TriNet is a leading professional employer organization (PEO) that offers hire-to-retire HR support, payroll, and industry-specific compliance support. Its strategic HR offerings are top-notch—but they may be more than you need, especially since it’s more expensive than many PEO services. Thus, you may benefit from choosing a reputable TriNet competitor instead.

We evaluated several companies similar to TriNet for their price, ease of use, and features to help you select the best one for your needs. Here are the top five TriNet alternatives:

- Rippling: Best TriNet competitor for small to midsize companies (especially those in tech) needing hardware and software onboarding

- ADP TotalSource PEO: Best TriNet alternative for growing or large businesses

- Paychex: Best TriNet competitor for solopreneurs and very small businesses that want to grow into a PEO option

- Justworks PEO: Best TriNet alternative for companies with contractors (alongside employees)

- Papaya Global: Best TriNet alternative for multinational businesses

What is a PEO?

PEOs differ from other HR software in that they take full administrative responsibility for your employees in terms of payroll, taxes, and benefits. You share other responsibilities with them and are in charge of day-to-day assignments and operations. PEOs are more expensive than payroll or HR software and could be more than you need. Learn more about PEOs and what they can do for your business.

Best TriNet Competitors Compared

All the PEOs on our list offer the standard benefits of medical, dental, 401(k), commuter, and HSA/FSA. They also handle onboarding, document management, and some risk and compliance support. We list the noteworthy additions.

Starting monthly pricing | Unlimited payroll runs | Standout benefits | Talent management | PEO only | Best for (company size)** | |

|---|---|---|---|---|---|---|

$150 per employee* | ✓ | Home and auto | ✓ | No | Small to medium | |

$65 per employee* | ✓ | Online health advisor | Costs extra | Can activate / deactivate at will | Small to large | |

| $85 per employee* | No | Group legal plan, funeral planning | ✓ | No | Small to large |

$100 per employee* | No | Financial wellness, business insurances | Costs extra | No | Solopreneurs to large | |

$59 per employee | ✓ | Health advocacy services, gym memberships | No | ✓ | Small to medium | |

$15/employee for payroll; $599/employee for EoR*** | ✓ | International, country-specific benefit plans | ✓ | No | Medium to large | |

*Prices based on quotes we received; please call providers for custom quotes.

**Based on analysis by enlyft.com.

***EoR=Employer of Record; learn more about what they do in our Employer of Record article.

Is a PEO too much?

If a PEO is more than you need, there are cheaper options for handling payroll or managing basic HR functions. Check out our lists of the best human resources payroll software and best payroll services for simpler options. If you’re not sure what to look for, check out our guide to finding the right payroll solution for your business.

TriNet is best for well-established small and midsize businesses that want to outsource their payroll and HR. Its strategic HR advisers can help keep your company strong. Meanwhile, it watches for changing industry laws and compliance rules to make sure you stay compliant, even in the most highly regulated industries. It offers a full range of payroll and HR services and can be an international PEO in some circumstances. However, its pricing is not for those on a tight budget.

TriNet can be found in several of our buyer’s guides:

If you’re still considering TriNet but want more information, check out our complete TriNet review.

Rippling: Best TriNet Alternative for Companies With Heavy IT Needs

Pros

- Highly rated, intuitive platform

- Turn PEO on and off with a click

- Easily integrated system

- Can onboard your employee with software and hardware as well

Cons

- Phone support to HR experts costs extra

- Must call for quote

- Modular system can get pricey as you add features

Rippling Pricing

- Call for a quote

- Our Quote*: $65 per employee monthly

- HR payroll Plan*: $35 plus $8 per employee monthly for access to Rippling’s core workforce management platform plus full-service payroll and time tracking solutions

Other Per-Module Costs *

- App, device, and computer inventory management: $8 per employee monthly

- Includes IT tools to manage business apps and computer provisioning and deprovisioning processes

- Benefits administration: Pricing varies, depending on your insurance broker

- HR help desk: Custom-priced

- One-on-one email/phone support from HR experts

*Pricing based on quote

Rippling is a top HR and payroll software solution that focuses on making tech easier. It does this with its intuitive interface, amazing number of integrations, and ability to onboard employees with hardware as well as software. It offers a PEO solution that not only lets you take advantage of those tools but is itself easy to turn off and on. As such, we think it’s the best TriNet competitor for high-tech companies or those that need a lot of software to run their business.

