It’s simple to learn how to do payroll in South Carolina, as most of its regulations are in line with federal labor laws. You’ll be required to have an employee identification number and register with the South Carolina revenue and employment departments for withholding and unemployment accounts. Besides tax registrations, there are a few payroll/HR regulations to pay close attention to. Using our guide below will ensure you take the proper steps to correctly do payroll in South Carolina.

Rippling is an easy-to-use payroll software for small businesses looking to save time and consolidate systems |

|

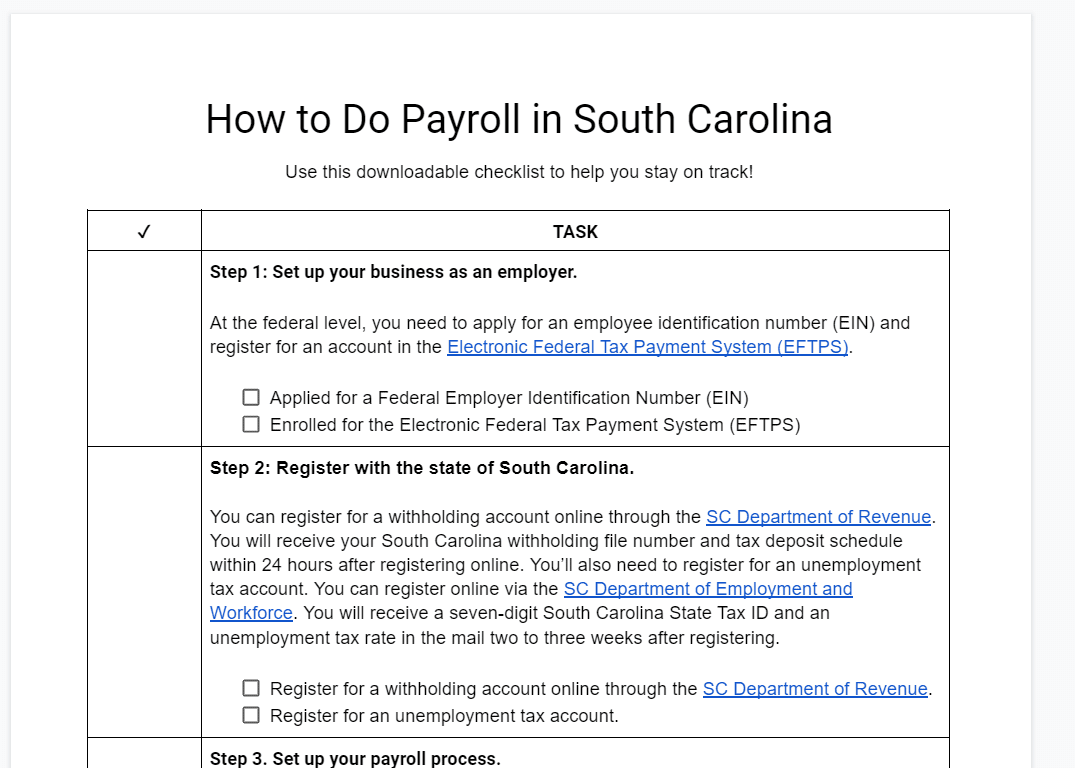

Step-by-Step Instructions to Running Payroll in South Carolina

Step 1: Set up your business as an employer. At the federal level, you need to apply for an employee identification number (EIN) and register for an account in the Electronic Federal Tax Payment System (EFTPS).

Step 2: Register your business in South Carolina. You can register for a withholding account online through the SC Department of Revenue. You will receive your South Carolina withholding file number and tax deposit schedule within 24 hours after registering online.

You’ll also need to register for an unemployment tax account. You can register online via the SC Department of Employment and Workforce. You will receive a seven-digit South Carolina State Tax ID and an unemployment tax rate in the mail two to three weeks after registering.

Step 3: Set up your payroll. Whether you’re going to do payroll yourself or use a payroll software, you’ll need to determine a payroll process that works best for your business and is compliant with the rules and regulations in South Carolina. This includes deciding when and how you’ll pay employees, how you’ll collect and submit payroll forms when necessary, how and when to verify employee time worked, etc.

