Small businesses wanting to expand to online sales will need to sign up with a traditional merchant services provider or payment processor to accept online payments. These companies provide the technology that allows online platforms (such as websites) to securely process credit card payments.

Taking credit card payments online involves selecting a payment processor, setting up your online payments, adding tools to increase conversion, testing your payment system, and securing your site.

Key Takeaways:

- Online payments are faster and more convenient but are more susceptible to fraud, which causes higher fees than in-person transactions.

- Businesses will need a payment gateway and payment processor to accept credit cards on websites and other online platforms.

- Security and compliance measures are more stringent for businesses that process credit card payments online.

Here’s how to accept credit card payments online in five steps:

Step 1: Choose a Payment Processor

A payment processor is a service provider that handles payment processing. This includes everything from capturing payment information, passing transaction data between merchant accounts and banks, and moving transaction amounts from customer to merchant.

Most payment processors offer a variety of ways to accept online payments. Businesses that want online credit card processing may do it in several ways:

- Through a website or ecommerce platform for customers to go to when making purchases, such as online shops

- By sending an invoice or a payment link that will take customers to a secure hosted payment page for one-time purchases

- By setting up recurring payments, such as for subscription-based products

- By using a virtual terminal to input credit card information, such as for mail and telephone orders

Unlike an ecommerce checkout page, payment links (also called direct payment link or checkout link) can be used in multiple platforms, such as an email, invoice, social media post, or live messaging platforms without integration. It redirects customers to a merchant’s hosted checkout page where they can enter their payment information to complete a transaction.

Learn more about:

When choosing the right provider, look for competitive processing fees and a solution that is compatible with how you would like to receive online credit card payments. There are a number of low-cost options that offer the right payment processing tools to match different business types.

Here are our top user-friendly choices for accepting credit cards online and what they are best for:

- Square: New or new-to-online businesses needing an easy, immediate, and affordable solution

- PayPal: Adding a user-friendly checkout to any site

- Stripe: Online startups and anyone wanting a custom online checkout

All of the solutions on our list include at least merchant account services and payment gateways. They also offer user-friendly invoicing tools to accept payments through email invoices. Some solutions provide tools to build a website. For example, Square has free tools to build an online store or checkout page. Others, like PayPal, let you add Buy Buttons to any site.

Related reading:

Step 2: Set Up Your Online Credit Card Payments

We walk you through how to use each of our recommended payment processors to accept payments online below:

What We Like

- Instant sign up—no application or approval process

- Transparent, flat-rate pricing

- Free online store, checkout, and invoicing

What's Missing

- Not as easy to add to non-Square websites

- Limited customer support

Square Features

- Flat-rate payment processing

- No long-term contracts, setup fees, monthly fees, or cancellation fees

- Multiple transfer options including standard next-day deposits or instant for a 1.5% fee

- Real-time sales and inventory updates

- Free chargeback management services

- Flexible checkout options including Apple Pay, Google Pay, PayPal, Square Pay, and Cash App Pay

Square is great for businesses that want to accept credit cards online because it is free and fast to set up. Plus, it has affordable processing fees for new businesses and a free point-of-sale (POS) system for accepting in-person payments. Overall, Square is the best fit for small and startup businesses that want a solution that has no monthly fee, minimum transaction requirements, or application process.

This platform makes it easy for small businesses to accept payments online by offering a few different solutions, all with no contract. Businesses can create a free website through Square, connect Square payments to one of their ecommerce partners like WooCommerce, BigCommerce, and Wix, or use Square application programming interfaces (APIs) to add Square Checkout to their custom website.