In the News:

In January 2023, Rippling became an official Apple Authorized Reseller.

Rippling can be found in our following best-of lists:

Rippling earned the highest score by a long shot, with 4.18 out of 5 in our evaluation. This was mostly due to the strength of its HR tools, particularly the technical onboarding of computers and software, and its immigration services education, plus the ability to switch easily to a non-PEO option. It took a hit for its modular functionality, as you have to pay extra for many services others include in their packages.

Rippling Pricing

Rippling offers custom quotes, which are flat-rate and per-employee but vary by organization size, features, types of insurance you want, and more. Therefore, you must call for a customized quote. However, its tools are grouped into modules with their own prices. And, if you sign up for a Rippling plan, you will get your first month FREE!

We received a quote of $65 per employee for the PEO option. Pricing for other modules runs from $5 to $100 per month, with the possibility of discounts for multiple add-ons. The PEO option itself can be added or removed monthly; for HR + payroll, our quote was $35 + $8 per person monthly.

Rippling Features

Rippling’s onboarding includes hardware and software, along with all the other needed documents. (Source: Rippling Demo)

- IT onboarding: Rippling is unique to all the PEO services we looked at because, in addition to the standard onboarding for payroll, benefits, and the like, it can onboard your new employee’s computer as well. With the software module, it can automatically add new employees to the apps they need, and with the device management module, it will take responsibility for hardware from issuing to decommissioning. It’s great for those that want to outsource IT as well as HR.

- Integrations: Here, too, Rippling takes the lead as the best TriNet app alternative for companies that use a lot of software. It can integrate with over 500 different apps—more than any other PEO on our list—and, unlike the others on our list, it lets employees easily access programs on their Rippling dashboard.

- Payroll: Rippling says you can complete payroll in as little as 90 seconds because it syncs all aspects of payroll automatically, from hours worked to automatic withholdings. Others on our list don’t make this claim, but several (including TriNet) do sync hours, PTO, and expenses. Like Justworks, you can pay by checks or direct deposit. If you want pay cards, consider ADP or Paychex.

- International payroll: Rippling global payroll allows you to run payroll for employees in any of the 50 countries it caters to. Employees will be paid in their local currency. Just like with US-based payroll, it’s compliant with local laws, has internal error-checking, and, in many cases, can be done in 90 seconds.

- Expense and Corporate Card Management: In 2022, Rippling added an expense management system that gives you a lot of control. You can get a Rippling Corporate Card, plus you can restrict spending to limits or locations, get automated warnings for expenses above a certain amount, and automatically connect expenses and payroll from reimbursement to reports. TriNet has expense management, but not a corporate card.

- Learning management: Rippling offers an excellent learning management system. You can select any of its 1,000+ ready-made online courses or upload your own. Courses are easy to access on tablets, can include built-in quizzes, and generate certificates for compliance. TriNet, by comparison, offers about half as many courses.

- Compliance: While TriNet has compliance support, Rippling provides compliance enforcement. Rippling has automated enrollment in state-mandated training so you can make sure your employees stay compliant year after year. You can even deny employees clock-in until they complete a mandatory course (such as for safety).

- Ease of use: Real-world users praise Rippling for its ease of use and intuitive interface. They give it 4.76 out of 5 stars, averaged across multiple user reviews—the highest user score on our list (Justworks was second with 4.63 out of 5). Compare this to TriNet’s score of 3.7 out of 5.