Step 4: Collect employee payroll forms. It’s best to collect employment forms from new hires during the onboarding process. Federal payroll forms include the W-4, I-9, and a direct deposit authorization form. South Carolina also requires employees to fill out an additional document for state withholding called the SC W-4.

Step 5: Collect, review, and approve time sheets. South Carolina law states that regular paydays need to be established and provided to all employees in writing upon hire. To ensure your team is always paid on time to remain in compliance, collect and approve timecards a couple of days before payday. Use one of our free time sheet templates if you don’t yet have an established time and attendance system.

Step 6: Calculate payroll and pay employees. There are many ways to calculate payroll, and it’s up to you to decide which is best for your business. You can use payroll software, a calculator (use our free time card calculator to do some basic time calculations), or even Excel (we have a free template).

Step 7: File payroll taxes with the federal government. Federal tax payments must be made via EFTPS. Generally, you have to deposit federal income tax withheld and both employer and employee Social Security (6.2% of each employee’s earnings) and Medicare taxes (1.45% + 0.9% for employees making over $200,000 per year) based on the schedule assigned to your business by the IRS. The IRS can assign you to one of the following depositing schedules:

- Monthly Depositor: Requires that you deposit employment taxes on payments made during a month by the 15th day of the following month.

- Semiweekly Depositor: Requires that you deposit employment taxes for payments made Wednesday, Thursday, and/or Friday by the following Wednesday. Deposit taxes for payments made Saturday, Sunday, Monday, and/or Tuesday by the following Friday.

It’s important to note that schedules for depositing and reporting taxes are not the same. Employers who deposit both monthly and semiweekly should only report their taxes quarterly or annually by filing Form 941 or Form 944.

Step 8: File payroll taxes with the state of South Carolina. South Carolina employers need to file and pay taxes withheld from employee wages. Filings are due quarterly, and payments are due either quarterly or monthly based on how much is withheld.

- If the total withholding amount is less than $500 per quarter, and the remittance is due by the last day of the month following the end of the quarter—payments are due quarterly.

- If the total withholding amount is more than $500 per quarter, and the remittance is due by the 15th of the following month—payments are due monthly.

Returns and payments can be sent via mail to the appropriate mailing address or filed electronically via the MyDORWAY website. Employers who withhold $15,000 or more per quarter or who make 24 or more withholding payments in a year must file and pay electronically.

Return due dates are as follows:

Quarter | Due Date |

|---|---|

1st Quarter (January, February, March) | April 30 |

2nd Quarter (April, May, June) | July 31 |

3rd Quarter (July, August, September) | Oct. 31 |

4th Quarter (October, November, December) + Annual Filings | Jan. 31 |

Step 9: Document and store your payroll records. It’s important to keep records for all of your employees, even those terminated, for at least three years. Learn more in our article on retaining payroll records.

Step 10: Complete year-end payroll reports. You will need to complete W-2s for all employees, and 1099s for all independent contractors. Both employees and contractors must have received these documents by Jan. 31 of the following year. You’ll also need to submit individual copies for each worker to the IRS along with a form that summarizes the information on each (W3 Form summarizes all W2 forms, and Form 1096 summarizes all 1099 forms).

Download our free checklist to help you keep track as you do the steps.

For a more general overview of what you should know when doing payroll according to federal standards, check out our guide on how to do payroll.

South Carolina Payroll Law, Taxes & Regulations

South Carolina is a pretty simple state in which to process payroll, but there are a few laws and regulations that you’ll need to know. Unlike some of the other states that are less complicated, South Carolina does in fact have personal income taxes that will need to be withheld and remitted on time to ensure that you are in compliance. There are a few other things regarding payroll that stand out as well. Here’s everything you’ll need to know.

South Carolina Payroll Taxes

Employers in South Carolina are responsible for paying payroll taxes, in addition to Social Security and Medicare (FICA) and federal unemployment (FUTA) taxes. Social Security and Medicare are both employee and employer taxes, meaning that the employee portion will be withheld from their paychecks and the employer portion will be your responsibility.