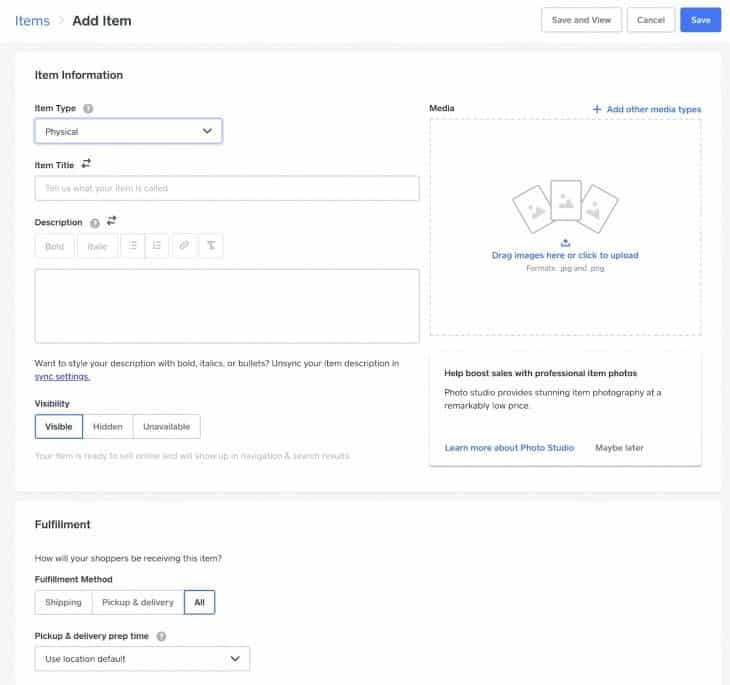

Here’s how to accept credit cards online with Square:

1. Sign up for Square Payments: It’s free to create an account, which includes a basic POS system for in-store and mobile sales and invoicing software. And businesses only pay a 2.6% plus 10 cents per transaction payment processing fee. There are no software fees or monthly minimums to use Square’s payment processing features.

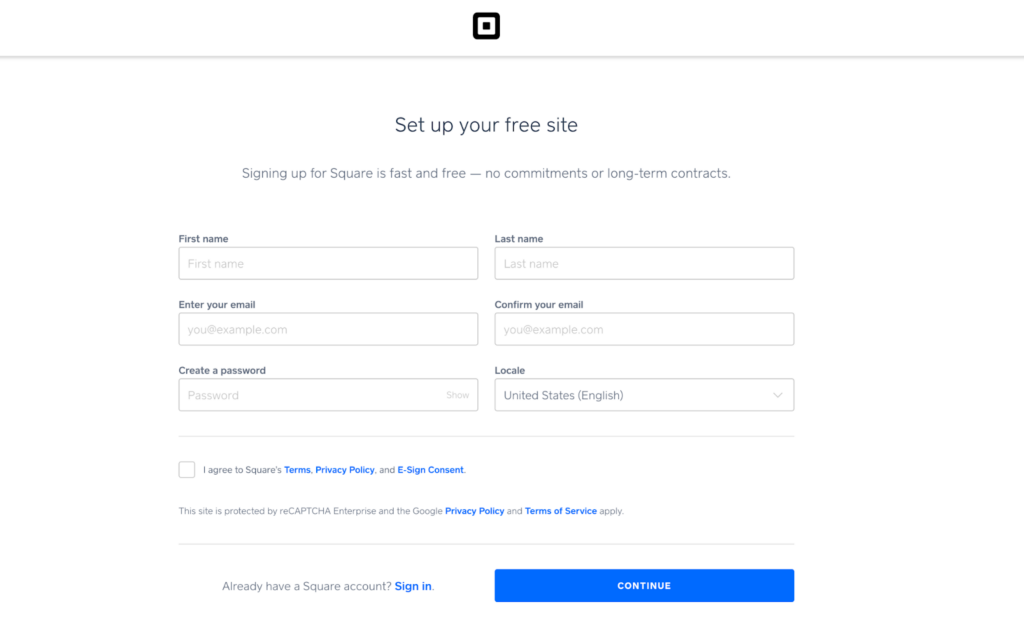

Use Square’s online form to create your Square account. (Source: Square)

