certain period or based on certain employment terms.

South Carolina labor laws will only enforce that you pay severance payments to your employees if there is a signed written agreement in place between an organization and an employee. If you choose to provide severance pay, you must comply with the terms of that agreement. In the case of disputed wages, you are required to inform the employee in writing how much you believe they are due and pay them that amount. The employee can accept this pay without losing his right to claim the balance.

Accrued Paid Time Off Payouts

South Carolina state laws don’t require employers to pay out accrued PTO or vacation time upon their termination unless it’s specifically detailed in the employer’s policy.

South Carolina HR Laws That Affect Payroll

South Carolina does not have many HR laws that don’t align with federal labor laws. Most of its regulations are pretty straightforward and don’t require much additional attention or documentation. As long as you file all new hires on time and adhere to child labor regulations, you will have an easy time remaining in compliance.

South Carolina New Hire Reporting

All new and rehired employees must be reported online using the South Carolina New Hire Reporting portal. Employers have 20 days after the employee’s first day of work to report all new hires.

The following information needs to be included when filing new hire paperwork:

Employer Information | Employee Information |

|---|---|

|

|

New Hire information can only be used for the purposes prescribed by law, which includes:

- Establishing and enforcing child support orders

- Detecting unemployment benefits overpayments and fraud

- Detecting workers’ compensation overpayments and fraud

- Detecting overpayments and fraud in government programs (welfare, food stamps, etc.)

The penalty for an employer failing to report newly hired or rehired employees is:

- $25 for the second offense and $25 for each offense thereafter

- $500 for each and every offense, if the failure to report is the result of a conspiracy between the employer and the employee not to supply the required information or to supply false or incomplete information

Meal Breaks

There is no requirement under South Carolina law for an employer to provide employees with breaks or a lunch period.

Though you’re not required to offer breaks or meal periods by law, you may want to consider how offering breaks can affect employee morale. If you choose to offer breaks, make sure to include in your employee handbook the details of how long, how often, and whether or not the breaks will be paid.

Paid Sick Leave & Paid Time Off

There is no South Carolina law requiring private sector employers to provide employees with either sick time or vacation time, paid or unpaid.

While it’s not required to provide time off by law, it’s important to remember that promising it to employees can create a legal obligation to do so. Be very clear with employees and on all employee documentation about what your policies are.

Child Labor Laws

South Carolina rules and regulations on child labor are adopted from the Wage and Hour Regulations mandated by the Department of Labor. Generally, minors under the age of 14 are not allowed to work, as employment under the age of 14 is defined as oppressive child labor.

There are, however, quite a few restrictions:

Age Range | Working Hours | Allowed Jobs | Prohibited Jobs |

|---|---|---|---|

Ages 12-13 |

|

|

|

Ages 14-15 |

|

|

|

Ages 16-17 |

|

|

|

In addition, at any age, minors may deliver newspapers and/or work at a business that is 100% owned and operated by their parents.

For more information on federal child labor laws, check out our guide to hiring minors.

Payroll Forms

South Carolina has its own form for state income tax withholding, as well as other withholding forms. Here are some of the important documents you will want to make sure you have on hand when processing payroll in South Carolina.

South Carolina State Forms

South Carolina’s Withholding Allowance Certificate (SC W-4) is the state-specific withholding form that all employees in South Carolina are required to complete for their personal income tax withholding. This will need to be completed by every employee, in addition to the federal W-4.

- WH-1601 (Withholding Tax Payment): This form needs to be completed and returned with all payments that are being sent to the DOR for personal income tax withholding, whether made on a monthly or quarterly basis.

- WH-1605 (Withholding Quarterly Tax Return): This form is the quarterly tax return that needs to be filed to report all personal income tax that has been withheld from employees and remitted within the quarter. Use this for the first three quarters and WH-1606 for the last quarter.

- WH-1606 (SC Withholding Fourth Quarter and Annual Reconciliation Return): All employers registered with the South Carolina Department of Revenue are required to file a reconciliation return at the end of the fourth quarter, reporting all personal income tax withheld throughout the year. If you are an annual filer, this will be the only return you will be required to file. Even if no withholding has been made during the final quarter of the year, a WH-1606 will still be required.

Federal Payroll Forms

- Form W-4: To help employers calculate taxes to withhold from employee paychecks

- Form W-2: To report total annual wages earned (one per employee)

- Form W-3: To report total wages and taxes for employees to the IRS (summary of W-2s)

- Form 940: To report and calculate unemployment taxes due to the IRS

- Form 941: To file quarterly income and FICA taxes withheld from paychecks

- Form 944: To report annual income and FICA taxes withheld from paychecks

- Form 1099-MISC: To provide nonemployee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide to federal payroll forms you may need.

South Carolina Payroll Resources & Sources

- South Carolina Department of Labor, Licensing and Regulation: Apply for a license (real estate commission, social work examiners, speech-language pathology and audiology, cosmetology, cemetery board, building codes council, etc.), file a complaint, read about OSHA regulations, and gather information about wages and child labor.

- South Carolina Department of Employment and Workforce: Get information about unemployment laws and regulations, register for an unemployment account, maintain your employer account, and file wage reports.

- South Carolina Department of Revenue: Register a new business or tax account, search for compliance issues such as revoked or suspended licenses, apply for an alcohol license, make payments, and more.

- South Carolina Code of Laws: Find the most current laws for employers and commerce. Of particular interest are:

Frequently Asked Questions (FAQs)

In South Carolina, you can run payroll as frequently as you choose, but most employers opt for biweekly or semimonthly pay periods. Federal law requires that whatever pay frequency you select, you must be consistent and put all pay-related details in writing upon hiring.

To ensure compliance with South Carolina payroll regulations, it’s essential to maintain records, such as employee earnings, hours worked, tax withholdings, pay rates, benefits, and deductions. Additionally, keep records of payroll tax filings, including federal and state tax deposits, along with employee forms, such as W-4s and I-9s. These records should be retained for at least three years. Lastly, keep these records organized and easily accessible for potential audits or inquiries.

Bottom Line

Overall, learning how to do payroll in South Carolina is a pretty simple process. Though you’ll need to withhold state income tax and be sure to remit it to the DOR on time, you won’t need to worry about any local/city taxes or complicated overtime calculations. This is great news for South Carolina businesses or anyone looking to expand there. For the most part, as long as you follow federal guidelines, there won’t be much you’ll need to change when you start processing South Carolina payroll.