As an employer, you will be responsible for the following rates for each of these tax amounts:

- Social Security – 6.2% of each employee’s pay up to $147,000

- Medicare – 1.45% of each employee’s pay up to $200,000

- Additional Medicare: 0.9% of each employee whose wages exceed $200,000 a year

- FUTA – 6% of the first $7,000 of each employee’s pay

In the News:

In 2023, the Social Security wage base will increase to $160,200, with a maximum contribution of $818.40.

In addition to federal tax liabilities, you’ll also need to be sure that you comply with withholding and remitting state and local taxes as required.

Use our free calculators below to help you out:

State Income Tax

South Carolina has a simplified income tax structure that follows an employee’s federal taxable income. Your employee’s federal taxable income is the starting point in determining their state income tax liability. Individual income tax rates range from 0.2% to a top rate of 7% on taxable income. Tax brackets are adjusted annually for inflation.

You will be responsible for withholding and remitting income taxes to the South Carolina Department of Revenue on a regular and timely basis. You can always refer to SC1040 for the most up-to-date tax tables or check the South Carolina Department of Revenue website.

Local Income Tax

There are no local or city taxes in South Carolina, making it one of the easier states in which to file payroll taxes. You’ll only need to worry about state withholding.

Unemployment Insurance Tax

South Carolina has a state unemployment insurance fund that protects workers against job loss by providing temporary income to qualified individuals. Employers are charged for the first $14,000 that each employee earns in a calendar year, which is the primary funding for the program. Employer base rates range from 0% to 5.4% and are computed based on a couple of different factors. Newly registered employees typically begin at a rate of 0.49%.

Under South Carolina law, tax rate schedules adjust yearly based on a formula that considers the projected benefits cost for the year or the “base rate” and the projected amount required to return the Trust Fund to an adequate balance or the “solvency surcharge.” Tax rates are set each year to fund these components.

Each employer is also responsible for a Departmental Administrative Contingency Assessment (DACA) surcharge of 0.06%, which is added to the base rate and interest surcharge. The total tax rate is: Total Tax Rate = Base Rate + Solvency Surcharge (zero) + DACA (0.06%).

Tip:

When you pay state unemployment taxes, you may qualify for up to a 5.4% discount on your FUTA taxes. This can significantly reduce what you pay to the IRS—from 6% to 0.6%.

Workers’ Compensation Insurance

All companies with four or more employees, including part-time workers and family members, are required to have workers’ comp coverage in South Carolina. Coverage can be obtained from any private insurance provider.

There are a few exemptions to this rule, including:

- Licensed real estate agents working for a broker

- Federal employees of the state

- Casual employees, meaning that they don’t work regularly or only work when needed

- Employers with less than $3,000 in annual payroll from the previous year

- Agricultural employees or people selling agricultural products

- Railroad or railway express company employees

- Drivers who hold a bona fide lease-purchase or installment-purchase agreement on a vehicle they use while serving as a driver to a motor carrier

Minimum Wage Laws in South Carolina

South Carolina does not have a statewide minimum wage. Instead, it follows the federal minimum wage of $7.25 per hour, which was last raised in 2008.

Businesses must pay tipped employees at least $2.13 per hour, provided that their tips get them to the hourly minimum wage. If not, the company must make up the difference.

South Carolina Overtime Regulations

Employees in South Carolina are entitled to overtime pay at 1.5x their regular pay rate for any hours worked over 40 in a “single workweek.” Based on the Fair Labor Standards Act (FLSA), a single workweek is any seven days worked consecutively.

While some states have daily overtime limits that require employers to pay overtime for a certain amount of hours worked in a single day, South Carolina does not.

Use our free overtime calculator below to help:

Different Ways to Pay Employees in South Carolina

While there are many ways to pay employees, the South Carolina Office of Wages and Child Labor specifies that an employer must pay wages by either:

Tip:

It’s important to note that South Carolina law does not explicitly allow or prohibit the use of pay cards as a form of payment to employees. To err on the side of caution, it’s best practice to use one of the payment methods explicitly mentioned by the state labor regulations.