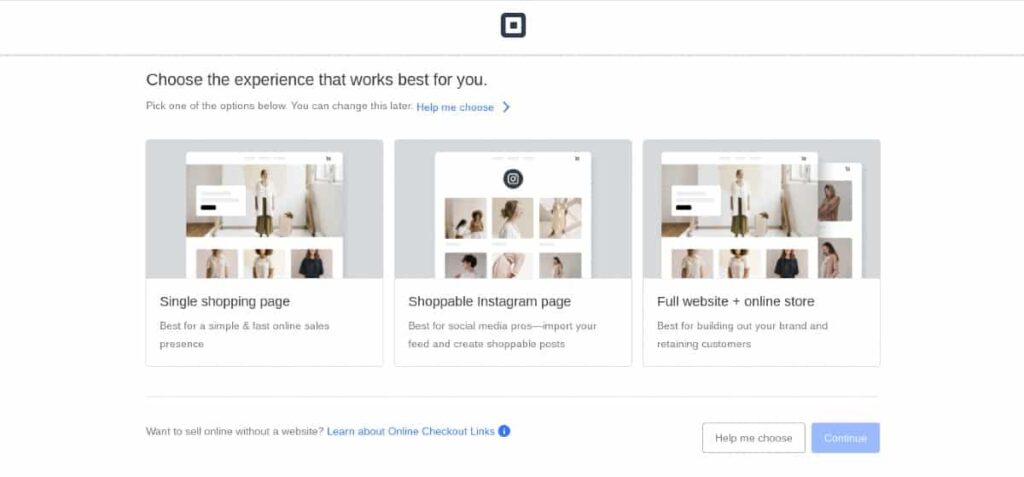

2. Create a Square Online store: You can create a basic ecommerce site for free with Square Online or invest in a paid plan for a more customizable site. Square also has options for checkout pages and selling on social media channels. Learn how to create a website with Square Online through our step-by-step guide.

Square lets you easily customize your ecommerce store. (Source: Square)

OR

1. Integrate with an ecommerce site: Square Payments also integrates directly with popular ecommerce platforms, including WooCommerce, Wix, BigCommerce, and Magento. This is a good option if you sell in-store with Square and also want to grow a sizable ecommerce store. Square can also be added to any custom website through Square’s open API.

2. Load your products and start selling: If you’re creating a new site through Square or an ecommerce platform, load the products you want to sell on your site, including product photos, product descriptions, and pricing. If you’re setting up to take payments with Square’s API, drop the code in your existing site to set up a payment.

You can also use Square to send and process online invoices and recurring payments, as well as phone or mail orders through its virtual terminal.

What We Like

- Easy for customers to use

- Flexible checkout options

- Can be added to any site

What's Missing

- Not suitable for high-risk businesses

- Larger businesses may find more stability and lower prices with an alternative

PayPal Features

- Flat-rate payment processing

- No long-term contracts, setup fees, or withdrawal or cancellation fees

- Funds from customer purchases are transferred to your PayPal business account in minutes

- Accept Venmo and PayPal Credit

- Free PayPal marketing solutions and customer insights

- Variety of Buy Buttons including donate and subscribe.

PayPal is the best way to accept credit cards online for businesses that want to increase conversions with a one-click button at checkout. In addition to traditional credit card payments, PayPal allows businesses to also accept PayPal Credit and Venmo payments.

These one-click checkout options are very customer-friendly. Online shoppers who opt for PayPal checkout don’t have to enter credit card or shipping information manually, as it’s populated automatically by PayPal. Learn more about one-click checkout.

With PayPal, you can set up a hosted checkout, add PayPal to your existing site, integrate with most ecommerce platforms, or stick Buy Buttons on any blog or webpage—making it a flexible solution. PayPal is unique because it can be combined with other payment processing solutions if you want to accept PayPal payments but want to use another credit card processing service.