ADP TotalSource PEO: Best for Growing or Large Businesses

Pros

- Feature-rich, customizable

- International PEO available

- Caters to multiple industries, including restaurant

- Pay via pay card

Pros

- Not always easy to reach customer support

- Must call for pricing

- International PEO for >50 employees

ADP TotalSource PEO Pricing

- Custom: Pricing starts at $85/employee/month

- Some tools cost extra

ADP TotalSource PEO did well when comparing TriNet vs ADP, especially if you are a large business or a business that anticipates scaling up. Like TriNet, it works with small and medium businesses, but it’s well suited for larger ones—as well as for international businesses. It also carries your employees from hire to retire, offers strategic and industry-specific HR features, and provides custom pricing.

You’ll find ADP on many of our best-of lists, and not just for PEOs. Its payroll service, ADP Run, is also an excellent product. This is just another way it can grow with you. Here are some categories where ADP ranks high:

- Best HR Payroll Software

- Best Online Payroll Services (ADP Run)

- Best HR Software (ADP Run)

- Best HRIS Software (ADP Run)

On this list, ADP scored 3.88 out of 5, with a perfect score for reporting and high scores for ease of use and HR tools. It does not do technical onboarding like Rippling, which brought down the score some. It also lost points for taking 72 hours for direct deposit, whereas Paychex does it in 48 or less. For user-review scores, it was lowest after Paychex, but still higher than TriNet. Overall, ADP is a solid and popular product.

ADP TotalSource PEO Pricing

Like with TriNet, you need to call ADP for a custom quote (this is typical of most PEO companies; only Papaya and Justworks on our list offer fully transparent pricing). Also, like TriNet, your quote will vary by your geographic location and the features you choose.

A representative told us prices start at $85 per employee monthly, which is significantly cheaper than TriNet. However, you’ll want to compare features, as, like Paychex, it will charge more for add-ons. Justworks and Rippling are cheaper but may not have as many tools included.

ADP TotalSource PEO Features

ADP has an easy-to-use interface as well as an excellent mobile app. (Source: ADP)

- Flexibility: First, ADP serves businesses of all sizes, from a handful of employees to companies of over 1,000. TriNet, by contrast, works best for medium and larger businesses. Second, it offers non-PEO services, so you can outsource your HR services to ADP or select only ADP Run for payroll (Rippling and Paychex also offer this flexibility). Finally, like Paychex and Rippling, you can select the tools you need, paying only for them.

- Payroll: While TriNet offers electronic payments, ADP can pay by checks and does check-stuffing, like Paychex. Plus, ADP can pay employees by pay card—TriNet and Paychex do this as well. This is a popular option with millennials and Gen Z. ADP has audit and reconciliation services, something we did not see in other PEOs, although TriNet and others do have automations to ensure information is correct and compliant with local law.

- Strategic HR: ADP’s strategic HR services are similar to TriNet, in that they include advisers. With ADP, you get a strategic HR expert, a payroll adviser, a benefits team, and even workplace safety consultants. Your employees benefit from ADP MyLife advisers who can help them with questions about benefits and referrals. Compare this to Rippling, whose HR experts may cost you extra.

- Industry-specific HR: ADP is experienced in a wide range of industries, and may serve them better than TriNet. One example is the restaurant business: ADP’s program includes time tracking, tip calculation and reporting, and more. TriNet does not promote anything specific for this industry on its website, although it can create a plan (for comparison, ADP and Paychex are both on our best restaurant payroll software list).

- International HR: Since our last update, ADP has significantly increased its international capabilities, with HR and payroll services in 140 countries. If you need an Employer of Record, however, you may still need to work through its partner, Globalization Partners (we compared G-P with Papaya for this list and found Papaya better, however). TriNet can work internationally, but this is not a focus.

- Excellent mobile app: ADP’s mobile app has the highest user scores of those on our list—4.7 out of 5 on iOS (2.9 million ratings) and 4.4 out of 5 on Android (445,000 ratings). The TriNet app on iOS scored higher (4.8 with 27,200 ratings) but significantly lower on Android (2.9 with 1,100 ratings).