South Carolina Pay Stub Laws

Many states have regulations that require employers to provide documentation with payroll that includes certain details regarding the payment. South Carolina employers are required to provide each employee with an itemized statement showing the following:

- The employee’s gross pay

- All deductions made from his wages

Tip:

While gross pay and deductions are the only official pay stub requirements in South Carolina, we still recommend that you include all important payment information as a best practice. Use one of our free pay stub templates to start.

Minimum Pay Frequency

In South Carolina, there are no regulations specifying mandatory paydays. Private employers have the right to decide when and how frequently to pay employees. State government employees must be paid semimonthly (two times per month). Though there are no regulations regarding paydays for private employers, most choose biweekly or semimonthly. Federal law just requires you’re consistent.

Employers with five or more employees are required to give written notice at the time of hire that includes wages to be paid, expected hours of work, and the time and place of payment (whether the payments will be made via cash, direct deposit, or check).

Paycheck Deduction Rules

Employers in South Carolina are not allowed to withhold any portion of an employee’s wages unless:

- It is permitted by state or federal law (Social Security, income taxes, etc.)

- The employer has given the employee written notice of the deduction at the time of hire

- The employer has given the employee at least seven days written notice of the deduction

Severance Pay in South Carolina

As an employer in South Carolina, you don’t have to provide your employees with severance pay if they are terminated or voluntarily leave. There are no legal requirements that mandate severance pay after a certain period or based on certain employment terms.

South Carolina labor laws will only enforce that you pay severance payments to your employees if there is a signed written agreement in place between an organization and an employee. If you choose to provide severance pay, you must comply with the terms of that agreement. In the case of disputed wages, you are required to inform the employee in writing how much you believe they are due and pay them that amount. The employee can accept this pay without losing his right to claim the balance.

Final Paycheck Laws in South Carolina

South Carolina requires employers to pay an employee all wages due them within 48 hours of the day of separation or on the next regularly scheduled payday. The period of time between separation and the final paycheck may not exceed 30 days. If you terminate a sales representative, you need to pay them all their accrued commissions per the terms of the contract.

Separating from an employee can often be a difficult process for business owners, often starting with notifying them of their termination. For guidance and a free template, check out our guide to termination letters.

Accrued Paid Time Off Payouts

South Carolina state laws don’t require employers to pay out accrued PTO or vacation time upon their termination unless it’s specifically detailed in the employer’s policy.

South Carolina HR Laws That Affect Payroll

South Carolina does not have many HR laws that don’t align with federal labor laws. Most of its regulations are pretty straightforward and don’t require much additional attention or documentation. As long as you file all new hires on time and adhere to child labor regulations, you will have an easy time remaining in compliance.

South Carolina New Hire Reporting

All new and rehired employees must be reported online using the South Carolina New Hire Reporting portal. Employers have 20 days after the employee’s first day of work to report all new hires.

The following information needs to be included when filing new hire paperwork:

Employer Information: | Employee Information: |

|---|---|

|

|

New Hire information can only be used for the purposes prescribed by law, which includes:

- Establishing and enforcing child support orders

- Detecting unemployment benefits overpayments and fraud

- Detecting workers’ compensation overpayments and fraud

- Detecting overpayments and fraud in government programs (welfare, food stamps, etc.)

The penalty for an employer failing to report newly hired or rehired employees is:

- $25 for the second offense and $25 for each offense thereafter

- $500 for each and every offense, if the failure to report is the result of a conspiracy between the employer and the employee not to supply the required information or to supply false or incomplete information

Meal Breaks

There is no requirement under South Carolina law for an employer to provide employees with breaks or a lunch period.

Though you’re not required to offer breaks or meal periods by law, you may want to consider how offering breaks can affect employee morale. If you choose to offer breaks, make sure to include in your employee handbook the details of how long, how often, and whether or not the breaks will be paid.

Paid Sick Leave & Paid Time Off

There is no South Carolina law requiring private sector employers to provide employees with either sick time or vacation time, paid or unpaid.