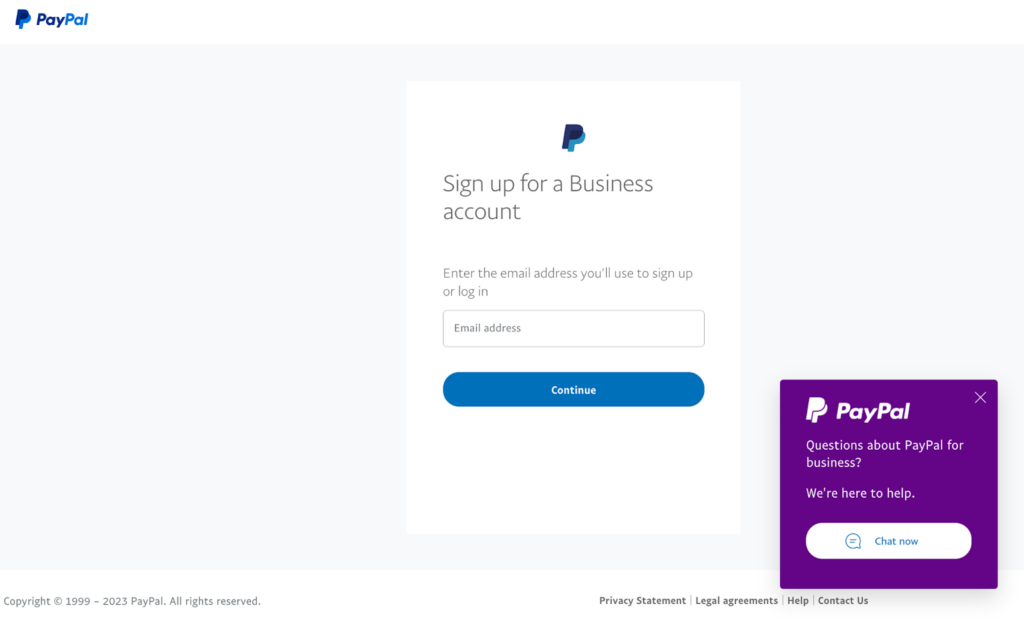

There are three ways businesses can use PayPal to accept credit cards online, each of which requires you to sign up for a free account first.

PayPal offers easy sign-up for merchants right on the PayPal website. (Source: PayPal)

With a PayPal Ecommerce Partner

PayPal works with several ecommerce platforms, including Shopify, BigCommerce, and Magento. PayPal customers who build ecommerce sites through one of these platforms can receive a discount and connect a PayPal checkout seamlessly. Many sites have app and plugin marketplaces where you can install PayPal with just a few clicks and a little technical know-how.

On a Custom Website

PayPal Payments Pro offers a fully customizable checkout solution for accepting all major credit cards, debit cards, PayPal, and Venmo online payments. This is a full online checkout solution you can add to any website.

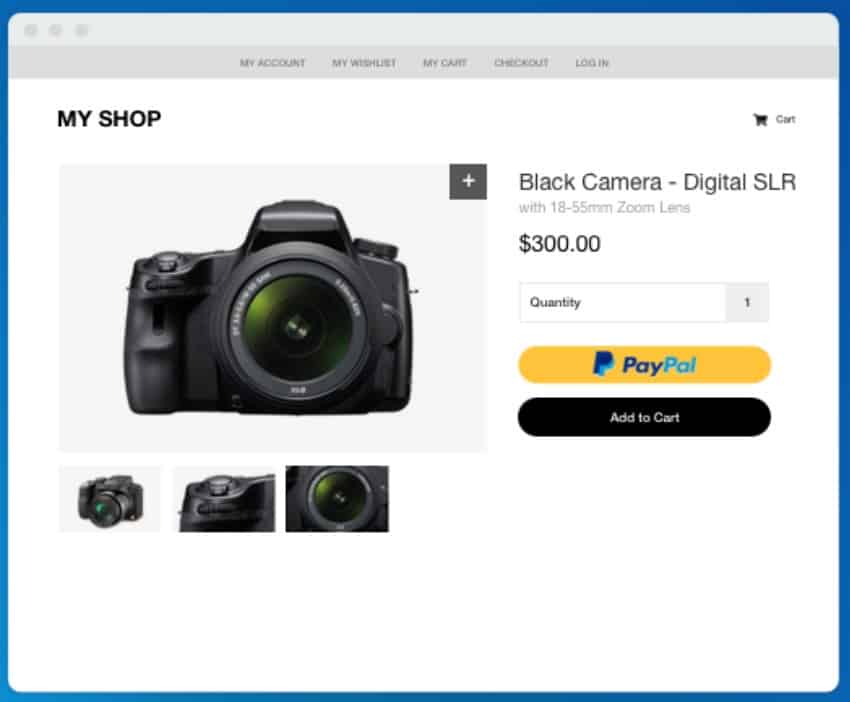

PayPal’s fully customized checkout allows users to include product information on the page. (Source: PayPal)

With a PayPal Button

Businesses can add a PayPal Buy Now or Pay Now button to checkout, providing a simplified checkout solution. To do this, you’ll need to log in to your account and navigate to the PayPal button page.