Paychex: Best TriNet Competitor for Small Businesses Wanting a Future PEO Option

Pros

- Wide range of payroll and HR tools

- Handles new hire reporting

- PEO is optional

- 24/7 live support from customer service and HR experts; offers dedicated payroll support

Cons

- Charges by pay runs

- Software has a steeper learning curve

- Can get pricey as you add tools

Paychex Pricing

Call for a quote—our most recent quote was $100 per employee monthly administrative fee. Paychex says that the savings they find in programs like workers’ comp often offset this price.

In comparing Trinet vs Paychex, Paychex wins when it comes to small businesses. TriNet is best suited for medium and large companies—so if you are a small company or even a solopreneur, consider an alternative like Paychex. While PEOs require five or more employees, Paychex can nonetheless take you on for payroll and other HR tools until you reach that level. It’s one of the most customizable services on our list, providing basic plans and additional options (for additional prices).

You can find Paychex on several of our best-of lists:

Paychex earned 3.85 out of 5 on our rubric. Pricing and Additional Software & Tools were its lowest scores, in part because, like Rippling, it charges more for certain tools. However, only it and ADP had a perfect score for licensing and reporting. It also scored points for having a dedicated representative. However, its real-world user score was the lowest on the list.

Paychex Pricing

Like many on our list, Paychex requires a custom quote. For a company of 20, we received a tentative quote of $100 per employee for the administrative fee. This includes payroll, 401(k), administration of health benefits, access to ancillary benefits like dental coverage, workers’ compensation, and a designated payroll expert and HR expert whom you can access daily if needed. Our rep also told us that most often, it will pay for itself in the savings they find in programs like 401(k) and medical insurance. Unlike TriNet, Rippling, Justworks, and Papaya, it does not allow unlimited payroll and charges more for weekly pay runs.

Paychex Features

Paychex uses the Paychex Flex system for its interface for payroll, onboarding, and more. (Source: Paychex)

- Payroll: Like ADP, you can get check-stuffing services or pay by pay card (TriNet has pay cards, but not check-stuffing). It has a two-day direct deposit; most on our list, including TriNet, take longer. Paychex handles payroll tax payments and filings but may charge extra for year-end tax reporting.

- Business tools: In addition to incorporation services, Paychex offers a wide range of business insurances, including workers’ compensation, liability, umbrella, cyber liability, and commercial property insurance. TriNet offers a few of these, like liability and workers’ comp, while ADP offers nearly as many as Paychex.

- Strong HR tools: You get access to HR and payroll professionals. You get a dedicated payroll rep with higher plans (such as when using them as a PEO). The HR consultants can alert you of changes in local, state, or federal labor laws. It has a full range of HR tools, and like Rippling, you can add them as needed. However, unlike Rippling, they are not grouped into packages.

- Reports: Paychex blows away the competition when it comes to reporting with over 160 standard reports and a custom report builder. You can also save your favorite reports to rerun with a push of a button.

- User reviews: With a user score of 4.09 out of 5 stars on several review sites, Paychex is the lowest-scoring on our list but much higher than TriNet, which earned 3.7 out of 5 from real-world customers. We continue to see a trend toward increasing satisfaction, with its score rising by 0.03 in this update.

- Serves solopreneurs: Sometimes, even a business of one can benefit from outsourcing its payroll and benefits. While you don’t need a PEO for this, Paychex is the only service on our list that offers a Solo Plan with self-employed payroll and tax services, incorporation services, and even a 401(k) for retirement planning. It can take a lot of the heavy work off your hands.