While it’s not required to provide time off by law, it’s important to remember that promising it to employees can create a legal obligation to do so. Be very clear with employees and on all employee documentation about what your policies are.

In the News:

There is a bill, H3469, to amend the South Carolina laws to require employees to accrue sick leave at the rate of one hour of paid leave for every 30 hours worked. This bill was introduced in January 2021 and currently sits in the House Committee on Labor, Commerce, and Industry.

Child Labor Laws

South Carolina rules and regulations on child labor are adopted from the Wage and Hour Regulations mandated by the Department of Labor. Generally, minors under the age of 14 are not allowed to work, as employment under the age of 14 is defined as oppressive child labor.

There are, however, quite a few restrictions:

Age Range | Working Hours | Allowed Jobs | Prohibited Jobs |

|---|---|---|---|

Ages 12 and 13 |

|

|

|

Ages 14 and 15 |

|

|

|

Ages 16 and 17 |

|

|

|

In addition, at any age, minors may deliver newspapers and/or work at a business that is 100% owned and operated by their parents.

For more information on federal child labor laws, check out our guide to hiring minors.

Payroll Forms

South Carolina has its own form for state income tax withholding, as well as other withholding forms. Here are some of the important documents you will want to make sure you have on hand when processing payroll in South Carolina.

South Carolina State Forms

South Carolina’s Withholding Allowance Certificate (SC W-4) is the state-specific withholding form that all employees in South Carolina are required to complete for their personal income tax withholding. This will need to be completed by every employee, in addition to the federal W-4.

- WH-1601 (Withholding Tax Payment): This form needs to be completed and returned with all payments that are being sent to the DOR for personal income tax withholding, whether made on a monthly or quarterly basis.

- WH-1605 (Withholding Quarterly Tax Return): This form is the quarterly tax return that needs to be filed in order to report all personal income tax that has been withheld from employees and remitted within the quarter. Use this for the first three quarters and WH-1606 for the last quarter.

- WH-1606 (SC Withholding Fourth Quarter and Annual Reconciliation Return): All employers registered with the South Carolina Department of Revenue are required to file a reconciliation return at the end of the fourth quarter, reporting all personal income tax withheld throughout the year. If you are an annual filer, this will be the only return you will be required to file. Even if no withholding has been made during the final quarter of the year, a WH-1606 will still be required.

Federal Payroll Forms

- Form W-4: To help employers calculate taxes to withhold from employee paychecks

- Form W-2: To report total annual wages earned (one per employee)

- Form W-3: To report total wages and taxes for employees to the IRS (summary of W-2s)

- Form 940: To report and calculate unemployment taxes due to the IRS

- Form 941: To file quarterly income and FICA taxes withheld from paychecks

- Form 944: To report annual income and FICA taxes withheld from paychecks

- Form 1099-MISC: To provide nonemployee pay information that helps the IRS collect taxes on contract work

For a more detailed discussion of federal forms, check out our guide to federal payroll forms you may need.

South Carolina Payroll Resources & Sources

- South Carolina Department of Labor, Licensing and Regulation: Apply for a license (real estate commission, social work examiners, speech-language pathology and audiology, cosmetology, cemetery board, building codes council, etc.), file a complaint, read about OSHA regulations, and gather information about wages and child labor.

- South Carolina Department of Employment and Workforce: Get information about unemployment laws and regulations, register for an unemployment account, maintain your employer account, and file wage reports.

- South Carolina Department of Revenue: Register a new business or tax account, search for compliance issues such as revoked or suspended licenses, apply for an alcohol license, make payments, and more.

- South Carolina Code of Laws: Find the most current laws for employers and commerce. Of particular interest are:

Also, check with your payroll software or service for resources and state-specific features.

Bottom Line

Overall, learning how to do payroll in South Carolina is a pretty simple process. Though you’ll need to withhold state income tax and be sure to remit it to the DOR on time, you won’t need to worry about any local/city taxes or complicated overtime calculations. This is great news for South Carolina businesses or anyone looking to expand there. For the most part, as long as you follow federal guidelines, there won’t be much you’ll need to change when you start processing South Carolina payroll.