- Select the type of button you want.

- Enter payment information, including the name of the product you’re selling, any tracking or ID numbers, pricing, and currency.

- As an optional step, you can add product options and different pricing, customize the look of your button, and override default tax and shipping information.

- When you’re happy with your button, copy and paste the HTML code onto your website or pages where you want the button to appear.

Like Square, you can also use PayPal to create and send online invoices and collect phone and mail order payments through a virtual terminal. Check out our guide to the best virtual terminals.

In addition to the Buy Now button, PayPal offers Add to Cart, Donate, Subscribe, and Automatic Billing buttons. (Source: PayPal)

What We Like

- Developer-friendly

- Speedy, mobile-optimized checkout built for conversions

- Built-in fraud prevention and chargeback tools

What's Missing

- Add on fees for online invoicing and recurring billing

- Harder to set up than Square or PayPal

Stripe Features

- Flat-rate payment processing

- No monthly, startup, or cancellation fees

- Flexible solution (works with any site)

- Payment Card Industry (PCI)-compliant

- Customizable fraud detection tools

- Accept over 135 currencies and ACH

- 24/7 support specialists via email, chat, or phone

Stripe is a payment processing system that allows businesses to accept credit card payments online and is designed to handle more complex and customized payment situations like subscriptions, recurring fees, and storing card data. It is a great, secure way to accept credit cards online for businesses that want to create a custom solution.

Additionally, Stripe is an international company, operating in 39 countries and accepting over 135 currencies, making it a good fit for any business looking to cater to international customers. Apart from small businesses, Stripe powers ecommerce giants like Amazon and online brands like Glossier.

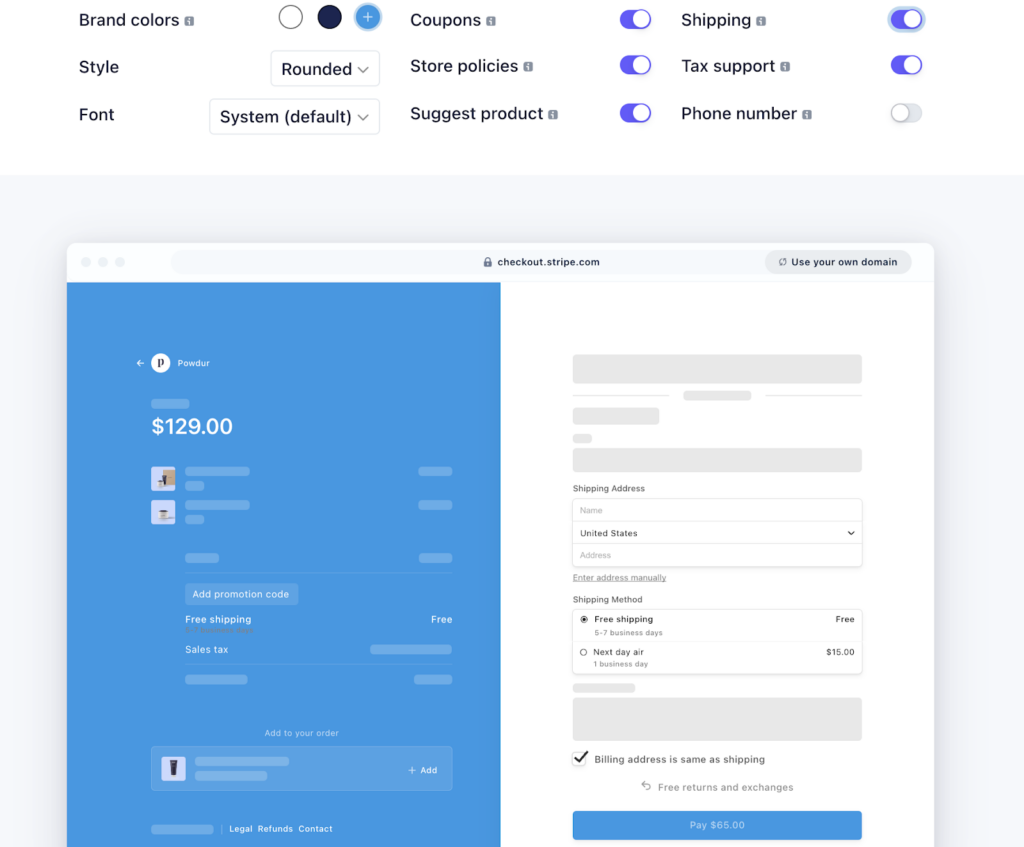

Stripe has a suite of APIs that allow businesses to choose how they want to accept credit card payments online. Here are three ways that businesses can accept credit cards online with Stripe:

Use a Pre-built, Hosted Checkout Page

Stripe offers hosted checkout pages that can be easily integrated to any website. (Source: Stripe)

You can use Stripe Checkout with any site and customize it to match your brand’s settings. This checkout page includes address auto-complete powered by Google, real-time card validation, and third-party autofill, plus Google Pay and Apple Pay checkout. Here’s how to set it up:

- Sign up for and log in to your Stripe account.

- Redirect your website’s current or default checkout to a Stripe Checkout Session.

- Set up your payment success page.

- Add all the necessary code to your website’s backend.

- Test the checkout process from the front end.

You also have the option of doing the following:

- Add products and pricing information.

- Set up saved customer IDs for faster checkout and better data collection.

- Store and secure payment information for faster checkout.

- Have separate authorization and funds capture

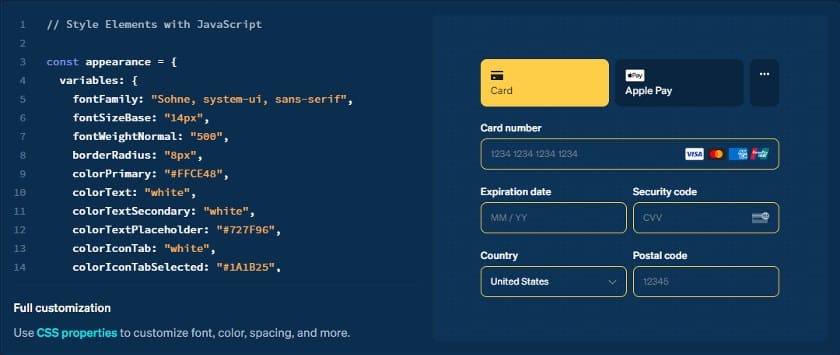

Create a Custom Form

Stripe is a developer-friendly payments services provider with extensive documentation for custom-made checkouts. (Source: Stripe)

The custom integration allows you to use any HTML element or JavaScript event to trigger Checkout. This method has several steps and requires solid JavaScript skills.

Use a Partner Integration

There are dozens of platforms that have extensions or plug-ins for creating Stripe checkouts to accept credit cards on your website. Stripe’s partners include WordPress, Wix, Weebly, and Shopify. Stripe also has plug-ins for PrestaShop and WooCommerce, to name a couple. Visit the corresponding app or plug-in marketplace for a straightforward setup in a matter of clicks.

Because Stripe is built for developers and is meant to be highly customizable, you can adjust your online checkout at any point regardless of which setup method you choose.

Step 3: Increase Conversions With One-click Checkouts & Installment Payments

Research shows that an average of 70.19% of online shopping carts were abandoned in 2024. One way to combat high cart abandonment rates is by creating an easy checkout process, including one-click checkouts with platforms like Google Pay, Apple Pay, Amazon Pay, and PayPal. Payment processors that specialize in online payments or retail (including Square and Stax) offer these kinds of one-click checkout options.