Justworks PEO: Best TriNet Competitor for Contractor Pay

Pros

- Transparent pricing

- Affordable for small companies

- Payroll for contractors is no extra cost

- In-app employee training resources

Cons

- Not for large businesses

- No hiring tools

- International payroll tools cost extra

Justworks PEO Pricing

- Basic Plan: $59 per employee monthly*

- Plus Plan: $109 per employee monthly*

*Contractor payroll and tax reporting is no extra cost

Justworks Time Tracking: $8 per user monthly

Justworks is a great alternative to TriNet for two reasons—its pricing is transparent and, in most cases, cheaper than TriNet’s, and it includes contractor payroll in its plans. TriNet charges extra for this function. It falls short of several on our list, because it does not offer international payroll, and is the only one that does not have hiring tools (it does have onboarding, however).

Nonetheless, its otherwise excellent toolset and high user approval landed it top slots in several of our best-of lists:

Justworks earned 3.81 out of 5 in our evaluation. Its low scores for HR tools and additional tools reflect that it lacks some of the standout features we looked for—immigration support, technical onboarding, and training tools. It also does not have recruiting and applicant tracking. Its core HR features are sound, however, which reflects in the Expert Score. It earned excellent scores for pricing and ease of use.

Justworks PEO Pricing

Justworks offers two plans—Basic and Plus. Pricing depends not only on the plan but the number of employees you have. The pricing is the same whether you pay monthly or annually. Unlike others on our list, Justworks does not charge extra for contractor payroll or tax filing.

- Basic Plan ($59/employee/month): Payroll including unlimited payments, tax filings, employee onboarding, PTO management, basic training, workers’ comp, life and disability insurance, 401(k), health and wellness perks, HR consulting

- Plus Plan ($109/employee/month): Everything in Basic Plan, plus employee benefit plans for Health Advocacy Services, COBRA administration, medical insurance, FSA/HSA, dental and vision insurance (benefits are pay-by-employee)

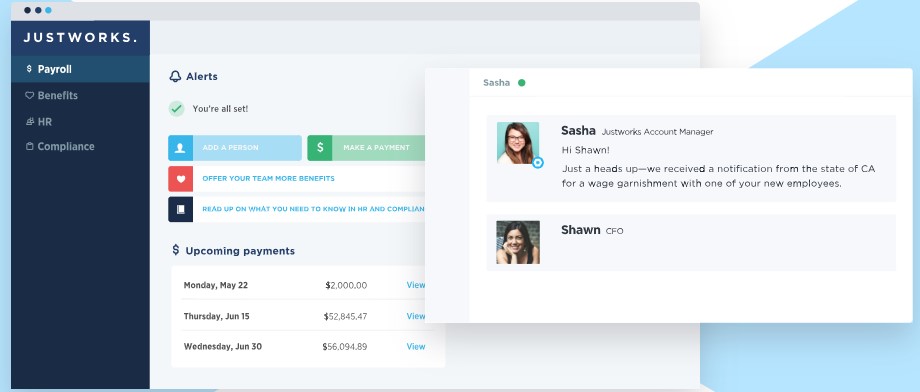

Justworks PEO Features

Justworks has a simple platform whose dashboard makes it easy to tackle important tasks fast. (Source: Justworks)

- Payroll processing: Like TriNet and its other competitors, Justworks pays employees by direct deposit or paper checks. However, you need to distribute paper checks yourself (ADP, by contrast, charges you but will send them individually). Justworks has set schedules (weekly, biweekly) for paying employees, although you can select from those schedules (Paychex charges more if you pay more often). If you need custom pay periods, consider Rippling. It offers options for off-cycle payments and prorating paychecks.

- Time tracking and timecards: Justworks has a time tracker, Justworks Hours, which is a mobile app. However, it costs an extra $8 per user monthly. TriNet does not charge extra for its time-tracking tool. The others on our list do, whereas Papaya does not offer time tracking at all.

- Compliance: Compliances are a big reason for hiring a PEO. Justworks, like the others on our list, helps you stay compliant by offering workers’ compensation, keeping track of changes in federal and state regulations, and handling new hire reporting. However, it stands apart in that it provides, free of charge, basic required training like sexual harassment prevention training. Most offer similar training but as part of their talent management tools, which cost extra.

- Benefits: Like TriNet and all the alternatives on our list, Justworks offers medical, dental, vision, HSA, FSA, accidental death and disability, and life insurance. Justworks manages its own 401(k) program, while most of the others outsource. However, if you already have your benefits providers and are not interested in changing, then Rippling might be a better choice, as it integrates with just about anyone.

- User response: Real-world users on multiple review sites rate Justworks 4.61 out of 5. They praise the easy user interface and strong customer support. Only Rippling has a higher user score with 4.76 out of 5. TriNet, by contrast, earned a 3.7 out of 5.

Papaya Global: Best TriNet Alternative for Multinational Companies

Pros

- Handles salary, hourly, and contractor payroll

- Transparent pricing

- International scope, local currency

- Expense management tools

Cons

- Most expensive on our list

- Not for single-country PEO

- Does not mail checks

Papaya Global Pricing

- Global EoR: $599 per employee monthly

- Payroll only: $15 per employee monthly

- Contractor management: $30 per contractor monthly

- Global Expertise service: $190 per employee monthly (global health, immigration support, global equity)

- Payroll platform license: $3 per employee monthly

- Data & Insights platform license: $150 per location monthly

- Payments-as-a-service: $3 per employee monthly

- Volume discounts available

Papaya is our top pick for the best international payroll service; it provides an intuitive platform, excellent local support, and contractor-only options. TriNet did not make the international PEO list, while Ripping ranked second to Papaya. Unlike TriNet or Rippling, Papaya does not require you to be a US-based business. Plus, it has transparent pricing, something only Justworks on this list provides.

Papaya made several of our best-of lists:

Since Our Last Update:

Papaya Global has changed some of its pricing plans, reducing the per-worker monthly fees of its EOR from $650 to $599. Contractor management has also changed and is now $30 per month per contractor.

Papaya earned 3.54 out of 5 in our evaluation, but we included it because of its excellent EoR capabilities. Like with Justworks, it has strong HR features, but not the standouts we used to judge it against TriNet and others—hence, the low score for HR tools and additional tools. If you need time and attendance or learning management, you need add-ons (or consider ADP). It had a perfect score on pricing because of its transparency.

Papaya Global Pricing

Since Our Last Update: Papaya has changed its pricing and plans.

All prices are starting prices; there may be discounts for volume. Contact Papaya for details.

Papaya’s Employer of Record plan is its international PEO and starts at $599 per month. Its in-country partners serve as the employer of record, taking responsibility for payroll, workforce management, benefits, and compliances, while you handle the day-to-day tasking of your employee.

If you are looking for something simpler, Papaya offers these programs:

- Payroll ($15/employee/month): The entire payroll process, integration with your HRIS and ERP, pays in local currency.

- Payroll Platform License ($3/employee/month): Use the software but keep your existing network.

- Contractor ($30/employee/month): Lets you outsource work to contractors at home or abroad.

- Data and Insights Platform License ($150/month/location): Real-time business intelligence reporting, employer and payroll costs across locations, and more.

- Payments-as-a-service ($3/employee/month): Use their embedded platform for workforce payments that is licensed to move funds across borders.

Papaya Global Features

Papaya lets you handle payroll and analyze costs and trends across all countries. (Source: Papaya)

- Employer of Record: As an EOR, Papaya hires and pays employees on your behalf, handling the PEO responsibilities while you manage the day-to-day tasking. It provides enterprise-level benefits that comply with local laws. It can even help you offer equity. While used by major corporations like Toyota and Microsoft, it nonetheless works with small companies. ADP, meanwhile, requires workers in at least three countries. TriNet requires you to call to see if your company is a good fit.

- International payroll: Papaya’s Global EoR plan pays your employees, files taxes, and assumes responsibility for errors. Papaya works in 160+ countries (The last count we found for TriNet was 115+; ADP, 140+; and Rippling, 50+). Like others on our list that handle international payroll, it can work with contractors. If you need checks mailed, you’ll want to consider ADP, since Papaya does not provide this service.