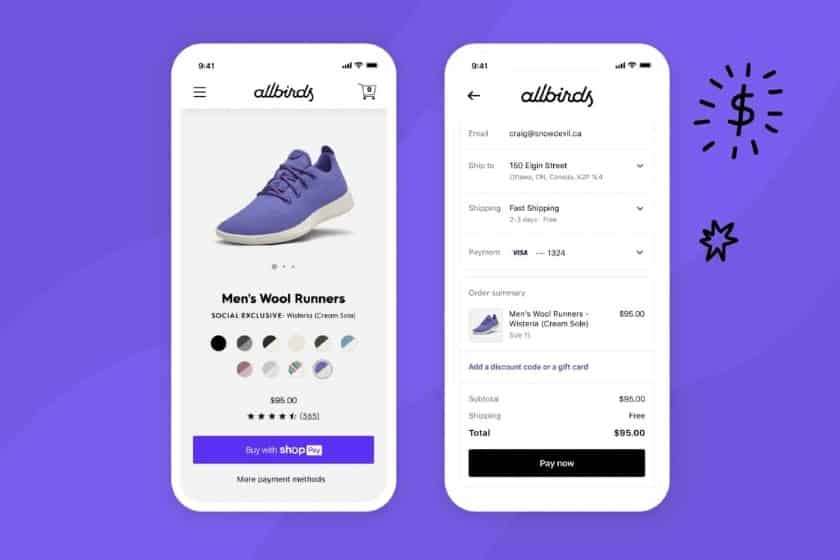

Other processors, like Shopify, offer their own one-click checkout solution (Shop Pay), in addition to Apple Pay and Google Pay. Shopify surveyed its own merchants and found that sites with Shop Pay have a checkout-to-order rate of 1.5x higher than those going through regular checkouts without Shop Pay. Read more about Shop Pay.

Enabling one-click checkout options, like Shopify’s Shop Pay, is the next step in setting up your online payments. (Source: Shopify)

In other words, it’s not enough just to set up online payments—you need to optimize your checkout process so it’s convenient for your customers. In return, you’ll see a boost to your bottom line.

In many cases, particularly for retailers, shoppers expect the convenience of flexible payment terms in addition to one-click checkouts. BNPL Buy Now, Pay Later , for example, is a form of custom financing that offers interest-free installment payments, allowing shoppers to pay over time.

Most popular small business website builders and ecommerce platforms work with customer financing solutions—like Klarna, Afterpay, and PayPal’s PayPal Credit or Pay Monthly.

Learn more:

Step 4: Test Your Online Payment Processor

Most payment processors allow you to test and run trial transactions. Check out your payment processor’s setup guide and look for test credit cards you can use to run transaction simulations.

From the front end:

- Make sure to review the overall look and feel of your checkout page.

- Review the number of steps it takes to complete a transaction (tip: some customers abandon their carts if there are too many steps in the checkout process).

- Ensure that your shipping, return, and refund policies are clearly displayed and that confirmation prompts are included to minimize chargebacks.

- Review your digital receipt and confirm that all the necessary information is included.

- Measure the length of time it takes between clicking on the Pay button and the confirmation (anything more than three seconds can become a concern and cost you repeat customers).

From the back end:

- Trace how transactions are recorded. Some transactions may have to appear in more than one report, such as invoicing, receivables, payout batch processing, and customer profile.

- If your payment processor allows you to initiate a chargeback test transaction, find out where the event is recorded on the system.

Step 5: Secure Your Site

One of the most important things you will need to double-check is your payment security process. It’s important to get this step locked down as soon as possible to make sure all your transactions are protected. At a minimum, you want to meet the requirements outlined in the Payment Card Industry Data Security Standard (PCI DSS), also known as the PCI standard.

There’s a higher risk associated with online payments because the card isn’t physically present for the purchase, which poses a greater risk of fraud. So banks and credit card companies charge higher processing fees to cover the risks associated with processing online payments.

Regular occurrences of fraud and chargebacks will increase your processing fees. Look for a payment processor with built-in chargeback and fraud prevention or third-party software. Many online processors have features like address verification services (AVS) or machine-learning algorithms to help prevent fraudulent transactions from being approved. Learn how to prevent chargebacks

How Online Credit Card Processing Works

For any kind of online credit card payment, an online payment gateway is necessary to process the transaction and send the encrypted payment information. This is a customer-facing page where payment information is collected during checkout, encrypted, then sent to the payment processor.

The illustration below explains how to take credit card payments online:

Some small business solutions, such as ecommerce platforms and invoicing software, either have their own payment gateways or allow users to integrate their service with other payment gateways for payment processing.

Related reading:

Pros & Cons of Accepting Credit Card Payments Online

| Pros | Cons |

|---|---|

| Expanded sales channel | Riskier than card-present payments |

| Customer convenience | Fees are more expensive than in-person |

| More payment methods | Stricter security compliance requirements |

Adding online platforms to your sales channels allows you to reach more customers, such as those who are nowhere near your physical stores and those who prefer to shop online. Statista estimates that retail ecommerce sales exceeded US $4.1 trillion in 2024 and will continue to rise.