- In-country HR support: Papaya stands out from the rest in that it provides the platform for managing your employees but subcontracts the HR support to local organizations it has vetted. Papaya says this lets them work with the most knowledgeable resources for local labor laws, compensation, and cultural issues affecting HR. However, ADP, it should be noted, has headquarters in over 140 countries.

- License Software: Want to DIY but need a proven international software? Papaya licenses its software and payment services at cut-rate prices. This is unique to all the PEO services on our list.

- Immigration support: Papaya is the best for immigration, with the ability to arrange work permits for expats and short-term laborers as well as permits for a worker’s family. TriNet can also do this, while Rippling and ADP may be able to advise you and offer multiple articles on the process.

- Reports and analysis: The dashboard makes it easy to see employment costs across your entire company or drill down to the individual basics. Papaya can also create customized reports. Thus, like TriNet, it’s a good alternative for job costing.

How We Evaluated

Unlike our competitors, who offer payroll or HR software as an alternative to TriNet, we limited our search for TriNet competitors to top-rated PEOs so we could compare the companies most like Trinet. As noted above, many are on our best-of lists.

From there, we considered price, ease of use, and features like compliance, payroll, and HR support. We required basic HR and payroll tools to make the rubric, then compared them by the standout tools that make the PEO the best. We also looked at user reviews, selecting only those that were popularly and favorably reviewed.

Click through to see the scoring criteria:

20% of Overall Score

We looked for providers with transparent pricing, zero setup fees, and that charge on a per-employee basis. Most PEOs in this guide do not list their pricing online and require you to call and get a custom quote—except for Justworks and Papaya Global, which publish PEO pricing information on their websites, earning them perfect scores.

20% of Overall Score

We looked for robust HR administrative support, from hiring to retiring, including compliance tracking, immigration support, onboarding of computers and software, and benefits offerings that are available across the US. Ripping led the pack with 4.75 out of 5.

10% of Overall Score

We checked whether PEOs provide additional HR solutions, such as recruiting, applicant tracking, time and attendance, and learning management tools. ADP had the top score here, but most scored low because they charge extra for these tools.

5% of Overall Score

The IRS and the Employer Services Assurance Corporation (ESAC) both certify PEOs for adherence to strict standards and ethical practices, so we checked whether these providers are certified. We also considered customized reports as these are often for compliance issues. Rippling and Papaya lack both certifications. Paychex and ADP earned perfect scores.

15% of Overall Score

To make our list, these PEOs had to handle federal, state, and local taxes. We looked for automatic payroll runs, direct deposit speed, paper check options, and W-2 reporting. ADP had the highest score at 4.13 out of 5.

15% of Overall Score

While all the products on our list offer great features, this criterion looked at how well they worked for the needs of small businesses, especially those on a budget. All scored as high or higher than TriNet, but only Rippling earned 5 out of 5 here, due mainly to its flexible PEO solution that allows users to turn it off and then easily transition to using its HR software again.

15% of Overall Score

In addition to having helpful features like how-to guides, dedicated representatives, and customer support options, we looked at user reviews from third-party sites like G2 and Capterra. Then, we averaged the ratings on a 5-star scale, wherein an average of 4.5+ stars is ideal. Justworks took the lead with 4.75 out of 5.

Bottom Line

TriNet is a popular and feature-rich PEO service, but it may not be the best for you. Small businesses, businesses on a tight budget, or those based outside the US will want to consider other options. We’ve looked at many possibilities and narrowed them down to the five best companies like Trinet.

Rippling, Papaya, and Justworks offer tools to meet very specific needs that TriNet doesn’t meet or doesn’t meet as well. Paychex is a top choice for small businesses. ADP, meanwhile, can grow with you as you expand in scope, size, or reach. All are excellent services. However, we found Rippling to be the best overall in terms of price and service. Call Rippling today and see what it can do for you.