Online checkouts and payments are faster because there is no queue, and payment methods are more flexible with the right payment processor. For example, PayPal’s online checkout can be your primary payment gateway or as an additional gateway that can be integrated alongside other payment processors.

On the other hand, the primary downside to accepting online payments is the added potential risk of fraud and loss in the form of chargeback claims. This is why the fees that merchants pay for online transactions are more expensive than accepting payments in person.

Online platforms are also a primary target for hackers looking to access customers’ personal and financial information. This potential threat is why there are stricter compliance requirements, such as the Payment Card Industry Data Security Standard (PCI DSS) that merchants have to meet when accepting payments online. Learn more about PCI DSS.

Cost to Accept Credit Card Payments Online

There are different pricing models when it comes to credit card processing (interchange plus, flat rate, and tiered), and each model is composed of a monthly fee + interchange rate + assessment fee + payment processor markup.

The pricing models are also based on transaction volume, in such a way that merchants will pay less per transaction as their sales volume grows. Below are example rates for online transactions in different pricing models:

- Flat rate: Monthly fee of $0 to $30; 2.9% + 30 cents per transaction

- Interchange plus: Monthly fee of $0; interchange plus 0.5% + 25 cents per transaction

- Wholesale interchange plus: Monthly fee of $99; Interchange plus 18 cents per transaction

- Tiered (mid-qualified): 2.0% to 2.8% per transaction

Some businesses that sell online also cater to international clients. When accepting foreign credit cards, merchants are charged an additional cross-border transaction fee in the form of currency conversion and/or card network fees.

- Currency conversion fee: 1% per transaction

- Card network fee: 1.5%

Another key cost of accepting online payments is the chargeback fee. Customers can claim that online transactions against their credit card are erroneous—even fraudulent—and will request for a reversal of the charge. When this happens, payment processors remove the transaction amount in question from the merchant account and return it to the customer. It also imposes a fine on merchants in the form of a chargeback fee.

- Chargeback fee: $0 to $100 per claim

Note that some payment processors impose a chargeback fee regardless if the merchant wins the dispute against the customer, while others will reverse the charge. But aside from the monetary effect, businesses that are plagued with, and loses, chargeback disputes are at risk of having their ability to accept credit card payments (in-person or online) cancelled.

Learn more:

Tips on How to Lower Credit Card Processing Fees

For microbusinesses and occasional payments, services like Venmo for Business and Chase QuickPay have options to send and receive funds for free. However, most businesses will need a merchant account. For businesses processing under $5,000 monthly, Square typically offers the best value. For businesses over that threshold, Helcim is often the cheapest credit card processor.

As your business grows, continue to negotiate lower rates with your payment processor. Once you’re consistently processing $15,000 to $20,000 monthly, you may qualify for custom rates.

Depending on your business type, you can also consider accepting ACH payments, which is one of the lowest cost-payment types. While standard online credit card processing fees are 2.9% plus 30 cents, ACH processing fees are typically 1%.

ACH transactions require customers to enter their bank information, so this payment type is typically best for recurring payments like subscriptions, ongoing services, and very expensive or high-end transactions.

Related reading:

How to Accept Credit Cards Online Frequently Asked Questions (FAQs)

Businesses need a merchant account to be able to accept credit card payments. That said, digital wallets will allow peer-to-peer payments if you are using the same application. These are, however, limited, and will not provide you with seller protection.

No, Zelle will only allow its users to link Zelle-partner bank accounts, which means businesses that use Zelle can only receive bank transfers.

Yes, Venmo customers can link their credit card information to use as a source of payment. The tap-to-pay feature also allows businesses to accept credit cards via a contactless transaction (NFC).

Bottom Line

There are many ways to accept credit cards online. You may accept credit card payments on a website, by sending an invoice, through recurring payments, or using a virtual terminal. The best way to accept credit card payments online depends on your business. If you are a sole proprietor, a new business, or merely budget-conscious, a simple solution such as Square offers a user-friendly website builder, online store, virtual terminal, and invoice payments.